Shanghai Wanye Enterprises PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shanghai Wanye Enterprises Bundle

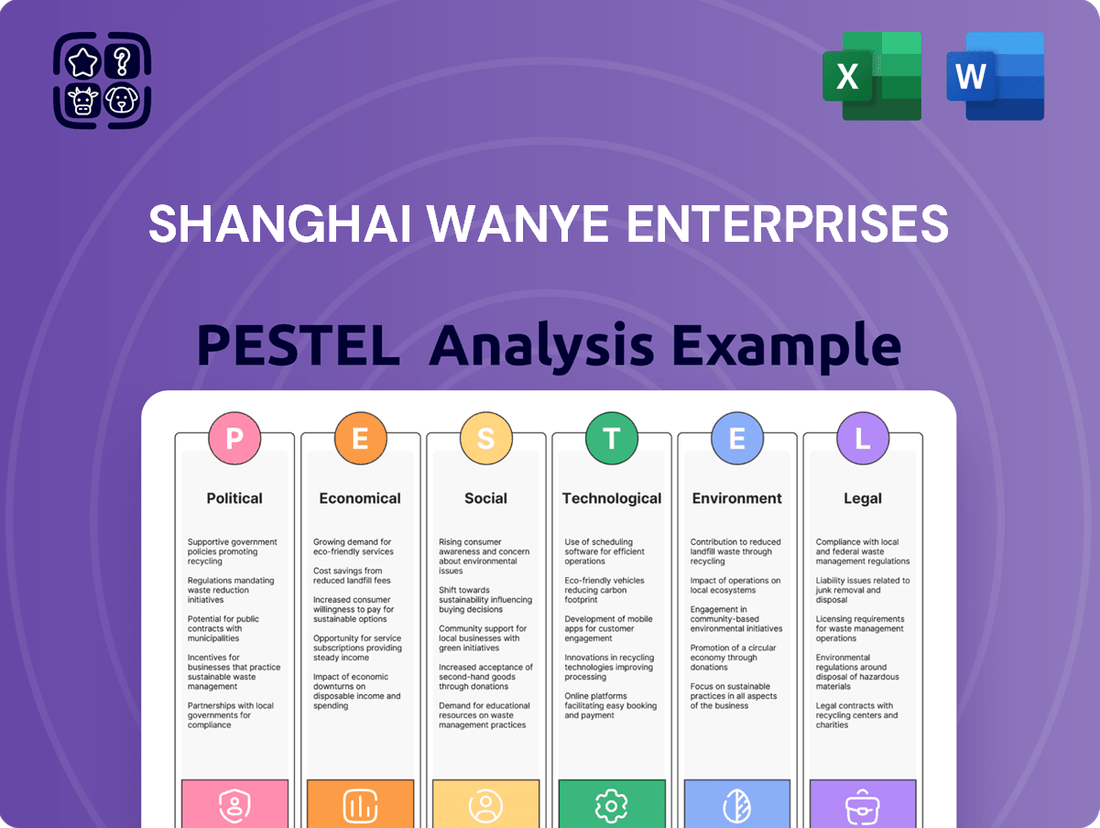

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping Shanghai Wanye Enterprises. Our meticulously researched PESTLE analysis provides a strategic roadmap, revealing hidden opportunities and potential threats. Equip yourself with the foresight needed to navigate the dynamic Chinese market. Download the full, actionable report now and gain a decisive competitive advantage.

Political factors

The Chinese government's commitment to semiconductor self-sufficiency, exemplified by programs like Made in China 2025 and the National IC Industry Investment Fund (often referred to as the 'Big Fund'), directly benefits companies in the sector. This robust political backing translates into tangible advantages such as potential subsidies and tax incentives, fostering domestic manufacturing growth.

The 'Big Fund' alone has committed substantial capital, with its phase I and II phases reportedly injecting over 130 billion USD into the domestic chip industry. This significant financial injection underscores the government's strategic priority to reduce reliance on foreign semiconductor technology, a move that creates a more supportive operational landscape for companies like Shanghai Wanye.

The ongoing US-China trade and tech war continues to reshape global supply chains, particularly impacting the semiconductor industry. US export controls, implemented in late 2023 and further tightened in early 2024, restrict China's access to advanced chip-making equipment and technology. This has led to a significant slowdown in China's ability to produce cutting-edge semiconductors, affecting numerous downstream industries.

Despite these challenges, the restrictions are fueling China's commitment to achieving technological self-sufficiency. This drive for indigenous innovation creates opportunities for domestic suppliers, including those in the industrial equipment sector. For instance, Chinese companies are investing heavily in developing alternative manufacturing processes and equipment, potentially benefiting firms like Shanghai Wanye that can cater to this growing domestic demand for localized solutions.

