TÜV Rheinland AG Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TÜV Rheinland AG Bundle

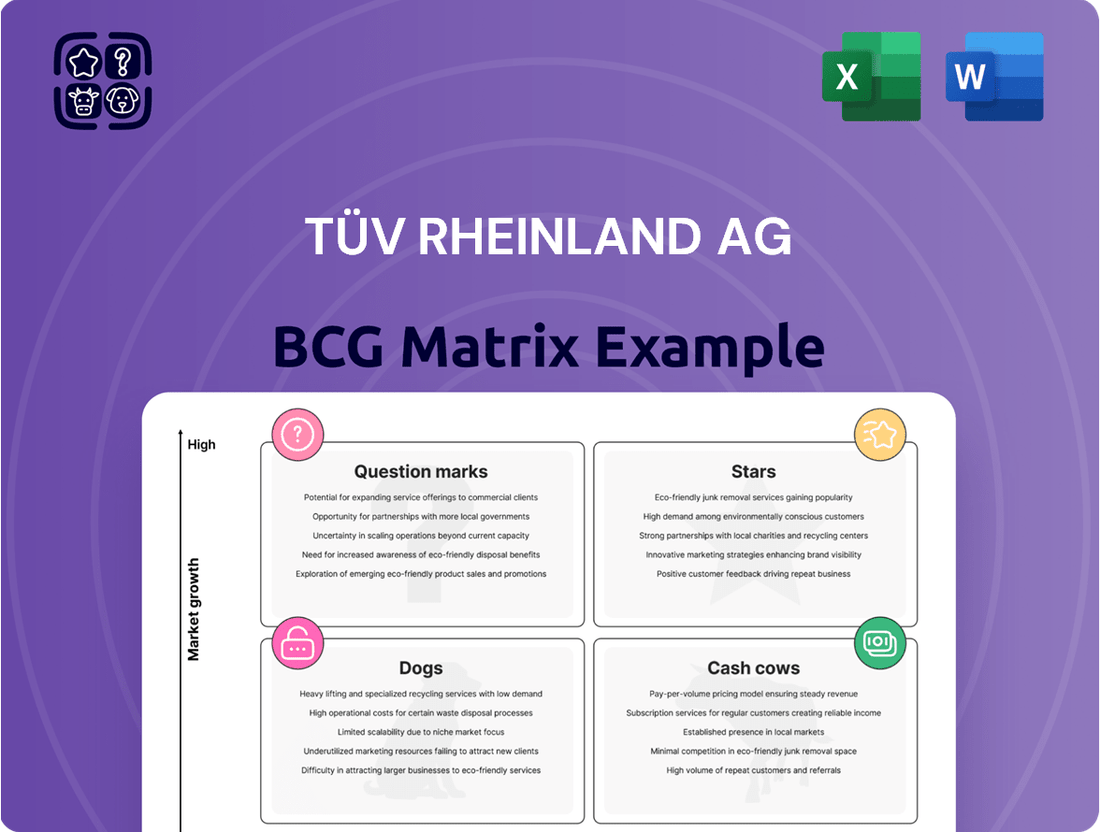

Curious about TÜV Rheinland AG's strategic product portfolio? Our preview offers a glimpse into their market positioning, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Understand where their innovations and established services are thriving and where challenges lie. This snapshot is designed to spark your strategic thinking.

To truly unlock TÜV Rheinland AG's competitive advantage, you need the full picture. Purchase the complete BCG Matrix to gain a detailed quadrant-by-quadrant analysis, complete with data-backed recommendations and actionable insights. This comprehensive report is your roadmap to optimizing resource allocation and driving future growth for TÜV Rheinland AG.

Stars

Cybersecurity Services within TÜV Rheinland AG's BCG Matrix are positioned as a strong Star. The company is significantly increasing its investment in this sector, fueled by stringent new regulations like the EU's Cyber Resilience Act and NIS-2 Directive, alongside a rise in sophisticated cyber threats.

TÜV Rheinland provides crucial services such as testing, industrial security audits, and data protection audits specifically for IoT and cloud infrastructures. This segment demonstrates substantial growth potential, a key indicator for a Star.

