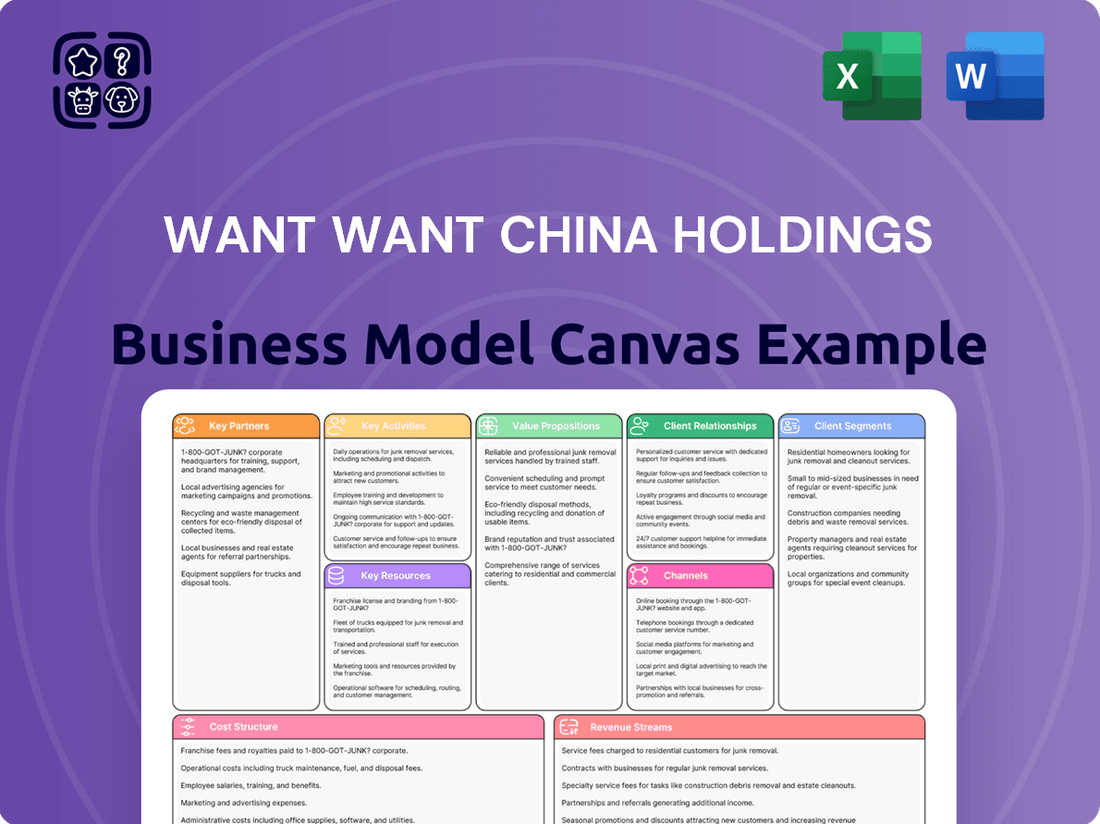

Want Want China Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Want Want China Holdings Bundle

Want Want China Holdings masterfully leverages its extensive distribution network and strong brand recognition to reach diverse customer segments. This Business Model Canvas unveils their strategic approach to product innovation and cost management, crucial for their sustained market dominance. Understand their key resources and activities that fuel their success.

Unlock the full strategic blueprint behind Want Want China Holdings's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Want Want China Holdings relies heavily on its suppliers of raw materials such as rice, milk, sugar, and packaging. These partnerships are absolutely essential for ensuring the consistent quality of their diverse product range, from snacks to dairy beverages. For instance, in 2023, the company's cost of raw materials represented a significant portion of its operating expenses, highlighting the direct impact these supplier relationships have on profitability and product integrity.

Cultivating long-term, stable relationships with these key suppliers is a strategic imperative. It allows Want Want China to better manage procurement costs and proactively mitigate potential disruptions within its supply chain. This stability is crucial for maintaining efficient production schedules and upholding the high product standards that consumers expect.

Logistics and distribution partners are absolutely critical for Want Want China Holdings to navigate China's immense geography and get its products into the hands of consumers everywhere. These collaborations are the backbone of their market expansion strategy. For instance, relying on established local logistics providers in 2024 allows Want Want to tap into their intricate understanding of regional delivery challenges and existing networks, ensuring products reach even remote areas efficiently.

These partnerships directly enable widespread product availability, a key factor in Want Want's success. By working with a robust network of distributors, the company can guarantee that its popular snacks and beverages are consistently stocked in a multitude of retail channels, from bustling city supermarkets to smaller village stores. This broad reach is essential for maintaining market share and capturing demand across diverse consumer segments.

Want Want China Holdings actively collaborates with major e-commerce platforms such as Tmall and JD.com. These alliances are crucial for reaching China's vast and expanding online shopper demographic.

These partnerships facilitate direct-to-consumer (DTC) sales, boosting Want Want’s brand presence and offering direct engagement with customers. In 2023, Tmall and JD.com accounted for a significant portion of China's total e-commerce retail sales, exceeding 70%.

By utilizing these platforms, Want Want gains access to valuable consumer insights, including purchasing habits and preferences. This data is instrumental in refining product development and marketing strategies, allowing for more targeted campaigns and product offerings in the dynamic digital marketplace.

Retail Chains and Modern Trade Partners

Want Want China Holdings cultivates strategic alliances with major retail chains, including supermarket giants like Walmart China and hypermarkets such as Carrefour, alongside extensive convenience store networks. These partnerships are crucial for securing prominent shelf placement and ensuring broad accessibility to their product portfolio across the vast Chinese market. For example, in 2023, modern retail channels accounted for a significant portion of Want Want's sales, demonstrating the power of these collaborations in reaching mass consumers.

These collaborations are foundational for Want Want's strategy to penetrate deeply into both traditional and evolving modern retail environments. By working closely with these partners, the company benefits from their established distribution networks and consumer traffic. This symbiotic relationship allows Want Want to effectively showcase its diverse range of food and beverage products to a wide audience.

- Strategic Alliances: Partnerships with national supermarket chains, hypermarkets, and convenience stores.

