Viatris Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Viatris Bundle

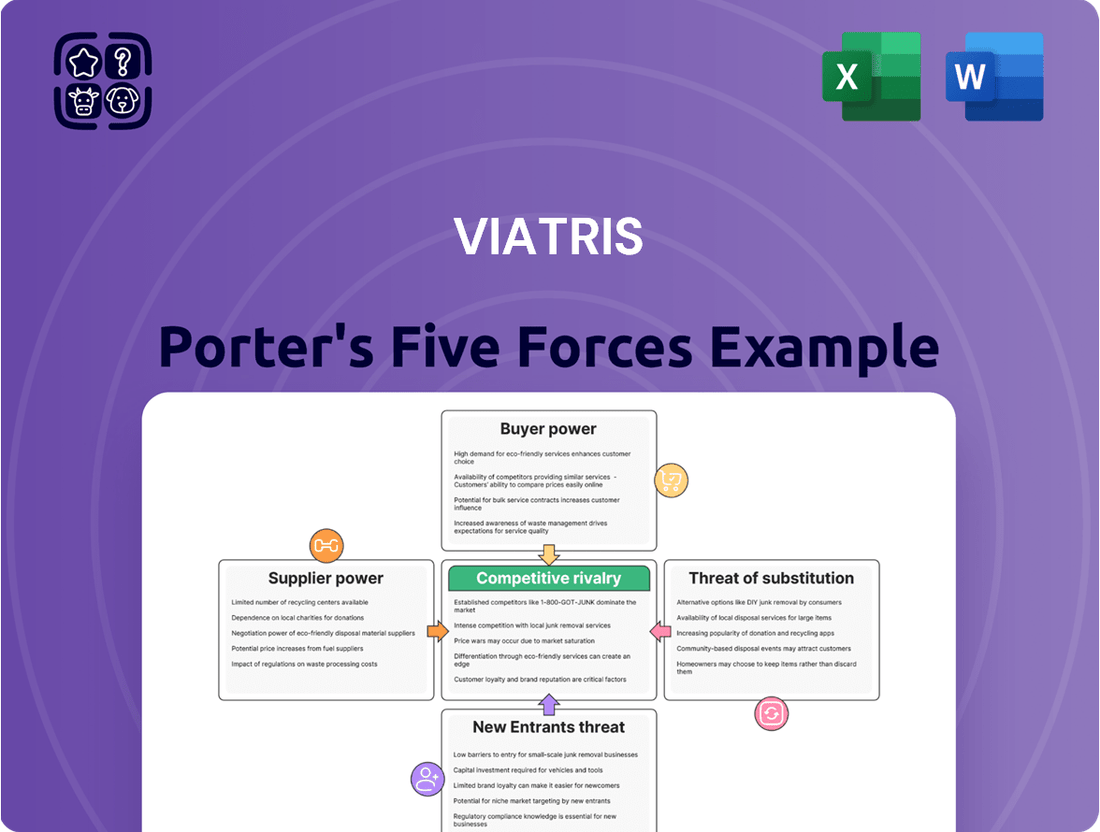

A Porter's Five Forces analysis for Viatris reveals a complex pharmaceutical landscape. Understanding the bargaining power of buyers and suppliers, the threat of new entrants, the intensity of rivalry among existing competitors, and the ever-present threat of substitutes is crucial for Viatris's strategic planning. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Viatris’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Viatris relies on a diverse global network for its critical raw materials and active pharmaceutical ingredients (APIs). However, for highly specialized APIs or unique drug formulations, the number of qualified suppliers can be considerably limited. For instance, certain complex generics or biosimil components may only be produced by a handful of specialized manufacturers worldwide. This concentration means these specialized suppliers can wield significant bargaining power, potentially influencing pricing and ensuring a stable supply chain for Viatris.

Viatris faces substantial switching costs when changing suppliers for its pharmaceutical ingredients and manufacturing components. These costs include rigorous re-qualification processes, which can take months, and obtaining new regulatory approvals from bodies like the FDA for each ingredient from a new source. For instance, a delay in a key active pharmaceutical ingredient (API) supplier’s approval could halt production lines, impacting Viatris’s ability to meet demand for critical medications.

The complexity of integrating a new supplier into Viatris’s established supply chain is considerable. This involves extensive testing, quality control validation, and ensuring seamless integration with existing manufacturing processes. Given the highly regulated nature of the pharmaceutical industry, any disruption can be costly, potentially leading to production stoppages and lost revenue. In 2023, Viatris reported significant investments in its supply chain infrastructure, highlighting the importance of stable, approved supplier relationships.

