Voith Turbo GmbH & Co. KG Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Voith Turbo GmbH & Co. KG Bundle

Voith Turbo GmbH & Co. KG operates in a complex industrial landscape, facing significant competitive pressures. The bargaining power of both buyers and suppliers can heavily influence pricing and profitability, particularly for specialized components. Intense rivalry among established players and the potential threat of new entrants seeking to disrupt the market demand constant innovation and efficiency.

Furthermore, the availability of substitute products, though perhaps less direct in this sector, still presents a strategic consideration for long-term market share. Understanding the interplay of these forces is crucial for navigating Voith Turbo's competitive environment effectively.

The complete report reveals the real forces shaping Voith Turbo GmbH & Co. KG’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Voith Turbo relies on a specialized and limited supplier base for critical components, including high-grade steel, advanced alloys, and precision electronics essential for its drive systems. The stringent quality and technical specifications required mean only a select few global suppliers can meet these demands, giving them significant bargaining power. For instance, global prices for specialized industrial steel alloys saw an increase of approximately 3-5% in early 2024, directly impacting procurement costs for manufacturers like Voith Turbo. This concentrated supplier market can lead to higher input costs and potential production vulnerabilities if key suppliers face disruptions.

Switching suppliers presents significant costs for Voith Turbo, encompassing vetting new partners and integrating them into its complex supply chain. This process is time-consuming, reflecting the specialized components often required for Voith's industrial solutions. Suppliers, having invested in tailored equipment to meet Voith's precise specifications, also face substantial losses if the relationship ends. This mutual dependency, typical in high-tech manufacturing, means Voith relies on a stable, specialized supplier base, limiting its immediate flexibility. For instance, in 2024, the global supply chain for precision engineering components remains highly specialized, reinforcing these inherent switching barriers.

The performance and reliability of Voith Turbo's drive systems fundamentally depend on the quality of raw materials and components used. Inferior inputs could lead to product failures, significantly damaging Voith's reputation and increasing warranty costs. For instance, defective components in their 2024 rail drive systems could impact operational efficiency and safety. This critical reliance on high-quality inputs undeniably strengthens the position of suppliers who consistently meet these stringent standards, potentially influencing procurement costs.

Potential for Forward Integration by Suppliers is Low

The likelihood of Voith Turbo's suppliers forward integrating to produce their own complex drive systems is notably low. This industry demands substantial capital investment, deep technical expertise in areas like power transmission and control, and extensive global sales and service networks, which are significant barriers to entry. Most of Voith's component suppliers, who often operate with gross margins around 15-20% in their specialized segments, are primarily focused on their core manufacturing capabilities. They typically lack the multi-billion Euro investment capacity and the decades of market presence required to directly compete with established players like Voith in the complete drive system market.

- Capital investment for a new drive system production facility can exceed €100 million.

- Developing comprehensive technical expertise in drive technology typically requires years of R&D.

- Establishing global sales and service networks for industrial applications costs tens of millions annually.

- Voith Turbo's 2024 revenue for its Mobility and Industry divisions highlights the scale needed to compete.

Long-Term Relationships and Partnerships

Voith fosters long-term, collaborative relationships with its key suppliers, emphasizing mutual trust and a shared commitment to quality and innovation. This partnership model enhances supply chain stability and integrates product development, as seen with their 2024 projects in electric drive systems. However, this deep integration can strengthen the bargaining power of these established suppliers, particularly those providing specialized components. For example, suppliers contributing to critical components for Voith's hydrogen and e-mobility solutions benefit from their embedded role.

- Voith's 2024 annual report highlighted strategic partnerships as crucial for innovation.

- Long-term supplier contracts often include joint development agreements.

- Suppliers of critical propulsion system components hold significant leverage.

- Voith's supply chain resiliency initiatives for 2024 focused on these core relationships.

