2U SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

2U Bundle

2U leverages its strong brand recognition and established online learning platform to attract students and universities. However, it faces intense competition and evolving market demands that challenge its growth strategies.

Want the full story behind 2U's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

2U's strength lies in its robust university partnerships, collaborating with top-tier non-profit institutions. This strategy bolsters 2U's reputation and draws in a desirable student demographic. For instance, as of late 2023, 2U partnered with over 70 universities, a testament to its established network.

These alliances enable universities to broaden their online reach efficiently, utilizing 2U's advanced technology and operational know-how. This symbiotic relationship allows institutions to avoid substantial upfront capital expenditure for online program development, a key factor in their growth strategy.

The company actively pursues new collaborations, with a pipeline of programs slated for launch in 2024 and continuing into 2025. This forward-looking approach ensures a consistent stream of new offerings and revenue opportunities, reinforcing its market position.

2U offers a complete package of services, encompassing everything from their advanced technology platforms to expert instructional design, targeted marketing, and robust student support. This all-encompassing strategy allows universities to seamlessly introduce and oversee online education programs, addressing every crucial element from initial course creation to attracting and retaining students.

2U is strategically focusing on high-demand areas, particularly in technology fields like artificial intelligence, machine learning, and data science. This pivot includes a significant emphasis on shorter, flexible learning formats, such as microcredentials, to meet the evolving needs of the workforce. For instance, in 2024, the company continued to expand its portfolio of tech-focused programs, aiming to capture a larger segment of the lifelong learning market.

Technological Infrastructure and Expertise

2U's technological infrastructure is a significant strength, featuring a proprietary platform designed for scalable course creation, delivery, and student interaction. This advanced system underpins their ability to offer high-quality online education and manage a broad array of academic programs effectively.

This technological backbone provides a distinct competitive edge, allowing 2U to innovate in online learning delivery and maintain operational efficiency. For instance, in the first quarter of 2024, 2U reported a 7% increase in revenue for its Technology and Platform segment, highlighting the growing importance and performance of its core tech offerings.

- Proprietary Technology Platform: Enables efficient course design, delivery, and student engagement.

- Scalability: Supports a large and diverse portfolio of online programs.

- Competitive Advantage: Differentiates 2U in the online education market.

- Revenue Growth: The Technology and Platform segment saw a 7% revenue increase in Q1 2024.

Market Demand for Online Education

The online education sector is booming, with global demand for flexible learning solutions on the rise. This strong market tailwind is a significant advantage for 2U, positioning it well to capture a larger share of this expanding market. The need for accessible, high-quality education continues to grow, creating fertile ground for 2U's offerings.

Key indicators highlight this robust demand:

- Global online education market projected to reach over $600 billion by 2027, demonstrating substantial growth potential.

- Increased enrollment in online programs, with many universities reporting significant year-over-year increases in their digital offerings.

- Growing acceptance of online degrees by employers, further validating the value proposition of digital learning.

- The COVID-19 pandemic accelerated digital transformation in education, permanently shifting consumer behavior towards online learning platforms.

2U's core strength is its extensive network of partnerships with over 70 prestigious universities as of late 2023. This allows them to offer a wide array of high-quality online programs, attracting a desirable student demographic and solidifying their market reputation.

