Vitro Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vitro Bundle

Vitro's competitive landscape is shaped by a complex interplay of forces, from the bargaining power of its buyers to the looming threat of new market entrants. Understanding these dynamics is crucial for any stakeholder looking to navigate the glass manufacturing industry.

This brief overview only scratches the surface of how these forces impact Vitro's strategic positioning and profitability. To truly grasp the nuances of its market, a deeper dive is essential.

The complete Porter's Five Forces Analysis of Vitro reveals detailed insights into supplier leverage, the intensity of rivalry, and the substitutability of its products.

Unlock the full Porter's Five Forces Analysis to explore Vitro’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers for Vitro is significantly influenced by supplier concentration. The glass manufacturing industry is dependent on essential raw materials like silica sand, soda ash, and limestone, as well as energy. If a small number of suppliers control these critical inputs, they gain considerable leverage, which can drive up Vitro's production costs. For instance, in 2024, global soda ash prices saw fluctuations due to supply chain disruptions, impacting glass manufacturers.

For Vitro, the bargaining power of suppliers is significantly influenced by switching costs. If Vitro needs to change suppliers for critical raw materials or specialized manufacturing equipment, the process can be expensive and time-consuming. This often involves costs associated with retooling production lines, rigorous testing of new materials or equipment, and potential disruptions to ongoing operations.

These high switching costs empower existing suppliers. They can leverage this situation to negotiate more favorable terms, knowing that Vitro faces considerable hurdles in seeking alternative sources. For instance, if a key supplier of specialized glass manufacturing machinery demands a price increase, Vitro's investment in integrating that machinery makes a switch to a competitor a substantial undertaking.

While long-term contracts and strong existing relationships can sometimes buffer against supplier power, market dynamics can force a change. If a primary supplier experiences significant quality degradation or faces production issues, Vitro may be compelled to explore new options despite the associated switching costs. For example, in 2024, disruptions in the global supply chain for certain rare earth elements, crucial for advanced glass coatings, highlighted how quickly supplier reliability can become a critical concern, even for established partnerships.

If Vitro relies on suppliers for highly specialized or proprietary inputs, like advanced coatings for low-emissivity glass or unique chemical compounds for pharmaceutical packaging, these suppliers gain considerable leverage. This is especially true if these critical components are not easily sourced elsewhere. For instance, a supplier of a patented, energy-efficient coating technology essential for Vitro's premium architectural glass would hold significant bargaining power.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into glass manufacturing for Vitro is generally low. This is because establishing and running a glass production facility demands substantial capital outlay and highly specialized technical knowledge, creating a significant barrier to entry. For instance, the global glass manufacturing industry saw investments in new capacity often exceeding hundreds of millions of dollars in the years leading up to 2024.

However, this isn't an absolute certainty. In specific, high-value niche markets or for critical, proprietary components, a major supplier might explore forward integration if they perceive a clear path to greater profitability and a competitive edge. For example, a specialized chemical supplier to the automotive glass sector might consider producing the glass itself if they develop a unique, high-demand coating technology.

While not an immediate concern, this potential threat can subtly influence negotiations between Vitro and its suppliers. Knowing that a supplier *could* potentially enter their market might give Vitro leverage in securing favorable terms for raw materials or other inputs. The strategic consideration of this threat, even if low, remains a factor in Vitro's supply chain management.

- High Capital Requirements: The cost of building a modern glass manufacturing plant can range from $100 million to over $500 million, depending on scale and technology, acting as a significant deterrent for suppliers.

- Specialized Expertise: Glass production requires deep knowledge in areas like furnace operation, chemical composition, and quality control, which most suppliers in adjacent industries may lack.

- Niche Market Opportunities: Forward integration might be considered by suppliers in specialized segments, such as high-performance architectural glass or advanced display glass, where margins are higher.

- Strategic Negotiation Leverage: The mere possibility of supplier forward integration can influence Vitro's bargaining power during contract discussions for raw materials and other essential inputs.

Cost of Inputs Relative to Product Cost

The cost of raw materials and energy represents a substantial portion of Vitro's production expenses. For instance, in 2024, the price of natural gas, a critical energy source for glass furnaces, experienced volatility, impacting operational costs. Similarly, increases in the cost of key inputs like silica sand and soda ash directly compress Vitro's profit margins. This sensitivity underscores the critical need for robust supply chain management to mitigate supplier pricing power.

