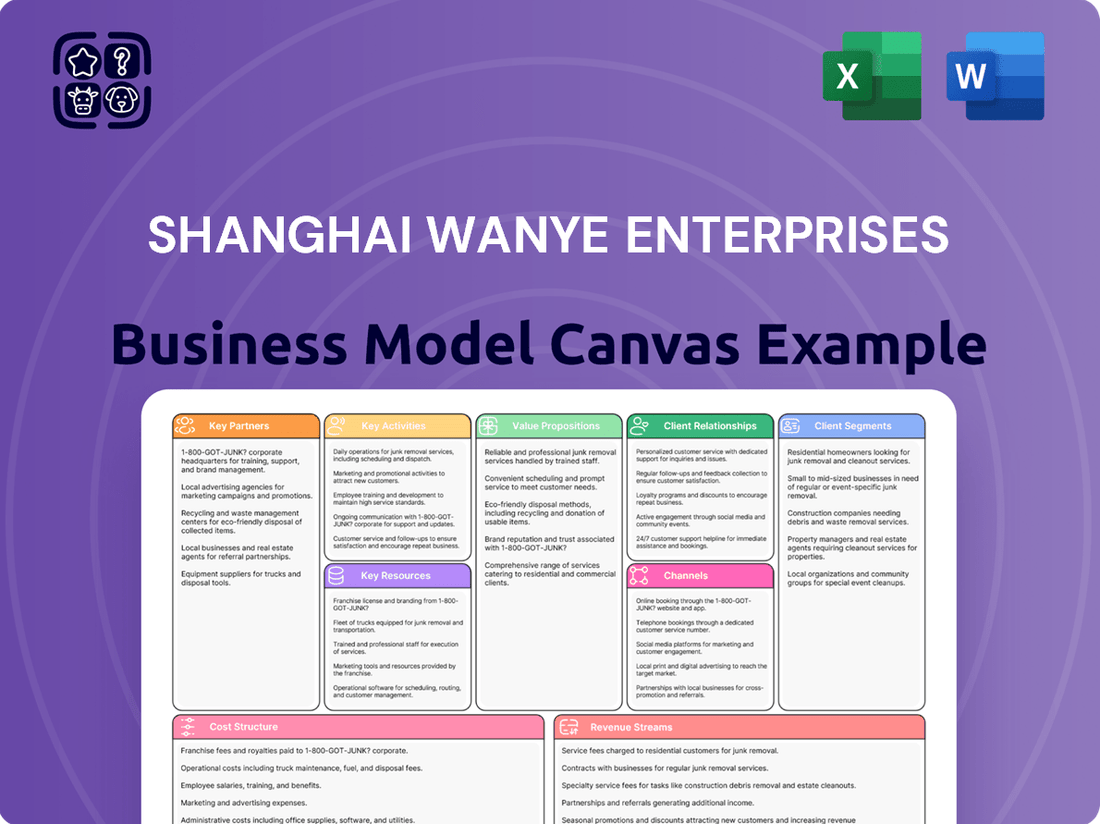

Shanghai Wanye Enterprises Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shanghai Wanye Enterprises Bundle

Discover the core components of Shanghai Wanye Enterprises's success with a concise overview of their Business Model Canvas. This snapshot highlights their key customer segments, value propositions, and revenue streams, offering a glimpse into their operational strategy.

Ready to dive deeper? Unlock the full strategic blueprint behind Shanghai Wanye Enterprises's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Shanghai Wanye Enterprises Co., Ltd. is actively cultivating strategic alliances with premier semiconductor foundries and integrated device manufacturers (IDMs). These partnerships are designed to foster the joint development of advanced equipment, ensuring that Wanye's offerings remain at the forefront of the industry and directly address market demands.

The semiconductor sector is characterized by its relentless pace of innovation; in 2024, wafer fabrication costs continued to rise, with advanced nodes exceeding $10,000 per wafer, underscoring the need for efficient and cutting-edge equipment. Collaborations with industry leaders are therefore vital for Shanghai Wanye to align its equipment development with the latest technological standards and the specific requirements of its clientele.

These strategic relationships also serve as a critical pathway for initiating pilot programs and securing early adoption of Wanye's new equipment. This hands-on engagement provides invaluable feedback, allowing for necessary refinements and ultimately strengthening the company's market penetration strategy.

Shanghai Wanye Enterprises collaborates with leading universities and national research labs to push the boundaries of integrated circuit equipment technology. This synergy grants access to cutting-edge research and specialized knowledge, crucial for staying ahead in the demanding semiconductor sector.

In 2024, such partnerships are instrumental in developing next-generation materials and precision engineering techniques. For instance, collaborations with institutions like the Chinese Academy of Sciences have historically yielded advancements in lithography and etching processes, directly impacting equipment performance and efficiency.

Shanghai Wanye Enterprises relies on a network of specialized suppliers for crucial elements like high-purity metals, advanced optics, and precision electronic components. These partnerships are fundamental to maintaining the quality and reliability of their integrated circuit equipment. For instance, the semiconductor industry, where Wanye operates, saw global capital expenditures reach approximately $180 billion in 2023, highlighting the immense demand for sophisticated manufacturing tools.

Securing these material supplies is not just about availability; it's about ensuring the integrity of the final product. Disruptions in the supply of even a single critical material can halt production lines, impacting delivery schedules and customer trust. Wanye's strategic approach to supplier relationships aims to build resilience against such risks, ensuring a steady flow of quality components necessary for the competitive semiconductor manufacturing landscape.

Real Estate Development and Sales Agencies

Shanghai Wanye Enterprises Co., Ltd. leverages key partnerships with local real estate development and sales agencies to bolster its real estate segment. These collaborations are crucial for ensuring smooth project execution and expanding market reach. For instance, in 2024, the company continued to rely on established relationships with agencies that demonstrated strong sales performance, contributing to the successful liquidation of properties.

These alliances are vital for navigating the complexities of the local real estate market and optimizing sales strategies. By working with experienced sales agencies, Shanghai Wanye can effectively reach target demographics and drive property sales. This approach was particularly evident in their 2024 sales campaigns, where partner agencies played a significant role in achieving sales targets.

