84 Lumber Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

84 Lumber Bundle

84 Lumber navigates a construction materials market with significant buyer power due to readily available alternatives and price sensitivity among contractors. The threat of new entrants is moderate, as establishing a physical presence and supply chain requires substantial capital, yet the industry's fragmentation offers opportunities.

The full analysis reveals the real forces shaping 84 Lumber’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The building materials sector, especially for foundational items like lumber, can see a few dominant suppliers controlling a large portion of the market. Even with recent price stabilization, lumber costs remain higher than pre-2020 figures. This is due to persistent supply chain disruptions, timber scarcity, and labor shortages at sawmills, granting these key material providers considerable influence.

New tariffs imposed on essential imported materials like lumber from Canada, steel, and aluminum directly inflate the cost of goods for building material suppliers such as 84 Lumber. For instance, the Section 232 tariffs on steel and aluminum, first implemented in 2018 and largely maintained through 2024, have demonstrably increased raw material expenses for many manufacturers and distributors.

These trade policies can significantly shift power towards foreign and domestic producers, enabling them to command higher prices. This forces companies like 84 Lumber to either absorb these increased costs, impacting their profit margins, or pass them along to their customers, potentially affecting sales volume and market competitiveness.

The increasing demand for sustainable building materials like cross-laminated timber and recycled content places significant bargaining power in the hands of specialized suppliers. These niche providers, often few in number, cater to a growing market segment driven by consumer and regulatory preferences for eco-friendly options. For instance, the global sustainable building materials market was valued at approximately $250 billion in 2023 and is projected to grow substantially, further solidifying the leverage of these key suppliers.

Supplier Switching Costs

Supplier switching costs represent a significant factor in 84 Lumber's bargaining power of suppliers. Transitioning to a new supplier for essential building materials or manufactured components can incur substantial expenses. These costs often include establishing new logistics networks, adapting quality control procedures to match new product specifications, and the administrative burden of renegotiating contractual terms. In 2024, the construction industry continued to face supply chain volatility, making these switching costs even more pronounced.

These embedded costs effectively lock 84 Lumber into existing supplier relationships, thereby enhancing the leverage of those suppliers. For instance, if a supplier provides specialized, custom-molded components, the cost and time required to find and vet an alternative could be prohibitive. This situation grants established suppliers a stronger hand in price negotiations and other terms of service.

- High Switching Costs: For 84 Lumber, changing suppliers for key materials like lumber, trusses, or specialized hardware can involve significant upfront investment in new tooling, training, and testing.

- Logistical Complexity: Reconfiguring delivery routes, warehousing, and inventory management systems to accommodate a new supplier adds another layer of cost and operational disruption.

- Quality Assurance Adjustments: Ensuring consistent quality from a new supplier requires rigorous testing and validation, which can be time-consuming and expensive, particularly for materials with strict building code requirements.

- Supplier Loyalty: Long-term relationships with reliable suppliers often come with negotiated pricing advantages and preferential treatment, making the perceived benefits of switching less attractive.

Forward Integration Threat from Suppliers

While raw material suppliers typically don't pose a significant forward integration threat, manufacturers of building components could potentially move into distribution, directly challenging 84 Lumber. This is a less common scenario, but it's a possibility to consider within the competitive landscape.

However, the substantial investment required to replicate 84 Lumber's established distribution network and comprehensive service offerings presents a formidable barrier for most potential entrants. Building such infrastructure and customer relationships takes considerable time and capital, making direct competition through forward integration a high-risk strategy for many suppliers.

- Supplier Forward Integration: Manufacturers of building components may explore integrating into distribution, directly competing with 84 Lumber.

- High Barrier to Entry: Replicating 84 Lumber's extensive distribution network and service offerings is a significant challenge for suppliers.

- Limited Threat: For most suppliers, the capital and operational complexity make forward integration into distribution a less viable strategy.

The bargaining power of suppliers for 84 Lumber is considerable, particularly for specialized or essential building materials where supplier concentration is high. Persistent supply chain issues and labor shortages in 2024 continued to bolster the leverage of key lumber and component providers. Furthermore, new tariffs on imported materials have directly increased costs for distributors, strengthening the pricing power of both foreign and domestic producers.

