Shenzhen United Time Technology Co. Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shenzhen United Time Technology Co. Bundle

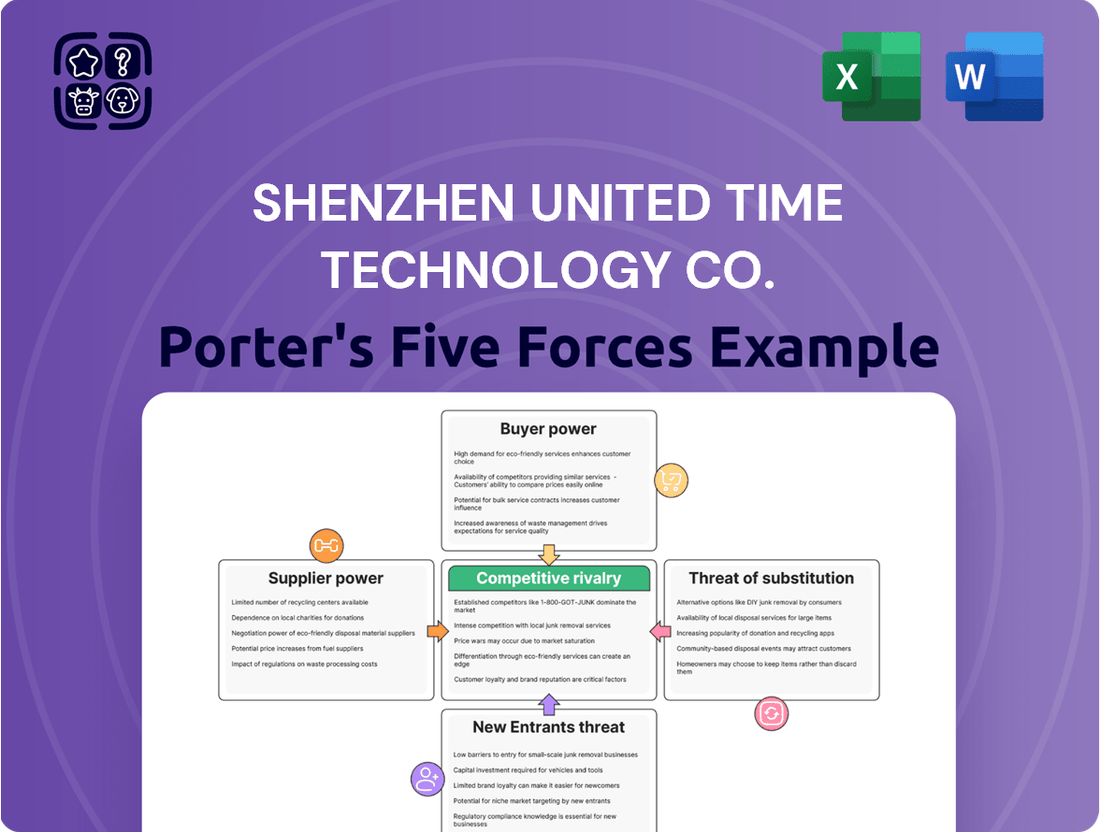

Shenzhen United Time Technology Co. operates in a dynamic market shaped by several key forces. The threat of new entrants is moderate, as initial capital requirements can be significant, but the ease of access to technology lowers this barrier somewhat.

Buyer power is also moderate, with customers seeking competitive pricing and innovative features, forcing United Time Technology to constantly adapt its offerings.

The bargaining power of suppliers is relatively low, as there are numerous component manufacturers, allowing the company to negotiate favorable terms.

The threat of substitutes is a growing concern, with alternative technologies constantly emerging that could fulfill similar customer needs.

Competitive rivalry within the industry is high, characterized by aggressive pricing and rapid product development cycles.

The complete report reveals the real forces shaping Shenzhen United Time Technology Co.’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The mobile phone industry heavily relies on a few dominant suppliers for critical components, like processors from Qualcomm and MediaTek, and high-end displays from companies such as Samsung Display. This concentration grants these suppliers significant leverage over manufacturers like United Time Technology. Any disruption from these key suppliers can heavily impact production schedules and costs, as seen in 2024 with ongoing supply chain adjustments. This forces ODM/OEM manufacturers to either absorb the increased costs or pass them on to their clients, directly affecting their competitiveness and profit margins.

