The Yates Companies PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Yates Companies Bundle

Navigate the complex external forces impacting The Yates Companies with our comprehensive PESTLE analysis. Discover how political shifts, economic volatility, and technological advancements are creating both challenges and opportunities. This meticulously researched report provides actionable intelligence, crucial for anyone looking to understand or invest in The Yates Companies. Don't get left behind; gain the strategic foresight you need. Download the full PESTLE analysis now and empower your decision-making.

Political factors

Government infrastructure spending, a significant driver for construction firms like The Yates Companies, saw continued emphasis in 2024 and projections for 2025. The Bipartisan Infrastructure Law, enacted in 2021, continues to allocate substantial funds towards repairing and upgrading roads, bridges, public transit, and water systems. For instance, in early 2024, the U.S. Department of Transportation announced billions in grants for critical infrastructure projects, directly benefiting companies involved in large-scale construction.

These government investments directly translate into increased project opportunities and a more robust pipeline for The Yates Companies. Fluctuations in federal and state budgets, however, remain a key consideration. While the long-term commitment to infrastructure renewal is evident, the pace of project awards can be influenced by annual budget cycles and political priorities, impacting the predictability of revenue streams.

Strategic planning for The Yates Companies hinges on a deep understanding of these government commitments. The ongoing focus on improving national infrastructure, including the modernization of utilities and expansion of broadband access, signals sustained demand for construction services. For example, projected federal spending on transportation infrastructure alone is expected to remain in the hundreds of billions annually through 2025, providing a stable foundation for growth.

Changes in building codes, particularly those focusing on energy efficiency and seismic resilience, are significantly impacting construction costs. For instance, updated energy codes implemented in California in 2023 are projected to increase upfront construction costs by an estimated 2-5%, according to industry reports. The Yates Companies must adapt its designs and material sourcing to meet these evolving standards, potentially affecting project timelines and budgets.

Zoning regulations continue to shape development opportunities. In many major metropolitan areas, including parts of Texas and Florida, updated zoning laws in 2024 are increasingly favoring mixed-use developments and higher density housing. This shift presents both opportunities and challenges for The Yates Companies, requiring careful site selection and project planning to align with local land use policies and maximize market access.

Political stability in the United States, where The Yates Companies primarily operates, remains a key driver for investor confidence in the construction sector. Following the 2024 elections, a continuation of current policies or potential shifts in fiscal and monetary approaches will directly influence construction project financing and demand. For instance, any changes in infrastructure spending bills, such as potential expansions or reallocations of federal funds for road and bridge improvements, could significantly impact the company's backlog and revenue streams.

Government policies on urban development and zoning laws are critical. In 2024, many municipalities are grappling with housing shortages and are exploring regulatory changes to encourage new construction, which could present opportunities for Yates. Conversely, stricter environmental regulations or changes in building codes, especially those related to sustainability and energy efficiency, could increase project costs and timelines.

Economic stimulus packages, if implemented by the federal government in response to inflation or economic slowdowns anticipated for late 2024 or early 2025, could boost private sector investment in commercial and residential real estate. Such measures, like tax incentives for businesses or home buyers, would likely translate into increased demand for construction services, benefiting companies like The Yates Companies.

Trade Policies and Tariffs

International trade policies, particularly those affecting construction materials and equipment, significantly impact The Yates Companies' project costs. For instance, in 2024, ongoing trade tensions could lead to a 5-10% increase in the cost of imported steel and specialized machinery, directly affecting project bids and profitability.

Supply chain vulnerabilities exposed by trade disputes can create material shortages or price volatility. This was evident in early 2024 when tariffs on lumber from certain regions caused a temporary spike in material costs, potentially reducing profit margins by 2-4% on projects reliant on those materials.

Monitoring global trade relations is crucial for effective cost forecasting and procurement. For example, shifts in trade agreements, like potential revisions to the USMCA in late 2024 or early 2025, could alter the landed cost of key components, necessitating adjustments to long-term procurement strategies.

- Tariffs on imported steel and machinery could increase project costs by 5-10% in 2024.

- Trade disputes can cause material cost spikes, potentially reducing project profit margins by 2-4%.

- Changes in trade agreements, such as USMCA revisions, may affect component costs in 2024-2025.

- Proactive monitoring of trade policies is essential for accurate cost forecasting and strategic procurement.

Government Incentives for Sustainable Construction

Government programs offering tax credits, grants, or subsidies for green building initiatives and sustainable construction practices can significantly influence project design and client demand. For instance, in 2024, the U.S. Inflation Reduction Act continued to provide significant tax credits for energy-efficient building upgrades and renewable energy installations, potentially reducing project costs for developers and owners. These incentives are projected to drive further investment in sustainable construction through 2025.

The Yates Companies can leverage these incentives to offer more attractive and environmentally responsible solutions, aligning with growing client interest in sustainable development. This strategic alignment can lead to increased market share and a stronger brand reputation. For example, a company utilizing the 179D energy efficient commercial building deduction could see substantial tax savings, making their proposals more competitive.

- Federal Tax Credits: Continued availability of credits like the Investment Tax Credit (ITC) for solar energy and the aforementioned 179D deduction for energy-efficient buildings.

- State and Local Programs: Many states and municipalities offer additional grants, rebates, and property tax abatements for LEED-certified or net-zero energy buildings.

