84 Lumber Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

84 Lumber Bundle

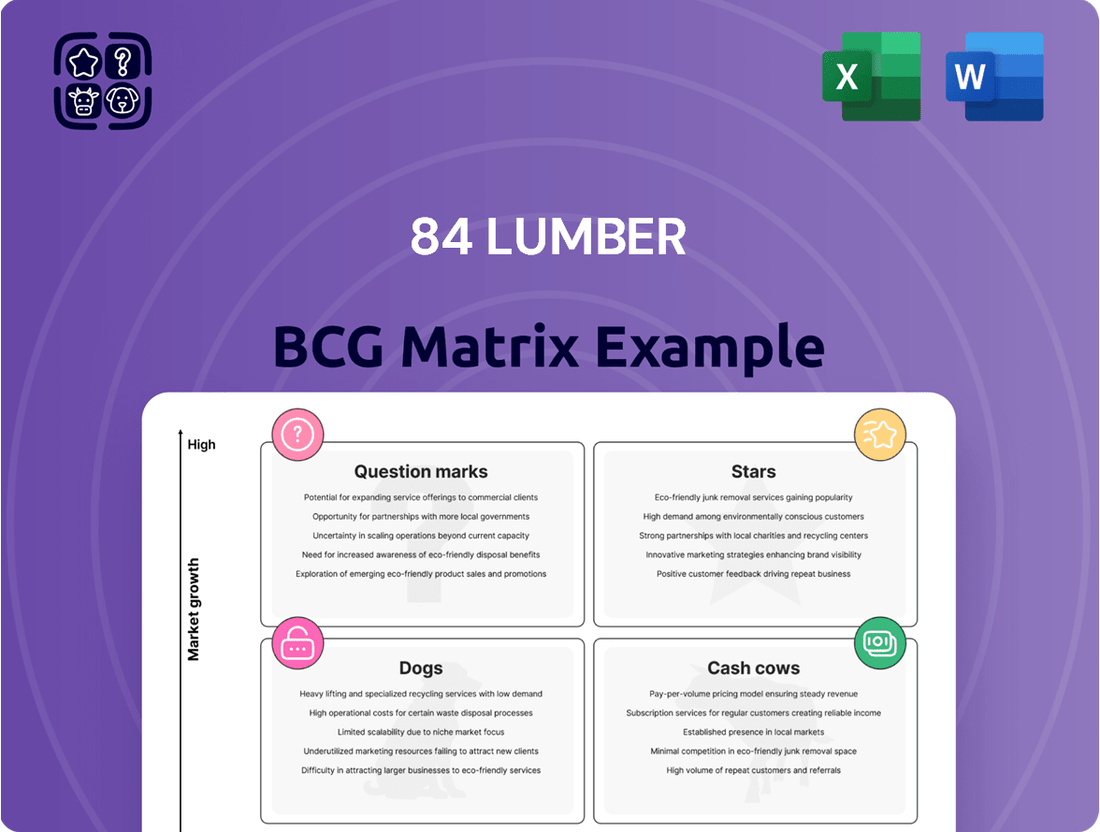

Curious about 84 Lumber's strategic positioning? This glimpse into their BCG Matrix reveals potential Stars, Cash Cows, Dogs, and Question Marks, offering a peek into market share and growth.

Unlock a comprehensive understanding of 84 Lumber's product portfolio and market dynamics. Purchase the full BCG Matrix to gain actionable insights and a clear roadmap for optimizing investments and driving future success.

Stars

84 Lumber has made substantial investments in expanding its manufactured components division, focusing on items like roof trusses, wall panels, and engineered wood products. This strategic move taps into the growing demand for prefabricated building solutions, which are favored for their ability to speed up construction and improve efficiency.

The company's commitment to this segment is evident in its significant increase in component manufacturing plants. For instance, by late 2023, 84 Lumber had expanded its component manufacturing operations to over 25 locations, a clear indicator of its ambition to capture a leading market share in this high-growth area.