- Market Access: Ensures prominent shelf placement and broad consumer reach.

- Sales Drivers: Collaborative marketing initiatives with retail partners boost product visibility and drive sales.

- Channel Penetration: Fundamental for reaching mass market consumers through established retail infrastructure.

Technology and Innovation Partners

Want Want China Holdings actively partners with technology providers to integrate advanced manufacturing processes, aiming for greater efficiency and product consistency. For instance, in 2023, the company invested significantly in upgrading its production lines, incorporating automation technologies from leading global suppliers. These collaborations are crucial for streamlining operations and maintaining a competitive edge in the dynamic food and beverage sector.

The company also leverages partnerships with data analytics firms to gain deeper insights into consumer behavior and market trends. This allows Want Want to refine its product development and marketing strategies, ensuring offerings resonate with its target audience. By utilizing sophisticated analytics, they can better forecast demand and optimize inventory management, a critical factor for a large-scale producer.

Collaborations with research institutions are another cornerstone, fostering product innovation and enhancing quality control. These academic partnerships help Want Want stay ahead of emerging food science advancements and ensure their products meet rigorous safety and quality standards. Such alliances are vital for the company's long-term growth and its commitment to delivering high-quality products.

- Technology Providers: Collaborations with firms specializing in automation and advanced manufacturing for production line upgrades.

- Data Analytics Firms: Partnerships to enhance consumer insights and optimize supply chain management.

- Research Institutions: Engagements to drive new product development and maintain stringent quality standards.

Want Want China Holdings collaborates with a wide array of partners to ensure its expansive product reach and operational efficiency. These include suppliers of essential raw materials like rice and milk, logistics providers for nationwide distribution, and major e-commerce platforms such as Tmall and JD.com for online sales.

Strategic alliances with large retail chains, including Walmart China and Carrefour, are vital for securing prime shelf space and broad market penetration. Furthermore, partnerships with technology and data analytics firms bolster production efficiency and consumer insight generation, while collaborations with research institutions drive product innovation and quality assurance.

These multifaceted partnerships are crucial for Want Want's ability to maintain product quality, manage costs, and effectively reach its diverse consumer base across China, both online and offline.

What is included in the product

This Business Model Canvas for Want Want China Holdings outlines its strategy for serving a broad consumer base with affordable, accessible snack and beverage products through extensive distribution networks and efficient manufacturing.

It details customer segments, channels, and value propositions, reflecting the company's focus on mass-market appeal and operational efficiency in the Chinese food and beverage industry.

Want Want China Holdings' Business Model Canvas acts as a pain point reliever by offering a high-level, digestible overview of their operations, simplifying complex strategies for quick review and team understanding.

This one-page snapshot of Want Want China Holdings' business model effectively addresses the pain point of information overload, providing a clean and concise layout ideal for brainstorming and internal strategy discussions.

Activities

Want Want China Holdings' manufacturing and production activities are centered around the large-scale creation of a wide array of food and beverage items. This includes their well-known rice crackers, alongside dairy products, various snacks, and confectionery. The company operates numerous production lines to cater to this diverse product portfolio.

A critical aspect of these operations involves rigorous quality control measures and strict adherence to food safety standards. For instance, in 2023, the company reported that its manufacturing facilities consistently met international quality certifications, ensuring consumer trust and product integrity across its extensive product range.

The efficiency of these manufacturing processes is paramount. It directly impacts the company's ability to meet market demand, which in 2023 saw significant growth in their snack and dairy segments. Maintaining product consistency across all batches is also a key focus, underpinning the brand's reputation for reliable quality.

Want Want China Holdings actively invests in research and development to stay ahead of consumer tastes and market shifts. This involves continuous innovation in product formulations, exploring new flavors, and enhancing packaging to appeal to modern preferences.

Their R&D efforts are crucial for developing entirely new product lines and refining existing offerings. For example, in 2024, the company continued to focus on healthier snack options and beverages, aligning with growing consumer demand for wellness. This commitment ensures Want Want maintains a competitive edge in the fast-moving food and beverage sector.

Want Want China Holdings focuses on robust brand building and marketing to drive sales and maintain its strong market position. The company actively develops and executes comprehensive marketing campaigns, utilizing a mix of traditional advertising, digital marketing strategies, and engaging promotional activities across various platforms to highlight product benefits and cultivate consumer loyalty.

In 2024, the company continued its investment in brand awareness. For instance, their extensive advertising efforts aim to reinforce their image as a trusted provider of snacks and beverages. This focus is crucial for retaining their loyal customer base and attracting new consumers in a competitive market.

Sales and Distribution Management

Want Want China Holdings' sales and distribution management focuses on an expansive network across China, reaching consumers efficiently. This involves overseeing a large sales force and meticulously managing relationships with numerous distributors and retailers to ensure products are readily available in diverse markets.

The company strategically plans for market penetration, employing robust sales forecasting techniques to anticipate demand and optimize inventory levels. This proactive approach is fundamental to their revenue generation strategy, ensuring consistent sales performance and market share growth.

- Sales Network Oversight: Managing a vast sales force and extensive distribution infrastructure across China’s diverse regions.

- Channel Management: Cultivating strong relationships with key retailers and distributors to maximize product reach.

- Market Penetration Strategy: Implementing targeted plans for entering and expanding in new and existing markets.

- Sales Forecasting and Optimization: Utilizing data to predict sales trends and streamline the distribution process for efficiency.

Supply Chain Optimization

Want Want China Holdings actively manages its entire supply chain, from sourcing raw materials like rice and flour to delivering finished snacks and beverages. The company prioritizes efficiency and cost-effectiveness throughout this process. This involves meticulous inventory management to avoid overstocking or shortages and seamless logistics coordination to ensure timely distribution across its vast network. In 2023, Want Want reported that its cost of goods sold represented approximately 61.5% of its revenue, highlighting the critical importance of supply chain efficiency in maintaining profitability. Effective supplier relationship management is also key to securing stable, high-quality inputs.

Key activities in supply chain optimization include:

- Procurement Excellence: Securing reliable and cost-effective sourcing of essential raw materials.

- Inventory Control: Implementing just-in-time principles and advanced forecasting to minimize holding costs and waste.

