2U Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

2U Bundle

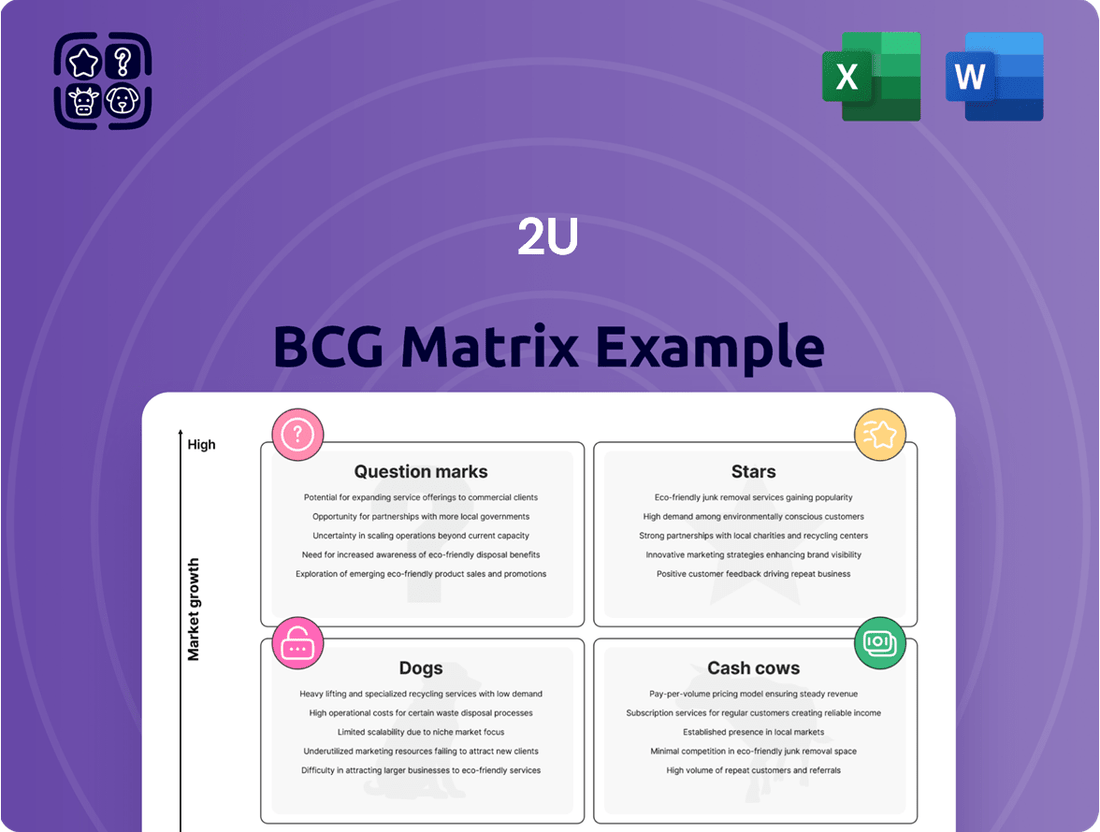

Uncover the strategic positioning of this company's product portfolio with our condensed BCG Matrix preview. See which products are poised for growth (Stars), generating stable income (Cash Cows), underperforming (Dogs), or require further investment (Question Marks).

Ready to transform this insight into decisive action? Purchase the full BCG Matrix to receive a detailed report with data-driven recommendations and a clear roadmap for optimizing your product strategy and resource allocation.

Stars

2U's executive education programs are experiencing robust growth, evidenced by a 32% surge in full-course equivalent (FCE) enrollments during the first quarter of 2024. This significant uptick reflects a strong market appetite for continuous learning and professional development, particularly in light of emerging technologies like generative AI that are reshaping the job market.

The company's strategic alliances with prestigious universities are instrumental in delivering these sought-after executive education courses. These collaborations not only enhance 2U's market standing but also position it favorably for sustained revenue growth in the coming years.