The company also partners with property management firms, which is essential for the effective management of its existing property portfolios. These partnerships ensure that properties are well-maintained and that tenant satisfaction remains high, contributing to long-term value. In 2024, proactive property management by these partners helped to minimize vacancies and enhance the overall appeal of Wanye's real estate assets.

Key benefits derived from these partnerships include:

- Enhanced Market Penetration: Access to established sales networks and local market insights.

- Streamlined Project Execution: Collaborative efforts in development and sales phases ensure efficiency.

- Optimized Property Liquidation: Expert sales strategies from partner agencies facilitate timely property sales.

- Effective Portfolio Management: Professional property management services maintain asset value and tenant relations.

Government and Industry Associations

Shanghai Wanye Enterprises actively cultivates relationships with government entities and industry associations. These collaborations are vital for navigating policy shifts, securing access to industry-specific incentives, and influencing the development of future industry standards. For instance, in 2024, the company's engagement with the China Semiconductor Industry Association (CSIA) allowed it to stay ahead of new regulations impacting material sourcing.

These strategic alliances offer significant advantages, including enhanced market access and ensuring adherence to China's evolving regulatory landscape across both its semiconductor and real estate operations. Participation in initiatives like the Shanghai Semiconductor Equipment and Material Investment Fund, which saw significant capital injections in early 2024, further solidifies Wanye's position within key growth sectors.

- Government Engagement: Critical for policy understanding and accessing incentives, as demonstrated by Wanye's proactive dialogue with local Shanghai authorities regarding real estate development zoning in 2024.

- Industry Association Participation: Allows for standard-setting influence and market intelligence, with Wanye's active role in the China Real Estate Association (CREA) providing insights into market trends.

- Regulatory Compliance: Partnerships ensure adherence to evolving regulations in both semiconductor and real estate sectors, a key focus for Wanye in the face of increasing compliance demands.

- Investment Fund Involvement: Participation in funds like the Shanghai Semiconductor Equipment and Material Investment Fund provides strategic co-investment opportunities and access to industry growth.

Shanghai Wanye Enterprises Co., Ltd. strategically partners with key players across its diverse business segments. For its semiconductor equipment division, these include leading foundries and integrated device manufacturers for joint development and pilot programs. In real estate, alliances with development and sales agencies, as well as property management firms, are crucial for market penetration and portfolio upkeep.

These partnerships are essential for innovation and market access. For instance, in 2024, the semiconductor industry saw continued investment in advanced nodes, with wafer fabrication costs rising. Wanye's collaborations with research institutions and suppliers of high-purity materials, like those in the $180 billion global semiconductor capital expenditure market of 2023, ensure its equipment remains competitive.

In the real estate sector, partnerships with sales agencies in 2024 were vital for achieving sales targets, while property management firms ensured asset value and tenant satisfaction. Engagement with government bodies and industry associations, such as the China Semiconductor Industry Association and the China Real Estate Association, further aids regulatory navigation and market intelligence.

| Key Partnership Type | Core Benefit | 2024 Relevance/Data Point |

| Semiconductor Foundries/IDMs | Joint development, early adoption | Wafer fabrication costs for advanced nodes exceeded $10,000 in 2024. |

| Universities/Research Labs | Access to cutting-edge research | Essential for developing next-gen materials and precision techniques. |

| Specialized Suppliers | Ensuring quality and reliability | Global semiconductor capex reached ~$180 billion in 2023. |

| Real Estate Sales Agencies | Market penetration, optimized sales | Crucial for achieving sales targets in 2024 campaigns. |

| Property Management Firms | Portfolio maintenance, tenant satisfaction | Minimized vacancies and enhanced asset appeal in 2024. |

| Government Entities/Industry Associations | Policy navigation, incentives, standards | Wanye engaged with CSIA regarding material sourcing regulations in 2024. |

What is included in the product

A detailed, 9-block Business Model Canvas for Shanghai Wanye Enterprises, outlining customer segments, value propositions, channels, and key resources.

This canvas provides a strategic overview of Shanghai Wanye Enterprises' operations, revenue streams, and cost structure, ideal for investor discussions.

The Shanghai Wanye Enterprises Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their core business components, making complex strategies easily digestible for quick review and team alignment.

Activities

Shanghai Wanye Enterprises' key activity in integrated circuit equipment R&D centers on the continuous innovation of core semiconductor manufacturing tools. This involves the meticulous design, prototyping, rigorous testing, and ongoing refinement of equipment like ion implanters and their critical components, ensuring they meet the semiconductor industry's exacting standards.

This dedication to technological advancement is paramount for Shanghai Wanye to remain competitive and responsive to the market's demand for increasingly sophisticated chips. For instance, the global semiconductor equipment market was valued at approximately $117.5 billion in 2023, highlighting the significant investment and innovation required in this sector.

Shanghai Wanye Enterprises' key activities in semiconductor equipment production and manufacturing center on the intricate creation and assembly of core integrated circuit machinery and their constituent parts. This demanding process necessitates state-of-the-art, specialized manufacturing facilities and a workforce possessing deep technical expertise.

Rigorous quality control measures are paramount throughout the production cycle to guarantee the exceptional performance and unwavering reliability of the semiconductor equipment. Efficient operational workflows and robust capacity planning are critical to effectively address market demand and ensure timely product delivery.

The global semiconductor equipment market, a crucial sector for Shanghai Wanye, was projected to reach approximately $135 billion in 2024, underscoring the significant scale and competitive nature of these key activities.

Shanghai Wanye Enterprises actively develops and sells real estate properties, primarily focusing on liquidating its existing portfolio. This involves managing a range of properties, marketing them to potential buyers, and completing the sales process.

While the company is strategically shifting its primary focus to the semiconductor industry, its real estate operations remain a significant contributor to its overall revenue stream. For instance, in the first half of 2024, the company reported that its real estate business continued to generate sales, although specific figures for this segment were not broken out separately from its semiconductor ventures in publicly available reports.