- Logistics Network Management: Optimizing transportation routes and warehousing for efficient product movement.

- Supplier Partnerships: Building strong, collaborative relationships with suppliers to ensure quality and consistent supply.

Want Want China Holdings' key activities revolve around creating a diverse range of food and beverage products, including their signature rice crackers, dairy items, and snacks. The company places a strong emphasis on rigorous quality control and food safety, consistently meeting international standards to build consumer trust. In 2023, their manufacturing operations were a cornerstone of their ability to meet increasing market demand, particularly in the growing snack and dairy segments, ensuring product consistency and brand reliability.

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you are previewing is the actual document you will receive upon purchase. This comprehensive overview dissects Want Want China Holdings' core operations, detailing key partners, customer segments, value propositions, and revenue streams. You'll gain insight into their cost structure, key activities, resources, and channels, providing a complete understanding of their strategic framework. This is not a sample; it's the genuine deliverable, ready for your in-depth analysis.

Resources

Want Want China Holdings boasts a formidable collection of well-recognized brands, including household names like Want Want and Hot-Kid. These brands are not just labels; they represent high consumer trust and familiarity across the vast Chinese market.

This strong brand portfolio acts as a crucial intangible asset. It directly influences consumer choice, making it easier for Want Want to introduce new products and expand its reach into different market segments.

The brand equity Want Want has cultivated is a significant differentiator in a competitive landscape. For instance, in 2024, the Want Want brand continues to be a top-of-mind choice for rice crackers and dairy snacks, a testament to its enduring appeal and market penetration.

This established brand recognition translates into a substantial competitive advantage, enabling the company to command premium pricing and maintain customer loyalty, thereby supporting consistent sales and market share.

Want Want China Holdings operates a vast network of manufacturing facilities, boasting numerous modern production plants. These sites are outfitted with advanced technology, enabling the high-volume and high-quality production of a wide array of food and beverage products.

This extensive infrastructure is crucial for meeting significant market demand across China and supports the company's ongoing efforts in product diversification. In 2023, the company reported that its production capacity was a key driver of its performance, allowing it to maintain a strong market presence.

Want Want China Holdings boasts an extensive nationwide sales and distribution network, a cornerstone of its business model. This network comprises sales offices, warehouses, and robust logistics infrastructure, ensuring products reach consumers across all of China's provinces and city tiers.

This vast infrastructure is a critical asset, enabling unparalleled market reach and timely delivery. In 2023, the company's distribution network covered over 2.5 million retail outlets nationwide, highlighting its commitment to product availability.

The sheer scale of this network means Want Want products are readily accessible, whether consumers are in major metropolitan areas or more remote regions. This widespread availability is key to maintaining market share and driving sales volume.

By ensuring products are where consumers are, Want Want solidifies its position as a leading food and beverage provider in the competitive Chinese market, demonstrating the strategic importance of its distribution capabilities.

Skilled Human Capital

Want Want China Holdings heavily relies on its skilled human capital as a core resource. This includes a dedicated workforce encompassing R&D specialists driving product innovation, production engineers ensuring operational efficiency, and sales and marketing professionals expanding market reach. Experienced management teams provide strategic direction and oversight, crucial for navigating the competitive food and beverage landscape.

The expertise and unwavering commitment of its employees are fundamental to Want Want China's ability to foster innovation, achieve operational excellence, and effectively execute its business strategies. This human capital is not merely a cost but a vital engine for sustained growth and competitive advantage.

In 2024, the company’s focus on talent development is evident in its continued investment in employee training and retention programs. These initiatives are designed to cultivate specialized skills and maintain a high level of engagement across all departments, supporting the company's ambitious growth targets.

- Research and Development Talent: Specialists focused on new product development and quality enhancement.

- Production and Operations Expertise: Engineers and technicians ensuring efficient and high-quality manufacturing.

- Sales and Marketing Professionals: Teams driving brand awareness and market penetration.

- Management and Leadership: Experienced individuals guiding strategic decision-making and corporate governance.

Intellectual Property and Proprietary Recipes

Want Want China Holdings leverages its intellectual property, particularly its unique product recipes and manufacturing processes, as a cornerstone of its business model. These proprietary assets are not just trade secrets; they are the very essence that differentiates Want Want's snacks and beverages in a crowded market. This focus on originality and quality, protected by intellectual property rights, fuels consumer loyalty and provides a significant competitive advantage. For example, the distinct taste profiles of their rice crackers and milk drinks are meticulously guarded, ensuring that no competitor can easily replicate their appeal.

The company's strong portfolio of trademarks further reinforces its brand identity and market positioning. These trademarks, such as the iconic Want Want logo, are instantly recognizable and evoke trust and familiarity among consumers. This brand equity, built over years of consistent product quality and effective marketing, is a critical intangible asset. In 2024, Want Want continued to invest in brand building, recognizing that the value of their intellectual property extends beyond recipes to the trust and recognition associated with their brand name.

- Proprietary Recipes: The secret formulations for iconic snacks like Want Want Senbei rice crackers are a key differentiator, contributing to their enduring popularity.

- Manufacturing Processes: Advanced and efficient production techniques ensure consistent quality and cost-effectiveness, providing a competitive edge.

- Trademarks: The strong recognition of the Want Want brand name and logos fosters consumer trust and brand loyalty across its diverse product range.

- Innovation Pipeline: Ongoing investment in research and development to create new flavors and product variations ensures continued market relevance and appeal.

Want Want China Holdings' Key Resources are anchored by its powerful brand portfolio, extensive manufacturing capabilities, a vast distribution network, skilled human capital, and protected intellectual property.

These elements collectively form the bedrock of its competitive advantage in the Chinese food and beverage market.

The company's commitment to leveraging these resources is evident in its consistent market performance and brand recognition.