- Significant Input Costs: Raw materials and energy typically account for a large percentage of total manufacturing costs in the glass industry.

- Energy Price Sensitivity: Fluctuations in energy prices, particularly natural gas, directly influence Vitro's profitability.

- Raw Material Price Impact: Increases in the cost of silica sand and soda ash, essential components, can negatively affect Vitro's bottom line.

- Supply Chain Importance: Vitro's profitability is closely tied to its ability to manage supplier relationships and negotiate favorable pricing for its inputs.

The bargaining power of suppliers for Vitro is influenced by the concentration of suppliers for critical inputs like silica sand, soda ash, and energy. If a few dominant suppliers control these essential materials, they can exert significant pricing pressure on Vitro, impacting production costs. For example, global soda ash prices saw notable fluctuations in 2024 due to supply chain disruptions, directly affecting glass manufacturers.

Switching costs are another key factor amplifying supplier power. For Vitro, the expense and time required to change suppliers for specialized equipment or raw materials, including retooling and quality testing, create high barriers. This makes it difficult for Vitro to switch, allowing existing suppliers to negotiate more favorable terms. For instance, a supplier of proprietary glass manufacturing machinery can leverage Vitro's investment in their equipment to demand price increases.

The threat of suppliers integrating forward into glass manufacturing is generally low for Vitro due to the immense capital investment and specialized expertise required for glass production facilities. However, in niche, high-value markets, a supplier might consider this if they possess unique technologies. The potential for forward integration, even if small, can still influence Vitro's negotiating stance.

The cost of raw materials and energy forms a substantial part of Vitro's operational expenses. Volatility in energy prices, such as natural gas in 2024, directly impacts profitability. Similarly, price hikes in essential inputs like silica sand and soda ash can significantly compress Vitro's profit margins, highlighting the critical importance of managing supplier pricing power.

| Factor | Impact on Vitro | 2024 Relevance |

|---|---|---|

| Supplier Concentration | Increased pricing power for dominant suppliers | Global soda ash price fluctuations affected costs |

| Switching Costs | High costs to change suppliers empower existing ones | Investment in specialized machinery limits flexibility |

| Forward Integration Threat | Generally low due to high industry barriers | Niche market suppliers might consider it |

| Input Cost Sensitivity | Profitability directly tied to raw material and energy prices | Natural gas price volatility impacted operations |

