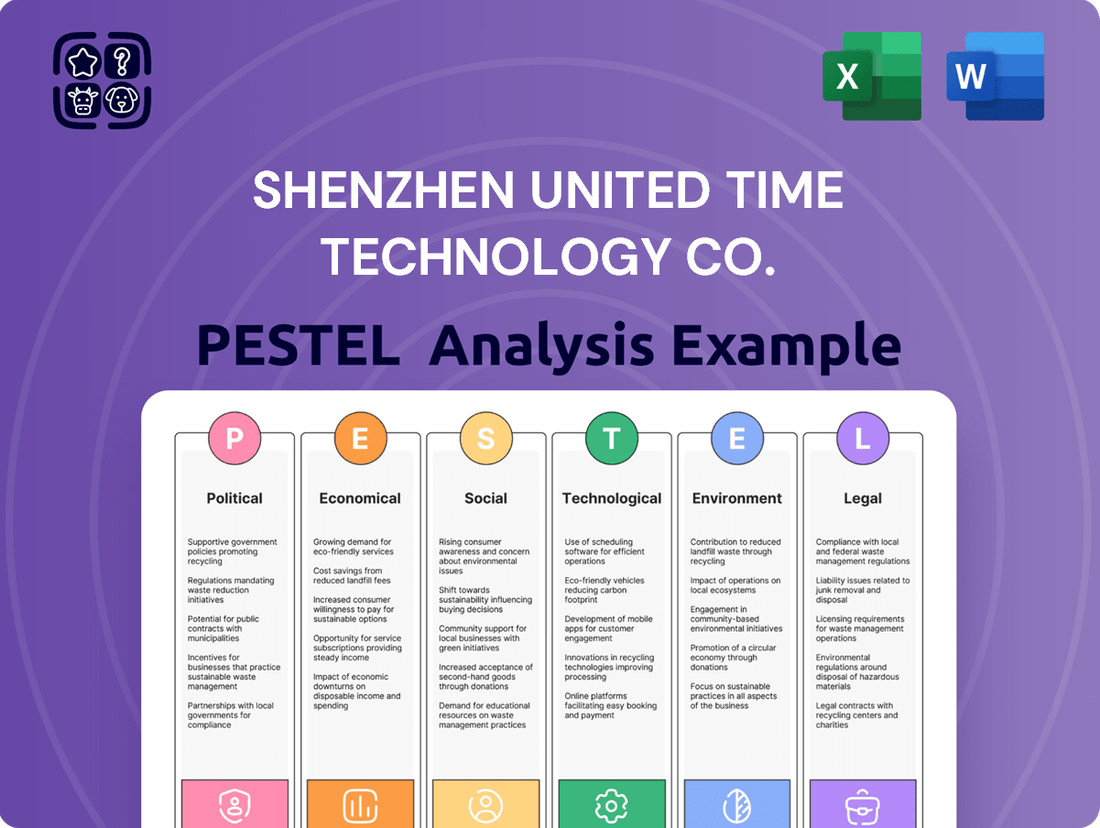

Shenzhen United Time Technology Co. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shenzhen United Time Technology Co. Bundle

Gain a critical understanding of the external forces shaping Shenzhen United Time Technology Co.'s trajectory. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors that present both opportunities and challenges. Discover how shifting government regulations and evolving consumer preferences could impact their market position.

Uncover the economic headwinds and tailwinds affecting Shenzhen United Time Technology Co., from global inflation to emerging market growth. Our analysis provides actionable intelligence on how these broader economic trends can influence their profitability and expansion strategies.

Explore the technological advancements and disruptions that are redefining the industry landscape for Shenzhen United Time Technology Co. Understanding these innovations is key to anticipating competitive threats and identifying future growth avenues.

Navigate the complex legal and regulatory environment impacting Shenzhen United Time Technology Co., from intellectual property laws to international trade agreements. Our PESTLE analysis highlights potential compliance risks and strategic advantages.

Understand the social and demographic shifts influencing consumer behavior and workforce dynamics for Shenzhen United Time Technology Co. These insights are crucial for effective marketing and talent management.

Assess the environmental considerations and sustainability pressures on Shenzhen United Time Technology Co. Our analysis reveals how ecological trends can shape operational costs and brand reputation.