What is included in the product

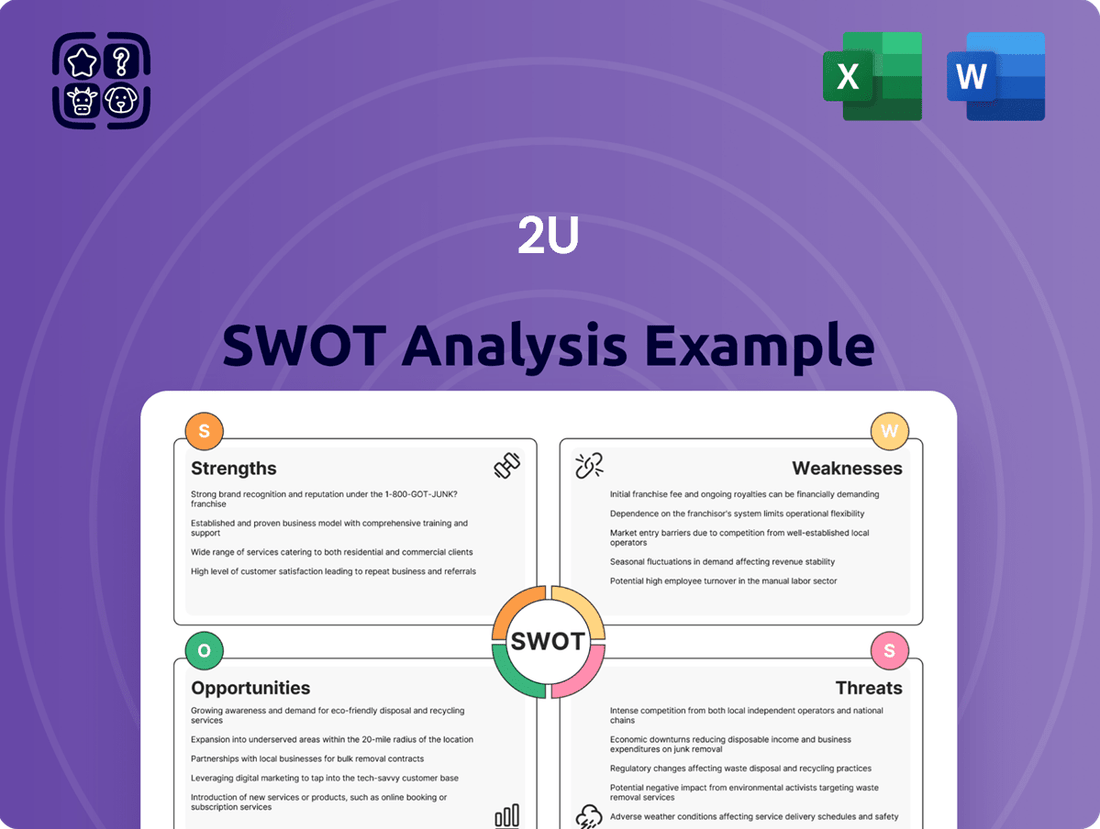

Analyzes 2U’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address critical business challenges.

Weaknesses

2U's significant debt burden, exceeding $900 million, largely stemming from strategic acquisitions such as edX, presented a major weakness. This substantial financial obligation put considerable pressure on the company's operations and future growth prospects.

The company's filing for Chapter 11 bankruptcy in July 2024 was a direct consequence of these financial difficulties. This move was intended to facilitate a comprehensive financial restructuring, specifically targeting a reduction in debt by over 50% and the infusion of new capital to stabilize its financial standing.

2U has faced significant headwinds with declining revenues across its degree and alternative credential segments throughout 2024. This downturn is attributed partly to strategic portfolio management initiatives and a noticeable drop in student enrollments, particularly within its bootcamp offerings. These factors highlight ongoing difficulties in attracting and retaining students in a competitive educational technology landscape.

2U's historical reliance on a substantial revenue-sharing model, where it typically captured around 60% of tuition income, presents a significant weakness. This model, while once lucrative, is facing headwinds as the Online Program Management (OPM) market evolves.

The industry is increasingly favoring fee-for-service arrangements over revenue sharing. This shift could directly impact 2U's profitability and requires the company to adapt its strategies to remain competitive in this changing landscape.

Negative Perception and Regulatory Scrutiny

2U has grappled with a negative public perception, stemming from accusations of prioritizing rapid growth over the quality of its educational offerings. Concerns have been raised about the value proposition of some of its certificate programs, with allegations of aggressive and potentially misleading marketing tactics. This has unfortunately resulted in significant legal challenges from investors, creating a cloud of uncertainty around the company's future.