What is included in the product

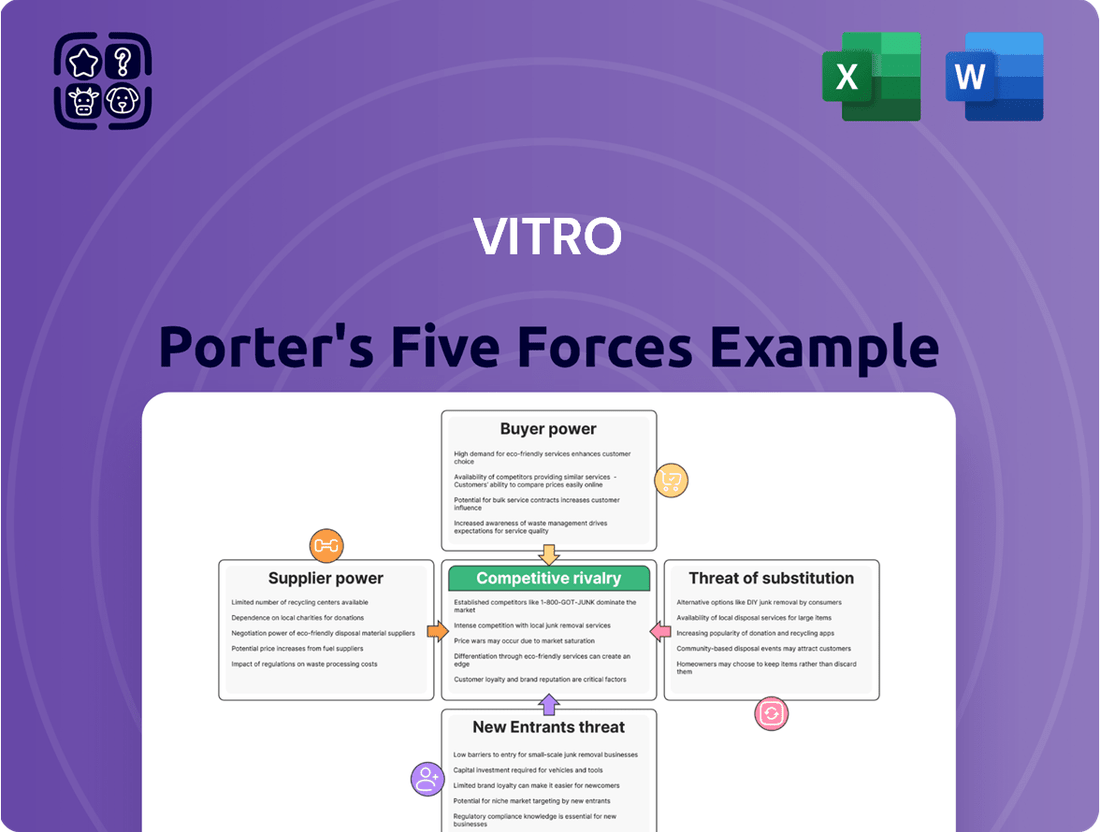

Assesses the competitive intensity and profitability potential within Vitro's industry by examining industry rivalry, the threat of new entrants, buyer bargaining power, supplier bargaining power, and the threat of substitutes.

Quickly identify and address competitive threats with a visual breakdown of each force, enabling targeted strategic adjustments.

Customers Bargaining Power

Vitro's customer base is spread across various vital sectors like food and beverage, pharmaceuticals, construction, and automotive. This diversity means the company isn't overly reliant on any single industry, which generally strengthens its position. However, within these sectors, certain large clients stand out due to their substantial purchasing volumes.

Major players in the food and beverage industry, or prominent automotive original equipment manufacturers (OEMs), are key customers for Vitro. Their significant demand for glass products translates directly into considerable bargaining power.

These high-volume purchasers can leverage their scale to negotiate for reduced prices, more flexible payment terms, or specific product customizations. For instance, a large beverage company might demand a specific bottle design and a guaranteed price per unit, putting pressure on Vitro's margins.

The ability of a few key customers to command better terms can impact Vitro's profitability and operational flexibility. In 2024, reports indicated that major automotive contracts, which often involve long-term commitments and high volumes, were a significant factor in pricing negotiations for glass manufacturers.

Customers often have readily available alternatives to glass products. For instance, in packaging, options like plastic, aluminum, and paper compete directly with glass containers. This abundance of substitutes significantly enhances the bargaining power of customers, as they can easily shift their purchases if glass manufacturers impose unfavorable pricing or terms.

The construction and automotive industries also see glass facing competition from materials such as plastics and advanced composites. When these alternatives offer comparable performance at a lower cost or with added benefits, customers gain leverage. For example, the automotive sector's increasing use of lightweight plastics instead of glass in certain applications reflects this trend, impacting glass demand.

However, the bargaining power derived from substitutes is not uniform across all glass segments. While common glass products face strong substitution threats, specialized glass, like certain types used in electronics or high-performance optics, may have fewer readily available alternatives. This limited substitutability in niche markets can reduce customer bargaining power for those specific glass products.

For Vitro's customers, the cost of switching glass suppliers can be significant. For instance, those in the container glass market might need to re-tool their filling lines, a process that can involve substantial capital expenditure and downtime. Similarly, customers in the flat glass sector, particularly those in construction or automotive manufacturing, may face the expense and complexity of adapting their assembly processes to accommodate a new supplier's product specifications. These adjustments can easily run into thousands or even millions of dollars, depending on the scale of operations.

These switching costs directly impact customer bargaining power. When it's expensive and disruptive to change suppliers, customers are less likely to switch, giving Vitro more leverage in price negotiations. For example, a major beverage bottler that has invested heavily in machinery calibrated for Vitro's specific container glass dimensions and quality standards would likely hesitate to switch to a competitor without a compelling cost-benefit analysis that accounts for re-tooling expenses. Research from 2024 indicates that capital investment for new manufacturing line setup can range from $100,000 to over $1 million for specialized equipment.

However, the degree of switching costs isn't uniform across Vitro's customer base. For customers purchasing standard, commodity-like glass products, the barriers to switching might be relatively low. They might simply need to source from a different supplier offering similar specifications. In contrast, customers who require custom-designed glass solutions, perhaps with unique shapes, coatings, or performance characteristics, will likely face much higher switching costs. Developing and validating these custom specifications with a new supplier would involve extensive R&D and testing, further solidifying their reliance on Vitro once a relationship is established.