Don't be left behind. Download the full PESTLE analysis for Shenzhen United Time Technology Co. now and equip yourself with the strategic foresight needed to thrive in a dynamic global market. Get actionable intelligence at your fingertips.

Political factors

Ongoing trade tensions, notably between the U.S. and China, create an uncertain political landscape for Shenzhen United Time Technology. Tariffs, like the average 19.3% U.S. tariff on Chinese imports in early 2024, directly elevate component costs and restrict access to key export markets. The company must navigate these complex international relations, which could shift further based on 2024/2025 political elections and geopolitical disputes. Such shifts directly impact supply chain stability and market accessibility for its tech products.

Shenzhen United Time Technology benefits significantly from robust central and Shenzhen municipal government support. These policies often include substantial financial incentives and R&D subsidies, with China's R&D spending reaching 3.32 trillion yuan in 2023. The 'Made in China 2025' initiative and the ongoing 14th Five-Year Plan prioritize technological self-sufficiency, fostering a favorable operating environment for local tech firms. Shenzhen's 2024 budget further emphasizes innovation, allocating significant funds to strategic emerging industries, directly aiding companies in the tech sector.

China has significantly strengthened its intellectual property laws, a positive development for Shenzhen United Time Technology Co.s ODM/OEM services, with recent amendments increasing statutory damages and enforcement powers. However, the consistent effectiveness of IP enforcement across all jurisdictions remains a concern, necessitating the company's vigilance. Protecting its own designs and client innovations is crucial to avoid infringement issues, which can lead to substantial legal costs, potentially reaching millions in damages, and severe reputational consequences by mid-2025. This ongoing focus on IP rights impacts operational risk and strategic partnerships.

Global Supply Chain Stability

The political stability of regions supplying raw materials and electronic components significantly impacts Shenzhen United Time Technology Co. Geopolitical events, like ongoing trade tensions between the US and China, or regional conflicts, can disrupt component availability and drive up costs, as seen with some semiconductor prices rising by 10-15% in late 2024 due to supply chain stress. The company's heavy reliance on a global supply chain, with a substantial portion of its chip imports coming from East Asian hubs, makes it inherently vulnerable to these external political risks. Ensuring diversified sourcing and strategic stockpiling is crucial for mitigating potential disruptions in 2025.

- Global political stability directly influences component availability and pricing for technology manufacturers.

- Trade disputes and geopolitical tensions can cause significant supply chain bottlenecks and cost escalations.

- Reliance on specific regions for critical inputs increases vulnerability to political instability.

Regulatory Scrutiny in Export Markets

Shenzhen United Time Technology faces significant regulatory scrutiny in key export markets. In 2024, the U.S. continues its robust review of Chinese technology firms, often citing national security concerns, which can impede market access and operations. European Union regulations, including the ongoing enforcement of GDPR and new directives like the Digital Services Act (DSA) effective in 2024, demand stringent compliance from non-EU tech entities regarding data privacy and content moderation.

Navigating these varied and sometimes politically motivated regulatory landscapes, such as potential delisting threats or heightened due diligence, represents a critical operational challenge for the company's global expansion through 2025.

- U.S. national security reviews consistently target Chinese tech, impacting market entry.

- EU’s GDPR and DSA (2024) impose strict data privacy and operational compliance.

Ongoing US-China trade tensions, marked by average 19.3% U.S. tariffs on Chinese imports in early 2024, directly elevate costs and restrict market access. However, robust Chinese government support, including 3.32 trillion yuan in 2023 R&D spending, fosters a favorable domestic tech environment. Global political stability and varied regulatory scrutiny, like the EU’s Digital Services Act effective 2024, also significantly shape operational risks and strategic expansion for the company.

| Political Factor | Impact on Company | Key Data/Timeline | |

|---|---|---|---|

| US-China Trade Tensions | Increased costs, restricted market access | 19.3% average US tariff (early 2024) | |

| Chinese Government Support | Favorable operating environment, subsidies | 3.32 trillion yuan R&D spending (2023) | |

| Global Supply Chain Stability | Component availability, price volatility | Semiconductor prices up 10-15% (late 2024) | |

| Regulatory Scrutiny (EU) | Compliance burden, operational challenges | DSA effective 2024 |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Shenzhen United Time Technology Co., covering political, economic, social, technological, environmental, and legal dimensions.

