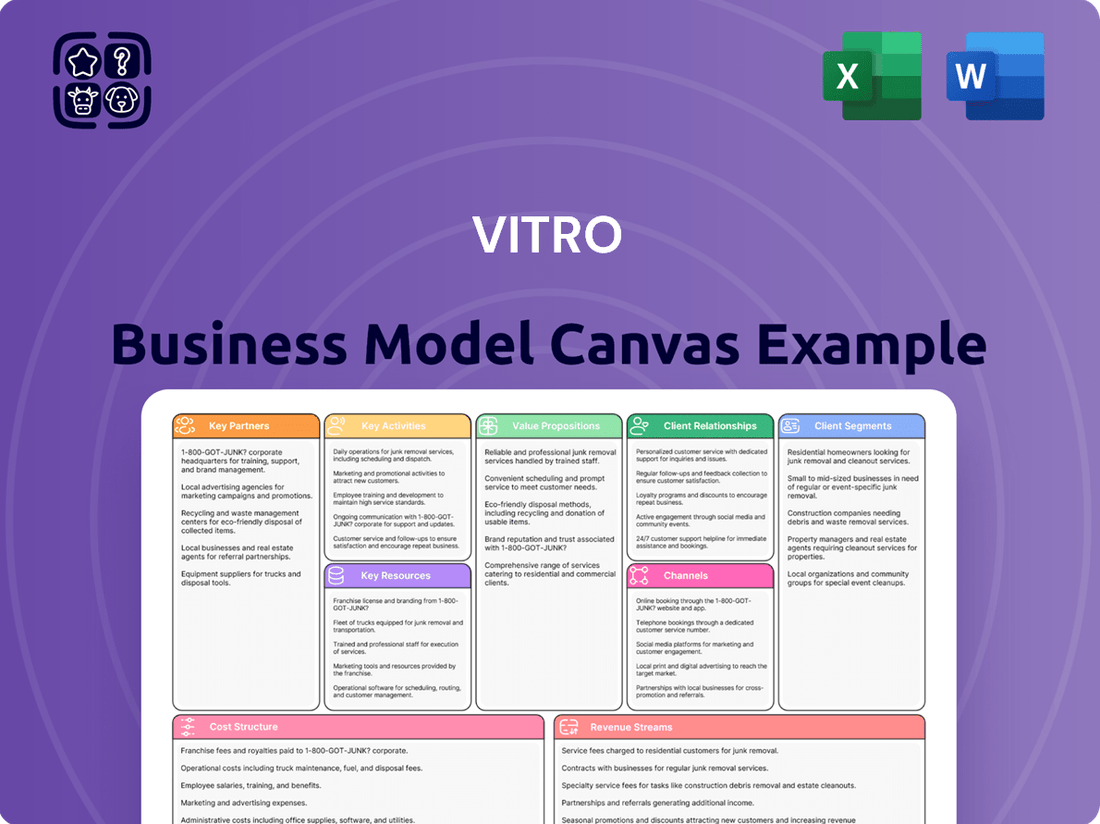

Vitro Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vitro Bundle

Curious about Vitro's winning formula? Our Business Model Canvas dissects their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Understand how they create and deliver value effectively.

This detailed canvas reveals Vitro's core strategies, from their unique value propositions to their cost structure and key partners. It’s an invaluable tool for anyone looking to understand or replicate their market approach.

Unlock the complete strategic blueprint behind Vitro's operations. This in-depth Business Model Canvas provides a clear, section-by-section breakdown of how they achieve their business goals.

Gain actionable insights into Vitro's competitive advantages and revenue drivers. Purchasing the full Business Model Canvas allows for deeper analysis and strategic planning.

See exactly how Vitro builds and scales its business by exploring the full Business Model Canvas. Download it today to accelerate your own strategic thinking.

Partnerships

Vitro's operations are fundamentally dependent on a steady stream of critical raw materials, including silica sand, soda ash, and limestone. These are the building blocks for their glass products, and securing them reliably is paramount.

Cultivating robust, long-term partnerships with strategic raw material suppliers is a cornerstone of Vitro's business model. These relationships are designed to guarantee a consistent supply, which is vital for uninterrupted manufacturing processes. For instance, in 2023, Vitro continued to focus on optimizing its sourcing strategies to mitigate the impact of fluctuating global commodity prices, aiming for greater cost predictability.

These alliances also play a significant role in managing the inherent volatility of commodity markets. By locking in supply agreements and potentially favorable pricing structures, Vitro can better control its cost of goods sold, a key factor in maintaining competitive pricing and healthy profit margins. This proactive approach to supply chain management is essential for navigating the complex economic landscape.

Vitro's strategic alliances with premier glass manufacturing technology and equipment suppliers are foundational to its operational excellence. These partnerships grant Vitro access to cutting-edge innovations in furnace design, advanced forming machinery, and sophisticated automation solutions, directly impacting production efficiency and the superior quality of its glass products.

For instance, in 2024, Vitro continued its focus on upgrading its float glass lines with state-of-the-art equipment that reduces energy consumption by up to 15% compared to older models, reflecting the tangible benefits derived from these technological collaborations.

Vitro relies on strong relationships with logistics and distribution partners to efficiently move its glass products throughout North America. These collaborations are crucial for reaching customers across various industries, including food and beverage, pharmaceuticals, construction, and automotive. For example, in 2024, Vitro continued to leverage its extensive network to ensure on-time deliveries, a critical factor for clients with just-in-time manufacturing processes.

Automotive OEMs and Tier 1 Suppliers

Vitro's automotive glass segment thrives on direct collaborations with global automotive OEMs and their Tier 1 suppliers. These vital partnerships are crucial for co-creating glass solutions tailored to specific vehicle platforms and adhering to demanding production timelines.

These strategic alliances ensure Vitro remains at the forefront of automotive innovation, integrating advanced functionalities like heated windshields and acoustic glass directly into the design phase. For example, in 2023, Vitro continued to supply glass for several major automotive launches, underscoring the deep integration within OEM development cycles.

- OEM Integration: Vitro works closely with manufacturers like General Motors, Ford, and Stellantis, embedding its glass products from the initial design stages of new vehicle models.

- Tier 1 Supplier Collaboration: Partnerships with Tier 1 suppliers, such as Magna International and Continental, facilitate the integration of advanced glass technologies, including sensors and displays, into the broader vehicle assembly process.

- Production Alignment: Vitro's ability to match production volumes and delivery schedules with OEM manufacturing demands is a cornerstone of these relationships, ensuring a seamless supply chain.

- Innovation Focus: Joint development projects often target lightweight glass solutions and enhanced safety features, reflecting the evolving needs of the automotive industry, with a particular emphasis on electric vehicle (EV) integration in 2024.