Price Sensitivity of Customers

Customers in highly competitive sectors, such as fast-moving consumer goods or automotive manufacturing, often exhibit significant price sensitivity. They actively seek the lowest possible input costs, which directly translates into increased bargaining power. For instance, in 2024, the average consumer in developed economies reported being more likely to switch brands based on price, with over 60% indicating price as a primary decision factor in their grocery purchases.

Vitro, like other companies in competitive markets, faces this challenge. The ability to differentiate its offerings is crucial. By emphasizing unique selling propositions such as superior quality glass, innovative design aesthetics, or demonstrable sustainability credentials, Vitro can lessen the direct impact of price competition. Companies that successfully build brand loyalty through these factors often find customers less prone to switching solely based on minor price variations.

- Price Sensitivity in Key Industries: In 2024, the automotive sector saw average transaction prices increase by approximately 4% year-over-year, yet consumer demand remained robust, indicating a complex interplay of price sensitivity and product desirability.

- Impact on Bargaining Power: High price sensitivity empowers customers, allowing them to negotiate more favorable terms or switch to competitors offering lower prices.

- Vitro's Differentiation Strategy: Focusing on product quality, unique design features, and environmental, social, and governance (ESG) commitments can build customer loyalty and reduce susceptibility to price-driven decisions.

- Mitigating Price Pressure: Successful differentiation allows Vitro to command a premium, thereby mitigating the adverse effects of intense price competition from rivals.

Threat of Backward Integration by Customers

The threat of Vitro's customers integrating backward into glass manufacturing is generally considered low. This is primarily due to the significant capital outlay, specialized technical knowledge, and the sheer scale of operations needed to produce glass effectively. For instance, establishing a new float glass plant can cost hundreds of millions of dollars, making it an unattractive proposition for most buyers.

However, extremely large or strategically focused customers might contemplate backward integration if they face persistent supply chain disruptions or unacceptably high input costs. Such a move would be a substantial undertaking, requiring significant investment in technology and personnel. For example, a major automotive manufacturer might explore this if Vitro's pricing or delivery reliability significantly impacts their production schedules.

- High Capital Requirements: Building a modern glass manufacturing facility requires hundreds of millions in investment, a substantial barrier for most customers.

- Technical Expertise: Glass production involves complex processes and specialized knowledge that customers may lack.

- Economies of Scale: Existing large-scale producers like Vitro benefit from economies of scale that are difficult for new entrants to match.

- Rarity of Occurrence: While theoretically possible for very large buyers, actual instances of backward integration by customers in the glass industry are infrequent.

Vitro's customers wield significant bargaining power due to the availability of substitutes like plastic, aluminum, and advanced composites in various sectors, forcing Vitro to compete on price and value. High price sensitivity, particularly in competitive industries like automotive and consumer goods, further amplifies this power, as seen in 2024 consumer behavior favoring price. While switching costs can mitigate some of this power, especially for custom glass, the general threat of customers shifting to alternatives remains a key consideration for Vitro's pricing strategies.

| Factor | Impact on Vitro | 2024 Data/Trend |

| Availability of Substitutes | High (Plastic, Aluminum, Composites) | Increasing adoption of lightweight materials in automotive and packaging |

| Price Sensitivity | High (Especially in Automotive & FMCG) | Consumers prioritizing price; over 60% in developed economies cite price as a key factor |

| Switching Costs | Variable (Low for standard, High for custom) | Re-tooling costs for new suppliers can range from $100k to over $1M |

| Backward Integration Threat | Low (High capital, technical barriers) | Requires hundreds of millions for new plants; generally infrequent |

Preview the Actual Deliverable

Vitro Porter's Five Forces Analysis

This preview showcases the complete Vitro Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the industry. The document you see here is precisely what you will receive immediately after purchase, ensuring transparency and no hidden surprises. It delves into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. This professionally formatted analysis is ready for your immediate use, providing actionable insights for strategic decision-making.

Rivalry Among Competitors

The North American glass manufacturing arena is a competitive landscape featuring several major global and regional contenders. Companies like Vitro, O-I Glass, Ardagh Group, Guardian Industries, and Saint-Gobain all hold significant market positions. This concentration of large players fuels a high level of rivalry.