The impact on Shanghai Wanye Enterprises will likely be a mixed one. While global export markets for certain high-tech components might be constrained due to US sanctions, the increased focus on domestic production within China could bolster demand for its specialized equipment and services. China's stated goal of reducing reliance on foreign technology by 2025, with significant government funding allocated to domestic semiconductor development, underscores this potential shift.

China's drive for national self-sufficiency in semiconductors, particularly in integrated circuit core equipment, is a significant political factor for Shanghai Wanye. While the ambitious 70% domestic content target for 2025 under the "Made in China 2025" initiative may not be fully realized, the underlying policy momentum remains strong. This national imperative fuels investment and demand for domestic solutions, directly benefiting companies like Shanghai Wanye that are involved in this critical sector.

Local Government Policies in Shanghai

Shanghai’s local government actively shapes its economic landscape through targeted policies, particularly those fostering technological advancement and urban development. These initiatives often mirror national directives, aiming to bolster key sectors. For instance, Shanghai’s commitment to becoming a global innovation hub includes preferential policies for high-tech enterprises, potentially benefiting Shanghai Wanye’s real estate ventures in tech-centric zones.

Specific urban planning directives in Shanghai can directly influence Shanghai Wanye’s real estate portfolio. These policies might include zoning changes, infrastructure investments in developing districts, or incentives for green building practices, all of which can impact property values and development opportunities. The city’s focus on smart city development, for example, creates demand for modern, connected commercial and residential spaces.

Local government support can extend to specific industry clusters. Shanghai’s strategic push into sectors like semiconductors or artificial intelligence often comes with localized incentives, such as tax breaks or streamlined approval processes for businesses operating within these designated areas. Shanghai Wanye may leverage these localized advantages, particularly if its projects are situated within or adjacent to these government-supported industrial parks.

- Shanghai's 2024 Pudong New Area plan emphasizes integrated urban development, potentially creating new commercial and residential opportunities relevant to Shanghai Wanye.

- Local incentives for green construction in Shanghai, part of the city's sustainability goals, can offer cost advantages and attract environmentally conscious buyers to Shanghai Wanye's developments.

- Government support for the integrated circuit industry in Shanghai, with significant investment planned through 2025, could drive demand for specialized commercial real estate managed or developed by Shanghai Wanye.

Intellectual Property Protection and Enforcement

China is actively enhancing its intellectual property (IP) framework, aiming to create a more favorable business climate. This includes speeding up trademark law revisions and tightening controls on abusive trademark filings. For Shanghai Wanye Enterprises, a company deeply involved in integrated circuit equipment, strong IP protection is vital for securing its technological advancements and deterring potential infringements.

The government’s focus on IP optimization is a positive development for technology firms. For instance, in 2023, China saw a significant rise in IP-related court cases, indicating increased enforcement efforts. However, despite these improvements, challenges in fully realizing robust IP protection and enforcement remain a consideration for companies like Shanghai Wanye.

- Trademark Law Revisions: Accelerating the process to strengthen protections against infringement.

- Malicious Registration Regulation: Implementing stricter measures to curb bad-faith trademark applications.

- Impact on Technology Firms: Crucial for safeguarding innovation in sectors like integrated circuit equipment.

- Enforcement Challenges: Ongoing efforts to ensure consistent and effective IP protection.

The Chinese government's strategic push for semiconductor self-sufficiency, backed by substantial funding like the 'Big Fund' (over $130 billion invested in phases I and II), creates a supportive environment for domestic players. This policy aims to reduce reliance on foreign technology, directly benefiting companies involved in the integrated circuit supply chain.

While US export controls enacted in late 2023 and early 2024 have impacted China's access to advanced chip-making equipment, this has intensified the drive for indigenous innovation. This creates opportunities for domestic suppliers and manufacturers, potentially benefiting Shanghai Wanye by catering to the growing demand for localized solutions.

Shanghai's local government policies, mirroring national directives, focus on technological advancement and urban development. Initiatives like the Pudong New Area plan for 2024 and incentives for green construction can create favorable conditions and demand for Shanghai Wanye's real estate and development projects, especially in tech-focused zones.

China's ongoing efforts to strengthen its intellectual property (IP) framework, including trademark law revisions and tighter controls on abusive filings, are crucial for technology firms like Shanghai Wanye. While enforcement remains an area of focus, improved IP protection safeguards innovation in the critical integrated circuit equipment sector.

| Political Factor | Description | Impact on Shanghai Wanye | Supporting Data/Initiatives |

|---|---|---|---|

| Semiconductor Self-Sufficiency | Government drive to reduce foreign reliance in chip manufacturing. | Increased demand for domestic equipment and services; potential for subsidies. | 'Big Fund' investment exceeding $130 billion; Made in China 2025 initiative. |

| US-China Tech War | Trade restrictions and export controls impacting technology access. | Constrained global markets but boosted domestic demand for alternatives. | US export controls (late 2023/early 2024); China's focus on indigenous innovation. |

| Local Urban Planning | Shanghai's city development policies and zoning. | Creation of new commercial/residential opportunities; demand for modern spaces. | Shanghai's 2024 Pudong New Area plan; smart city development initiatives. |

| Intellectual Property (IP) Protection | Government efforts to enhance IP laws and enforcement. | Safeguarding technological advancements and deterring infringement. | Trademark Law Revisions; increased IP-related court cases in 2023. |

What is included in the product

This PESTLE analysis delves into the external macro-environmental factors influencing Shanghai Wanye Enterprises, examining Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by highlighting opportunities and threats derived from current market trends and regulatory landscapes.