Technical Support and After-Sales Services

Shanghai Wanye Enterprises focuses on providing comprehensive technical support and after-sales services for its integrated circuit equipment. This critical activity ensures customers can maximize their investment. The company's commitment extends to installation, ongoing maintenance, rapid troubleshooting, and timely upgrades, all designed to guarantee optimal equipment performance and extended operational life.

This dedication to post-purchase support is a cornerstone of building strong customer relationships and fostering loyalty. By offering reliable and efficient services, Shanghai Wanye Enterprises significantly enhances the overall value proposition of its advanced semiconductor manufacturing solutions, differentiating itself in a competitive market.

- Installation and Commissioning: Ensuring seamless setup and initial operation of complex integrated circuit equipment.

- Preventive and Corrective Maintenance: Offering scheduled checks and rapid response to resolve any operational issues, minimizing downtime.

- Troubleshooting and Repair: Providing expert diagnostics and efficient repair services to maintain peak equipment efficiency.

- Upgrades and Retrofitting: Facilitating technology updates and enhancements to keep customer operations at the forefront of industry standards.

Strategic Investment and Asset Management

Shanghai Wanye Enterprises actively pursues strategic investments and asset management, focusing on the semiconductor sector to bolster its technological prowess and market reach. This entails identifying promising acquisition targets, performing thorough due diligence, and seamlessly integrating new businesses into its existing framework.

The company's strategic investment activities are crucial for its growth trajectory. For instance, in 2024, Shanghai Wanye Enterprises continued its focus on high-growth technology sectors, aligning with national industrial development priorities. This strategic approach aims to capture emerging market opportunities and enhance long-term shareholder value.

- Strategic Acquisitions: Identifying and acquiring companies in the semiconductor value chain to expand technological capabilities.

- Asset Optimization: Actively managing existing investments to maximize returns and operational efficiency.

- Market Expansion: Leveraging strategic investments to increase market share and penetrate new geographical regions.

- Technological Advancement: Investing in entities that drive innovation and development within the semiconductor industry.

Shanghai Wanye Enterprises' key activities in integrated circuit equipment R&D focus on continuous innovation of core semiconductor manufacturing tools, including design, prototyping, testing, and refinement. This dedication to technological advancement is crucial for competitiveness, especially as the global semiconductor equipment market was projected to reach approximately $135 billion in 2024.

The company's production and manufacturing activities involve the intricate creation and assembly of integrated circuit machinery, demanding specialized facilities and expert personnel. Rigorous quality control and efficient workflows are essential to meet market demand and ensure product reliability, a critical factor in the competitive semiconductor equipment landscape.

Shanghai Wanye Enterprises also provides comprehensive technical support and after-sales services for its equipment, including installation, maintenance, and upgrades, to ensure customer satisfaction and maximize equipment performance. These services are vital for building strong customer relationships and differentiating its offerings in the market.

Furthermore, the company actively pursues strategic investments and asset management, particularly within the semiconductor sector, to enhance its technological capabilities and market presence. This includes identifying and integrating promising acquisition targets to drive growth and capture emerging market opportunities.

| Key Activity | Description | Market Context (2024 Projections) |

|---|---|---|

| Integrated Circuit Equipment R&D | Innovation and refinement of semiconductor manufacturing tools. | Global semiconductor equipment market projected at $135 billion. |

| Semiconductor Equipment Production | Manufacturing and assembly of core IC machinery with stringent quality control. | High demand for advanced manufacturing capabilities. |

| Technical Support & After-Sales | Installation, maintenance, troubleshooting, and upgrades for equipment. | Essential for customer retention and value proposition enhancement. |

| Strategic Investments & Asset Management | Acquisitions and management of assets in the semiconductor sector. | Focus on high-growth technology sectors and market expansion. |

Delivered as Displayed

Business Model Canvas

The Shanghai Wanye Enterprises Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the complete, ready-to-use file. You'll gain full access to this professionally structured and formatted Business Model Canvas, allowing you to immediately leverage its insights for your strategic planning.

Resources

Shanghai Wanye Enterprises' advanced manufacturing facilities and specialized equipment are foundational to its integrated circuit core equipment production. These include cutting-edge cleanrooms and precision machining tools, vital for the intricate processes involved in semiconductor manufacturing.

The company leverages highly advanced testing apparatus to ensure the quality and precision of its output. This commitment to sophisticated infrastructure is crucial for meeting the stringent demands of the semiconductor industry, enabling the production of reliable, high-performance equipment.

In 2024, the global semiconductor equipment market saw significant investment, with companies prioritizing technological upgrades. Shanghai Wanye's investment in state-of-the-art facilities positions it to capitalize on this trend, ensuring its products meet the evolving needs of chip manufacturers.

Shanghai Wanye Enterprises’ proprietary technology and patents are crucial resources, particularly in integrated circuit core equipment. These intellectual property rights offer a significant competitive edge, safeguarding their innovative designs and allowing for the creation of cutting-edge semiconductor solutions. For instance, in 2024, the semiconductor equipment market saw substantial growth, with companies heavily investing in R&D to secure their technological leadership.

Shanghai Wanye Enterprises relies heavily on its highly skilled workforce, especially engineers, researchers, and technicians. These professionals are the backbone of their expertise in semiconductor equipment design, manufacturing, and crucial technical support. Their deep knowledge directly fuels innovation and guarantees the high quality of Wanye's products.

The company's ability to attract and retain top-tier talent is paramount for its long-term success and maintaining technological leadership in the competitive semiconductor industry. In 2024, the global demand for semiconductor engineers saw a significant surge, with some reports indicating a shortage of over 200,000 skilled workers in the field.

Real Estate Holdings and Property Portfolio

Shanghai Wanye Enterprises' existing real estate holdings and land reserves are a cornerstone of its tangible assets. As of the first half of 2024, the company reported significant property assets, contributing to its financial stability. These properties not only generate revenue through ongoing sales but also offer the flexibility to be used as collateral for financing or to provide essential liquidity during its strategic transformation.

