Want Want China Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Want Want China Holdings Bundle

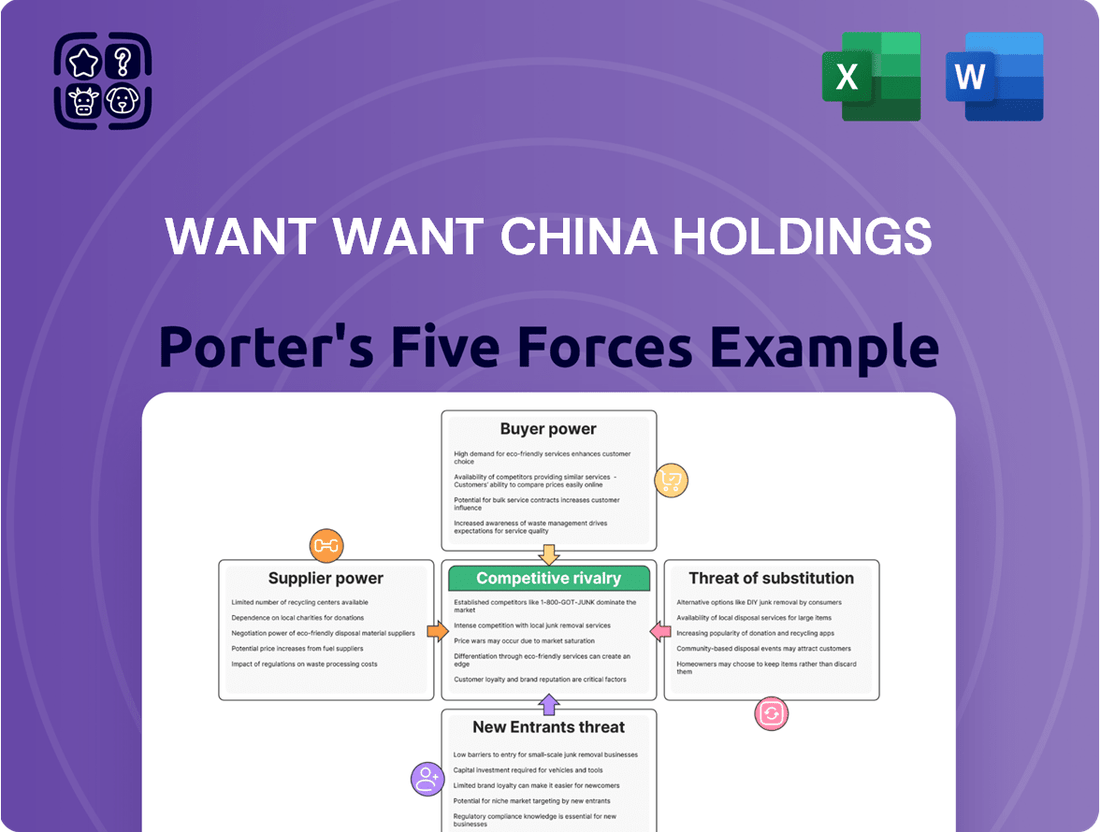

Want Want China Holdings navigates a dynamic landscape shaped by intense rivalry and substantial buyer power, particularly from large retailers. The threat of substitutes is moderate, as consumers have various snack and beverage options. Supplier power is also a key consideration, with raw material costs influencing profitability. Understanding these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Want Want China Holdings’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Want Want's bargaining power of suppliers is influenced by how concentrated its supplier base is and how critical the inputs are. If Want Want relies heavily on a few suppliers for essential ingredients like rice, milk, or sugar, those suppliers gain more leverage. This is particularly true if these ingredients are specialized or make up a large part of Want Want's production expenses.

The dairy sector in China is facing potential challenges. Projections indicate a decline in domestic milk production for 2025. This anticipated reduction in supply could strengthen the position of dairy suppliers, giving them greater bargaining power over buyers like Want Want.