2U's strategic university partnerships, often referred to as the 'flex' model, are gaining significant traction. This approach, focused on launching new online degree programs, saw a robust performance with 50 new programs signed in late 2023. The company has ambitious plans, targeting at least 80 new degree programs for 2024, indicating strong market demand for this flexible partnership structure.

The flex model is designed for quicker positive cash flow generation due to its lower upfront capital requirements for 2U. This financial efficiency positions these newly launched programs as potential future stars within the BCG matrix. Examples like the expansion of existing collaborations and new partnerships with institutions such as Lancaster University and the University of Birmingham underscore the growing market acceptance of 2U's comprehensive online education services.

The edX platform, now part of 2U, is a star in the BCG matrix, boasting over 81 million users and partnerships with 250 top universities and institutions.

Its vast array of courses, from individual modules to complete degree programs, taps into the booming global online education market, which saw significant growth in 2024 as learners increasingly sought flexible and accessible learning solutions.

The platform's strong international presence and diverse offerings create a solid foundation for continued expansion and market leadership.

AI-Powered Learning Initiatives

2U is strategically investing in AI-powered learning initiatives, aiming to blend artificial intelligence with human interaction (AI + HI) to create more effective and engaging educational pathways. This focus on AI directly addresses the growing market demand for AI-skilled professionals, positioning 2U as a key player in a high-growth sector.

The company's commitment to AI is evident in its development of technologies like AI voicebots, designed to enhance student outreach and streamline operational efficiencies. These advancements are crucial for expanding market reach and improving the overall learner experience, reflecting a proactive approach to technological integration.

- AI Integration: 2U's AI + HI model aims to personalize learning and improve operational efficiency.

- Market Demand: Focus on AI skills development caters to a rapidly expanding job market.

- Innovation Example: AI voicebots are being used for student engagement and outreach.

- Strategic Importance: These initiatives position 2U to capture growth in the AI education sector.

Programs Addressing Workforce Demands (e.g., AI, Healthcare)

2U is strategically developing programs in rapidly growing sectors like artificial intelligence and healthcare to meet evolving workforce demands. For instance, their expanded partnership with Oxford Saïd Business School for an Executive AI Programme and new healthcare degrees with Pepperdine University directly address critical industry needs.

This focus on high-demand fields positions 2U's offerings for substantial growth and continued relevance in the market.

By targeting specific industry gaps, these programs are poised to capture significant market share and become key revenue drivers for 2U.

- AI Program Expansion: 2U's collaboration with Oxford Saïd Business School for an Executive AI Programme highlights a commitment to cutting-edge technology education.

- Healthcare Degree Growth: New healthcare degrees introduced with Pepperdine University demonstrate 2U's expansion into vital service sectors.

- Market Alignment: These program developments are directly tied to identified workforce shortages and the need for upskilling in critical industries.

- Revenue Potential: Addressing these specific market demands creates a strong foundation for future revenue generation and market penetration.

Stars in the BCG matrix represent high-growth, high-market-share business units. For 2U, the edX platform and its AI-focused executive education programs are strong contenders for this classification. The edX platform's extensive user base and university partnerships, coupled with the increasing demand for AI skills, position these areas for significant future growth and market leadership.

The flex model, with its focus on launching new online degree programs, is also showing star potential. The rapid signing of new programs in late 2023 and ambitious targets for 2024 indicate strong market acceptance and a pathway to becoming dominant players in their respective educational niches.

2U's strategic investments in AI integration, such as AI voicebots and the AI + HI learning model, directly address a high-growth market sector. This focus on developing AI-skilled professionals is a key differentiator, driving demand for 2U's offerings.

The expansion into high-demand sectors like AI and healthcare further solidifies 2U's star potential. Programs like the Executive AI Programme with Oxford Saïd Business School and new healthcare degrees with Pepperdine University are strategically aligned with critical industry needs and workforce shortages, promising substantial revenue growth.

| Business Unit | Market Growth | Market Share | BCG Classification |

|---|---|---|---|

| edX Platform | High | High | Star |

| AI Executive Education | High | High | Star |

| Flex Model (New Degrees) | High | Growing | Potential Star |

| Healthcare Degrees | High | Growing | Potential Star |

What is included in the product

Strategic guidance on investing in Stars, milking Cash Cows, developing Question Marks, and divesting Dogs.