The threat of supplier forward integration for Viatris is a significant factor in assessing supplier bargaining power. If Viatris's key suppliers, such as active pharmaceutical ingredient (API) manufacturers or excipient providers, were to move into producing finished dosage forms or even engaging in direct distribution, their leverage over Viatris would substantially increase. This would allow them to capture more of the value chain and potentially compete directly with Viatris.

Considering the pharmaceutical industry's complex regulatory landscape and high capital investment for manufacturing and distribution, a complete forward integration by Viatris's suppliers is generally considered a low to moderate threat. However, niche suppliers with specialized APIs might possess the capability for limited forward integration, particularly in developing generic or biosimilar versions of their own products.

For instance, if a supplier of a critical, complex API used in a blockbuster Viatris drug were to develop the capacity to manufacture the final drug product themselves, they could dictate terms more forcefully or even withdraw supply to pursue their own market entry. This scenario would significantly disrupt Viatris's operations and profitability, underscoring the importance of maintaining strong supplier relationships and exploring alternative sourcing strategies.

Importance of Viatris to Suppliers

The bargaining power of suppliers for Viatris hinges significantly on how much of their business Viatris represents. If Viatris is a major client, accounting for a substantial percentage of a supplier's annual revenue, Viatris naturally gains leverage in negotiations over pricing and terms. Conversely, if Viatris is a smaller customer for a supplier, that supplier might hold more sway, potentially dictating higher prices or less favorable contract conditions.

Considering Viatris's global scale and diverse product portfolio, it's likely that many of its key suppliers, particularly those providing active pharmaceutical ingredients (APIs) or specialized manufacturing components, depend on Viatris for a notable portion of their sales. For instance, a supplier of a niche API crucial for a Viatris blockbuster drug would find themselves in a weaker bargaining position if Viatris is their primary customer for that specific ingredient. In 2023, Viatris reported total revenues of approximately $13.8 billion, indicating a significant purchasing volume that would be attractive to many suppliers.

- Supplier Dependency: The degree to which Viatris's volume constitutes a significant portion of a supplier's overall revenue directly influences supplier bargaining power.

- Viatris's Purchasing Power: Viatris's $13.8 billion in revenue for 2023 suggests it can command favorable terms from suppliers who rely on its business.

- API Sourcing: For suppliers of critical active pharmaceutical ingredients, Viatris's substantial demand can reduce their ability to dictate terms.

- Specialized Inputs: Suppliers of highly specialized or unique components may have more leverage if Viatris has limited alternative sources.

Availability of Substitute Inputs

The availability of substitute inputs significantly impacts the bargaining power of suppliers for Viatris. If Viatris can readily access alternative raw materials or employ different manufacturing processes, suppliers' ability to dictate terms weakens. For instance, if a key active pharmaceutical ingredient (API) has multiple viable sources or if a generic drug manufacturer can switch to a different, equally effective API, the supplier of the original API faces reduced leverage.

In 2023, the pharmaceutical industry saw continued innovation in drug delivery systems and API sourcing. Companies like Viatris, with a broad portfolio, are often positioned to explore diverse supply chains. The ease and cost of transitioning to substitute inputs are crucial; if switching requires substantial investment in new equipment or regulatory hurdles, suppliers retain more power. Viatris's strategic sourcing and vertical integration efforts aim to mitigate this dependency.

- Substitutability of APIs: Viatris's ability to source APIs from multiple qualified suppliers or to develop in-house manufacturing capabilities for key components directly curbs supplier power.

- Alternative Manufacturing Processes: The existence of alternative synthesis routes or formulation technologies that bypass reliance on a single supplier's specialized input reduces supplier leverage.

- Cost of Switching: High switching costs, such as revalidation of processes or significant capital expenditure for new equipment, can limit Viatris's ability to switch, thereby strengthening supplier power.

- Regulatory Landscape: Changes in regulatory approvals for alternative inputs or manufacturing methods can either enhance or diminish the viability of substitutes, influencing supplier bargaining power.

The bargaining power of Viatris's suppliers is moderate, influenced by the availability of substitutes and the concentration of specialized input providers. While Viatris’s large scale provides some leverage, the critical nature and limited sources for certain active pharmaceutical ingredients (APIs) can empower specific suppliers. Switching costs and regulatory hurdles further solidify the position of established suppliers.