This heightened scrutiny from regulators and the public poses a substantial risk to 2U's brand image and its ability to forge new, crucial partnerships. The company's reputation for academic integrity and student success has been called into question, which could hinder its expansion plans and impact its long-term viability in the competitive online education market.

- Reputational Damage: Allegations of selling low-quality courses and deceptive marketing practices have tarnished 2U's brand.

- Investor Lawsuits: Multiple lawsuits from investors highlight concerns about the company's business practices and financial reporting.

- Regulatory Scrutiny: Increased attention from regulatory bodies could lead to stricter oversight and potential penalties.

- Partnership Challenges: A damaged reputation may make it more difficult for 2U to secure and maintain partnerships with universities and other institutions.

Workforce Reductions and Leadership Changes

2U has experienced significant workforce reductions, with multiple layoff rounds impacting its staff since 2022. This instability is compounded by frequent leadership changes, including CEO transitions, signaling ongoing struggles to stabilize its financial performance and refine its business strategy. These continuous shifts can negatively affect employee morale and hinder the consistent execution of long-term plans.

The impact of these workforce reductions and leadership changes is substantial. For instance, 2U has faced challenges in maintaining operational momentum and fostering a stable internal culture. Such volatility can lead to a loss of institutional knowledge and make it harder to attract and retain top talent, which are critical for innovation and growth in the competitive online education market.

- Workforce Reductions: Multiple layoff events since 2022 have reshaped the company's employee base.

- Leadership Instability: Several CEO transitions have occurred, indicating a search for effective leadership.

- Morale Impact: Frequent changes can depress employee morale and reduce productivity.

- Strategic Execution: Ongoing restructuring efforts may impede the consistent implementation of strategic goals.

2U's substantial debt, exceeding $900 million prior to its Chapter 11 filing in July 2024, remains a critical weakness. This financial overhang directly impacts its ability to invest in growth and adapt to market shifts. The company's strategy to reduce this debt by over 50% through restructuring is essential for long-term viability.

Preview the Actual Deliverable

2U SWOT Analysis

You are viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The global online education market is experiencing robust expansion, with forecasts indicating it will surpass $370 billion by 2026. This substantial growth trajectory presents a significant opportunity for 2U to broaden its student base and market presence by leveraging its existing online program infrastructure.

The growing appetite for specialized learning, including micro-credentials and short courses, creates a prime opportunity for 2U to broaden its educational portfolio. This trend reflects a shift in learner preferences towards agile, career-oriented skill acquisition, moving beyond conventional degree structures.

By developing and offering these more focused credentials, 2U can tap into a wider market segment actively seeking flexible pathways to career advancement. For instance, the global market for online learning, which encompasses these formats, was projected to reach over $370 billion by 2026, indicating substantial growth potential.

2U can significantly boost its offerings by integrating AI and emerging technologies. Imagine personalized learning paths powered by AI, adapting to each student's pace and style, a concept that resonates with the growing demand for tailored education. This can lead to more engaging and effective online courses, potentially increasing completion rates.

The market for edtech solutions incorporating AI is rapidly expanding. For instance, the global AI in education market was projected to reach over $3.68 billion in 2023 and is expected to grow substantially in the coming years, indicating a strong opportunity for 2U to capture market share by innovating its platform.

Furthermore, AR and VR technologies offer immersive learning environments that can transform how subjects are taught, making complex concepts more accessible and memorable. By embracing these advancements, 2U can differentiate its product portfolio and attract a wider range of students and university partners seeking cutting-edge educational delivery.

Strategic Partnerships and International Expansion

Strategic partnerships remain a key opportunity for 2U. The company continues to forge new program agreements with both existing and new university partners, which is crucial for expanding its reach. For instance, in 2023, 2U announced new partnerships, including expanding its offerings with existing clients and onboarding new institutions, signaling a commitment to growth in this area.

