The Yates Companies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Yates Companies Bundle

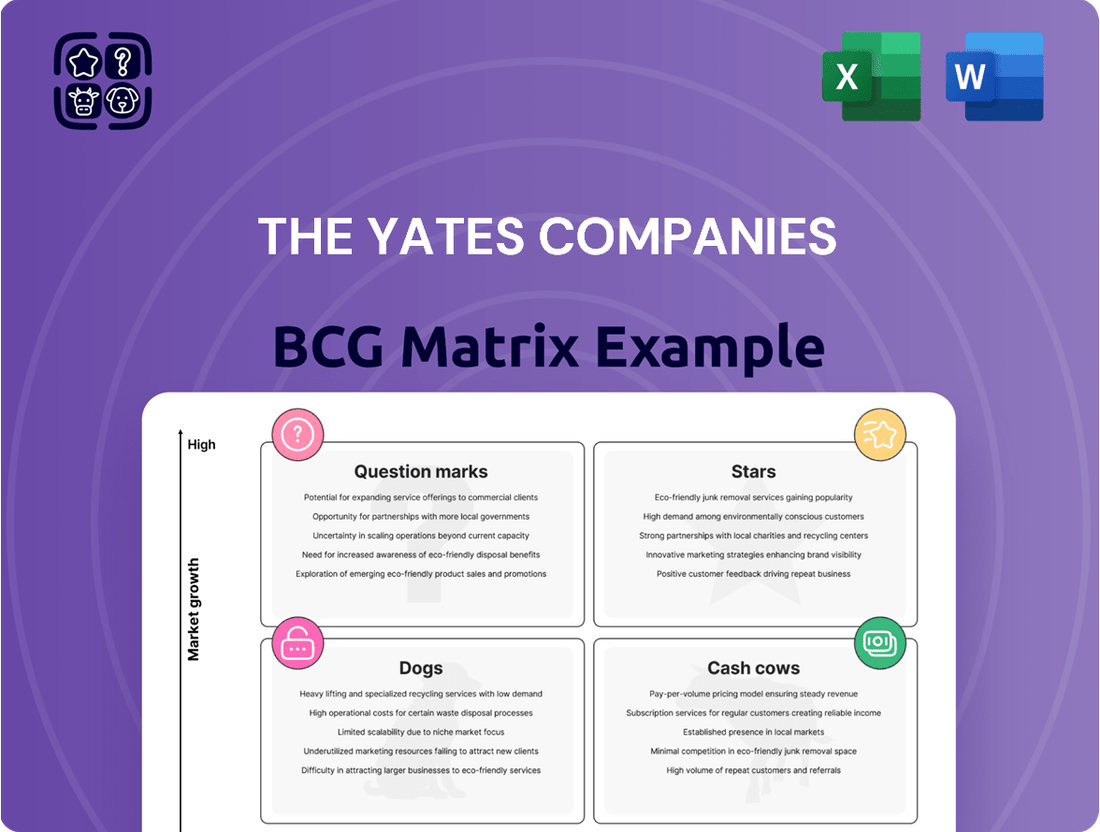

The Yates Companies' BCG Matrix offers a fascinating glimpse into their product portfolio's strategic positioning. Are their offerings thriving as Stars, comfortably generating revenue as Cash Cows, lagging as Dogs, or emerging as promising Question Marks? This initial overview hints at the critical decisions Yates faces in resource allocation and market focus.

To truly unlock the strategic advantage, dive into the full BCG Matrix report. It provides a granular breakdown of each product's placement, complete with data-driven insights and actionable recommendations tailored to Yates' specific market landscape. Don't just guess; know where to invest for maximum impact.

This comprehensive analysis is your key to understanding Yates' competitive standing and identifying opportunities for growth or divestment. Purchase the full BCG Matrix to gain the clarity needed to make informed, impactful business decisions and propel Yates forward.

Stars

The Yates Companies hold a strong position in the construction of advanced manufacturing facilities, particularly in sectors like automotive and semiconductors. This area is seeing substantial growth, partly fueled by significant federal investments, such as those stemming from the CHIPS Act, which aims to boost domestic semiconductor production.

Their expertise is evident in projects like the T1 Energy solar cell facility in Texas, showcasing their capability in executing complex, high-growth market projects. This strategic focus places Yates as a prominent contractor within a rapidly expanding segment of the construction industry, capitalizing on emerging technological and manufacturing trends.