Voith Turbo’s suppliers wield significant bargaining power due to their specialized and limited nature, providing critical high-grade components like precision electronics and advanced alloys. Switching costs for Voith are high, given the complex integration required for new partners. The critical dependency on supplier quality for product performance further strengthens their leverage, even as the threat of suppliers forward integrating into drive systems remains low.

| Factor | Impact on Voith | 2024 Data Point |

|---|---|---|

| Supplier Specialization | Limited alternatives | Steel alloy prices up 3-5% |

| Switching Costs | High integration effort | Global precision component supply specialized |

| Quality Dependency | Product reliability risk | Defective rail components impact efficiency |

What is included in the product

This analysis reveals how Voith Turbo GmbH & Co. KG navigates intense rivalry, substantial buyer power, and the threat of substitutes in the global powertrain market.

Effortlessly assess competitive pressures from suppliers, buyers, new entrants, substitutes, and existing rivals with a dynamic, easily customizable analysis.

Gain immediate strategic clarity on Voith Turbo's market position to proactively mitigate threats and capitalize on opportunities.

Customers Bargaining Power

Voith Turbo operates in niche heavy industries like energy, oil and gas, and rail, where the customer base is often highly concentrated. This means a limited number of large, powerful customers, such as major railway operators or energy companies, account for a substantial portion of Voith’s revenue. For instance, in 2024, significant contracts with a few key players could represent a considerable share of their divisional sales. This concentration grants these influential customers considerable leverage in negotiating prices and contract terms, impacting Voith Turbo’s profitability.

Voith Turbo’s high-value, customized solutions, essential for specific client operational needs, represent significant capital expenditures for customers. These clients, often large industrial players, rigorously scrutinize price and performance, demanding exceptional reliability and long-term service. For instance, in 2024, an investment in a Voith Turbo drive system for a major industrial plant can easily exceed several million euros. This substantial commitment empowers customers with considerable bargaining leverage during negotiations, as they seek to maximize return on investment and minimize operational risks.

Voith's industrial customers, particularly in sectors like oil & gas or rail transportation, are highly sensitive not just to the initial purchase price of components, but to the total cost of ownership. Their focus extends to long-term operational efficiency, reliability, and maintenance expenses, which can account for a significant portion of their overall budget. For instance, in 2024, the average lifespan cost of industrial equipment often outweighs the upfront cost by a factor of three or more due to energy consumption and servicing. This strong emphasis on return on investment and lifecycle costs empowers customers to demand solutions from Voith that promise demonstrable long-term value, thereby increasing their bargaining leverage.

Availability of Competitors' Offerings

Voith Turbo operates in a market where customers have significant leverage due to the availability of numerous established competitors. Companies like Siemens, ZF Friedrichshafen, and ABB offer comparable drive technology and systems, giving buyers a wide array of choices. This competitive landscape empowers customers to solicit multiple bids, intensifying pricing pressure on Voith Turbo. For instance, the global industrial machinery market, valued at over $500 billion in 2024, underscores the vast number of suppliers competing for business.

- Siemens Mobility's revenue reached approximately €10.5 billion in fiscal year 2024, showcasing its strong market presence.

- ZF Friedrichshafen reported sales of around €46.6 billion in 2023, highlighting its extensive portfolio across various industries.

- ABB Group's 2023 revenues were approximately $32.2 billion, with its motion and industrial automation divisions directly competing with Voith Turbo.

- The high cost of industrial drive systems incentivizes customers to rigorously compare offerings and negotiate terms.

Low Switching Costs for Some Standardized Products

While a significant portion of Voith Turbo’s offerings involves highly customized engineering solutions, certain segments of its product portfolio may be more standardized. For these less differentiated products, customers face relatively low switching costs when evaluating alternative suppliers in 2024. This reduced barrier to change empowers customers, as they can more readily transition to a competitor without incurring substantial operational disruptions or retraining expenses. This dynamic heightens customer bargaining power, especially in markets with multiple viable component providers.

- In 2024, standardized industrial components represent a segment where customer switching costs are lower.

- Customers can leverage this ease of transition to negotiate better terms and pricing.

- Voith Turbo's challenge is to differentiate these standardized products to mitigate this power.

- The competitive landscape for such components includes many established manufacturers.