The growing demand for sustainable building materials, a market valued at over $250 billion in 2023, gives specialized suppliers of eco-friendly options significant leverage. High switching costs, encompassing logistics, quality assurance, and contractual renegotiations, further entrench 84 Lumber with existing suppliers, limiting its flexibility in sourcing and pricing.

| Factor | Impact on 84 Lumber | Data/Trend (2023-2024) |

|---|---|---|

| Supplier Concentration | High leverage for dominant material providers | Lumber prices remain above pre-2020 levels due to ongoing supply constraints. |

| Tariffs on Materials | Increased raw material costs, reduced profit margins or higher prices for customers | Section 232 tariffs on steel and aluminum maintained through 2024, inflating input costs. |

| Demand for Sustainable Materials | Increased bargaining power for niche eco-friendly suppliers | Sustainable building materials market exceeded $250 billion in 2023. |

| Switching Costs | Lock-in effect, reinforcing supplier leverage | Supply chain volatility in 2024 made switching suppliers more costly and disruptive. |

What is included in the product

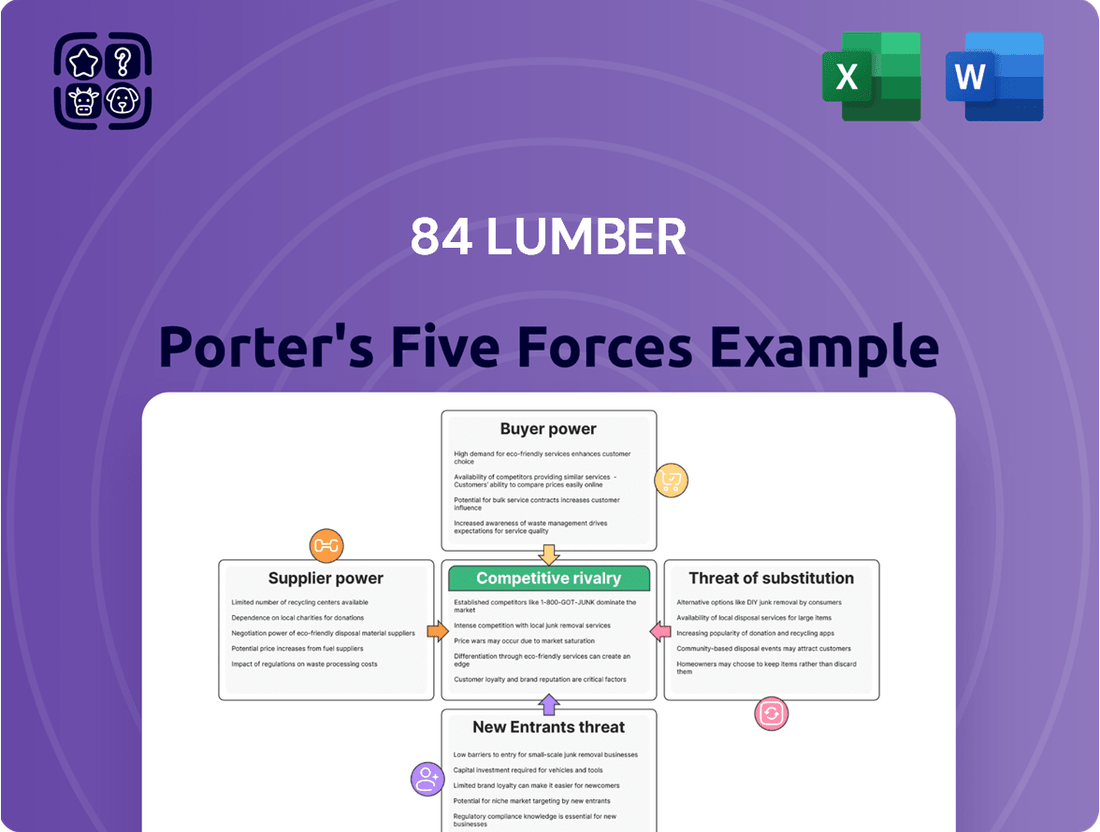

This analysis dissects the competitive forces impacting 84 Lumber, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the building materials industry.