Viatris's substantial revenue, $13.8 billion in 2023, makes it a significant customer for many suppliers, potentially reducing their ability to dictate terms. However, suppliers of highly specialized APIs, for which Viatris may have few alternatives, can command greater influence. The threat of forward integration by suppliers remains a factor, particularly for niche input providers.

| Factor | Impact on Supplier Bargaining Power | Viatris Context |

| Availability of Substitute Inputs | Lowers Power | Viatris actively seeks diverse sourcing and alternative processes. |

| Supplier Concentration for Specialized Inputs | Raises Power | Limited qualified suppliers for complex APIs grant them leverage. |

| Switching Costs | Raises Power | Rigorous re-qualification and regulatory approvals make supplier changes costly and time-consuming. |

| Viatris's Contribution to Supplier Revenue | Lowers Power | Viatris's $13.8 billion revenue in 2023 indicates significant purchasing volume, increasing its negotiation leverage with many suppliers. |

| Threat of Forward Integration | Raises Power (potentially) | Niche API suppliers could integrate forward into finished drug products, increasing their leverage. |

What is included in the product

Analyzes the competitive intensity within the pharmaceutical industry, focusing on Viatris's position relative to rivals, buyer and supplier power, and the threat of new entrants and substitutes.

Effortlessly assess competitive intensity across the industry spectrum, from buyer power to substitutes, to identify Viatris' strategic vulnerabilities and opportunities.

Customers Bargaining Power

Viatris's customer base is notably concentrated, with large pharmacy chains, major wholesalers, hospital networks, and government health systems representing significant sales channels. This concentration means that a few key customers can account for a substantial portion of Viatris's overall revenue, directly impacting their bargaining leverage. For instance, in 2023, Viatris reported that its top five customers accounted for approximately 30% of its total net sales, underscoring the considerable influence these entities wield.

The substantial volume purchased by these large customers further amplifies their bargaining power. When these entities procure medicines in massive quantities, they have the leverage to negotiate more favorable pricing and terms. This can put pressure on Viatris's profit margins, as these powerful buyers can often demand significant discounts or preferential treatment to secure their business.

Viatris operates in markets, particularly generics and biosimil, where customers exhibit significant price sensitivity. This is driven by the nature of these product categories, often serving as lower-cost alternatives to originator brands. For instance, in 2024, the generic drug market continued to be characterized by intense competition, with many customers prioritizing the lowest cost option available. This high price sensitivity directly translates into increased bargaining power for Viatris's customers, as they can readily switch to competitors offering comparable products at lower prices.

Reimbursement policies and government tenders further amplify this price sensitivity. In many regions, healthcare systems and government bodies procure pharmaceuticals through competitive bidding processes, where price is a primary determinant. Viatris's ability to secure contracts often hinges on its pricing strategy, as customers, whether they are distributors, pharmacies, or healthcare providers, are incentivized to negotiate favorable terms. The pressure to manage healthcare costs globally means customers are constantly seeking value, making Viatris’s pricing decisions crucial for market access and sales volume.

Viatris's customers, particularly in the generic and biosimilar segments, face a wide array of substitute products. The ease with which these customers can switch to alternatives directly impacts Viatris's pricing power. For instance, the highly competitive generic drug market, where Viatris has a significant presence, is characterized by numerous players offering chemically equivalent products, granting customers substantial leverage.

The availability of multiple branded and generic alternatives for many of Viatris's key therapeutic areas means customers can readily compare prices and opt for the most cost-effective option. This is especially true in markets where patents have expired, leading to an influx of competitors. For example, in 2024, the global generic drugs market was estimated to be worth hundreds of billions of dollars, highlighting the intense competition and the customer's ability to choose from many providers.

Viatris's portfolio, while broad, includes many products that lack significant differentiation in terms of efficacy or safety compared to competitors' offerings, especially within the generics and biosimil categories. This lack of unique selling propositions further empowers customers, as they perceive less risk in switching providers. When customers can easily find comparable products, their bargaining power increases, potentially leading to price erosion for Viatris.

Customer Information and Transparency

Viatris's customers, particularly in the pharmaceutical sector, increasingly have access to a wealth of information. This includes detailed product comparisons, clinical trial data, and pricing benchmarks from various sources. For instance, in 2024, platforms like GoodRx and similar international equivalents provide consumers with transparent drug pricing and prescription discount information, directly impacting their perception of value and their willingness to negotiate.

This heightened transparency significantly bolsters customer bargaining power. Well-informed buyers are empowered to compare Viatris's offerings against competitors not just on price but also on efficacy and patient outcomes. The availability of real-world evidence and comparative effectiveness research further strengthens their position, allowing them to demand better terms and more favorable contracts.

- Information Access: Customers can easily access Viatris's product pricing, clinical data, and competitor offerings through online portals and industry publications.

- Market Data Empowerment: Access to market data, including competitor pricing and formulary status, allows buyers to negotiate more effectively.

- Transparency Impact: Increased transparency on drug costs and value propositions directly influences customer expectations and their ability to bargain.

- Digital Tools: The proliferation of digital health platforms and price comparison tools in 2024 amplifies customer awareness and bargaining leverage.

Threat of Customer Backward Integration

The threat of backward integration by Viatris's major customers, like large pharmacy chains or healthcare systems, could significantly increase their bargaining power. If these entities could credibly threaten to manufacture or source their own generic or specialty drugs, it would put immense pressure on Viatris's pricing and margins.

