2U Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

2U Bundle

2U faces a dynamic competitive landscape shaped by intense rivalry, significant buyer power from students and universities, and the looming threat of new entrants in the online education space. Understanding these forces is crucial for navigating the future of digital learning.

The complete report reveals the real forces shaping 2U’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

University partners are fundamental to 2U's business model, acting as the source for educational content, curriculum development, and the essential accreditation that underpins its online degree programs. The prestige and academic standing of these institutions directly impact 2U's ability to attract students and generate revenue, making their role critically important.

Given 2U's dependence on these academic institutions, universities wield considerable bargaining power. This leverage can influence partnership agreements and pricing structures, particularly as universities explore more adaptable and profitable online education delivery methods. For instance, in 2024, many universities are actively renegotiating revenue-share agreements with online program managers like 2U, seeking terms that better reflect their brand value and the increasing demand for online learning.

2U relies heavily on technology providers for its online learning platforms and digital infrastructure. Companies like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud dominate the cloud services market, giving them considerable leverage in pricing and contract terms. For instance, in 2023, AWS held approximately 31% of the global cloud infrastructure market, demonstrating their significant influence.

The dependence on these major cloud providers means that any increase in their service costs or changes in their terms of service can directly affect 2U's operational expenses. This pricing power can squeeze 2U's profit margins, especially as digital learning platforms require substantial and ongoing investment in robust cloud computing resources to support a growing user base and complex functionalities.

Content creators and educators, including specialized subject matter experts and instructional designers, are crucial suppliers for 2U. Their unique skills and knowledge, especially in high-demand or niche academic areas, grant them significant bargaining power. For instance, in 2024, the demand for specialized online course instructors in fields like AI and cybersecurity saw a notable increase, allowing these experts to command higher compensation.

Marketing and Recruitment Vendors

2U's dependence on marketing and recruitment vendors for digital advertising, lead generation, and student acquisition presents a significant bargaining power challenge. These specialized firms control crucial access to potential students, meaning their pricing and service delivery directly impact 2U's top-line growth and operational costs. For instance, in 2023, 2U's marketing and sales expenses represented a substantial portion of its operating costs, highlighting the leverage these vendors hold.

The effectiveness of these external partners in driving enrollments is paramount. If vendors can demonstrate a strong ROI for 2U, they can command higher fees. Conversely, if 2U struggles to achieve its enrollment targets through these channels, it may seek to renegotiate terms or explore alternative providers, though the specialized nature of digital marketing can limit readily available substitutes.

- Vendor Concentration: A limited number of high-performing digital marketing and student acquisition agencies could consolidate power.

- Performance-Based Contracts: 2U may leverage performance-based contracts to mitigate vendor pricing power, aligning vendor success with enrollment outcomes.

- In-House Capabilities: Developing more in-house marketing and recruitment expertise could reduce reliance on external vendors and their associated bargaining power.

- Market Demand for Programs: The inherent demand for 2U's online programs influences the effectiveness of marketing efforts, indirectly affecting vendor leverage.

Other Service Providers

Beyond its core educational offerings, 2U relies on a network of other service providers crucial for its operations. These include entities handling student support services, payment processing, and essential data analytics. The bargaining power of these suppliers stems from their availability, the degree of differentiation in their services, and the overall competitive intensity within their respective markets. For instance, if there are numerous providers for student support with similar service levels, 2U can leverage this competition to secure better pricing. Conversely, a highly specialized or unique service provider might command greater leverage.

The competitive landscape for these ancillary services directly impacts 2U's ability to negotiate favorable terms. A fragmented market with many players typically empowers 2U, allowing for price comparisons and negotiation. However, if a particular service is dominated by a few large providers, 2U's negotiating position weakens. Efficiently managing these supplier relationships is therefore paramount for safeguarding 2U's profit margins and operational efficiency. For example, in 2024, the market for cloud-based student information systems, a key component for many educational technology providers, saw consolidation, potentially increasing the bargaining power of the remaining larger players.

