Viatris PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Viatris Bundle

Navigate the complex external landscape impacting Viatris with our meticulously crafted PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are shaping the pharmaceutical giant's strategic direction and market positioning. Our insights are crucial for anyone seeking to anticipate Viatris's challenges and opportunities.

This comprehensive PESTLE analysis dives deep into the social, technological, legal, and environmental factors influencing Viatris's global operations. Gain a competitive advantage by leveraging this expert-researched intelligence to inform your investment decisions and strategic planning.

Unlock actionable insights into the external forces driving Viatris's performance and future growth. Our ready-to-use PESTLE analysis is an indispensable tool for investors, consultants, and business strategists looking to stay ahead in the dynamic pharmaceutical industry.

Don't miss out on critical market intelligence. Purchase the full Viatris PESTLE analysis today and equip yourself with the knowledge needed to make informed, forward-thinking business decisions.

Political factors

Government healthcare policies significantly shape Viatris's operational landscape. For instance, evolving drug pricing controls and reimbursement policies in major markets directly influence the company's revenue streams and ability to access patient populations. In 2024, many countries are actively pursuing strategies to curb healthcare expenditure, which could pressure Viatris's profitability, particularly for its established generic and biosimilar portfolios.

Regulatory pathways for generics and biosimilars are also critical. Streamlined approval processes can accelerate market entry, boosting sales, while stricter requirements can introduce delays and increase development costs. Viatris's success hinges on navigating these varying regulatory environments effectively, especially as it aims to expand its biosimilar offerings globally.

The global push to reduce healthcare costs presents both challenges and opportunities for Viatris. Policies aimed at promoting cost-effective alternatives, such as generics and biosimilars, align with Viatris's core business model. However, aggressive price reduction mandates could limit the company's pricing power and overall revenue growth in the coming years.

Global trade relations significantly influence Viatris's operations. For instance, the United States International Trade Commission reported that in 2023, the pharmaceutical sector faced varying tariff impacts depending on specific product categories and import origins, directly affecting the cost of raw materials for Viatris's diverse portfolio.

Geopolitical tensions, such as those observed in Eastern Europe in 2024, can disrupt established supply chains, leading to increased logistics costs and potential delays in product distribution for companies like Viatris that rely on a global manufacturing footprint. This necessitates agile adaptation of their supply chain strategies.

International trade agreements, both bilateral and multilateral, can either facilitate or hinder Viatris's market access and pricing strategies. For example, preferential trade agreements can reduce import duties on Viatris's finished goods in certain markets, thereby improving affordability and availability for patients.

Conversely, the imposition of new tariffs or trade barriers, as seen in some trade disputes in 2024, can raise the cost of imported Active Pharmaceutical Ingredients (APIs) or finished products, impacting Viatris's profitability and the competitive pricing of its medications in affected regions.

Government policies significantly shape the pace and requirements for drug approvals worldwide. Viatris's market entry and product launches are directly impacted by these regulatory frameworks, which can vary considerably between nations. For instance, the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have distinct pathways and timelines for evaluating new treatments.

Political stability and a government's focus on healthcare innovation play a crucial role. Countries prioritizing rapid access to medicines may streamline approval processes, benefiting companies like Viatris. Conversely, political uncertainty or a focus on other national priorities can delay these crucial approvals, potentially hindering Viatris's commercialization efforts for both new and established pharmaceuticals.

Intellectual Property Rights Protection

Viatris navigates a complex global intellectual property (IP) landscape, where varying levels of protection for its branded pharmaceuticals and biosimilars significantly influence its market strategies. Stronger IP protection in developed markets allows Viatris to recoup R&D investments, but it also necessitates robust anti-counterfeiting measures to safeguard its product integrity.

The company faces challenges in emerging markets where patent enforcement can be weaker, creating opportunities for generic competition but also risks of unauthorized production. For instance, in 2024, the World Intellectual Property Organization (WIPO) reported continued efforts by member states to strengthen IP frameworks, yet disparities remain. Viatris's approach involves strategic patent filings and diligent monitoring of infringement, especially for key products like those in its cardiovascular portfolio.

- Global Patent Landscape: Viatris's success hinges on understanding and leveraging diverse patent protection lengths and enforcement rigor across its operating regions.

- Biosimilar Strategy: The company's biosimilar business is directly impacted by patent expirations and the strength of regulatory pathways for biosimilar approval and market entry.

- Anti-Counterfeiting: Protecting its branded products from counterfeit versions is a critical operational and reputational concern, with significant investment in track-and-trace technologies.

- R&D Investment Returns: The ability to secure and enforce IP rights is crucial for Viatris to achieve a return on its substantial investments in drug development and innovation.

Government Initiatives for Generic and Biosimilar Adoption

Government initiatives aimed at increasing the adoption of generic and biosimilar medicines directly impact Viatris, a company with a substantial presence in these markets. These policies often stem from a political drive to reduce healthcare expenditures and enhance patient access to more affordable treatments. For instance, many countries are actively encouraging healthcare providers and patients to switch to generics when available, which can pressure branded drug sales but boost Viatris's generic segment. The push for cost-effective healthcare solutions means Viatris's strong generic and biosimilar portfolio is well-positioned to benefit from these evolving political landscapes.

The implications of these government-led efforts are significant for Viatris's market share and strategic planning. By promoting biosimilars, governments can foster competition, potentially leading to lower prices for complex biologic drugs and opening new avenues for Viatris's biosimilar offerings. This political focus on affordability is a key driver for companies like Viatris that specialize in providing cost-effective alternatives to originator pharmaceuticals. For example, legislative efforts in the United States and European Union continue to streamline the approval and market entry of biosimilars, creating a more favorable environment for Viatris’s growth in this segment.

