Tourism Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tourism Holdings Bundle

Tourism Holdings operates within a dynamic market shaped by several key competitive forces. Understanding the intensity of rivalry among existing players, the bargaining power of buyers, and the influence of suppliers is crucial for strategic planning. Furthermore, the threat of new entrants and the availability of substitute products significantly impact Tourism Holdings' profitability and market position.

The complete report reveals the real forces shaping Tourism Holdings’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of vehicle manufacturers for Tourism Holdings Limited (THL) is a notable factor, leaning towards moderate to high. THL's entire operation, renting out motorhomes and campervans, is fundamentally reliant on securing a steady supply of these specialized vehicles. While THL's substantial order volumes do give it some clout, the niche market for recreational vehicles means there are fewer large-scale manufacturers, which can empower these suppliers.

Disruptions in global supply chains, which have been a recurring theme in the automotive sector, can significantly impact THL. These constraints can limit the availability of new vehicles, directly affecting THL's fleet expansion and replacement plans, and potentially driving up acquisition costs. For instance, during periods of semiconductor shortages, the production of many vehicles, including RVs, was slowed considerably, demonstrating this supplier leverage.

While individual fuel suppliers hold little power due to the highly commoditized nature of fuel, the broader fuel market exerts considerable influence on Tourism Holdings Limited (THL) due to price volatility. For instance, average global Brent crude oil prices saw significant fluctuations throughout 2024, impacting operational expenses. This volatility directly affects THL's profitability if increased fuel costs cannot be passed on to consumers without dampening demand.

Suppliers of specialized vehicle parts and maintenance services hold moderate bargaining power over Tourism Holdings Limited (THL). This power stems from the proprietary nature of certain components and the need for specialized repair expertise for their motorhome fleet. For instance, if a critical part for a specific model is only available from a single manufacturer, THL's options are limited, potentially driving up costs.

This dependency can directly impact operational efficiency. Delays in obtaining specialized parts or securing qualified technicians can mean vehicles remain out of service longer than anticipated. In 2024, the average turnaround time for complex motorhome repairs, particularly those involving specialized engine components, saw an increase of approximately 15% across the industry due to global supply chain adjustments, a factor THL must navigate.

The ability of THL to negotiate favorable terms with these suppliers is therefore crucial. Diversifying their network of certified service providers and maintaining a robust inventory of commonly needed specialized parts can help mitigate the impact of any single supplier's leverage. For example, by establishing relationships with at least three certified repair centers for their most common vehicle types, THL can create a competitive environment among service providers.

Technology and Software Providers

The bargaining power of technology and software providers for Tourism Holdings Limited (THL) leans towards moderate to high, especially concerning essential systems like their booking platforms and fleet management tools. These systems are deeply embedded in THL's worldwide operations, making the cost and complexity of switching significant once implemented. For instance, a major booking system upgrade could involve substantial capital outlay and operational disruption.

Providers who deliver distinctive, efficient, or highly scalable software solutions are in a strong position to negotiate higher prices. This leverage is amplified when these solutions offer a competitive edge that is difficult for THL to replicate internally. While the growing availability of cloud-based and adaptable software does offer THL some leverage, the specialized nature of critical operational software can still limit their negotiating power.

- Mission-critical systems like booking and fleet management are vital for THL's global operations.

- Switching costs for integrated software solutions can be substantial, increasing provider leverage.

- Unique or highly efficient software offerings allow providers to command premium pricing.

- The rise of cloud-based and customizable software provides some counter-leverage for THL.

Labor Market Conditions

The bargaining power of labor within Tourism Holdings (THL) is significantly shaped by prevailing labor market conditions. Skilled technicians essential for vehicle maintenance, customer service representatives, and experienced tour guides all represent critical labor inputs. When there are shortages of qualified individuals in the regions where THL operates, this scarcity can push wages higher, potentially affecting profitability and the ability to maintain consistent service quality. For instance, in 2024, many tourism-dependent economies faced tight labor markets, with reports indicating a 5% increase in average wages for hospitality roles in key tourist destinations across Australia and New Zealand.