- Growing Market Demand: A significant percentage of new commercial construction projects in 2024 and anticipated for 2025 are incorporating green building standards due to both regulatory push and client pull.

- Cost Reduction Opportunities: These incentives directly reduce the upfront costs associated with sustainable materials and technologies, making them more accessible.

Government infrastructure spending remains a significant tailwind, with billions allocated through the Bipartisan Infrastructure Law continuing into 2024 and 2025. These investments in roads, bridges, and utilities directly fuel project pipelines for construction firms. However, the company must remain attuned to potential shifts in federal and state budget priorities, which can influence project award timelines and revenue predictability.

Changes in building codes and zoning regulations are also key political factors. For instance, 2024 saw updated energy codes in several states, potentially increasing construction costs by 2-5%. Simultaneously, evolving zoning laws favoring mixed-use developments in major metros present both opportunities and planning challenges.

Political stability and election outcomes in 2024 will shape future fiscal policies and infrastructure spending bills. Any adjustments to these could significantly impact The Yates Companies' backlog and overall revenue streams.

Government incentives for green building, such as those from the Inflation Reduction Act, continue to drive demand for sustainable construction. These programs offer tax credits and grants, making environmentally conscious projects more financially viable for clients and potentially boosting market share for companies like Yates.

What is included in the product

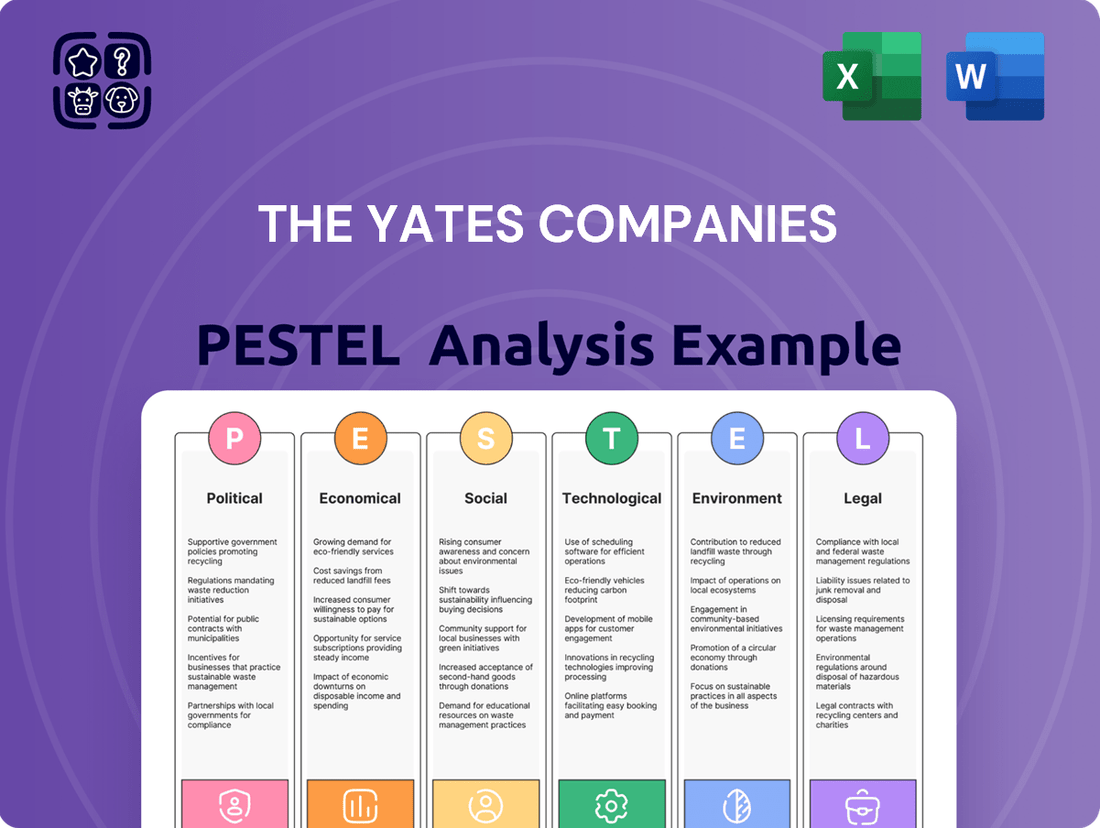

This PESTLE analysis of The Yates Companies examines the influence of political, economic, social, technological, environmental, and legal factors on its operations, offering a comprehensive view of the external landscape.

It provides actionable insights for strategic decision-making by identifying potential threats and opportunities stemming from these macro-environmental influences.

Offers a clear, actionable roadmap for navigating the external landscape, transforming complex PESTLE factors into manageable strategic insights for The Yates Companies.

Economic factors

Fluctuations in interest rates significantly impact The Yates Companies by altering the cost of capital for their own projects and influencing clients' borrowing capacity for new developments. For instance, the Federal Reserve's benchmark interest rate, which stood at 5.25%-5.50% as of early 2024, directly correlates with the cost of loans for construction and real estate acquisition.

Rising interest rates, such as those seen throughout 2022 and 2023, tend to make financing more expensive, potentially slowing down investment in commercial, industrial, and institutional sectors. This slowdown can translate to reduced project pipelines and dampened overall market demand for The Yates Companies' services.