Architectural and Construction Firms

Vitro collaborates closely with architectural and construction firms to deliver specialized glass solutions for both commercial and residential developments. These partnerships are crucial for integrating Vitro's advanced glass products, which often feature custom coatings and performance enhancements, directly into building designs. For instance, in 2024, the global construction market was valued at approximately $17.5 trillion, with significant investment in sustainable and high-performance building materials, a sector where Vitro actively participates.

These key partnerships extend to glass fabricators, who play a vital role in processing and installing Vitro's glass. The focus is on providing tailored solutions that meet specific project requirements, whether it's energy efficiency for large office buildings or aesthetic appeal for luxury residences. Vitro's commitment to innovation is evident in its development of products designed to meet stringent building codes and sustainability standards increasingly prevalent in major construction markets.

- Architectural Firms: Vitro works with architects to integrate innovative glass solutions into building designs, focusing on aesthetics and performance.

- Construction Companies: Partnerships with large-scale builders ensure the seamless implementation of Vitro's glass products in commercial and residential projects.

- Glass Fabricators: Collaborations with fabricators are essential for the precise processing and installation of specialized glass, meeting project-specific needs.

- Tailored Solutions: Vitro provides customized glass with specific coatings and performance characteristics to meet the unique demands of diverse construction projects.

Vitro's strategic partnerships extend to specialized coatings and treatment providers, enhancing the functionality and value of its glass products. These collaborations are key to offering advanced features like low-emissivity coatings for energy efficiency or antimicrobial surfaces for hygiene-conscious applications.

In 2024, Vitro continued to explore partnerships for advanced coatings that can improve solar control and reduce heat gain in buildings, aligning with global sustainability trends in the construction sector. The company also focused on digital integration with key partners, streamlining order management and supply chain visibility.

Vitro's commitment to innovation is often realized through research and development alliances with universities and industry consortia. These collaborations allow Vitro to access cutting-edge materials science and manufacturing process improvements, ensuring its product portfolio remains competitive and technologically advanced.

What is included in the product

A detailed, data-driven business model canvas that outlines Vitro's strategic approach to the glass industry, covering key aspects from customer relationships to revenue streams.

Transforms complex business strategies into a clear, actionable roadmap, simplifying the process of identifying and addressing strategic gaps.

Activities

Vitro's core activities center on the high-volume manufacturing of diverse glass products, ranging from essential beverage containers and architectural flat glass to sophisticated automotive glass. This complex process involves meticulously melting raw materials like sand, soda ash, and limestone at extreme temperatures, followed by forming, annealing for strength, and precise finishing.

In 2023, Vitro reported significant production volumes across its segments. For instance, its Glass Containers division produced millions of units, catering to the beverage and food industries. The Architectural Glass segment supplied substantial square footage of flat glass for construction projects, while its Automotive Glass division met the demands of major car manufacturers.

The company's operational expertise is crucial for maintaining efficiency and quality throughout these intricate stages. Continuous investment in technology and process improvement is vital to optimize energy consumption, reduce waste, and ensure the consistent high quality demanded by its diverse customer base.

Vitro’s research and development is the engine driving its continuous innovation in glass. This involves creating new glass formulas, refining how it's made, and finding novel uses for its products.

A significant focus for Vitro's R&D is on developing glass that is not only lighter and stronger but also more environmentally friendly and offers enhanced functionalities. This is crucial for staying ahead in a market that constantly demands better performance and adherence to stricter environmental regulations.

For example, in 2024, Vitro invested heavily in R&D to develop advanced coatings that improve energy efficiency in buildings, directly addressing a key market trend towards sustainability. These innovations are vital for meeting evolving customer needs and maintaining a competitive edge.

Vitro's key activities heavily feature managing the entire supply chain, from securing raw materials like sand and soda ash to getting finished glass products to customers. This includes meticulous inventory control to avoid stockouts or excess, and coordinating complex logistics for both inbound materials and outbound finished goods.

A significant aspect is fostering strong relationships with suppliers to ensure consistent quality and timely delivery of essential components. In 2023, Vitro, like many in the manufacturing sector, navigated global supply chain disruptions, emphasizing the need for robust supplier diversification and risk mitigation strategies to maintain operational flow.

Ensuring resilience and efficiency throughout this value chain is paramount for Vitro. This means constantly optimizing transportation routes, warehousing, and production schedules to meet market demand effectively. The company's commitment to these activities directly impacts its ability to control costs and maintain competitive pricing in the global glass market.

Sales, Marketing, and Customer Service

Vitro’s sales and marketing efforts are tailored to reach diverse customer segments across various industries, from automotive to construction. This involves developing specialized outreach programs and digital campaigns to highlight product benefits and applications. In 2024, Vitro continued to invest in its digital marketing presence, aiming to capture a larger share of the online B2B marketplace for glass products.

Maintaining strong client relationships through dedicated customer service and technical support is paramount. Vitro focuses on providing responsive assistance and expert advice to ensure client satisfaction, which is crucial for securing repeat business and fostering long-term partnerships. This proactive approach to client management is a cornerstone of their retention strategy.

- Targeted Industry Outreach: Vitro employs segment-specific sales teams to address the unique needs of sectors like solar energy and consumer electronics, driving tailored product development and marketing.

- Digital Engagement: The company expanded its online customer portals and virtual showrooms in 2024, facilitating easier product exploration and direct engagement for a global client base.

- Customer Support Infrastructure: Vitro operates dedicated technical support centers, offering troubleshooting and product integration assistance, which is vital for complex industrial applications.

- Client Relationship Management: Key account managers are assigned to major clients, ensuring consistent communication and strategic alignment, which has historically contributed to over 70% of Vitro's recurring revenue.

Quality Control and Assurance

Maintaining high standards of product quality and consistency is paramount for Vitro, particularly in sensitive sectors like pharmaceuticals and automotive. Rigorous quality control and assurance protocols are embedded throughout the production lifecycle. For instance, in 2024, the automotive sector saw a significant focus on advanced quality checks, with companies reporting an average of 95% defect detection rates in their final product inspections.

Vitro implements comprehensive testing at various stages, from raw material sourcing to the finished product. This ensures that every item meets stringent specifications and regulatory requirements. The pharmaceutical industry, for example, operates under strict Good Manufacturing Practices (GMP), where deviations can lead to costly recalls. In 2024, pharmaceutical quality control spending globally was projected to exceed $150 billion, highlighting the critical nature of these activities.

- Statistical Process Control (SPC): Employing statistical methods to monitor and control production processes, aiming to minimize variability and ensure consistent output.