In 2023, Want Want China reported robust sales driven by its strong brand equity and widespread availability, underscoring the tangible impact of these key resources on its financial outcomes.

| Key Resource | Description | Impact/Fact |

|---|---|---|

| Brand Portfolio | Well-recognized brands like Want Want and Hot-Kid | High consumer trust and familiarity; 2024: Top-of-mind for rice crackers and dairy snacks. |

| Manufacturing Facilities | Numerous modern, technologically advanced production plants | High-volume, high-quality production; 2023: Production capacity a key performance driver. |

| Sales & Distribution Network | Extensive nationwide network of sales offices, warehouses, and logistics | Unparalleled market reach and timely delivery; 2023: Covered over 2.5 million retail outlets. |

| Human Capital | Skilled workforce including R&D, production, sales, marketing, and management | Drives innovation, operational excellence, and strategy execution; 2024: Continued investment in talent development. |

| Intellectual Property | Proprietary recipes, manufacturing processes, and trademarks | Product differentiation, consumer loyalty, and brand equity; protected assets. |

Value Propositions

Want Want China Holdings boasts a diverse and popular product portfolio that forms a core part of its business model. They offer a wide array of beloved food and beverage items, skillfully catering to various tastes and consumption occasions, from everyday snacks to nutritious dairy options.

This extensive range ensures broad appeal, allowing consumers to easily find products that perfectly fit their individual preferences and daily routines. The sheer diversity of their offerings directly addresses multiple consumer needs, making Want Want a go-to brand for many.

For instance, in 2023, the company reported that its snack food segment, a significant portion of its diverse portfolio, continued to be a strong performer, contributing substantially to overall revenue. This demonstrates the market's strong acceptance of their varied product lines.

Want Want China Holdings benefits from a trusted brand with a deep heritage, a cornerstone of its business model. This long-standing reputation for quality and safety, cultivated over decades, has fostered immense confidence and loyalty among Chinese consumers.

The brand's heritage translates into a powerful sense of familiarity and reliability, positioning Want Want as a consistently preferred choice, particularly for families seeking dependable products.

This established trust serves as a significant differentiator in the highly competitive Chinese consumer goods market, allowing Want Want to command consumer attention and preference.

In 2024, Want Want China Holdings reported revenue of approximately RMB 21.4 billion, underscoring the market's continued embrace of its trusted offerings.

Want Want China Holdings boasts widespread availability, a cornerstone of its business model. Their products are readily accessible, reaching consumers through an expansive distribution network that blankets both bustling urban centers and more remote rural areas. This extensive reach ensures that whether you're in a large supermarket or a small neighborhood store, Want Want snacks and beverages are likely on the shelves.

This convenience directly translates to enhanced customer satisfaction and robust sales figures. In 2024, Want Want's commitment to accessibility remained a key driver of its market presence, allowing it to capture a significant share of the Chinese snack market. The company's strategy of maintaining high product availability across diverse retail formats, from traditional mom-and-pop shops to modern hypermarkets, solidifies its position as a go-to brand for everyday consumers.

Consistently High Quality and Taste

Want Want China Holdings places immense value on delivering consistently high-quality products with delicious and familiar tastes. This commitment is backed by stringent quality control measures implemented throughout their production processes.

This unwavering focus on quality directly translates into high consumer satisfaction, fostering strong brand loyalty among their customer base. The predictable and enjoyable taste profiles are key drivers for repeat purchases, as consumers know what to expect and appreciate the reliability.

By prioritizing these aspects, Want Want ensures that each product meets consumer expectations, reinforcing their market position. For instance, in 2023, Want Want's snack food segment reported robust performance, reflecting the impact of their quality and taste strategies.

- Rigorous quality control across all production stages.

- Development of appealing and consistent taste profiles.

- Enhanced consumer satisfaction and brand loyalty.

- Encouragement of repeat purchases through familiar flavors.

Affordable and Value for Money

Want Want China Holdings focuses on delivering products at competitive price points, ensuring consumers receive excellent value for their money. This strategy makes their diverse range of snacks and beverages accessible to a vast, mass-market consumer base, particularly appealing to those who are budget-conscious. The company's commitment to affordability doesn't mean a compromise on the quality or taste of their offerings, which is a key driver for repeat purchases.

This approach to value pricing significantly strengthens Want Want's market position, allowing them to capture a substantial market share. For instance, in 2024, the company continued to leverage its efficient production and distribution networks to maintain cost advantages. This allows them to pass savings onto consumers, a crucial factor in China's highly competitive snack food market.

- Competitive Pricing: Products are priced to offer superior value compared to competitors.

- Mass Market Accessibility: Ensures a broad consumer base can afford and enjoy their products.

- Quality Maintained: Affordability does not come at the expense of taste or product integrity.

- Market Share Growth: Value proposition directly contributes to increased sales volume and market penetration.

Want Want China Holdings' value proposition centers on providing a wide array of popular, high-quality snacks and beverages that are consistently delicious and familiar. This extensive product portfolio caters to diverse consumer preferences and occasions, fostering strong brand loyalty through trusted heritage and reliable taste profiles.

Their commitment to widespread availability ensures convenience for consumers across urban and rural areas, making their products easily accessible. Furthermore, Want Want maintains competitive pricing, delivering excellent value and ensuring broad market appeal, particularly for budget-conscious consumers.

| Value Proposition Aspect | Description | 2023/2024 Relevance |

|---|---|---|

| Product Diversity & Quality | Extensive range of popular, high-quality food and beverages with consistent, appealing tastes. | Snack food segment continued strong performance in 2023, reflecting market acceptance of diverse lines. |

| Brand Heritage & Trust | Deeply established reputation for quality and safety, fostering consumer confidence and loyalty. | Revenue of approximately RMB 21.4 billion in 2024 underscores continued market embrace of trusted offerings. |

| Widespread Availability | Extensive distribution network ensuring products are accessible in both urban and rural markets. | High product availability remains a key driver of market presence and market share in 2024. |

| Competitive Pricing & Value | Affordable price points that offer excellent value without compromising on quality or taste. | Continued leverage of efficient networks in 2024 to maintain cost advantages and pass savings to consumers. |

Customer Relationships

Want Want China Holdings actively cultivates brand community through vibrant social media engagement. They frequently run interactive online campaigns and share engaging content across platforms, fostering a sense of belonging among consumers. This direct interaction allows for immediate consumer feedback, crucial for adapting to market preferences.

This strategy directly contributes to building a loyal customer base, as evidenced by the strong consumer connection many of their products enjoy. By creating a space for consumers to interact with the brand and each other, Want Want strengthens the emotional bond, moving beyond mere product purchase to brand advocacy.