Consequently, close monitoring of monetary policy decisions, including anticipated rate adjustments by central banks, is crucial. For example, if the Federal Reserve signals a pause or potential cuts in interest rates later in 2024 or into 2025, it could signal a more favorable environment for capital-intensive projects and increased market activity.

The overall health of the economy, particularly reflected in Gross Domestic Product (GDP) growth, directly influences the demand for new construction projects for companies like Yates. A strong and expanding economy, such as the projected 2.2% GDP growth for the US in 2024, fuels business expansion and increased consumer spending, both of which translate into greater demand for commercial, residential, and industrial building.

Robust economic conditions encourage businesses to invest in new facilities and upgrades, while also boosting public sector investment in infrastructure projects. For instance, anticipated infrastructure spending in the US, driven by legislation like the Infrastructure Investment and Jobs Act, will create significant opportunities for construction firms throughout 2024 and 2025.

Conversely, an economic slowdown or recession, characterized by declining GDP, can have a severe negative impact. During downturns, companies often postpone or cancel capital expenditures, including new construction, and government budgets may face cuts, reducing public works spending. This can lead to a contraction in project pipelines and reduced revenue for construction companies.

Inflationary pressures are a significant concern for The Yates Companies, directly impacting the cost of essential raw materials like steel, concrete, and lumber. For example, lumber prices saw a substantial surge in late 2023 and early 2024, with futures contracts for certain grades trading at over $500 per thousand board feet, a notable increase from previous years. This volatility can drastically alter project budgets, potentially eroding profit margins if not anticipated and managed through contract clauses and robust procurement strategies.

Labor Costs and Availability

Labor costs and the availability of skilled workers are critical economic considerations for The Yates Companies. In the construction sector, wage rates for tradespeople directly impact project budgets and timelines. For instance, the U.S. Bureau of Labor Statistics reported that in May 2023, the median annual wage for construction laborers was $42,780, and for construction managers, it was $107,420. A scarcity of qualified professionals can lead to increased labor expenses and delays, whereas an ample supply might present opportunities for cost savings.

The Yates Companies needs a robust workforce strategy to secure competent employees at competitive prices. Emerging trends in 2024 and 2025 suggest ongoing demand for skilled trades, potentially exacerbating shortages in certain regions. Companies that invest in training and apprenticeships are better positioned to mitigate these risks.

- Skilled Labor Shortage: Persistent shortages in skilled trades, such as electricians and plumbers, are expected to continue driving up wages in 2024-2025.

- Wage Inflation: The average hourly wage for construction workers saw an increase, reflecting broader economic inflation and demand.

- Impact on Timelines: Labor availability directly correlates with project completion schedules; a lack of workers can extend project durations significantly.

- Strategic Workforce Management: Proactive recruitment, retention programs, and investment in training are essential for The Yates Companies to maintain a competitive edge.

Real Estate Market Trends

The health of the commercial, industrial, and institutional real estate markets significantly impacts The Yates Companies' potential for new construction projects. Factors like rising vacancy rates or declining property values in these sectors can shrink the pipeline of upcoming work. For instance, in early 2024, U.S. office vacancy rates hovered around 19.6%, a figure that continues to influence new development decisions for corporate and institutional clients.

Investment trends and property values are crucial indicators. A robust investment climate, where property values are appreciating and investor confidence is high, typically translates into more development activity. Conversely, economic uncertainty or rising interest rates can lead to a slowdown in speculative building and a more cautious approach from developers and end-users, directly affecting the demand for construction services.

Understanding regional market nuances is paramount for identifying growth opportunities. Markets experiencing strong population growth and economic diversification, such as the Sun Belt region in the U.S., often present more favorable conditions for real estate development compared to more mature or declining markets. In 2024, cities like Austin, Texas, continued to see substantial commercial and industrial construction activity, driven by tech sector expansion and population influx.

- Commercial Real Estate Outlook: As of Q1 2024, U.S. commercial real estate investment volume saw a notable decrease compared to the previous year, indicating a more cautious market.

- Industrial Sector Strength: The industrial sector, particularly logistics and warehousing, remained a bright spot, with low vacancy rates and sustained demand for new build-to-suit facilities driven by e-commerce growth.

- Institutional Investment Shifts: Institutional investors are increasingly scrutinizing returns and focusing on resilient sectors like multifamily and industrial, potentially altering the funding landscape for other property types.

- Regional Development Hubs: Key metropolitan areas continue to attract significant construction investment, with areas like the Southeast and Southwest leading in new project announcements.

Economic factors directly influence The Yates Companies' operational costs and revenue potential. Interest rate fluctuations, like the Federal Reserve's 5.25%-5.50% target range in early 2024, impact borrowing costs for projects and clients. Strong GDP growth, projected at 2.2% for the US in 2024, generally boosts demand for construction, while inflation, seen in lumber prices exceeding $500 per thousand board feet in late 2023, raises material expenses. Skilled labor availability and wages, with construction laborers earning a median annual wage of $42,780 in May 2023, are also critical cost drivers.

| Economic Factor | Impact on The Yates Companies | Key Data (2024/2025) |

|---|---|---|

| Interest Rates | Affects cost of capital, client financing capacity | Federal Reserve Target Rate: 5.25%-5.50% (early 2024) |

| GDP Growth | Drives demand for new construction projects | US GDP Growth Projection: 2.2% (2024) |

| Inflation | Increases cost of raw materials and labor | Lumber Futures: >$500/thousand board feet (late 2023/early 2024) |

| Labor Market | Impacts project costs, timelines, and skilled workforce availability | Construction Laborer Median Wage: $42,780 (May 2023) |

Full Version Awaits

The Yates Companies PESTLE Analysis

The preview you see here is the exact document you’ll receive after purchase, containing a comprehensive PESTLE analysis of The Yates Companies. This detailed breakdown covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain insights into the strategic landscape The Yates Companies operates within. The content and structure shown in the preview is the same document you’ll download after payment, ensuring you get precisely what you expect.