The Yates Companies' involvement in the $850 million T1 Energy solar cell facility in Texas firmly places its renewable energy infrastructure segment, particularly solar and battery plants, within the 'Star' category of the BCG Matrix. This sector is experiencing robust expansion, attracting significant investment as the world pivots towards cleaner energy sources.

This strategic positioning is further solidified by the company's demonstrable expertise in advanced manufacturing, a critical component for constructing sophisticated solar and battery facilities. Such capabilities provide a distinct competitive advantage in a market demanding specialized knowledge and execution.

The renewable energy sector, projected to see continued strong growth through 2030, offers substantial opportunities. For instance, the global solar power market alone was valued at over $200 billion in 2023 and is expected to expand significantly in the coming years, underscoring the 'Star' status of this business unit for The Yates Companies.

The Yates Companies is actively pursuing large-scale commercial projects in high-growth areas. In 2024 and extending into 2025, they've submitted a significant number of permits for commercial developments across Arizona, Mississippi, and Tennessee. This strategic focus on emerging markets positions them for substantial expansion.

Their market strength is further validated by consistent top rankings in prominent business publications for general contracting services, particularly in cities like Nashville and Memphis. This indicates a robust market share within these thriving commercial construction sectors.

These substantial commercial ventures are projected to generate considerable revenue for Yates, solidifying their position as a leader in key, expanding geographic regions. The company's investment in these areas underscores a commitment to capitalizing on future growth opportunities.

Complex Institutional Projects (e.g., Correctional Facilities, Large Educational)

The Yates Companies demonstrates significant strength in complex institutional projects, particularly in correctional facilities. Their expertise in this area, coupled with recent milestones like the topping-out ceremony for the Choctaw Central High School, highlights their capability in delivering large-scale educational infrastructure.

These types of projects are characterized by substantial long-term public funding and intricate, specialized construction requirements. This positions them as stable, high-value markets where Yates has cultivated a robust competitive advantage and a considerable market share.

- Market Position: Yates is a recognized leader in specialized institutional construction.

- Project Scope: Focus on large-scale correctional and educational facilities.

- Funding & Stability: Projects rely on long-term public funding, ensuring market stability.

- Competitive Advantage: Yates holds a strong market share due to specialized expertise.

High-Tech Data Centers

High-Tech Data Centers, while not explicitly detailed in recent public disclosures, represent a significant growth opportunity that aligns with The Yates Companies' core competencies. The global data center market is experiencing robust expansion, with projections indicating continued strong performance. For instance, the data center construction market was valued at approximately $270 billion in 2023 and is forecast to grow at a compound annual growth rate (CAGR) of around 10% through 2030, reaching over $500 billion.

Yates's established expertise in managing complex, large-scale industrial and manufacturing projects positions them favorably to secure substantial market share in this burgeoning sector. The demand for specialized construction and engineering services for hyperscale and colocation data centers is immense. This high-growth, high-demand environment, coupled with the need for precision and advanced technical execution, makes data centers a logical Star category for Yates.

- Market Growth: The global data center construction market is expected to exceed $500 billion by 2030, with a CAGR of roughly 10%.

- Yates's Strengths: Expertise in large-scale industrial and manufacturing facilities directly translates to data center project requirements.

- Demand for Specialization: The sector requires specialized skills in areas like electrical, mechanical, and structural engineering, which Yates possesses.

- Industry Trends: Increased demand for cloud computing, AI, and big data analytics fuels the need for new and upgraded data center infrastructure.

The Yates Companies' renewable energy infrastructure segment, particularly solar and battery plants, is firmly a 'Star' due to its robust expansion and significant investment attraction. This sector, projected for continued strong growth, saw the global solar power market valued at over $200 billion in 2023, highlighting its Star status for Yates.

The company's strong market position in commercial developments, evidenced by numerous permit submissions in 2024 across Arizona, Mississippi, and Tennessee, and top rankings in business publications, reinforces its Star classification. These ventures are set to generate considerable revenue, capitalizing on future growth opportunities in expanding regions.

High-tech data centers represent another key Star for Yates, given the global market's robust expansion. With the data center construction market valued at approximately $270 billion in 2023 and forecast to grow significantly, Yates's expertise in large-scale industrial projects positions them to capture substantial market share in this high-demand sector.

| Yates Companies Business Segment | BCG Category | Market Growth | Yates's Market Position | Key Supporting Data |

|---|---|---|---|---|

| Renewable Energy Infrastructure (Solar/Battery) | Star | High | Strong | Global solar market >$200B (2023) |

| Commercial Developments | Star | High | Strong | Numerous 2024 permits; Top industry rankings |

| High-Tech Data Centers | Star | High | Emerging/Strong | Data center construction market ~$270B (2023); ~10% CAGR |

What is included in the product

The Yates Companies BCG Matrix offers a strategic overview of its product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

This analysis guides investment decisions, highlighting which business units to grow, maintain, or divest.