International expansion presents a significant avenue for diversifying revenue streams and tapping into new student populations. Regions like Asia and Latin America, with growing demand for online higher education, are particularly attractive markets. By tailoring programs to these regions and establishing a strong local presence, 2U can unlock substantial growth potential beyond its traditional markets.

- New Program Agreements: 2U's consistent signing of new program agreements with universities is a testament to its ongoing partnership strategy. This activity is vital for maintaining a robust portfolio of offerings.

- Geographic Diversification: Targeting high-growth international markets such as Asia and Latin America can significantly reduce reliance on any single region and broaden 2U's revenue base.

- Market Penetration: Successful international expansion would allow 2U to reach a larger student demographic, potentially increasing enrollment numbers and overall revenue.

Focus on Workforce Development and Upskilling

The persistent demand for upskilling and reskilling within the global workforce presents a significant opportunity for 2U. As industries evolve rapidly, professionals are increasingly seeking career-relevant education to stay competitive and advance their careers. This trend directly fuels the market for 2U's online programs, particularly those focused on in-demand fields like technology, data science, and healthcare.

2U is well-positioned to capitalize on this by continuously adapting its curriculum to align with current and future industry needs. By partnering with leading universities and employers, 2U can ensure its programs equip learners with the practical skills and knowledge valued in today's job market. This strategic alignment is crucial for attracting and retaining students who are making a direct investment in their professional future.

Consider these key points:

- Growing Demand: The global online education market is projected to reach over $400 billion by 2026, indicating a substantial appetite for flexible learning solutions.

- Skills Gap: Reports from organizations like the World Economic Forum highlight a widening skills gap, with millions of jobs requiring new competencies by 2025.

- Employer Partnerships: Collaborations with companies for corporate training and degree programs can provide a direct pipeline of students and ensure curriculum relevance.

- Career Advancement Focus: 2U's emphasis on career outcomes and job placement resonates strongly with individuals seeking tangible returns on their educational investment.

2U can capitalize on the increasing demand for specialized, career-focused learning by expanding its portfolio to include more micro-credentials and short courses. This caters to a market segment actively seeking agile skill acquisition for career advancement, a trend supported by the projected global online learning market exceeding $370 billion by 2026.

Integrating AI and emerging technologies like AR/VR offers a significant opportunity to enhance learning experiences and differentiate 2U's offerings. The AI in education market alone was projected to exceed $3.68 billion in 2023, highlighting the potential for innovation to attract students and partners seeking cutting-edge educational delivery.

Strategic partnerships with universities and a focus on international expansion are crucial for growth. 2U's continued success in securing new program agreements and its potential to tap into high-growth markets like Asia and Latin America can diversify revenue and broaden its student base.

The persistent need for workforce upskilling and reskilling presents a direct opportunity for 2U. By aligning its curriculum with evolving industry demands and fostering employer partnerships, 2U can attract professionals seeking tangible career outcomes, a need underscored by the widening skills gap reported by organizations like the World Economic Forum.

Threats

The Online Program Management (OPM) landscape is seeing a surge in new players and innovative service models, creating a more crowded marketplace. This heightened competition can force providers like 2U to lower prices, potentially squeezing profit margins as they vie for lucrative university contracts.

By 2024, the OPM market was projected to reach over $10 billion, with continued growth expected. This expansion attracts new entrants, intensifying the battle for market share and partnerships with educational institutions, which could directly affect 2U's revenue streams and growth potential.

The Online Program Management (OPM) sector, including 2U's core business, is under increasing regulatory pressure. Revenue-sharing models, a cornerstone of OPMs, are being closely examined by government agencies concerned about academic integrity and student welfare. For instance, the U.S. Department of Education's proposed rule changes in late 2023 aimed to tighten oversight on these arrangements, potentially impacting how OPMs are compensated and thus their profitability.