The cost and quality of these third-party services can significantly affect 2U's overall cost structure and service delivery. Suppliers offering specialized student support or advanced data analytics can command premium pricing if their services are perceived as indispensable or highly differentiated. 2U must continuously evaluate its vendor relationships to ensure it is receiving competitive pricing and high-quality service, which is vital for maintaining its competitive edge and financial health.

Consider the following factors influencing the bargaining power of other service providers for 2U:

- Availability and Substitutability: The more readily available and substitutable a service is, the lower the supplier's bargaining power.

- Differentiation of Services: Highly specialized or unique services increase supplier leverage.

- Competitive Intensity: A fragmented market for a service generally benefits 2U, while a concentrated market empowers suppliers.

- Importance of the Service: Critical operational services often give suppliers more bargaining power.

The bargaining power of suppliers for 2U is a significant factor influencing its profitability and operational efficiency. This power is particularly pronounced with university partners, cloud service providers, and specialized content creators. For instance, in 2024, universities are actively seeking more favorable revenue-share agreements, reflecting their increased leverage in the online education market.

Major cloud providers like AWS, which held roughly 31% of the global cloud market in 2023, possess substantial pricing power. Similarly, the demand for niche expertise in fields like AI in 2024 allows specialized instructors to negotiate higher compensation. Marketing and recruitment vendors also wield considerable influence, as their performance directly impacts 2U's student acquisition, with marketing and sales expenses forming a significant cost component in 2023.

The concentration of providers in certain service areas, such as cloud computing or specialized marketing agencies, can amplify supplier leverage. 2U's strategy to mitigate this includes developing in-house capabilities and employing performance-based contracts to align vendor incentives with enrollment outcomes.

| Supplier Category | Key Suppliers | 2023/2024 Data Point | Impact on 2U | Mitigation Strategies |

|---|---|---|---|---|

| University Partners | Various Universities | Universities renegotiating revenue share in 2024 | Increased partnership costs, potential margin pressure | Negotiating favorable terms, diversifying partnerships |

| Cloud Services | AWS, Microsoft Azure, Google Cloud | AWS held ~31% of global cloud market in 2023 | Higher infrastructure costs, dependence on provider terms | Exploring multi-cloud strategies, optimizing usage |

| Content Creators/Experts | Subject Matter Experts, Instructional Designers | Increased demand for AI/Cybersecurity experts in 2024 | Higher compensation for specialized content | Long-term contracts, internal content development |

| Marketing & Recruitment | Digital Marketing Agencies | Marketing & Sales expenses significant portion of costs in 2023 | High student acquisition costs, reliance on vendor performance | Performance-based contracts, in-house marketing capabilities |