- Increased Generic Prescribing: Policies encouraging physicians to prescribe generics when available directly increase demand for Viatris's generic products.

- Biosimilar Uptake Targets: Some governments set targets for biosimilar usage in specific therapeutic areas, creating market opportunities for Viatris.

- Reimbursement Policies: Favorable reimbursement policies for generics and biosimilars enhance their competitive standing against originator drugs.

- Regulatory Streamlining: Faster regulatory pathways for generics and biosimilars accelerate market entry and revenue generation for Viatris.

Government healthcare policies are a primary driver for Viatris. The company's strategy is heavily influenced by regulations concerning drug pricing, reimbursement, and approval pathways for generics and biosimilars. For instance, a growing number of nations are implementing measures to control healthcare spending, which could affect Viatris's profitability, especially in its established product lines.

Political stability and a nation's commitment to healthcare innovation directly impact Viatris's market access and product launch timelines. Countries that prioritize faster access to medicines often streamline regulatory processes, benefiting companies like Viatris. Conversely, political instability or shifting national priorities can delay approvals, hindering Viatris's commercialization efforts.

Intellectual property (IP) laws and their enforcement across different regions significantly shape Viatris's market strategies. Robust IP protection in developed markets is essential for Viatris to recoup its research and development investments, while weaker enforcement in emerging markets presents challenges with generic competition and the risk of counterfeiting.

Government initiatives promoting the use of generics and biosimilars are crucial for Viatris's business model. These policies, often driven by a desire to lower healthcare costs and improve patient access, directly boost demand for Viatris's offerings. For example, legislative efforts in the US and EU continue to streamline biosimilar approvals, creating a more favorable environment for Viatris's expansion in this sector.

| Political Factor | Impact on Viatris | 2024/2025 Data/Trend |

|---|---|---|

| Drug Pricing & Reimbursement Policies | Affects revenue streams and market access. | Many governments are actively seeking to reduce healthcare expenditure, potentially pressuring Viatris's pricing power. |

| Regulatory Approval Pathways | Influences speed of market entry and development costs. | Varying regulatory environments necessitate agile navigation, especially for biosimilar expansion. |

| Intellectual Property (IP) Protection | Impacts R&D investment returns and market exclusivity. | WIPO reported continued efforts to strengthen IP frameworks in 2024, but disparities persist. |

| Generic & Biosimilar Adoption Initiatives | Drives demand for Viatris's core products. | Policies encouraging generic prescribing and biosimilar usage are creating market opportunities. |

What is included in the product

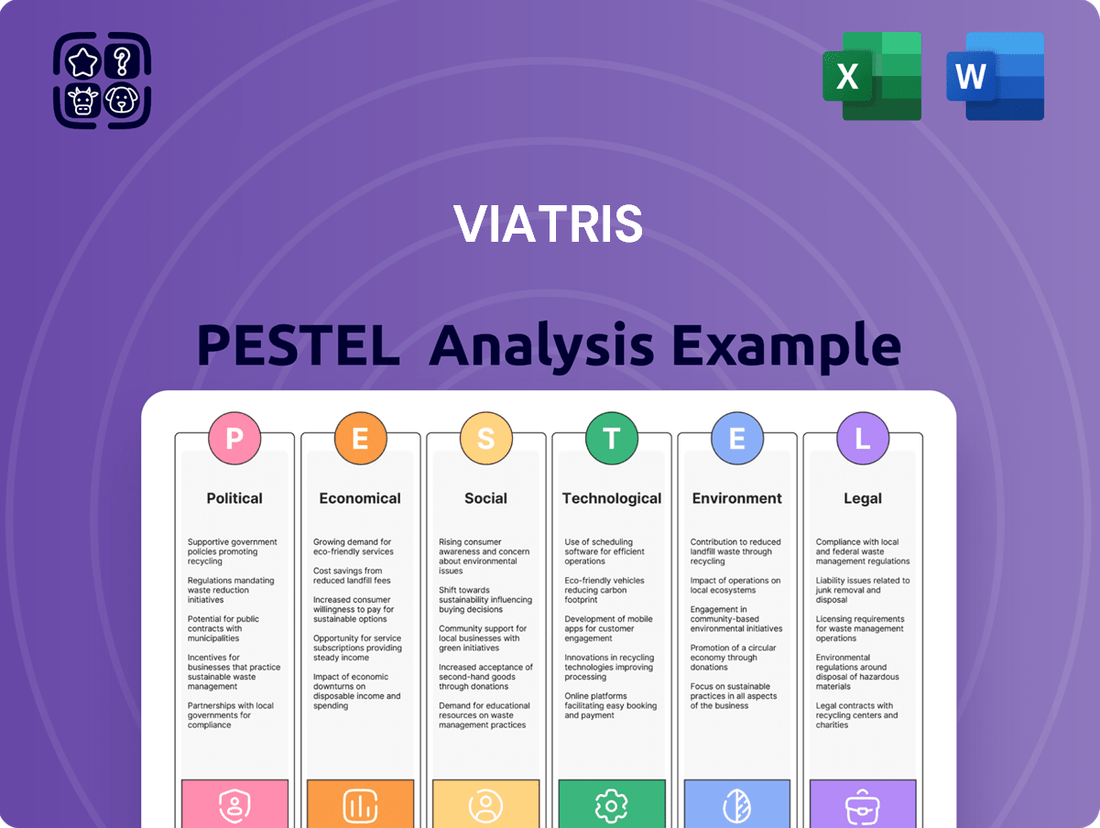

This PESTLE analysis provides a comprehensive evaluation of the external macro-environmental factors impacting Viatris, examining political, economic, social, technological, environmental, and legal influences.