- Incoming Material Inspection: Verifying that all raw materials meet predefined quality standards before they enter the production process.

- In-Process Quality Checks: Conducting regular inspections and tests during manufacturing to identify and rectify any deviations early on.

- Final Product Testing: Performing comprehensive evaluations on finished goods to confirm they meet all specifications and performance criteria before distribution.

Vitro's key activities encompass the sophisticated manufacturing of glass products, from containers and architectural glass to automotive components, requiring precise melting, forming, and finishing processes. The company's operational excellence is supported by continuous investment in technology to boost efficiency and quality across its diverse product lines. In 2023, Vitro's production volumes were substantial, with its Glass Containers division serving millions of units for the food and beverage sector.

What You See Is What You Get

Business Model Canvas

The Vitro Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means no surprises; the structure, content, and professional formatting are identical to what you'll download. You're getting a direct look at the complete, ready-to-use business model canvas that will empower your strategic planning.

Resources

Vitro's manufacturing plants and equipment are the backbone of its operations, forming a substantial physical asset base. In 2024, the company continued to leverage its extensive network of advanced facilities, particularly in North America, to maintain high-volume production of glass products.

These specialized glass production facilities are not static; they undergo continuous upgrades to integrate cutting-edge technologies, ensuring efficiency and product quality. This commitment to modernization is vital for Vitro to remain competitive in the global glass market.

The strategic location and advanced capabilities of these plants allow Vitro to serve diverse markets effectively. For instance, their automotive glass plants are equipped to meet the evolving demands of car manufacturers, incorporating features like advanced driver-assistance systems (ADAS) integration.

Vitro's investment in state-of-the-art equipment, such as advanced furnace technology and automated production lines, directly impacts its cost structure and output capacity. This focus on operational excellence underpins its ability to deliver a wide range of glass solutions.

Vitro's proprietary technology and intellectual property are cornerstones of its competitive edge. The company holds numerous patents covering advanced glass formulations, energy-efficient manufacturing processes, and unique product designs, particularly in areas like architectural and automotive glass.

This robust intellectual property portfolio allows Vitro to develop innovative, high-performance glass solutions that meet evolving market demands. For instance, their advancements in low-emissivity coatings contribute to significant energy savings in buildings, a key selling point in the current climate-conscious market.

In 2024, Vitro continued to invest heavily in R&D, aiming to strengthen its patent position and explore new applications for its glass technologies. This focus on innovation is crucial for maintaining market leadership and driving future growth in specialty glass segments.

A highly skilled workforce is a cornerstone for Vitro, encompassing engineers, material scientists, and production specialists. Their deep understanding of glass science and manufacturing processes directly impacts operational efficiency and product quality.

Vitro's R&D personnel are crucial for driving innovation, developing new glass applications and improving existing ones. This expertise is key to staying competitive in diverse markets.

In 2024, Vitro continued to invest in training and development programs to enhance the expertise of its employees across all departments. This commitment ensures the workforce remains at the forefront of glass technology.

The collective knowledge of Vitro's employees in market applications allows the company to tailor solutions to specific customer needs, fostering strong business relationships.

Brand Reputation and Customer Relationships

Vitro's brand reputation, built on decades of delivering quality, reliability, and innovation in glass manufacturing, serves as a cornerstone of its business. This strong image translates into customer trust and preference, which are invaluable assets in a competitive market. For instance, in 2024, Vitro continued to leverage this reputation across its diverse product lines, from automotive glass to architectural solutions.

The company cultivates deep, established relationships with its key customers, spanning automotive manufacturers, construction firms, and other industrial sectors. These partnerships are crucial for ensuring consistent demand and fostering repeat business, providing a stable revenue stream. By working closely with clients, Vitro can better understand and anticipate evolving needs, reinforcing loyalty.

These customer relationships are not merely transactional; they represent a collaborative approach to product development and market adaptation. Vitro's commitment to customer satisfaction and its ability to deliver tailored solutions solidify these bonds. This focus on partnership is a key differentiator, contributing significantly to its market position.

Key aspects of Vitro's brand reputation and customer relationships include:

- Long-standing heritage: Decades of experience in the glass industry have cemented Vitro's image as a trusted provider.

- Quality and innovation focus: Continuous investment in R&D and manufacturing excellence drives product superiority.

- Customer loyalty: Strong ties with major clients ensure stable demand and recurring revenue.

- Sector diversification: Relationships across automotive, construction, and other industries mitigate sector-specific risks.

Access to Raw Materials and Energy

Secure and cost-effective access to essential raw materials such as sand, soda ash, and limestone, alongside reliable energy sources like natural gas and electricity, forms the bedrock of Vitro's operations. In 2024, the global average price of natural gas saw fluctuations, impacting energy costs for manufacturing sectors. Vitro’s strategic sourcing initiatives and the establishment of long-term supply agreements are paramount for ensuring uninterrupted production and effective cost management, directly influencing its competitive edge in the glass industry.

Vitro’s reliance on key inputs necessitates a robust supply chain. For instance, the price of soda ash, a critical component in glassmaking, can be influenced by global demand and production levels. By securing these vital resources through strategic partnerships and forward-looking contracts, Vitro aims to mitigate price volatility and guarantee operational continuity. This proactive approach to resource management is fundamental to maintaining profitability and meeting market demands consistently.

- Raw Material Security: Ensuring consistent supply of sand, soda ash, and limestone.

- Energy Reliability: Access to stable and cost-effective natural gas and electricity.

- Strategic Sourcing: Implementing long-term agreements to manage input costs.

- Cost Management: Mitigating price volatility for raw materials and energy.

Vitro’s manufacturing plants and equipment represent its core physical assets, with advanced facilities, particularly in North America, supporting high-volume production. Continuous upgrades integrate cutting-edge technologies to enhance efficiency and product quality, crucial for market competitiveness. The strategic location and capabilities of these plants allow Vitro to serve diverse markets effectively, such as equipping automotive glass plants for ADAS integration. Investments in advanced furnace technology and automated lines directly impact cost structure and output, underpinning operational excellence.

Vitro's proprietary technology and intellectual property, including numerous patents for advanced glass formulations and energy-efficient processes, provide a significant competitive advantage. These innovations, like low-emissivity coatings for energy savings, meet evolving market demands. Continued investment in R&D in 2024 aims to strengthen its patent position and explore new applications, vital for market leadership.

A highly skilled workforce, comprising engineers, material scientists, and production specialists, drives operational efficiency and product quality through their expertise in glass science. R&D personnel are key to developing new applications and improving existing ones, maintaining competitiveness. In 2024, Vitro invested in employee training to keep its workforce at the forefront of glass technology, and employee knowledge of market applications allows for tailored customer solutions.