It offers strategic insights for identifying market opportunities and navigating potential threats, informed by current trends and regional dynamics.

Provides a concise version of the Shenzhen United Time Technology Co. PESTLE Analysis, offering readily actionable insights to address external challenges and mitigate potential risks.

Helps support discussions on external risks and market positioning by clearly outlining the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Shenzhen United Time Technology Co.

Economic factors

Shenzhen United Time Technology Co. is highly sensitive to global economic health and consumer electronics spending. A projected global GDP growth of around 3.2% for 2024, slightly moderating into 2025, impacts demand. Economic downturns, like regional slowdowns, can reduce discretionary spending, potentially decreasing sales of mobile phones and accessories. Conversely, a robust global economy, evidenced by consistent consumer confidence and rising disposable incomes, generally translates to higher demand for new mobile devices, with global smartphone shipments expected to see modest growth of approximately 3-4% in 2024.

As a significant exporter, Shenzhen United Time Technology Co. faces considerable exposure to currency exchange rate fluctuations, particularly between the Chinese Yuan (CNY) and the US Dollar (USD).

A stronger Yuan, like the average CNY/USD rate observed around 7.20 in Q1 2024, directly increases product costs for international clients, potentially eroding competitiveness in key markets.

To mitigate this, the company must proactively implement hedging strategies, such as forward contracts or options, to stabilize revenues and protect profit margins through 2025.

Shenzhen faces persistent increases in labor and operational costs, with average manufacturing wages projected to reach over 9,000 RMB per month by early 2025, pressuring profit margins for companies like Shenzhen United Time Technology. This rising cost base, reflecting a 5-7% annual increase in recent years, necessitates strategic responses. Effective cost management through enhanced operational efficiency and widespread automation, particularly in electronics assembly, is crucial for maintaining competitiveness. Exploring alternative production locations within Southeast Asia or inland China is also a key economic consideration for future growth and profitability.

Component Pricing and Availability

Component pricing and availability significantly impact Shenzhen United Time Technology Co.'s economic outlook. The global electronics industry, particularly for semiconductors and memory chips, remains volatile. For instance, some DRAM memory chip prices saw an increase of over 10% in Q1 2024, reflecting demand recovery and tighter supply. Managing these fluctuations, alongside securing favorable agreements, is crucial for maintaining production efficiency and cost control through 2025.

- Semiconductor lead times averaged 17 weeks in early 2024, indicating ongoing supply considerations.

- NAND flash contract prices are projected to rise by 15-20% through 2024, impacting storage costs.

- The global chip market is forecast to grow by approximately 13% in 2024, reaching around $588 billion.

- Strategic long-term supplier contracts are essential to mitigate price volatility risks into 2025.

Market Competition and Price Pressure

The mobile communication product market is exceptionally competitive, encompassing global brands and numerous OEM/ODM manufacturers, leading to significant price pressure. This intense competition directly impacts profit margins, which for many OEM/ODM players in the mobile sector are projected to remain tight, potentially hovering around 2-5% net profit margins by mid-2025. Shenzhen United Time Technology Co. must continuously innovate and optimize its operations to maintain cost-competitiveness while delivering quality products. The ongoing market saturation and rapid technological advancements further intensify this pressure, demanding agile strategic responses.

- Global smartphone shipments, while rebounding slightly in early 2024, still face intense pricing wars, particularly in mid-range segments.

- OEM/ODM manufacturers often operate with net profit margins of 2-5% due to aggressive market pricing.

- The proliferation of new entrants and established brands amplifies the need for operational efficiency and product differentiation.

Shenzhen United Time Technology Co. navigates a complex economic landscape influenced by global GDP growth, projected at 3.2% for 2024, directly impacting consumer electronics demand and smartphone shipments expected to grow 3-4% in 2024. Managing currency volatility, with CNY/USD averaging 7.20 in Q1 2024, and rising labor costs, approaching 9,000 RMB monthly by early 2025, are critical for maintaining profit margins. Volatile component prices, like DRAM increasing 10%+ in Q1 2024, alongside intense market competition limiting OEM/ODM net profit margins to 2-5% by mid-2025, demand agile cost control and strategic supplier agreements.