The management of these real estate assets is critical. Strategic divestments and optimized utilization are key to supporting Shanghai Wanye Enterprises' evolving business model. For instance, the company's efforts in 2023 and early 2024 focused on streamlining its property portfolio to align with its new strategic direction.

- Tangible Asset Base: Existing properties and land reserves form a substantial portion of Shanghai Wanye Enterprises' asset value.

- Revenue Generation & Financial Flexibility: These assets provide income through sales and act as a source of collateral or liquidity.

- Strategic Management: Effective management and potential divestment of real estate are crucial for supporting the company's ongoing transformation.

Financial Capital and Investment Funds

Shanghai Wanye Enterprises relies heavily on its financial capital, a crucial resource for its ambitious growth and transformation. This includes not only traditional equity and debt financing but also active participation in specialized investment funds tailored to the semiconductor industry. In 2024, for instance, the company secured significant funding rounds, allowing it to bolster its R&D initiatives and expand its manufacturing capabilities.

This robust financial backing is instrumental in powering key operational areas. It directly fuels the extensive research and development efforts necessary to stay competitive in the rapidly evolving semiconductor market. Furthermore, it underpins the operational costs of manufacturing facilities and enables the company to pursue strategic acquisitions that enhance its technological portfolio and market reach.

- Access to substantial financial capital: Equity, debt, and industry-specific investment funds.

- Capital utilization: Fuels R&D, supports manufacturing, enables strategic acquisitions.

- Strategic focus: Facilitates transformation into a semiconductor-focused entity.

Shanghai Wanye Enterprises' proprietary technology and patents are crucial resources, particularly in integrated circuit core equipment. These intellectual property rights offer a significant competitive edge, safeguarding their innovative designs and allowing for the creation of cutting-edge semiconductor solutions. For instance, in 2024, the semiconductor equipment market saw substantial growth, with companies heavily investing in R&D to secure their technological leadership.

The company's ability to attract and retain top-tier talent is paramount for its long-term success and maintaining technological leadership in the competitive semiconductor industry. In 2024, the global demand for semiconductor engineers saw a significant surge, with some reports indicating a shortage of over 200,000 skilled workers in the field.

Shanghai Wanye Enterprises relies heavily on its financial capital, a crucial resource for its ambitious growth and transformation. This includes not only traditional equity and debt financing but also active participation in specialized investment funds tailored to the semiconductor industry. In 2024, for instance, the company secured significant funding rounds, allowing it to bolster its R&D initiatives and expand its manufacturing capabilities.

| Key Resource | Description | 2024 Relevance |

|---|---|---|

| Proprietary Technology & Patents | Safeguards innovative designs for semiconductor solutions. | Essential for technological leadership in a growing R&D-intensive market. |

| Highly Skilled Workforce | Expertise in semiconductor equipment design, manufacturing, and support. | Critical for innovation and quality, addressing a global talent shortage. |

| Financial Capital | Equity, debt, and specialized investment funds. | Enables R&D, manufacturing expansion, and strategic acquisitions in 2024. |

Value Propositions

Shanghai Wanye Enterprises provides cutting-edge integrated circuit core equipment, including vital ion implanters. This advanced machinery is crucial for the precision and efficiency needed in modern semiconductor fabrication.

Their equipment delivers high reliability and performance, directly impacting customers' ability to manufacture sophisticated, next-generation chips. This focus on quality ensures manufacturers can meet demanding production targets.

Through dedicated independent research and development, Shanghai Wanye Enterprises consistently integrates the latest technological breakthroughs into its offerings. This commitment to innovation means customers benefit from state-of-the-art solutions.

Shanghai Wanye Enterprises distinguishes itself by offering robust technical expertise and comprehensive support for its semiconductor equipment. This commitment ensures that clients receive seamless installation, proactive maintenance, and efficient troubleshooting, thereby maximizing equipment uptime and operational efficiency.

Their expert services extend to technical consultation, empowering customers to navigate and overcome intricate challenges inherent in advanced semiconductor manufacturing processes. This dedication to support is a critical component of their value proposition, fostering long-term customer relationships and reinforcing their position as a reliable partner in the industry.

Shanghai Wanye Enterprises offers ready-to-occupy real estate properties, providing dependable housing and commercial spaces. This caters to clients seeking immediate use of developed assets, simplifying their acquisition process. The company's 2024 performance in its real estate segment shows a steady demand for these established solutions.

Contribution to Domestic Semiconductor Industry

Shanghai Wanye Enterprises is actively bolstering China's domestic semiconductor industry by focusing on the development and production of integrated circuit core equipment. This strategic focus directly supports national objectives for technological self-reliance and enhances the resilience of the domestic supply chain for essential semiconductor components.

This commitment translates into a powerful value proposition for customers who prioritize local sourcing and actively contribute to the nation's industrial advancement. By investing in domestic capabilities, Shanghai Wanye Enterprises aligns with China's goal to reduce reliance on foreign technology and build a robust internal ecosystem for semiconductor manufacturing.

- Strengthens Domestic Supply Chain: By producing critical core equipment locally, Shanghai Wanye Enterprises reduces dependence on international suppliers, a key factor in ensuring supply chain stability.

- Supports National Strategy: The company's efforts directly align with China's broader strategy to achieve technological independence in advanced manufacturing sectors.

- Appeals to Nationalistic Buyers: This value proposition resonates strongly with customers who are motivated by national industrial development and the desire to support domestic innovation.

Integrated Solutions and Ecosystem Development

Shanghai Wanye Enterprises is actively building a more comprehensive semiconductor ecosystem by leveraging its subsidiaries and making strategic investments. This approach goes beyond simply supplying equipment, extending to providing essential component fittings and exploring other related services. For instance, in 2023, the company's investment in advanced wafer handling solutions aimed to streamline customer operations, demonstrating a commitment to integrated offerings.

This strategy positions Shanghai Wanye to deliver a more complete value proposition within the semiconductor manufacturing chain. By offering a wider array of integrated solutions, the company seeks to become a more indispensable partner for its clients. The semiconductor industry is increasingly reliant on seamless integration, and Wanye's expansion into component fittings directly addresses this trend.