Shanghai Wanye Enterprises' PESTLE analysis provides a clear, summarized version of external factors, relieving the pain point of information overload during strategic planning.

Economic factors

The global semiconductor market is on a strong upward trajectory, fueled by the insatiable demand for advanced technologies like artificial intelligence, robust data centers, high-performance computing (HPC), and a wide array of electronic devices. This surge in demand is expected to propel the market into continued double-digit growth throughout 2025, with sales figures anticipated to set new all-time highs.

This impressive market expansion creates a favorable environment for Shanghai Wanye Enterprises, whose core business revolves around the development, production, and sale of integrated circuit core equipment. The increasing need for sophisticated semiconductor manufacturing tools directly benefits companies like Shanghai Wanye, positioning them to capitalize on this sustained industry boom.

China's position as the globe's foremost semiconductor consumer fuels robust domestic demand for manufacturing equipment. The nation's aggressive push for self-sufficiency in chip production directly translates into substantial investment in semiconductor fabrication facilities and the machinery they require.

This internal market strength is a significant advantage for companies like Shanghai Wanye, offering a degree of insulation from unpredictable international trade policies and global economic downturns. For instance, China's integrated circuit industry investment fund, often referred to as the "Big Fund," has channeled billions into domestic semiconductor companies, underscoring the government's commitment to this sector.

Shanghai Wanye Enterprises' real estate segment faces a nuanced market. While China's property sector grappled with issues, Shanghai's market, especially the high-end, demonstrated a tentative rebound in early 2025. This recovery was fueled by government stimulus measures and deferred buyer interest.

Data from early 2025 indicated a notable uptick in luxury property transactions in Shanghai, with some reports suggesting a year-on-year increase of over 15% in sales volume for prime residential units. This resilience in a key market segment offers a degree of optimism for Wanye's property sales revenue.

Investment in High-Tech Manufacturing

China's unwavering commitment to advancing its manufacturing sector, particularly in high-tech areas, provides a fertile ground for Shanghai Wanye Enterprises. The nation's strategic investments in automation, digitization, and cutting-edge industries are designed to foster industrial upgrading, directly fueling demand for sophisticated equipment and specialized technical services that Shanghai Wanye offers.

This national drive translates into a robust and consistent market for advanced manufacturing solutions. For instance, China's industrial robot installations saw a significant increase, with the country accounting for over 50% of global installations in recent years, highlighting the scale of this technological adoption. This trend is projected to continue, with further expansion anticipated through 2025 and beyond, creating sustained opportunities for companies aligned with these national priorities.

- National Strategy: China's Made in China 2025 initiative prioritizes advanced manufacturing, robotics, and AI.

- Investment Growth: Government and private sector investment in R&D for high-tech manufacturing is set to exceed 2.5 trillion RMB by 2025.

- Market Demand: The adoption of smart manufacturing technologies is expected to drive a compound annual growth rate of over 15% for related equipment and services through 2026.

- Automation Trends: China's density of industrial robots per 10,000 workers is projected to reach 300 by 2025, up from approximately 137 in 2022, indicating massive growth.

Impact of Global Supply Chain Resilience Efforts

Global geopolitical tensions are a major catalyst for supply chain resilience initiatives, with a notable trend towards regionalizing critical manufacturing sectors like semiconductors. This shift is projected to reshape global trade flows, impacting companies like Shanghai Wanye Enterprises by potentially altering sourcing strategies and market access.

The push for reshoring and nearshoring, driven by concerns over disruptions, could foster growth for domestic suppliers. However, it also necessitates careful navigation of shifting trade policies and the formation of new international partnerships. For instance, the US CHIPS Act, enacted in 2022 with over $52 billion in funding, aims to boost domestic semiconductor production, signaling a broader global movement towards supply chain diversification.

- Regionalization: Increased focus on localized production hubs for critical goods.

- Trade Policy Evolution: Companies must adapt to evolving international trade agreements and tariffs.

- Investment in Resilience: Significant capital is being directed towards diversifying supply chain dependencies.

China's economic landscape in 2024-2025 is characterized by a strategic focus on high-tech manufacturing and domestic consumption, creating a supportive environment for companies like Shanghai Wanye Enterprises. Government initiatives, such as the Made in China 2025 plan, continue to drive investment in advanced industries, directly benefiting Wanye's core semiconductor equipment business.