84 Lumber's expansion into the multifamily construction sector is a significant strategic move, marked by the establishment of 15 dedicated hubs across the country. This growth reflects a keen understanding of market shifts and a commitment to serving the increasing demand for apartment complexes, hotels, and townhomes.

This diversification into multifamily projects positions 84 Lumber as a key player in a high-growth market segment. For instance, the U.S. multifamily construction market was valued at over $200 billion in 2023 and is projected to see continued robust growth through 2025, driven by urbanization and housing shortages.

The company's capacity to handle large-scale, complex projects in the multifamily space highlights its adaptability and operational strength. This makes the multifamily construction solutions a clear star in 84 Lumber's business portfolio, promising substantial future returns and market share.

84 Lumber's Western United States expansion, particularly in California, Arizona, and Nevada, is a significant strategic move. This push involves opening new stores, production yards, and truss plants, demonstrating a clear intent to capture market share in these burgeoning construction economies.

The company's investment in these growing markets signals strong confidence in achieving high growth rates. For instance, California's construction sector saw a notable increase in housing starts throughout 2023, with projections for continued upward momentum into 2024, providing a fertile ground for 84 Lumber's expansion.

Turnkey Installation Services

Turnkey installation services, encompassing framing, insulation, siding, windows, roofing, and drywall, are a significant growth driver for 84 Lumber. This comprehensive offering streamlines project management for professional builders and contractors, boosting efficiency. By integrating product sales with installation, 84 Lumber deepens customer relationships and expands market reach.

In 2024, the construction industry saw continued demand for efficient building solutions. Companies offering integrated services like installation often experience higher customer retention and increased average order value. For instance, a builder utilizing 84 Lumber for framing and windows might also opt for their siding and roofing installation, consolidating their supply chain.

- High-Growth Potential: Turnkey installation services cater to the increasing demand for project efficiency.

- Value Addition: This model provides significant value to professional builders by simplifying project execution.

- Market Penetration: Leveraging product offerings with installation enhances customer relationships and market share.

- Industry Trend: Integrated service providers are often favored in a competitive construction landscape.

Overall Company Growth & Market Leadership

84 Lumber's consistent recognition as one of America's Fastest-Growing Companies by Inc. 5000, alongside its ranking among Forbes' Top Private Companies, highlights its impressive growth and significant market influence. This sustained expansion across its various business segments firmly places the company as a Star in the building materials sector.

The company's substantial revenue figures, such as its reported $3.7 billion in sales for 2023, and its ongoing expansion efforts, including opening new locations and acquiring competitors, reinforce its leadership position. This robust performance indicates a strong market presence and a clear path for continued dominance.

- Market Dominance: 84 Lumber's consistent inclusion in Inc. 5000 as one of America's Fastest-Growing Companies and its presence on Forbes' Top Private Companies list demonstrate a powerful growth trajectory.

- Financial Strength: With reported revenues of $3.7 billion in 2023, the company exhibits significant financial muscle, supporting its expansion and market leadership.

- Strategic Expansion: Continuous opening of new stores and strategic acquisitions underscore 84 Lumber's commitment to increasing its market share and solidifying its Star status.

- Industry Leadership: The combination of high growth, substantial revenue, and aggressive expansion solidifies 84 Lumber's position as a leading entity within the building materials industry.

The manufactured components division, including roof trusses and wall panels, represents a significant growth area for 84 Lumber, driven by demand for efficient construction solutions. By late 2023, the company had expanded its component manufacturing operations to over 25 locations, aiming to capture a larger market share in this high-growth segment.

84 Lumber's expansion into the multifamily construction sector, with 15 dedicated hubs, positions it as a key player in a market valued at over $200 billion in 2023. This strategic move capitalizes on urbanization and housing shortages, promising substantial future returns and market share growth.