Want Want China Holdings prioritizes responsive customer service through accessible channels for inquiries and feedback, ensuring a positive post-purchase experience. This focus on prompt and helpful support enhances customer satisfaction and builds trust in the Want Want brand.

In 2024, the company continued to invest in digital platforms and trained its customer service teams to address concerns effectively. This commitment is crucial for fostering long-term customer relationships and loyalty, directly impacting repeat purchases and brand advocacy.

Want Want China Holdings actively cultivates customer loyalty through well-structured programs that reward repeat purchases. These initiatives, often featuring points systems or tiered benefits, encourage sustained engagement and build strong brand preference. For instance, in 2024, the company continued to refine its digital loyalty platforms, aiming to enhance the personalized experience for its vast consumer base.

Targeted promotions and special offers are key components in driving repeat business for Want Want China. By strategically deploying discounts and bundled deals, the company incentivizes immediate purchases while also nurturing long-term customer relationships. These efforts are crucial in a competitive market where consumer choices are frequently influenced by value and exclusivity.

These customer relationship strategies foster a palpable sense of appreciation among consumers, translating into higher retention rates. In 2024, Want Want China observed a positive correlation between the adoption of its enhanced loyalty programs and increased purchase frequency, underscoring the effectiveness of these customer-centric approaches in solidifying market position.

Retailer and Distributor Support

Want Want China Holdings cultivates robust relationships with its extensive network of retailers and distributors by offering dedicated support and comprehensive training programs. These initiatives are designed to ensure that products are optimally displayed and promoted at the point of sale, directly enhancing sales performance and benefiting the end consumer.

Collaborative marketing efforts are a cornerstone of this strategy. By partnering with channel partners on promotional activities, Want Want China Holdings reinforces brand visibility and drives consumer demand. This B2B focus is critical for achieving deep market penetration and maintaining a competitive edge in the fast-moving consumer goods sector.

- Dedicated Support: Providing resources and assistance to retailers and distributors to facilitate smooth operations.

- Training Programs: Educating channel partners on product knowledge, merchandising techniques, and sales strategies.

- Collaborative Marketing: Jointly developing and executing marketing campaigns to boost brand awareness and sales.

- B2B Relationship Vitality: Recognizing that strong partnerships with business customers are essential for market reach and sales volume.

Consumer Insights and Feedback Integration

Want Want China Holdings actively gathers and analyzes consumer data and feedback to refine its product development and marketing. For instance, by monitoring sales trends and social media sentiment in 2024, the company identified a growing demand for healthier snack options. This insight directly informed the development of new low-sugar and whole-grain product lines.

Understanding consumer preferences is crucial for Want Want China to adapt its extensive product portfolio and maintain market relevance. The company leverages this data-driven approach to ensure its offerings resonate with evolving tastes and dietary concerns, thereby strengthening customer alignment and loyalty.

- Data Collection: Utilizes online surveys, in-store feedback mechanisms, and social media monitoring to gather consumer insights.

- Product Development: Integrates feedback directly into R&D for new flavors and healthier alternatives, as seen with the 2024 launch of reduced-sugar biscuits.

- Marketing Strategy: Tailors promotional campaigns based on consumer segmentation derived from purchasing habits and demographic data.

- Service Improvement: Employs customer service interactions and online reviews to identify areas for enhancement in distribution and product availability.

Want Want China Holdings fosters strong customer relationships through a multi-faceted approach, blending digital engagement, loyalty programs, and responsive service. The company actively uses consumer data to tailor offerings, as demonstrated by the 2024 focus on healthier snack options informed by market trends. This customer-centric strategy aims to build lasting loyalty and drive repeat purchases.

| Customer Relationship Aspect | Description | 2024 Focus/Data Point |

|---|---|---|

| Brand Community & Social Media | Engaging consumers through interactive campaigns and content. | Continued investment in digital platforms for enhanced consumer interaction. |

| Loyalty Programs | Rewarding repeat purchases and fostering sustained engagement. | Refinement of digital loyalty platforms for a more personalized experience. |

| Customer Service | Providing accessible and responsive support for post-purchase satisfaction. | Training customer service teams for effective issue resolution. |

| Data-Driven Insights | Utilizing consumer feedback for product development and marketing. | Identified demand for healthier snacks, influencing new product lines. |

Channels

Traditional retail outlets form the backbone of Want Want China Holdings' consumer reach, leveraging an extensive network of small grocery stores, kiosks, and local supermarkets. This strategy is particularly effective in penetrating rural areas and lower-tier cities where these outlets are the primary sources of consumer goods.

The company’s success in these channels is heavily reliant on well-established local distribution networks and cultivated personal relationships with store owners. This approach ensures deep market penetration and consistent product availability across diverse geographical regions.

In 2023, Want Want China Holdings reported that its sales channels, including these traditional retail outlets, contributed significantly to its revenue. While specific figures for this channel alone are not always segmented publicly, the overall distribution strength is a key driver of their market presence.

Want Want China Holdings secures prominent placement in major modern trade channels like Walmart and Carrefour, as well as significant local supermarket and hypermarket chains across China. These outlets are critical purchasing hubs for a vast number of urban consumers, offering high visibility and driving substantial sales volumes due to their organized retail environments and extensive customer reach. For instance, in 2024, hypermarkets and supermarkets continued to represent a dominant share of China's fast-moving consumer goods (FMCG) retail landscape, with sales figures consistently showing robust growth in these organized channels.

Strategic partnerships with these large retail chains are paramount for Want Want. These collaborations ensure optimal shelf space and promotional support, directly influencing consumer purchasing decisions. In 2024, data indicated that brands with strong relationships and effective in-store marketing within these modern trade formats experienced significantly higher market penetration and sales compared to those with weaker ties.

The high traffic and structured shopping experience of supermarkets and hypermarkets allow Want Want to effectively showcase its diverse product portfolio, from snacks to beverages. This channel strategy capitalizes on the consumer preference for convenience and variety found in these large-format stores, reinforcing brand presence and accessibility in key urban markets throughout 2024.

Want Want China Holdings effectively utilizes major e-commerce platforms like Tmall, JD.com, and Pinduoduo to connect with China's digitally native consumers. These online marketplaces provide unparalleled access to a vast customer base, extending their market reach far beyond traditional brick-and-mortar locations.