High switching costs for raw materials significantly empower suppliers. If Want Want China Holdings needs to re-tool machinery or undergo lengthy re-certification processes to adopt new ingredient specifications from alternative suppliers, existing suppliers gain considerable leverage. This inertia makes changing suppliers a costly and time-consuming endeavor.

For instance, in 2023, the global food ingredients market saw significant price volatility, with some key commodities experiencing double-digit percentage increases. This environment exacerbates the impact of switching costs, as finding and integrating a new, potentially less reliable, supplier for critical ingredients could disrupt production and incur substantial upfront investment, thereby strengthening the position of established suppliers.

Want Want China Holdings' reliance on suppliers for differentiated or proprietary ingredients significantly impacts supplier bargaining power. When suppliers provide unique or specialized inputs, they can command higher prices or more favorable terms, strengthening their position. This is particularly relevant for authentic Chinese ingredients, where specialized importers can wield considerable influence due to the niche nature of their offerings.

Conversely, when Want Want sources commodity-like inputs, where numerous suppliers offer interchangeable products, the bargaining power of those suppliers is considerably weaker. In such scenarios, Want Want can leverage competition among suppliers to negotiate better pricing and terms, reducing the cost of goods sold. The availability of multiple, similar suppliers limits any single supplier's ability to dictate terms.

Threat of Forward Integration by Suppliers

The potential for a key supplier to move into food and beverage manufacturing, essentially competing with Want Want, would dramatically increase that supplier's leverage. This would compel Want Want to nurture robust supplier partnerships to safeguard its production pipeline and avoid potential disruptions. For instance, a major ingredient supplier with established manufacturing facilities could leverage its existing infrastructure to produce finished goods, directly challenging Want Want's market share.

- Supplier Integration Risk: A significant threat arises if major suppliers, particularly those providing essential ingredients like rice or dairy, develop the capacity and ambition to integrate forward into producing finished Want Want products.

- Enhanced Bargaining Power: Such forward integration would grant suppliers considerable bargaining power, allowing them to dictate terms and potentially increase costs for Want Want, impacting profitability.

- Supply Chain Security: To mitigate this risk, Want Want must cultivate and maintain strong, collaborative relationships with its suppliers, ensuring reliable access to raw materials and preventing opportunistic price hikes.

- Competitive Landscape Shift: A supplier's entry into the manufacturing space would intensify competition, forcing Want Want to innovate and maintain a competitive edge in product quality and pricing.

Volume of Purchases and Importance to Suppliers

Want Want China Holdings' substantial purchase volumes, driven by its widespread operations in snacks and beverages, position it as a key client for many of its raw material and packaging suppliers. This significant scale of procurement could grant Want Want considerable bargaining power. For instance, if a supplier derives a large portion of its revenue from Want Want, the potential loss of this business due to price negotiations would create substantial pressure on the supplier to concede favorable terms.

In 2023, Want Want China reported total revenue of approximately RMB 22.03 billion (US$3.04 billion). This massive revenue stream is directly linked to its procurement activities, underscoring the importance of its purchasing power. A supplier heavily reliant on Want Want’s orders faces a significant risk if they cannot meet Want Want's pricing expectations.

The company's diversified product portfolio, from rice crackers to dairy drinks, means it sources a wide array of inputs. This broad demand base can amplify its influence, as many suppliers may cater to multiple Want Want product lines, making the relationship even more critical for them. This could translate into a reduced bargaining power for suppliers who might otherwise have leverage.

The impact of Want Want's purchasing volume can be quantified by considering the supplier's dependence. If a single supplier's revenue from Want Want represents, for example, 15% or more of its total sales, Want Want gains a notable advantage in price discussions, potentially mitigating supplier-driven cost increases.

Want Want's substantial purchasing volume, evidenced by its 2023 revenue of approximately RMB 22.03 billion (US$3.04 billion), grants it significant leverage over many suppliers. This scale means that losing Want Want as a customer would represent a considerable blow to a supplier's revenue, incentivizing them to offer favorable terms and pricing.