A comprehensive breakdown of the competitive landscape, allowing 84 Lumber to proactively address threats and capitalize on opportunities.

Customers Bargaining Power

Professional builders and contractors, a key customer group for 84 Lumber, are acutely aware of material costs. These costs directly affect their profit margins and their ability to win bids. This means they are constantly looking for the best deals and cost-effective solutions.

The current economic climate sees construction costs remaining high, further intensifying this price sensitivity. Builders are actively seeking value-engineered alternatives and competitive pricing to manage their project budgets effectively. For instance, in 2024, lumber prices, a significant component for builders, have seen fluctuations, making cost-conscious sourcing paramount.

Large contractors, like those building multi-family housing, are key customers for 84 Lumber. In 2024, these professional builders are increasingly consolidating their purchasing power. This means they buy in bulk, giving them significant leverage to negotiate better prices and terms.

Customers can easily find alternative suppliers for building materials, as the market includes large chains like Home Depot and Lowe's, alongside numerous independent and specialty yards. This wide availability means buyers aren't reliant on a single source, giving them considerable leverage.

The ability for customers to switch providers quickly, particularly for standard lumber and building supplies, directly impacts 84 Lumber's pricing power. For instance, in 2024, the U.S. Census Bureau reported that residential construction spending remained robust, indicating a healthy demand but also a competitive landscape where price is a key differentiator.

DIY Customer Cost-Consciousness and Information Access

DIY customers are becoming much more aware of costs and have easy access to a wealth of information online. This includes tutorials, product reviews, and direct price comparisons, which really helps them make smarter buying choices. For example, in 2024, online searches for home improvement project costs saw a significant increase, indicating heightened DIYer research. This increased transparency and a strong focus on getting the best value for their money naturally boosts their bargaining power.

- DIYer Information Access: Online platforms provide DIY customers with extensive product knowledge and pricing data.

- Cost-Consciousness: The DIY segment is highly sensitive to price fluctuations and seeks the most economical solutions.

- Increased Bargaining Power: Empowered by information, DIY customers can negotiate better terms or seek alternative suppliers.

- Market Trends: A growing DIY market, as seen in the projected 4.5% annual growth rate for the home improvement retail sector through 2028, amplifies this customer segment's influence.

Customer Ability to Backward Integrate

The ability of customers to backward integrate, meaning they could produce the products or services themselves, poses a potential threat. For 84 Lumber, this threat is generally low for most of its customer base, which includes individual DIY enthusiasts and smaller contractors.

However, for very large construction firms or major developers, the possibility of direct sourcing of certain materials or even manufacturing basic components cannot be entirely dismissed. This could reduce their reliance on suppliers like 84 Lumber. Despite this, the significant capital investment and operational complexity associated with producing a wide range of building materials typically limit the extent of backward integration.

In 2024, the construction industry saw continued focus on supply chain efficiency. For example, large developers might explore partnerships for pre-fabricated components, a form of partial backward integration, rather than full in-house manufacturing of all materials.

- Limited Threat: Most 84 Lumber customers, like DIYers and small contractors, lack the scale and resources for backward integration.

- Potential for Large Firms: Major construction companies might consider direct sourcing or partial in-house production of specific materials.

- Capital & Complexity Barrier: Full backward integration across the diverse range of lumber and building supplies is economically prohibitive for most.

- Industry Trend: While full integration is rare, large developers may pursue pre-fabrication or strategic sourcing as partial alternatives.

Customers, particularly professional builders and contractors, wield significant bargaining power due to their price sensitivity and the availability of alternative suppliers. In 2024, the competitive landscape for building materials means that buyers can easily compare prices and terms from various sources, including large retail chains and independent yards. This makes it challenging for 84 Lumber to dictate pricing, as customers can switch providers if better deals are found.

The increasing consolidation of purchasing power among large contractors further amplifies their leverage. These major buyers procure materials in bulk, enabling them to negotiate more favorable prices and payment terms. This trend was evident in 2024, with robust construction spending reported by the U.S. Census Bureau, highlighting a market where cost efficiency is paramount for winning bids and maintaining profitability.