The company is actively enhancing its market standing through specialized expertise and strategic growth initiatives. This proactive approach aims to solidify TÜV Rheinland's leadership role in safeguarding the evolving digital landscape.

The Environmental, Social, and Governance (ESG) verification market is booming, driven by heightened corporate and regulatory attention to sustainability. TÜV Rheinland has capitalized on this trend, generating roughly €650 million from its ESG services in 2024, a clear indicator of their substantial market presence and dedication.

TÜV Rheinland's comprehensive suite of ESG services, which includes carbon footprint verification, circular economy solutions, and support for new reporting mandates like the Corporate Sustainability Reporting Directive (CSRD), solidifies their strong position. This robust offering highlights their significant share in an expanding and increasingly vital sector.

The electric mobility sector is experiencing tremendous growth, creating a significant market for testing and certification services. TÜV Rheinland is making substantial investments to expand its expertise in this area, including building new labs focused on cutting-edge battery and automotive electronics. For instance, the global electric vehicle market was valued at over $380 billion in 2023 and is projected to reach over $1.5 trillion by 2030, highlighting the immense opportunity.

TÜV Rheinland's strategic focus on e-mobility testing and certification places it in a strong position within the BCG matrix. Their work in battery diagnostics for pre-owned electric vehicles further strengthens their standing in this rapidly expanding, high-demand sector. This expansion aligns with the global push towards sustainability and reduced emissions, driving demand for reliable testing and validation of EV components.

AI Safety & Ethics Certification

As artificial intelligence becomes more woven into the fabric of business, the need for assurance around AI safety and ethical practices is skyrocketing. TÜV Rheinland is actively shaping this crucial landscape.

They are involved in creating important standards, such as ISO/PAS 8800, specifically for AI used in road vehicles, ensuring these systems are reliable and secure. This proactive engagement positions them as a key player in a market that is just beginning to mature but shows immense growth potential.

Furthermore, TÜV Rheinland is offering conformity assessments for AI systems deemed high-risk under the EU AI Act. This means they are providing the necessary checks and balances to ensure compliance with evolving regulations in this fast-paced field.

This strategic focus allows TÜV Rheinland to build significant expertise and establish early leadership in the AI safety and ethics certification sector, a market expected to see substantial expansion in the coming years.

- Market Demand: The global AI market is projected to reach over $1.5 trillion by 2026, highlighting the growing need for associated safety and ethical certifications.

- Regulatory Influence: TÜV Rheinland's involvement in standards like ISO/PAS 8800 and conformity assessments for the EU AI Act demonstrates their impact on shaping industry best practices.

- Growth Potential: This nascent certification market is anticipated to grow rapidly as AI adoption increases across diverse industries, creating a strong revenue opportunity.

- Expertise Development: By actively participating in standard-setting and offering assessments, TÜV Rheinland is cultivating deep expertise in a critical and emerging field.

Renewable Energy Project Certification

The global pivot towards renewable energy, particularly solar and wind, is fueling a substantial demand for rigorous project certification and inspection. TÜV Rheinland is actively participating in this growth, demonstrated by their strategic investments in advanced solar module testing facilities and their active engagement with key industry bodies such as the Solar Energy Industries Association (SEIA).

This sector represents a significant opportunity for TÜV Rheinland within a BCG matrix framework. The growing emphasis on ensuring quality and transparency throughout the renewable energy supply chain solidifies its position as a high-growth market segment where the company already holds considerable market share.

- High Growth: The renewable energy sector is projected for continued expansion, driven by global decarbonization efforts and supportive government policies.

- High Market Share: TÜV Rheinland's established expertise and infrastructure in testing and certification give it a competitive edge in this expanding market.

- Investment Focus: Continued investment in solar module laboratories and industry partnerships signals a strategic commitment to capturing further market share.

- Demand Drivers: Increasing regulatory requirements and consumer demand for reliable, high-quality renewable energy solutions bolster the need for certification services.