Sociological factors

Demographic shifts, including population growth and evolving migration patterns, directly fuel demand for construction services. For instance, the U.S. population is projected to reach over 370 million by 2030, creating a sustained need for new housing and commercial spaces.

Increasing urbanization is a significant driver, concentrating demand in metropolitan areas. Cities like Phoenix, which saw a 13.1% population increase between 2020 and 2023, require substantial investment in infrastructure, residential development, and commercial facilities.

The Yates Companies needs to monitor these trends to align its services with emerging market needs. This includes anticipating demand for specialized construction, such as healthcare facilities, which are seeing increased investment due to an aging population and advancements in medical technology.

Furthermore, the growth of educational institutions, driven by population increases and evolving learning needs, presents another key area for adaptation. Understanding these demographic currents allows for proactive service development and market positioning.

Public perception of the construction sector, especially concerning safety and environmental impact, significantly shapes project approvals and client relationships. Concerns about community disruption can lead to delays or outright opposition, impacting project timelines and costs for companies like The Yates Companies.

The Yates Companies' focus on safety and quality, as stated in their mission, directly addresses these public concerns, aiming to cultivate a positive reputation and build trust. A strong safety record is not just a compliance issue; it's a crucial element in fostering goodwill with local communities and securing client confidence.

For instance, in 2024, a significant percentage of construction projects faced public scrutiny due to environmental or safety-related issues, underscoring the importance of proactive management. Companies demonstrating superior safety performance, often measured by metrics like Total Recordable Incident Rate (TRIR), tend to experience smoother project execution and enhanced stakeholder support.

The Yates Companies faces a dynamic workforce landscape shaped by shifting demographics. In 2024, the U.S. labor force continues to diversify, with a notable increase in representation from underrepresented groups. This evolving makeup means companies must adapt their strategies to attract and retain a broad talent pool, recognizing varying needs and expectations.

Evolving employee expectations, particularly concerning work-life balance and continuous learning opportunities, directly influence The Yates Companies' talent acquisition and retention efforts. A 2024 survey indicated that over 60% of employees consider flexible work arrangements a key factor when choosing an employer. Meeting these demands is vital for securing and keeping skilled professionals.

Attracting and retaining a skilled, diverse workforce is not just about compliance; it's a driver of operational efficiency and innovation for The Yates Companies. Diverse teams often bring a wider range of perspectives, leading to more creative problem-solving. By 2025, companies with highly diverse workforces are projected to outperform their less diverse counterparts by up to 35% in profitability.

Cultivating an inclusive culture presents a significant competitive advantage for The Yates Companies. When employees feel valued and respected, regardless of their background, engagement and productivity tend to rise. This fosters a positive work environment that can attract top talent and reduce costly turnover, contributing directly to the company's long-term success.

Health and Wellness Trends in Building Design

Societal focus on health and wellness is profoundly reshaping building design, with occupants increasingly prioritizing environments that promote well-being. This trend is particularly evident in commercial and institutional sectors where companies like The Yates Companies can anticipate heightened demand for specific features. For instance, the global green building market was valued at approximately $297.5 billion in 2023 and is projected to reach $530.7 billion by 2028, indicating a significant shift towards healthier construction practices.

The Yates Companies can capitalize on this by integrating elements that enhance indoor environmental quality. This includes advanced ventilation systems for superior indoor air quality, maximizing natural daylight penetration, and incorporating biophilic design principles that connect occupants with nature. These adaptations are not merely aesthetic; they directly address growing consumer and corporate demand for healthier workspaces and living environments.

Meeting these evolving preferences can unlock new market opportunities and strengthen The Yates Companies' competitive edge. Consider these key areas of influence:

- Indoor Air Quality (IAQ): Increased demand for buildings with enhanced filtration, low-VOC materials, and superior ventilation rates. Studies show poor IAQ can reduce cognitive performance by up to 62%.

- Natural Lighting and Views: Growing preference for designs that maximize daylight exposure and offer views of nature, linked to improved mood and productivity. Buildings with ample natural light can see a 15% increase in worker productivity.

- Biophilic Design: Integration of natural elements like plants, water features, and natural materials, which studies suggest can reduce stress and improve overall occupant satisfaction.

- Wellness Amenities: Incorporation of features such as fitness centers, meditation spaces, and access to outdoor areas, reflecting a broader commitment to occupant health.

Community Engagement and Social Responsibility

Societal expectations for corporate social responsibility are increasingly shaping how construction firms are perceived. The Yates Companies' commitment to community engagement and ethical operations directly influences its brand reputation. For instance, a strong track record in local volunteerism or supporting community development projects can significantly boost public perception.