This strong purchasing power is further amplified by Want Want's diverse sourcing needs across its snack and beverage portfolio. Suppliers catering to multiple product lines are more dependent on the company, diminishing their individual bargaining power.

For instance, if a supplier's sales to Want Want constitute 15% or more of their total revenue, Want Want gains a notable advantage in price negotiations, helping to offset potential cost increases from suppliers.

| Factor | Impact on Want Want's Bargaining Power | Supporting Data/Observation |

|---|---|---|

| Purchasing Volume | High | 2023 Revenue: RMB 22.03 billion (US$3.04 billion) |

| Supplier Dependence (Example) | High if >15% of supplier revenue | Quantifiable leverage in price discussions |

| Product Portfolio Diversity | Increases leverage | Sourcing for snacks, dairy, beverages, etc. |

What is included in the product

This analysis of Want Want China Holdings reveals the intense competitive pressures from established rivals and emerging brands, alongside the significant bargaining power of distributors and retailers that impact profitability.

Instantly visualize competitive intensity with a clear, actionable summary of Want Want China's Porter's Five Forces, simplifying strategic planning.

Customers Bargaining Power

Customers in China's competitive food and beverage market, especially for everyday snacks and drinks, are quite sensitive to price. This means Want Want faces pressure to keep its prices attractive. In 2023, the average consumer spending on food and beverages in China saw a steady increase, but value-for-money remains a key consideration for a vast segment of the population.

Want Want's well-known brands offer some protection, but the sheer number of competing products means customers can readily switch to cheaper alternatives if Want Want's pricing isn't perceived as competitive. This ease of switching significantly boosts customer bargaining power, forcing Want Want to carefully manage its pricing strategies to retain market share.

Large retail chains and distributors in China wield significant influence over Want Want China Holdings due to their substantial purchasing volume. These powerful buyers can leverage their size to negotiate better prices, demand preferential treatment, and secure favorable payment terms. In 2023, major hypermarket chains and e-commerce platforms accounted for a significant percentage of Want Want's revenue, giving them considerable leverage.

This concentration of buyers means that Want Want must carefully manage relationships with key accounts. Failure to meet their demands for discounts or promotional support could lead to reduced shelf space, loss of market access, and ultimately, a direct hit to Want Want's profitability. The ability of these retailers to switch suppliers, though potentially costly, remains a constant pressure point.

The availability of substitute products significantly impacts Want Want China Holdings. In the highly competitive Chinese market, consumers have a vast selection of snack foods, dairy products, and beverages. This abundance of alternatives directly translates to increased bargaining power for customers, as they can easily switch to competitors if Want Want's offerings don't meet their price or preference expectations.

For instance, the snack food sector in China is incredibly fragmented, with numerous domestic and international brands vying for market share. This intense competition, fueled by readily available substitutes, means consumers are less likely to develop strong brand loyalty. In 2023, the Chinese snack market was valued at over $150 billion, highlighting the sheer volume of choices available to the average consumer.

Customer Information and Switching Costs

Customers of Want Want China Holdings are increasingly empowered due to readily available product information and online reviews. This transparency allows them to easily compare pricing and quality across different brands, placing greater pressure on Want Want to remain competitive. For instance, in 2024, online review platforms saw a significant surge in activity, with consumers actively sharing their experiences with food and beverage products, directly impacting brand perception and purchasing decisions.

The low switching costs associated with many of Want Want's product categories significantly bolster customer bargaining power. Consumers can easily try new snack or beverage brands with minimal financial or effort commitment. This ease of transition means that if customers perceive better value or quality elsewhere, they can quickly shift their loyalty. This dynamic is particularly relevant in the highly competitive snack market, where new product introductions are frequent.

- Informed Consumers: By July 2025, it's projected that over 80% of consumers will rely on online reviews and product comparisons before making purchasing decisions in the FMCG sector.