In 2024, the market dynamics continue to be shaped by these substantial entities. For instance, O-I Glass, a leading global glass container manufacturer, reported net sales of approximately $7.0 billion in 2023, highlighting the scale of operations for key players. Similarly, Ardagh Group's Glass – North America division is a substantial contributor to its overall business, demonstrating the significant market share these companies command.

The glass manufacturing industry in North America shows promising growth, with the glass packaging segment expected to expand at a compound annual growth rate (CAGR) of 2.98%. This steady upward trend generally eases competitive pressures as there's more market to go around.

However, this growth doesn't entirely eliminate rivalry. The flat glass sector, for instance, is also seeing growth exceeding 3%. Intense competition can still flare up, particularly within specific product niches or if economic conditions lead to a slowdown in overall demand.

While many glass products can be seen as interchangeable, Vitro actively combats this by focusing on innovation. They offer specialized glass like low-emissivity (low-e) glass, which significantly improves energy efficiency in buildings, and smart glass that can change its tint electronically. This focus on advanced, sustainable, and specialized products allows Vitro to move away from pure price competition.

This product differentiation is crucial for reducing rivalry. For instance, by offering cutting-edge solutions like bird-safe glass, which is designed to prevent avian collisions, Vitro appeals to a segment of the market willing to pay more for environmental and safety benefits. Such innovations enable premium pricing and create a competitive moat, lessening the direct pressure from competitors who primarily offer standard glass.

High Fixed Costs and Exit Barriers

The glass manufacturing sector, including companies like Vitro, is burdened by substantial fixed costs. These are tied to the continuous operation of energy-intensive furnaces, specialized machinery, and extensive plant infrastructure. For instance, the upfront investment in a modern float glass production line can easily run into hundreds of millions of dollars.

These high capital requirements, coupled with the specialized nature of plant and equipment, erect formidable exit barriers. Once established, it is incredibly difficult and costly for companies to discontinue operations or repurpose their assets. This financial trap forces firms to maintain production, even when demand falters.

Consequently, Vitro and its competitors are compelled to operate at or near full capacity to spread these fixed costs over a larger volume of output. This necessity fuels intense price competition, as companies strive to cover their operational expenses. Even during periods of economic slowdown, the pressure to keep furnaces running leads to aggressive pricing strategies.

- High Capital Investment: Setting up a new glass manufacturing facility can cost upwards of $250 million, according to industry estimates from 2024.

- Specialized Assets: Glass furnaces and rolling mills are highly specific and cannot be easily converted to other industrial uses, increasing the cost of exit.

- Operational Necessity: Furnaces must run continuously to prevent damage, meaning companies incur significant costs even with low production volumes.

- Price Wars: The drive to cover fixed costs often results in price wars, eroding profit margins across the industry.

Strategic Objectives of Competitors

Competitors' strategic objectives significantly shape the intensity of rivalry within the glass and aluminum solutions industry. Many firms are aggressively pursuing market share expansion. For example, Trulite Glass & Aluminum Solutions has actively engaged in strategic acquisitions, integrating new capabilities and customer bases to bolster its market presence.

Other players are prioritizing technological leadership, investing heavily in research and development to introduce innovative products and manufacturing processes. This drive for innovation can create a dynamic where companies must constantly adapt to stay competitive. Those focusing on cost leadership aim to achieve economies of scale and operational efficiencies to offer more competitive pricing.

The pursuit of these varied strategic goals creates a complex competitive environment. For instance, in 2024, the architectural glass market saw continued consolidation, with companies like Oldcastle BuildingEnvelope making strategic acquisitions to enhance their product portfolios and geographic reach.

The interplay of these objectives means that companies must remain agile and responsive to shifts in the market. Key strategic objectives observed in 2024 include:

- Market Share Expansion: Companies like Trulite and Oldcastle BuildingEnvelope actively pursue growth through mergers and acquisitions.

- Technological Leadership: Investment in advanced manufacturing and product innovation is a common strategy to differentiate.

- Cost Leadership: Focus on operational efficiency and scale to maintain competitive pricing.

- Geographic Reach: Expanding into new markets to diversify revenue streams and customer bases.

The North American glass manufacturing sector is characterized by intense rivalry due to the presence of several large, established global players like Vitro, O-I Glass, and Ardagh Group. This high concentration of formidable competitors means that companies must constantly innovate and differentiate to avoid direct price wars.