This digital strategy is crucial for capturing the convenience-seeking shopper who values a wide array of product choices readily available at their fingertips. By offering their diverse snack and beverage portfolio online, Want Want caters directly to evolving consumer purchasing behaviors.

The growth in digital sales is a significant contributor to Want Want's overall revenue. In 2024, the e-commerce sector continued its upward trajectory, with online retail sales in China projected to exceed trillions of yuan, a trend that directly benefits platforms where Want Want maintains a strong presence.

Convenience Stores

Want Want China Holdings effectively leverages convenience stores as a key distribution channel. These outlets, like FamilyMart and 7-Eleven, are vital for capturing impulse purchases and catering to consumers needing on-the-go snacks and beverages. Their widespread presence ensures high accessibility, meeting immediate consumer demands.

The ubiquity of convenience stores makes them indispensable for Want Want China's snack and beverage sales strategy. In 2024, convenience stores accounted for a significant portion of retail sales in China, with their total retail sales volume reaching an estimated 5.7 trillion yuan. This highlights the immense reach and importance of these channels for fast-moving consumer goods.

- Extensive Reach: Convenience stores offer unparalleled accessibility, allowing Want Want China's products to be readily available to a vast consumer base.

- Impulse Purchases: Strategic placement within these stores encourages unplanned buying, boosting sales of popular snack and beverage items.

- On-the-Go Consumption: These locations perfectly align with consumer lifestyles demanding quick and convenient food and drink options.

- Market Penetration: Partnering with major convenience store chains facilitates deep market penetration across urban and suburban areas in China.

Wholesale and Institutional Sales

Want Want China Holdings leverages wholesale and institutional sales channels to distribute its diverse product range. This involves supplying products in bulk to independent wholesalers, who then manage onward distribution to a vast network of smaller, independent retailers across China.

This wholesale model is crucial for achieving broad market penetration and ensuring widespread availability of Want Want products. It allows for significant volume sales, contributing substantially to the company's revenue streams.

Furthermore, these channels extend to direct sales to institutions such as schools, universities, hotels, and corporate cafeterias. This institutional segment provides a stable demand base and further solidifies the company's market presence.

For instance, in 2024, Want Want China Holdings reported that its wholesale and distribution network was a key driver for its snack food segment, which saw consistent demand. The company actively manages relationships with thousands of distributors to maintain efficient supply chains.

- Bulk Supply: Products are sold in large quantities to intermediaries.

- Retailer Reach: Wholesalers distribute to numerous small, independent shops.

- Institutional Sales: Direct supply to schools, hotels, and corporate canteens.

- Market Footprint: Expands product availability and brand visibility across diverse locations.

Want Want China Holdings also reaches consumers through specialized channels like vending machines and smaller, independent kiosks. These micro-channels are crucial for capturing immediate, localized demand and offering convenience in high-traffic areas such as transit hubs and office buildings.

This strategy complements their broader distribution by ensuring product availability in niche locations where larger retail formats might not be present. In 2024, the deployment of smart vending machines saw increased investment, reflecting their growing importance in the convenience sector.

The agility of these smaller channels allows Want Want to test new products or promotions with specific demographics, gaining valuable consumer insights. This approach contributes to their overall market responsiveness and brand visibility in diverse urban settings.

| Channel Type | Key Characteristics | 2024 Relevance | Impact on Want Want |

| Traditional Retail | Small grocers, kiosks, local supermarkets | Deep penetration in lower-tier cities | Ensures broad availability and local market strength |

| Modern Trade | Hypermarkets, supermarkets (Walmart, Carrefour) | High urban consumer traffic, organized retail | Drives significant sales volume and brand visibility |

| E-commerce | Tmall, JD.com, Pinduoduo | Rapidly growing digital sales in China | Captures convenience-seeking shoppers, extends reach |

| Convenience Stores | FamilyMart, 7-Eleven | High accessibility, impulse purchases | Catches on-the-go consumption, significant retail sales volume |

| Wholesale & Institutional | Independent wholesalers, schools, hotels | Bulk supply, stable demand | Achieves broad market penetration and volume sales |

| Vending Machines & Kiosks | Niche locations, immediate demand | Growing importance in convenience sector | Captures localized demand and offers product testing opportunities |

Customer Segments

Mass market consumers in China represent the core customer base for Want Want China Holdings. This segment is vast, spanning all ages and income brackets, and they primarily look for food and beverage products that are both affordable and readily recognizable.

Convenience, appealing taste, and the trust associated with a reliable brand are key purchasing drivers for this broad demographic. Want Want's extensive and diverse product portfolio is specifically designed to meet these varied demands across the nation.

In 2024, the Chinese food and beverage market continued its robust growth, with the mass market segment being a significant contributor, driven by increasing disposable incomes and evolving consumer preferences for convenient, ready-to-eat, and snackable items.

Families with children represent a crucial customer segment for Want Want China Holdings, particularly for their dairy, snack, and confectionery offerings. Parents in this group are actively seeking products that are not only safe and nutritious but also appealing to their kids' tastes. For instance, Want Want's milk beverages and rice crackers are directly marketed to capture this demand.

Brand trust is paramount for parents making purchasing decisions for their children. Want Want's long-standing presence and reputation contribute significantly to this trust. The perceived health benefits of their products, such as fortified milk drinks, also play a vital role in attracting and retaining these family-oriented consumers.

Young adults and teenagers are a key customer segment for Want Want China Holdings, drawn to their trendy, flavorful, and convenient snack and beverage offerings. This demographic is heavily influenced by social media trends and peer recommendations, actively seeking out novel product experiences. Want Want taps into this by consistently introducing innovative products and employing modern branding strategies, aiming to capture a significant share of their spending. For instance, in 2024, the snack and beverage market in China, which heavily features these categories, saw continued robust growth, with young consumers being a primary driver of this expansion.