Sustainable building practices, such as reducing waste or incorporating eco-friendly materials, are also becoming a key metric for evaluation. In 2024, the construction industry saw a growing emphasis on green building certifications, with projects incorporating these elements often receiving preferential treatment or incentives. The Yates Companies' adherence to fair labor practices, ensuring safe working conditions and equitable pay, further solidifies its standing as a responsible corporate citizen.

These factors are not merely about good PR; they directly impact the company's ability to secure new projects. Clients and investors alike are increasingly prioritizing partners who demonstrate a genuine commitment to social responsibility.

- Community Investment: Many construction firms, including those in the US, allocate a percentage of their profits or employee volunteer hours to local initiatives. For example, in 2023, the Associated General Contractors of America reported that member firms contributed billions of dollars and millions of volunteer hours to community causes.

- Sustainability Metrics: The U.S. Green Building Council reported that over 100,000 LEED-certified projects existed globally by the end of 2024, highlighting the market demand for sustainable construction.

- Ethical Labor: Violations of labor laws in the construction sector can lead to significant fines and reputational damage. Companies with robust ethics programs and transparent labor practices, like those emphasizing fair wages and safety, tend to attract and retain talent more effectively.

- Brand Perception: Studies in 2024 indicated that companies with strong CSR profiles saw a 10-15% higher brand valuation compared to their less socially responsible peers.

Societal emphasis on health and wellness is driving demand for construction that prioritizes occupant well-being, influencing design choices for firms like The Yates Companies. The global green building market, valued at approximately $297.5 billion in 2023, is projected to reach $530.7 billion by 2028, demonstrating this significant market shift.

This trend encourages the integration of features like advanced ventilation for improved indoor air quality, increased natural light, and biophilic design elements. For instance, buildings with ample natural light can see a 15% increase in worker productivity, while poor indoor air quality can reduce cognitive performance by up to 62%.

| Factor | Impact on Construction | Relevant Data (2023-2025) |

|---|---|---|

| Health & Wellness Focus | Demand for healthier building features | Green building market: $297.5B (2023) to $530.7B (2028) |

| Indoor Air Quality (IAQ) | Need for enhanced filtration, low-VOC materials | Poor IAQ reduces cognitive performance by up to 62% |

| Natural Lighting | Preference for daylighting and views | Increased natural light boosts worker productivity by 15% |

Technological factors

Building Information Modeling (BIM) adoption is rapidly reshaping the construction landscape. The Yates Companies needs to embrace BIM to streamline project lifecycles, from initial design through to construction and facility management. This technology facilitates better coordination among stakeholders, significantly reducing errors and costly rework.

By integrating BIM, The Yates Companies can achieve more accurate cost estimations and improved scheduling. For instance, BIM adoption in the UK construction sector saw a significant increase, with over 70% of firms reporting using BIM on projects in recent surveys, highlighting its growing importance for competitive advantage and client satisfaction.

Innovations in construction materials, such as self-healing concrete and advanced composites, are transforming the industry by enhancing durability and performance. For instance, research into self-healing concrete suggests it could extend the lifespan of infrastructure by decades, significantly reducing long-term maintenance costs. The Yates Companies should monitor these material science breakthroughs, as adoption could lead to more resilient and sustainable projects.

New construction methodologies, including modular building and prefabrication, are proving highly effective in streamlining project timelines and reducing overall expenses. Modular construction, for example, can cut project delivery times by up to 50% compared to traditional methods, as reported in various industry studies. By evaluating and potentially integrating these modern techniques, The Yates Companies can achieve greater efficiency and cost savings, bolstering its competitive edge in the market.

Automation and robotics are significantly reshaping the construction industry, offering tangible benefits. For instance, robotic bricklayers can lay up to 1,000 bricks per hour, a rate far exceeding human capabilities, while also improving precision and reducing waste. This trend directly addresses persistent labor shortages that have impacted construction projects globally, with some regions experiencing deficits of over 300,000 skilled workers in recent years.

The Yates Companies should closely track advancements in automated site surveying using drones and lidar technology, which can capture detailed topographical data with remarkable accuracy, reducing the need for manual surveys. Furthermore, robotic demolition systems are enhancing safety by allowing hazardous tasks to be performed remotely, minimizing human exposure to risks. As of 2024, the global construction robotics market is projected to reach $3.5 billion, indicating substantial investment and growth in this sector.

Project Management Software and Data Analytics

The adoption of advanced project management software and data analytics tools is fundamentally reshaping the construction industry. For The Yates Companies, these technologies offer a significant competitive edge. Sophisticated platforms allow for real-time progress tracking, dynamic scheduling adjustments, and precise budget oversight, directly impacting project efficiency. For instance, a 2024 industry report indicated that companies leveraging integrated project management software saw an average reduction of 15% in project delays and a 10% decrease in cost overruns.

Cloud-based collaboration platforms further enhance operational synergy, enabling seamless communication and document sharing among dispersed teams and stakeholders. This fosters greater transparency and quicker decision-making. Data analytics, in turn, transforms raw project data into actionable intelligence. The Yates Companies can harness these insights to identify trends, predict potential issues, and refine methodologies for future projects, leading to improved profitability and client satisfaction. By the end of 2024, construction firms that actively used data analytics in project management reported a 20% improvement in resource allocation efficiency.

- Enhanced Efficiency: Sophisticated software optimizes scheduling and resource allocation.

- Cost Control: Real-time budget tracking minimizes overruns, with industry data showing up to 10% savings.