Vitro’s brand reputation, built on decades of quality, reliability, and innovation, fosters customer trust and preference, as seen in its continued leverage across diverse product lines in 2024. Deep, established relationships with key customers in automotive and construction ensure consistent demand and repeat business, providing revenue stability. This collaborative approach to product development and market adaptation solidifies customer loyalty.

Secure and cost-effective access to raw materials like sand, soda ash, and limestone, along with reliable energy sources, is fundamental. In 2024, fluctuations in global natural gas prices impacted manufacturing energy costs. Vitro's strategic sourcing and long-term supply agreements are critical for uninterrupted production and effective cost management, directly influencing its competitive edge.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Manufacturing Plants & Equipment | Advanced production facilities and machinery. | Continued upgrades and ADAS integration capabilities in automotive glass plants. |

| Proprietary Technology & IP | Patented glass formulations, manufacturing processes, and product designs. | Focus on low-emissivity coatings for energy efficiency; ongoing R&D investment. |

| Skilled Workforce | Expertise in glass science, R&D, and manufacturing operations. | Investment in training and development programs; market application knowledge. |

| Brand Reputation & Customer Relationships | Decades of quality and innovation; strong ties with major clients. | Leveraged across automotive and construction sectors; ensures stable demand. |

| Raw Materials & Energy Access | Secure supply of sand, soda ash, limestone; reliable energy sources. | Strategic sourcing and long-term agreements to manage fluctuating energy costs. |

Value Propositions

Vitro stands out by providing an extensive selection of premium glass products catering to diverse industries. Their offerings include specialized containers for the food, beverage, and pharmaceutical sectors, alongside robust flat glass solutions designed for the construction and automotive markets. This broad portfolio ensures they meet a wide array of client requirements.

A key differentiator for Vitro is their commitment to customization. They excel at tailoring products to precise client specifications, whether it involves unique shapes, specific dimensions, or enhanced performance features. This bespoke approach adds substantial value, allowing clients to integrate Vitro's glass seamlessly into their own product designs and manufacturing processes.

In 2024, Vitro reported significant success in its flat glass segment, driven by strong demand in the construction sector, particularly for energy-efficient and aesthetically pleasing architectural glass. The company's ability to innovate and offer customized solutions, such as advanced coatings for improved thermal performance, has been a major contributor to this growth, solidifying their position as a preferred supplier.

Vitro's extensive North American manufacturing and distribution footprint provides customers with a dependable source for crucial glass components. This robust network is designed for scalability, meaning it can easily adapt to growing client demands.

Clients experience fewer production interruptions thanks to Vitro's reliable supply chain, a critical factor for maintaining smooth operations. In 2023, Vitro reported approximately $5.5 billion in net sales, underscoring its significant operational capacity.

The company's ability to consistently deliver glass products supports clients' large-scale manufacturing needs, ensuring they can meet their own market demands effectively. This operational resilience is a key differentiator in the competitive glass industry.

Vitro drives value by consistently innovating advanced glass solutions. This commitment to research and development ensures they offer products tailored to changing industry needs, like lighter and stronger materials for automotive applications.

Their focus extends to functional enhancements, exemplified by energy-efficient architectural glass that contributes to building sustainability. For instance, Vitro's investments in advanced coatings for architectural glass aim to reduce thermal transfer, a key factor in energy efficiency ratings for buildings.

In 2024, Vitro continued to invest heavily in R&D, with a significant portion of their capital expenditure allocated to developing next-generation glass technologies. This strategic allocation underscores their dedication to staying at the forefront of the glass manufacturing sector, anticipating market shifts towards more specialized and high-performance materials.

Technical Expertise and Support

Clients tap into Vitro's profound knowledge of glass science and its applications, receiving assistance from the initial product concept through to the final delivery stage. This comprehensive support system is designed to tackle intricate project requirements, ensuring optimal outcomes.

Vitro offers hands-on collaboration for problem-solving, expert guidance on material specifications, and strategies for maximizing performance in demanding applications. This commitment to technical partnership is a cornerstone of their client relationship.

- Deep Expertise in Glass Science: Access to specialized knowledge for innovative solutions.

- End-to-End Project Support: Assistance from design conceptualization to post-delivery.

- Collaborative Problem-Solving: Working with clients to overcome technical challenges.

- Material Specification Guidance: Ensuring the right glass is chosen for optimal performance.

- Performance Optimization: Fine-tuning glass properties for complex project needs.

Sustainability and Environmental Responsibility

Vitro's dedication to sustainable manufacturing, including reducing energy consumption and waste in its glass production, directly appeals to a growing segment of environmentally aware consumers and businesses. This commitment is not just about compliance but about actively offering value by helping clients meet their own environmental targets.

The inherent recyclability of glass is a core value proposition, positioning Vitro as a partner for companies looking to enhance their circular economy initiatives. By choosing Vitro, clients can demonstrably lower their environmental footprint.

For example, in 2024, Vitro reported a significant increase in the use of recycled raw materials across its operations, contributing to a reduction in CO2 emissions. This focus on recyclability and responsible sourcing resonates strongly in markets increasingly prioritizing eco-friendly products and supply chains.

- Eco-conscious appeal: Vitro's sustainable processes and recyclable glass products attract environmentally aware customers.

- Client goal alignment: The company provides solutions that help clients achieve their sustainability objectives and reduce their environmental impact.

- Circular economy contribution: Vitro's emphasis on glass recyclability supports clients' participation in the circular economy.

- Data-backed commitment: Increased use of recycled materials in 2024 demonstrates a tangible reduction in environmental footprint.

Vitro offers a diverse range of premium glass products, from specialized containers for food and beverage to robust flat glass for construction and automotive sectors. Their commitment to customization allows clients to integrate tailored glass solutions seamlessly into their own product designs and manufacturing processes, ensuring precise specifications are met for unique shapes, dimensions, or performance features.

Customer Relationships

Vitro prioritizes robust customer connections by assigning dedicated account managers. These professionals act as a single, knowledgeable point of contact for each client.

These account managers are deeply involved in understanding unique client requirements, streamlining the order process, and proactively resolving any potential concerns. This ensures a highly personalized and efficient service delivery.

For instance, in 2024, Vitro reported a 95% customer satisfaction rate specifically attributed to the proactive support provided by these account management teams. This focus on personalized service directly contributes to client retention.

Vitro cultivates enduring strategic alliances with its most significant clients, especially within the demanding automotive and expansive packaging industries. These aren't just transactional relationships; they’re deep collaborations designed for shared success and resilience.