It offers actionable insights for strategic decision-making, identifying potential threats and opportunities to inform Viatris's future business planning.

Provides a concise PESTLE analysis for Viatris, simplifying complex external factors into actionable insights for improved strategic planning and risk mitigation.

Economic factors

Global economic growth is a critical determinant for Viatris, directly influencing healthcare spending. As of early 2025, projections from the IMF suggest moderate global GDP growth, around 3.0%, but with increasing downside risks, particularly in developed economies. Slower growth or recessionary pressures can lead to reduced discretionary healthcare expenditure, as consumers and governments prioritize essential spending, potentially impacting Viatris's sales volumes and overall revenue.

Recessionary fears, especially in key markets like North America and Europe, could tighten household budgets, making consumers more sensitive to out-of-pocket healthcare costs. This might push patients towards lower-cost alternatives or delay elective treatments, thereby affecting demand for Viatris’s diverse product portfolio. For instance, a slowdown in countries with significant private healthcare markets could see a more pronounced impact on sales of non-essential or lifestyle medications.

Viatris's performance is therefore closely tied to the economic resilience of its operating regions. Countries experiencing robust GDP growth, such as several emerging markets anticipated to grow at over 5% in 2025, may offer more stable or even expanding healthcare markets. Conversely, economies facing contraction or high inflation, like some in Eastern Europe, could present challenges to affordability and market access for Viatris’s products.

Healthcare spending is a critical factor for Viatris. In 2024, global healthcare expenditure is projected to reach $10.1 trillion, a significant increase reflecting ongoing demand for medical services and pharmaceuticals. This trend directly impacts Viatris by influencing market size and revenue potential for its diverse product portfolio.

Reimbursement policies, particularly those set by major payers like Medicare and private insurers, heavily shape Viatris's pricing power and profitability. Changes in these policies, such as stricter formulary management or preferred drug lists, can alter market access and sales volumes. For example, shifts towards value-based care, where providers are reimbursed based on patient outcomes rather than service volume, necessitate pharmaceutical companies demonstrating the cost-effectiveness and clinical utility of their drugs, a key consideration for Viatris in its market strategies.

Global inflation significantly impacts Viatris's operational expenses. Rising prices for raw materials, active pharmaceutical ingredients (APIs), and manufacturing components directly increase production costs. For instance, the cost of certain chemical precursors saw double-digit percentage increases in 2023, affecting pharmaceutical production worldwide.

Transportation and logistics expenses, crucial for Viatris's global distribution network, have also climbed due to higher fuel prices and shipping rates. This surge in supply chain costs can put considerable pressure on Viatris's profit margins, especially for generic and biosimilar products where price sensitivity is high. Average global shipping costs for pharmaceutical goods experienced a notable rise of over 15% in late 2023 compared to the previous year.

To counter these escalating costs, Viatris may need to implement price adjustments on some of its product lines. This strategy, however, carries the risk of reduced sales volume and increased competition from lower-cost alternatives, particularly in markets with strict price controls.

Currency Exchange Rate Fluctuations

Viatris, with its extensive global footprint, is significantly impacted by currency exchange rate fluctuations. The volatility of currencies directly affects the value of its international revenues and expenses when translated back into its reporting currency. For instance, if the US dollar strengthens against other major currencies, Viatris's revenues earned in those foreign markets will translate into fewer dollars, potentially dampening reported earnings. This dynamic is crucial for understanding the company's true financial performance across its diverse operating regions.

Unfavorable currency movements can also erode the competitiveness of Viatris's products in various markets. When a company's home currency strengthens, its products can become more expensive for customers in countries with weaker currencies, potentially leading to decreased sales volume. Conversely, a weaker home currency can make its products more affordable abroad, boosting sales. This constant interplay between exchange rates and pricing strategies is a key consideration for Viatris's market penetration and profitability.

For example, during the first quarter of 2024, Viatris reported that foreign currency headwinds had a negative impact on its net sales. While specific figures vary quarter to quarter, this trend highlights the ongoing challenge. The company actively manages this risk through hedging strategies and operational adjustments, aiming to mitigate the financial impact of currency volatility.

- Global Revenue Translation: Fluctuations in exchange rates directly alter the dollar value of sales made in international markets, impacting Viatris's consolidated financial statements.

- Cost of Goods Sold: Expenses incurred in foreign currencies for manufacturing or raw materials can become more or less expensive in dollar terms depending on currency movements.

- Competitive Pricing: A strong US dollar can make Viatris's products pricier for international customers, potentially hurting sales volume and market share.

- Reported Earnings Impact: Unfavorable currency swings can lead to lower reported earnings per share, even if underlying operational performance remains strong.

Competitive Pricing Pressures

Viatris operates in highly competitive markets, especially within generics and biosimil segments. This intense rivalry puts significant pressure on pricing, forcing the company to constantly re-evaluate its strategies to maintain market share. For instance, in the U.S. generics market, price erosion can be substantial, with some products experiencing double-digit percentage declines within months of a competitor's entry.

The influence of bulk purchasers, such as pharmacy benefit managers (PBMs) and large hospital systems, further exacerbates these pricing pressures. These entities leverage their significant purchasing power to negotiate lower prices, directly impacting Viatris's revenue streams. Successfully navigating this landscape requires Viatris to focus on operational efficiencies and product differentiation where possible.

- Price Erosion: Generic drug prices in the US have historically seen rapid declines, with some estimates suggesting average price drops of over 15% in the first year of generic competition.