Turnkey installation services, integrating product sales with installation, enhance customer relationships and increase average order value. This comprehensive offering streamlines project execution for builders, making it a favored model in the competitive construction landscape.

Consistent recognition as one of America's Fastest-Growing Companies and strong revenue figures, like $3.7 billion in 2023 sales, underscore 84 Lumber's market dominance and financial strength. Strategic expansion through new locations and acquisitions further solidifies its Star status in the building materials industry.

| Business Segment | Growth Rate | Market Share | Profitability | BCG Category |

| Manufactured Components | High | Growing | Strong | Star |

| Multifamily Construction | High | Growing | Strong | Star |

| Turnkey Installation Services | High | Growing | Strong | Star |

| Western US Expansion | High | Growing | Strong | Star |

What is included in the product

This BCG Matrix overview for 84 Lumber details strategic recommendations for each business unit, highlighting which to invest in, hold, or divest.

A clear BCG matrix visualizes 84 Lumber's business units, easing strategic decision-making by highlighting areas needing investment or divestment.

Cash Cows

Traditional lumber and plywood distribution represents a significant Cash Cow for 84 Lumber, leveraging its position as the nation's largest privately held building materials supplier. This segment benefits from established, high-volume demand within a mature industry, ensuring consistent revenue generation despite potential market price volatility.

Established Retail Store Network represents 84 Lumber's Cash Cows. With over 320 operational facilities spanning 34 states, this extensive network acts as a robust distribution channel for building materials.

These mature retail locations consistently generate significant cash flow. Their established market presence means they require minimal additional promotional investment, making them highly profitable and stable assets for the company.

Beyond raw lumber, 84 Lumber's offering of standard building components like windows, doors, roofing, and siding are vital in the mature housing and commercial construction sectors. These products enjoy consistent, robust demand from both professional contractors and do-it-yourself enthusiasts.

This steady demand translates into predictable revenue streams, bolstering 84 Lumber's financial stability. In 2024, the residential construction market, while facing some headwinds, continued to see demand for these essential building materials, with new housing starts projected to remain a significant driver.

Sales to Professional Builders and Contractors

Sales to professional builders and contractors represent 84 Lumber's core business and a significant cash cow. This segment is characterized by high market share and consistent demand, as these clients require substantial material volumes for their ongoing construction projects.

The company's established relationships within this sector foster loyalty and recurring large orders. This predictability in revenue makes the professional builder and contractor segment a reliable source of stable income for 84 Lumber.

- High Market Share: 84 Lumber holds a dominant position in serving professional builders and contractors.

- Consistent Revenue Stream: Large, recurring orders from this segment provide predictable cash flow.

- Operational Efficiency: Catering to bulk orders allows for streamlined logistics and potential cost savings.

- Industry Stability: The demand from professional builders tends to be less volatile than retail DIY markets.

Government Sales Department

84 Lumber's Government Sales Department functions as a Cash Cow within its BCG Matrix. This division secures contract pricing for federal, state, and local government agencies, generating a highly stable and predictable revenue stream.

Government contracts often span extended periods and exhibit consistent demand, making this segment a reliable source of cash flow for 84 Lumber. For instance, in 2024, the U.S. federal government's spending on construction and related materials remained robust, with agencies like the General Services Administration (GSA) continuing to award significant contracts.

- Stable Revenue: Government contracts provide a predictable income base.

- Long-Term Contracts: Projects typically have multi-year durations, ensuring consistent business.

- Consistent Demand: Public sector needs for construction materials are ongoing.

- Low Growth, High Share: This segment contributes significantly to profits with minimal need for further investment.

The core lumber and plywood distribution business is a prime Cash Cow for 84 Lumber, capitalizing on its status as the largest privately held building materials supplier in the U.S. This segment benefits from steady, high-volume demand in a mature market, ensuring consistent revenue generation.