Even DIY customers are more informed than ever, leveraging online resources for price comparisons and product reviews. This heightened transparency empowers them to seek the best value, contributing to their overall bargaining strength. The growing DIY market, projected for continued growth, means this segment's influence is only likely to increase.

| Customer Segment | Key Bargaining Factors | Impact on 84 Lumber |

|---|---|---|

| Professional Builders/Contractors | Price sensitivity, bulk purchasing, availability of alternatives | Limits pricing power, requires competitive pricing strategies |

| Large Developers/Construction Firms | Consolidated buying power, potential for direct sourcing/partial integration | Significant negotiation leverage, potential for reduced reliance on suppliers |

| DIY Customers | Information access, cost-consciousness, online price comparisons | Drives demand for value, necessitates clear pricing and product information |

Same Document Delivered

84 Lumber Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It meticulously details each of Porter's Five Forces as they apply to 84 Lumber, providing a comprehensive understanding of the competitive landscape. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry, all presented in a professionally formatted and ready-to-use file.

Rivalry Among Competitors

The building materials and construction supply sector is highly competitive, featuring a blend of national giants like Home Depot and Lowe's, alongside a vast network of regional and local independent suppliers. This fragmentation means 84 Lumber, despite its significant presence across 34 states as the largest privately held supplier, contends with thousands of active competitors.

The U.S. construction industry demonstrated robust fundamentals throughout 2024, marked by a notable increase in both output and overall spending. This positive trajectory, however, is anticipated to encounter headwinds in 2025, primarily stemming from persistent labor shortages and ongoing fluctuations in material costs.

While new residential and commercial construction projects are projected to experience modest growth, the remodeling and repair sectors present more substantial opportunities. This dual-market dynamic can offer some relief from intense competitive pressures, but the overall market environment is expected to remain volatile.

Competitive rivalry in the building materials sector extends beyond mere price competition. 84 Lumber distinguishes itself through an extensive product catalog, superior service quality, and unique value-added services like pre-fabricated components, specialized custom shops, and complete installation solutions. This focus on comprehensive project support caters to both residential and commercial clients, setting it apart from competitors who may offer a narrower range of products or services.

High Fixed Costs and Inventory Management

The building supply industry, including companies like 84 Lumber, is characterized by significant fixed costs. These costs stem from maintaining a widespread network of retail locations, manufacturing facilities, and substantial inventory levels. For instance, the capital expenditure for a single lumber yard can run into millions of dollars.

These high fixed costs necessitate high sales volumes to achieve profitability, which in turn fuels intense competition. Companies are driven to aggressively pursue market share to spread these overheads across a larger revenue base. This pressure often leads to price wars and aggressive marketing campaigns.

- High Capital Investment: Operating a national chain of lumber yards and manufacturing plants requires substantial upfront investment in real estate, equipment, and infrastructure.

- Inventory Holding Costs: Maintaining a diverse and ample stock of building materials incurs significant warehousing, insurance, and potential obsolescence costs.

- Economies of Scale Imperative: Companies must achieve high sales volumes to offset fixed costs, making market share a critical determinant of success and profitability.

- Operational Efficiency Focus: Intense rivalry pushes firms to constantly optimize their supply chains and operational processes to reduce costs and maintain competitive pricing.

Mergers, Acquisitions, and Consolidation Trends

The building materials supply industry is actively undergoing mergers and acquisitions. Major players are consolidating to gain market share and achieve greater operational efficiencies through vertical or horizontal integration. This trend is particularly evident as larger companies acquire more retail locations, thereby increasing competitive pressure on smaller, independent suppliers.

These consolidation efforts create significant purchasing power for the larger, combined entities. This enhanced buying leverage allows them to negotiate more favorable terms with manufacturers and suppliers, often resulting in lower costs. Consequently, independent suppliers face a heightened challenge in matching the pricing and product availability offered by these consolidated competitors.

- Industry Consolidation: The building materials sector has seen a notable increase in M&A activity, with companies aiming to expand their footprint and market dominance.

- Purchasing Power Advantage: Consolidated firms benefit from bulk purchasing, enabling them to secure better pricing and terms, which independent rivals struggle to match.

- Impact on Independents: This consolidation intensifies competition, putting smaller suppliers at a disadvantage in terms of cost and scale.