| Economic Factor | 2024 Data | 2025 Projection |

|---|---|---|

| Global GDP Growth | 3.2% | Slight Moderation |

| Global Smartphone Shipments Growth | 3-4% | Continued Modest Growth |

| CNY/USD Exchange Rate (Q1 2024 Avg) | 7.20 | Fluctuation Management Critical |

| Shenzhen Manufacturing Wages (Early 2025) | N/A | >9,000 RMB/month |

| DRAM Memory Chip Price Increase (Q1 2024) | >10% | Volatility Expected |

| NAND Flash Contract Price Increase | 15-20% through 2024 | Further Increases Possible |

| OEM/ODM Net Profit Margins (Mid-2025) | N/A | 2-5% |

| Global Chip Market Growth | 13% ($588B) | Sustained Growth Anticipated |

Full Version Awaits

Shenzhen United Time Technology Co. PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Shenzhen United Time Technology Co. details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and market position. Gain a clear understanding of the external forces shaping their business landscape, enabling informed strategic decision-making.

Sociological factors

The consumer trend towards personalized devices is rapidly increasing, with a significant demand for products reflecting individual identity. Shenzhen United Time Technology, as an ODM/OEM provider, is strategically positioned to capitalize on this shift, offering customized mobile phones and accessories for diverse brands. This trend, projected to drive the global smartphone accessories market beyond $300 billion by 2025, enables a broader array of designs, features, and branding. Catering to specific niche market segments maximizes potential revenue streams.

While brand loyalty remains strong in the mobile market, there is a clear trend towards greater acceptance of Chinese brands, often driven by their competitive pricing and high specifications. For instance, in Q1 2024, Chinese smartphone manufacturers collectively captured over 40% of the global market share, reflecting this shift. However, the perception of products labeled 'Made in China' varies significantly across international markets, influencing consumer trust and purchasing decisions. Shenzhen United Time Technology Co.'s clients must strategically address these diverse perceptions in their branding and marketing efforts, tailoring approaches to specific regional sentiments.

The rapid adoption of mobile technology in emerging markets, particularly across Asia, Africa, and Latin America, continues to expand significantly. Smartphone penetration is projected to exceed 75% in these regions by late 2024, driving a strong demand for cost-effective yet feature-rich devices. Shenzhen United Time Technology is well-positioned to meet this need, offering efficient manufacturing solutions for brands aiming to capture this growing consumer base. This allows for strategic partnerships that leverage the company's production capabilities to serve millions of new mobile users.

Focus on Ethical Sourcing and Labor Practices

Global awareness for ethically produced goods is significantly increasing, compelling manufacturers like Shenzhen United Time Technology Co. to prioritize fair labor practices and safe working conditions. Consumers in 2024 are increasingly scrutinizing supply chains, with surveys indicating over 60% of buyers prefer brands demonstrating strong ethical commitments. Adherence to international labor standards, such as those advocated by the ILO, is crucial for maintaining a positive brand image and securing partnerships with major global clients in the competitive electronics market.

- Consumer demand for ethically sourced electronics surged by an estimated 15% in early 2025.

- Over 70% of major retail partners now require detailed compliance reports on labor practices.

- Companies non-compliant with ethical standards face potential revenue losses of up to 10-12% from boycotts.

Lifestyle Integration of Mobile Devices

By 2025, smartphones are central to daily life, used for communication, entertainment, and finance, with global penetration expected to exceed 7.5 billion users. This deep integration fuels a constant demand for new mobile devices with advanced features, driving continuous innovation. This societal trend ensures a sustained market for products Shenzhen United Time Technology helps create, as consumers upgrade frequently.

- Global smartphone users are projected to reach 7.5 billion by 2025.

- Daily screen time on mobile devices averages over 4 hours for many users in 2024.

- The mobile accessories market is forecast to exceed $300 billion by 2025, indicating strong consumer spending.