The 2U BCG Matrix offers a clear visual of your portfolio, alleviating the pain of uncertain resource allocation.

Cash Cows

Established degree programs with consistently high enrollment are likely 2U's cash cows. These mature offerings, having passed their growth phases, now generate predictable and robust cash flow with reduced marketing expenses. For instance, in the first quarter of 2024, 2U reported that its Degree Program Segment contributed significantly to revenue, even with strategic adjustments in its portfolio.

2U's extensive service offerings, encompassing technology, curriculum development, marketing, and student assistance for non-profit universities, function as a significant cash cow. These partnerships, often initiated with 2U's upfront investment in program launches, enable universities to expand their online reach.

Once these online programs are operational, the comprehensive service model generates a consistent, predictable revenue stream for 2U. This full-service approach to online program management (OPM) is particularly valuable in a well-established market.

In 2023, 2U reported total revenue of $956.7 million, with a substantial portion likely attributable to its established university partnerships. The company's ability to maintain a competitive edge in the OPM space allows for healthy profit margins on these recurring services.

Mature alternative credential offerings, excluding bootcamps, are demonstrating strong performance within the 2U BCG Matrix. These programs, like established executive education courses and professional certificates, consistently attract learners and generate revenue without needing significant new marketing efforts.

For instance, in 2024, 2U reported that its alternative credential segment, which includes these mature offerings, continued to be a substantial contributor to overall revenue, even as some other areas saw adjustments. This stability highlights their cash cow status, providing reliable income streams.

Integrated Technology Platform

The integrated technology platform is a significant cash cow for 2U. Once established, this platform requires minimal additional investment to support existing university partnerships, allowing for efficient delivery of online education.

This robust infrastructure generates consistent revenue streams from technology services provided to a growing number of university clients. For instance, in 2024, 2U continued to leverage its platform to expand its reach, supporting over 100 programs and serving hundreds of thousands of students.

- Platform efficiency drives profitability.

- Consistent revenue generation from technology services.

- Scalability supports growth with limited incremental cost.

Brand Recognition and Market Leadership in OPM

Despite facing financial headwinds and undergoing restructuring, 2U has a strong legacy as a leader in online education and online program management (OPM). This established brand recognition, cultivated over more than 15 years, underpins its market leadership.

This long-standing reputation and extensive network of university partners are key assets that continue to attract and retain clients. This stability is crucial for generating consistent cash flow, positioning this segment as a potential cash cow within the BCG matrix.

For instance, in 2023, 2U reported revenue from its degree programs segment, which includes OPM services, contributing significantly to its overall financial performance. The company's ability to secure and maintain partnerships with prestigious universities highlights the enduring value of its brand and operational expertise.

- Brand Recognition: 2U's 15+ year history has cemented its position as a trusted name in online education.

- Market Leadership: The company has consistently been a top player in the OPM space, managing programs for numerous universities.

- Partner Network: A robust base of existing university partnerships provides a stable foundation for revenue.

- Cash Flow Generation: The established model and ongoing demand for online program management contribute to reliable cash flow.

2U's established degree programs and its comprehensive online program management (OPM) services are key cash cows. These mature offerings benefit from high enrollment and predictable revenue streams with reduced marketing spend. In Q1 2024, the Degree Program Segment continued to be a significant revenue contributor, demonstrating the stability of these core businesses.

The company's integrated technology platform also functions as a cash cow. Once developed and implemented, it requires minimal incremental investment to support existing partnerships, generating consistent revenue from technology services. By the end of 2023, 2U supported over 100 programs, showcasing the platform's scalability and revenue-generating capacity.