THL must proactively address this by focusing on competitive compensation packages and robust employee development initiatives. Investing in training programs not only enhances the skills of the existing workforce but also aids in attracting new talent. Effective employee retention strategies are also paramount to ensure a stable and proficient team. By building a reputation as an employer of choice, THL can reduce its reliance on external hiring and lessen the bargaining power of labor suppliers in these crucial skill areas.

- Labor Shortages Impact: In 2024, certain regions experienced a shortage of qualified tourism staff, leading to an estimated 7-10% rise in labor costs for operators.

- Key Skill Sets: Technicians for vehicle fleets and experienced tour guides are particularly vulnerable to market fluctuations in labor supply.

- THL's Mitigation Strategy: Investment in competitive wages, ongoing training, and retention programs is crucial to maintain workforce stability.

- Competitive Advantage: A strong employer brand can reduce dependence on the external labor market and strengthen THL's negotiating position.

The bargaining power of suppliers for Tourism Holdings Limited (THL) is generally moderate, influenced by the type of supplier. While some suppliers, like niche vehicle parts manufacturers, can exert considerable influence due to proprietary components, others, such as fuel providers, have less individual power but are subject to market-wide price volatility.

THL's reliance on specialized motorhomes and campervans means vehicle manufacturers hold significant leverage, particularly when supply chain disruptions limit options, as seen with semiconductor shortages impacting production in 2024. Similarly, specialized parts and maintenance providers can command higher prices when THL requires unique expertise or components unavailable elsewhere, impacting operational uptime.

The bargaining power of technology and software providers is also notable, especially for mission-critical systems like booking platforms. High switching costs and the unique value of specialized software allow these providers to negotiate favorable terms. In 2024, the industry saw an average increase of 15% in repair turnaround times for complex motorhome systems, highlighting potential supplier-driven cost increases.

| Supplier Type | Bargaining Power Assessment | Impact on THL | 2024 Relevant Data/Trend |

| Vehicle Manufacturers | Moderate to High | Fleet acquisition costs, availability | Supply chain disruptions impacted production availability. |

| Specialized Parts & Maintenance | Moderate | Repair costs, vehicle downtime | Increased average repair times for complex systems. |

| Fuel Providers | Low (individual), High (market) | Operational costs | Significant price volatility in global oil markets. |

| Technology/Software Providers | Moderate to High | System integration costs, operational efficiency | High switching costs for embedded systems. |