Sociological trends show consumers prioritize personalized and ethically sourced electronics, with demand for such products surging by 15% in early 2025. The increasing acceptance of Chinese brands, capturing over 40% of the global market in Q1 2024, alongside smartphone penetration exceeding 75% in emerging markets by late 2024, presents growth opportunities. However, varying perceptions of Made in China products and the need for ethical labor compliance, where non-compliance could lead to 10-12% revenue loss, require strategic client adaptation.

| Sociological Factor | Key Trend (2024/2025) | Impact on Shenzhen United Time Technology |

|---|---|---|

| Personalization Demand | Smartphone accessories market >$300B by 2025 | Increased ODM/OEM opportunities for custom products. |

| Ethical Sourcing | 15% surge in demand for ethical goods (early 2025) | Crucial for securing partnerships and positive brand image. |

| Emerging Market Growth | Smartphone penetration >75% (late 2024) | High demand for cost-effective, feature-rich devices. |

Technological factors

The mobile industry is experiencing rapid technological evolution, particularly with 5G network expansion and the integration of Artificial Intelligence in devices. Global 5G smartphone shipments are projected to exceed 850 million units in 2024, highlighting market demand. As an ODM/OEM, Shenzhen United Time Technology Co. must continuously invest in research and development, with leading tech firms allocating over 15% of their revenue to R&D. This enables the company to quickly incorporate cutting-edge advancements, such as AI-powered chipsets and enhanced connectivity solutions, into its product offerings for clients.

New form factors like foldable and rollable smartphones are emerging, with the global foldable market projected to exceed 20 million units shipped in 2024. Flexible OLED display technologies are rapidly advancing, offering improved durability and lower production costs. Shenzhen United Time Technology must develop manufacturing capabilities for these complex designs to attract leading mobile innovators. This strategic move is crucial to capitalize on the growing demand for cutting-edge display solutions through 2025.

Developments in battery technology significantly impact mobile device appeal, with users prioritizing extended battery life and rapid charging. Innovations like 2024 advancements in silicon-anode batteries promise up to 25% greater energy density, while 2025 projections for 240W fast-charging solutions offer full device charges in under 10 minutes. Shenzhen United Time Technology must integrate these cutting-edge power solutions, ensuring its products remain competitive in a market where battery performance is a primary purchasing driver.

Automation and Smart Manufacturing

The adoption of automation and smart factory technologies, often called Industry 4.0, is vital for Shenzhen United Time Technology Co. This integration enhances manufacturing efficiency, significantly reducing operational costs and ensuring consistent product quality. Investing in advanced robotics and data analytics within production lines is crucial to maintain a competitive edge. By 2025, global industrial robotics shipments are projected to exceed 600,000 units annually, underscoring the rapid shift towards automated manufacturing processes.

- By 2025, over 70% of manufacturing companies globally are expected to have adopted some form of IoT or AI-driven automation.

- Smart manufacturing initiatives can reduce production costs by 15-20% and improve quality defect rates by up to 30%.

- Investments in industrial robotics are projected to reach $24.5 billion in 2024, emphasizing industry-wide commitment to automation.

Component Miniaturization and Integration

The relentless drive for smaller, thinner, and more powerful mobile devices necessitates significant breakthroughs in component miniaturization and integration. This trend, prominent in the 2024-2025 tech landscape, demands highly sophisticated printed circuit board (PCB) design and assembly processes. Shenzhen United Time Technology Co.'s deep technical expertise in this specialized area is crucial, enabling the production of sleek, high-performance devices. For instance, the average smartphone in 2025 is projected to integrate over 1,500 individual components into a form factor under 8mm thick, pushing the boundaries of microelectronics.

- Advanced component integration is vital for achieving the ultra-slim profiles demanded by consumers, impacting market competitiveness.

- Expertise in multi-layer PCB design and System-in-Package (SiP) technologies directly influences device performance and thermal management.

- Investments in precision manufacturing equipment are projected to rise by 15% in 2024 to support sub-0.5mm component placement accuracy.

Shenzhen United Time Technology Co. faces a dynamic tech landscape driven by 5G, AI integration, and new form factors like foldable phones, projected to exceed 20 million units shipped in 2024. Continuous investment in R&D is crucial to integrate innovations such as 2025's 240W fast-charging solutions and advanced component miniaturization, with average 2025 smartphones integrating over 1,500 components. Adopting Industry 4.0 automation, where global industrial robotics shipments exceed 600,000 units annually by 2025, is vital for efficiency and cost reduction, alongside developing manufacturing capabilities for complex designs. This strategic focus ensures competitiveness in a market prioritizing cutting-edge performance and sleek device profiles.

| Technological Factor | 2024 Projection | 2025 Projection |

|---|---|---|

| Global 5G Smartphone Shipments | >850 million units | N/A |

| Global Foldable Phone Shipments | >20 million units | N/A |

| Industrial Robotics Shipments | $24.5 billion investment | >600,000 units annually |

| Manufacturing IoT/AI Adoption | N/A | >70% of companies |

Legal factors

Shenzhen United Time Technology Co. navigates a complex landscape of international trade agreements, tariffs, and customs regulations, significantly impacting its global operations. Changes in these laws, such as the 2024 adjustments to semiconductor import tariffs in key markets, directly influence supply chain logistics and import/export costs. For instance, new EU customs codes effective Q1 2025 could alter market access and increase compliance burdens. Strict adherence to the specific legal requirements of each country is crucial to avoid substantial penalties and operational delays, ensuring seamless global commerce.