However, the practicalities and likelihood of such integration are complex. Setting up drug manufacturing facilities requires substantial capital investment, specialized expertise, and navigating stringent regulatory approvals. For instance, establishing a new pharmaceutical manufacturing plant can cost hundreds of millions of dollars and take several years to become operational.

- High Capital Investment: Building or acquiring manufacturing capabilities demands significant upfront funding, often in the hundreds of millions of dollars.

- Regulatory Hurdles: Gaining approval from bodies like the FDA for new manufacturing sites and processes is time-consuming and complex.

- Technical Expertise: Pharmaceutical manufacturing requires highly specialized scientific and engineering talent, which may be difficult for non-traditional players to acquire quickly.

- Supply Chain Complexity: Customers would need to establish reliable sourcing for raw materials and active pharmaceutical ingredients (APIs), adding another layer of operational challenge.

Viatris's bargaining power with customers is moderate to high, influenced by customer concentration, price sensitivity, and the availability of substitutes. For example, in 2023, Viatris reported that its top five customers accounted for approximately 30% of its total net sales, highlighting the leverage these large entities possess. The generic and biosimilar markets, where Viatris has a strong presence, are particularly price-sensitive, with customers prioritizing cost-effectiveness. This dynamic is further amplified by the broad availability of alternative products, allowing customers to easily switch providers. In 2024, the global generic drugs market, valued in the hundreds of billions, exemplifies this intense competition and customer choice.

| Factor | Impact on Viatris | Key Data/Observation (2023-2024) |

|---|---|---|

| Customer Concentration | High Leverage | Top 5 customers represented ~30% of 2023 net sales. |

| Price Sensitivity | High Pressure | Generic market in 2024 driven by lowest cost options. |

| Availability of Substitutes | Reduced Viatris's Power | Global generic market worth hundreds of billions in 2024, indicating numerous alternatives. |

| Information Transparency | Increased Bargaining | Digital tools and price comparison sites empower buyers in 2024. |

What You See Is What You Get

Viatris Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis delves into the competitive landscape of Viatris, evaluating the intensity of rivalry among existing competitors, the bargaining power of buyers, the threat of new entrants, the bargaining power of suppliers, and the threat of substitute products or services. Understanding these forces is crucial for Viatris to formulate effective strategies and maintain its competitive edge in the pharmaceutical industry. This analysis provides actionable insights into Viatris's strategic positioning and potential areas for growth or risk mitigation.

Rivalry Among Competitors

Viatris navigates a landscape with a substantial number of competitors across its three main product segments: branded, generic, and biosimilar pharmaceuticals. The sheer volume of companies vying for market share, from established pharmaceutical giants to agile smaller players, significantly fuels competitive rivalry. For instance, in the generics market, Viatris contends with numerous companies like Teva Pharmaceutical Industries and Hikma Pharmaceuticals, all seeking to capture market share through aggressive pricing and efficient production.

These rivals vary greatly in size, financial resources, and strategic focus. Larger competitors often possess greater R&D budgets and established distribution networks, enabling them to launch new products and acquire smaller firms to consolidate market power. Smaller, specialized companies may focus on niche therapeutic areas or specific complex generics, posing a different kind of competitive threat. The strategic objectives of these competitors, whether focused on market penetration, portfolio expansion, or technological innovation, directly impact the intensity of competition Viatris experiences.

The diversity of competitors is particularly evident in the rapidly growing biosimil market. Here, Viatris faces competition from companies such as Amgen, Pfizer, and Samsung Bioepis, each with significant investments in developing and commercializing biosimilar versions of high-value biologic drugs. This segment is characterized by complex regulatory pathways and substantial capital requirements, attracting well-resourced players. As of early 2024, the global biosimil market continues to expand, with new entrants and product approvals constantly reshaping the competitive dynamics.

The pharmaceutical industry, especially the generics and biosimilars segments where Viatris is a major player, has experienced moderate to strong growth. For instance, the global generics market was valued at approximately $215 billion in 2023 and is projected to grow at a CAGR of around 6% through 2030. This growth, driven by patent expirations and increasing demand for affordable medicines, fuels intense competition as numerous companies vie for market share.

As these markets mature, the pace of innovation may slow, and differentiation becomes more challenging. In mature markets, competitive rivalry often intensifies because the primary means of gaining an edge shifts from novel product development to operational efficiency, cost leadership, and aggressive marketing strategies. This dynamic can lead to price wars and a greater focus on market share acquisition.

For Viatris, operating in these growing yet maturing segments means facing a crowded competitive landscape. Companies are constantly seeking to optimize their supply chains and expand their product portfolios to maintain or increase their market presence. The increasing number of players entering the biosimilar space, for example, adds another layer of competitive pressure, as these products often have lower margins than traditional generics.