- Low Switching Costs: The snack and beverage industry generally exhibits low switching costs; for example, a single purchase of a competitor's product is a minimal barrier compared to, say, changing a mobile phone provider.

- Price Sensitivity: Want Want's customer base, particularly in its core markets, often demonstrates price sensitivity, making them responsive to competitive pricing strategies from rivals.

Shifting Consumer Preferences and Health Trends

Chinese consumers are increasingly prioritizing health, driving demand for low-sugar, organic, and nutrient-rich snacks and beverages. This shift significantly enhances the bargaining power of customers, as they can now exert pressure on companies like Want Want China Holdings to reformulate existing products and develop new, healthier options. For instance, the market for healthy snacks in China saw substantial growth, with reports indicating a compound annual growth rate (CAGR) of over 10% in the years leading up to 2024, reflecting this strong consumer preference.

- Growing demand for functional foods: Consumers are actively seeking products with added health benefits, such as probiotics or added vitamins.

- Increased willingness to pay a premium: Health-conscious consumers are often willing to spend more on products that align with their wellness goals.

- Influence of social media and influencers: Health trends are amplified through social media, further empowering consumer choices and expectations.

- Regulatory push for healthier food standards: Government initiatives promoting healthier food options indirectly support consumer bargaining power.

The bargaining power of customers for Want Want China Holdings is significant, driven by price sensitivity and the abundance of alternatives in the Chinese food and beverage market. Consumers can easily switch to competitors if pricing isn't perceived as competitive, a trend amplified by readily available product information and online reviews. This dynamic forces Want Want to carefully manage its pricing and product development to meet evolving consumer demands, particularly the growing preference for healthier options.

| Factor | Description | Impact on Want Want | Supporting Data (2023/2024) |

| Price Sensitivity | Customers are highly responsive to price changes in everyday snacks and drinks. | Pressure on pricing strategies, need for value-for-money offerings. | Chinese consumer spending on food and beverages increased steadily, but value remains key. |

| Availability of Substitutes | Numerous domestic and international brands offer similar products. | Ease of switching brands, reduced brand loyalty, increased customer leverage. | The Chinese snack market, valued over $150 billion, is highly fragmented with vast choices. |

| Informed Consumers | Easy access to product information, online reviews, and price comparisons. | Heightened pressure for competitive pricing and product quality. | Projected over 80% of consumers to use online reviews for FMCG purchases by July 2025. |

| Low Switching Costs | Minimal financial or effort commitment to try new brands. | Customers can readily shift loyalty based on perceived value or quality. | Minimal barriers to trying a competitor's snack product compared to other industries. |

| Health Consciousness | Growing demand for low-sugar, organic, and nutrient-rich products. | Need to reformulate products and develop healthier alternatives. | Healthy snack market in China saw a CAGR over 10% leading up to 2024. |

Preview the Actual Deliverable

Want Want China Holdings Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It comprehensively analyzes Want Want China Holdings through Porter's Five Forces, detailing competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. This in-depth examination provides critical insights into the company's strategic positioning and the dynamics of its operating environment, equipping you with actionable intelligence.

Rivalry Among Competitors

The Chinese food and beverage sector is incredibly crowded, with a vast array of companies vying for consumer attention. This fragmentation means Want Want China Holdings faces intense rivalry from all sides.

You'll find major domestic players like Yili Group, a dairy giant, and Mengniu Dairy, both significant forces in their respective segments. Alongside them are global powerhouses such as PepsiCo and Nestle, bringing their international brand recognition and resources to the Chinese market. This creates a multi-layered competitive landscape where even smaller, regional brands can carve out significant market share through localized appeal.

The sheer number of these diverse competitors fuels aggressive strategies across all product categories. Companies constantly introduce new products, engage in price wars, and invest heavily in marketing to stand out. For instance, in 2023, the snack food market alone saw numerous new product launches and promotional campaigns from both domestic and international brands, illustrating the ongoing battle for market dominance.