- Biosimilar Competition: The growing biosimilar market presents similar pricing challenges, as these products are designed to be more affordable alternatives to originator biologics.

- Purchasing Power: Large payers and pharmacy benefit managers often secure significant discounts, impacting the net price Viatris receives for its products.

- Cost Management: To counteract pricing pressures, Viatris must maintain stringent cost controls throughout its manufacturing and supply chain operations.

Economic growth directly influences Viatris's revenue potential, with global GDP growth projected around 3.0% in early 2025, though with increasing downside risks. Recessions can reduce healthcare spending, pushing consumers towards cheaper alternatives, impacting Viatris's sales, especially for non-essential medications. Emerging markets with over 5% GDP growth in 2025 offer more stable markets compared to economies facing contraction or high inflation.

Global inflation significantly increases Viatris's production and logistics costs, with raw material and shipping expenses rising notably. For example, average global shipping costs for pharmaceuticals saw over a 15% increase in late 2023. This can pressure profit margins, particularly for generics, potentially leading to price adjustments that risk sales volume and market share.

Currency fluctuations materially impact Viatris's reported earnings, as revenues from international markets translate differently based on exchange rates. For instance, a strengthening US dollar can reduce the dollar value of foreign sales. Viatris actively manages this risk through hedging, but headwinds were reported in early 2024, highlighting the ongoing challenge.

Viatris faces intense competition, especially in generics and biosimil markets, leading to significant price erosion. Some U.S. generics have experienced double-digit percentage price declines shortly after competitor entry. Powerful buyers like PBMs further negotiate lower prices, necessitating Viatris's focus on operational efficiency and product differentiation to maintain market share.

What You See Is What You Get

Viatris PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Viatris PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the global pharmaceutical company. Understand the external forces shaping Viatris's strategic landscape, from regulatory changes and economic fluctuations to evolving healthcare trends and technological advancements. This detailed report provides actionable insights for navigating these complexities.

Sociological factors

The world's population is getting older, and with that comes a greater need for healthcare. By 2050, it's projected that nearly 1 in 6 people globally will be over age 65, a significant jump from 1 in 11 in 2019. This demographic shift directly fuels demand for Viatris's products, as older individuals often manage multiple chronic conditions.

Chronic diseases like cardiovascular issues, diabetes, and respiratory illnesses are on the rise worldwide. This growing burden of long-term health conditions creates a sustained and consistent market for Viatris's wide range of medicines, including both established branded drugs and more affordable generic and biosimilar options. For example, the global prevalence of diabetes alone was estimated to affect 537 million adults in 2021, a number expected to climb.

Increased public health awareness, fueled by widespread campaigns and accessible patient education, directly boosts demand for Viatris's diverse treatment portfolio. For instance, a greater understanding of chronic conditions like diabetes or cardiovascular disease encourages proactive health management, leading more individuals to seek and adhere to prescribed therapies. This heightened awareness translates into improved patient compliance, a critical factor for Viatris as it supports long-term treatment regimens.

The positive correlation between patient understanding and adherence significantly influences product uptake and market growth. When patients are better informed about their conditions and the benefits of their medications, they are more likely to follow treatment plans consistently. This improved compliance not only leads to better health outcomes but also solidifies Viatris's position in markets where adherence is paramount for sustained sales and market share. For example, in 2024, Viatris reported a strong performance in its established markets, partly attributed to its ongoing patient support programs.

Societal demands for fair healthcare access and affordable medications are growing, directly supporting Viatris's core mission. This trend is evident in initiatives like the World Health Organization's push to strengthen primary healthcare systems, aiming for universal health coverage by 2030, a goal that resonates with Viatris's commitment to making medicines more accessible.

However, significant healthcare access disparities persist globally. For instance, in 2023, the World Bank reported that nearly 600 million people still spend at least 10% of their household income on healthcare. These disparities create complex challenges for Viatris's global operations, requiring tailored strategies for diverse markets.

Conversely, these inequities also represent substantial opportunities. Viatris's established portfolio of complex generics and biosimilars positions it to address unmet needs in underserved populations. By focusing on markets with high out-of-pocket healthcare spending, such as parts of Southeast Asia and Africa, Viatris can expand its reach while fulfilling its social responsibility.

Lifestyle Changes and Disease Patterns

Global lifestyles are undergoing significant shifts, with increasing urbanization and sedentary habits contributing to a rise in non-communicable diseases (NCDs). For instance, the World Health Organization reported in 2023 that NCDs, such as cardiovascular diseases, cancer, diabetes, and chronic respiratory diseases, account for 74% of all deaths worldwide. This trend directly impacts therapeutic needs, creating a growing demand for treatments addressing these prevalent conditions.

Viatris is well-positioned to capitalize on these evolving disease patterns. The company’s diverse portfolio already includes treatments for many NCDs, and ongoing research and development efforts are focused on expanding this offering. By aligning its product pipeline with the increasing prevalence of lifestyle-related illnesses, Viatris can effectively meet emerging market demands.

- Rising NCD Burden: Lifestyle changes, including poor diet and lack of physical activity, are driving a global increase in NCDs, which constituted 74% of global deaths in 2023.

- Therapeutic Opportunities: This demographic shift creates significant market opportunities for pharmaceutical companies like Viatris that offer treatments for conditions like diabetes, heart disease, and respiratory ailments.

- Pipeline Alignment: Viatris's strategic focus on expanding its portfolio of treatments for chronic diseases directly addresses these growing therapeutic needs.