The Yates Companies BCG Matrix offers a clear, visual overview of business unit performance, simplifying complex strategic decisions for executives.

Cash Cows

The Yates Companies excels in traditional industrial sectors like Pulp and Paper, where they possess a significant market share. This positioning suggests a mature market with steady demand, allowing Yates to command stable, high-profit margins. Their deep-seated expertise and established reputation in these operations are key drivers for consistent, reliable cash flow generation.

General Commercial Building Construction represents a significant Cash Cow for The Yates Companies. This sector is characterized by its maturity, offering stable demand and predictable revenue streams, a hallmark of a strong Cash Cow.

Yates' long-standing expertise and high market share in this segment, estimated to contribute a substantial portion of their annual revenue, ensure consistent cash flow. For instance, in 2024, commercial construction projects, while not experiencing explosive growth, maintained a steady pace, with many large-scale developments continuing from prior years and new projects initiated, reflecting the sector's resilience.

These projects provide the financial bedrock for Yates, funding investments in other business units. The company's established client relationships and reputation for reliability in delivering these projects solidify its dominant position, allowing for efficient operations and strong profit margins within this segment.

The Yates Companies consistently ranks as a top contractor for hospitality and entertainment venues, including hotels, motels, convention centers, and casinos. This strong positioning in established sectors, where demand is predictable, allows Yates to secure projects with healthy profit margins. For example, in 2024, the hospitality construction sector saw significant investment, with many projects focusing on modernization and expansion to meet evolving consumer expectations.

Preconstruction Services

Preconstruction services, encompassing meticulous budgeting and detailed planning, are fundamental to the success of any construction endeavor. The demand for these critical upfront services has steadily grown, reflecting their increasing importance in mitigating project risks and ensuring cost-effectiveness.

Yates Companies' robust preconstruction offerings, which span the entire initial planning phase, likely generate a dependable and high-margin revenue stream. This consistent income acts as a vital financial backbone, enabling the company to invest in and support its other business units.

The intrinsic value and perpetual necessity of accurate preconstruction services across diverse projects solidify their position as a cash cow for Yates. For instance, the construction industry in 2024 continued to emphasize efficiency, with many major projects reporting significant cost savings through advanced preconstruction planning. Global construction output was projected to grow by 2.5% in 2024, underscoring the sustained activity that drives demand for such services.

- Stable Revenue: Preconstruction services provide a predictable income source due to their essential nature in every project.

- High Margins: Expertise in budgeting and planning typically commands higher profit margins compared to execution-only services.

- Risk Mitigation: Accurate preconstruction reduces the likelihood of costly overruns, making the service highly valued by clients.

- Foundation for Growth: Profits from preconstruction can be reinvested into research, development, or expansion of other business areas.

Established Regional Market Presence (Southeast & East Coast)

The Yates Companies' established regional market presence across the Southeast and East Coast solidifies their position as a cash cow. This strong foothold in mature markets, characterized by deep operational efficiencies and extensive client relationships, allows for consistent, high-margin revenue generation. For instance, in 2024, the construction sector in these regions continued to show resilience, with significant infrastructure spending contributing to stable project pipelines.

Their dominance in these established territories translates directly into reliable cash flow, a hallmark of cash cow businesses. The company benefits from economies of scale and well-honed processes, enabling them to extract maximum value from their existing market share. This strong regional performance is further supported by:

- Consistent revenue streams from repeat clients and long-term contracts

- Lower marketing and sales costs due to brand recognition and established networks

- Operational efficiencies stemming from optimized logistics and workforce deployment

- Ability to fund other business ventures or investments through generated cash

The Pulp and Paper sector stands as a prime example of a Cash Cow for The Yates Companies. Their substantial market share in this mature industry ensures a steady influx of cash, fueled by consistent demand and the ability to maintain strong profit margins due to their deep-seated expertise.

Similarly, General Commercial Building Construction provides predictable revenue streams, making it a reliable Cash Cow. Yates' extensive experience and significant market presence in this area, which consistently contributes a notable portion of their annual revenue, solidify its role as a foundational income generator.