What is included in the product

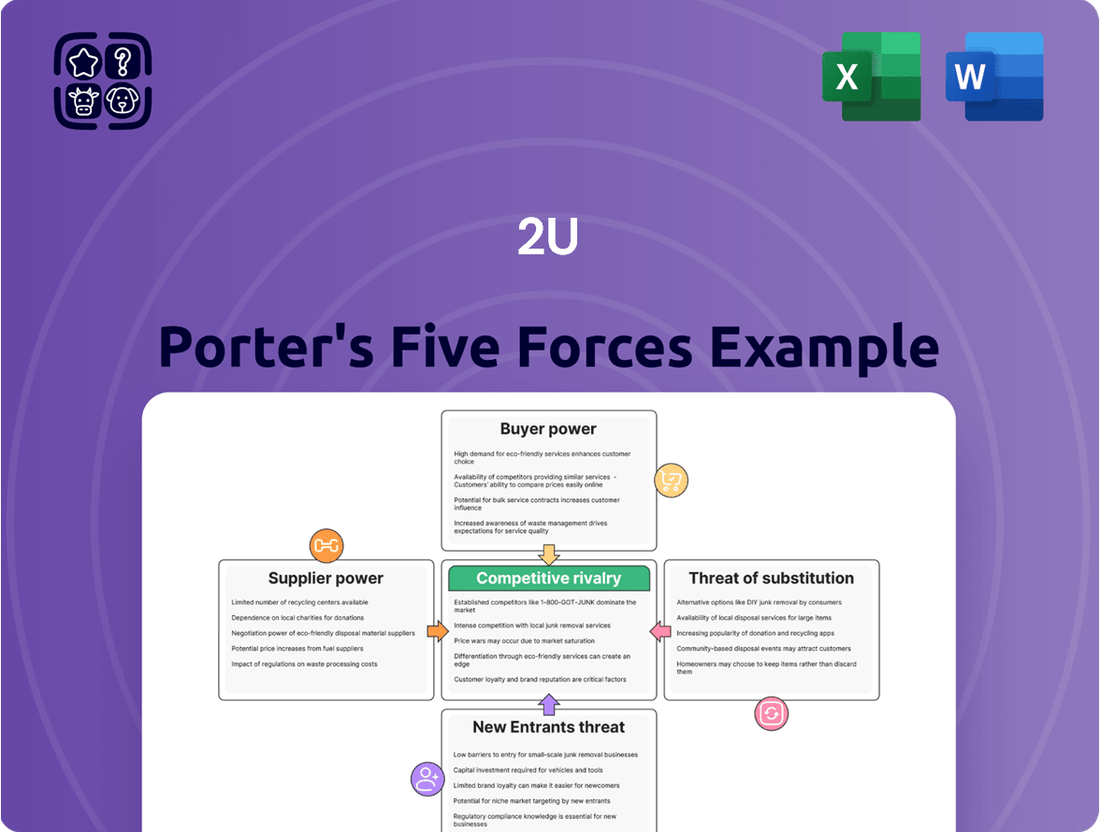

This analysis dissects the competitive forces impacting 2U, examining threats from new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the online education sector.

Instantly identify and mitigate competitive threats with a dynamic visualization of all five forces.

Customers Bargaining Power

University partners hold substantial bargaining power as 2U's direct customers. They can negotiate pricing, demand better revenue-sharing terms, and even explore developing their own online programs or teaming up with competing Online Program Management (OPM) providers.

The market trend shows a reduced interest in new OPM collaborations, and universities are actively reviewing their current arrangements. This indicates a growing leverage for these institutions, potentially impacting 2U's revenue streams and partnership renewals.

Students, as the end-users of online education, hold significant bargaining power. Their decision to enroll in a particular program directly impacts 2U's revenue, and with a plethora of online learning options available globally, students are increasingly discerning about both price and the quality of education offered. For instance, the global e-learning market was projected to reach over $370 billion by 2026, indicating a highly competitive landscape where student choice is paramount.

This power is amplified by the growing availability of transparent data. Information regarding graduation rates, alumni employment statistics, and employer satisfaction surveys allows students to make informed comparisons between institutions. In 2024, prospective students are more likely than ever to research these metrics, pressuring providers like 2U to demonstrate clear value and strong career outcomes to attract and retain enrollment.

For 2U, employers and industry partners are significant customers in the professional development and alternative credential space. Their demand for specific, in-demand skills directly influences 2U's program design and pricing, giving them considerable bargaining power. For instance, corporate learning budgets in 2024 saw continued growth as companies prioritized upskilling their workforce to meet evolving industry needs, a trend that empowers these partners to negotiate terms that align with their strategic talent development goals.

Availability of Alternatives

The sheer volume of online education choices available today significantly boosts customer bargaining power. Prospective students can easily compare offerings from various Online Program Managers (OPMs), universities with robust internal online programs, and even direct-to-consumer learning platforms. This wide array of options means customers face minimal switching costs, empowering them to demand better pricing or seek out providers that better align with their needs.

For instance, the online education market is highly competitive. In 2024, the global online education market was valued at over $300 billion and is projected to grow substantially. This growth is fueled by an increasing number of institutions and companies entering the space, offering a diverse range of courses and degrees. This accessibility directly translates to greater leverage for students when choosing where to invest their educational funds.

- Increased Competition: A multitude of online education providers means customers can readily switch if unsatisfied or if a better deal emerges.

- Lower Switching Costs: The digital nature of online learning minimizes the effort and expense required for a student to change institutions.

- Price Sensitivity: With many comparable options, customers are more likely to shop around for the best value, putting pressure on providers to remain competitive.