- 2024 Data Insight: While specific 2024 M&A deal values are still emerging, the trend of consolidation in the broader construction supply chain, including lumber, has been a persistent theme, with companies like Builders FirstSource continuing strategic acquisitions.

The competitive rivalry within the building materials sector is fierce, driven by a fragmented market and high fixed costs. 84 Lumber operates in an environment with numerous national, regional, and local competitors, necessitating a focus on differentiation through service and value-added offerings. The industry's consolidation trend, with larger players acquiring smaller ones, further intensifies this rivalry by increasing purchasing power and creating pricing advantages.

| Competitive Factor | Description | Impact on 84 Lumber |

|---|---|---|

| Market Fragmentation | Thousands of national, regional, and local suppliers compete. | Requires broad reach and localized service strategies. |

| High Fixed Costs | Significant investment in infrastructure and inventory. | Drives the need for high sales volume and operational efficiency. |

| Industry Consolidation | Mergers and acquisitions increase the scale of competitors. | Exacerbates pressure on smaller players due to enhanced purchasing power. |

| Differentiation Strategy | Focus on product breadth, service quality, and value-added services. | Key to standing out against price-focused competitors. |

SSubstitutes Threaten

Traditional construction methods, like wood framing and concrete block, continue to pose a threat to innovative building materials. Their deep-rooted acceptance in the industry means many builders and consumers are already familiar and comfortable with these techniques. For instance, in 2024, the U.S. single-family housing starts heavily relied on these established methods, with wood framing being a dominant material.

The perceived lower upfront cost of traditional materials also makes them a compelling substitute. While newer, sustainable options might offer long-term savings, the initial investment can be a barrier for many projects. This cost-effectiveness, coupled with established supply chains, ensures traditional methods remain a readily available and often preferred alternative for a significant segment of the market.

The threat of substitutes for traditional lumber is escalating with the emergence of innovative building materials. For instance, cross-laminated timber (CLT) offers comparable structural integrity and is increasingly adopted in mid-rise construction, a market segment previously dominated by lumber. The global CLT market was valued at approximately $1.2 billion in 2023 and is projected to grow significantly, indicating a direct substitution potential.

Materials like transparent wood and self-repairing concrete also present unique advantages, offering enhanced durability or novel aesthetic qualities that could sway construction choices away from conventional wood products. The increasing focus on sustainability and performance in the construction sector fuels the adoption of these alternatives, posing a direct challenge to lumber's market share.

Prefabricated and modular construction methods are increasingly impacting the building materials industry. These techniques, which involve building components or entire modules off-site, offer benefits like faster completion times and improved quality control. For instance, the modular construction market was valued at approximately $170 billion globally in 2023 and is projected to grow significantly, indicating a rising adoption rate.

The efficiency and cost-effectiveness of prefabrication present a clear substitute threat to traditional on-site construction methods. By reducing the need for on-site labor and minimizing material waste, modular building can lower overall project costs. This directly impacts demand for the raw materials and components typically supplied by companies like 84 Lumber, as more projects opt for these streamlined, factory-built solutions.

Digital Tools and Design Optimization

The threat of substitutes is amplified by advancements in digital tools. Technologies like Building Information Modeling (BIM) and sophisticated design optimization software are changing how construction projects are planned and executed. These tools can significantly reduce the amount of raw materials required by identifying efficiencies and minimizing waste.

For instance, in 2024, the construction industry saw increased adoption of BIM, with projections indicating continued growth. This shift means that projects might require fewer standard lumber products, directly impacting the sales volume for companies like 84 Lumber. The ability of these digital solutions to streamline processes and reduce material consumption presents a viable alternative to traditional, more material-heavy construction methods.

- Digital Design & Optimization: Software can virtually construct projects, identifying material needs precisely and minimizing over-ordering.

- BIM Adoption: Increased use of BIM in 2024 allows for better planning and material allocation, potentially reducing waste by up to 10-20% on some projects.

- Material Efficiency: Optimized designs can lead to a reduced demand for standard building supplies, substituting them with smarter material utilization.

- Cost Savings: These digital substitutes offer potential cost savings for builders through reduced material purchases and less waste disposal.