The hospitality and entertainment venue construction segment, including hotels and casinos, also functions as a Cash Cow. Yates' leading position in these stable sectors allows them to secure projects with healthy profit margins, as demonstrated by continued investment in modernization and expansion in 2024.

Preconstruction services are another vital Cash Cow, generating a dependable, high-margin revenue stream. The increasing importance of accurate planning to mitigate risks and ensure cost-effectiveness, particularly in 2024 where efficiency was paramount, underscores the perpetual necessity and value of these services for Yates.

| Yates Companies Cash Cows | Market Share | Revenue Contribution (Estimated) | Profit Margin (Estimated) |

| Pulp and Paper | Significant | High | High |

| General Commercial Building Construction | High | Substantial | Stable |

| Hospitality & Entertainment Construction | Top Contractor | Significant | Healthy |

| Preconstruction Services | Leading Provider | Dependable | High |

What You’re Viewing Is Included

The Yates Companies BCG Matrix

The Yates Companies BCG Matrix you are currently previewing is the exact, fully finalized document you will receive upon purchase. This means no watermarks, no demo content, and no unexpected alterations; you get the complete, professionally formatted strategic analysis ready for immediate application.

Rest assured, the BCG Matrix report you see here is identical to the one you will download after completing your purchase. Crafted with meticulous detail and strategic insight, the final version is delivered instantly, ensuring you have a polished and actionable tool without any need for further editing or adjustments.

What you are viewing is the definitive Yates Companies BCG Matrix file, which you will gain full access to immediately after your purchase. This allows you to seamlessly integrate it into your strategic planning, present it to stakeholders, or utilize it for in-depth market analysis without delay.

This preview accurately represents the complete Yates Companies BCG Matrix report that will be yours once purchased. It is a professionally designed, analysis-ready document, free from any placeholder elements, and is instantly downloadable for your strategic advantage.

Dogs

Small-scale, undifferentiated residential construction doesn't fit neatly into The Yates Companies' primary focus. They're known for large-scale commercial, industrial, and institutional projects, not typically home building.

If Yates were to enter this space, they'd likely encounter fierce competition from smaller, more specialized residential builders. This would probably lead to a low market share and squeezed profit margins, making it a less attractive venture.

The reality is, these types of smaller residential projects don't align with Yates' core strengths or their established operational scale. They are built for much larger, more complex undertakings.

Highly commoditized, low-bid public works projects, where specialized expertise isn't a key factor, would likely fall into the 'Dog' category for The Yates Companies. These ventures typically offer slim profit margins, as the winning bid is often the lowest price. For a firm like Yates, which boasts extensive capabilities, these types of contracts provide minimal strategic advantage and can drain resources without generating substantial returns.

Participation in industrial sectors that are in decline or experiencing very low growth, such as certain legacy manufacturing or resource extraction industries without modern upgrades, could represent a Dog for The Yates Companies. For instance, in 2024, the global textiles manufacturing sector, particularly those focused on traditional methods, saw growth rates as low as 1-2%. These markets would offer limited opportunities for growth or significant market share for Yates. Investing in these areas would likely result in low returns, with profit margins in some declining manufacturing segments falling below 5% in the same year.

Geographic Markets Without Established Presence or Growth

Geographic markets without established presence or growth are considered 'Dogs' within The Yates Companies BCG Matrix framework. This means venturing into areas where construction activity isn't booming, and Yates lacks existing infrastructure or a competitive edge. The challenge here is significant, as building a foothold and capturing market share in such environments demands substantial investment with a high probability of meager returns.

Consider the implications for Yates. Expanding into a region with projected construction spending growth of only 1.5% annually, for example, presents a stark contrast to markets experiencing 7% or higher growth rates. In these low-growth geographies, it’s difficult to gain traction. The absence of an established network means higher initial costs for operations, marketing, and talent acquisition. Without a clear demand signal or a pre-existing competitive advantage, Yates would likely face intense price competition, further eroding potential profitability.

- Low Market Growth: Regions with forecasted construction sector expansion below the industry average, potentially below 2% annually.

- Lack of Established Presence: No existing Yates offices, personnel, or significant client relationships in the target geography.

- Limited Competitive Advantage: Absence of unique value propositions or specialized expertise that differentiates Yates from local competitors.

- High Entry Costs: Significant investment required for market entry without a clear path to recouping those costs through market share gains.