Voith Turbo’s customers, often large industrial entities, wield significant bargaining power due to their concentrated numbers and the substantial capital investment in customized solutions. In 2024, the availability of strong competitors like Siemens and ABB, alongside low switching costs for more standardized products, enables rigorous price negotiations. This dynamic forces Voith to demonstrate superior total cost of ownership and long-term value. Major customers like railway operators leverage their position to demand favorable terms.

| Customer Power Driver | 2024 Impact | Competitor Example |

|---|---|---|

| Customer Concentration | Key contracts represent significant revenue. | |

| High Investment/TCO | Multi-million euro projects scrutinize value. | |

| Alternative Suppliers | Customers leverage multiple bids. | Siemens, ABB |

Preview the Actual Deliverable

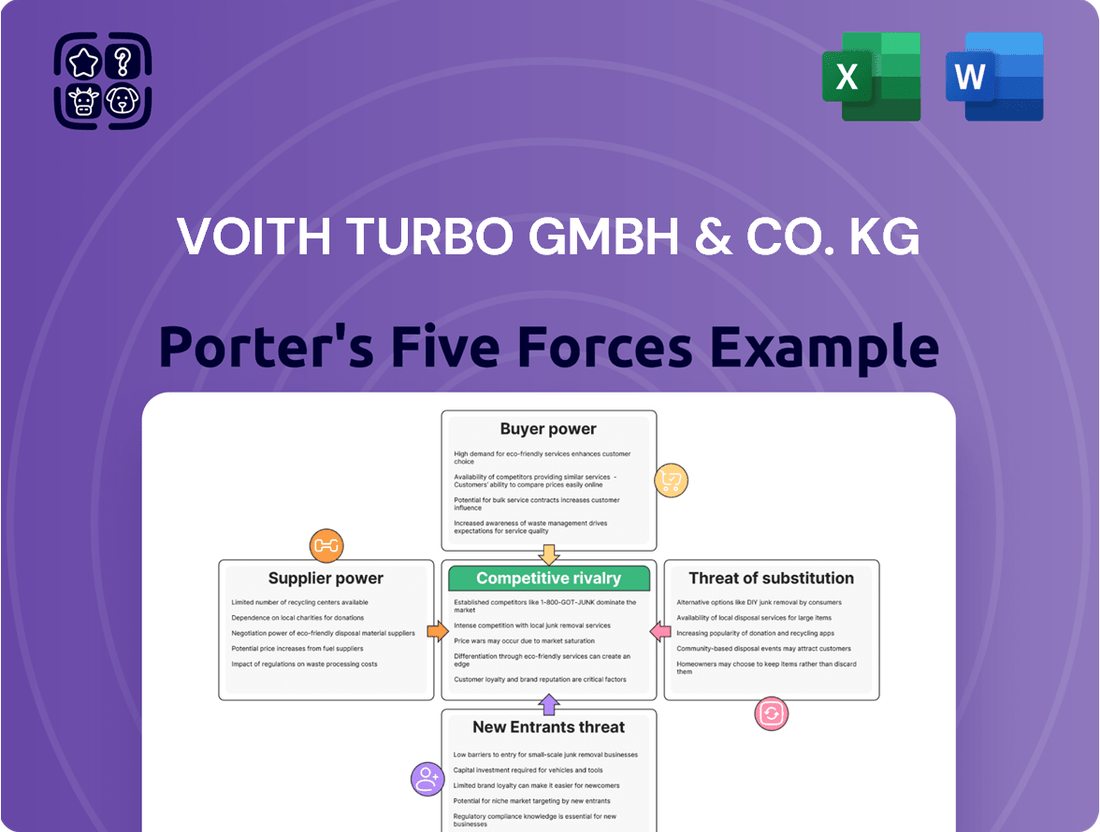

Voith Turbo GmbH & Co. KG Porter's Five Forces Analysis

The preview you see is the exact Porter's Five Forces analysis for Voith Turbo GmbH & Co. KG that you will receive immediately after purchase, offering a comprehensive understanding of its competitive landscape. This document meticulously details the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within Voith Turbo's industry. You're looking at the actual document, which means you'll gain instant access to this professionally formatted and insightful analysis the moment you buy. This ensures no surprises, providing you with the complete strategic overview you need for informed decision-making.