The Chinese food and beverage market is still expanding, with projections indicating the snacks segment alone could reach US$206.20 billion by 2033. The overall F&B sector is seeing robust annual growth of approximately 7.38%. However, this growth isn't uniform across all categories, as some, like dairy, might face slower expansion or even a dip in domestic output.

This uneven growth dynamic can significantly ramp up competition. When certain product categories mature and their growth slows, existing companies often find themselves fighting harder for a larger slice of a less rapidly expanding pie. This intensifies rivalry as players vie for consumer attention and market share within these more established segments.

Want Want China Holdings heavily invests in brand building, with flagship products like Hot-Kid milk and its iconic rice crackers holding significant market leadership. This strong brand recognition helps foster customer loyalty, a crucial factor in mitigating intense competition.

However, a substantial portion of Want Want's product portfolio, particularly within the snacks and beverages segments, faces the challenge of easy imitation. This necessitates a relentless focus on continuous product innovation to maintain a competitive edge.

The ease of replication means that price-based competition is a constant threat. Want Want's ability to cultivate and maintain strong brand loyalty is therefore paramount in defending its market share against rivals who might compete primarily on price.

For instance, in 2024, the Chinese snack market continued to be highly dynamic, with established players like Want Want facing pressure from both domestic and international brands, underscoring the ongoing need for differentiation and a robust brand connection with consumers.

High Fixed Costs and Capacity Utilization

The food manufacturing sector, including the operations of companies like Want Want China Holdings, is characterized by substantial fixed costs. These costs are associated with establishing and maintaining production facilities, sophisticated machinery, and extensive distribution networks. For instance, building and equipping a modern food processing plant can easily run into tens or even hundreds of millions of dollars.

These high fixed costs create a powerful incentive for companies to operate at or near full capacity. When demand fluctuates or competition intensifies, firms with high fixed costs are often compelled to lower prices to ensure their production lines remain busy. This drive for capacity utilization can lead to aggressive price wars, especially within a crowded and competitive market like China's food and beverage industry.

- High Capital Investment: Setting up food manufacturing plants involves significant upfront investment in land, buildings, and specialized equipment, creating a high barrier to entry and a substantial fixed cost base for existing players.

- Operational Leverage: Once production capacity is established, the marginal cost of producing an additional unit of food is relatively low. This operational leverage means that achieving higher sales volumes significantly boosts profitability, but also necessitates maintaining high output levels.

- Capacity Utilization Imperative: Companies must run their facilities efficiently to spread the high fixed costs over a larger volume of goods. Failure to do so can severely impact profit margins. For example, in 2024, the average capacity utilization rate for many large-scale food manufacturers globally hovered around 75-85%, with deviations impacting profitability.

- Price Competition: To fill excess capacity and cover fixed costs, firms may engage in aggressive pricing strategies, leading to intense rivalry and reduced profitability for all participants.

Exit Barriers for Competitors

For Want Want China Holdings, high exit barriers can trap less profitable competitors in the market. These barriers can include specialized production equipment, such as those for their snack food and beverage lines, which are difficult to repurpose or sell. Long-term supply agreements or distribution contracts also lock companies into operations, even when facing losses. These factors can lead to persistent overcapacity in the snacks and beverages sector, forcing companies to compete aggressively on price to move inventory.

For instance, the capital-intensive nature of food manufacturing, with significant investments in plant and machinery, creates a substantial hurdle for exiting players. Companies may also face reputational damage or employee severance costs that make a clean exit challenging. This situation often results in prolonged price wars as struggling firms fight for market share, directly impacting the profitability of all players, including Want Want China.

- Specialized Assets: Food processing machinery and packaging lines are often highly specific and difficult to redeploy.

- Long-Term Contracts: Commitments with suppliers and distributors can obligate companies to continued operations.