Public Perception of Pharmaceutical Companies

Public trust in pharmaceutical companies significantly impacts Viatris's brand and product acceptance. Concerns over drug pricing, such as the average increase of 7.4% for brand-name drugs observed in early 2024, can erode this trust. Viatris's commitment to corporate social responsibility and ethical conduct, including transparent communication about its pricing strategies and community engagement initiatives, is crucial for mitigating negative perceptions and fostering consumer loyalty.

Negative public sentiment can lead to increased regulatory scrutiny and pressure for price controls, directly affecting Viatris's market position. For instance, in 2023, several legislative proposals aimed at capping prescription drug costs were debated, reflecting public demand for affordability. Proactive engagement, such as Viatris's efforts in patient assistance programs and partnerships with healthcare providers, can help build a more positive image. These actions demonstrate a commitment beyond profit, aligning with societal expectations for accessible healthcare solutions.

Key aspects influencing public perception include:

- Drug Pricing Transparency: Public demand for clear explanations of drug costs and the value they provide.

- Corporate Social Responsibility (CSR): The industry's perceived commitment to societal well-being, environmental sustainability, and ethical business practices.

- Ethical Practices: Public scrutiny of marketing, research, and manufacturing standards, particularly concerning patient safety and access.

- Community Engagement: The extent to which companies like Viatris invest in and support the communities they serve through health initiatives and accessible medication programs.

Societal expectations for equitable healthcare access and affordable medications are growing, aligning with Viatris's mission to improve health for all. Despite efforts like the WHO's push for universal health coverage by 2030, significant disparities persist; in 2023, the World Bank noted nearly 600 million people spend over 10% of their income on healthcare. These inequities present both challenges and opportunities, with Viatris's generics and biosimilars poised to serve underserved populations in markets like Southeast Asia and Africa.

Technological factors

Technological advancements are significantly reshaping drug discovery and development. Cutting-edge technologies like AI-driven compound screening, genomics, and advanced bioinformatics are accelerating the identification of novel drug candidates and streamlining the development of biosimilars. For Viatris, embracing these innovations is crucial for enhancing its research and development pipeline and driving product innovation.

Viatris can leverage AI to analyze vast datasets, predict drug efficacy, and optimize clinical trial designs, potentially reducing R&D costs and timelines. The company's focus on biosimilars, in particular, benefits from genomic sequencing and bioinformatics to ensure product comparability and efficacy. By integrating these technologies, Viatris aims to bring more effective treatments to market faster, a critical factor in remaining competitive in the evolving pharmaceutical landscape.

Technological advancements are significantly reshaping biosimilar and generic drug manufacturing. Innovations in process analytical technology (PAT) and continuous manufacturing are enhancing production efficiencies and ensuring consistent quality for complex biosimilars. For instance, advancements in single-use bioreactors and advanced chromatography techniques are making biosimilar production more scalable and cost-effective.

These improvements directly impact Viatris by enabling reduced manufacturing costs and improved quality control. Automation in filling, packaging, and quality testing lines can lead to higher throughput and fewer errors. By adopting these technologies, Viatris can enhance its operational scalability, allowing it to meet growing global demand for affordable medicines more effectively.

The global market for biosimilars is projected to reach over $70 billion by 2026, highlighting the importance of efficient manufacturing. Similarly, the generic drug market continues to expand, with technological upgrades being crucial for maintaining competitiveness. Viatris's investment in these areas can solidify its position as a leading provider of accessible medicines.

The growing integration of digital health and telemedicine is reshaping patient care and pharmaceutical delivery. Viatris can capitalize on this trend by enhancing patient engagement and adherence through remote monitoring solutions and virtual consultations. For instance, the global telemedicine market was valued at approximately $125 billion in 2023 and is projected to grow significantly, presenting opportunities for Viatris to expand its digital offerings and improve patient access to its medications and support services.

Data Analytics and AI in Operations

Viatris is increasingly leveraging data analytics and artificial intelligence to sharpen its operational edge. In 2024, the company continued to invest in AI-driven demand forecasting to mitigate inventory risks and optimize production schedules, a critical factor in the pharmaceutical sector's complex supply chains. This focus aims to improve on-time delivery rates and reduce waste, directly impacting Viatris's bottom line.

The application of AI extends to enhancing marketing strategies by identifying patient populations and physician prescribing patterns. By analyzing vast datasets, Viatris can tailor its outreach efforts more effectively, leading to improved market penetration for its diverse portfolio of medicines. This data-centric approach is vital for navigating competitive landscapes and ensuring product uptake.

Operational efficiency gains are a primary driver for these technological adoptions. Insights derived from advanced analytics help in streamlining Viatris's global manufacturing and distribution networks. For instance, predictive maintenance models for manufacturing equipment are being explored to minimize downtime and ensure consistent product quality, a cornerstone of pharmaceutical operations.

- Supply Chain Optimization: AI algorithms are being deployed to predict supply chain disruptions and optimize logistics routes, aiming for a 5-10% reduction in transportation costs by late 2024.

- Demand Forecasting Accuracy: Enhanced predictive models are projected to improve demand forecasting accuracy by up to 15% in key therapeutic areas, minimizing stockouts and overstock situations.

- Marketing Personalization: Data analytics allows for more targeted marketing campaigns, with early results showing a potential 20% uplift in engagement rates with healthcare professionals.

- Operational Efficiency: AI-powered process automation is being piloted in administrative functions, targeting a 10% increase in departmental efficiency by the end of 2025.

Cybersecurity and Data Protection

The pharmaceutical industry, including Viatris, faces escalating cybersecurity threats. Protecting sensitive patient health information (PHI) and proprietary research data is paramount. A data breach could lead to severe reputational damage, regulatory fines, and loss of customer trust. For instance, the healthcare sector experienced a significant rise in ransomware attacks, with costs estimated to reach billions globally in the coming years.