In the highly competitive pharmaceutical landscape, Viatris faces significant rivalry, particularly in the generic drug market. While Viatris offers a broad portfolio, many of its products, especially generics, are largely undifferentiated, functioning as commodities where price often dictates market share. This lack of unique product features means customers can readily switch between Viatris and its competitors.

Switching costs for healthcare providers and patients are generally low in the generic pharmaceutical sector. Once a formulary is set or a prescription is written for a generic equivalent, the effort to change to a different manufacturer's product is minimal. This low barrier to switching directly fuels intense price competition among players like Viatris, as there's little inherent loyalty to a specific brand beyond availability and cost.

For instance, in 2024, the generic pharmaceutical market continues to be characterized by intense price pressure. With over 90% of prescriptions in the U.S. being for generics, companies like Viatris compete fiercely on cost. The U.S. FDA's expedited approval process for generics further exacerbates this by quickly bringing more competitors into the market for any given drug, diminishing the impact of any minor differentiation.

Exit Barriers for Competitors

Viatris faces significant exit barriers in the pharmaceutical market, making it difficult for competitors to leave, even during periods of low profitability. These barriers often stem from the highly specialized nature of pharmaceutical assets, including manufacturing facilities and intellectual property, which have limited alternative uses. For instance, a plant designed for sterile injectables cannot easily be repurposed for other industries. This situation can prolong competitive intensity as firms are compelled to remain in the market, potentially leading to aggressive pricing strategies to maintain market share.

Contractual obligations also play a crucial role. Pharmaceutical companies often enter into long-term supply agreements, research and development partnerships, and distribution contracts. Breaking these commitments can result in substantial penalties, further locking companies into the market. The strategic importance of certain product lines, even if currently underperforming, can also deter exits. A company might maintain a presence in a therapeutic area due to its perceived future potential or its role in a broader portfolio, as seen with established players in the generics market who leverage scale across multiple products.

- Specialized Assets: Pharmaceutical manufacturing requires highly specific equipment and facilities, making them difficult to sell or repurpose for other industries.

- Contractual Commitments: Long-term supply, R&D, and distribution agreements can impose significant financial penalties for early termination.

- Strategic Importance: Maintaining a presence in certain therapeutic areas, even if currently less profitable, can be vital for a company's overall portfolio strategy and future growth prospects.

- Brand Reputation and Loyalty: Established brands in the pharmaceutical sector benefit from significant customer loyalty, making it costly to divest product lines that have built this trust.

Intensity of Price Competition

Viatris operates in markets where price competition is a significant factor, especially concerning its generic and biosimilar offerings. These segments often face intense pressure to lower costs due to various market dynamics.

Factors like government tender systems, which award contracts to the lowest bidder, and payer negotiations for drug reimbursements directly contribute to downward price pressure. For example, in the generics market, which represents a substantial portion of Viatris's revenue, price erosion can be rapid after patent expiry of originator drugs.

The company's financial reports often highlight the impact of these pricing pressures on its performance. In 2023, Viatris continued to navigate a landscape where securing market share in generics and biosimilars often necessitates competitive pricing strategies, which can significantly impact profit margins.

- Price Sensitivity: Viatris's generic and biosimilar portfolios are highly sensitive to price, as customers, including governments and large healthcare providers, actively seek cost-effective treatments.

- Tender Systems: Many key markets utilize tender systems where Viatris must bid competitively to supply its products, often leading to price concessions.

- Payer Influence: Insurance companies and national health systems exert considerable pressure on Viatris to reduce prices in exchange for formulary access.

- Margin Erosion: Aggressive price competition directly impacts Viatris's gross margins, making efficient operations and product differentiation crucial for profitability.

Viatris faces intense rivalry within the pharmaceutical sector, particularly in its generics and biosimil segments. The market is crowded with numerous competitors, ranging from large, established pharmaceutical companies to smaller, specialized firms. This high degree of competition is driven by factors such as low switching costs for customers and the commoditized nature of many generic drugs, where price often becomes the primary determinant of market share.

The generic drug market, a significant area for Viatris, is characterized by aggressive price competition. With over 90% of prescriptions in the U.S. being for generics, companies like Viatris must compete fiercely on cost. As of 2024, the global generics market, valued at approximately $215 billion in 2023, continues to see rapid price erosion post-patent expiry, exacerbated by expedited FDA approval processes that quickly introduce more competitors.

In the biosimilar market, Viatris contends with well-funded players such as Amgen and Pfizer. This segment, though growing, demands substantial capital investment and navigating complex regulatory pathways. The competitive landscape is constantly evolving with new entrants and product approvals, intensifying rivalry as companies vie for market share in this high-potential area.