DIY Solutions and Online Resources

The rise of accessible online tutorials, readily available DIY kits, and direct-to-consumer e-commerce sales presents a significant threat of substitution for traditional lumber suppliers like 84 Lumber. Consumers can now more easily tackle complex home improvement projects themselves, bypassing the need for professional contractors who would typically source materials from these suppliers. This trend is particularly potent as it directly impacts the demand for both raw materials and potentially installation services, fragmenting the traditional value chain.

For example, in 2024, the home improvement market continued to see robust growth, with a significant portion attributed to DIY projects. Data from industry reports indicated that online sales for home building materials saw a year-over-year increase of over 15% in the first half of 2024, highlighting the growing consumer comfort with purchasing materials online for self-installation. This shift empowers consumers to bypass traditional retail channels and potentially reduce project costs, directly substituting the services and products offered by companies like 84 Lumber.

- Increased DIY Project Complexity: Online platforms now offer detailed guides and video demonstrations for tasks previously considered too complex for the average homeowner, reducing reliance on professional services.

- Direct-to-Consumer Material Sales: E-commerce allows manufacturers and specialized suppliers to sell directly to end-users, often at competitive prices, bypassing intermediaries like 84 Lumber.

- Cost Savings for Consumers: By undertaking projects themselves and sourcing materials directly, consumers can achieve substantial cost savings compared to hiring professionals and purchasing through traditional channels.

The threat of substitutes for traditional lumber is multifaceted, encompassing both established building materials and emerging alternatives. While wood framing remains dominant, innovations in engineered wood products and alternative materials like steel and composites are gaining traction. These substitutes often offer advantages in terms of durability, fire resistance, or sustainability, directly challenging lumber's market share. For instance, the global engineered wood market was valued at over $70 billion in 2023, with steady growth projected, indicating a significant substitution trend.

Furthermore, the increasing adoption of prefabrication and modular construction techniques presents a substantial substitute threat. These methods streamline the building process, often reducing the reliance on traditional on-site lumber. In 2024, the modular construction sector continued its expansion, with industry reports suggesting a compound annual growth rate of over 6% for the coming years. This efficiency-driven approach can lead to lower overall project costs and faster completion times, making it an attractive alternative for developers.

Digitalization also plays a role, with Building Information Modeling (BIM) and advanced design software enabling more precise material utilization and waste reduction. This can lead to projects requiring less raw lumber than previously. The growing integration of BIM in construction projects, with its adoption rate increasing significantly in 2024, signifies a shift towards more optimized material usage, indirectly substituting the volume demand for traditional lumber.

| Substitute Material/Method | Key Advantages | Market Trend/Growth (Approximate) | Impact on Lumber Demand |

|---|---|---|---|

| Engineered Wood Products (e.g., CLT) | Strength, Sustainability, Fire Resistance | Global market valued over $70 billion (2023), steady growth | Direct substitution in structural applications |

| Steel Framing | Durability, Fire Resistance, Pest Resistance | Significant market share in commercial construction, stable growth | Alternative for structural components |

| Modular/Prefabricated Construction | Speed, Cost-Efficiency, Quality Control | Global market projected to grow over 6% CAGR | Reduced on-site lumber requirements |

| Digital Design & Optimization (BIM) | Material Efficiency, Waste Reduction | Increased adoption in 2024, driving smarter material use | Indirectly reduces overall lumber volume needed |

Entrants Threaten

The building materials supply industry demands significant upfront capital. Think about the cost of acquiring land, building numerous retail locations, setting up manufacturing facilities for components, and creating an extensive logistics network. For a company like 84 Lumber, which operates hundreds of locations, this initial investment is immense, acting as a major deterrent for potential new competitors.

Furthermore, to effectively compete on price, new entrants must achieve substantial economies of scale. This means producing and distributing materials in large volumes to lower per-unit costs. Without this scale, it's incredibly difficult to match the pricing strategies of established players like 84 Lumber, making market penetration a steep uphill battle.

New entrants grapple with the immense challenge of establishing robust distribution and logistics networks. Replicating the scale and efficiency required for nationwide operations, especially in the building materials sector, demands significant capital investment and operational expertise.