Information Transparency

Increased transparency in online education, particularly regarding program costs, quality metrics, and student outcomes, significantly boosts the bargaining power of customers, both universities and individual students. This readily available information allows them to make more informed choices, compare different educational providers effectively, and actively negotiate for better value. For instance, data showing graduation rates and post-graduation employment figures directly influences a student's decision and their willingness to pay.

- Informed Decision-Making: Customers can easily access and compare data on tuition fees, course content, faculty qualifications, and student support services.

- Benchmarking and Comparison: Tools and platforms emerge that allow for direct comparison of online programs based on key performance indicators, such as student satisfaction scores or career placement rates.

- Demand for Value: With a clearer understanding of what constitutes quality and affordability, customers can more effectively demand better educational experiences and outcomes for their investment.

- Shifting Market Dynamics: Educational institutions that fail to provide transparent and competitive offerings may find themselves at a disadvantage as informed customers opt for providers demonstrating superior value.

Customers, both universities and students, wield considerable bargaining power in the online education market due to increased competition and readily available information. This allows them to negotiate terms and demand better value, directly impacting 2U's revenue and partnership strategies.

The sheer volume of online learning options available globally, with the global e-learning market projected to exceed $370 billion by 2026, empowers students to be highly discerning regarding price and quality. Furthermore, employers seeking specific skills for upskilling their workforce in 2024, a trend reflected in growing corporate learning budgets, also possess significant leverage in negotiating program terms with providers like 2U.

| Customer Segment | Bargaining Power Drivers | Impact on 2U |

|---|---|---|

| Universities | Ability to develop own programs, partner with competitors, review existing agreements | Potential for renegotiated terms, reduced reliance on 2U, impacting revenue share |

| Students | Abundance of choices, price sensitivity, demand for demonstrable outcomes | Pressure on tuition fees and program quality, need for strong value proposition |

| Employers/Industry Partners | Demand for specific skills, corporate learning budgets | Influence on curriculum design, pricing for professional development programs |

Preview the Actual Deliverable

2U Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for 2U, offering a detailed examination of competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document you see here is precisely the same professionally formatted and comprehensive analysis you will receive immediately after purchase, ensuring full transparency and readiness for your strategic planning.

Rivalry Among Competitors

The online program management (OPM) market is a hotbed of competition, with established OPM providers, educational publishers, and tech-savvy newcomers all vying for university partnerships. This fierce rivalry is fueled by the booming demand for online education, pushing companies to aggressively pursue collaborations and student recruitment. For instance, in 2024, the global online education market was projected to reach over $400 billion, highlighting the lucrative nature of this space and the intensity of the competition to capture market share.

Competitors are increasingly moving beyond traditional degree programs, offering a wider array of educational products like short courses, bootcamps, and micro-credentials. This diversification directly intensifies rivalry by allowing players to capture different market segments and learning needs. For instance, Coursera’s 2024 first quarter revenue reached $299.4 million, up 10% year-over-year, reflecting successful expansion into these alternative learning formats.

This strategic shift towards broader portfolios, coupled with a move towards more flexible or unbundled business models, creates a highly dynamic and competitive landscape. Companies are unbundling their offerings, allowing learners to pick and choose specific modules or skills, which pressures traditional, bundled degree structures. This flexibility is a key driver of growth; edX, acquired by 2U in 2021, has also been focusing on expanding its credential offerings to meet evolving workforce demands.

Traditional universities are increasingly developing their own online program capabilities, directly competing with Online Program Managers (OPMs) like 2U. This shift means institutions are building in-house expertise for everything from curriculum design to student recruitment, lessening their need for external partners.

For instance, a significant portion of universities are now investing heavily in their digital learning infrastructure. Data from 2024 indicates a substantial increase in university IT budgets allocated to online learning platforms and support services, signaling a move towards self-sufficiency.

This growing internal capacity directly intensifies competitive rivalry. As universities become more adept at managing their online offerings independently, they become more formidable competitors, potentially reducing the market share available for OPMs.

Price Pressure and Value Proposition

The online education landscape is intensely competitive, creating substantial price pressure. Both universities looking for partners and students seeking degrees are highly sensitive to cost. This forces companies like 2U to constantly refine their pricing strategies and highlight what makes their offerings stand out.