- Improved Collaboration: Cloud platforms facilitate seamless communication across project teams.

- Data-Driven Decisions: Analytics provide insights for better future planning and performance.

Sustainable Building Technologies

The development of new sustainable building technologies is rapidly reshaping the construction landscape. Innovations like advanced energy management systems, the seamless integration of renewable energy sources such as solar and geothermal power, and highly efficient HVAC systems are becoming standard expectations in building design and construction. These advancements directly influence material choices, operational costs, and the overall lifecycle of structures.

The Yates Companies has a significant opportunity to leverage this technological shift. By cultivating and showcasing expertise in the implementation of these cutting-edge sustainable building technologies, the company can effectively meet the escalating demand from clients for eco-friendly and energy-efficient buildings. This specialization can serve as a key differentiator in a competitive market.

Globally, the green building sector is experiencing robust growth. For instance, the global green building market was valued at approximately $298.5 billion in 2023 and is projected to reach $817.1 billion by 2030, growing at a compound annual growth rate (CAGR) of 15.1% during this period. In the United States, LEED-certified buildings have shown a 26% lower operating cost compared to conventional buildings, highlighting the financial benefits of sustainable practices.

- Growing Market Demand: Client demand for LEED, BREEAM, and other green certifications is increasing across commercial and residential sectors.

- Technological Integration: Expertise in smart building systems, IoT for energy monitoring, and advanced insulation materials is becoming crucial.

- Cost Savings & ROI: Sustainable technologies offer long-term operational cost reductions, improving the return on investment for building owners.

- Regulatory Push: Governments worldwide are implementing stricter energy efficiency standards and offering incentives for green construction.

The integration of advanced technologies like artificial intelligence (AI) and machine learning (ML) is revolutionizing construction project management and execution. These tools can optimize resource allocation, predict project delays, and enhance safety protocols, as evidenced by a 2024 study showing AI-driven scheduling reducing project timelines by an average of 10%. The Yates Companies can leverage these advancements for more efficient operations.

The increasing adoption of IoT devices on construction sites allows for real-time monitoring of equipment performance, environmental conditions, and worker safety. For instance, sensors can track machinery usage, predict maintenance needs, and alert supervisors to potential hazards, contributing to a safer work environment and reduced downtime. By 2025, the global IoT in construction market is projected to exceed $15 billion, underscoring its growing importance.

Digital twins, which are virtual replicas of physical assets, offer powerful capabilities for planning, simulation, and ongoing management of construction projects. These can help identify potential design clashes and optimize construction sequencing before physical work begins. As of 2024, the digital twin market is experiencing rapid growth, with construction being a key sector driving this expansion.

| Technology | Impact on Construction | 2024/2025 Data/Projections |

|---|---|---|

| AI/ML in Project Management | Optimized scheduling, risk prediction, resource allocation | AI-driven scheduling reduced project timelines by ~10% (2024 study) |

| IoT in Construction | Real-time monitoring, predictive maintenance, enhanced safety | Global IoT in construction market projected to exceed $15 billion (2025) |

| Digital Twins | Virtual prototyping, clash detection, simulation for planning | Rapid market growth, with construction as a key driver (2024) |

Legal factors

The Yates Companies must navigate a complex web of federal, state, and local labor laws. This includes compliance with the Fair Labor Standards Act (FLSA) for minimum wage and overtime, OSHA standards for workplace safety, and Title VII of the Civil Rights Act for non-discrimination. For instance, as of January 1, 2025, numerous states and cities implemented minimum wage hikes, with some reaching $17 per hour, directly affecting labor costs for The Yates Companies.

Changes in employment regulations can significantly impact operational costs and HR strategies. For example, proposed federal legislation in late 2024 aimed to expand overtime eligibility to a broader range of salaried employees, potentially increasing payroll expenses. Similarly, evolving unionization rules or new requirements for employee benefits could necessitate adjustments to compensation and workforce management practices.

Maintaining strict adherence to these legal frameworks is paramount to mitigating risks. Failure to comply can result in substantial fines, legal battles, and damage to the company's reputation. In 2023 alone, U.S. businesses paid out billions in settlements related to wage and hour disputes and workplace safety violations, underscoring the financial consequences of non-compliance.

The legal landscape for construction contracts significantly shapes The Yates Companies' operations. Standard contract forms, such as those from the American Institute of Architects (AIA) or ConsensusDocs, dictate terms for project execution, risk allocation, and payment. Clauses addressing delays, change orders, and force majeure events are critical for managing project timelines and costs, with disputes often arising from differing interpretations of these provisions.

Navigating these complex contractual agreements necessitates a strong understanding of dispute resolution methods. The Yates Companies must be prepared to engage in mediation or arbitration, which are common alternatives to litigation in the construction industry. For instance, in 2024, the construction industry continued to see a high volume of disputes, with many resolved through these alternative channels rather than lengthy court battles.

Environmental protection laws significantly shape The Yates Companies' operations, particularly concerning waste disposal and pollution. For instance, in 2024, construction and demolition waste in the US generated approximately 600 million tons, highlighting the scale of management challenges. Failure to comply with regulations on hazardous materials and land use can lead to substantial fines, potentially impacting profitability and project timelines.

The Yates Companies must navigate a complex web of permits and conduct thorough environmental impact assessments for each project. This ensures adherence to standards for pollution control and minimizes ecological disruption. Staying abreast of emerging green building codes, such as those promoting sustainable material sourcing and energy efficiency, is vital for both compliance and competitive advantage in the evolving construction landscape.