The real estate sector in Shanghai also shows signs of recovery, with stimulus measures and pent-up demand contributing to a modest rebound in luxury property sales in early 2025. This resilience in a key market segment offers a positive outlook for Wanye's property division, even as broader economic headwinds persist.

The nation's commitment to technological self-sufficiency, particularly in semiconductors, translates into substantial domestic demand for manufacturing equipment and services. This trend is amplified by significant government funding, like the "Big Fund," which underscores a long-term strategic commitment to bolstering the domestic chip industry through 2025 and beyond.

Shanghai Wanye Enterprises is well-positioned to benefit from these economic trends, leveraging China's industrial upgrading initiatives and strong domestic market demand for advanced manufacturing solutions. The company's diversified business model, encompassing both high-tech equipment and real estate, allows it to capitalize on multiple growth drivers within the Chinese economy.

| Economic Factor | 2024 Projection/Data | 2025 Projection/Data | Impact on Shanghai Wanye Enterprises |

|---|---|---|---|

| GDP Growth (China) | ~5.0% | ~4.8% | Stable domestic demand for Wanye's products and services. |

| Semiconductor Market Growth | 15-20% | 12-18% | Increased demand for Wanye's integrated circuit core equipment. |

| Shanghai Property Market (Luxury Segment) | Tentative Rebound | Moderate Growth | Positive impact on Wanye's real estate revenue. |

| Government Investment in High-Tech Manufacturing | Significant (e.g., "Big Fund" allocations) | Continued High Levels | Sustained market opportunities for Wanye's equipment and services. |

Same Document Delivered

Shanghai Wanye Enterprises PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Shanghai Wanye Enterprises delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic positioning.

Sociological factors

China's burgeoning semiconductor sector is grappling with a pronounced talent shortage, a critical sociological factor impacting growth. Demand for skilled professionals, from chip designers to advanced manufacturing technicians, significantly outstrips the available workforce, creating a competitive hiring landscape.

This deficit directly challenges Shanghai Wanye Enterprises, as the company must navigate fierce competition to attract and retain the specialized engineering and technical talent essential for its semiconductor operations. Reports from 2024 indicate that China's Ministry of Industry and Information Technology estimates a shortfall of over 200,000 skilled personnel in the integrated circuit industry, a figure expected to grow.

China's commitment to indigenous innovation, a key societal driver, is significantly boosting STEM education. This focus is designed to create a robust domestic talent pipeline, essential for technological advancement. By 2024, China's investment in R&D reached approximately 3.3 trillion yuan, underscoring this national priority.

This societal emphasis on building a skilled workforce through enhanced STEM programs directly benefits companies like Shanghai Wanye. It cultivates a culture where innovation is valued and nurtured, potentially leading to a more competitive and capable domestic talent pool by 2025.

The escalating consumer desire for sophisticated electronics, such as smartphones, personal computers, and AI-powered devices, is a significant driver of global and domestic integrated circuit demand. This trend directly translates into a sustained need for semiconductor manufacturing equipment, indirectly bolstering Shanghai Wanye's operational landscape.

In 2024, the global semiconductor market was projected to reach approximately $600 billion, with China being a major consumer and increasingly a producer. This robust demand for consumer electronics, a market segment that saw significant growth in 2023 and is expected to continue its upward trajectory into 2025, underpins the consistent requirement for the advanced machinery that companies like Shanghai Wanye supply.

Urbanization and Real Estate Demand in Shanghai

Shanghai's relentless urbanization continues to fuel robust demand for real estate. As a global economic hub, it attracts talent and investment, creating sustained interest in both residential and commercial properties. This trend is a significant driver for companies like Shanghai Wanye Enterprises operating within the city's property market.

Despite broader market fluctuations, Shanghai's unique status as a Tier-1 city provides a degree of resilience. The city's economic dynamism and its role as a gateway for international business mean that demand for prime real estate, particularly in key commercial districts, is likely to persist. This offers a stable base for Shanghai Wanye's real estate ventures.

- Urban Population Growth: Shanghai's permanent resident population reached 24.89 million by the end of 2023, indicating continued migration into the city.

- Economic Magnet: Shanghai's GDP grew by 5% in 2023, reaching approximately RMB 4.72 trillion (USD 650 billion), underscoring its economic strength and attractiveness.

- Property Market Trends: While the national property market experienced a downturn in 2024, Shanghai's premium segment often shows greater stability due to its economic fundamentals.

Workforce Skills Development and Training

The semiconductor industry's rapid advancement necessitates continuous workforce upskilling and reskilling. Shanghai Wanye Enterprises must prioritize investment in comprehensive training programs to equip its employees with cutting-edge technical expertise for operating and developing advanced equipment. This proactive approach ensures the company remains competitive in a dynamic market.