Viatris also contends with significant exit barriers, including specialized assets and contractual obligations, which can prolong competitive intensity. These factors compel companies to remain in the market, potentially leading to sustained aggressive pricing strategies to maintain their positions.

SSubstitutes Threaten

The threat of substitutes for Viatris's pharmaceutical products is a significant consideration. Many conditions treated by Viatris's medications can also be managed through alternative therapies. These include a range of non-pharmacological interventions such as physical therapy, psychotherapy, and dietary modifications, alongside lifestyle changes like exercise and stress management. For instance, in managing chronic pain, patients might opt for acupuncture or massage instead of pain relievers.

Emerging treatment modalities also present a growing substitution threat. Advances in areas like gene therapy, personalized medicine, and regenerative medicine offer novel approaches that could potentially bypass traditional pharmaceutical interventions. Patients and healthcare providers are increasingly exploring these options, especially for complex or chronic diseases, due to potential for fewer side effects or more targeted efficacy. The ease of switching to these alternatives depends on factors like accessibility, cost, and proven effectiveness, which are rapidly evolving.

The threat of substitutes for Viatris, a global healthcare company, is significantly influenced by the price-performance trade-off of alternative treatments. If generic or biosimilar versions of Viatris's key products offer comparable efficacy at a lower price point, the bargaining power of buyers increases, potentially impacting Viatris's market share and profitability.

For instance, in 2023, the global market for generic drugs was valued at approximately $450 billion, highlighting the substantial presence of lower-cost alternatives across various therapeutic areas. When patients and payers perceive that substitutes deliver similar health outcomes for less financial outlay, the attractiveness of Viatris’s branded or complex generics diminishes.

Conversely, if substitute products offer superior performance or a more convenient administration method at a similar or only slightly higher cost, this also elevates the threat. Consider the rise of novel drug delivery systems or therapies with fewer side effects; these can draw patients away from established treatments, even if Viatris’s products are more affordable.

Viatris must continuously innovate and demonstrate the unique value proposition of its portfolio, whether through improved formulations, patient support programs, or clinical evidence supporting superior outcomes, to mitigate the threat posed by substitutes that excel in either price or performance.

Viatris faces a significant threat from substitutes, particularly as patients and healthcare providers evaluate alternative treatments. The willingness to switch can be influenced by factors like patient education regarding new therapies and established physician prescribing habits that favor familiar options. For instance, a patient’s perception of a new generic drug’s efficacy versus a branded originator, or a physician’s comfort level with a novel treatment modality, directly impacts the ease of substitution.

Behavioral aspects are crucial here. If patients are well-informed about the benefits and comparable outcomes of generic or biosimilar options, their propensity to substitute increases. Similarly, if healthcare providers are confident in the safety and effectiveness of alternatives, they are more likely to prescribe them, thereby increasing the threat. This dynamic is particularly relevant in therapeutic areas where multiple treatment pathways exist, and patient adherence or physician preference can easily shift.

Emergence of New Drug Classes or Technologies

The emergence of novel drug classes and advanced therapeutic technologies presents a significant threat of substitution for Viatris. For instance, the rapid advancements in gene therapies and personalized medicine could potentially displace established treatments for chronic conditions that form a core part of Viatris's portfolio. The speed at which these innovations are gaining traction is a critical factor; by late 2024, several gene therapies were approved for rare diseases, demonstrating a clear pathway for disruption.

Viatris must closely monitor the development and market penetration of these innovative treatments. For example, the increasing clinical validation of mRNA technology beyond vaccines, potentially for cancer treatments, could represent a future substitute for existing oncological drugs. The potential for these new modalities to offer superior efficacy or fewer side effects directly impacts the long-term viability of Viatris's current product lines.

The threat is amplified by the investment pouring into biotech and medtech sectors. In 2024, venture capital funding continued to flow into companies developing next-generation therapies. This influx of capital fuels rapid innovation, accelerating the timeline for potential market disruption.

- Gene and Cell Therapies: Advancements in these areas offer potential cures for diseases previously managed with lifelong medication.

- Personalized Medicine: Tailoring treatments based on an individual's genetic makeup can outperform one-size-fits-all pharmaceuticals.

- Medical Device Innovation: Novel devices, such as advanced drug delivery systems or implantable monitors, could reduce the need for pharmaceutical interventions.

- Biologics and Biosimilars: While Viatris is involved in biosimilars, the continuous evolution of complex biologic drugs creates new therapeutic alternatives.

Regulatory or Policy Changes Favoring Substitutes

Changes in healthcare regulations can significantly bolster the threat of substitutes for established pharmaceutical products. For instance, if governments implement policies that encourage or mandate the use of biosimilars over originator biologics, this directly increases the substitutability for Viatris's biologic drugs. As of early 2024, many countries continue to refine their biosimilar adoption strategies, aiming to drive down costs. This trend is expected to accelerate, impacting the market share of traditional branded drugs.