What is included in the product

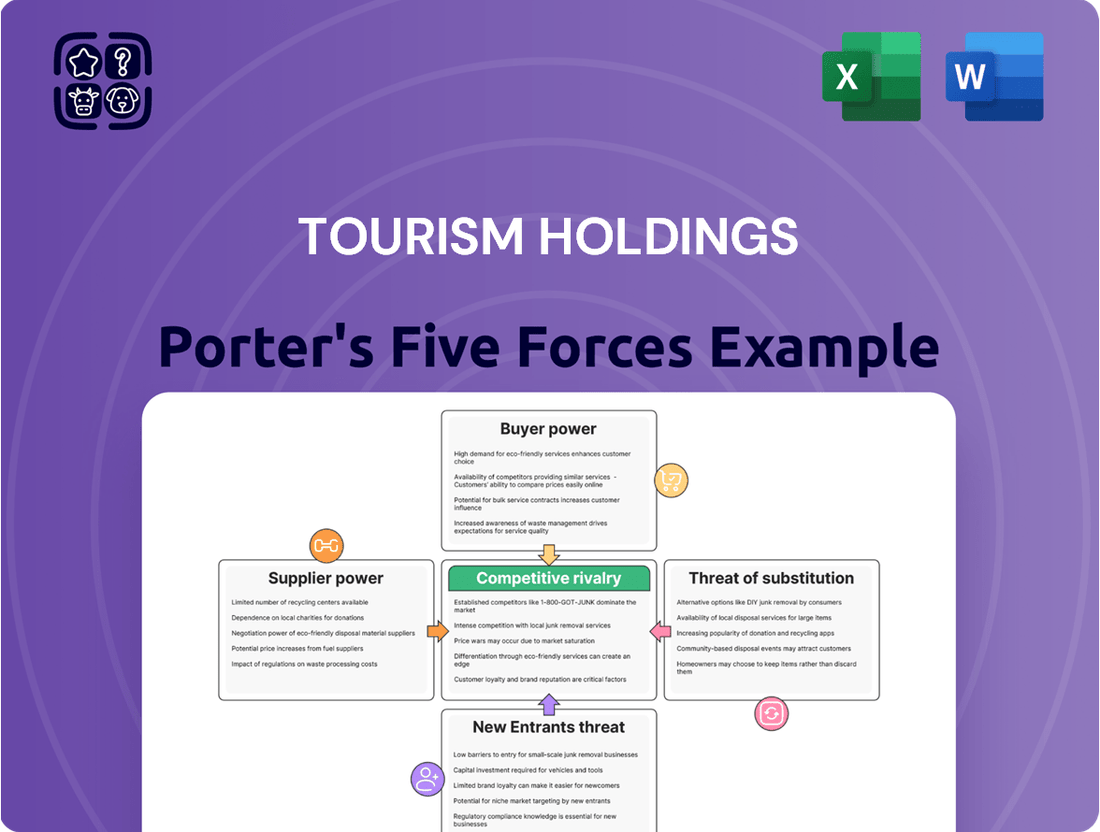

Tourism Holdings' Porter's Five Forces analysis reveals the intensity of competition, bargaining power of customers and suppliers, threat of new entrants, and the impact of substitutes on its market position.

Instantly identify and mitigate competitive threats with a visual breakdown of industry power dynamics.

Effortlessly assess supplier leverage and customer bargaining power to optimize cost structures.

Customers Bargaining Power

Customers, particularly leisure travelers, are very sensitive to price. This is made worse by how easy it is to compare prices online across many different rental companies and booking sites.

The abundance of information readily available, from customer reviews to detailed service descriptions, allows travelers to easily find the best deals. For instance, a quick search in mid-2024 for campervan rentals in popular destinations like Queenstown, New Zealand, often shows a wide range of prices for similar vehicle types, highlighting this comparison capability.

This transparency forces companies like Tourism Holdings Limited (THL) to keep their prices competitive. They must also constantly improve what they offer to keep customers coming back, ensuring they provide good value for the money spent.

The bargaining power of customers in the tourism rental market is significantly influenced by low switching costs. Travelers can easily compare prices and offerings across multiple providers, including Tourism Holdings Limited's (THL) own brands like maui and Britz, as well as a wide array of competitors. This accessibility means customers are not heavily invested in a single rental company, giving them considerable leverage to seek the best deals.

For instance, a customer looking for a campervan in New Zealand in 2024 can readily find numerous options from companies beyond THL, many of which may offer competitive pricing or package deals. This ease of comparison directly translates to increased customer bargaining power, as they can simply opt for a different provider if THL's offerings are not perceived as sufficiently attractive or cost-effective.

THL actively works to mitigate this by fostering brand loyalty. They aim to differentiate their services through superior customer experiences, unique fleet features, and convenient location networks. The goal is to make the decision to rent from THL more compelling than simply choosing the cheapest option, thereby reducing the practical impact of low switching costs.

Tourism Holdings Limited (THL) serves a broad range of customers. While individual holidaymakers might not wield significant individual power, larger groups or corporate entities could negotiate for better terms. For instance, in 2024, a significant portion of THL's bookings could be attributed to group travel, which inherently allows for more leverage in package deals or discounts.