- Social Considerations: Maintaining employment in local communities can be a factor discouraging outright closure.

- Impact on Rivalry: High exit barriers contribute to overcapacity and sustained price competition within the industry.

The competitive rivalry for Want Want China Holdings is incredibly fierce due to a fragmented market with numerous domestic and global players. This intense competition is further fueled by aggressive strategies like new product launches and price wars, especially evident in the dynamic snack food market. Want Want's strong brand loyalty for products like Hot-Kid milk is a key differentiator against rivals focused on price.

SSubstitutes Threaten

Consumers are always weighing the value they get from a product against what other options offer. If substitute snacks and beverages provide similar satisfaction at a lower cost, or even better quality for the same price, Want Want faces a real challenge to its sales. For instance, in 2024, the global snack market saw a rise in value-for-money private label brands, directly competing on price, while premium and health-focused alternatives also gained traction, demonstrating this trade-off.

Consumer propensity to substitute for Want Want China Holdings products is a significant factor. The ease with which consumers can switch, influenced by evolving taste preferences, growing health consciousness, and the demand for convenience, directly shapes this threat. For instance, in 2024, the packaged food market in China saw a rise in demand for healthier snack options, presenting a readily available substitute for Want Want's traditional offerings.

Shifting lifestyles, particularly the ongoing urbanization trend in China, further fuels this threat. As more people move to cities, they increasingly seek convenient, ready-to-eat food solutions. This creates a fertile ground for a wide array of alternatives, from fresh meal kits to other types of convenience snacks, all competing for consumer attention and dollars, with the packaged food sector reaching an estimated value of over $200 billion in China by the end of 2024.

The threat of unrelated substitutes for Want Want China Holdings is significant, particularly as consumer preferences shift towards healthier options. Beyond direct competitors in the snack and beverage aisles, individuals may opt for fresh fruits, vegetables, or homemade meals as alternatives to packaged goods. This trend is amplified by increasing health consciousness, which drives demand for natural, organic, and minimally processed foods.

For instance, the global market for fresh fruit is substantial, with projections indicating continued growth. In 2024, the global fruit market was valued at over $1.3 trillion, demonstrating the significant spending power consumers allocate to these natural alternatives. This broadens the competitive landscape for Want Want, as consumers consider a wider array of food choices that may not be immediately apparent within the traditional snack category.

Technological Advancements in Substitute Products

Technological advancements continuously introduce novel food products that can serve as substitutes for Want Want China Holdings' offerings. Innovations in food technology are creating snacks and beverages with unique benefits, such as improved nutritional profiles or entirely new sensory experiences, which could divert consumer demand. For example, the burgeoning market for plant-based dairy alternatives directly challenges traditional dairy products, a segment that influences consumer preferences across the broader beverage and snack industry. In 2023, the global plant-based food market was valued at approximately $40.2 billion, indicating a significant and growing consumer shift towards alternatives.

These emerging substitutes often leverage new processing techniques or ingredient formulations to provide perceived advantages over established products. Want Want China Holdings must monitor these technological shifts closely. For instance, advancements in fermentation technology could lead to novel beverage options with probiotic benefits, potentially impacting the market share of traditional milk-based drinks and juices. The company's traditional rice crackers and dairy-based snacks face potential disruption from these innovative alternatives that cater to evolving health and wellness trends.

- Innovations in food technology introduce new snack and beverage types with unique benefits like enhanced nutrition or novel textures.

- The rise of plant-based milk alternatives exemplifies how new technologies can impact traditional sectors, affecting consumer choices.

- The global plant-based food market's substantial valuation in 2023 highlights a significant consumer shift towards alternatives.

- Want Want China Holdings' core product categories are susceptible to disruption from innovative substitutes driven by evolving health and wellness trends.