TÜV Rheinland's Artificial Intelligence (AI) safety and ethics certification services are a prime example of a Star within their BCG Matrix. The company is actively developing expertise and offering conformity assessments for high-risk AI systems under regulations like the EU AI Act.

This sector shows immense growth potential, as the global AI market is projected to exceed $1.5 trillion by 2026, creating a significant demand for assurance around AI safety and ethical practices.

By participating in standard-setting, such as ISO/PAS 8800 for AI in road vehicles, TÜV Rheinland is establishing itself as a leader in this nascent but rapidly expanding market.

Their focus on AI safety and ethical certification positions them to capture substantial market share in a field critical for future technological development and societal trust.

What is included in the product

This BCG Matrix overview for TÜV Rheinland AG offers clear strategic insights for Stars, Cash Cows, Question Marks, and Dogs.

It highlights which business units to invest in, hold, or divest based on market growth and share.

The TÜV Rheinland AG BCG Matrix provides a clear, one-page overview, alleviating the pain of complex business unit analysis.

Cash Cows

TÜV Rheinland's industrial plant and equipment inspection services are true cash cows. They hold a strong, long-standing position in mandatory inspections, like those for pressure vessels and elevators. This dominance is fueled by stable, recurring revenue and deep market penetration, largely due to regulatory mandates.

While the market for these services doesn't see rapid growth, the consistent demand is undeniable. TÜV Rheinland's established expertise and vast client network ensure this segment reliably generates significant cash flow, providing a solid foundation for the company's operations.

TÜV Rheinland's Vehicle Inspection Services, often referred to as TÜV Checks, represent a classic cash cow within its business portfolio. In core markets like Germany, where these inspections are legally mandated, the company commands a substantial portion of the market. This translates into a reliable and consistent revenue stream, as the demand for these services remains high and relatively inelastic, requiring minimal new investment in marketing or innovation.

The strategic acquisition of Bilprovningen, Sweden's leading vehicle inspection company, further solidifies TÜV Rheinland's dominance in this sector. This move not only expands its geographical footprint but also reinforces its position in a mature, yet indispensable, market. The predictable nature of these inspections ensures a steady cash flow, allowing the company to fund growth initiatives in other business areas.

In 2024, the global automotive aftermarket, which includes vehicle inspection services, continued to show resilience. While growth rates might be moderate, the essential nature of safety and emissions testing underpins the stability of TÜV Rheinland's cash cow. The company's established network and brand recognition provide a significant competitive advantage, ensuring continued market leadership and profitability in this segment.

Management system certifications, such as ISO 9001 for quality and ISO 14001 for environmental management, represent a stable and profitable segment for TÜV Rheinland AG. This is a mature service area with consistent demand across virtually all industries globally, making it a reliable cash cow.

TÜV Rheinland's established reputation as a leading certification body ensures a continuous stream of clients seeking these crucial accreditations. The recurring nature of audits and renewals, typically every three years, provides a predictable revenue base.

These services generally require minimal ongoing investment in new technology or product development, leading to high profit margins. For instance, the global market for management system certification services is substantial, with many companies prioritizing compliance and operational excellence.

In 2024, the continued emphasis on quality, sustainability, and operational efficiency worldwide underpins the ongoing demand for these certifications. This consistent need translates into robust and predictable earnings for TÜV Rheinland in this category.

Traditional Product Safety Testing & Certification

Traditional Product Safety Testing & Certification represents a cornerstone for TÜV Rheinland AG, functioning as a classic Cash Cow within its business portfolio.

This segment thrives on the consistent and high-volume demand for ensuring consumer products meet fundamental safety standards, such as electrical safety and CE marking for established categories. TÜV Rheinland's long-standing reputation for quality and trust acts as a significant competitive moat, enabling them to command market share in this mature but stable sector.

The predictable revenue streams generated here provide a reliable financial backbone, allowing for investment in other, more growth-oriented areas of the company. In 2024, the global product testing, inspection, and certification (TIC) market, which this segment is a part of, was valued at approximately $220 billion and is expected to grow steadily.

- Market Maturity: A well-established and high-volume market.