Competitors frequently engage in price wars to capture market share. They might offer lower tuition fees or package deals that appear more attractive. This means 2U must not only manage its expenses efficiently but also continuously prove its value through program quality and student outcomes.

- Market Saturation: The online program management (OPM) sector has seen a significant influx of providers, intensifying competition.

- Price Sensitivity: In 2024, many prospective students weigh tuition costs heavily, especially given broader economic conditions.

- Value Demonstration: 2U's ability to showcase strong graduate employment rates and career advancement for its partner universities' programs is crucial to justifying its pricing.

- Cost Optimization: Continuous efforts to streamline operations and technology investments are necessary to maintain competitive pricing without sacrificing program quality.

Financial Performance and Strategic Adjustments

2U's recent financial restructuring, including exiting certain programs and focusing on specific verticals, underscores the intense competitive pressures within the online education sector. This strategic pivot, announced in late 2023 and continuing into 2024, reflects a necessary adaptation to a market where rivals are aggressively pursuing market share and innovation.

Competitors' performance and strategic maneuvers directly impact 2U's imperative to adapt. For instance, Coursera's continued expansion into enterprise solutions and its strong performance in the credentialing market, as evidenced by its reported revenue growth in early 2024, exert pressure on 2U to refine its own offerings. Similarly, emerging players and established universities with robust online programs force 2U to constantly innovate to retain its market position and attract students.

- Strategic Realignment: 2U's decision to divest its boot camp business in late 2023, a move aimed at streamlining operations and focusing on core degree programs, directly addresses competitive pressures.

- Market Dynamics: The online education market saw significant consolidation and strategic partnerships in 2023 and early 2024, forcing companies like 2U to re-evaluate their competitive stance.

- Competitor Performance: Competitors like Emeritus reported strong growth in 2023, indicating a healthy market but also highlighting the need for 2U to differentiate its value proposition.

- Innovation Imperative: To counter rivals, 2U must continue investing in new program development and technology to offer unique learning experiences and maintain its competitive edge.

The competitive rivalry in the online program management (OPM) market is intense, driven by a growing number of players and the increasing demand for online education. This leads to significant price pressure, as both institutions and students are cost-conscious, forcing OPMs to constantly demonstrate their value proposition. For instance, the global online education market was projected to exceed $400 billion in 2024, indicating a highly attractive but fiercely contested space.

Companies are diversifying their offerings beyond traditional degrees to include short courses and micro-credentials, further intensifying competition. Coursera's first-quarter 2024 revenue of $299.4 million, a 10% year-over-year increase, highlights the success of this broader approach. This strategic shift, combined with a move towards more flexible, unbundled learning models, creates a dynamic environment where differentiation through program quality and student outcomes is paramount.

Universities are also building in-house online capabilities, becoming direct competitors to OPMs and reducing their reliance on external partners. This trend is supported by university IT budget increases for online learning infrastructure in 2024. Consequently, OPMs like 2U must continuously innovate and optimize costs to remain competitive and justify their service fees against the backdrop of increasing in-house expertise and aggressive competitor strategies.

| Competitor Action | Impact on Rivalry | Example (2024 Data) |

|---|---|---|

| Portfolio Diversification (e.g., micro-credentials) | Increases rivalry by capturing new market segments | Coursera's Q1 2024 revenue up 10% YoY, driven by diverse offerings |

| University In-house Development | Intensifies rivalry as institutions become self-sufficient | Increased university IT budgets for online learning platforms |

| Price Sensitivity & Promotions | Creates price pressure and demands value demonstration | Global online education market projected over $400 billion in 2024 |

| Strategic Divestitures/Focus | Aims to sharpen competitive edge and streamline operations | 2U's late 2023 divestment of boot camp business |

SSubstitutes Threaten

Despite the surge in online learning, traditional on-campus education continues to be a potent substitute for 2U. Many students still value the immersive campus experience, networking opportunities, and direct faculty engagement offered by brick-and-mortar institutions. This preference means 2U must constantly enhance its digital platforms to offer distinct advantages that rival the traditional university model.

Industry-specific certifications, workshops, and corporate training programs are significant substitutes for 2U's offerings. These alternatives provide focused, skill-based learning that can be directly applied to career advancement, directly competing with 2U in the workforce development market.