Occupational Health and Safety (OSHA) Regulations

The Yates Companies must rigorously adhere to Occupational Safety and Health Administration (OSHA) standards and other industry-specific safety regulations. In 2024, OSHA reported over 2.8 million workplace injuries and illnesses across various sectors, highlighting the critical need for robust safety protocols. Failure to comply can result in significant fines, with average penalties for willful violations reaching tens of thousands of dollars per incident, and can lead to severe legal liabilities.

Maintaining a safe work environment necessitates continuous efforts. This includes implementing regular, comprehensive safety training programs for all employees and conducting frequent safety audits. For instance, a well-executed safety program can reduce lost-time injury frequency rates by as much as 40%, according to industry benchmarks. Such diligence not only protects workers but also safeguards the company’s financial stability and reputation.

- OSHA Compliance: Strict adherence to OSHA regulations is crucial for worker safety and avoiding penalties.

- Accident Reduction: Effective safety measures directly contribute to lowering workplace accidents and injuries.

- Financial Impact: Non-compliance can lead to substantial fines and legal costs, impacting profitability.

- Proactive Measures: Regular training and audits are essential for maintaining a culture of safety.

Permitting and Licensing Requirements

The construction industry is heavily regulated, with a complex web of permits and licenses necessary for any project. These requirements differ significantly based on location, from federal environmental regulations to local zoning ordinances. For The Yates Companies, navigating this legal landscape is critical. Failing to secure the correct permits can lead to substantial fines, project delays, and even outright cancellation, impacting profitability and reputation. For instance, in 2024, construction project delays due to permitting issues cost the U.S. construction industry an estimated $10 billion, according to industry reports.

Meticulous management of the permitting process is therefore essential. This involves understanding the specific approvals needed at each stage, from initial site preparation to final occupancy. The Yates Companies must maintain a proactive approach, anticipating requirements and submitting applications well in advance. This diligence helps ensure projects stay on schedule and within budget, mitigating legal risks and operational disruptions. As of early 2025, the average time for obtaining major building permits in large metropolitan areas across the United States has increased by approximately 15% compared to 2022, underscoring the growing complexity.

- Jurisdictional Variance: Permits vary by state, county, and city, impacting everything from building codes to environmental impact assessments.

- Project-Specific Needs: Different project types (e.g., residential, commercial, infrastructure) require distinct sets of licenses and permits.

- Timeliness is Key: Early and accurate application submission is crucial to avoid project delays and associated costs.

- Compliance Costs: The fees associated with obtaining permits and licenses can represent a significant portion of a project's initial budget.

The Yates Companies operates within a framework of evolving intellectual property laws, requiring vigilance in protecting its designs and innovations. Patent filings and copyright registrations are crucial for safeguarding proprietary information, especially as the company develops new construction techniques or software solutions. In 2024, the U.S. Patent and Trademark Office saw a significant increase in applications related to sustainable building technologies, a trend The Yates Companies must monitor to maintain its competitive edge.

Contractual law is fundamental to The Yates Companies' business, governing everything from client agreements to subcontractor relationships. Adherence to contract terms, including payment schedules, performance standards, and dispute resolution clauses, is essential for project success and financial stability. As of early 2025, construction contract disputes in the U.S. continue to be a major concern, with payment issues and scope changes frequently cited as primary causes.

Regulatory compliance extends to data privacy and cybersecurity. With increasing digitalization of operations and client data, The Yates Companies must adhere to laws like the California Consumer Privacy Act (CCPA) and potential federal privacy regulations. In 2024, cybersecurity threats against businesses, including those in the construction sector, remained a significant risk, with data breaches potentially leading to substantial financial and reputational damage.

The legal landscape surrounding antitrust and fair competition also impacts The Yates Companies. Adherence to regulations preventing monopolistic practices and ensuring fair bidding processes is vital. In 2024, increased scrutiny on large construction firms regarding anti-competitive behavior was observed in several regions, emphasizing the need for transparent and ethical business dealings.

Environmental factors

Climate change is increasingly driving demand for resilient infrastructure. Extreme weather events, such as those seen globally in 2024 with record-breaking heatwaves and intense rainfall, necessitate construction methods and materials capable of withstanding these challenges. The Yates Companies will likely need to adapt by focusing on designs and materials that enhance durability against severe storms and floods, reflecting a growing market need for climate-resilient building solutions.

The increasing global focus on environmental responsibility is directly impacting the construction sector. Clients and regulatory bodies are increasingly prioritizing projects that minimize ecological impact, leading to a greater demand for sustainable building practices and certifications such as LEED (Leadership in Energy and Environmental Design) or BREEAM (Building Research Establishment Environmental Assessment Method). The Yates Companies can significantly boost its market position by showcasing proficiency in eco-friendly construction methods, effective waste management, and the implementation of energy-efficient designs. This strategic alignment addresses both client preferences and the growing regulatory imperative for greener built environments.

The construction sector is a major waste generator, facing growing pressure for better waste disposal and recycling. The Yates Companies needs strong waste management strategies, prioritizing reduction, reuse, and recycling of construction and demolition materials to lessen landfill burden and meet environmental regulations.