Collaboration with academic institutions is crucial for aligning training with industry demands. For instance, partnerships can facilitate curriculum development focused on emerging semiconductor technologies, ensuring a pipeline of skilled talent. This strategic alignment helps bridge the gap between academic learning and practical industry application.

The global demand for semiconductor talent is high, with reports indicating a significant shortage in specialized roles. For example, the Semiconductor Industry Association (SIA) projected in 2023 that the industry would need to hire hundreds of thousands of new workers globally in the coming years to meet demand. Shanghai Wanye's commitment to workforce development directly addresses this critical talent gap.

- Upskilling Initiatives: Shanghai Wanye is investing in advanced training modules for its engineers in areas like AI-driven chip design and advanced materials science.

- Educational Partnerships: Collaborations with leading technical universities in China are being strengthened to offer specialized semiconductor manufacturing courses.

- Talent Acquisition Strategy: The company is enhancing its recruitment efforts to attract graduates with strong foundational skills in electrical engineering and computer science.

- Retention Programs: To combat the high turnover in the tech sector, Shanghai Wanye is introducing new professional development pathways and mentorship programs.

Societal attitudes towards technology and innovation significantly influence the demand for advanced products and services, which in turn affects companies like Shanghai Wanye. China's growing middle class, with increasing disposable income, fuels demand for sophisticated consumer electronics, a key market for semiconductors.

The emphasis on national self-reliance in critical technologies, particularly semiconductors, is a powerful societal driver. This national priority encourages domestic production and innovation, creating opportunities and challenges for companies operating within this ecosystem.

The aging demographic in some developed nations contrasts with China's relatively younger population, impacting labor force dynamics and consumer behavior. Understanding these demographic shifts is crucial for strategic planning.

Public perception and trust in technology, especially regarding data privacy and AI, can shape market acceptance and regulatory environments. Companies must be mindful of these evolving societal expectations.

| Sociological Factor | 2023/2024 Data Point | Impact on Shanghai Wanye |

|---|---|---|

| Consumer Demand for Electronics | Global smartphone shipments declined by 11.7% year-over-year in Q1 2024, but demand for AI-enabled devices is rising. | Drives demand for semiconductor components, requiring Shanghai Wanye to adapt its product focus. |

| National Innovation Drive | China's R&D spending reached approximately 3.3 trillion yuan in 2024, a 10% increase from 2023. | Supports domestic semiconductor development, creating opportunities for local suppliers like Shanghai Wanye. |

| Talent Pool & Education | China aims to graduate over 1.2 million STEM graduates annually by 2025. | Addresses the talent shortage, potentially improving the availability of skilled labor for Shanghai Wanye. |

Technological factors

The relentless march of integrated circuit technology, marked by the shrinking of advanced nodes and the rise of innovations like high-bandwidth memory (HBM) and chiplet architectures, significantly shapes the market for semiconductor manufacturing equipment. For Shanghai Wanye Enterprises, a key player in this sector, staying ahead means a constant drive for innovation to meet the escalating demands for precision and capability in chip production.

The rapid advancement and widespread adoption of Artificial Intelligence (AI) and High-Performance Computing (HPC) are fundamentally reshaping industries, particularly the semiconductor sector. This surge in demand for sophisticated processing power directly translates into a need for specialized chips and the advanced manufacturing equipment required to produce them.

Shanghai Wanye Enterprises is strategically positioned to benefit from this technological wave. Their core business revolves around integrated circuit core equipment, placing them at the forefront of supplying the tools necessary for manufacturing the advanced semiconductors that power AI and HPC applications. For instance, the global AI chip market was valued at approximately $20 billion in 2023 and is projected to grow significantly, reaching an estimated $100 billion by 2028, according to various market research reports.

China's ambition to achieve 50% self-sufficiency in semiconductor equipment by 2025 is a significant technological shift. This drive directly benefits Shanghai Wanye by opening doors to increased domestic market penetration and lessening dependence on international suppliers for critical components and machinery.

Automation and Smart Manufacturing Trends

China's industrial sector is rapidly embracing automation and smart manufacturing, a trend significantly boosted by national strategies like 'Made in China 2025.' This push means a greater demand for advanced machinery and intelligent production systems across various industries. Shanghai Wanye, as a provider of equipment, is well-positioned to capitalize on this industrial evolution.

The adoption of these technologies is not just about efficiency; it's about enhancing competitiveness. For instance, the manufacturing sector's investment in intelligent equipment saw significant growth. In 2023, China's industrial robot installations increased by 10%, indicating a strong market for automated solutions.

- Increased Demand for Advanced Equipment: The drive for smart manufacturing directly translates to higher sales for companies like Shanghai Wanye that supply automated machinery.

- Focus on Digitalization: The trend emphasizes digital integration in production, creating opportunities for equipment that supports data collection and analysis.

- Government Support: Policies encouraging technological upgrading provide a favorable environment for the adoption of smart manufacturing solutions.