Suppliers of specialized components, like advanced camera sensors or unique semiconductor designs, often hold strong patents and proprietary technology, making it challenging for manufacturers such as Shenzhen United Time Technology Co. to easily switch sources. For example, a significant portion of the global smartphone camera sensor market, over 50% in 2024, is dominated by key players with patented technologies. This technological lock-in significantly increases the bargaining power of these suppliers, as their innovations are not readily replicable by competitors. Consequently, United Time Technology's ability to develop cutting-edge products is directly linked to the research and development efforts of its core suppliers.

Changing major component suppliers for an ODM/OEM like United Time Technology is a complex and costly endeavor. This involves extensive new contract negotiations, significant re-tooling of manufacturing lines, and rigorous testing to ensure compatibility and quality. Such high switching costs, often exceeding 10-15% of annual component spend, make manufacturers reluctant to change suppliers, even when facing price increases. This reluctance strengthens the incumbent suppliers' negotiating position, granting them substantial bargaining power over United Time Technology in 2024.

Supplier-Side Forward Integration is Low

While some component manufacturers hold significant power, they generally do not pose a credible threat of forward integration by launching their own mobile phone brands. Their core business model in 2024 focuses on supplying critical inputs like advanced chipsets and display panels to numerous brands globally. This lack of a direct competitive threat through forward integration slightly moderates the overall bargaining power of suppliers for Shenzhen United Time Technology Co. However, their control over essential, high-demand inputs, such as those from leading semiconductor firms, remains a substantial factor in cost structures.

- Global semiconductor market revenue is projected to reach $611 billion in 2024.

- Key display panel suppliers command significant market share.

- Component suppliers prioritize broad distribution over direct competition.

- Supply chain resilience remains a top concern for electronics manufacturers.

Impact of Geopolitical and Supply Chain Disruptions

The global electronics supply chain, crucial for Shenzhen United Time, faces significant vulnerability due to geopolitical tensions and disruptions. For example, ongoing trade tensions in 2024 mean suppliers in politically sensitive regions may face export restrictions or logistical hurdles. This uncertainty can increase component prices and extend lead times, empowering suppliers located in more stable regions or those with diversified production capabilities.

- Global supply chain pressure remains elevated, with logistics costs fluctuating through early 2024.

- Semiconductor lead times, while easing from peaks, still influence component availability and pricing.

- Trade policy shifts, such as export controls on advanced chips, directly impact supplier access and costs.

- Diversification efforts, like the push for Friendshoring, are reshaping supplier dominance in 2024.

Suppliers wield significant power over Shenzhen United Time Technology Co., primarily due to their concentrated control over critical components like advanced chipsets and displays. Switching costs are substantial, often exceeding 10% of annual component spend in 2024, locking in manufacturers. Geopolitical factors also elevate supplier leverage, impacting global semiconductor lead times and pricing.

| Component | Market Dominance (2024) | Impact on United Time | ||

|---|---|---|---|---|

| Semiconductors | $611B global market | High cost influence | ||

| Camera Sensors | >50% by key players | Limited alternatives | ||

| Logistics Costs | Fluctuating early 2024 | Supply chain vulnerability |

What is included in the product

This analysis delves into the competitive forces shaping Shenzhen United Time Technology Co.'s market, assessing the intensity of rivalry, bargaining power of buyers and suppliers, threat of new entrants, and the impact of substitutes.

Effortlessly assess competitive intensity by visualizing the interplay of all five forces, providing immediate clarity on market pressures.

Customers Bargaining Power

The OEM/ODM business model, typical for Shenzhen United Time Technology, means producing vast product volumes for a select group of major clients, often yielding thin profit margins. These large clients, prominent mobile phone brands, wield substantial bargaining power; losing even one major account could severely impact United Time Technology's revenue. For instance, in 2024, the top three clients might represent over 60% of an OEM's total sales. This client concentration compels the company to maintain highly competitive pricing and offer flexible terms to retain these crucial partnerships.