Viatris must invest heavily in advanced cybersecurity solutions to safeguard its operations. This includes implementing multi-factor authentication, regular security awareness training for employees, and robust data encryption protocols. Compliance with evolving data privacy regulations, such as GDPR and HIPAA, is not just a legal requirement but a fundamental aspect of maintaining operational integrity and patient confidence.

Technological advancements also present opportunities for enhanced data protection. Viatris can leverage AI-powered threat detection systems and blockchain technology for secure data management. The global cybersecurity market size was projected to exceed $300 billion in 2024, reflecting the growing industry focus on these critical areas.

- Increased cyber threats targeting healthcare data.

- Need for robust protection of patient health information and intellectual property.

- Compliance with stringent data privacy regulations like GDPR and HIPAA is essential.

- Investment in advanced cybersecurity measures and employee training is critical for operational integrity.

Viatris is actively integrating AI and machine learning to refine its R&D processes, aiming to accelerate drug discovery and the development of biosimilars. By leveraging these technologies, the company can analyze vast datasets for predictive efficacy and optimize clinical trials, potentially reducing development costs and timelines. For example, AI-driven compound screening can identify promising drug candidates more efficiently than traditional methods, a key advantage in a competitive market.

Manufacturing efficiency is being boosted through advancements like process analytical technology (PAT) and continuous manufacturing, which are crucial for producing complex biosimilars cost-effectively. Viatris benefits from these innovations by lowering production expenses and enhancing quality control. Automation in packaging and quality testing also contributes to higher throughput and fewer errors, supporting scalability to meet global demand for affordable medicines.

The rise of digital health and telemedicine presents Viatris with opportunities to improve patient engagement and medication adherence through remote monitoring and virtual support. With the global telemedicine market valued at approximately $125 billion in 2023, expanding digital offerings can enhance patient access to Viatris's products and services.

Viatris is focusing on AI for demand forecasting and supply chain optimization, which in 2024 aimed for a 5-10% reduction in transportation costs. Enhanced predictive models are expected to improve demand forecasting accuracy by up to 15%, minimizing stockouts. Furthermore, data analytics is enabling more personalized marketing campaigns, with early results indicating a potential 20% uplift in engagement rates with healthcare professionals.

| Technology Area | Viatris's Application | Projected Impact/Benefit |

|---|---|---|

| AI & Machine Learning | Drug discovery, biosimilar development, demand forecasting, marketing personalization | Accelerated R&D, reduced costs, improved supply chain efficiency (e.g., 15% demand accuracy increase), enhanced marketing engagement (e.g., 20% uplift) |

| Process Analytical Technology (PAT) & Continuous Manufacturing | Biosimilar and generic drug production | Increased manufacturing efficiency, improved quality control, reduced production costs |

| Digital Health & Telemedicine | Patient engagement, medication adherence, expanded service offerings | Improved patient access, enhanced support services |

| Cybersecurity | Data protection, intellectual property security, regulatory compliance | Mitigation of data breach risks, maintenance of patient trust, operational integrity |

Legal factors

Viatris operates within a highly regulated pharmaceutical landscape, requiring adherence to stringent global approval processes. Navigating the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and numerous other national health authorities is a critical and complex undertaking. The company must consistently demonstrate product safety and efficacy through rigorous clinical trials and comprehensive documentation, a process that can take years and significant investment.

Beyond initial approval, Viatris faces ongoing compliance demands for manufacturing standards, often referred to as Good Manufacturing Practices (GMP). This includes meticulous oversight of production facilities, quality control measures, and supply chain integrity. Failure to maintain these standards can result in product recalls, fines, and severe damage to reputation. For instance, in 2023, the pharmaceutical industry saw numerous recalls due to manufacturing quality issues, highlighting the constant vigilance required.

Post-market surveillance is another crucial legal factor, obligating Viatris to monitor its products for adverse events and unexpected side effects once they are available to patients. This involves robust pharmacovigilance systems and the timely reporting of any safety concerns to regulatory bodies. The company’s ability to adapt to evolving regulatory requirements and maintain compliance directly impacts its market access and long-term viability.

Intellectual property and patent laws are critical for Viatris, especially concerning the expiration of patents on its branded drugs. As patents lapse, generic and biosimilar competitors can enter the market, significantly impacting revenue. For instance, the patent cliff for blockbuster drugs is a recurring challenge across the pharmaceutical industry, and Viatris must navigate this by having robust strategies for both defending existing IP and developing new ones.

The legal landscape surrounding biosimilar development presents both challenges and opportunities. Viatris is actively involved in this space, but the legal frameworks governing biosimilar approvals and market exclusivity can be complex and vary by region. Successfully bringing biosimilars to market requires careful attention to patent litigation and regulatory pathways, influencing Viatris's competitive positioning and its ability to capture market share from originator products.

Patent litigation is an inherent part of the pharmaceutical business, and Viatris frequently engages in or faces such disputes. These legal battles can delay or prevent market entry for generic and biosimilar versions of its products, or conversely, challenge Viatris's own IP. A strong intellectual property strategy, including proactive patent filing and defense, is therefore essential for maintaining market exclusivity and ensuring Viatris’s long-term profitability and competitive advantage.

Antitrust and competition regulations significantly shape Viatris's operations. For instance, the Federal Trade Commission (FTC) in the United States actively scrutinizes pharmaceutical mergers and acquisitions to prevent undue market concentration. In 2023, the FTC continued its robust enforcement of antitrust laws, reviewing numerous transactions within the healthcare sector, which could impact Viatris's strategic growth initiatives.