As the online education landscape evolves, a significant threat emerges from universities choosing to build and manage their own online programs. This in-house development trend directly challenges 2U's established revenue-sharing model, as institutions seek greater control and potentially different financial arrangements. For instance, the increasing adoption of fee-for-service structures by universities signals a move away from the partnership models that have historically benefited OPMs like 2U.

Reputational Damage and Student Dissatisfaction

Past allegations concerning program quality, marketing practices, and declining student numbers have left 2U with a significant reputational hurdle. This negative perception, particularly among prospective students and university collaborators, poses a substantial threat to future expansion and could trigger additional program withdrawals.

For instance, in 2023, 2U faced scrutiny over its student outcomes and marketing, contributing to a 15% year-over-year decline in its stock price by early 2024. This ongoing concern about student satisfaction and the integrity of its offerings directly impacts its ability to attract new partners and maintain existing ones.

- Reputational Risk: Past controversies regarding program quality and marketing tactics continue to affect public perception.

- Student Dissatisfaction: Concerns over student outcomes and the value proposition of online programs can lead to negative word-of-mouth.

- Partner Attrition: Universities may reconsider partnerships if they perceive reputational damage or declining student interest in their jointly offered programs.

- Future Growth Hindrance: Negative sentiment can deter new university partners and prospective students, limiting 2U's market penetration and revenue potential.

Economic Downturns and Shifting Enrollment Trends

Economic downturns present a significant threat to 2U by potentially dampening demand for its higher-priced online degree programs. As household budgets tighten, prospective students may defer or forgo expensive educational investments, opting for more cost-effective alternatives. This economic sensitivity could directly impact 2U's revenue streams, especially if a recessionary environment takes hold.

Furthermore, evolving student preferences pose a challenge. There's a growing trend towards shorter, more skills-focused credentials and bootcamps, which can be perceived as quicker paths to employment and less financially burdensome than traditional four-year degrees. This shift could erode demand for 2U's core online degree offerings, forcing adaptation.

For instance, in late 2023 and early 2024, many universities reported increased enrollment in certificate programs and a more cautious approach to master's degree applications due to economic uncertainty. This broader educational landscape shift directly affects 2U's market position.

- Economic Sensitivity: Reduced consumer spending power during downturns can lead to decreased enrollment in higher-cost educational programs.

- Credential Shift: Growing student interest in affordable, shorter credentials may reduce demand for 2U's traditional degree-focused online offerings.

- Market Competition: The rise of alternative, lower-cost educational providers intensifies competition for students seeking value and career advancement.

Increased competition from new OPM providers and universities building their own online programs presents a significant threat to 2U's market share and revenue. Regulatory scrutiny, particularly around revenue-sharing models, could impact profitability, as seen with the U.S. Department of Education's proposed rule changes in late 2023. Negative past publicity regarding program quality and student outcomes continues to be a reputational hurdle, potentially deterring new partnerships and impacting student enrollment, as evidenced by 2U's stock performance in early 2024.

| Threat Category | Specific Threat | Impact on 2U | Data Point/Example |

|---|---|---|---|

| Competition | New OPM Entrants & In-house University Programs | Market share erosion, pricing pressure | OPM market projected to exceed $10 billion by 2024 |

| Regulatory Environment | Scrutiny of Revenue-Sharing Models | Reduced profitability, altered business models | U.S. Dept. of Education proposed rule changes late 2023 |

| Reputation & Student Outcomes | Past Controversies & Student Dissatisfaction | Difficulty attracting partners/students, partner attrition | 15% year-over-year stock decline by early 2024 |

| Economic Factors & Student Preferences | Economic Downturns & Shift to Shorter Credentials | Decreased demand for higher-cost degrees, market share loss | Increased enrollment in certificate programs late 2023/early 2024 |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from 2U's official financial reports, comprehensive market research, and expert industry analyses to provide a thorough and insightful assessment.