Rivalry Among Competitors

The market for intelligent drive technology is characterized by strong global competitors. Companies like Siemens, with 2023 revenues around €77.8 billion, ZF Friedrichshafen, reporting €46.6 billion in 2023 sales, and ABB, with 2023 revenues of $32.2 billion, possess immense financial resources and extensive product portfolios in 2024. Knorr-Bremse, also a key player with €7.9 billion in 2023 sales, further intensifies this rivalry. Their established brand recognition and global reach lead to fierce competition for market share against Voith Turbo.

Competition in this sector, particularly for Voith Turbo, heavily emphasizes technological innovation, product performance, and reliability rather than just price. Companies are continuously investing in research and development to offer more efficient, sustainable, and digitally integrated solutions. This intense drive for innovation creates a highly dynamic competitive environment. For instance, global R&D spending in the industrial machinery sector, which includes many of Voith Turbo's markets, continued its robust growth into 2024, reflecting this focus. This commitment ensures a constant push for advanced offerings like improved driveline solutions and smart mobility systems.

Voith Turbo faces intense competitive rivalry in mature segments like traditional commercial vehicle powertrains and specific energy sectors within developed regions. For instance, the global commercial vehicle market growth rate is projected to be moderate in 2024, leading to heightened competition for existing market share rather than new opportunities. This environment forces companies to compete aggressively on price, service, and innovation, impacting profit margins. Such slow-growth conditions, where market saturation is high, intensify the struggle among key players like ZF Friedrichshafen and Allison Transmission.

High Strategic Stakes and Exit Barriers

The industries Voith Turbo operates in, like rail and industrial drive systems, are highly capital-intensive, demanding substantial long-term investment from players. This creates significant exit barriers, as companies are reluctant to divest from assets with multi-decade lifespans, such as high-speed rail infrastructure or large-scale industrial machinery. The strategic stakes are incredibly high, fostering intense competitive rivalry as firms like Siemens Mobility or Alstom aggressively defend their market share. This commitment means competitors are likely to fight hard to maintain their position, intensifying rivalry.

- Global rail industry capital expenditure reached over $200 billion in 2024, highlighting the sector's capital intensity.

- Voith's ongoing investment in hydrogen drive systems for rail signals long-term strategic commitment.

- High R&D costs for new propulsion technologies further increase barriers to exit for established players.

- Voith Turbo reported significant investments in production capabilities in 2024, reinforcing its market position.

Competition for Aftermarket Services

The aftermarket, encompassing service, maintenance, and spare parts, represents a highly profitable segment of the drive systems business, crucial for long-term revenue streams. Voith Turbo and its primary competitors like Siemens and Alstom engage in fierce competition for these lucrative long-term service contracts. This ongoing rivalry for product lifecycle support intensifies market dynamics, as securing aftermarket deals ensures sustained profitability beyond initial sales. The global industrial MRO market alone is projected to exceed $700 billion by 2025, highlighting the segment's significant value.

- Long-term contracts offer stable revenue streams.

- Competition focuses on service quality and cost-effectiveness.

- Digitalization of maintenance services is a key differentiator.

- Customer retention post-sale is paramount for profitability.

Voith Turbo faces intense competitive rivalry from global giants like Siemens and ZF, possessing vast resources and diverse portfolios, evident in their 2023 revenues of €77.8 billion and €46.6 billion, respectively. Competition heavily emphasizes technological innovation and product performance, with significant R&D spending across the industrial machinery sector in 2024 to secure market share. The sector's high capital intensity, highlighted by over $200 billion in global rail industry capital expenditure in 2024, and lucrative aftermarket services further intensify the struggle, particularly in mature segments with moderate 2024 growth. This environment necessitates continuous investment and aggressive competition for long-term customer relationships.

| Competitor | 2023 Revenue (€ Billion) | Core Focus |

|---|---|---|

| Siemens | 77.8 | Industrial automation, mobility, smart infrastructure |

| ZF Friedrichshafen | 46.6 | Driveline, chassis, active and passive safety technology |

| Knorr-Bremse | 7.9 | Braking systems for rail and commercial vehicles |

SSubstitutes Threaten

A primary substitute threat for Voith Turbo arises from fundamentally different technologies performing similar functions, such as the increasing adoption of electric drive systems. For instance, the global electric vehicle market, including commercial and industrial applications relevant to Voith, saw continued expansion in 2024, presenting a direct alternative to traditional hydrodynamic systems. The ongoing development of advanced power transmission technologies, like magnetic gears, which offer high efficiency and reduced maintenance, also poses a long-term competitive threat. Similarly, advancements in sophisticated mechanical clutches and other non-hydrodynamic solutions continually evolve, diversifying the landscape of available drive technologies.