Rural and Lower-Tier City Consumers

Rural and lower-tier city consumers represent a significant customer segment for Want Want China Holdings, drawn to the brand's affordability and widespread availability. Their purchasing decisions are heavily influenced by familiar brands and the ease of finding products in local neighborhood stores, a testament to Want Want's extensive distribution network. This demographic is experiencing a notable increase in disposable income, making it an increasingly attractive and growing market. In 2023, for instance, rural consumption in China saw robust growth, with retail sales in rural areas often outpacing urban centers in percentage terms, highlighting the economic potential of these regions. Want Want's established presence in these areas provides a distinct competitive edge.

This segment values products that offer good value for money, and Want Want's staple offerings like rice crackers and dairy drinks fit this need perfectly. The brand's familiarity acts as a trust signal, simplifying purchasing choices for consumers in less saturated retail environments. Want Want's ability to ensure consistent stock availability across these geographically dispersed areas is crucial to maintaining customer loyalty and market share. By prioritizing these consumers, Want Want taps into a large, often underserved, market that is ripe for continued expansion.

- Affordability and Value: Consumers in these areas prioritize cost-effective products, making Want Want's accessible price points highly appealing.

- Brand Familiarity: Long-standing brand recognition fosters trust and simplifies purchasing decisions for these consumers.

- Distribution Reach: Want Want's deep network ensures product availability in remote and smaller urban areas, a key competitive advantage.

- Growing Disposable Income: This segment's increasing purchasing power presents a significant opportunity for sales growth.

Snack and Beverage Enthusiasts

Snack and Beverage Enthusiasts represent a core customer base for Want Want China Holdings. This group actively seeks out enjoyable and convenient snack and drink options to incorporate into their daily lives. They value a wide selection of flavors and product types, from savory crisps to sweet confections and thirst-quenching beverages, often prioritizing taste and specific product characteristics.

This segment is particularly receptive to Want Want's diverse product offerings. For instance, in 2023, Want Want reported strong sales in its snack segment, which directly appeals to these consumers. Their openness to innovation means they are likely to be early adopters of new product introductions within Want Want's extensive portfolio.

- Daily Consumption: Individuals who regularly incorporate snacks and beverages into their routines.

- Variety Seekers: Customers looking for a broad range of flavors and product types.

- Attribute-Driven Purchases: Consumers who choose products based on specific qualities like taste, texture, or ingredients.

- Product Trial: This segment readily tries new items from Want Want's expanding product lines.

Want Want China Holdings primarily serves the mass market in China, with a strong focus on families with children and young adults. Their offerings are also popular with rural consumers and those in lower-tier cities who value affordability and brand familiarity. Additionally, a segment of dedicated snack and beverage enthusiasts actively seeks out Want Want's diverse and flavorful products.

| Customer Segment | Key Characteristics | 2024 Market Relevance |

|---|---|---|

| Mass Market Consumers | Broad demographic, seeking affordable, recognizable food and beverages. | Continued growth in Chinese F&B market, driven by convenience and evolving preferences. |

| Families with Children | Prioritize safe, nutritious, and kid-appealing dairy, snacks, and confectionery. | Parents actively seek trusted brands for their children's consumption. |

| Young Adults & Teenagers | Attracted to trendy, flavorful, and convenient snacks and beverages. | Significant drivers of growth in snack and beverage categories, influenced by social media. |

| Rural & Lower-Tier City Consumers | Value affordability, availability, and brand familiarity. | Increasing disposable income in these areas presents significant growth opportunities. |

| Snack & Beverage Enthusiasts | Seek enjoyable, convenient options with a wide variety of flavors and types. | Highly receptive to new product introductions and Want Want's diverse portfolio. |

Cost Structure

Want Want China Holdings' cost structure heavily relies on raw material procurement, representing a significant portion of its expenditures. Major costs stem from essential ingredients like rice, milk powder, sugar, and various food additives, crucial for their diverse snack and beverage portfolio. Packaging materials also contribute substantially to this category.

The company is directly exposed to the volatility of commodity prices, meaning fluctuations in the cost of these key inputs can significantly impact profitability. For instance, a rise in global rice prices, a staple for many of their products, would directly increase their cost of goods sold.

In 2024, continued global supply chain pressures and inflationary trends likely maintained upward pressure on these raw material costs. For example, reports indicated that the average price of milk powder experienced a notable increase in the first half of 2024 compared to the previous year, directly affecting dairy-based products.

Consequently, Want Want China Holdings must employ efficient procurement strategies to manage these costs effectively. This involves building strong supplier relationships, potentially engaging in forward contracts for key commodities, and optimizing inventory management to mitigate the impact of price swings.

Want Want China Holdings' manufacturing and production expenses are substantial, encompassing labor wages for its factory workforce, essential utilities like electricity and water, and the ongoing costs of machinery maintenance and equipment depreciation. In 2023, the company reported significant expenditures in these areas as it continued its extensive production operations across numerous facilities. For instance, optimizing production lines and investing in more energy-efficient machinery are key strategies to manage these considerable operational outlays.

Want Want China Holdings incurs significant expenses in its distribution and logistics. These costs encompass warehousing, managing its own transportation fleet, fuel, and the intricate operation of its extensive supply chain network throughout China. These operational necessities are fundamental to ensuring products reach consumers promptly, but they represent a substantial financial outlay. In 2024, the company's continued focus on expanding its market reach directly correlates with increased expenditure in these areas, underscoring the direct link between logistical efficiency and market penetration.

Marketing and Sales Expenses

Want Want China Holdings dedicates substantial resources to marketing and sales, a key component of its cost structure. This includes significant investment in advertising campaigns, promotional activities, and ongoing brand-building initiatives to maintain strong consumer recognition.

These expenditures are directly tied to driving sales volume and securing market share in the competitive food and beverage industry. The company's sales force also represents a considerable cost, encompassing salaries and commission structures designed to incentivize performance.

- Advertising and Promotions: Want Want China Holdings invests heavily in diverse advertising channels, including television, digital media, and point-of-sale promotions, to reach a broad consumer base.

- Sales Force Costs: The operational costs associated with maintaining a robust sales team, including salaries, benefits, and performance-based commissions, are a significant outlay.

- Brand Building: Expenditures on activities aimed at enhancing brand equity and customer loyalty are crucial for long-term market positioning and sales growth.