- Brand Strength: TÜV Rheinland's reputation is a key differentiator.

- Revenue Stability: Generates consistent and predictable income.

- Industry Contribution: Forms a foundational service for manufacturers worldwide.

Personnel Training & Qualification

TÜV Rheinland AG's Personnel Training & Qualification segment operates as a significant Cash Cow within its business portfolio. The company's robust training programs, spanning diverse technical and professional domains, consistently generate substantial revenue streams. This is a testament to their established expertise and the ongoing demand for professional development and regulatory adherence across industries.

Leveraging a vast pool of industry specialists, TÜV Rheinland provides essential training that addresses evolving skill requirements and compliance mandates. In 2024, the demand for specialized certifications in areas like renewable energy and digitalization remained exceptionally strong, directly benefiting this segment. The company's long-standing reputation for quality and reliability in this mature market provides a distinct competitive advantage, ensuring stable and predictable cash flow generation.

- Consistent Revenue Generation: TÜV Rheinland's training and qualification services are a reliable source of income, driven by continuous demand for upskilling and compliance.

- Expertise and Reputation: Deep industry knowledge and a strong brand reputation allow TÜV Rheinland to command premium pricing and maintain market leadership.

- Mature Market Dominance: Operating in a well-established market, the company benefits from its established presence and trusted brand, leading to steady cash flow.

- Adaptability to Industry Needs: The training offerings are continuously updated to meet current industry demands, ensuring sustained relevance and profitability.

TÜV Rheinland's robust Industrial Plant and Equipment Inspection services are a prime example of a cash cow. This segment benefits from a mature market with consistent, recurring revenue streams, largely driven by regulatory requirements for safety and compliance. Its strong market penetration and established expertise ensure predictable cash flow, minimizing the need for significant new investment.

Similarly, their Vehicle Inspection Services, particularly in regions with mandatory testing, function as dependable cash cows. The predictable, high-volume demand, coupled with TÜV Rheinland's strong brand recognition and extensive network, guarantees stable earnings. For instance, in Germany, where these inspections are legally mandated, TÜV Rheinland maintains a significant market share, contributing substantially to its cash flow.

Management System Certifications and Traditional Product Safety Testing & Certification also represent key cash cows. These mature service areas benefit from ongoing demand across diverse industries, driven by the need for quality, safety, and compliance. The recurring nature of audits and renewals, alongside a strong reputation, ensures consistent revenue generation with relatively low investment requirements.

| Service Segment | Market Characteristic | Revenue Stability | Investment Need | Cash Flow Generation |

|---|---|---|---|---|

| Industrial Plant & Equipment Inspection | Mature, Regulatory Driven | High, Recurring | Low | Strong, Predictable |

| Vehicle Inspection Services | Mature, Mandatory Testing | High, Consistent Volume | Low | Strong, Reliable |

| Management System Certifications | Mature, Broad Industry Demand | High, Recurring Audits | Low | Strong, Stable |

| Product Safety Testing & Certification | Mature, High Volume Consumer Goods | High, Consistent | Low | Strong, Foundational |

Preview = Final Product

TÜV Rheinland AG BCG Matrix

The TÜV Rheinland AG BCG Matrix you are currently previewing is precisely the comprehensive report you will receive immediately after your purchase. This means you are seeing the final, unwatermarked, and fully formatted document, ready for immediate strategic application without any need for revisions or additional content.

Dogs

Outdated Niche Industrial Testing represents a potential Dogs category within TÜV Rheinland AG's portfolio. These are specialized testing methods or certifications that cater to industries experiencing decline or have been outmoded by advancements in technology and evolving regulatory landscapes. For instance, certain legacy testing for older manufacturing equipment might fall into this group, with demand shrinking as industries modernize.

TÜV Rheinland may continue to offer these legacy services, but they likely face very low market demand and exhibit limited growth potential. Consider the market for testing specific, older types of industrial machinery components; as these machines are retired, the need for their specialized testing diminishes significantly. This means these services generate minimal revenue.