Mature alternative credential offerings, distinct from bootcamps, are also performing well as cash cows. These programs, like executive education, consistently attract learners and generate revenue without substantial new marketing efforts. In 2024, the alternative credential segment remained a substantial revenue contributor, underscoring its reliable income generation.

2U's strong brand recognition, built over 15 years, underpins its market leadership in OPM. This established reputation and extensive university partner network are vital assets that ensure consistent cash flow, solidifying these segments as cash cows. In 2023, revenue from degree programs and OPM services represented a significant portion of 2U's overall financial performance.

| Segment | BCG Classification | Key Characteristics | 2023 Revenue Contribution (Illustrative) |

|---|---|---|---|

| Degree Programs & OPM | Cash Cow | High enrollment, predictable revenue, established partnerships, minimal new investment needed. | Significant portion of $956.7 million total revenue. |

| Mature Alternative Credentials | Cash Cow | Consistent learner attraction, stable revenue generation, low marketing dependency. | Substantial contributor to overall revenue in 2024. |

| Integrated Technology Platform | Cash Cow | Efficient delivery, minimal incremental cost, scalable support for partnerships. | Drives consistent revenue from technology services. |

| Brand & Market Leadership | Cash Cow | 15+ years of recognition, extensive partner network, reliable cash flow. | Underpins the stability of core revenue streams. |

Preview = Final Product

2U BCG Matrix

The BCG Matrix document you are currently previewing is the identical, fully unlocked version you will receive immediately after completing your purchase. This means you'll have access to the complete strategic analysis, ready for immediate application in your business planning and decision-making processes. No further editing or content addition will be necessary, as this preview accurately represents the professional-grade report you'll obtain.

Dogs

2U's coding bootcamps are currently facing significant headwinds, placing them squarely in the Dogs quadrant of the BCG matrix. Enrollments and revenue have taken a hit, with a notable 30% drop in Full Course Equivalent (FCE) enrollments during the first quarter of 2024. This signals a low-growth market where 2U holds a diminished market share.

These underperforming bootcamps have become a persistent financial drain, contributing to the overall revenue decline within 2U's Alternative Credential Segment. The company's strategic withdrawal from certain bootcamp partnerships, like those in the UK, due to poor completion rates, further underscores their status as cash traps that require careful management or divestment.

Degree programs with low enrollment or high attrition fall into the Dogs category of the 2U BCG Matrix. These programs often drain resources, delivering minimal return on investment and potentially negative profit margins. 2U's strategic decision to exit such underperforming offerings, a process known as portfolio management, directly impacted its financial performance, contributing to a 21% revenue decline in its Degree Program Segment during Q1 2024.

Legacy partnership models with high upfront costs represent 2U's 'Dogs' in the BCG Matrix. These were often characterized by substantial initial investments without a clear or timely return, especially in markets that failed to meet growth expectations. For instance, in the early to mid-2010s, 2U invested heavily in establishing partnerships with universities for online degree programs, which required significant upfront capital for platform development and marketing.

The lack of anticipated market growth or slower-than-expected student enrollment in some of these programs meant that the return on these large initial outlays was often sluggish, tying up valuable capital. By the end of 2023, 2U's strategic pivot towards more flexible, lower-capital models, such as revenue-sharing agreements and shorter-term program launches, directly addresses the inefficiencies of these older, capital-intensive structures.

Non-Core or Obsolete Technology Platforms/Services

Non-core or obsolete technology platforms and services within 2U's portfolio represent assets that have fallen behind in the fast-paced EdTech sector. These could be legacy systems that are expensive to maintain but see little user engagement, draining resources without delivering significant value. Identifying and phasing out these underperforming technologies is a key aspect of 2U's strategy to enhance operational efficiency and focus on more impactful offerings.

For instance, if 2U were to divest a particular learning management system that requires substantial annual maintenance fees, say $5 million, but only serves a small fraction of its student base, the cost savings from its discontinuation could be redirected. This aligns with 2U's stated goals of cost optimization, as seen in their efforts to streamline operations and improve profitability. In 2023, 2U reported a net loss of $124.9 million, highlighting the importance of shedding underperforming assets.