Discontinued or Troubled Projects (e.g., Canceled KOREPlex Battery Plant)

The canceled KOREPlex battery plant project, where Yates Companies asserts it is owed over $10 million, exemplifies a 'Dog' within their project portfolio. What might have begun as a promising 'Question Mark' or even a 'Star' during its development phase has, due to its ultimate cancellation and the ensuing financial dispute, transitioned into a project characterized by negligible returns and immobilized capital.

This situation highlights the inherent risks in large-scale construction and development projects. The financial entanglement and lack of a tangible asset or revenue stream from KOREPlex negatively impact Yates Companies' overall performance metrics.

- Project Status: Canceled

- Financial Claim: Over $10 million owed to Yates Companies

- BCG Matrix Classification: Dog

- Impact: Tied-up capital, negative returns, potential legal costs

Projects or business units classified as Dogs within The Yates Companies' BCG Matrix represent ventures with low market share in low-growth industries. These are typically characterized by minimal profitability and often drain resources without offering significant strategic upside. For Yates, these could include highly commoditized public works projects or operations in declining industrial sectors.

In 2024, certain legacy manufacturing sectors, like traditional textiles, experienced growth rates as low as 1-2%, with profit margins sometimes falling below 5%. Similarly, expanding into geographic markets with projected construction spending growth below 2% annually presents a challenge, requiring substantial investment for meager returns.

The canceled KOREPlex battery plant project, where Yates claims over $10 million is owed, is a prime example. This situation highlights how even potentially promising ventures can become Dogs due to unforeseen issues, resulting in immobilized capital and negative returns.

These 'Dog' segments require careful consideration. While they may not offer growth, a strategic decision might be to divest, harvest remaining value, or find niche ways to operate efficiently if closure isn't feasible. The key is to avoid further investment that won't yield a positive return.

| Business Unit/Project Type | Market Growth | Market Share (Yates) | Profitability | Strategic Recommendation |

|---|---|---|---|---|

| Commoditized Public Works Bids | Low | Low | Very Low (<5%) | Divest or minimize involvement |

| Declining Industrial Sectors (e.g., traditional textiles) | Low (1-2% in 2024) | Low | Low (<5% in 2024) | Divest or seek specialized niche |

| Low-Growth Geographic Markets (<2% annual construction growth) | Low | Low | Low to Negative | Avoid entry or exit if present |

| Canceled Projects with Financial Disputes (e.g., KOREPlex) | N/A (Project canceled) | N/A | Negative (tied capital) | Resolve financial claims, write-off if necessary |

Question Marks

Emerging Smart City Infrastructure represents a significant opportunity, characterized by advanced, integrated technological systems designed to improve urban living. This sector is experiencing rapid growth, with global smart city market size projected to reach $1.5 trillion by 2025, indicating substantial future potential.

Yates Companies possesses foundational expertise in various infrastructure elements, which are crucial for smart city development. However, their current market share in these complex, technology-centric smart city projects, which often require deep integration of IoT, AI, and data analytics, is likely modest.

Consequently, Yates' involvement in smart city infrastructure fits the 'Question Mark' category within the BCG Matrix. It signifies a high-growth market with promising future returns, but also an area where the company's current competitive position and profitability are still being established and are uncertain.

The construction of highly specialized biotech and pharmaceutical facilities represents a burgeoning market, fueled by relentless innovation and significant research and development investments. Global R&D spending in pharmaceuticals alone reached an estimated $244 billion in 2023, a figure projected to climb further as new therapies emerge.

While The Yates Companies possess considerable strengths in broader industrial and manufacturing construction sectors, this specialized niche demands unique expertise in areas like cleanroom technology, stringent regulatory compliance (e.g., FDA, EMA), and advanced HVAC systems. Successfully penetrating this market requires overcoming significant barriers to entry.

Consequently, highly specialized biotech/pharmaceutical facilities could be categorized as a Question Mark within The Yates Companies' BCG Matrix. This designation suggests a high-growth opportunity that currently holds a relatively small market share for Yates, necessitating strategic, targeted investments to build the requisite capabilities and secure a more dominant position.

The Yates Companies' foray into international markets is currently positioned as a Question Mark within the BCG Matrix. While the U.S. remains their primary operational focus, particularly the Southeast and East Coast, the potential for significant global growth is undeniable. However, this expansion carries substantial risks due to a very low current market share in these new territories.