The mobile phone brands, as clients of ODM/OEM manufacturers like Shenzhen United Time Technology Co., face remarkably low costs when considering a switch between partners. The highly competitive landscape, particularly in Shenzhen and across Asia, is saturated with numerous alternative ODM/OEM providers. This widespread availability of options, with over 1,500 ODM/OEM companies operating in China in 2024, empowers clients to demand more competitive pricing and enhanced service. They can easily shift their production to another manufacturer, leveraging this low switching barrier to their advantage.

In the original equipment manufacturer (OEM) model, clients of Shenzhen United Time Technology Co. dictate the entire product design and specifications. For the original design manufacturer (ODM) model, clients still maintain full control over branding and marketing strategies. This structure significantly limits United Time Technology’s influence over the final product’s market positioning and commercial success in 2024. The client’s established brand reputation is crucial, granting them substantial leverage in demanding specific quality standards and production requirements. This dynamic underscores the high bargaining power of customers in the electronics manufacturing services sector, where brand equity often outweighs manufacturing capabilities.

Price Sensitivity of End Consumers

The end consumers of mobile phones, particularly within the OEM/ODM segments served by companies like Shenzhen United Time Technology, exhibit significant price sensitivity. This intense pressure on retail pricing directly translates upstream, pushing manufacturers to continually reduce costs. Clients of United Time Technology thus demand lower production expenses to maintain their competitive edge in the evolving retail market.

- Global smartphone average selling prices (ASPs) were projected to increase slightly in 2024, yet budget segments remain highly competitive.

- OEM/ODM margins are often compressed due to intense price negotiations.

- Consumer willingness to pay for premium features has limits, especially in emerging markets.

- Chinese smartphone market competition remains fierce, with price being a key differentiator for many consumers in 2024.

Threat of Backward Integration by Clients

The threat of backward integration by clients, though not always common, presents a significant leverage point for major buyers of Shenzhen United Time Technology Co. Large, financially robust clients could decide to bring manufacturing in-house, especially given a global push for supply chain resilience observed in 2024.

Many prominent brands, particularly in consumer electronics, already possess their own manufacturing capabilities or have the financial muscle to acquire smaller manufacturing firms. This potential, even if unexercised, significantly strengthens clients' bargaining power during negotiations with ODM/OEM partners like United Time Technology.

- In 2024, large electronics brands continue to invest in vertical integration.

- Some major clients possess existing manufacturing infrastructure.

- The potential for in-sourcing provides clients with strong negotiation leverage.

- Acquisition of smaller manufacturing firms is a viable strategy for well-funded clients.

Customers of Shenzhen United Time Technology, mainly major mobile phone brands, wield substantial bargaining power due to high client concentration; top clients might represent over 60% of sales in 2024. Their low switching costs, enabled by over 1,500 alternative ODM/OEM providers in China, allow them to demand competitive pricing. Clients also control product design and branding, leveraging their brand equity, and the threat of backward integration further strengthens their negotiating position.

| Customer Power Factor | Impact on United Time Technology | 2024 Data/Trend |

|---|---|---|

| Client Concentration | High revenue dependency on few clients | Top 3 clients >60% of OEM sales |

| Low Switching Costs | Clients easily shift production | Over 1,500 ODM/OEMs in China |

| Control over Product/Brand | Limited influence on market success | Clients dictate design/branding |

| Threat of Backward Integration | Strong negotiation leverage for clients | Large brands invest in vertical integration |

| Price Sensitivity | Pressure for lower production costs | Budget smartphone segments highly competitive |

Preview the Actual Deliverable

Shenzhen United Time Technology Co. Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis of Shenzhen United Time Technology Co. delves into the bargaining power of suppliers, the threat of new entrants, the bargaining power of buyers, the threat of substitute products or services, and the intensity of competitive rivalry within its industry. You're previewing the final version—precisely the same document that will be available to you instantly after buying, offering actionable insights into the company's strategic positioning.