While the overall market, particularly glass packaging, is experiencing growth (e.g., a projected 2.98% CAGR for glass packaging), this expansion doesn't negate the competitive pressures. Companies are actively pursuing market share through acquisitions and technological advancements, as seen with Trulite Glass & Aluminum Solutions and Oldcastle BuildingEnvelope in 2024.

High fixed costs associated with energy-intensive operations and specialized machinery compel manufacturers to maintain high production volumes, often leading to aggressive pricing strategies. Vitro's focus on specialized products like low-e glass and bird-safe glass aims to mitigate this by commanding premium pricing and reducing reliance on pure price competition.

| Key Player | 2023 Net Sales (Approx.) | Strategic Focus |

| O-I Glass | $7.0 billion | Global Market Share |

| Vitro | N/A (Segmented reporting) | Product Differentiation, Innovation |

| Ardagh Group (Glass - North America) | N/A (Part of larger conglomerate) | Market Presence |

| Trulite Glass & Aluminum Solutions | N/A | Acquisitions, Market Expansion |

| Oldcastle BuildingEnvelope | N/A | Strategic Acquisitions, Product Portfolio |

SSubstitutes Threaten

Glass containers are under pressure from lighter, often cheaper alternatives like plastic bottles (PET, HDPE) and aluminum cans. In 2024, the global plastics market, a key substitute, continued its robust growth, with the packaging segment being a major driver, demonstrating the cost and convenience advantages these materials offer. For instance, the lower density of PET compared to glass translates to significant savings in transportation costs, a critical factor in the beverage industry.

For flat glass applications, materials such as polycarbonate and acrylic present viable substitutes. These plastics offer superior shatter resistance and are considerably lighter than glass, making them attractive for specific uses like automotive components or protective glazing where safety and weight are paramount. The market for engineered plastics, including polycarbonate, saw steady demand in 2024, driven by their performance characteristics in niche applications where glass's clarity or scratch resistance is less critical.

Customers are increasingly willing to switch to alternative packaging if it offers better value or aligns with their evolving preferences. For example, concerns about plastic waste are driving some consumers towards glass, especially for premium beverages. However, the cost-effectiveness and lighter weight of plastic and aluminum continue to make them attractive substitutes in many markets, impacting glass packaging demand.

The costs for Vitro's customers to switch from glass to alternative packaging materials can be substantial. These include investments in new filling and sealing machinery, which can run into hundreds of thousands of dollars per line, and adjustments to their supply chain and distribution networks. For instance, a beverage company switching from glass bottles to aluminum cans might need to retool its entire bottling plant.

Furthermore, marketing and branding efforts to re-educate consumers about a new packaging format also represent a significant, albeit less tangible, switching cost. While these upfront investments can deter immediate shifts, the allure of substantial cost savings or superior performance from substitutes, such as lighter-weight plastics or more durable metal containers, can eventually compel customers to make the change, especially if glass prices rise significantly.

In 2024, the global packaging market saw continued growth in flexible packaging and metal, with plastic packaging holding a significant market share. For example, the demand for aluminum cans saw a notable increase due to recyclability initiatives and consumer preference for lighter options, signaling a potential shift away from glass in certain beverage segments.

Innovation in Substitute Materials

Continuous innovation in alternative materials significantly heightens the threat of substitutes for traditional glass products. Advances in areas like bioplastics, recycled PET, and lightweight aluminum are making these substitutes more appealing due to enhanced functionality and sustainability. For instance, the development of paper-based bottles with plastic liners presents a lighter and more environmentally friendly option compared to glass, particularly in beverage packaging like wine.

This ongoing material science progress means that products historically reliant on glass now face increasingly viable and often cost-competitive alternatives. The industry must remain vigilant, as these innovations can rapidly shift consumer preferences and market share. For example, by mid-2024, the global bioplastics market was projected to reach over $7 billion, demonstrating substantial investment and growth in substitute materials.

- Emerging Material Technologies: Bioplastics, advanced recycled polymers, and novel composites are gaining traction.

- Performance Enhancements: Substitutes are increasingly matching or exceeding glass in durability and barrier properties.

- Sustainability Drivers: Growing consumer and regulatory demand for eco-friendly packaging boosts the appeal of alternatives.

- Cost Competitiveness: Innovations are driving down production costs for substitute materials.