The primary concern with such offerings is their inefficiency. They can tie up valuable resources, including skilled personnel and specialized equipment, which could otherwise be allocated to more promising or high-growth areas of TÜV Rheinland's business. For example, dedicating lab space and expert technicians to obsolete testing methods diverts capacity from emerging fields like advanced materials testing or cybersecurity certification.

By 2024, the global industrial testing market is vast, but niche segments tied to outdated technologies represent a shrinking portion. While specific financial data for these exact "Dogs" within TÜV Rheinland isn't publicly disclosed, the overall trend in industrial sectors shows a clear move towards digitization and new materials, making legacy testing a diminishing prospect.

In highly competitive markets, basic inspection services offered by TÜV Rheinland AG can face significant price pressure. This intensifies competition, potentially leading to lower profit margins for the company. For instance, in some European countries, the market for standard automotive inspections is saturated with numerous providers, driving down the average price per inspection.

If TÜV Rheinland's presence in these commoditized segments is characterized by a small market share and limited growth prospects, these services could be categorized as Dogs within the BCG matrix. Such operations may consume resources without generating substantial returns, acting as cash traps.

For example, if TÜV Rheinland's basic electrical safety testing in a mature market has only a 5% market share and is growing at a mere 2% annually, this aligns with the characteristics of a Dog. This situation necessitates careful evaluation to either divest or find a niche for differentiation.

TÜV Rheinland AG's engagement with legacy IT system audits for phased-out technologies likely positions these services within the 'Dogs' quadrant of the BCG Matrix. The demand for audits of systems like older versions of COBOL-based financial platforms or unsupported operating systems is inherently shrinking as organizations migrate to modern solutions.

While specific market share data for TÜV Rheinland in this niche is not publicly detailed, it's reasonable to infer it would be minimal given the declining nature of the technology itself. For instance, in 2024, the global IT spending on legacy system modernization was estimated to be in the billions, indicating a shift away from maintaining older infrastructure.

Non-Core, Undifferentiated Consulting Services

Non-core, undifferentiated consulting services represent a category where TÜV Rheinland AG may not hold a distinct competitive edge or strong market recognition. These offerings, often generic in nature, are susceptible to significant competition from a wide array of consulting firms. Consequently, TÜV Rheinland’s market share in these areas is likely to be limited, with constrained potential for future growth.

For instance, if TÜV Rheinland were to offer general business process improvement consulting without a specific industry focus or proprietary methodology, it would likely fall into this category. Such services are readily available from numerous global and local consulting players, making it challenging for TÜV Rheinland to differentiate itself and capture substantial market share. This can lead to lower profitability and a need for strategic re-evaluation.

- Low Market Share: These services typically struggle to gain a significant foothold due to the crowded competitive landscape.

- Limited Growth Potential: Without unique value propositions, expansion opportunities are often capped.

- Intense Competition: Broader consulting firms with established reputations and wider service portfolios dominate these segments.

- Resource Drain: Investing heavily in non-core areas can divert resources from TÜV Rheinland's more specialized and profitable service lines.

Very Traditional, Low-Tech Training Programs

Very Traditional, Low-Tech Training Programs represent a segment within TÜV Rheinland AG's portfolio that offers fundamental, time-tested educational content. These offerings often lack substantial investment in digital innovation or niche specialization, positioning them in a market where competition from smaller, more cost-effective providers and online learning platforms is intense. This can lead to a situation where these programs experience a gradual decrease in both student numbers and revenue generation, consequently holding a reduced market share in an increasingly standardized training environment.

The challenge for these programs lies in their inability to differentiate themselves in a crowded marketplace. For example, many providers now offer basic safety or compliance training at significantly lower price points than traditional institutions. In 2024, the global e-learning market was valued at over $300 billion, demonstrating the massive shift towards digital and accessible learning solutions. Without adapting to these trends, TÜV Rheinland's traditional programs risk becoming obsolete.

- Market Saturation: Basic, traditional training is widely available, leading to intense competition.

- Low Differentiation: Lack of technological advancement or specialization makes these programs less appealing.

- Price Sensitivity: Cheaper online alternatives are eroding the market share of traditional, higher-cost programs.