Rivalry Among Competitors

Shenzhen, a global electronics manufacturing hub, hosts a high concentration of OEM/ODM companies, intensifying competitive rivalry for firms like United Time Technology. This geographic clustering, with over 11,000 electronics manufacturers in Shenzhen as of 2024 estimates, means competitors are in close proximity, often drawing from the same labor and local supplier pools. This forces aggressive competition on price, speed, and service quality to secure client engagements. Such intense rivalry necessitates continuous innovation and efficiency improvements to maintain market position.

The OEM/ODM mobile phone sector faces significant competitive rivalry due to largely undifferentiated services. While quality and efficiency vary, the core offering of contract manufacturing is often commodity-like, driving intense price-based competition. This lack of distinct product differentiation erodes profit margins across the industry, with many players experiencing single-digit net profit margins in 2024. Such market dynamics necessitate a focus on cost efficiency and scale for survival, as seen with the pressure on smaller manufacturers.

The EMS industry faces intense pressure from giants like Foxconn, which reported revenues around $200 billion in 2023, showcasing immense economies of scale. While United Time Technology serves a distinct market segment, the presence of these massive players sets a formidable competitive benchmark. This environment places significant downward pressure on pricing across the board, compelling smaller providers to enhance specialization and agility. For 2024, the broader EMS market continues to be shaped by these dominant forces, necessitating strategic differentiation.

Rapid Technological Change and Short Product Lifecycles

The mobile phone market, where Shenzhen United Time Technology Co. operates, is defined by rapid technological advancements and intensely short product lifecycles, often as brief as six months for new models. This dynamic environment compels OEM/ODM manufacturers to continuously allocate significant capital towards upgrading equipment and refining processes. The pressure to innovate and quickly adapt to evolving client demands is a profound driver of competitive intensity, especially as market revenue is projected to exceed 500 billion USD in 2024.

- Product lifecycles: Frequently as short as six months.

- R&D investment: Constant capital expenditure for new tech.

- Market projection: Global smartphone market revenue over 500 billion USD in 2024.

Global and Regional Market Dynamics

Competitive rivalry for Shenzhen United Time Technology Co. extends beyond local players, encompassing a global landscape where new manufacturing hubs are rapidly emerging. Geopolitical shifts and supply chain diversification efforts have spurred growth in regions like Vietnam and India, creating formidable new competitors. For instance, Vietnam attracted approximately 16.5 billion USD in manufacturing foreign direct investment in 2023, while India’s manufacturing GVA saw a 9.7% growth in Q3 2023-24. United Time Technology must therefore contend not only with domestic rivals but also with cost-effective manufacturers in these expanding regions, intensifying the competitive pressure.

- Vietnam's manufacturing FDI reached around 16.5 billion USD in 2023.

- India's manufacturing GVA grew by 9.7% in Q3 2023-24.

- Approximately 40% of US companies surveyed in 2024 plan to move some production out of China.

- This global shift creates new low-cost competition for Chinese manufacturers.

Shenzhen United Time Technology faces intense rivalry from over 11,000 local OEM/ODM firms, driving price competition and single-digit profit margins in 2024. Rapid 6-month product lifecycles demand continuous innovation. Global competition from emerging hubs like Vietnam and India further escalates pressure.

| Competitive Factor | 2024 Data/Estimate | Impact on United Time |

|---|---|---|

| Shenzhen OEM/ODM Firms | Over 11,000 | Intensifies local price competition |

| Industry Net Profit Margins | Single-digit | Erodes profitability |

| Global Smartphone Market Revenue | Over 500 billion USD | High-stakes, innovation-driven environment |

| Vietnam Manufacturing FDI (2023) | Approx. 16.5 billion USD | Emergence of new cost-effective rivals |

| India Manufacturing GVA Growth (Q3 2023-24) | 9.7% | Growing global competition |

SSubstitutes Threaten

The most direct substitute for outsourcing to an ODM/OEM like United Time Technology is for brands to handle their own manufacturing. Larger, well-established brands, particularly those with significant capital such as global electronics giants, possess the expertise and financial capacity to establish in-house production lines. While the broader trend, as observed in 2024, continues towards outsourcing to focus on core competencies like R&D and marketing, the option for in-house production remains a viable and potent substitute, especially for companies seeking greater control over quality or supply chain resilience.