- Efficiency Gains for Clients: Shanghai Wanye's clients benefit from improved productivity and reduced operational costs through automation.

Research and Development Investment

Continuous and substantial investment in research and development (R&D) is paramount for Shanghai Wanye to maintain its edge in the competitive semiconductor equipment sector. The company’s commitment to innovation directly impacts its capacity to create advanced, proprietary technologies.

Given the global emphasis on technological self-reliance, Shanghai Wanye's R&D expenditure is a key determinant of its future growth and market position. For instance, in 2023, leading global semiconductor equipment manufacturers like ASML and Applied Materials allocated significant portions of their revenue to R&D, often exceeding 10%, to drive next-generation lithography and advanced packaging solutions. While specific 2024/2025 figures for Shanghai Wanye are still emerging, their strategic investments in areas like advanced metrology and inspection systems are crucial.

- R&D as a Competitive Differentiator: Innovation in process technology and equipment design is essential for capturing market share.

- Geopolitical Influence on R&D: National policies encouraging indigenous innovation directly impact R&D priorities and funding for companies like Shanghai Wanye.

- Industry Benchmarks: High R&D spending by global peers underscores the necessity for Shanghai Wanye to invest consistently to keep pace.

The technological landscape is rapidly evolving, with advancements in AI, HPC, and integrated circuits driving demand for sophisticated semiconductor equipment. Shanghai Wanye Enterprises is positioned to capitalize on this, particularly with China's push for domestic semiconductor self-sufficiency, aiming for 50% by 2025.

Smart manufacturing and automation are key trends, boosting the market for companies providing advanced machinery. Shanghai Wanye's focus on core integrated circuit equipment aligns with these industrial shifts, as seen in the 10% increase in China's industrial robot installations in 2023.

Continued investment in R&D is crucial for Shanghai Wanye to remain competitive, mirroring global leaders who invest over 10% of revenue in R&D. Strategic focus areas include advanced metrology and inspection systems, vital for next-generation chip production.

| Technological Factor | Impact on Shanghai Wanye | Supporting Data/Trend (2023-2025) |

|---|---|---|

| AI & HPC Demand | Increased need for advanced chip manufacturing equipment. | Global AI chip market projected to reach $100 billion by 2028 (from ~$20 billion in 2023). |

| Semiconductor Self-Sufficiency (China) | Opens domestic market opportunities, reduces reliance on imports. | China's goal of 50% self-sufficiency in semiconductor equipment by 2025. |

| Smart Manufacturing & Automation | Higher demand for automated machinery and intelligent production systems. | China's industrial robot installations increased by 10% in 2023. |

| R&D Investment | Essential for innovation and maintaining competitive edge. | Global peers invest >10% of revenue in R&D; Shanghai Wanye focuses on metrology/inspection. |

Legal factors

US export controls, particularly those targeting advanced semiconductor technology and equipment destined for China, present a significant legal hurdle for Shanghai Wanye Enterprises. These regulations can directly restrict the company's access to critical foreign-sourced components and advanced manufacturing equipment, potentially hindering its technological development and production capabilities. For instance, in late 2023, the US Department of Commerce expanded its export restrictions on certain advanced AI chips and semiconductor manufacturing equipment, impacting companies reliant on such technologies.

Consequently, Shanghai Wanye must meticulously navigate this complex legal landscape, ensuring full compliance with all applicable sanctions and export control regimes. This necessitates a thorough understanding of evolving international trade laws and a proactive strategy to mitigate risks associated with these restrictions. The company is likely exploring and investing in domestic alternatives and supply chains to reduce its reliance on technologies subject to such controls, a trend observed across many Chinese tech firms seeking greater self-sufficiency.

China's industrial policies, particularly those stemming from the 'Made in China 2025' initiative and its successors, establish a clear legal and regulatory landscape for the semiconductor sector. These directives are crucial for companies like Shanghai Wanye, shaping their operational environment and strategic opportunities.

These policies frequently incorporate preferential treatment, financial subsidies, and specific development mandates. For instance, government funding for domestic chip production and R&D has been substantial, with the National Integrated Circuit Industry Investment Fund (also known as the "Big Fund") playing a significant role. The second phase of this fund, launched in 2019, reportedly raised over $20 billion, aiming to bolster China's self-sufficiency in advanced chip manufacturing and design, a direct benefit Shanghai Wanye can potentially tap into.

Environmental protection laws are a significant factor for Shanghai Wanye, particularly given the semiconductor industry's inherent resource intensity and potential for pollution. China, and Shanghai specifically, has been tightening its environmental regulations, impacting how businesses operate.

Shanghai has revised its mandatory local standard for pollutant discharge by semiconductor companies. This means both new facilities and existing ones, like those operated by Shanghai Wanye, must adhere to these updated, stricter requirements. Compliance is no longer optional, and failure to meet these standards can result in penalties.