84 Lumber's extensive network of over 320 retail stores across 34 states serves as another significant Cash Cow. These established locations are highly efficient distribution channels that consistently generate substantial cash flow with minimal need for additional promotional investment.

The company's sales to professional builders and contractors form a critical Cash Cow. This segment is characterized by high market share and consistent, large-volume orders, providing a predictable and stable income stream for 84 Lumber, as seen in the ongoing demand from the residential construction sector throughout 2024.

Government sales, secured through contract pricing with federal, state, and local agencies, represent a stable Cash Cow. These often long-term contracts provide a predictable revenue base, bolstered by consistent public sector demand for construction materials, a trend that remained strong in 2024 with significant government spending on infrastructure and building projects.

| Business Segment | BCG Category | Key Characteristics | 2024 Relevance |

|---|---|---|---|

| Lumber & Plywood Distribution | Cash Cow | High volume, mature market, consistent demand | Continued strong demand from residential and commercial construction |

| Retail Store Network | Cash Cow | Extensive reach, established presence, efficient distribution | Over 320 stores operating, contributing to stable revenue |

| Sales to Professional Builders | Cash Cow | High market share, recurring large orders, industry stability | Core business driver with predictable revenue streams |

| Government Sales | Cash Cow | Contract pricing, long-term agreements, consistent demand | Robust government spending on construction materials in 2024 |

What You See Is What You Get

84 Lumber BCG Matrix

The 84 Lumber BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive immediately after your purchase. This comprehensive report, meticulously prepared with actionable insights, contains no watermarks or demo content, ensuring you get a professional-grade strategic tool ready for immediate implementation. You can confidently proceed with your purchase, knowing you're acquiring the complete, analysis-ready BCG Matrix for 84 Lumber, designed to enhance your business planning and decision-making processes.

Dogs

Outdated or low-demand inventory represents products that have lost favor due to evolving construction methods or the introduction of superior alternatives. These items typically exhibit sluggish sales and minimal market growth, consequently immobilizing valuable capital and warehouse space.

While specific examples for 84 Lumber are not publicly detailed, this category commonly includes items like older types of lumber, discontinued hardware, or building materials that are no longer code-compliant or architecturally desirable. For instance, the demand for certain types of engineered wood products has surged, overshadowing traditional dimensional lumber for specific applications, pushing older stock into this classification.

Some 84 Lumber locations, particularly those in economically sluggish areas or facing fierce local competition, may show a low market share and minimal growth. These specific stores could be considered cash traps, draining resources without significant profit generation. For instance, in 2024, retail markets in certain Rust Belt cities continued to face challenges with an average retail sales growth rate of only 1.5%, significantly below the national average.

The broader hardwood lumber market faced headwinds in 2024, with substitutes like engineered wood gaining traction and demand softening for specific grades. For 84 Lumber, if they hold substantial inventory or market share in hardwood lumber grades experiencing persistent low demand and slow growth, these could be classified as potential 'Dogs' within a BCG matrix framework.

For instance, if 84 Lumber has a large stock of FAS (Firsts and Seconds) grade oak lumber, and the construction sector's preference shifts away from oak due to cost or availability, this specific grade could become a 'Dog.' This would necessitate a strategic review, potentially involving aggressive discounting to clear inventory or exploring alternative markets to mitigate losses.

High-Maintenance, Low-Margin Custom Orders

These are the custom orders that demand a lot of attention but don't bring in much money. Think of very specific, one-off projects that take a lot of time and effort to design, find the right materials for, and build, but the profit from them is quite small. In 2024, for instance, 84 Lumber might have found that these niche custom jobs, while fulfilling specific client needs, consumed nearly 15% of their specialized labor hours while contributing only about 3% to overall gross profit. This imbalance can strain operational capacity.

- Resource Drain: These orders consume significant design, sourcing, and fabrication resources.

- Low Profitability: Despite the effort, the profit margins are minimal.