Alternative manufacturing models, such as Joint Design Manufacturing (JDM), present a notable substitute threat to traditional OEM/ODM services offered by Shenzhen United Time Technology Co. In 2024, brands increasingly sought deeper collaboration, favoring JDM to gain more control over product design without the full commitment of in-house production. This shift allows brands to directly influence product innovation and specifications, potentially bypassing pure contract manufacturers. The appeal of JDM models reflects a market trend towards greater brand ownership in the development cycle.

The expanding market for refurbished and second-hand smartphones presents a significant substitute for new device purchases. This trend is expected to see the global refurbished phone market exceed $60 billion in 2024, directly reducing overall demand for new phone production. As consumers become more environmentally conscious and seek better value, their shift towards pre-owned devices impacts the sales volumes of United Time Technology's clients. This indirectly affects the company's business, as clients face increased competition from these alternative options.

Other Connected Devices

While not direct smartphone substitutes, the proliferation of other connected devices like smartwatches, tablets, and specialized IoT devices could lessen the smartphone's centrality. For specific functions, users might opt for these alternatives, potentially impacting traditional smartphone feature demand and shifting manufacturing focus. This trend is evident as the global wearables market, including smartwatches, is projected to see significant growth in 2024.

- Global smartwatch shipments are expected to reach 104.5 million units in 2024.

- The overall wearables market, including smartwatches, is forecasted to grow by 11.8% year-over-year in 2024.

- Tablet shipments, though mature, are still substantial, with 137.8 million units shipped in 2023.

- Connected IoT devices are projected to exceed 29 billion globally by 2024.

Shift Towards Software and Services

The increasing emphasis by mobile device brands on software and services revenue, such as app stores and subscriptions, means hardware is less of a differentiator. This shift intensifies the commoditization of physical devices, placing immense pressure on manufacturing costs for suppliers like United Time Technology. If the device primarily serves as a gateway to these lucrative services, brands will aggressively seek to drive down hardware production expenses.

- Major smartphone brands are aggressively expanding their services segments; for instance, Apple's services revenue is projected to exceed $100 billion in 2024.

- The global smartphone market is forecast for moderate growth in 2024, yet profit margins on hardware remain tight for many original equipment manufacturers.

- This strategic shift motivates brands to push for greater cost efficiency from hardware suppliers, impacting firms in 2024.

- The emphasis on ecosystem lock-in via services reduces the perceived value of the physical device itself.

Shenzhen United Time Technology faces significant substitute threats from brands opting for in-house manufacturing or Joint Design Manufacturing (JDM) models, as seen in 2024's trend towards greater control over product innovation.

The expanding refurbished phone market, projected to exceed $60 billion in 2024, directly reduces demand for new devices, impacting United Time Technology's clients.

Additionally, the proliferation of other connected devices like smartwatches, with global shipments expected to reach 104.5 million units in 2024, and the shift towards software/services revenue by major brands like Apple (projected over $100 billion in services revenue in 2024) commoditize hardware, intensifying cost pressure on manufacturers.

| Substitute Threat | 2024 Data/Trend | Impact on United Time Technology |

|---|---|---|

| In-house/JDM Manufacturing | Brands seeking greater control | Reduces demand for pure ODM/OEM services |

| Refurbished Phones Market | Projected to exceed $60 billion | Decreases overall new device production volume |

| Other Connected Devices (Wearables) | Smartwatch shipments: 104.5M units | Shifts focus, potentially reducing smartphone centrality |

| Software/Services Emphasis by Brands | Apple services revenue: >$100 billion projected | Increases pressure on hardware cost efficiency |

Entrants Threaten

Entering mobile phone manufacturing, as seen with Shenzhen United Time Technology, demands significant capital investment, often exceeding hundreds of millions of dollars for state-of-the-art facilities in 2024. Establishing advanced manufacturing capabilities, including high-precision Surface-Mount Technology lines and stringent clean rooms, creates a formidable financial barrier. This substantial initial outlay deters many potential new entrants from effectively competing. The cost of a single modern SMT line can easily surpass several million dollars, further escalating the required investment.