Regulatory and Environmental Pressures

Increasingly strict regulations targeting packaging waste and promoting recyclability are significantly influencing consumer and industry choices, thereby posing a threat to traditional materials like glass. For instance, by 2024, many regions have implemented or are planning to implement extended producer responsibility (EPR) schemes that can increase costs for non-recyclable or difficult-to-recycle packaging. This regulatory pressure encourages a shift towards materials that are more easily processed or have a demonstrably lower environmental impact throughout their lifecycle.

Consumer demand for sustainable materials is a powerful driver, pushing manufacturers to explore and adopt alternatives to glass. This trend is evident in the growing market share of lightweight plastics, paper-based packaging, and innovative biomaterials designed for compostability or biodegradability. While glass boasts high recyclability, the inherent energy required for its production and transportation due to its weight can be a disadvantage compared to lighter substitutes.

The push for packaging with lower carbon footprints is another critical factor. Life cycle assessments often highlight that while glass is inert and infinitely recyclable, the energy-intensive manufacturing process and the increased transportation emissions due to weight can make substitutes more attractive from a carbon emissions perspective. By 2025, many companies are setting ambitious net-zero targets, making the carbon footprint of their packaging a key consideration in material selection.

- Regulatory Push: Growing implementation of EPR schemes and recycling mandates by 2024 incentivizes the use of easily recyclable or lightweight packaging materials.

- Consumer Demand: A rising preference for sustainable and eco-friendly packaging drives innovation in alternative materials like bioplastics and paper-based solutions.

- Carbon Footprint Concerns: The energy-intensive production and heavier weight of glass contribute to higher transportation emissions, making lighter substitutes with lower carbon footprints increasingly appealing.

- Recyclability Nuances: Despite glass's high recyclability, challenges in collection, sorting, and the energy required for reprocessing can make alternatives with simpler recycling streams or lower overall environmental impact competitive.

The threat of substitutes for glass packaging remains significant, driven by material innovations and evolving consumer preferences. Lighter, more cost-effective alternatives like plastics and aluminum continue to gain market share, especially in the beverage industry. For example, the global plastics market saw continued robust growth in 2024, with packaging being a key segment, highlighting the persistent advantages of these substitutes.

Innovations in materials like bioplastics and advanced recycled polymers are further strengthening the substitute threat. These advancements often address sustainability concerns, making them more attractive to both consumers and regulators. By mid-2024, the bioplastics market was projected to exceed $7 billion, indicating substantial investment and growth in these alternative materials.

Switching costs for Vitro's customers can be substantial, involving new machinery and supply chain adjustments. However, the long-term cost savings and performance benefits offered by substitutes can eventually outweigh these initial investments. The demand for aluminum cans, for instance, saw a notable increase in 2024 due to recyclability initiatives and a preference for lighter options, signaling a potential market shift.

| Substitute Material | Key Advantages | 2024 Market Trend/Data Point |

| Plastic Bottles (PET, HDPE) | Lighter weight, lower cost, shatter resistance | Global plastics packaging market continued robust growth. |

| Aluminum Cans | Lighter weight, high recyclability, consumer preference | Notable increase in demand for aluminum cans in 2024. |

| Polycarbonate/Acrylic | Shatter resistance, lighter weight | Steady demand in niche applications like automotive glazing. |

| Bioplastics | Sustainability, compostability/biodegradability | Projected to exceed $7 billion market value by mid-2024. |

Entrants Threaten

The glass manufacturing industry demands substantial capital investment, creating a significant barrier for potential new entrants. Companies must acquire expensive furnaces, advanced machinery, and dedicated production facilities, often costing hundreds of millions of dollars. For instance, a new float glass production line can easily exceed $200 million in upfront costs, a figure that deters many smaller or less capitalized businesses from entering the market. This high capital requirement ensures that only well-funded organizations can realistically consider establishing a competitive presence.

Established players like Vitro leverage substantial economies of scale, particularly in manufacturing and raw material sourcing. This means they can produce glass products at a much lower cost per unit than a new company just starting out. For instance, Vitro's extensive production facilities and bulk purchasing power in 2024 likely translate to significant cost advantages.

New entrants face a formidable barrier in achieving comparable production volumes. Without the ability to spread fixed costs over a large output, their per-unit costs will be higher, making it difficult to compete on price with incumbents. This cost disadvantage is a major deterrent for potential new market participants.