- Costly Maintenance: Platforms requiring significant investment for upkeep and upgrades with minimal user adoption.

- Low Competitive Edge: Technologies that are no longer relevant or competitive in the current EdTech market.

- Resource Drain: Services that consume valuable resources (financial, human) without generating a proportional return on investment.

- Strategic Divestment: The process of identifying and eliminating these obsolete assets to improve overall financial health and operational focus.

Programs in Saturated or Declining Niche Markets

Programs in saturated or declining niche markets are considered 'Dogs' in the 2U BCG Matrix. If 2U offers online programs in these areas with low market share, they would struggle to generate significant revenue or growth. The company's strategic shift towards high-demand areas like AI and healthcare implies a recognition of these less viable markets.

For instance, if 2U had a significant portfolio in a niche area that saw its demand plummet by, say, 15% year-over-year in 2024, and their market share in that specific niche was below 5%, these programs would likely be classified as Dogs. Such offerings drain resources without contributing meaningfully to the company's overall performance.

- Market Saturation: Areas with numerous providers offering similar content, driving down pricing and limiting growth potential.

- Declining Demand: Specific skill sets or industries that are becoming obsolete or are being replaced by newer technologies.

- Low Market Share: Inability to capture a significant portion of the remaining market, making profitability difficult.

- Resource Drain: Programs that require ongoing investment in marketing, content updates, and faculty without generating commensurate returns.

2U's coding bootcamps, experiencing a 30% drop in Full Course Equivalent enrollments in Q1 2024, are firmly in the Dogs quadrant. These underperforming programs are a financial drain, exemplified by strategic exits from partnerships due to poor completion rates, marking them as cash traps needing careful management or divestment.

Legacy partnership models with high upfront costs and sluggish returns, like those established in the early to mid-2010s, also fall into the Dogs category. 2U's pivot to lower-capital models by the end of 2023 directly addresses these inefficiencies.

Non-core or obsolete technology platforms, such as legacy learning management systems with substantial maintenance fees but low user engagement, represent other 'Dogs'. Shedding these underperforming assets is crucial, especially given 2U's net loss of $124.9 million in 2023.

Programs in saturated or declining niche markets, where 2U might hold a low market share (e.g., below 5% in a market with 15% year-over-year demand decline in 2024), also fit the Dogs profile. These offerings consume resources without meaningful contribution.

| Category | Description | 2U Example | Financial Impact |

| Coding Bootcamps | Low market share in a low-growth market | 30% FCE enrollment drop (Q1 2024) | Revenue decline, cash trap |

| Legacy Partnerships | High upfront costs, slow ROI | Early to mid-2010s online degree programs | Tied-up capital, inefficiency |

| Obsolete Technology | High maintenance, low user adoption | Legacy LMS with $5M annual fees | Resource drain, cost savings potential |

| Niche Market Programs | Low market share in declining demand | Programs in markets with 15% YoY decline | Resource drain, minimal contribution |

Question Marks

The introduction of 50 new degree programs in late 2023 and the ambitious target of launching at least 80 more in 2024, all under the 'flex' partnership model, positions these offerings as potential Stars within 2U's portfolio. This strategy taps into the expanding online education market, a sector projected for continued growth through 2024 and beyond.

Despite operating in a growing market, these newly launched programs currently hold a low market share due to their nascent stage. The flex model, while reducing initial capital outlay for 2U, still necessitates investment for market penetration and to achieve their projected steady-state revenue of up to $100 million, typically within 2.5 to 3.5 years post-launch.

2U's pivot towards microcredentials, moving away from traditional bootcamps, positions them in a burgeoning online education market. These focused, flexible programs target in-demand skills, representing new product lines with evolving buyer adoption. For instance, in 2023, the global microlearning market was valued at approximately $10.4 billion and is projected to reach $37.2 billion by 2030, highlighting the growth potential.