Intellectual property law is crucial for Shenzhen United Time Technology Co., particularly given its focus on product design and development. This encompasses robust protection for patents, trademarks, and design rights, which are vital assets in the competitive electronics sector. The company must establish strong legal frameworks to safeguard its proprietary innovations and the IP of its ODM/OEM clients. Moreover, strict adherence to IP regulations is essential to mitigate infringement risks, avoiding costly litigation that could reach millions of RMB, especially as China saw over 500,000 patent applications in 2023.

Shenzhen United Time Technology Co. must navigate stringent product safety and quality standards for mobile communication devices across global markets. Compliance with certifications like Europe's CE marking and the US FCC regulations is critical; for instance, the EU's Radio Equipment Directive (RED) 2014/53/EU continues to mandate strict conformity for devices entering the European Economic Area in 2024-2025. Failure to meet these requirements can lead to severe penalties, including fines that can reach significant percentages of annual turnover, as seen with some non-compliant companies facing multi-million dollar penalties, and extensive product recalls impacting profitability and brand reputation.

Labor and Employment Laws

Shenzhen United Time Technology Co. must strictly adhere to China's labor and employment laws, which dictate working hours, wages, and workplace safety standards. For instance, Shenzhen's monthly minimum wage is 2,360 CNY as of January 2024, and companies must comply with overtime compensation rules. As a supplier to global brands, the company also faces scrutiny under international supplier codes of conduct, often aligning with ILO labor standards. Maintaining compliance is crucial for ethical operations and mitigating reputational and legal risks in the 2024-2025 period.

- China's standard working hours are 8 hours per day, 44 hours per week.

- Mandatory social insurance contributions include pensions and medical care.

- Regular labor inspections by Chinese authorities are common.

- International brand audits often scrutinize forced labor and child labor.

Data Privacy and Security Regulations

With mobile device connectivity soaring, data privacy and security regulations represent critical legal hurdles for Shenzhen United Time Technology Co. While the company primarily manufactures hardware, the integrated software and applications within its devices must rigorously comply with global data protection laws. For instance, adherence to Europe's GDPR remains paramount, with potential fines reaching up to 4% of annual global turnover, a significant risk for the company's 2024/2025 operations. This compliance heavily influences product design and software development, ensuring user data protection from the outset.

- Global data privacy regulations are expanding, with over 150 countries expected to have some form of data protection law by 2025.

- The average cost of a data breach globally reached approximately $4.45 million in 2023, highlighting the financial risk of non-compliance.

- EU GDPR fines have cumulatively exceeded €2 billion by late 2023, impacting companies with a European presence.

- Emerging US state-level privacy laws like California's CPRA and new regulations in states like Texas (effective 2024) add complexity to compliance for device manufacturers.

Shenzhen United Time Technology Co. faces complex legal challenges including evolving global trade tariffs and stringent IP protection, crucial for its 2024-2025 operations. Compliance with international product safety standards like EU RED 2014/53/EU and US FCC regulations is vital, alongside adherence to China's labor laws, such as Shenzhen's 2,360 CNY monthly minimum wage as of January 2024. Data privacy, notably GDPR, remains critical, with potential fines reaching 4% of annual global turnover.

| Legal Area | Key Compliance | 2024/2025 Impact |

|---|---|---|

| Trade & Customs | Tariff adjustments, EU customs codes | Supply chain costs, market access |

| Intellectual Property | Patents, Trademarks | Mitigate litigation, safeguard innovation |

| Product Safety | CE, FCC, EU RED | Avoid recalls, significant fines |

| Labor Laws | Minimum wage, social insurance | Ethical operations, reputational risk |

| Data Privacy | GDPR, US State Laws | Product design, financial penalties |

Environmental factors

Governments globally are tightening regulations on electronic waste, significantly impacting manufacturers like Shenzhen United Time Technology. Directives such as the EU's updated RoHS, enforced for 2024 compliance, restrict hazardous substances, while WEEE mandates product recycling and disposal responsibilities. This necessitates designing products with their entire lifecycle in mind, from material selection to end-of-life management, to avoid penalties. Compliance costs are rising, especially as global e-waste generation is projected to exceed 68 million metric tons by 2025, adding considerable operational complexity.