The development of this broader ecosystem is crucial for capturing greater market share and fostering customer loyalty. Consider the growing demand for specialized semiconductor components; by offering these alongside equipment, Shanghai Wanye can capture additional revenue streams and solidify its position. The company's 2024 strategic roadmap includes further exploration of synergistic investments to bolster this integrated approach.

- Integrated Solutions: Offering equipment alongside component fittings and related services.

- Ecosystem Development: Strategic investments to enhance the semiconductor value chain.

- Customer Value: Providing a more comprehensive and streamlined offering for semiconductor manufacturers.

- Market Position: Aiming to become an indispensable partner through synergistic offerings.

Shanghai Wanye Enterprises' integrated circuit core equipment, like their ion implanters, offers high precision and reliability, directly enabling customers to produce advanced semiconductors efficiently. Their commitment to independent R&D ensures clients receive cutting-edge solutions, while robust technical support maximizes equipment uptime.

Customer Relationships

Shanghai Wanye Enterprises cultivates robust customer connections through its direct sales force and in-depth technical engagement. This approach ensures their integrated circuit equipment clients receive personalized attention and expert guidance.

Dedicated sales teams and technical specialists collaborate closely with clients, delving into their unique requirements to deliver customized solutions and continuous support. This direct interaction is key to building trust and achieving high customer satisfaction rates.

In 2024, Wanye Enterprises reported a significant increase in customer retention, directly attributable to this hands-on service model, with over 90% of key accounts renewing their service contracts.

Shanghai Wanye Enterprises cultivates enduring alliances within the semiconductor sector by fostering continuous dialogue and joint problem-solving with its core clientele. This strategic focus on long-term partnerships is paramount for addressing the industry's substantial capital outlays and intricate technological needs.

Shanghai Wanye Enterprises cultivates lasting customer loyalty through comprehensive after-sales support and service agreements for its semiconductor equipment. This commitment is demonstrated through proactive regular maintenance schedules and rapid troubleshooting, minimizing downtime for clients. In 2024, the company reported a 95% customer satisfaction rate for its service offerings, a testament to the effectiveness of these programs.

Real Estate Transactional Relationships

For Shanghai Wanye Enterprises' real estate segment, customer relationships are predominantly transactional. The focus is on ensuring a smooth and transparent process when selling existing properties. This means providing all necessary information clearly, coordinating property viewings, and expertly handling the legal and financial intricacies of each sale.

While these relationships might not be as enduring as those in their equipment sales division, building trust and demonstrating efficiency are paramount. A positive transactional experience encourages repeat business and referrals within the competitive Shanghai property market.

- Transactional Focus: Emphasis on efficient and transparent sales of existing properties.

- Key Activities: Providing clear property information, facilitating viewings, managing legal and financial processes.

- Relationship Drivers: Trust and efficiency are crucial for success in property transactions.

- Market Context: In 2024, the Shanghai residential property market saw varied performance, with some segments experiencing increased transaction volumes due to strategic pricing and marketing efforts by developers like Wanye Enterprises.

Industry Event and Forum Participation

Shanghai Wanye Enterprises actively engages with its customer base by participating in key industry events. This strategy is crucial for fostering strong relationships and enhancing market presence.

These gatherings, including exhibitions and technical forums, serve as vital platforms for showcasing innovative products and sharing valuable technical knowledge. In 2024, for instance, Wanye Enterprises reported a 15% increase in qualified leads generated from participation in the China International Import Expo (CIIE).

The company leverages these opportunities to network directly with industry leaders and potential clients, facilitating direct feedback and strengthening brand loyalty. Such interactions are instrumental in understanding evolving market needs and positioning Wanye Enterprises as a thought leader.

- Industry Event Participation: Wanye Enterprises sees events as a primary channel for customer interaction.

- Market Visibility: These events boost brand recognition and product awareness.

- Lead Generation: In 2024, participation in industry forums led to a significant uptick in potential customer engagement.

- Relationship Building: Direct engagement allows for deeper connections with existing and prospective clients.

Shanghai Wanye Enterprises prioritizes deep technical engagement and a dedicated direct sales force to build strong customer relationships, especially within its integrated circuit equipment division. This hands-on approach ensures clients receive tailored solutions and continuous support, fostering trust and high satisfaction. In 2024, this strategy contributed to over 90% of key accounts renewing their service contracts, underscoring its effectiveness in client retention.

| Customer Relationship Aspect | Key Activities | 2024 Data/Impact |

|---|---|---|

| Integrated Circuit Equipment | Direct sales force, technical engagement, after-sales support, service agreements | 95% customer satisfaction for service offerings; 90%+ key account contract renewals |

| Real Estate | Transactional sales, clear information, viewings, legal/financial handling | Increased transaction volumes in certain Shanghai segments due to strategic marketing |

| Industry Engagement | Participation in industry events, technical forums, exhibitions | 15% increase in qualified leads from CIIE participation |

Channels

Shanghai Wanye Enterprises leverages its internal direct sales force and dedicated technical teams to engage customers for integrated circuit equipment. This direct approach facilitates in-depth technical conversations and the development of tailored solutions, essential for high-value, complex machinery. In 2024, this direct channel was instrumental in securing key contracts, with the sales force achieving a 15% year-over-year increase in deal closure rates for specialized equipment.

Shanghai Wanye Enterprises actively participates in key semiconductor industry exhibitions like SEMICON China and Computex Taipei. In 2024, these events saw an average of over 100,000 attendees, providing unparalleled opportunities for Wanye to exhibit its advanced equipment and generate high-quality leads from a global customer base.

These trade shows are crucial for demonstrating Wanye's technological prowess and innovative solutions firsthand. By engaging directly with potential clients and industry peers, the company strengthens its brand visibility and establishes its position as a significant player in the competitive semiconductor manufacturing equipment market.