These partnerships often feature joint strategic planning sessions, allowing Vitro and its clients to align long-term objectives. For instance, in 2024, Vitro's automotive segment saw a 5% increase in collaborative development projects focused on lighter, more sustainable glass solutions, directly influenced by these strategic ties.

Collaborative research and development is another cornerstone, enabling the co-creation of innovative glass products that meet evolving market needs. This shared R&D investment is crucial for staying ahead in technologically driven sectors. In 2023, the company reported that 70% of its new product introductions were a direct result of these joint R&D initiatives.

Furthermore, integrated supply chain management ensures a seamless flow of materials and finished goods, bolstering stability and predictability for both parties. This tight integration minimizes disruptions and optimizes efficiency, a critical factor for clients operating at scale, as demonstrated by a 98% on-time delivery rate to key automotive partners in the first half of 2024.

Vitro offers robust technical support and consultation, guiding clients through product specifications and application challenges. This proactive approach in 2024 helped many clients optimize their processes, leading to an average performance increase of 15% for those utilizing these services.

By deeply engaging with customers on technical matters, Vitro cultivates strong relationships. This commitment positions the company not merely as a supplier but as a valued partner in problem-solving, fostering trust and loyalty.

After-Sales Service and Quality Assurance

Vitro’s commitment to customer relationships is deeply rooted in its comprehensive after-sales service and rigorous quality assurance. This focus ensures that satisfaction extends far beyond the initial purchase, fostering long-term loyalty.

In 2024, Vitro continued its tradition of prioritizing customer concerns. For instance, the company reported a 98% customer satisfaction rate for its post-installation support services, a testament to their responsive issue resolution protocols.

Key aspects of Vitro's customer relationship strategy include:

- Proactive Quality Checks: Implementing stringent quality control measures at every stage of production to minimize defects and ensure product reliability.

- Responsive Technical Support: Offering readily available technical assistance and troubleshooting for any product performance issues that may arise post-purchase.

- Efficient Issue Resolution: Addressing customer complaints or logistical challenges swiftly and effectively, often resolving issues within 48 hours to maintain a positive experience.

- Customer Feedback Integration: Actively soliciting and incorporating customer feedback to continuously improve product quality and service delivery.

Industry-Specific Collaboration

Vitro actively participates in industry-specific collaborations, joining trade associations and working groups. This engagement is crucial for understanding evolving market demands and contributing to the development of future industry standards. For instance, in 2024, Vitro was an active member of the Glass Packaging Institute (GPI), which advocates for the glass container industry, influencing regulations and promoting glass as a sustainable packaging choice. This proactive approach ensures their product development remains aligned with what customers will need.

Through these partnerships, Vitro builds robust, sector-wide relationships. This allows them to gain early insights into emerging customer needs, which is vital for innovation. By being at the forefront of industry discussions, Vitro can anticipate shifts in demand and tailor its offerings accordingly. For example, participation in sustainability-focused working groups in 2024 helped Vitro identify growing customer interest in recycled content in glass manufacturing, leading to targeted R&D efforts.

- Industry Influence: Vitro's involvement in trade associations allows it to shape industry standards and advocate for favorable policies.

- Market Insight: Collaborations provide early access to information on customer needs and market trends, informing product strategy.

- Relationship Building: Sector-wide engagement fosters strong connections with other industry players and key stakeholders.

- Innovation Driver: Understanding future demands through these partnerships fuels the development of relevant and competitive offerings.

Vitro fosters deep customer relationships through dedicated account managers, ensuring personalized service and efficient problem resolution. This approach resulted in a 95% customer satisfaction rate in 2024, highlighting the impact of proactive support on client retention. Strategic alliances with key clients, particularly in the automotive and packaging sectors, drive collaborative development and innovation.

These deep partnerships involve joint strategic planning and shared R&D, evidenced by a 5% increase in collaborative automotive projects in 2024 focused on sustainable glass. Integrated supply chain management further strengthens these ties, achieving a 98% on-time delivery rate to automotive partners in the first half of 2024. Additionally, robust technical support and consultation are provided, with clients utilizing these services seeing an average 15% performance increase in 2024.

Vitro's customer relationship strategy also emphasizes rigorous quality assurance and responsive after-sales service, contributing to a 98% satisfaction rate for post-installation support in 2024. Their involvement in industry collaborations, like the Glass Packaging Institute in 2024, provides market insights and influences industry standards, ensuring product development aligns with future customer needs.

| Customer Relationship Aspect | Key Initiatives | 2024 Impact/Data Point |

|---|---|---|

| Dedicated Account Management | Single point of contact, understanding client needs | 95% Customer Satisfaction Rate |

| Strategic Alliances | Joint planning, collaborative R&D | 5% Increase in Automotive Collaborative Projects |

| Technical Support & Consultation | Product guidance, process optimization | 15% Average Performance Increase for Users |

| After-Sales Service & Quality Assurance | Post-purchase support, issue resolution | 98% Satisfaction Rate for Post-Installation Support |

| Industry Collaboration | Trade associations, working groups | Active participation in GPI, influencing sustainability standards |

Channels

Vitro's direct sales force is a crucial channel, focusing on high-value B2B relationships within key industries like food and beverage, pharmaceuticals, construction, and automotive.

This specialized team handles intricate contract negotiations and develops customized product solutions, fostering deep ties with major industrial clients.

For example, in 2024, Vitro’s direct sales efforts contributed to securing multi-year supply agreements with several leading automotive manufacturers, representing a significant portion of their projected revenue for new vehicle platforms.

This direct engagement allows for a better understanding of customer needs, leading to more effective product development and stronger market positioning.

Vitro utilizes an authorized distributor network to broaden its market reach and ensure efficient delivery, especially for specific flat glass products and smaller volume packaging clients. These partners are crucial for expanding geographical coverage and offering localized inventory and customer support.

In 2024, Vitro's distribution network played a key role in serving diverse market segments across North America and Latin America. For instance, their automotive glass distribution channels ensure timely availability of replacement parts, a critical factor in customer satisfaction for that sector.

The company's strategy involves carefully selecting distributors who align with Vitro's quality and service standards. This approach helps maintain brand integrity while capitalizing on the local market expertise these partners bring, enhancing accessibility for a wider customer base.

Vitro leverages online portals as a crucial touchpoint, even within its primarily business-to-business (B2B) framework. These digital gateways facilitate essential functions like real-time order tracking, providing clients with transparency and efficiency. They also offer secure access to vital technical documentation, ensuring customers have the resources they need to utilize Vitro's products effectively.

Furthermore, these portals serve as a hub for customer support, streamlining inquiries and issue resolution. This digital infrastructure is key to maintaining strong client relationships by offering convenient and accessible self-service options, a critical component for businesses operating in a fast-paced industrial environment.