There is a significant global push for manufacturers, including Shenzhen United Time Technology Co., to adopt more environmentally friendly practices, driven by evolving regulations and consumer demand. This includes reducing energy consumption, with China targeting significant industrial energy efficiency improvements by 2025, and minimizing waste through circular economy initiatives. Adopting green manufacturing not only ensures compliance with stricter environmental protection laws but also enhances the company's reputation, appealing to the growing segment of environmentally conscious clients who increasingly value sustainable products.

Global concerns about climate change are intensifying, compelling industries to drastically reduce their carbon footprint. Manufacturing firms like Shenzhen United Time Technology face heightened scrutiny regarding their energy consumption and greenhouse gas emissions. China's commitment to peak emissions before 2030 and achieve carbon neutrality by 2060 necessitates significant investment in sustainable practices. The company will likely need to allocate capital towards energy-efficient technologies and processes to comply with evolving 2024/2025 emissions standards, impacting operational costs and strategic planning.

Supply Chain Sustainability

The environmental impact across the entire supply chain is under increasing scrutiny for companies like Shenzhen United Time Technology Co., particularly concerning electronic components. This includes the responsible sourcing of raw materials, such as conflict minerals, and the environmental practices of component suppliers. By 2025, many global regulations and consumer demands necessitate that the company collaborates closely with its partners to ensure the entire value chain adheres to stringent environmental standards, aiming for reduced carbon footprints and waste.

- Global supply chain emissions average approximately 5.5 times a company's direct operational emissions.

- Over 70% of consumers globally prioritize sustainable practices when making purchasing decisions in 2024.

- New EU regulations, effective by late 2024/early 2025, will mandate greater supply chain transparency on environmental due diligence.

- Investment in green supply chain technologies is projected to reach $150 billion by 2025.

Use of Hazardous Materials

The electronics industry, including Shenzhen United Time Technology Co., faces increasing scrutiny over its historical use of hazardous materials in manufacturing. Global regulations are tightening, particularly concerning substances like lead, mercury, and cadmium, impacting electronic component supply chains into 2025. For instance, the demand for lead-free components continues to rise, with compliance crucial for accessing key international markets. Ensuring products meet these stringent material restrictions, such as those observed in the EU’s RoHS directive, is essential for market penetration and sustained growth.

- Global regulatory pressures on hazardous materials in electronics are intensifying, with a focus on compliance by 2025.

- Lead, mercury, and cadmium restrictions directly impact manufacturing processes and product design for international sales.

- Adherence to standards like RoHS is critical for Shenzhen United Time Technology Co. to secure access to European and other regulated markets.

Shenzhen United Time Technology faces escalating environmental regulations like EU RoHS by 2024 and WEEE mandates, driving up compliance costs as global e-waste hits 68 million metric tons by 2025. The company must invest in green manufacturing and energy efficiency, aligning with China's 2030 carbon peak goal, while addressing supply chain emissions averaging 5.5 times direct operations. Consumer demand for sustainable products, prioritized by over 70% of buyers in 2024, necessitates rigorous hazardous material control and full supply chain transparency by late 2024/early 2025.

| Environmental Factor | 2024/2025 Impact | Data Point |

|---|---|---|

| E-waste Generation | Rising compliance costs and operational complexity | Projected to exceed 68 million metric tons by 2025 |

| Supply Chain Emissions | Increased scrutiny and need for transparency | Average 5.5x company's direct operational emissions |

| Consumer Preference | Demand for sustainable products | Over 70% prioritize sustainable practices in 2024 |

| Hazardous Materials | Strict regulatory adherence for market access | Global regulatory focus on compliance by 2025 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Shenzhen United Time Technology Co. is built on a robust foundation of data from official Chinese government agencies, international economic forums, and leading technology industry research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.