For instance, many professionals in fields like tech and finance pursue certifications from bodies such as CompTIA or the CFA Institute. In 2024, the demand for upskilling and reskilling remained high, with reports indicating that over 60% of workers sought new skills to stay relevant in their careers, many through shorter, targeted programs.

The rise of free and low-cost self-learning platforms and open educational resources poses a significant threat to 2U. Platforms like Coursera and edX, even with 2U's ownership of edX, continue to offer substantial free content, directly competing with 2U's paid programs. This accessibility allows individuals to gain valuable skills without the financial commitment of traditional tuition, potentially diverting learners and revenue from 2U's core business model.

Informal Learning Networks and Communities

The burgeoning landscape of informal learning networks and online communities presents a significant threat of substitutes for traditional educational providers like 2U. Platforms such as Reddit's r/learnprogramming, Discord servers dedicated to specific skills, and LinkedIn Learning groups offer accessible, often free, avenues for knowledge acquisition and peer support. These communities empower individuals to bypass formal course structures, seeking practical, up-to-date information directly from practitioners and fellow learners.

These informal networks are particularly potent substitutes because they cater to a growing demand for flexible and cost-effective learning. For instance, in 2024, the global e-learning market was valued at over $350 billion, with a substantial portion driven by user-generated content and community-based learning initiatives. Learners can gain valuable skills through collaborative projects, Q&A sessions, and shared resources, often at no financial cost.

The threat is amplified by the sheer volume and diversity of these substitute offerings:

- Accessibility: Many informal networks are free to join and participate in, removing financial barriers to entry.

- Community Engagement: These platforms foster a sense of belonging and collaborative learning, which can be more engaging than solitary online courses.

- Real-time Information: Discussions in these communities often reflect the latest industry trends and practical applications, offering a dynamic learning experience.

- Niche Expertise: Learners can find highly specialized knowledge and mentorship within specific online communities, often exceeding the scope of broader, generalized courses.

In-House Corporate Training Programs

Many corporations are increasingly developing their own in-house training and upskilling programs. These internal initiatives often leverage proprietary content and internal subject matter experts, directly competing with external online professional development courses.

Companies can tailor these in-house programs to their specific operational needs and gain greater control over associated costs. For instance, a significant portion of companies, around 60% in a 2024 survey, reported an increase in investment in internal learning and development platforms to address skill gaps.

- Internal Expertise: Companies utilize their own subject matter experts, reducing reliance on external instructors.

- Customization: Training content is tailored to specific company roles and strategic objectives.

- Cost Control: In-house programs can be more cost-effective than purchasing external courses, especially for large-scale employee development.

- Scalability: Internal platforms can be scaled to meet the training needs of a growing workforce.

The threat of substitutes for 2U is multifaceted, encompassing traditional education, industry certifications, and informal learning networks. Traditional on-campus education remains a strong competitor, offering an immersive experience and direct faculty interaction that digital platforms must actively counter. In 2024, the demand for upskilling and reskilling continued to drive professionals toward targeted programs, with over 60% seeking new skills, many through certifications like CompTIA or CFA.

Entrants Threaten

The digital nature of online education significantly lowers traditional barriers like physical infrastructure and geographic reach, making it easier for new competitors. For instance, in 2024, the global online education market was valued at over $300 billion, attracting numerous tech startups and niche providers eager to capture market share.

New players are entering the Online Program Management (OPM) space by concentrating on specific, underserved areas or by offering isolated services like marketing or technology support. This unbundling strategy enables them to cater to particular university requirements or student demographics, presenting a fresh challenge to established, comprehensive OPM providers.

For instance, in 2024, several startups emerged focusing solely on digital marketing for online courses or providing specialized learning management system integrations. This contrasts with traditional OPMs that offer a complete package of services, from curriculum design to student support. This trend means established firms like 2U face competition not just from other full-service providers but also from agile, specialized entrants.