- Declining Profitability: Reduced enrollment and competitive pricing put pressure on profit margins.

Services like legacy industrial testing, outdated IT system audits, and basic, low-tech training programs can be classified as Dogs for TÜV Rheinland AG. These offerings typically have low market share and minimal growth prospects, often due to technological obsolescence or intense competition from more agile providers. For instance, in 2024, the global market for digital transformation technologies continued to grow, making investments in legacy systems less attractive.

These "Dog" services can drain valuable resources, including personnel and capital, that could be better utilized in higher-growth or more profitable areas of the business. The challenge lies in their low profitability and inability to command premium pricing. A prime example is basic safety training; while necessary, it faces immense competition from online platforms, as evidenced by the e-learning market's rapid expansion, valued over $300 billion in 2024.

Strategic decisions for these segments often involve divestment, phasing out, or finding a minimal niche to sustain them without significant investment. The focus shifts from growth to resource optimization, ensuring these services do not hinder the company's overall strategic objectives. For example, the demand for testing components of machinery phased out by 2025 will naturally decline, making such services a clear candidate for a Dogs classification.

TÜV Rheinland's involvement in commoditized inspection services, particularly in saturated markets like standard automotive checks in Europe, also presents Dog-like characteristics. Here, a small market share combined with low growth, often exacerbated by price wars among numerous competitors, means these services may barely cover their costs.

| Service Category | BCG Quadrant | Market Share | Growth Potential | Key Challenges |

|---|---|---|---|---|

| Legacy Industrial Testing | Dog | Low | Very Low | Technological obsolescence, declining demand |

| Outdated IT System Audits | Dog | Low | Very Low | Migration to modern solutions, shrinking user base |

| Basic, Low-Tech Training | Dog | Low | Low | Intense competition from online platforms, low differentiation |

| Commoditized Inspection Services | Dog | Low | Low | Market saturation, price pressure, high competition |

Question Marks

The certification of advanced digital twin models for industrial applications represents a burgeoning sector within the Industry 4.0 landscape, signaling significant future growth. While the market is still in its formative stages, formal certification standards are not yet widely established, placing it in a Question Mark category for TÜV Rheinland AG's BCG Matrix.

TÜV Rheinland is strategically positioning itself in this nascent market, acknowledging its substantial long-term potential despite a currently low market share. Investments are being channeled into developing expertise and frameworks for validating the accuracy and reliability of complex digital twin simulations for critical industrial assets and processes.

The demand for such certifications is expected to surge as industries increasingly rely on digital twins for predictive maintenance, performance optimization, and risk management. For instance, the global digital twin market was projected to reach USD 57.7 billion by 2027, with significant growth driven by industrial sectors.

Quantum computing's rapid development necessitates robust security testing for quantum-safe algorithms and hardware. TÜV Rheinland is positioned to address this emerging high-growth, low-market-share sector, which represents a speculative but potentially lucrative investment for the company.

The global quantum computing market is projected to reach $2.2 billion in 2024, with significant growth expected as post-quantum cryptography (PQC) standards are finalized and adopted. TÜV Rheinland's expertise in testing and certification aligns perfectly with the upcoming demand for validating the security of quantum-resistant technologies.

This area is characterized by substantial uncertainty regarding market adoption timelines and competitive landscapes, making it a classic "question mark" in the BCG matrix. However, early investment in developing capabilities for quantum security testing could provide TÜV Rheinland with a first-mover advantage.

By 2030, the market for quantum security solutions, including testing and certification, is anticipated to surge, driven by government mandates and enterprise preparedness for quantum threats. TÜV Rheinland's strategic focus on this niche positions it to capitalize on this future growth, provided it can effectively navigate the technological and market complexities.

The burgeoning field of smart city infrastructure, encompassing everything from intelligent traffic management to secure smart grids, presents a significant growth opportunity. As of 2024, global smart city investments are projected to exceed $200 billion annually, highlighting the rapid expansion. TÜV Rheinland's certification services play a crucial role in ensuring the safety, security, and interoperability of these complex, interconnected systems, which is vital for public trust and operational efficiency.