THL's diverse product portfolio, ranging from motorhome rentals to curated holiday packages, allows it to cater to various customer needs. This diversification helps in managing the varying degrees of bargaining power across different customer segments, ensuring that even smaller individual bookings contribute to overall revenue without unduly impacting profit margins.

Availability of Rental Alternatives

The availability of numerous rental alternatives significantly boosts the bargaining power of customers in the tourism sector. Travelers can choose from a wide array of options, including smaller, specialized campervan companies that might offer more personalized service or unique vehicle types. Furthermore, the rise of peer-to-peer rental platforms, such as Outdoorsy and RVshare, has expanded the market considerably, providing access to a broader selection of vehicles, often at competitive price points. For example, in 2024, the peer-to-peer RV rental market continued to grow, with platforms like RVshare reporting a substantial increase in listings and bookings year-over-year.

This increased competition among rental providers means customers can easily compare offerings and negotiate for better terms or prices. They are not solely reliant on larger, established companies like Tourism Holdings Limited (THL). The ease with which customers can switch between providers, especially with the accessibility of online booking and comparison tools, puts pressure on all players to maintain competitive pricing and high service standards.

- Diverse Alternatives: Customers can select from niche operators and peer-to-peer platforms, increasing their choices.

- Price Competition: The availability of alternatives drives competitive pricing, benefiting consumers.

- Platform Growth: Peer-to-peer platforms like Outdoorsy and RVshare have seen continued expansion in 2024, offering more options.

- Customer Leverage: This broad market access empowers customers to demand better value and service.

Influence of Online Reviews and Reputation

The rise of online reviews and social media has significantly amplified the bargaining power of customers in the tourism sector. Platforms like TripAdvisor and Google Reviews allow travelers to easily share their experiences, creating a collective voice that heavily influences purchasing decisions. For instance, a study in 2024 found that over 80% of consumers regularly consult online reviews before booking travel services, giving them considerable sway over market demand.

Tourism Holdings Limited (THL) must therefore actively manage its online reputation. A consistent stream of positive feedback regarding vehicle condition, customer service, and overall experience can attract new business, directly impacting revenue. Conversely, negative reviews can quickly erode customer trust and lead to a decline in bookings, highlighting the direct financial implications of customer sentiment.

- Influence of Online Feedback: Customer reviews on platforms like TripAdvisor and Google Reviews are pivotal in travel booking decisions, granting collective customer feedback substantial power in the market.

- Reputation as a Key Asset: A positive online reputation for service quality and vehicle condition is crucial for attracting new customers, while negative feedback can deter potential bookings.

- Proactive Online Management: THL needs to actively monitor and engage with online feedback, ensuring high customer satisfaction to leverage positive word-of-mouth and mitigate the impact of negative reviews.

- Data Insight: In 2024, research indicated that a significant majority of travelers rely on online reviews, underscoring the direct correlation between online reputation and booking volumes.

Customers wield significant power due to the ease of price comparison online and the availability of numerous rental alternatives, including peer-to-peer platforms which saw continued growth in 2024. This transparency and choice empower travelers to seek the best value, forcing companies like Tourism Holdings Limited (THL) to maintain competitive pricing and enhance service quality to foster loyalty. The collective voice amplified by online reviews further strengthens customer leverage, making reputation management a critical factor for THL.

| Factor | Impact on THL | Customer Action |

|---|---|---|

| Price Sensitivity & Comparison | Forces competitive pricing; pressure on margins. | Easily compares rates across providers online. |

| Low Switching Costs | Requires strong differentiation; loyalty programs. | Can move to alternative providers with minimal effort. |

| Availability of Alternatives | Increased competition from niche players and P2P. | Chooses from a wider pool of options beyond major brands. |

| Online Reviews & Social Media | Reputation management is crucial; impacts bookings. | Relies on collective feedback to make informed decisions. |

Same Document Delivered

Tourism Holdings Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Tourism Holdings' competitive landscape through Porter's Five Forces, analyzing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the RV rental and tourism sector. This comprehensive analysis provides critical insights into the strategic positioning and potential challenges faced by Tourism Holdings.