Consider 84 Lumber's extensive infrastructure; they manage a fleet exceeding 2,000 trucks, a critical asset for timely and cost-effective deliveries across numerous states. This established logistical capability represents a formidable barrier for any new player attempting to enter the market.

Established players like 84 Lumber benefit from deep-rooted ties with numerous material manufacturers and timber suppliers. These existing relationships often translate into preferential pricing and guaranteed availability of essential products, a significant hurdle for newcomers. For instance, in 2024, the U.S. lumber market saw prices fluctuate, making consistent and cost-effective sourcing a critical competitive advantage.

Brand Recognition and Customer Loyalty

84 Lumber has cultivated a robust brand image, earning accolades that underscore its reputation for reliability and market leadership. This established trust is a significant barrier for newcomers aiming to attract professional builders and DIY enthusiasts in a crowded marketplace.

New entrants face a formidable challenge in replicating 84 Lumber's brand recognition and the deep customer loyalty it commands. For instance, in 2023, 84 Lumber reported over $3 billion in revenue, a testament to its strong market presence and customer base.

- Brand Strength: 84 Lumber's awards and consistent performance have built a strong foundation of trust.

- Customer Loyalty: Repeat business from professional contractors and homeowners is a key competitive advantage.

- Market Saturation: The building materials sector is highly competitive, making it difficult for new players to gain traction.

- High Entry Costs: Significant investment is required to build brand awareness and establish a distribution network comparable to 84 Lumber.

Labor Shortages and Skilled Workforce Requirements

The construction and building supply industry grapples with ongoing labor shortages, especially for skilled trades and experienced drivers. New entrants would face significant hurdles in recruiting and retaining the essential workforce needed for operations, manufacturing, and logistics, thereby increasing barriers to market entry.

For instance, in 2024, the U.S. Bureau of Labor Statistics reported a substantial demand for construction laborers, with projections indicating a need for 575,000 additional workers by 2032. This scarcity directly impacts a new company's ability to scale and compete effectively.

- Skilled Labor Gap: Difficulty in finding experienced carpenters, electricians, and plumbers.

- Driver Shortage: A critical lack of qualified truck drivers impacts supply chain reliability.

- Training Costs: New entrants must invest heavily in training to develop a competent workforce.

- Wage Competition: Entrants must offer competitive wages and benefits to attract talent from established players.

The threat of new entrants in the building materials supply industry, particularly for a company like 84 Lumber, is significantly mitigated by several high barriers. These include the substantial capital required for infrastructure, the need for economies of scale to compete on price, and the complexity of establishing efficient distribution networks. For example, 84 Lumber's fleet of over 2,000 trucks highlights the logistical scale a new player must replicate.

Established relationships with suppliers and strong brand loyalty further deter new competitors. In 2024, the fluctuating U.S. lumber market emphasized the advantage of consistent, cost-effective sourcing that established players like 84 Lumber possess. The company's 2023 revenue exceeding $3 billion underscores its entrenched market position and customer trust, making it difficult for newcomers to gain traction.

The industry also faces a critical shortage of skilled labor and drivers, as noted by the U.S. Bureau of Labor Statistics projections for construction workers. New entrants would need to invest heavily in recruitment, training, and competitive wages to overcome this challenge, adding another layer of difficulty to market entry.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Land acquisition, retail/manufacturing facilities, logistics network | Extremely high initial investment |

| Economies of Scale | Lower per-unit costs through high-volume production/distribution | Difficult to match pricing of established players |

| Distribution Network | Nationwide logistics and delivery capabilities | Requires massive investment and expertise |

| Supplier Relationships | Preferential pricing and guaranteed product availability | Newcomers face challenges in securing reliable, cost-effective supply |

| Brand Recognition & Loyalty | Established trust and repeat business | Significant hurdle to attract customers |

| Labor Shortages | Scarcity of skilled trades and drivers | Increased recruitment and training costs, operational delays |

Porter's Five Forces Analysis Data Sources

Our 84 Lumber Porter's Five Forces analysis is built upon a foundation of robust data, including industry-specific market research reports, financial disclosures from publicly traded competitors, and economic indicators relevant to the construction and building materials sector.