However, the smart city certification market is still in its nascent stages and highly fragmented, with numerous niche players. TÜV Rheinland, despite its established reputation in testing and certification, likely holds a relatively small share within this broad and rapidly evolving sector. This positions the service as a potential question mark within the BCG matrix, with high growth potential but currently uncertain market dominance.

Blockchain-based Supply Chain Traceability Solutions

Blockchain-based supply chain traceability solutions, while addressing a critical need for transparency and verification, are still navigating early adoption phases. For TÜV Rheinland AG, this technological niche represents a promising area for future growth, aligning with increasing demands for secure and verifiable product journeys.

The market for advanced traceability solutions is expanding, driven by consumer demand for ethical sourcing and regulatory pressures for greater accountability. While traditional methods currently dominate, the unique capabilities of blockchain in providing immutable records position it for significant disruption.

In the context of a BCG Matrix, TÜV Rheinland's blockchain traceability offerings would likely fall into the 'Question Mark' category. This is due to their high potential growth driven by market trends, but a currently low market share as the technology matures and broader industry acceptance takes hold. For instance, the global blockchain in supply chain market size was projected to reach USD 2.7 billion in 2023 and is expected to grow at a CAGR of over 50% through 2030, indicating a rapidly expanding, albeit nascent, opportunity.

- High Growth Potential: Driven by increasing demand for supply chain transparency and combating counterfeiting.

- Low Market Share: Adoption is still limited compared to established, non-blockchain traceability methods.

- Investment Required: Significant R&D and market development are needed to capture market share.

- Strategic Importance: Positions TÜV Rheinland at the forefront of innovative verification technologies.

Specialized Drone Inspection Services for New Industries

Specialized drone inspection services for new industries represent a potential star in TÜV Rheinland's BCG matrix. While the overall drone inspection market is growing, these niche applications, such as detailed structural health monitoring for advanced manufacturing facilities or precision surveying for emerging renewable energy projects like offshore wind farms, are experiencing rapid expansion. TÜV Rheinland is likely investing in developing expertise and technology for these high-growth, but currently low-share, segments, positioning itself for future dominance.

Consider the agricultural sector, where specialized drone services for precise crop health analysis, pest detection, and yield prediction are gaining traction. For instance, the global agricultural drone market was valued at approximately $2.0 billion in 2023 and is projected to reach over $5.0 billion by 2028, showcasing significant growth potential. TÜV Rheinland's strategic focus on these emerging industrial applications aligns with a BCG matrix approach, aiming to capture market share in areas with high future revenue prospects.

- High Growth Potential: Emerging industries like advanced manufacturing, precision agriculture, and novel infrastructure projects (e.g., specialized bridges, tunnels) are increasingly adopting drone technology for inspections.

- Low Current Market Share: TÜV Rheinland may currently hold a smaller percentage of these highly specialized market segments compared to more established inspection areas.

- Strategic Investment: Developing advanced sensor payloads, AI-driven data analysis platforms, and specialized operational expertise for these new industries is crucial for future leadership.

- Future Star Candidate: By investing in these niche, high-growth areas, TÜV Rheinland aims to transform these segments from question marks into stars within its service portfolio.

The certification of advanced digital twin models for industrial applications, quantum computing security testing, and smart city infrastructure certification all represent areas where TÜV Rheinland AG is investing in high-growth potential markets with currently limited market share.

These sectors, characterized by technological evolution and nascent market adoption, align with the 'Question Mark' category in the BCG matrix, necessitating strategic investment to capture future market leadership.

For instance, the global digital twin market was projected for significant growth, and the quantum computing market is expected to expand rapidly as post-quantum cryptography standards are adopted, with smart city investments projected to exceed $200 billion annually in 2024.

TÜV Rheinland's early engagement in these fields positions them to capitalize on emerging trends and establish a strong foothold, provided they effectively navigate the inherent market and technological uncertainties.

BCG Matrix Data Sources

Our TÜV Rheinland AG BCG Matrix leverages comprehensive market data from financial reports, industry growth projections, and internal performance metrics to accurately position business units.