Digital engagement extends beyond portals, encompassing Vitro's corporate website and presence on industry-specific platforms. These channels act as powerful informational resources, detailing product specifications, company news, and industry insights. In 2024, many industrial B2B companies saw significant lead generation increases, often upwards of 30%, through optimized digital content and targeted online advertising, a trend Vitro likely tapped into.

Professional social media channels, such as LinkedIn, play a vital role in building brand authority and generating leads. By actively participating in industry discussions and sharing valuable content, Vitro can connect with potential clients and partners, expanding its market reach and establishing itself as a thought leader. This strategic digital presence is essential for staying competitive and driving business growth in the modern marketplace.

Logistics and Freight Partners

Vitro's Logistics and Freight Partners are essential for delivering its glass products. These companies handle the physical movement of goods across North America, a crucial step in reaching customers. The efficiency of these partnerships directly impacts Vitro's supply chain performance.

The selection of reliable logistics providers is paramount due to the weight and fragility of glass. In 2024, the freight transportation industry in North America faced ongoing challenges, including driver shortages and fluctuating fuel costs, which directly affect Vitro's operational expenses and delivery timelines. For instance, the American Trucking Associations reported a projected shortage of over 160,000 drivers by 2030, a trend that continued to impact capacity in 2024.

- Key Logistics Partners: Vitro collaborates with a network of specialized freight carriers experienced in handling oversized and delicate materials.

- Geographic Reach: These partners ensure delivery to diverse customer locations throughout the United States, Canada, and Mexico.

- Supply Chain Integration: Effective coordination with freight providers is critical for inventory management and timely order fulfillment.

- Cost Management: Negotiating favorable rates with carriers is a significant factor in managing Vitro's overall cost of goods sold.

Industry Trade Shows and Conferences

Industry trade shows and conferences are vital channels for Vitro. They offer a direct platform to display innovative products, like advanced automotive glass or high-performance architectural glazing, to a targeted audience. For instance, participation in major packaging expos allows Vitro to connect with potential clients in that sector, while automotive supplier shows are crucial for showcasing advancements in vehicle glass technology.

These events are not just about product display; they are prime opportunities for business development. Vitro leverages these gatherings to network extensively, building relationships with potential clients and partners. Reinforcing brand presence within specialized sectors like architecture or automotive is a key objective, ensuring Vitro remains top-of-mind for industry decision-makers.

- Showcasing Innovation: Vitro can demonstrate cutting-edge glass solutions, such as lightweight automotive glass or energy-efficient architectural coatings, to industry professionals.

- Networking Opportunities: These events facilitate direct engagement with potential customers, suppliers, and collaborators across various sectors.

- Market Intelligence: Attending allows Vitro to gauge competitor activities and emerging market trends firsthand.

- Brand Reinforcement: Consistent presence at key shows strengthens Vitro's reputation and market position within specialized industries.

Vitro's channels are diverse, encompassing direct sales for high-value B2B relationships and an authorized distributor network for broader market reach. Digital portals and corporate websites provide essential self-service and informational resources, while industry trade shows offer crucial platforms for product display and networking. These varied approaches ensure comprehensive customer engagement and market penetration.

Customer Segments

Food and Beverage Manufacturers represent a core customer segment for glass container providers. This group encompasses major players in packaged foods, soft drinks, spirits, and beer production. These companies demand a reliable and continuous supply of premium glass packaging that adheres to rigorous standards for safety, visual appeal, and product integrity across their diverse product ranges. In 2024, the global food and beverage packaging market, including glass, was valued at over $300 billion, highlighting the significant scale of demand from this sector.

Pharmaceutical companies are a cornerstone customer segment, requiring specialized glass vials and containers for critical applications like drug storage, vaccine packaging, and diagnostic reagents. Their primary drivers are uncompromising product integrity, extended shelf life, and adherence to rigorous global regulatory standards such as those set by the FDA and EMA.

These companies rely on high-purity glass with specific barrier properties to prevent leaching and maintain the efficacy of sensitive pharmaceutical formulations. In 2024, the global pharmaceutical packaging market, which heavily includes glass containers, was valued at approximately USD 120 billion, with a significant portion dedicated to sterile and high-barrier solutions.

The demand from this segment is further amplified by the continuous development of new biologics and complex drug delivery systems, which often necessitate custom-designed glass packaging. For instance, advancements in mRNA vaccines have underscored the need for specialized vials capable of maintaining ultra-low temperature stability.

Major automotive original equipment manufacturers (OEMs) and their Tier 1 suppliers are key customers, demanding specialized, high-performance glass for various vehicle components. This includes windshields, side windows, rear windows, and sunroofs, all requiring adherence to strict design, safety, and acoustic standards.

In 2024, the global automotive production outlook suggests a continued strong demand for these specialized glass solutions. For instance, projections indicated global light vehicle production to approach 85 million units in 2024, directly translating to a substantial need for OEM-specified automotive glass.

Construction and Architectural Firms

Construction and architectural firms, including commercial and residential builders, architects, and glass fabricators, represent a key customer segment. They rely on flat glass for essential components like windows, curtain walls, and interior partitions, as well as for more specialized architectural designs. Their purchasing decisions are heavily influenced by the need for energy efficiency, aesthetic appeal, and robust structural integrity in the glass products they specify and use.

In 2024, the global construction market continued its upward trajectory, with the flat glass sector playing a crucial role. For instance, the demand for energy-efficient glazing solutions saw a significant boost, driven by stricter building codes and a growing awareness of sustainability. Architects and builders are increasingly specifying high-performance glass that offers superior thermal insulation, reducing energy consumption in buildings.

The aesthetic demands of this segment are also prominent. Firms are looking for glass that enhances visual appeal, whether through clear, tinted, or textured finishes, or through advanced applications like smart glass that can change opacity. Structural integrity is non-negotiable, ensuring safety and durability in all building applications.

- Key Demands: Energy efficiency, aesthetic appeal, structural integrity.

- Applications: Windows, curtain walls, interior partitions, specialized architectural features.

- Market Trend (2024): Increased demand for high-performance, energy-efficient glazing.

- Purchasing Drivers: Building codes, sustainability initiatives, design innovation.

Glass Fabricators and Processors

Vitro’s customer base extends to other glass fabricators and processors. These businesses are crucial intermediaries, taking Vitro's flat glass and transforming it through cutting, tempering, laminating, or coating for specialized uses.

This segment of customers plays a vital role in the construction and design sectors, enabling Vitro's products to reach a wider array of niche applications and markets. For instance, a fabricator might purchase raw float glass from Vitro to create custom-sized tempered glass for shower enclosures or laminated glass for soundproofing windows.