These regulations directly influence Viatris's pricing strategies for its wide range of generic and specialty medicines. Authorities are keen to ensure fair competition, preventing practices that could stifle innovation or lead to exorbitant drug costs for consumers. For example, investigations into alleged pay-for-delay agreements in the pharmaceutical industry highlight the legal risks associated with market exclusivity strategies.

Viatris must navigate varying antitrust landscapes across its global markets. The European Commission, for example, also maintains strict oversight on competition within the pharmaceutical sector, assessing potential impacts of mergers and pricing on market dynamics. Their focus on preventing abuse of dominant market positions means Viatris must continually demonstrate that its business practices foster, rather than hinder, fair competition.

Product Liability and Safety Regulations

Viatris, like all pharmaceutical companies, faces significant legal risks stemming from product liability. This includes the potential for lawsuits arising from adverse drug reactions or alleged manufacturing defects. For instance, in 2023, the pharmaceutical industry continued to see substantial settlements related to product liability claims, with some major players allocating billions to address ongoing litigation concerning older drugs and opioid-related issues. Viatris must navigate these risks by maintaining rigorous quality control and robust pharmacovigilance systems.

The company operates under strict safety regulations and reporting requirements imposed by global health authorities like the FDA in the United States and the EMA in Europe. These regulations mandate comprehensive testing, post-market surveillance, and prompt reporting of any safety concerns or adverse events. Failure to comply can result in severe penalties, product recalls, and damage to reputation. For example, in 2024, regulatory bodies have increased scrutiny on manufacturing practices, leading to more frequent inspections and stricter enforcement actions against non-compliant facilities.

- Product Liability Exposure: Lawsuits can arise from patient harm due to medication side effects or manufacturing flaws, impacting Viatris's financial health and operational stability.

- Stringent Regulatory Compliance: Adherence to global pharmaceutical safety standards, including Good Manufacturing Practices (GMP) and pharmacovigilance, is critical for minimizing legal and financial repercussions.

- Reporting Obligations: Viatris must meticulously report adverse drug reactions and any product quality issues to regulatory agencies, with penalties for delays or omissions.

- Evolving Legal Landscape: The legal framework surrounding pharmaceuticals is dynamic, requiring continuous adaptation to new regulations and judicial interpretations concerning drug safety and efficacy.

Data Privacy and Healthcare Information Laws

Viatris must navigate a complex web of data privacy and healthcare information laws globally. Regulations like the General Data Protection Regulation (GDPR) in Europe and the Health Insurance Portability and Accountability Act (HIPAA) in the United States dictate how the company handles sensitive patient and commercial data. Strict adherence is crucial not only to avoid substantial financial penalties, which can reach millions of dollars, but also to preserve the critical trust of patients and healthcare providers in Viatris's operations worldwide.

Non-compliance carries significant risks. For instance, GDPR fines can amount to up to 4% of annual global turnover or €20 million, whichever is higher. HIPAA violations can result in penalties ranging from $100 to $50,000 per violation, with annual caps. These legal frameworks impact Viatris's data collection, storage, processing, and sharing practices, affecting everything from clinical trial data to marketing insights.

- GDPR Fines: Up to 4% of global annual turnover or €20 million.

- HIPAA Penalties: Ranging from $100 to $50,000 per violation, with annual maximums.

- Impact on Operations: Affects data handling in clinical trials, marketing, and patient support programs.

- Reputational Risk: Data breaches can severely damage patient trust and brand image.

Viatris navigates a complex legal environment shaped by stringent pharmaceutical regulations, patent laws, and antitrust considerations. Compliance with global health authorities like the FDA and EMA is paramount, encompassing everything from product approval and manufacturing standards (GMP) to ongoing pharmacovigilance and adverse event reporting. The company must also manage intellectual property challenges, including patent expirations and biosimilar competition, while adhering to antitrust laws that prevent market concentration and ensure fair pricing. Product liability exposure remains a significant risk, necessitating robust quality control and safety monitoring systems to mitigate potential lawsuits and regulatory penalties.

| Legal Factor | Key Aspects | Impact on Viatris | Examples/Data (2023-2025) |

| Regulatory Compliance | FDA, EMA approvals, GMP, pharmacovigilance | Market access, product lifecycle management, operational costs | Increased scrutiny on manufacturing in 2024; potential for fines and recalls for non-compliance. |

| Intellectual Property | Patent protection, patent cliffs, biosimilar litigation | Revenue streams, market exclusivity, R&D investment strategy | Ongoing patent litigation is common; patent expirations can lead to significant revenue drops for specific products. |

| Antitrust & Competition | Merger reviews, pricing regulations, market dominance | Growth strategies, market positioning, pricing flexibility | FTC and European Commission actively review healthcare transactions; focus on preventing anti-competitive practices. |

| Product Liability | Adverse events, manufacturing defects, litigation | Financial exposure, reputational damage, insurance costs | Pharmaceutical industry saw billions in settlements for product liability in 2023, highlighting ongoing risk. |

| Data Privacy | GDPR, HIPAA compliance | Data handling protocols, operational costs, reputational risk | GDPR fines can reach 4% of global turnover; HIPAA penalties vary by violation type. |

Environmental factors

Viatris is actively pursuing sustainable manufacturing and operations to shrink its environmental impact. This includes initiatives focused on enhancing energy efficiency across its global facilities, implementing water conservation measures, and driving significant waste reduction. For instance, in 2023, Viatris reported a 15% reduction in greenhouse gas emissions compared to its 2020 baseline, showcasing tangible progress in its environmental stewardship.