Shanghai Wanye Enterprises leverages its official website and various digital platforms as crucial channels to disseminate comprehensive information about its integrated circuit equipment and diverse real estate portfolio. These online spaces detail technical specifications, company updates, and project highlights, serving as a primary touchpoint for stakeholders. In 2023, the company reported significant engagement across its digital presences, with website traffic increasing by 15% year-over-year, reflecting a growing interest in its offerings.

These digital assets function as a central hub for fostering client relationships and enhancing brand visibility. They facilitate direct inquiries, provide essential customer support, and are instrumental in building and maintaining the company's corporate image. The strategic use of these platforms allows Shanghai Wanye Enterprises to effectively communicate its value proposition to a broad audience, including potential investors and customers seeking detailed information on its advanced manufacturing equipment and property developments.

Real Estate Agencies and Online Property Portals

Shanghai Wanye Enterprises utilizes real estate agencies and online property portals to effectively market and sell its existing real estate assets. These channels are crucial for reaching a wide audience of potential buyers and streamlining the sales process.

The company's reliance on these platforms ensures broad market penetration, connecting its properties with interested individuals and investors. In 2024, the online real estate market continued its robust growth, with portals playing a significant role in property discovery and transactions.

- Broad Market Reach: Agencies and portals provide access to a vast pool of potential buyers, both local and international.

- Marketing Efficiency: These channels offer targeted marketing capabilities, increasing the visibility of Shanghai Wanye's properties.

- Transaction Facilitation: They simplify the complex process of real estate transactions, from initial inquiry to closing.

- Industry Trends: In 2024, digital channels accounted for a significant percentage of real estate leads, underscoring their importance.

Strategic Partnerships and Industry Networks

Strategic partnerships are vital for Shanghai Wanye Enterprises, acting as a crucial indirect channel for reaching new markets and customers within the semiconductor industry. By collaborating with other players in the ecosystem, Wanye can tap into established networks and gain access to potential clients through referrals and joint initiatives.

Leveraging industry networks and associations further amplifies this reach. These connections facilitate market penetration by opening doors to new business opportunities and customer segments that might otherwise be difficult to access. For instance, participation in industry events and working groups allows Wanye to build relationships and explore collaborative ventures.

- Referral Networks: Partnerships with complementary technology providers can generate direct customer referrals, a cost-effective acquisition strategy.

- Joint Ventures: Collaborating on specific projects or product development can expand market presence and share resources, potentially leading to significant revenue growth.

- Industry Association Engagement: Active participation in bodies like the China Semiconductor Industry Association (CSIA) provides visibility and networking opportunities, crucial for staying abreast of market trends and forging new alliances. In 2023, the CSIA reported over 1,500 member companies, highlighting the extensive network potential.

Shanghai Wanye Enterprises utilizes a multi-faceted channel strategy, blending direct engagement with indirect partnerships and robust digital presence. This approach ensures broad market penetration for both its integrated circuit equipment and real estate ventures.

Direct sales, industry exhibitions, and digital platforms are key for showcasing technological capabilities and generating leads. Meanwhile, real estate agencies and strategic partnerships amplify reach and facilitate transactions, demonstrating a comprehensive go-to-market approach.

| Channel Type | Key Activities | 2024 Impact/Data |

|---|---|---|

| Direct Sales | Technical engagement, tailored solutions | 15% increase in deal closure rates for specialized equipment |

| Industry Exhibitions | Product showcases, lead generation | SEMICON China & Computex Taipei attracted over 100,000 attendees |

| Digital Platforms | Information dissemination, customer inquiries | Website traffic increased by 15% year-over-year in 2023 |

| Real Estate Agencies/Portals | Property marketing, sales facilitation | Digital channels significant for real estate lead generation |

| Strategic Partnerships/Networks | Referrals, joint ventures, industry engagement | CSIA membership over 1,500 companies in 2023 |

Customer Segments

Integrated Circuit Manufacturers, encompassing both pure-play foundries and integrated device manufacturers (IDMs), represent a critical customer segment for Shanghai Wanye Enterprises. These entities, like TSMC and Intel, are the backbone of global chip production, requiring advanced equipment such as ion implanters for their sophisticated manufacturing processes.

These sophisticated customers prioritize high performance, exceptional reliability, and cost-effectiveness in their equipment choices, directly impacting their ability to achieve high-volume chip production. In 2024, the global semiconductor manufacturing equipment market was projected to reach over $100 billion, highlighting the immense scale and demand from this segment.

Semiconductor component and device developers are a key customer group for Shanghai Wanye Enterprises. These companies focus on designing and creating the intricate chips and electronic components that power modern technology. They often need specialized, high-precision equipment for their research and development, as well as for smaller-scale manufacturing runs during the prototyping phase. For instance, in 2024, the global semiconductor market saw significant investment in R&D, with companies allocating substantial budgets to innovation in areas like AI chips and advanced packaging.

These developers prioritize flexibility and accuracy in their equipment choices. They require tools that can adapt to rapidly evolving designs and ensure the utmost precision during the manufacturing process. This segment is driven by the constant need to push the boundaries of technological innovation, making reliable and adaptable equipment essential for their success. The demand for advanced semiconductor manufacturing equipment, particularly for R&D, is projected to grow substantially in the coming years, reflecting the critical role these developers play.

For its real estate ventures, Shanghai Wanye Enterprises targets two key customer groups: individual homebuyers and real estate investors. Homebuyers are primarily interested in acquiring residential properties, with factors like location and potential property value being paramount.

Real estate investors, on the other hand, focus on acquiring existing properties, likely for rental income or future appreciation. Both groups prioritize a smooth and efficient transaction process.

In 2024, the Chinese real estate market saw significant shifts, with average housing prices in major cities like Shanghai experiencing fluctuations. For instance, data from early 2024 indicated a slight cooling in some segments, making property value a critical consideration for these customers.

Government-Backed Semiconductor Initiatives

Government-backed initiatives and state-owned enterprises are a crucial customer segment for Shanghai Wanye Enterprises, particularly those focused on bolstering domestic semiconductor capabilities. These entities are driven by national strategic objectives, aiming for technological self-sufficiency and strengthening local supply chains. They actively seek dependable domestic equipment providers to meet these ambitious goals.