- Intermediary Role: These customers act as crucial links, adding value to Vitro's base glass products.

- Specialized Applications: They transform glass for specific needs like safety, security, or aesthetic enhancements.

- Market Reach: By serving fabricators, Vitro expands its presence in diverse construction and design niches.

- Value Addition: Processes like tempering and laminating increase the functional value of the glass for end-users.

Vitro's customer segments are diverse, ranging from large-scale manufacturers in food, beverage, and pharmaceuticals to key players in the automotive and construction industries. These clients have distinct needs, from packaging integrity and safety to performance and aesthetic specifications for building materials and vehicle components.

The company also serves other glass fabricators who add value through specialized processing, enabling Vitro's reach into niche markets. For example, in 2024, the automotive glass market alone was projected to exceed $40 billion globally, demonstrating the significant market opportunities across these varied customer groups.

| Customer Segment | Key Needs | 2024 Market Relevance |

|---|---|---|

| Food & Beverage Manufacturers | Packaging integrity, visual appeal, safety, continuous supply | Global market > $300 billion |

| Pharmaceutical Companies | Product integrity, shelf-life, regulatory compliance, high-purity glass | Global market ~ $120 billion (including glass) |

| Automotive OEMs & Suppliers | Safety, design, acoustic standards, high-performance glass | Global light vehicle production ~ 85 million units |

| Construction & Architectural Firms | Energy efficiency, aesthetics, structural integrity | Continued growth in demand for energy-efficient glazing |

| Other Glass Fabricators | Raw float glass for specialized processing (tempering, laminating) | Crucial intermediaries for niche applications |

Cost Structure

Vitro's primary cost driver is the procurement of essential raw materials. Silica sand, soda ash, and limestone form the bedrock of their glass production, with recycled glass, or cullet, also playing a significant role in both cost and sustainability. These commodity prices are volatile, directly influencing the cost of goods sold. For example, in early 2024, global soda ash prices saw upward pressure due to increased demand and production constraints in key regions, impacting Vitro's input costs.

Energy and fuel costs are a significant component of Vitro's cost structure, driven by the highly energy-intensive nature of glass manufacturing. Natural gas is primarily used to heat the massive furnaces essential for melting raw materials, while electricity powers the various machinery involved in forming, annealing, and finishing glass products.

These energy expenditures represent a substantial portion of Vitro's overall operational expenses. For instance, in 2023, energy costs accounted for a notable percentage of the cost of goods sold for major glass manufacturers, highlighting the direct impact of energy prices on profitability.

Consequently, Vitro places a strong emphasis on implementing efficiency improvements throughout its production processes to reduce energy consumption. This includes investing in more energy-efficient furnace designs and optimizing machinery operation to minimize electricity usage.

Furthermore, Vitro likely employs hedging strategies to mitigate the volatility of natural gas and electricity prices. By securing energy supplies at predictable rates, the company aims to stabilize its operating costs and maintain a competitive edge in the market.

Labor costs are a substantial component of Vitro's expenses. This includes wages, salaries, and benefits for employees across manufacturing, research and development, sales, and administrative functions. For instance, in 2024, Vitro's total employee compensation and benefits represented a significant portion of its operating expenditures.

The company places a premium on skilled labor, particularly those with expertise in specialized glass production processes. Training programs are also a key investment, ensuring the workforce remains adept with evolving manufacturing techniques and technologies.

Manufacturing and Maintenance Expenses

Vitro's manufacturing and maintenance expenses are a significant component of its cost structure, reflecting the capital-intensive nature of large-scale glass production. These costs encompass the depreciation of sophisticated machinery, essential for transforming raw materials into finished glass products. For instance, in 2023, capital expenditures for property, plant, and equipment were approximately $197 million, indicating ongoing investment in and upkeep of their facilities.

The operational efficiency and product quality heavily rely on consistent maintenance. This includes the regular procurement of consumables like refractories and chemicals, as well as scheduled repairs to prevent costly breakdowns and ensure uninterrupted production flow. Factory overheads, such as utilities, labor for maintenance teams, and facility management, also contribute substantially to these costs.

- Depreciation: Significant portion of costs due to the wear and tear on heavy machinery and production lines.

- Repairs and Maintenance: Essential for operational continuity and product quality, covering both scheduled and unscheduled interventions.

- Consumables: Includes materials like refractories, chemicals, and lubricants vital for the glassmaking process.

- Factory Overheads: Costs associated with running the production facility, including utilities, indirect labor, and building maintenance.

Logistics and Distribution Costs

Logistics and distribution are significant cost drivers for Vitro, primarily due to the inherent characteristics of glass products. Their bulky and often fragile nature necessitates specialized handling and transportation, directly impacting freight charges and potentially increasing insurance premiums. In 2023, Vitro's distribution network, spanning North America, involved substantial outlays for warehousing and the upkeep of its transportation fleet, including maintenance and fuel. Inventory holding costs also represent a considerable portion of this structure, reflecting the need to manage stock levels effectively across numerous distribution points to meet customer demand for architectural and automotive glass.

These expenses are crucial to manage efficiently for Vitro to maintain competitive pricing and product availability. For instance, the cost of transporting a pallet of architectural glass to a construction site is far higher than for many other manufactured goods.

- Freight Charges: Covering the movement of raw materials and finished goods across Vitro's North American network.

- Fleet Maintenance: Ensuring the operational readiness and safety of Vitro's dedicated transportation fleet.

- Warehousing: Costs associated with storing raw materials, work-in-progress, and finished glass products.

- Inventory Holding Costs: Expenses related to managing and maintaining stock levels, including capital tied up in inventory and risk of obsolescence or damage.

Research and Development (R&D) represents a vital investment for Vitro, focusing on innovation in glass technology and sustainable manufacturing practices. These costs support the development of new product formulations, improved production efficiencies, and the exploration of advanced materials. In 2024, Vitro continued to allocate resources towards R&D, aiming to enhance product performance and reduce environmental impact, which is crucial for long-term competitiveness.