These eco-friendly practices are not just about corporate responsibility; they directly contribute to long-term cost savings. By optimizing energy consumption and minimizing waste, Viatris can lower operational expenses, leading to improved profitability. This strategic approach aligns with the company's commitment to achieving its corporate responsibility goals while also bolstering its financial resilience.

Viatris navigates stringent environmental regulations concerning pharmaceutical waste disposal and emissions control. The company prioritizes compliant waste management, including the safe handling and disposal of hazardous materials generated during drug manufacturing to minimize ecological impact. In 2023, Viatris reported achieving a 92% waste diversion rate from landfills across its global operations, demonstrating a commitment to sustainable practices.

Control of air and water pollution from Viatris' manufacturing sites is paramount. The company invests in advanced pollution abatement technologies to meet or exceed regulatory standards for emissions and wastewater discharge. For instance, Viatris' facilities in 2024 are implementing upgraded wastewater treatment systems, aiming for a further 15% reduction in chemical oxygen demand (COD) in their effluent by the end of the year.

Climate change poses a significant threat to Viatris's global supply chain. Extreme weather events like hurricanes, floods, and droughts can disrupt the sourcing of raw materials, particularly those derived from agriculture, and impede the transportation of finished products. For instance, a severe drought in a key agricultural region could impact the availability and cost of active pharmaceutical ingredients (APIs) that Viatris relies on.

The increasing frequency and intensity of these events necessitate robust, resilient supply chain strategies. Viatris must invest in diversifying its supplier base and transportation routes to mitigate the impact of localized disruptions. Developing contingency plans for alternative sourcing and logistics is crucial to ensure continued product availability for patients worldwide.

Resource Scarcity and Circular Economy Initiatives

Viatris faces increasing pressure from resource scarcity, particularly concerning specialized chemicals vital for pharmaceutical production and water for manufacturing processes. The company is actively exploring circular economy principles to mitigate these risks. For instance, in 2024, Viatris reported a 5% reduction in water consumption across its key manufacturing sites through enhanced recycling and reuse programs.

These initiatives are crucial for operational sustainability and can lead to significant cost efficiencies. By focusing on recycling and reusing materials, Viatris aims to reduce its reliance on virgin resources, thereby buffering against price volatility and supply chain disruptions. This strategic approach to resource management directly impacts the bottom line, contributing to a more resilient and cost-effective business model.

- Water Usage Reduction: Viatris's focus on water recycling in 2024 reduced consumption by 5% at major facilities.

- Chemical Sourcing Strategies: Evaluating alternative and more sustainable chemical suppliers is a key priority for 2025 to address potential scarcity.

- Waste Material Repurposing: The company is investing in technologies to repurpose manufacturing by-products, aiming for a 10% increase in recycled material content in packaging by the end of 2025.

ESG Reporting and Investor Pressure

Viatris is experiencing significant pressure from investors and stakeholders demanding more robust Environmental, Social, and Governance (ESG) reporting. This trend highlights how crucial a company's environmental footprint and its transparency in disclosing this information have become in attracting capital and bolstering its public image.

For Viatris, demonstrating strong environmental performance is no longer just a compliance issue; it's a strategic imperative. Investors are increasingly scrutinizing companies' sustainability practices, and those with clear, data-backed ESG reports are better positioned to secure investment. For instance, as of early 2025, a growing number of institutional investors are integrating ESG scores into their due diligence processes, with some actively divesting from companies that fall short on environmental metrics.

- Growing Investor Demand: Many large asset managers, including BlackRock and Vanguard, have publicly stated their commitment to ESG investing, influencing portfolio allocations.

- Reputational Impact: Strong ESG reporting can enhance Viatris's brand reputation, making it more attractive to customers, employees, and partners.

- Regulatory Scrutiny: Evolving regulations globally, such as those in the EU, are mandating more detailed environmental disclosures, which Viatris must address.

- Risk Mitigation: Proactive environmental management and transparent reporting can help Viatris mitigate operational and regulatory risks associated with climate change and pollution.

Viatris is actively reducing its environmental footprint through enhanced energy efficiency and waste minimization programs. The company reported a 15% decrease in greenhouse gas emissions by 2023 compared to a 2020 baseline, demonstrating commitment to sustainability.

Stringent regulations govern pharmaceutical waste disposal and emissions control, areas Viatris prioritizes for compliance and minimal ecological impact. In 2023, 92% of waste was diverted from landfills across its global operations, reflecting effective waste management strategies.

Climate change presents supply chain risks, necessitating resilient strategies to mitigate disruptions from extreme weather events impacting raw material sourcing and product transportation. Viatris is also addressing resource scarcity by exploring circular economy principles, achieving a 5% water consumption reduction at key manufacturing sites in 2024.

| Environmental Factor | Viatris Initiatives/Data (2023-2025) | Impact/Significance |

|---|---|---|

| Greenhouse Gas Emissions | 15% reduction by 2023 (vs. 2020 baseline) | Lower operational costs, improved environmental stewardship |

| Waste Diversion | 92% diversion rate from landfills (2023) | Reduced environmental impact, efficient resource management |

| Water Consumption | 5% reduction at key sites (2024) | Mitigates resource scarcity risks, enhances operational sustainability |

| Pollution Control | Upgraded wastewater treatment systems (2024) | Meets regulatory standards, minimizes ecological impact |

PESTLE Analysis Data Sources

Our Viatris PESTLE analysis is informed by a comprehensive blend of data, including reports from major pharmaceutical industry associations, global health organizations like the WHO, and economic indicators from entities such as the IMF and World Bank. We also incorporate regulatory updates from key government health agencies and market research from leading healthcare analytics firms.