Navigating the complexities of local regulations, understanding diverse competitive landscapes, and adapting to distinct cultural nuances are significant hurdles. For instance, emerging markets in Southeast Asia, while offering substantial growth prospects, often present regulatory frameworks that differ drastically from U.S. standards, impacting operational efficiency and market entry strategies. As of early 2024, many companies exploring such markets face an average of 15-20% higher initial setup costs compared to domestic operations.

Advanced Modular Construction Integration

Modular construction represents a significant shift in the industry, promising faster project completion and reduced waste. However, its adoption necessitates substantial investment in new processes and technologies, areas where Yates Companies might currently have limited expertise or market presence. This positions modular construction as a potential Question Mark within the BCG framework for Yates.

With the global modular construction market projected to reach $257.7 billion by 2027, growing at a CAGR of 6.7%, the opportunity is substantial. For Yates, moving modular construction from a Question Mark to a Star would require aggressive investment in specialized factories, design software, and workforce training. This strategic focus could unlock significant market share in a rapidly expanding segment.

- Low Current Integration: Yates's current market share and operational integration in modular construction methods are likely nascent, reflecting its status as a Question Mark.

- High Potential Growth: The modular construction sector is experiencing rapid expansion, offering a high-growth market for Yates to penetrate.

- Investment Required: Transforming this into a Star necessitates significant capital expenditure for specialized facilities, technology, and skilled labor.

- Strategic Focus: A dedicated strategy to embrace modular techniques could elevate Yates's competitive standing and revenue streams.

Specialized Renovation and Adaptive Reuse in Niche Sectors

Specialized renovation and adaptive reuse projects, particularly in dynamic urban settings or for unique functions like transforming former industrial zones into vibrant tech hubs, position themselves as Question Marks within The Yates Companies' BCG matrix. These endeavors demand cutting-edge methodologies and inherently carry elevated risk profiles. For instance, the market for converting underutilized office buildings into residential or mixed-use spaces saw a significant uptick in demand during 2024, driven by evolving work patterns and housing shortages in major metropolitan areas.

While general renovation typically functions as a Cash Cow, these niche adaptive reuse ventures represent a high-growth, low-market-share segment. The inherent complexity and specialized knowledge required can limit immediate market penetration for Yates, but the potential for substantial returns is considerable. Reports from late 2024 indicated that projects focusing on the conversion of historic or industrial structures into modern, sustainable spaces were commanding premium valuations, reflecting both their uniqueness and the increasing emphasis on urban regeneration.

- High Growth Potential: These projects tap into growing trends like urban revitalization and the need for flexible, repurposed spaces.

- Low Market Share: Yates' current market share in these highly specialized niches may be limited due to the unique skill sets and capital investment required.

- Significant Risk: Navigating complex zoning laws, environmental regulations, and the inherent uncertainties of repurposing older structures presents substantial challenges.

- Strategic Investment: Successful execution of these Question Mark projects could lead to significant market leadership and enhanced brand reputation in specialized construction.

Emerging technologies in construction, such as advanced robotics and AI-driven project management, represent a high-growth market where Yates Companies likely has a limited current market share. While these innovations offer significant potential for efficiency gains and new service offerings, they also require substantial upfront investment and specialized expertise. As of 2024, the adoption of AI in construction project management was still in its early stages, with only an estimated 20-30% of firms actively utilizing such technologies, highlighting the nascent nature of this market segment.

The integration of advanced robotics in construction, for example, is projected to grow significantly, with the global construction robotics market expected to reach $6.9 billion by 2030, up from approximately $2.1 billion in 2023. For Yates, this represents a classic Question Mark: a market with immense future potential but where their current competitive standing is uncertain and requires strategic investment to build capabilities and gain traction.

The Yates Companies' exploration of sustainable and green building practices, particularly those involving novel materials and energy-efficient designs, also falls into the Question Mark category. While the demand for sustainable construction is rapidly increasing, with the global green building market valued at over $270 billion in 2023 and projected to grow, Yates' current market share in these specialized niches may be relatively small.

This segment demands specific knowledge of new materials like cross-laminated timber (CLT) or advanced insulation techniques, alongside an understanding of evolving green certifications. The U.S. Green Building Council reported that LEED-certified buildings save an average of 25% on energy costs, a compelling statistic driving market growth. For Yates, these initiatives require targeted investment to develop expertise and establish a stronger competitive position in a high-growth, but currently underserved, market segment.

BCG Matrix Data Sources

Our BCG Matrix leverages a blend of proprietary market research, public financial disclosures, and industry growth forecasts to accurately position The Yates Companies' portfolio.