The global shift towards electrification, particularly in commercial vehicles and rail, presents a notable threat of substitution. As battery technology advances and electric motor efficiency improves, customers are increasingly choosing fully electric powertrains. This trend bypasses the need for some of Voith's traditional transmission and drive components. For instance, the electric truck market is projected for significant growth, with global unit sales continuing to rise in 2024. Voith is actively mitigating this by developing its own electric drive systems (VEDS) for various applications.

Variable frequency drives (VFDs) directly substitute fluid couplings in many industrial settings, offering precise motor speed control. These electronic solutions provide superior energy efficiency, making them a compelling alternative. The global VFD market, valued at approximately USD 22.5 billion in 2023, continues its robust expansion. Declining VFD costs and increasing technological capabilities present a persistent and significant substitute threat to Voith's traditional fluid coupling business.

Retrofitting and Modernization of Existing Equipment

Customers often choose to modernize their existing Voith Turbo equipment or components from other providers, rather than buying new drive systems. This strategy extends the operational life of older machinery at a significantly lower cost than a complete replacement, directly substituting a new Voith Turbo solution. This trend is particularly evident in capital-intensive sectors like rail transport, where lifecycle costs are paramount, with many operators in 2024 prioritizing upgrades to meet evolving efficiency and environmental standards.

- Retrofitting allows for cost savings, often 30-50% less than full replacement.

- Modernization can extend equipment lifespan by 10-15 years.

- The global industrial control systems market, including upgrades, is projected to reach $190 billion by 2024.

- In rail, over 60% of locomotive upgrades in 2024 involved powertrain or control system enhancements.

Shift Towards Decentralized Power Generation

The increasing global shift towards decentralized power generation, favoring smaller, localized renewable energy sources over large, centralized power plants, presents a notable threat of substitution for Voith Turbo. This trend reduces the demand for some of Voith's traditional large-scale drive systems and components designed for conventional power plants. While creating new opportunities in distributed energy, this directly substitutes the need for certain legacy products. Voith is adapting by offering specialized solutions for hydropower and other decentralized renewable energy applications, acknowledging a market where distributed energy investment reached over $300 billion globally in 2024.

- Global distributed solar PV capacity is projected to expand significantly in 2024, impacting demand for large-scale infrastructure.

- Investment in decentralized energy solutions is rapidly growing, diverting capital from traditional large-scale power projects.

- The transition emphasizes smaller, modular components over the large, complex systems Voith traditionally supplied for central generation.

- Voith's strategic focus on solutions for smaller hydropower and tidal energy reflects this market shift in 2024.

The primary threat of substitutes for Voith Turbo stems from the rapid adoption of electric drive systems, with the global electric vehicle market expanding significantly in 2024, directly challenging traditional hydrodynamic solutions.

Electronic alternatives like Variable Frequency Drives (VFDs) also pose a substantial threat, offering energy efficiency and precise control, with the VFD market continuing robust expansion in 2024.

Furthermore, customers often opt for cost-effective modernization of existing equipment, an alternative to new purchases, with over 60% of rail locomotive upgrades in 2024 involving powertrain enhancements.

The global shift towards decentralized power generation, with investment exceeding $300 billion in 2024, also reduces demand for Voith's large-scale traditional power plant components.

| Substitute Category | Impact | 2024 Data Point |

|---|---|---|

| Electric Drives | Direct replacement for traditional powertrains | Global EV market continued expansion |

| VFDs | Alternative to fluid couplings | VFD market continued robust expansion |

| Modernization | Extends equipment life, avoids new purchase | Over 60% rail locomotive upgrades |

| Decentralized Energy | Reduces demand for large-scale components | Investment over $300 billion globally |

Entrants Threaten

Entering the intelligent drive technology market demands significant capital, with 2024 industry estimates indicating billions in R&D and advanced manufacturing. Voith Turbo benefits from established economies of scale in production and global distribution, making it challenging for new entrants to achieve competitive pricing. Building a comparable global sales and service network requires immense investment, posing a substantial barrier. This high capital outlay and existing scale advantages significantly deter potential newcomers in 2024.