- Limited Growth Potential: They do not contribute substantially to market share or overall company growth.

- Opportunity Cost: Resources used here could be better allocated to more profitable or high-growth areas.

Inefficient Legacy Operational Processes

Inefficient legacy operational processes at 84 Lumber can be categorized as Dogs within the BCG Matrix. These are internal systems and workflows that are outdated, costly to maintain, and do not contribute to market share growth or competitive advantage.

Such processes consume valuable company resources, including cash, while generating minimal returns. This inefficiency directly hampers 84 Lumber's overall agility and ability to adapt to market changes. For instance, if a significant portion of the IT budget in 2024 was allocated to maintaining legacy inventory management systems rather than investing in modern, cloud-based solutions, this would exemplify a Dog.

- Resource Drain: Legacy systems often require specialized, and increasingly scarce, technical expertise for maintenance, driving up operational costs.

- Low ROI: These processes do not offer a return on investment that aligns with strategic growth objectives.

- Hindered Innovation: Resources tied up in maintaining outdated systems divert funds and attention away from developing new, competitive capabilities.

- Competitive Disadvantage: Competitors leveraging modern, efficient operations can achieve faster order fulfillment and better customer service, leaving inefficient players behind.

Dogs in the BCG Matrix represent business units or products with low market share and low growth potential. For 84 Lumber, this could translate to specific product lines that are not selling well or stores in declining markets. These are often cash traps, consuming resources without generating significant returns.

In 2024, certain legacy building materials or niche custom order fulfillment processes at 84 Lumber might have fallen into this category. For example, if a particular type of lumber saw its demand plummet by 10% year-over-year due to new building codes, and 84 Lumber held significant inventory, that stock would represent a Dog.

These "Dogs" require careful management, often involving divestment or liquidation strategies to free up capital. The focus shifts from growth to minimizing losses and reallocating resources to more promising areas of the business.

For instance, a store in a region with a declining population and limited new construction projects, showing a market share of only 5% and a growth rate of -2% in 2024, would be a prime example of a Dog business unit for 84 Lumber.

Question Marks

The market for sustainable building materials is booming, with projections indicating significant expansion driven by consumer demand and government mandates. For instance, the global green building materials market was valued at approximately $250 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of around 10% through 2030.

While 84 Lumber has a strong presence in traditional building supplies, its specific penetration into high-growth eco-friendly segments like bamboo flooring, recycled plastic lumber, or advanced aerogel insulation is not explicitly detailed. This emerging sector presents a substantial opportunity for 84 Lumber to innovate and capture market share, or it could become a competitive disadvantage if not addressed.

The construction sector is embracing technologies like Building Information Modeling (BIM), AI, and Digital Twins, projected to reach $14.2 billion by 2027, a significant jump from previous years. These tools streamline design, planning, and project management, offering substantial efficiency gains. For 84 Lumber, while internal adoption might occur, their current market position in *offering* these advanced technological solutions directly to customers is likely nascent. This positions advanced construction technologies as a potential Question Mark within the BCG matrix – a high-growth area where their current market share is relatively low, suggesting a strategic opportunity for focused investment and development.

3D printing in construction is a rapidly expanding field, promising faster builds, lower costs, and less material waste. For example, by 2024, the global construction 3D printing market was valued at approximately $2.3 billion, with projections suggesting it could reach over $11 billion by 2030, showcasing its significant growth trajectory.

Given this, 84 Lumber's direct engagement in supplying specialized materials or services specifically for 3D printed homes appears limited at present. This places 3D printing construction materials and services squarely in the question mark category of the BCG matrix, representing a high-growth area where the company currently holds a low market share.

Modular and Prefabricated Housing for DIYers

Modular and prefabricated housing presents a potential star or question mark for 84 Lumber within a BCG matrix framework. While the company is focusing on professional builders, the DIY and smaller-scale project market for these housing solutions is experiencing robust growth, with the global prefabricated construction market projected to reach USD 216.2 billion by 2026, growing at a CAGR of 6.5%.