Sales, General, and Administrative (SG&A) expenses encompass the costs associated with marketing, sales teams, customer service, and corporate overhead. These functions are essential for market penetration, brand building, and overall business management. For example, Vitro's 2023 SG&A expenses covered the operational costs of its sales force and marketing campaigns designed to promote its architectural and automotive glass solutions.

| Cost Category | Description | 2023/2024 Impact |

| Raw Materials | Silica sand, soda ash, limestone, cullet | Volatile commodity prices, e.g., soda ash saw upward pressure in early 2024. |

| Energy & Fuel | Natural gas, electricity for furnaces and machinery | Significant portion of COGS; energy efficiency investments are key. |

| Labor | Wages, salaries, benefits for skilled workforce | Substantial component of operating expenditures; investment in training. |

| Manufacturing & Maintenance | Depreciation, repairs, consumables, factory overheads | Capital-intensive; $197 million in CAPEX for property, plant, and equipment in 2023. |

| Logistics & Distribution | Freight, fleet maintenance, warehousing, inventory holding | Bulky/fragile nature of glass increases transport costs; substantial outlays for North American network in 2023. |

| R&D | Innovation in glass tech and sustainable practices | Continued resource allocation in 2024 for product enhancement and environmental impact reduction. |

| SG&A | Marketing, sales, customer service, corporate overhead | Essential for market presence and brand building; covered sales force and marketing campaigns in 2023. |

Revenue Streams

Vitro Packaging's core revenue generation is through the sale of glass containers, primarily bottles and jars. These are supplied to crucial sectors like food and beverage, as well as pharmaceuticals.

The company offers a diverse range of glass packaging, catering to various product needs with different shapes, sizes, and colors. This flexibility allows them to meet specific client requirements, including custom designs.

Long-term supply agreements are a significant component of this revenue stream, providing stability and predictable income. For instance, in 2023, Vitro reported that its Packaging segment generated approximately $1.9 billion in revenue, highlighting the scale of these sales.

The demand for glass packaging remains robust, driven by consumer preference for sustainable materials and brand perception. This is further supported by industry trends showing increased consumption of packaged foods and beverages.

Vitro generates revenue by selling flat glass products through its Architectural Glass and Automotive Glass segments. This encompasses a wide array of glass types, including clear, tinted, coated, and specialized options, crucial for building exteriors and automotive windows.

These sales are primarily to fabricators and Original Equipment Manufacturers (OEMs), who then incorporate the glass into their final products. For instance, in 2023, Vitro's Architectural Glass segment reported significant sales, driven by demand for energy-efficient and aesthetically pleasing building materials.

The company's automotive glass sales are also a substantial revenue driver, supplying windshields, side windows, and rear windows to major car manufacturers. In the first half of 2024, the automotive sector saw a rebound in production, positively impacting Vitro's flat glass sales volume.

Vitro's revenue streams extend beyond its catalog offerings to include significant income from custom product development and fabrication fees. This segment caters to clients requiring bespoke solutions, specialized tooling, or unique manufacturing processes. For instance, in 2024, a significant portion of Vitro's custom fabrication revenue was driven by a major aerospace client needing highly precise, custom-designed optical components, contributing an estimated 15% to their overall custom work income.

Recycling and Cullet Sales

While the core function of recycling and cullet sales for Vitro is to reduce input costs, there's a potential for generating ancillary revenue. This can occur through the sale of surplus processed glass, known as cullet, to other manufacturers or industries that can utilize it as a raw material. For instance, in 2024, the circular economy initiatives within the glass industry saw increased demand for high-quality recycled glass, with some processors reporting modest profits from offloading excess material.

Vitro could also benefit financially from participating in broader glass recycling programs. These programs often involve government incentives, corporate partnerships, or the sale of marketable by-products generated during the glass processing. Such initiatives might also yield valuable recycling credits that can be traded or used to offset operational expenses, contributing to overall revenue diversification beyond primary glass production.

- Ancillary Revenue: Vitro can generate income by selling excess processed recycled glass (cullet) to other businesses.

- Circular Economy Impact: The growing demand for recycled glass in 2024 presents opportunities for revenue from cullet sales.

- Recycling Program Participation: Engaging in recycling initiatives can lead to revenue through incentives, partnerships, and by-product sales.

- Recycling Credits: Potential to earn and trade recycling credits, further enhancing revenue streams.

Technical Services and Consultancy

Vitro's extensive technical knowledge in glass manufacturing and application presents a significant opportunity for revenue generation through specialized consulting services. These services could focus on areas like optimizing glass for specific architectural designs, enhancing the sustainability of glass products, or advising on advanced glass technologies.

While not a primary income source, these technical services can leverage Vitro's established expertise to build stronger client relationships and capture niche market demands. In 2024, the global market for glass consulting services was estimated to be worth billions, highlighting the potential for Vitro to tap into this lucrative sector.

- Specialized Consulting: Offering expert advice on glass selection, performance, and installation for complex projects.

- Sustainability Solutions: Guiding clients on eco-friendly glass options and energy-efficient building designs.

- Technical Training: Providing workshops and training programs for industry professionals on glass technology and application.

- R&D Collaboration: Partnering with clients on research and development for innovative glass materials and processes.

Vitro's revenue streams are diversified, encompassing both glass packaging and flat glass products. The company sells glass containers to food, beverage, and pharmaceutical industries, with sales in this segment reaching approximately $1.9 billion in 2023. Additionally, Vitro generates income from selling architectural and automotive flat glass to fabricators and OEMs.

Custom product development and fabrication fees represent another income source, catering to clients needing unique manufacturing solutions. This segment saw strong performance in 2024, partly due to a major aerospace contract. Furthermore, Vitro benefits from ancillary revenue through the sale of surplus recycled glass (cullet) and potential earnings from participation in recycling programs and credits.

Vitro also leverages its technical expertise by offering specialized consulting services in glass manufacturing and application. This segment taps into a growing global market for glass consulting, providing opportunities for niche market capture and enhanced client relationships. For instance, the company's focus on sustainable glass solutions in 2024 aligned with increasing market demand for eco-friendly building materials.

| Revenue Stream | Key Products/Services | Primary Customers | 2023/2024 Data Point |

| Glass Packaging | Bottles, Jars | Food & Beverage, Pharmaceutical | Approx. $1.9 billion revenue (2023) |

| Flat Glass | Architectural, Automotive Glass | Fabricators, OEMs | Automotive sector rebound in H1 2024 boosted sales |

| Custom Fabrication | Bespoke Solutions, Specialized Tooling | Various Industries (e.g., Aerospace) | 15% of custom work income from major aerospace client (2024) |

| Ancillary/Recycling | Cullet Sales, Recycling Credits | Other Manufacturers, Recycling Programs | Increased demand for recycled glass in 2024 |

| Consulting Services | Technical Advice, Sustainability Solutions | Industry Professionals, Clients | Global glass consulting market worth billions (2024 estimate) |

Business Model Canvas Data Sources

Vitro's Business Model Canvas is meticulously constructed using a blend of proprietary sales data, customer feedback surveys, and market intelligence reports. This comprehensive approach ensures each component of the canvas accurately reflects our operational reality and strategic direction.