Shifting Consumer Preferences and Health Trends

Shifting consumer preferences, particularly a growing awareness of health and wellness, present a significant threat of substitutes for companies like Want Want China Holdings. Consumers are increasingly scrutinizing ingredients, moving away from high-sugar, artificially flavored, or heavily processed snacks and beverages. This trend directly impacts demand for Want Want's traditional product lines, such as its popular rice crackers and milk drinks, which often fall into these categories.

The demand for healthier alternatives is accelerating this shift. For instance, the global healthy snacks market was valued at approximately $85.6 billion in 2023 and is projected to grow significantly. This growth indicates a strong consumer preference for products perceived as nutritious and natural. Want Want faces direct competition from brands offering low-calorie options, plant-based snacks, and items with clean ingredient labels. These substitutes directly address consumer concerns about sugar content and artificial additives, presenting a clear alternative to Want Want's offerings.

- Growing Demand for Healthy Snacks: The global healthy snacks market is expanding rapidly, indicating a strong consumer pull towards healthier options.

- Consumer Health Concerns: Increased awareness about sugar, artificial ingredients, and processed foods is leading consumers to seek alternatives.

- Availability of Substitutes: A wide range of low-calorie, nutrient-rich, and naturally flavored snacks and beverages are readily available, directly competing with Want Want's portfolio.

- Impact on Traditional Products: This trend poses a threat to Want Want's core product categories, potentially leading to reduced market share if not addressed.

The threat of substitutes for Want Want China Holdings is substantial, driven by evolving consumer preferences towards healthier and more convenient options. As consumers become more health-conscious, they increasingly turn to fresh foods, natural snacks, and plant-based alternatives, diverting demand from Want Want's traditional offerings. For example, the global market for fresh produce continues to grow, with the global fruit market alone valued at over $1.3 trillion in 2024, showcasing a significant alternative for consumers seeking healthier choices.

Technological advancements also introduce new competitive products. Innovations in food processing and ingredients are creating novel snacks and beverages with unique health benefits or sensory experiences. The burgeoning plant-based food sector, valued at approximately $40.2 billion globally in 2023, exemplifies this, directly challenging traditional dairy and snack products. Want Want must adapt to these shifts to mitigate the risk of losing market share to these innovative substitutes.

Entrants Threaten

Establishing a significant presence in China's food and beverage sector, particularly in areas like rice crackers and dairy drinks where Want Want China Holdings is a major player, demands considerable financial resources. We're talking about millions, if not billions, of dollars for advanced manufacturing facilities, sophisticated distribution networks, and extensive marketing campaigns to build brand recognition.

These high initial capital requirements act as a formidable barrier, effectively discouraging many smaller or less-funded companies from even attempting to enter the market. For instance, setting up a modern, high-capacity production line for snacks can easily cost tens of millions of USD, a sum that many aspiring competitors simply cannot raise.

This capital intensity means that only well-capitalized firms or those with strong backing can realistically challenge established giants like Want Want. The sheer scale of investment needed to achieve comparable production efficiency and market reach is a significant deterrent, ensuring that the threat of new, large-scale entrants remains relatively low in the immediate term.

Want Want China Holdings, like many established players in the consumer goods sector, benefits immensely from economies of scale. Their robust sourcing, production, and an expansive distribution network, reportedly involving approximately 10,000 distributors, allow them to achieve cost efficiencies that are difficult for newcomers to replicate.

This scale means Want Want can often negotiate better prices for raw materials and achieve lower per-unit production costs. For instance, in 2023, their revenue reached approximately RMB 21.4 billion, demonstrating the sheer volume of their operations which underpins these scale advantages.

New entrants face a significant hurdle in matching these cost advantages. Without the same purchasing power and established logistical infrastructure, they would likely incur higher per-unit costs, making it challenging to compete on price with established brands like Want Want.

Furthermore, the sheer reach of Want Want's distribution network means their products are readily available across a vast geographical area. A new competitor would need substantial investment to build a comparable distribution system, a task that is both time-consuming and capital-intensive.