The rise of direct-to-consumer (D2C) online learning platforms, such as Coursera, edX, and Udemy, presents a significant threat of new entrants for established educational institutions and companies. These platforms directly target learners with a vast array of courses and certifications, often at competitive price points, bypassing traditional university partnerships. For example, Coursera reported over 129 million registered learners as of the end of 2023, showcasing their extensive reach and ability to attract a large student base independently.

University In-Housing of OPM Functions

Universities are increasingly developing their own in-house online program management (OPM) capabilities. This trend acts as a threat of new entrants, as these internal departments can offer services previously outsourced to companies like 2U, thereby diminishing the market for external providers. For example, data from the 2023-2024 academic year indicates a growing number of institutions investing in their digital learning infrastructure, potentially reducing reliance on third-party OPM services.

The growing expertise of universities in online education means they are more equipped to manage OPM functions internally. This self-sufficiency reduces the need for external partners and creates a competitive pressure. By 2024, many universities have established dedicated online learning divisions, capable of handling recruitment, course development, and student support, directly competing with established OPM providers.

- Growing In-House Expertise: Universities are building internal teams with the skills to manage online programs end-to-end.

- Reduced Outsourcing Demand: As institutions become more capable, they are less likely to contract with external OPM providers.

- Market Share Erosion: The rise of in-house OPM functions directly competes for market share previously held by companies like 2U.

Capital and Partnership Requirements

While barriers to entry in the online education sector have generally decreased, substantial capital is still a critical factor. Building advanced technology platforms, creating engaging and high-quality educational content, and forging partnerships with established universities demand significant financial investment. This can act as a deterrent for smaller, less-funded startups looking to enter the market.

Despite these capital requirements, the robust growth and increasing investment within the EdTech industry continue to draw new entrants. Companies with access to substantial funding are actively entering the space, aiming to capitalize on the expanding demand for online learning solutions. For instance, the global EdTech market was valued at approximately $121.3 billion in 2023 and is projected to reach $331.7 billion by 2030, indicating a strong incentive for new players with adequate financial backing.

- Capital Intensive Infrastructure: Developing sophisticated learning management systems (LMS) and robust digital content often requires millions in upfront investment.

- Partnership Costs: Securing agreements with reputable universities or accreditation bodies can involve licensing fees or revenue-sharing arrangements.

- Marketing and Brand Building: Establishing a recognizable brand and reaching a broad student base necessitates significant marketing expenditure, especially in a competitive landscape.

- Ongoing R&D: Continuous innovation in pedagogical approaches and technology requires sustained investment in research and development to remain competitive.

The threat of new entrants in online education is amplified by the digital nature of the industry, which lowers traditional barriers. In 2024, the global online education market, valued at over $300 billion, saw numerous tech startups and niche providers emerge. These new players often focus on specific services or underserved markets, challenging established comprehensive providers.

Direct-to-consumer platforms like Coursera, which had over 129 million registered learners by the end of 2023, directly compete with traditional university offerings. Furthermore, universities are increasingly developing in-house online program management capabilities, reducing their reliance on external partners like 2U. This growing self-sufficiency means institutions are less likely to outsource, directly impacting the market share of existing OPM providers.

While capital requirements for technology, content, and partnerships remain significant, the booming EdTech market, projected to grow from approximately $121.3 billion in 2023 to $331.7 billion by 2030, continues to attract well-funded entrants. These new players leverage substantial investment to build sophisticated platforms and forge strategic alliances.

| Factor | Impact on New Entrants | Example Data (2023-2024) |

|---|---|---|

| Digital Nature | Lowers barriers to entry | Global online education market > $300 billion (2024) |

| Specialization | Enables niche players to enter | Emergence of startups focusing on digital marketing or LMS integrations |

| D2C Platforms | Direct competition for learners | Coursera: 129 million+ registered learners (end of 2023) |

| In-house Capabilities | Reduces demand for external OPMs | Increased university investment in digital learning infrastructure |

| Capital Requirements | Can deter smaller entrants | EdTech market: $121.3 billion (2023) to $331.7 billion (2030) |

Porter's Five Forces Analysis Data Sources

Our 2U Porter's Five Forces analysis leverages a robust combination of publicly available data, including 2U's annual reports and SEC filings, alongside industry-specific market research reports and competitor financial statements.