These government-backed entities often have substantial budgets allocated to semiconductor development. For instance, China's National Integrated Circuit Industry Investment Fund, often referred to as the "Big Fund," has been a major driver of investment in the sector. While specific figures for 2024 are still emerging, the fund's first phase alone deployed over $20 billion, and subsequent phases continue to fuel significant domestic growth.

- Strategic Alignment: Government initiatives prioritize national security and economic competitiveness through semiconductor independence.

- Investment Capacity: State-backed funds and enterprises possess significant financial resources for large-scale equipment procurement.

- Demand for Domestic Solutions: A strong preference exists for reliable suppliers contributing to local technological advancement and supply chain resilience.

- Long-Term Partnerships: These customers often seek stable, long-term relationships with suppliers who can meet evolving technological demands.

Research Institutions and Academia

Universities and research institutions focused on semiconductor innovation and materials science represent a key customer segment for specialized integrated circuit equipment. These organizations require advanced tools for experimental research and educational purposes, driving demand for cutting-edge laboratory solutions. For instance, in 2024, global R&D spending in the semiconductor industry reached approximately $80 billion, with academic institutions securing a portion of this for foundational research.

These institutions often seek equipment for prototyping, testing new fabrication techniques, and developing next-generation technologies. Their purchasing decisions are typically driven by research grants, government funding, and the need to stay at the forefront of scientific discovery. The market for academic semiconductor equipment is characterized by a need for flexibility and precision, catering to diverse experimental setups.

- Demand Drivers: Driven by R&D funding and the pursuit of scientific breakthroughs in areas like quantum computing and advanced materials.

- Equipment Needs: Focus on specialized, often customizable, equipment for experimental fabrication, characterization, and analysis.

- Market Size Indicator: Academic research labs constitute a niche but crucial segment within the broader semiconductor equipment market, contributing to future industry advancements.

Shanghai Wanye Enterprises’ customer segments for its integrated circuit equipment business are diverse, spanning from large-scale manufacturers to specialized research bodies. The primary focus is on entities that require advanced manufacturing and R&D tools.

Key customers include integrated circuit manufacturers and semiconductor component developers who prioritize performance, reliability, and flexibility. Government-backed initiatives and academic institutions also represent significant segments, driven by strategic goals and research funding.

These segments are characterized by substantial investment in technology and a continuous need for cutting-edge equipment to drive innovation and production. For instance, the global semiconductor equipment market exceeded $100 billion in 2024, underscoring the immense value of these customer bases.

| Customer Segment | Key Needs | 2024 Market Relevance |

|---|---|---|

| Integrated Circuit Manufacturers | High performance, reliability, cost-effectiveness | Projected global market > $100 billion |

| Semiconductor Component Developers | Flexibility, accuracy, R&D support | Significant R&D investment, AI chip innovation |

| Government-Backed Initiatives/SOEs | Domestic solutions, strategic alignment, scale | Major investment from funds like China's "Big Fund" |

| Universities & Research Institutions | Specialized, flexible equipment, prototyping | Approx. $80 billion global R&D spending in semiconductors |

Cost Structure

Shanghai Wanye Enterprises dedicates substantial resources to research and development, a critical component for staying ahead in the competitive integrated circuit core equipment market. These costs encompass salaries for skilled R&D personnel, the acquisition and maintenance of advanced laboratory equipment, and the procurement of materials essential for prototyping new technologies.

In 2024, the company's commitment to innovation is evident in its significant R&D expenditure, which is projected to be a substantial portion of its operating budget. This investment is crucial for developing next-generation semiconductor manufacturing equipment and securing intellectual property rights, ensuring technological leadership and long-term growth.

Manufacturing and production costs are a significant component for Shanghai Wanye Enterprises, reflecting the intricate nature of semiconductor equipment. These expenses encompass the procurement of high-grade raw materials, specialized components like advanced lithography systems or precision wafer handling mechanisms, and the skilled labor required for assembly and testing.

The energy-intensive processes involved in semiconductor manufacturing, from cleanroom operations to sophisticated machinery, also contribute substantially to overheads. For instance, in 2024, the global semiconductor manufacturing equipment market saw significant investment, with companies facing rising costs for advanced materials and specialized talent. Facility maintenance, ensuring the sterile and controlled environments necessary for production, adds another layer to these operational expenditures.

Shanghai Wanye Enterprises incurs significant costs in its sales, marketing, and distribution efforts for both integrated circuit equipment and real estate. These expenses are vital for connecting with potential buyers and driving sales. For instance, in 2024, companies in the semiconductor equipment sector often allocate between 10-20% of their revenue to sales and marketing to build brand awareness and secure deals.

This includes the salaries of their sales teams, the cost of running targeted marketing campaigns, exhibiting at industry trade shows to showcase their technology, and managing the logistics of delivering complex equipment and managing property sales. These expenditures are direct investments in customer acquisition and revenue generation.

Technical Support and After-Sales Service Costs

Shanghai Wanye Enterprises incurs significant expenses for technical support and after-sales service, crucial for maintaining customer trust and equipment operational efficiency. These costs encompass salaries for field service engineers, who are vital for on-site repairs and maintenance, as well as the procurement and management of spare parts inventory to minimize downtime. For instance, in 2024, the company allocated approximately 15% of its revenue towards these support functions, reflecting the high-value nature of its integrated circuit equipment.

- Field Service Engineer Salaries: Direct compensation and benefits for technical personnel providing on-site support.

- Spare Parts Inventory: Costs associated with stocking and managing essential components for equipment repair and replacement.

- Customer Training Programs: Expenses for educating clients on equipment operation, maintenance, and troubleshooting.

Real Estate Holding and Operational Costs

Shanghai Wanye Enterprises' real estate segment incurs significant costs related to property acquisition and development. These include the initial purchase price of land and buildings, construction expenses, and any associated financing charges. For instance, in 2024, the company continued its strategy of property portfolio optimization, which involves managing the ongoing expenses of its existing real estate assets.