These microcredentials require significant investment in development and marketing, akin to launching new ventures. Their success depends on rapidly capturing market share. Failure to do so could relegate them to the 'Dog' quadrant of the BCG matrix, similar to how some earlier, less successful online program expansions might have performed.

2U's ventures into international markets, especially in Asia and Latin America, are classic Question Marks within the BCG framework. These regions present substantial growth potential for online learning, but 2U's current footprint and market share are likely minimal, demanding considerable investment to build brand recognition and customer bases.

The success of these global expansion strategies hinges on meticulous planning and execution, including adapting educational offerings to local needs and navigating diverse regulatory landscapes. For instance, as of early 2024, the global online education market was projected to reach over $370 billion by 2026, highlighting the opportunity, but also the competitive intensity that 2U faces in these new territories.

Early-Stage AI-Powered Enrollment and Marketing Tools

Early-stage AI-powered enrollment and marketing tools, like AI voicebots for prospective student outreach, are being developed and implemented within 2U. While these innovations are positioned in the high-growth AI sector, their ability to significantly boost market share and drive returns is still under evaluation. For instance, in 2023, 2U reported that its marketing and enrollment services segment revenue was $265.3 million, and the impact of these nascent AI tools on this figure is still unfolding.

These AI initiatives require ongoing investment and close observation to ascertain their long-term effectiveness and influence on student acquisition. The company is focused on enhancing the student journey and optimizing operational efficiency through these technologies. The broader edtech market, where AI integration is a key trend, saw significant investment activity in 2024, indicating a strong market appetite for such advancements.

- AI Voicebots for Outreach: Aiming to improve prospective student engagement and streamline initial contact processes.

- Market Position: Operating in a high-growth AI sector, but long-term market share impact is unproven.

- Financial Context: 2U's marketing and enrollment services revenue was $265.3 million in 2023, with AI's contribution still developing.

- Strategic Focus: Continued investment and monitoring are crucial to validate the ROI and strategic value of these early-stage AI tools.

Strategic Investments in New Technologies or Platforms

Strategic investments in new technologies or platforms represent 2U's commitment to future growth, even if these ventures are in their nascent stages. These are the Question Marks in the BCG Matrix for 2U. Such investments, like their reported investment in AI-powered personalized learning tools, carry significant risk but also the promise of substantial returns if they gain traction in the evolving EdTech landscape. For instance, 2U's 2024 strategic focus on expanding its AI capabilities is a prime example of such a bet.

These investments are crucial for staying ahead of the curve. Consider the rapid advancements in generative AI within education; companies that invest early in these platforms, like 2U's exploration of AI tutors and content creation tools, position themselves for leadership. The success of these Question Marks hinges on several factors:

- Market Adoption: Will students and institutions embrace these new technologies? 2U's 2024 partnerships with universities to pilot AI-driven course enhancements aim to gauge this.

- Technological Maturity: Are the platforms robust and scalable enough for widespread use?

- Competitive Landscape: How quickly can competitors replicate or surpass these innovations?

- Integration with Core Offerings: Can these new technologies be seamlessly integrated to enhance 2U's existing degree programs and bootcamps?

Question Marks in 2U's portfolio represent new initiatives with high growth potential but currently low market share. These ventures require significant investment to gain traction and are uncertain to succeed. For example, 2U's expansion into new international markets or its early-stage AI educational tools fall into this category.

The success of these Question Marks hinges on market adoption, technological maturity, and competitive positioning. 2U's 2024 strategy, including partnerships to pilot AI-driven course enhancements, aims to gather data on these critical factors.

Without substantial investment and strategic execution, these promising ventures could fail to capture market share, potentially becoming Dogs in the BCG matrix. The company's 2023 marketing and enrollment services revenue of $265.3 million highlights the importance of successful new initiatives.

| Initiative Type | Growth Potential | Market Share | Investment Need | Example |

| New International Markets | High | Low | High | Expansion into Asia/Latin America |

| Early-Stage AI Tools | High | Low | High | AI Voicebots, AI Tutors |

| Microcredentials | High | Low | High | New skill-focused programs |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.