Rivalry Among Competitors

The vehicle rental and tourism sector is characterized by fierce competition, with Tourism Holdings Limited (THL) navigating a landscape populated by major global brands and a multitude of smaller, localized businesses. THL's strategic acquisition of Apollo significantly bolstered its standing, making it the world's largest operator of commercial recreational vehicles (RVs). Despite this consolidation, robust competition remains a defining feature in its primary operating regions, including New Zealand, Australia, North America, and Europe.

Competitive rivalry in the tourism rental sector is significantly shaped by the size and up-to-dateness of a company's vehicle fleet. Operators are in a continuous race to offer a wider selection of vehicles, from compact cars to larger motorhomes, and to ensure these vehicles are equipped with modern amenities. This focus on fleet modernity is crucial for attracting and retaining customers who often seek comfort and the latest features in their travel experiences.

The need to maintain a competitive fleet necessitates substantial and ongoing capital investment. Companies must regularly refresh their vehicles to avoid obsolescence and to meet evolving customer expectations. For example, Tourism Holdings Limited (THL) reported an 11% increase in its rental fleet size in its FY25 interim results, demonstrating a clear commitment to expanding capacity and enhancing the quality of its offerings in response to competitive pressures.

Competitive rivalry in the tourism sector, particularly for companies like Tourism Holdings Limited (THL), is intense and frequently plays out through aggressive pricing. Businesses often resort to discounts and special promotions, especially to stimulate demand during slower periods or when the overall market experiences a downturn. This is amplified by the ease with which consumers can compare prices online, putting constant pressure on providers to offer competitive rates.

THL navigates this challenge by needing to strike a delicate balance. The company must offer prices that attract customers in a competitive landscape while simultaneously ensuring that these pricing strategies do not erode its profitability. This is a critical consideration, especially when factoring in the impact of fluctuations in vehicle sales, which can significantly influence the company's overall profit margins.

High Fixed Costs and Exit Barriers

The tourism vehicle rental industry, where Tourism Holdings Limited (THL) operates, is defined by substantial fixed costs. These include the significant capital outlay for acquiring and maintaining a diverse fleet of vehicles, as well as establishing and operating a widespread network of depots. These high upfront and ongoing expenses act as considerable exit barriers.

These substantial exit barriers mean that companies are often compelled to remain in the market and compete vigorously, even when economic conditions are unfavorable. Rather than absorbing the substantial losses associated with exiting and disposing of assets, operators tend to fight for market share to cover their fixed overheads. This intense competition can put pressure on pricing and profitability.

THL actively addresses this high fixed-cost environment through dedicated cost-out and optimization programs. For instance, in the fiscal year 2023, THL reported a focus on fleet utilization and operational efficiencies as key drivers for improving profitability. These initiatives are crucial for maintaining competitiveness and ensuring the business remains viable despite the industry's inherent cost structure.

- High Capital Investment: Significant funds are required for vehicle fleets, depot infrastructure, and technology.

- Operational Rigidity: Fixed costs for maintenance, insurance, and staffing create a baseline expenditure that must be met regardless of demand.

- Fleet Utilization Focus: Maximizing the use of rental vehicles is paramount to offsetting high fixed costs and achieving profitability.

Service Differentiation and Integrated Offerings

While the fundamental campervan rental might seem like a basic commodity, the competitive landscape in the tourism sector is fierce, pushing companies to differentiate their services. This competition often hinges on building a strong brand reputation and offering a more comprehensive, integrated tourism experience beyond just vehicle hire. Tourism Holdings Limited (THL) exemplifies this strategy by utilizing its well-recognized brands such as maui, Britz, and Apollo.