In 2023, the US construction industry generated an estimated 600 million tons of construction and demolition debris. Effective waste diversion, aiming for at least 50% of materials to be recycled or reused, is crucial for companies like Yates to maintain compliance and improve their environmental footprint, potentially reducing disposal costs by up to 30%.

Resource Scarcity and Material Sourcing

Concerns about the scarcity of key natural resources and the environmental toll of material extraction are significantly shaping how companies like The Yates Companies make material choices and manage their supply chains. This is particularly relevant as global demand for commodities continues to rise. For instance, the International Energy Agency (IEA) projected in 2024 that demand for critical minerals like lithium and cobalt, essential for batteries, could increase by over 40 times by 2040 compared to 2020 levels, highlighting potential future scarcity.

As a result, The Yates Companies will likely accelerate its pursuit of sustainable or recycled materials, a trend already seen across many industries. They may also prioritize local sourcing to cut down on transportation-related emissions, aligning with circular economy principles. For example, many construction firms are increasingly using recycled concrete and steel, with the global recycled construction materials market expected to reach over $60 billion by 2027, according to some market research reports. Responsible material selection is thus becoming a critical component of operational strategy.

- Growing demand for critical minerals: IEA projects over 40x increase in demand for minerals like lithium and cobalt by 2040.

- Shift towards sustainable materials: Increased adoption of recycled concrete and steel in construction.

- Supply chain resilience: Prioritizing local sourcing to reduce transportation emissions and mitigate global supply disruptions.

- Circular economy integration: Focus on materials that support reuse and reduce waste.

Pollution Control and Biodiversity Protection

The Yates Companies face significant environmental considerations, particularly concerning pollution control and biodiversity protection during construction. Projects can generate air pollution through dust and emissions, water pollution from runoff carrying sediment and chemicals, and noise pollution impacting local wildlife and communities. For instance, in 2024, construction projects across the US faced increased scrutiny regarding stormwater management, with regulatory bodies issuing fines for non-compliance with Clean Water Act provisions, highlighting the financial risks associated with inadequate controls.

To mitigate these impacts, The Yates Companies must implement robust pollution control strategies. This includes measures like dust suppression systems, advanced erosion and sediment control plans, and noise abatement techniques. Protecting biodiversity involves conducting thorough environmental impact assessments to identify and safeguard sensitive habitats, endangered species, and critical ecosystems within or near project sites. Adherence to regulations like the Endangered Species Act and state-specific environmental protection laws is paramount for responsible land stewardship and avoiding costly penalties.

Key strategies for The Yates Companies include:

- Implementing comprehensive dust control measures such as water spraying and covering stockpiles to reduce airborne particulate matter, a common concern in construction.

- Developing and executing effective stormwater management plans to prevent sediment and pollutant discharge into waterways, a critical factor given the 2024 increase in environmental enforcement actions.

- Employing noise reduction technologies and scheduling practices to minimize disruption to surrounding areas and wildlife.

- Conducting biodiversity surveys and implementing habitat protection protocols to ensure minimal impact on local flora and fauna, aligning with the growing emphasis on ecological responsibility in the construction sector.

The construction industry is under increasing pressure to adopt sustainable practices, driven by climate change and growing environmental awareness. Companies like The Yates Companies must integrate eco-friendly methods and materials to meet client and regulatory demands, as seen with the global rise in demand for climate-resilient infrastructure and certifications like LEED.

Waste management is a critical environmental factor, with the US construction industry generating substantial debris annually. Effective waste diversion strategies, aiming for significant material recycling, are essential for compliance and cost reduction, with Yates needing robust plans for waste reduction, reuse, and recycling.

Resource scarcity and the environmental impact of material extraction are pushing for greater use of recycled and locally sourced materials. This shift aligns with circular economy principles and is supported by a growing market for recycled construction materials, with companies like Yates expected to prioritize sustainable sourcing to ensure supply chain resilience.

Pollution control and biodiversity protection are also key concerns, with construction projects facing scrutiny for air, water, and noise pollution. Robust environmental management systems, including dust suppression and stormwater control, are vital to avoid penalties and protect local ecosystems, reflecting a heightened regulatory focus in 2024.

| Environmental Factor | Impact on Construction | Yates Companies' Strategy | Relevant Data/Trend |

| Climate Change & Extreme Weather | Demand for resilient infrastructure | Focus on durable designs and materials | Record heatwaves and rainfall globally in 2024 |

| Environmental Responsibility & Sustainability | Demand for eco-friendly practices & certifications | Showcase LEED/BREEAM proficiency, green methods | Growing client preference for sustainable building |

| Waste Management | Pressure for better disposal/recycling | Implement strong reduction, reuse, recycling strategies | US construction generated 600M tons debris in 2023; aim for 50% diversion |

| Resource Scarcity & Material Sourcing | Need for sustainable/recycled materials | Prioritize recycled/local sourcing, circular economy | Critical mineral demand to increase 40x by 2040 (IEA); Recycled materials market >$60B by 2027 |

| Pollution Control & Biodiversity | Scrutiny on air, water, noise pollution | Implement dust suppression, stormwater management, noise abatement | Increased enforcement on stormwater management in 2024 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for The Yates Companies is built on a foundation of diverse and credible data sources. We draw from official government publications, reputable economic databases, and leading industry research firms to ensure comprehensive and accurate insights into the political, economic, social, technological, legal, and environmental landscapes.