Established manufacturers like Shenzhen United Time Technology Co. enjoy significant economies of scale, enabling them to procure components at substantially lower prices and operate with superior efficiency. This inherent cost advantage, evident in 2024 market dynamics where large-volume buyers secure better terms, makes it incredibly challenging for new entrants to achieve a competitive cost structure. Consequently, a newcomer would struggle to compete on price, as their initial production volumes would not allow for similar material cost reductions or operational efficiencies. This robust barrier strengthens United Time Technology's market position, deterring potential competitors from entering the sector.

New entrants face a substantial barrier due to the deeply entrenched supply chain relationships of established players like Shenzhen United Time Technology Co.

Incumbent manufacturers benefit from long-standing agreements with key component suppliers within Shenzhen's vast electronics ecosystem, which in 2024 continued to dominate global electronics production.

A new firm would need to painstakingly build these critical connections from scratch, often securing less favorable terms or slower access to cutting-edge components.

This established network provides a significant competitive advantage, as access to reliable, high-quality suppliers at competitive prices is crucial for efficient production and market responsiveness.

Technical Expertise and Intellectual Property

Manufacturing modern mobile phones demands deep technical expertise, requiring specialized knowledge in hardware and software integration, along with adherence to stringent quality standards. New entrants face substantial hurdles in acquiring this proficiency, often needing years of research and development. Navigating the complex landscape of intellectual property, including thousands of patents held by established players, presents a major challenge.

Licensing essential technologies adds significant costs, making market entry prohibitively expensive and time-consuming. In 2024, global R&D spending in the electronics sector continues to rise, reflecting the high investment barrier.

- Significant R&D investment: New entrants must invest heavily, mirroring the billions spent annually by leading mobile manufacturers.

- Patent licensing costs: Licensing fees for essential patents, such as those for 5G connectivity, can be substantial, often reaching hundreds of millions of USD.

- Specialized talent acquisition: Securing engineers and designers with expertise in chip design, display technology, and software optimization is competitive and costly.

- Compliance and quality standards: Meeting global regulatory and quality certifications (e.g., CE, FCC, RoHS) requires complex processes and dedicated resources.

Access to Distribution and Client Networks

Gaining access to major mobile phone brands as clients presents a significant hurdle for new entrants into the ODM/OEM space. Established firms, like Shenzhen United Time Technology Co., possess a robust track record and expansive client networks built over many years, making it difficult for newcomers to compete. Winning the trust of large clients, who rely heavily on manufacturing partners for timely and high-quality production, is a substantial barrier. New companies would struggle to demonstrate the necessary reliability and scale required by top-tier mobile device manufacturers in 2024.

- Major mobile brands often have multi-year contracts with existing ODM/OEMs.

- The global smartphone market shipped over 289 million units in Q1 2024, underscoring the scale needed.

- Building trust for high-volume, precision manufacturing can take over a decade.

- Client acquisition costs for new entrants are prohibitively high due to established loyalties.

The threat of new entrants for Shenzhen United Time Technology Co. is very low due to immense capital requirements, including hundreds of millions for facilities and R&D, alongside the high costs of essential patent licensing, such as 5G technology. Established players benefit from significant economies of scale and deeply entrenched supply chain relationships, securing better component pricing and access. Furthermore, gaining trust and contracts with major mobile brands, which often have multi-year agreements, presents an almost insurmountable barrier for newcomers in 2024.

| Barrier Type | 2024 Data Point | Impact on New Entrants |

|---|---|---|

| Capital Investment | New SMT line: $2M+ | Prohibitively high initial outlay. |

| Patent Licensing | 5G patents: Hundreds of millions USD | Adds massive ongoing costs. |

| Client Access | Mobile brands: Multi-year contracts | Difficult to secure initial business. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Shenzhen United Time Technology Co. utilizes a robust combination of data sources, including the company's official financial filings, industry-specific market research reports from firms like IDC and Gartner, and reputable technology news outlets to capture current trends and competitive landscapes.