Shanghai Wanye must therefore ensure its production processes and equipment are designed and maintained to meet these evolving environmental laws. This might involve investments in advanced wastewater treatment, air filtration systems, and responsible waste management to avoid non-compliance and potential operational disruptions.

Intellectual Property Laws and Enforcement

China's commitment to enhancing intellectual property (IP) protection is a significant legal factor for Shanghai Wanye. Recent years have seen substantial reforms, including amendments to patent and trademark laws aimed at increasing penalties for infringement and streamlining enforcement. For instance, the average compensation for patent infringement cases has seen an upward trend, reflecting the government's focus on safeguarding innovation.

Shanghai Wanye must navigate this evolving legal landscape to secure its technological advancements and brand identity. Effective IP strategy, including robust patent filings and vigilant trademark monitoring, is vital for maintaining a competitive edge. The company's ability to leverage these strengthened IP laws will directly impact its capacity to prevent unauthorized use of its innovations and build a defensible market position.

- Strengthened Enforcement: China's Supreme People's Court reported a significant increase in IP-related litigation, indicating more robust enforcement mechanisms.

- Increased Damages: Amendments to IP laws have led to higher damage awards for infringement, incentivizing greater compliance.

- Focus on Innovation: The legal framework increasingly supports the protection of high-tech innovations, crucial for companies like Shanghai Wanye.

- International Alignment: China's IP reforms are increasingly aligning with international standards, facilitating global business operations.

Real Estate Regulations and Property Law

Shanghai Wanye Enterprises' real estate ventures operate under a complex web of national and local property laws. These govern everything from land acquisition and zoning to construction standards, sales practices, and property taxes. For instance, China's ongoing efforts to manage housing market volatility, a key concern in 2024 and projected into 2025, can significantly alter development costs and sales revenue.

Recent policy shifts underscore the dynamic nature of this legal landscape. In 2024, various cities implemented measures to cool overheated markets, including stricter mortgage lending rules and purchase restrictions. These regulatory adjustments directly influence Shanghai Wanye's strategic planning and financial performance in its property development and sales segments.

- Land Use Policies: Regulations dictating how land can be utilized, impacting project feasibility and scale.

- Construction Standards: Compliance with building codes and safety regulations, affecting development timelines and costs.

- Sales and Taxation: Laws governing property transactions, including sales contracts, registration, and various taxes like deed tax and VAT, which can impact profitability.

- Market Stabilization Measures: Government interventions aimed at controlling property prices and market speculation, such as purchase limits and loan-to-value ratios, which directly influence demand and sales volume.

Navigating US export controls, particularly those targeting advanced semiconductor technology, presents a significant legal challenge for Shanghai Wanye Enterprises, potentially restricting access to critical components and hindering technological development. China's industrial policies, like the 'Made in China 2025' initiative, create a legal framework with preferential treatment and substantial government funding, such as the $20 billion second phase of the National Integrated Circuit Industry Investment Fund, which Shanghai Wanye can leverage. The company must also comply with increasingly strict environmental protection laws in Shanghai, which mandate advanced pollution control measures for semiconductor facilities, impacting operational costs and compliance strategies.

Furthermore, strengthened intellectual property (IP) protection laws in China, with increased penalties for infringement and a focus on safeguarding high-tech innovations, require Shanghai Wanye to implement robust IP strategies to protect its advancements. The company's real estate ventures are subject to dynamic national and local property laws, including market stabilization measures implemented in 2024 that affect development costs and sales revenue, necessitating careful strategic planning.

Environmental factors

The semiconductor industry's reliance on resources like water and energy presents a significant environmental challenge. For instance, chip fabrication plants can consume millions of gallons of water daily, and the energy required for advanced manufacturing processes is substantial. Shanghai Wanye, as a supplier of critical equipment, must innovate to reduce the environmental impact of its offerings, potentially through more energy-efficient designs or water recycling technologies.

Semiconductor manufacturing, a key industry for Shanghai, inherently produces diverse waste streams and pollutants. For Shanghai Wanye Enterprises, adhering to stringent environmental regulations is paramount. For instance, Shanghai's updated discharge standards for the semiconductor sector, implemented in 2024, mandate stricter controls on wastewater and air emissions, with non-compliance potentially leading to significant fines.

Effective waste management and pollution control are therefore critical operational considerations for Shanghai Wanye. This includes investing in and utilizing equipment that supports efficient treatment of chemical waste, recycling of materials, and reduction of airborne pollutants. Failure to do so not only poses environmental risks but also financial liabilities, impacting the company's sustainability and reputation within the competitive Shanghai market.

Climate change is increasingly impacting global supply chains, with more frequent and intense extreme weather events posing significant risks. For a company like Shanghai Wanye, which relies on materials for semiconductor equipment, these disruptions can be particularly damaging. For instance, the severe flooding in parts of China during 2024 highlighted the vulnerability of logistics networks, potentially delaying shipments of critical components.