Reimbursement policies also play a critical role. When insurers or national health systems favor coverage for generic drugs, alternative therapies, or even non-pharmaceutical interventions like lifestyle changes or physical therapy, the demand for branded pharmaceuticals can diminish. For example, a shift in reimbursement from prescription drugs to coverage for wellness programs could divert patient spending and reduce the perceived necessity of certain medications.

Government initiatives focused on preventive care or the integration of alternative medicine into mainstream healthcare pathways can also elevate the threat of substitution. Initiatives promoting dietary interventions, mental health support, or traditional healing practices as primary treatment options for certain conditions directly compete with pharmaceutical solutions. By 2024, there's a growing emphasis on holistic health approaches that may reduce reliance on medication for some patient populations.

- Biosimilar Adoption: Regulatory frameworks in major markets like the US and EU continue to evolve, aiming to increase biosimilar market penetration, which directly impacts originator drug substitution.

- Reimbursement Shifts: Healthcare payers are increasingly scrutinizing drug costs, potentially favoring lower-cost alternatives or non-drug therapies in their coverage decisions.

- Preventive Care Focus: Government and public health campaigns promoting lifestyle changes and preventive measures can reduce the incidence of diseases requiring pharmaceutical intervention.

- Alternative Medicine Integration: Growing acceptance and integration of complementary and alternative medicine (CAM) into healthcare systems offer non-pharmaceutical substitutes for certain conditions.

Viatris faces a substantial threat from substitutes, particularly as patients and healthcare providers increasingly consider alternatives. The ease of switching is influenced by factors such as patient awareness of new therapies and ingrained physician prescribing habits. For instance, a patient’s perception of a new generic’s efficacy compared to a branded drug, or a physician’s comfort with novel treatment methods, directly affects substitution potential.

Behavioral elements are key; informed patients and confident physicians are more likely to opt for alternatives, especially in therapeutic areas with multiple treatment pathways. This dynamic is amplified by the rapid innovation in gene therapies and personalized medicine, which by late 2024 saw several gene therapies approved for rare diseases, showcasing a clear path for market disruption.

| Substitute Type | Examples | Impact on Viatris |

| Non-Pharmacological | Physical therapy, lifestyle changes, psychotherapy | Reduces demand for certain Viatris medications |

| Generics/Biosimilars | Lower-cost versions of Viatris products | Increases buyer power, potentially lowers Viatris's prices and market share |

| Advanced Therapies | Gene therapy, personalized medicine | Potential to displace established Viatris treatments, especially for chronic/complex diseases |

| Medical Devices | Advanced drug delivery systems | May reduce the need for Viatris's pharmaceutical interventions |

Entrants Threaten

The threat of new entrants in the pharmaceutical industry, including for companies like Viatris, is significantly dampened by formidable regulatory hurdles and lengthy approval processes. Agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) impose rigorous testing and documentation requirements, making it exceptionally difficult and time-consuming for new drugs to reach the market.

Navigating these complex pathways demands substantial financial investment and scientific expertise, often running into hundreds of millions of dollars and taking many years to complete. For instance, the average cost to develop a new drug and bring it to market was estimated to be over $2 billion by Tufts University’s Center for the Study of Drug Development in recent years, a figure that continues to rise with increasing regulatory stringency.

This high barrier to entry means that only well-established companies with deep pockets and extensive experience in regulatory affairs can realistically compete, thereby limiting the influx of new players and protecting existing market participants.

The pharmaceutical industry, including companies like Viatris, faces significant barriers to entry due to the sheer magnitude of research and development (R&D) costs. Bringing a new drug from discovery to market can cost billions of dollars. For instance, estimates often cite figures exceeding $2.6 billion per new drug approved.

This immense financial commitment, coupled with a high failure rate in clinical trials, acts as a formidable deterrent for potential new entrants. Companies without substantial access to capital and a robust R&D pipeline struggle to compete.

The lengthy development timelines, often 10-15 years, further increase the risk and upfront investment required, making it difficult for smaller or newer firms to challenge established players.

New entrants into the pharmaceutical market, like Viatris, face considerable hurdles in securing access to critical distribution channels. Established players have cultivated deep-rooted relationships with pharmacies, hospitals, and healthcare systems, often solidified through long-term contracts and loyalty programs. For instance, in 2024, many major pharmaceutical distributors reported that over 80% of their volume was tied to existing, long-term agreements with major manufacturers, making it difficult for newcomers to gain shelf space or preferred formulary status.