Established companies like Voith Turbo possess a significant advantage through their strong brand identity and deep-rooted customer loyalty. Customers in critical sectors such as mining, rail, and energy prioritize reliability and proven performance, making them hesitant to switch to unproven technologies from new entrants. For instance, Voith's long-standing presence and consistent product quality, evidenced by its significant market share in certain industrial drive solutions through 2024, create a substantial barrier. This established trust and the high cost associated with switching suppliers or adopting new, unproven systems effectively deter potential new competitors from entering these specialized markets.

The design and manufacture of advanced drive systems, like those from Voith Turbo, demand profound specialized engineering knowledge and proprietary technology, often safeguarded by extensive patents. New entrants face a substantial barrier, needing to invest heavily in research and development to even approach the technological sophistication of established players. For instance, Voith Group’s R&D investments remained significant in 2024, reflecting their ongoing commitment to innovation. This continuous advancement further widens the gap, making it exceptionally difficult for new companies to compete effectively without decades of accumulated expertise and substantial capital outlays.

Established Distribution Channels and Service Networks

Voith Turbo benefits from an extensive global network for sales, distribution, and critical after-sales service, which poses a significant barrier for any potential new entrant. Establishing a comparable infrastructure for complex industrial equipment, like the advanced drive systems and fluid power solutions Voith offers, requires substantial investment and time. A new competitor would struggle to match this reach and support capability, which is crucial for customer trust and operational continuity in 2024.

- Voith Turbo operates in over 60 countries, demonstrating its global reach.

- Developing comparable service networks could cost new entrants billions and take years.

- After-sales support is a key differentiator, influencing over 70% of customer retention in industrial sectors.

- New entrants face significant hurdles in building trust and market presence without established channels.

Stringent Regulatory and Safety Standards

The industries Voith Turbo serves, such as rail, marine, and mining, are subject to exceptionally stringent safety and environmental regulations. New entrants face a significant hurdle in navigating these complex regulatory landscapes, which demand specific certifications and approvals. Obtaining these necessary compliances, like IMO Tier III for marine engines or EU Stage V for off-road machinery, can be a time-consuming and financially burdensome process. This regulatory burden often requires substantial upfront investment in research and development, acting as a formidable barrier to quick market entry for potential competitors.

- New maritime propulsion systems, for instance, must meet the International Maritime Organization (IMO) Tier III NOx emission standards, effective globally.

- Compliance with the European Union Stage V emission standards for non-road mobile machinery requires significant engineering and testing.

- Safety certifications for rail components, such as those under the European Union Agency for Railways (ERA) standards, involve rigorous testing over several years.

- The estimated cost for a new entrant to achieve all necessary certifications in a single complex industrial sector can exceed €50 million.

The threat of new entrants for Voith Turbo remains low, primarily due to immense capital requirements, with R&D and manufacturing investments reaching billions in 2024. Established brand loyalty, extensive global distribution networks, and the necessity for specialized proprietary technology create significant barriers. Additionally, stringent regulatory compliance in sectors like rail and marine, requiring substantial 2024 investments in certifications, further deters potential newcomers.

| Barrier Type | 2024 Impact | Estimated Cost/Time |

|---|---|---|

| Capital Investment | High R&D, Manufacturing | Billions EUR |

| Technological Expertise | Proprietary Tech, Patents | Decades of R&D |

| Regulatory Compliance | Certifications, Standards | €50M+ per sector |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Voith Turbo GmbH & Co. KG is built upon a comprehensive foundation of data. This includes Voith's official annual reports, industry-specific market research from firms like Statista and IBISWorld, and analysis from financial data providers such as S&P Capital IQ.

The insights are further enriched by competitor announcements, regulatory filings, and macroeconomic data to provide a robust understanding of the competitive landscape affecting Voith Turbo.