Research and Development Costs

Research and Development (R&D) costs are a critical investment for Want Want China Holdings, fueling its drive for innovation in the competitive food and beverage market. These expenditures are vital for developing new products, enhancing existing ones through flavor innovation, and improving packaging design to attract consumers. Furthermore, significant investment in food science research ensures product quality and safety, maintaining the company's reputation.

In 2024, Want Want China Holdings continued to prioritize R&D to stay ahead of evolving consumer tastes and market trends. This commitment is fundamental for long-term growth, enabling the company to adapt its offerings and create future revenue streams. The company's strategic allocation to R&D underscores its dedication to maintaining a competitive edge and meeting the dynamic demands of its customer base.

- Investment in Innovation: Want Want China Holdings allocates substantial resources to R&D, focusing on new product development and flavor exploration.

- Consumer-Centric Design: Packaging design is a key R&D focus, aiming to enhance consumer appeal and shelf presence.

- Food Science Expertise: The company invests in food science research to ensure product quality, safety, and innovation.

- Long-Term Growth Driver: R&D costs are viewed as essential investments that secure future revenue streams and market relevance.

Want Want China Holdings' cost structure is dominated by raw materials, manufacturing, distribution, and marketing. Fluctuations in commodity prices, such as rice and milk powder, directly impact profitability, with 2024 seeing continued inflationary pressures. The company's investment in R&D and sales force are also significant components, driving innovation and market penetration.

| Cost Category | Key Components | 2024 Trend/Consideration |

|---|---|---|

| Raw Materials | Rice, milk powder, sugar, additives | Upward pressure from inflation and supply chain issues |

| Manufacturing & Production | Labor, utilities, machinery maintenance | Ongoing operational outlays, focus on efficiency |

| Distribution & Logistics | Warehousing, transportation, fuel | Increased expenditure with market expansion focus |

| Marketing & Sales | Advertising, promotions, sales force | Crucial for sales volume and market share |

| Research & Development | New product development, flavor innovation | Investment for competitive edge and future revenue |

Revenue Streams

The sale of rice crackers is a primary revenue generator for Want Want China Holdings. This segment thrives on the company's established brand recognition and the enduring popularity of its diverse range of rice cracker products and flavors, which have been a staple for consumers for a long time. For instance, in the first half of 2024, Want Want China reported that its snacks segment, which heavily features rice crackers, continued to be a significant contributor to its overall sales performance, reflecting consistent consumer demand.

Want Want China Holdings generates substantial revenue from its sales of dairy products and beverages. This segment includes popular items like milk drinks, flavored milk, and other dairy-based beverages, which have a broad appeal, particularly to children and families. The company has experienced consistent growth in this area, driven by rising health consciousness and increased consumer demand for these products, making it a significant contributor to their overall financial performance.

Want Want China Holdings generates substantial income from a wide array of snack items. Beyond their signature rice crackers, this includes popular puffed snacks, crispy potato chips, and a variety of other savory and sweet confectioneries. This broad product portfolio diversifies revenue streams and caters to different snacking preferences and occasions throughout the day.

In 2024, the company continued to focus on innovation within its snack food segment. For instance, new product launches and flavor extensions are key drivers for capturing evolving consumer tastes and maintaining market share. This commitment to novelty is crucial for sustained revenue growth in the competitive snack industry.

Sales of Confectionery

Want Want China Holdings generates revenue through the sale of a variety of confectionery items, including candies and jellies. This category often capitalizes on impulse buying behavior and is frequently associated with festive periods and gift-giving occasions, adding to the company's diverse product portfolio.

The confectionery segment, while potentially smaller in scale compared to core product lines like rice crackers, plays a crucial role in broadening Want Want's market appeal and contributing to overall sales volume. For instance, in 2023, the company's snacks segment, which includes confectionery, contributed a significant portion to its total revenue, demonstrating the ongoing importance of these product categories.

- Candy Sales: Direct revenue from the sale of various hard and soft candies.

- Jelly Products: Income derived from the sale of fruit jellies and other gelatin-based sweets.

- Impulse Purchases: This stream benefits from strategic placement and promotions to encourage unplanned buying.

- Seasonal & Celebratory Sales: Revenue boosts tied to holidays and special events where confectionery is a popular choice.

Other Product Sales and Export

Want Want China Holdings generates revenue from sales of less prominent product categories, contributing to a diversified income stream. In 2024, the company continued to leverage its brand recognition across a wider array of food and beverage items beyond its core offerings.

Export sales represent another significant revenue stream, allowing Want Want China to expand its geographical footprint. The company actively targets international markets, including those with substantial Chinese diaspora communities, capitalizing on existing brand loyalty and familiarity. This strategy diversifies income sources and unlocks new growth potential beyond its domestic market.

- Diversified Product Portfolio: Revenue is bolstered by sales from secondary product lines, complementing core offerings and broadening market appeal.

- International Market Expansion: Export sales to various global regions, particularly those with significant Chinese populations, contribute to revenue growth and geographical diversification.

- Targeted Niche Markets: Specialized products and sales to Chinese diaspora communities abroad represent a strategic avenue for capturing additional revenue.

- Growth Potential: Exploring and penetrating new international markets offers substantial opportunities for increased sales and overall company expansion.

Want Want China Holdings generates revenue through a comprehensive product portfolio. Their core snack segment, including rice crackers, remains a dominant force, with the company consistently reporting strong performance in this area throughout 2024. Additionally, dairy products and beverages, catering to a broad consumer base, contribute significantly to their income. The company also leverages confectionery sales and a growing international export market to diversify its revenue streams.

| Revenue Segment | Key Products | 2023 Performance Indicator |

|---|---|---|

| Snacks | Rice Crackers, Puffed Snacks, Potato Chips | Significant contributor to overall sales. |

| Dairy & Beverages | Milk Drinks, Flavored Milk | Consistent growth driven by demand. |

| Confectionery | Candies, Jellies | Broadens market appeal and drives impulse purchases. |

| Exports | Various product lines | Expands geographical footprint and diversifies income. |

Business Model Canvas Data Sources

Want Want China Holdings' Business Model Canvas is informed by a combination of internal financial reports, publicly available company filings, and extensive market research on the Chinese consumer goods sector. This data allows for a comprehensive understanding of their operations, customer base, and competitive landscape.