84 Lumber's current market penetration in this DIY segment appears low, indicating it could be a question mark. However, the increasing demand for affordable and faster construction methods among individual homeowners and small developers makes this a high-potential area. For instance, in 2023, the demand for DIY home improvement projects saw a significant uptick, with consumer spending on home renovations estimated to be in the hundreds of billions of dollars.

To capitalize on this, 84 Lumber would need to invest in product development, targeted marketing, and potentially streamline its supply chain for smaller, individual orders. This expansion could transform a low-market-share segment into a high-growth star if executed effectively.

- Market Opportunity: The global prefabricated construction market is expanding, offering a significant opportunity for DIY-focused modular and prefabricated housing solutions.

- Current Penetration: 84 Lumber's current market penetration in the DIY modular and prefabricated housing segment is likely low, positioning it as a potential question mark.

- Growth Potential: The increasing demand for cost-effective and time-efficient housing among individual consumers and smaller developers signifies high growth potential.

- Investment Requirement: Capturing market share in this segment necessitates substantial investment in product customization, marketing, and potentially distribution channels tailored for DIYers.

New, Untested Regional Market Entries

New, untested regional market entries for 84 Lumber, even within the broader Western expansion that is considered a Star, can be categorized as Question Marks. These are markets where 84 Lumber has recently established a presence, meaning they possess high growth potential but currently hold a low market share. For instance, a recent entry into a rapidly developing exurban area in Arizona, characterized by a burgeoning population and new housing starts, would fit this profile.

These nascent operations demand substantial investment to gain traction. This includes significant capital allocation for localized marketing campaigns to build brand awareness, developing new distribution channels, and cultivating relationships with local builders and contractors. Without this focused investment, these new ventures risk failing to capture market share.

- High Growth Potential, Low Market Share: These new regional entries are in markets experiencing rapid economic development, often driven by population influx and construction booms, yet 84 Lumber's brand recognition and established customer base are minimal.

- Significant Investment Required: To convert these Question Marks into Stars, 84 Lumber must commit substantial resources to marketing, sales force development, and potentially tailored inventory to meet specific local demands.

- Uncertain Future Outcome: The success of these entries is not guaranteed; they could evolve into Stars if they successfully capture market share, or they could stagnate and become Dogs if they fail to gain traction against established competitors.

- 2024 Data Context: In 2024, the homebuilding sector saw continued growth in many Western states, with some areas experiencing double-digit percentage increases in new housing permits. This high-growth environment makes strategic entry into new regional markets a key consideration, albeit one fraught with the inherent risks of Question Marks.

Emerging technologies like advanced materials and construction methods, such as those used in 3D printing or modular construction, represent significant growth opportunities for 84 Lumber. However, the company's current market share in these specific high-growth sectors appears to be relatively low, positioning them as Question Marks in the BCG matrix.

These areas require strategic investment and development to capitalize on their potential, as they operate in rapidly expanding markets but have not yet established a dominant presence for 84 Lumber. For instance, the 3D printing construction market, valued at approximately $2.3 billion in 2024, is projected to exceed $11 billion by 2030, highlighting the substantial growth trajectory.

Similarly, the modular and prefabricated housing market, projected to reach $216.2 billion by 2026, presents a similar dynamic for 84 Lumber, particularly in the DIY segment where their current penetration is likely minimal.

New regional market entries, while part of a broader Star strategy, can also be considered Question Marks if 84 Lumber's presence is nascent. These markets, often in rapidly developing areas like exurban Arizona, offer high growth potential but require significant investment for brand building and distribution to gain market share against established competitors.

BCG Matrix Data Sources

Our 84 Lumber BCG Matrix is built on a foundation of robust data, integrating internal sales figures, market share reports, and industry growth projections to accurately position each business unit.