Want Want China Holdings benefits immensely from decades of cultivating strong brand loyalty among Chinese consumers. This deep-seated trust makes it difficult for newcomers to capture market share, as consumers often gravitate towards familiar and reliable brands.

The company's established distribution channels are a significant barrier. In 2023, Want Want's extensive network covered over 2.5 million retail outlets across China, a daunting hurdle for any new entrant attempting to secure shelf space and reach consumers effectively.

New competitors must invest heavily in marketing and brand building to even begin to rival Want Want's established presence. The sheer scale of Want Want's reach, particularly in securing prime placement in hypermarkets and convenience stores, presents a substantial challenge to new entrants in the highly competitive Chinese FMCG sector.

Government Regulations and Licensing

The food and beverage sector in China, Want Want China Holdings operates within, is heavily regulated. New entrants face significant hurdles due to stringent health, safety, and import standards. For instance, in 2024, the Chinese government continued to emphasize food safety, with new regulations impacting product labeling and ingredient sourcing, increasing compliance costs for any new player.

These complex regulatory frameworks and the process of obtaining necessary licenses act as a substantial barrier. It requires considerable investment in time and resources to navigate these requirements, effectively raising the cost of entry and delaying market access for potential competitors.

- Stringent Health and Safety Standards: China's food safety laws, updated periodically, demand rigorous adherence to production and handling protocols.

- Import Regulations: For companies relying on imported ingredients or exporting finished goods, navigating customs and import/export licensing adds another layer of complexity and cost.

- Licensing and Permits: Obtaining all required operational licenses, from production permits to distribution licenses, is a time-consuming and often capital-intensive process.

- Evolving Regulatory Landscape: The constant evolution of Chinese regulations means new entrants must invest in ongoing compliance monitoring, a factor that deters less prepared competitors.

Retaliation by Incumbent Firms

Established players, such as Want Want China Holdings, possess significant financial clout and market dominance. They can deploy aggressive strategies like price wars or heightened marketing campaigns to stifle newcomers. For instance, in 2023, Want Want China reported revenues of approximately RMB 22.06 billion, demonstrating its substantial financial capacity to absorb short-term profit dips associated with competitive pricing.

The threat of retaliation by incumbent firms is a considerable barrier to entry. New entrants must anticipate that established companies will leverage their resources to make entry costly and unprofitable. Want Want's extensive distribution network, built over years, also serves as a competitive advantage that new firms would struggle to replicate quickly.

- Aggressive Pricing: Incumbents can lower prices, reducing profitability for new entrants.

- Increased Marketing: Higher advertising spend can drown out new brands.

- Exclusive Deals: Securing exclusive distribution or supplier agreements can lock out new players.

- Capacity Expansion: Incumbents might preemptively increase production capacity to signal their commitment to market share.

The threat of new entrants for Want Want China Holdings is relatively low due to substantial capital requirements for setting up advanced manufacturing and distribution networks. For example, establishing a modern snack production line can cost tens of millions of USD, a significant hurdle for many potential competitors.

Economies of scale achieved by Want Want, supported by their 2023 revenue of approximately RMB 21.4 billion, provide cost advantages that are difficult for newcomers to match. Replicating their extensive distribution network, which covers millions of retail outlets, also demands considerable investment and time.

The strong brand loyalty Want Want has cultivated over decades, coupled with their vast distribution reach in 2023 to over 2.5 million retail outlets, presents a significant challenge for new entrants. Furthermore, navigating China's stringent, evolving food safety regulations in 2024 adds complexity and cost, acting as another deterrent.

Established players like Want Want possess the financial capacity, demonstrated by their 2023 revenue of roughly RMB 22.06 billion, to engage in aggressive strategies such as price wars or increased marketing, which can deter new entrants.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Want Want China Holdings is built upon a foundation of publicly available financial statements, investor relations materials, and reputable market research reports. We also incorporate insights from industry-specific trade publications and news articles to capture current competitive dynamics.