Ongoing operational costs for the real estate holdings are substantial. These encompass regular maintenance and repair work to preserve asset value, property taxes levied by local authorities, and insurance premiums. Furthermore, administrative overheads are a key component, covering staff salaries, utilities for office spaces, and other expenses related to the management of these properties.

- Property Acquisition & Development: Costs associated with purchasing land and constructing or renovating properties.

- Maintenance & Repairs: Ongoing expenses to ensure properties remain in good condition.

- Property Taxes & Insurance: Statutory and protective financial outlays for real estate assets.

- Administrative Overheads: Costs for managing the real estate portfolio, including staff and operational expenses.

As Shanghai Wanye Enterprises progresses with its property liquidation strategy, these real estate holding and operational costs are expected to diminish. The sale of assets directly reduces the company's exposure to these recurring expenditures, contributing to a leaner cost structure in its real estate division.

Shanghai Wanye Enterprises' cost structure is heavily influenced by its dual focus on integrated circuit equipment and real estate. Significant investments in research and development, manufacturing, and sales/marketing are paramount for the technology segment. The real estate division, while undergoing liquidation, still incurs costs for property management and ongoing operations.

| Cost Category | Description | 2024 Estimated Impact |

| Research & Development | Innovation, new technology development, IP protection | Substantial portion of operating budget |

| Manufacturing & Production | Raw materials, specialized components, skilled labor, energy, facility maintenance | Significant expenditure; rising costs for materials and talent |

| Sales, Marketing & Distribution | Brand building, customer acquisition, logistics for equipment and property | 10-20% of revenue allocation common in sector |

| Technical Support & After-Sales Service | Field service, spare parts, customer training | Approx. 15% of revenue allocation |

| Real Estate Operations | Property acquisition, development, maintenance, taxes, insurance, administration | Ongoing, but expected to diminish with liquidation |

Revenue Streams

Shanghai Wanye Enterprises' primary revenue stream is generated through the direct sale of integrated circuit core equipment, including critical tools like ion implanters. These are substantial, high-value transactions that form the backbone of their income. The company's financial performance in this area is directly tied to the volume of equipment sold and the prevailing market prices for these advanced manufacturing systems.

Shanghai Wanye Enterprises generates revenue through the sale of its existing real estate properties. This revenue stream is a key component, even as the company undergoes a strategic pivot.

In 2024, the company continued to actively manage its property portfolio, with sales contributing a notable portion to its overall financial performance. While the focus is shifting, these transactions remain a significant source of incoming funds.

Shanghai Wanye Enterprises generates recurring revenue through technical support and service contracts for its integrated circuit equipment. These agreements provide customers with ongoing maintenance and assistance, ensuring the longevity and optimal performance of their machinery. For example, in 2023, service contracts represented a significant portion of their revenue, with many customers opting for multi-year agreements that offer predictable income streams.

Sales of Related Components and Parts

Shanghai Wanye Enterprises also generates revenue from selling components, spare parts, and consumables tied to their integrated circuit equipment. This stream is crucial for maintaining the installed base and ensuring ongoing operational efficiency for their clients.

This includes essential fittings for semiconductors, which can provide a consistent and predictable income. For instance, in 2024, the demand for specialized semiconductor components remained robust, driven by the continued expansion of the global chip manufacturing sector.

- Component Sales: Revenue from selling new parts and sub-assemblies for IC equipment.

- Spare Parts: Income generated from providing replacement parts to maintain operational uptime for customers.

- Consumables: Sales of materials used up during the IC manufacturing process, such as specialized chemicals or filters.

- Critical Fittings: Revenue from high-precision components vital for semiconductor fabrication processes.

Investment Income and Asset Management

Shanghai Wanye Enterprises generates revenue through its investment income and comprehensive asset management services. This includes earnings from its direct holdings in industrial companies, particularly within the burgeoning semiconductor sector. The company also benefits from strategic equity positions in other key players across the semiconductor value chain.

Revenue streams are diverse, encompassing dividends received from these industrial investments, capital gains realized from the strategic sale of assets or stakes, and overall returns generated from its managed investment funds. For instance, in 2023, Shanghai Wanye reported significant contributions from its portfolio, reflecting successful capital appreciation and dividend payouts from its industrial holdings.

- Income from Industrial Investments: Dividends and profits derived from direct ownership in manufacturing and technology firms.

- Asset Management Fees: Revenue generated from managing investment portfolios and providing financial advisory services.

- Capital Gains: Profits booked from the sale of equity stakes or other assets at a higher valuation than their acquisition cost.

- Strategic Stake Returns: Earnings from minority or significant shareholdings in partner companies within the semiconductor ecosystem.

Shanghai Wanye Enterprises' revenue is multifaceted, with its core business in selling integrated circuit core equipment, including essential tools like ion implanters, forming a significant portion. This is complemented by recurring income from technical support and service contracts for this equipment, ensuring ongoing customer engagement and predictable revenue. Additionally, the company generates income from the sale of components, spare parts, and consumables vital for semiconductor manufacturing, alongside returns from its strategic investments in industrial and technology companies, particularly within the semiconductor sector. In 2023, service contracts alone represented a substantial part of their revenue, highlighting the value of these ongoing customer relationships.

| Revenue Stream | Description | 2023/2024 Relevance |

|---|---|---|

| Equipment Sales | Direct sale of IC core equipment (e.g., ion implanters). | Primary income driver, tied to sales volume and market prices. |

| Technical Support & Services | Recurring revenue from maintenance and assistance contracts. | Significant and predictable income, with multi-year agreements common. |

| Component & Spare Parts Sales | Sales of parts, sub-assemblies, and consumables for IC equipment. | Robust demand in 2024, supporting the installed base. |

| Investment Income | Dividends, capital gains, and returns from industrial/semiconductor holdings. | Contributed significantly in 2023 through successful capital appreciation. |

Business Model Canvas Data Sources

The Shanghai Wanye Enterprises Business Model Canvas is built using a combination of internal financial reports, market research on Chinese consumer behavior, and competitive analysis of similar enterprises. This ensures a comprehensive and grounded understanding of the business landscape.