The ability to negotiate better terms with suppliers due to high volume purchasing is another facet of economies of scale that benefits established firms. Vitro’s established relationships and order sizes in 2024 allow them to secure raw materials like soda ash and limestone at more favorable prices, further widening the cost gap.

Consequently, a new entrant would need substantial upfront investment to build production capacity and achieve the necessary scale to challenge Vitro's cost structure. This capital requirement, coupled with the time needed to build market share, makes the threat of new entrants in the glass manufacturing sector moderate, primarily due to these scale-related efficiencies.

Access to distribution channels presents a significant barrier for potential new entrants into the glass manufacturing industry, particularly for established players like Vitro. Vitro has cultivated deep, long-standing relationships with major clients across critical sectors such as food and beverage, pharmaceuticals, construction, and automotive. These relationships, built over years of reliable service and tailored solutions, are not easily replicated.

Furthermore, Vitro commands an extensive and efficient distribution network throughout North America. This logistical infrastructure allows for timely and cost-effective delivery to a broad customer base. New companies would need substantial investment and time to develop comparable distribution capabilities, facing the challenge of securing shelf space or delivery routes that are already dominated by established firms.

For instance, in 2023, Vitro reported significant market share in the North American container glass segment, a testament to its strong distribution reach. New entrants would find it difficult to match this penetration without substantial capital outlays for logistics and marketing to gain visibility and trust with Vitro's existing customer base.

Proprietary Technology and Expertise

The glass manufacturing sector, especially for specialized products like architectural and automotive glass, demands intricate processes and deep technical know-how. Vitro's commitment to research and development, alongside its creation of unique technologies, effectively erects a significant hurdle for newcomers who haven't cultivated comparable technological prowess or assembled a similarly skilled workforce.

New entrants often struggle to replicate the sophisticated manufacturing techniques and specialized knowledge that Vitro has honed over years of operation. This technological moat is crucial for maintaining product quality and innovation. For instance, developing advanced coatings for energy-efficient windows or tempered glass for automotive safety requires substantial investment in intellectual property and specialized machinery, making it difficult for less-resourced competitors to enter the market.

- Proprietary Technology: Vitro's investment in R&D, including advanced glass formulations and manufacturing processes, creates a significant barrier.

- Technical Expertise: The need for highly skilled labor and specialized knowledge in areas like chemical composition and thermal processing deters new entrants.

- Capital Investment: Acquiring and mastering the complex machinery and technology required for high-performance glass production demands substantial upfront capital.

- Innovation Pipeline: Vitro's ongoing development of new glass types and applications, such as smart glass or enhanced safety features, continuously raises the technological bar for potential competitors.

Regulatory Hurdles and Environmental Standards

The glass industry faces significant regulatory hurdles, especially concerning environmental impact and safety. For instance, stringent emissions controls, like those mandated by the European Union's Industrial Emissions Directive, require substantial investment in abatement technologies, potentially costing new entrants millions of dollars.

New players must also contend with evolving waste management regulations and recycling mandates, which can necessitate specialized infrastructure and operational changes. These compliance costs act as a considerable barrier, deterring potential market entrants who may lack the capital or expertise to navigate such complex requirements.

In 2024, the focus on sustainability intensified, with many regions strengthening regulations around recycled content and energy efficiency in manufacturing processes.

- Environmental Regulations: Compliance with emission standards (e.g., SOx, NOx) and waste disposal rules adds significant upfront costs.

- Safety Standards: Meeting product safety certifications and workplace safety regulations requires investment in quality control and training.

- Capital Investment: Navigating these hurdles necessitates substantial capital for compliant technology and processes, estimated to be in the tens of millions for new large-scale facilities.

- Operational Complexity: Ongoing adherence to evolving regulations increases operational complexity and administrative burden.

The threat of new entrants into the glass manufacturing industry, particularly for a major player like Vitro, is generally considered moderate. This is primarily due to the significant capital requirements for establishing production facilities, which can run into hundreds of millions of dollars for a single float glass line.

Furthermore, established companies benefit from substantial economies of scale, allowing them to produce at lower costs per unit and secure better terms with suppliers due to high-volume purchasing. Access to established distribution channels and strong customer relationships, built over years of service, also presents a considerable barrier.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, investor presentations, and industry-specific market research databases to provide a comprehensive view of competitive dynamics.