To counter these environmental threats, Shanghai Wanye must prioritize supply chain diversification and build greater resilience. This means exploring alternative sourcing locations and transportation routes, as well as investing in technologies that can better predict and manage weather-related disruptions. By proactively addressing these challenges, the company can safeguard its operations and maintain a competitive edge in the face of a changing climate.

Energy Efficiency in Manufacturing

The drive for greener manufacturing and reduced carbon emissions is significantly elevating the importance of energy efficiency in semiconductor equipment. This trend presents Shanghai Wanye with a strategic opening to innovate and market energy-saving solutions, directly supporting China's environmental targets and appealing to a growing segment of eco-conscious customers.

In 2024, China's Ministry of Industry and Information Technology continued to emphasize green industrial development, with specific directives encouraging energy-saving technologies in manufacturing sectors. For instance, by the end of 2023, industrial energy consumption per unit of GDP in China had fallen by approximately 1.5% compared to the previous year, indicating a national focus on efficiency gains.

- Growing Demand for Eco-Friendly Equipment: As global environmental regulations tighten, manufacturers are increasingly seeking equipment that minimizes energy consumption.

- Alignment with National Policy: Shanghai Wanye can leverage China's strong commitment to carbon neutrality, announced with a goal of reaching peak carbon emissions before 2030 and carbon neutrality before 2060.

- Competitive Advantage: Developing and promoting energy-efficient semiconductor manufacturing equipment can differentiate Shanghai Wanye in a competitive market.

Corporate Environmental Responsibility

Environmental factors are increasingly shaping business landscapes, pushing companies like Shanghai Wanye Enterprises to prioritize sustainability. Growing public awareness and tightening regulations around corporate environmental responsibility mean businesses face greater scrutiny regarding their ecological footprint. For Shanghai Wanye, demonstrating a strong commitment to environmental stewardship, going beyond basic compliance, can significantly boost its reputation and appeal to investors and partners looking for genuinely sustainable enterprises.

China's environmental policies are becoming more stringent. For instance, the nation's commitment to peak carbon emissions before 2030 and achieve carbon neutrality by 2060, as announced in 2020, directly impacts industrial sectors. This national directive translates into stricter emission standards, waste management regulations, and incentives for green technologies. Companies failing to adapt risk penalties and operational disruptions.

- Stricter Emission Standards: China's Ministry of Ecology and Environment continues to update and enforce air and water quality standards, requiring significant investment in pollution control technologies for manufacturing and construction sectors.

- Renewable Energy Push: Government subsidies and mandates are driving the adoption of renewable energy sources, impacting energy costs and supply chain considerations for businesses. By the end of 2023, China's installed renewable energy capacity surpassed 50% of its total installed power generation capacity.

- Circular Economy Initiatives: Policies promoting waste reduction, recycling, and the reuse of materials are gaining traction, encouraging businesses to rethink their production processes and supply chains.

- ESG Reporting Emphasis: There's a growing expectation for companies to report on their Environmental, Social, and Governance (ESG) performance, influencing investor decisions and corporate strategy.

Environmental factors are increasingly critical for Shanghai Wanye Enterprises, particularly concerning resource consumption and waste management in the semiconductor industry. The company must navigate stringent regulations and a national push towards sustainability, as evidenced by China's commitment to peak carbon emissions before 2030 and carbon neutrality by 2060.

The drive for greener manufacturing, underscored by China's industrial energy consumption per unit of GDP falling by approximately 1.5% by the end of 2023, creates opportunities for Shanghai Wanye to offer energy-efficient solutions. Furthermore, the increasing emphasis on ESG reporting means that demonstrating robust environmental stewardship is vital for attracting investment and maintaining a competitive edge.

| Environmental Factor | Impact on Shanghai Wanye | Supporting Data/Initiatives |

|---|---|---|

| Resource Consumption (Water/Energy) | Need for efficient equipment designs and water recycling technologies. | Chip fabrication plants can consume millions of gallons of water daily. |

| Waste Management & Pollution Control | Adherence to stricter discharge standards and investment in treatment/recycling. | Shanghai's updated semiconductor sector discharge standards (2024). |

| Climate Change & Supply Chain Resilience | Risk of disruptions from extreme weather; need for supply chain diversification. | Flooding in China during 2024 highlighted logistics network vulnerability. |

| Green Manufacturing & Energy Efficiency | Opportunity to market energy-saving solutions aligned with national targets. | China's industrial energy consumption per unit of GDP fell ~1.5% by end of 2023. |

| National Environmental Policies | Compliance with stricter emission standards, waste management, and green tech incentives. | China's goal of carbon neutrality by 2060. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Shanghai Wanye Enterprises is built on a robust foundation of data from official Chinese government statistics, reputable financial news outlets, and leading industry market research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental landscape impacting the company.