These established networks represent a significant barrier to entry. Companies like Viatris benefit from sophisticated and optimized logistics, ensuring timely delivery and efficient inventory management across diverse healthcare settings. Building comparable infrastructure and trust takes substantial time and investment, often exceeding the initial capital available to a new entrant. This entrenched advantage means that even with a competitive product, a new company might struggle to get its medications into the hands of patients efficiently.

Brand Loyalty and Established Relationships

Brand loyalty for established pharmaceutical products, particularly for chronic or critical conditions, presents a significant barrier to entry. Viatris, for instance, benefits from strong brand recognition and patient trust built over years, making it challenging for newcomers to displace existing treatments. These established preferences are further solidified by deep-seated relationships with healthcare providers and payers who are accustomed to the efficacy, safety profiles, and reimbursement pathways of Viatris's portfolio.

New entrants must not only offer a comparable or superior product but also invest heavily in marketing and education to build similar levels of trust and familiarity. For example, in 2024, the pharmaceutical market continued to see significant marketing spend dedicated to reinforcing brand loyalty for existing blockbuster drugs, with many companies allocating over 20% of their revenue to sales and marketing efforts. Overcoming these entrenched connections requires substantial effort and resources.

- Brand Recognition: Viatris leverages decades of market presence for many of its key products, fostering strong patient and physician recall.

- Physician Trust: Long-term relationships with doctors and specialists, built on consistent product performance and support, create a loyalty that is difficult for new entrants to replicate quickly.

- Payer Relationships: Established contracts and formulary placements with insurance providers and government health programs favor existing, well-understood medications.

- Patient Adherence: Patients often prefer to stick with medications they are familiar with and that have proven effective for them, reducing switching behavior.

Intellectual Property and Patent Protection

Intellectual property, particularly patents, acts as a formidable barrier to entry in the pharmaceutical sector, including for companies like Viatris. Patents grant exclusive rights to market a drug for a set period, preventing competitors from selling generic versions. This exclusivity is crucial for recouping the substantial research and development costs associated with bringing new medicines to market.

The lifespan of a patent significantly impacts the threat of new entrants. Once a patent expires, generic manufacturers can enter the market, often leading to a sharp decline in the innovator drug's price and market share. For instance, the patent cliff, a term used to describe the period when a drug loses patent protection, can see revenue drop dramatically. In 2024, the pharmaceutical industry continues to grapple with this, as numerous blockbuster drugs approach or have recently passed their patent expiry dates.

This patent protection fundamentally limits the ability of new companies to directly compete with established, patented pharmaceutical products. Without their own proprietary innovations protected by strong intellectual property, potential entrants would struggle to gain market access and customer trust against well-established brands. This dynamic is a core reason why significant capital investment and innovative R&D are prerequisites for entry into the branded pharmaceutical space.

- Patent Exclusivity: Patents provide a defined period of market exclusivity for innovative drugs, shielding them from direct competition by generic versions.

- R&D Cost Recovery: This exclusivity is vital for pharmaceutical companies to recover the immense costs associated with drug discovery, development, and regulatory approval.

- Generic Entry Threshold: The threat of new entrants is significantly reduced until patent expiry, at which point generic manufacturers can enter, increasing competition and lowering prices.

- Market Dynamics: The ongoing expiration of patents in 2024 and beyond will continue to reshape the competitive landscape, opening doors for generic players but also highlighting the continuous need for innovation by established firms like Viatris.

The threat of new entrants for Viatris is significantly limited by the substantial capital requirements for research and development, often exceeding $2 billion per new drug. This immense financial commitment, coupled with lengthy development timelines and high failure rates in clinical trials, deters smaller or less-resourced companies from entering the market.

Regulatory hurdles, including rigorous testing and approval processes by bodies like the FDA and EMA, create additional barriers. These complex pathways demand extensive scientific expertise and financial investment, effectively restricting entry to well-established firms with proven regulatory navigation capabilities.

Established distribution channels and strong brand loyalty further fortify Viatris against new competitors. Long-term contracts with pharmacies and healthcare systems, along with deep-rooted patient and physician trust, make it difficult for newcomers to gain market access and displace existing treatments.

Intellectual property, particularly patents, provides a critical shield. Patents grant exclusive marketing rights, allowing companies like Viatris to recoup R&D costs and preventing generic competition until expiry. For instance, in 2024, the pharmaceutical industry continues to manage the impact of patent cliffs, underscoring the importance of this protection.

Porter's Five Forces Analysis Data Sources

Our Viatris Porter's Five Forces analysis is built upon a foundation of diverse data sources, including Viatris's own annual reports and SEC filings, alongside industry-specific market research from firms like IQVIA and GlobalData.

We also incorporate insights from financial news outlets, competitor press releases, and patent databases to comprehensively understand the competitive landscape.