THL further strengthens its competitive position by incorporating additional tourism attractions into its portfolio. For instance, its ownership of Kiwi Experience, a popular backpacker bus network, and Discover Waitomo Group, which offers iconic glowworm cave tours, allows THL to craft unique value propositions. This integration aims to provide customers with a seamless and enriched travel experience, setting THL apart from competitors who solely focus on the rental aspect of their business.

- Brand Strength: THL’s maui, Britz, and Apollo brands are recognized for quality and service in the RV rental market.

- Integrated Experiences: Ownership of Kiwi Experience and Discover Waitomo Group adds significant value beyond vehicle rental.

- Customer Value Proposition: This integration aims to offer a more complete and appealing travel package to tourists.

- Competitive Advantage: By bundling rentals with attractions, THL creates a unique offering that is harder for pure rental companies to replicate.

The competitive rivalry within the tourism vehicle rental sector is intense, characterized by aggressive pricing strategies and a constant need for fleet modernization. Tourism Holdings Limited (THL), following its acquisition of Apollo, stands as the world's largest operator of commercial recreational vehicles, yet still faces significant competition across its operational regions. This dynamic environment necessitates continuous investment in fleet upgrades and efficient operations to maintain market share and profitability, as evidenced by THL's FY25 interim results highlighting an 11% increase in its rental fleet size.

| Metric | THL (FY23) | Industry Average (Estimate) |

|---|---|---|

| Fleet Size (Units) | ~10,000+ | Varies widely; smaller operators have <100 units |

| Fleet Utilization Rate | Focus on improvement (FY23 initiative) | Typically 60-80% depending on seasonality |

| Pricing Strategy | Balancing competitiveness with profitability | Discounting common, especially in off-peak seasons |

SSubstitutes Threaten

The threat of substitutes for Tourism Holdings Limited (THL) is substantial, primarily from traditional accommodation and transport options. Hotels, motels, resorts, and the rapidly growing home-sharing market like Airbnb offer established and often preferred alternatives for many travelers. These options can be particularly appealing for shorter trips or for those prioritizing specific amenities and predictable service levels that might differ from the motorhome experience.

For instance, while THL offers a unique travel style, a family might choose a hotel with a pool and daily housekeeping for a weekend getaway, bypassing the need for vehicle rental and accommodation combined. Similarly, the convenience of a city hotel for business travelers or a resort for beach-focused vacations presents a direct substitute. In 2024, the global hotel market is projected to reach over $1.1 trillion, highlighting its vast scale and continued appeal.

Furthermore, the substitution threat extends to transport. Standard car rentals or even efficient public transportation networks can serve as alternatives for travelers who don't desire the self-contained nature of an RV. This means THL must continually articulate the distinct advantages of its offerings – the unparalleled freedom, flexibility, and the immersive nature of exploring destinations at one's own pace, which traditional options may not fully replicate.

Customers seeking leisure and holiday experiences have numerous alternatives to motorhome rentals. Think about cruises, all-inclusive package tours, or even simpler staycations and local entertainment options. These alternatives can fulfill the desire for a break and new experiences without the commitment or specific nature of a motorhome trip.

During times of economic uncertainty or when consumer tastes change, people tend to cut back on discretionary spending, and this can significantly impact the motorhome rental market. If budgets tighten, holidaymakers might opt for less expensive or more accessible leisure activities instead of a motorhome holiday.

Tourism Holdings Limited (THL) is aware of this. Their move into tourism attractions is a smart strategy to diversify and capture a wider slice of the overall leisure spending pie. However, their primary motorhome rental division still faces the direct competition from these substitute leisure activities.

For domestic travelers, the option of using their own private vehicle for road trips or owning a personal recreational vehicle (RV) acts as a direct substitute for Tourism Holdings Limited (THL) rental services. This personal ownership bypasses the need for renting altogether.

The increasing popularity and accessibility of peer-to-peer RV rental platforms further amplify this threat. These platforms provide a broader selection of privately owned vehicles, often at more competitive price points than traditional rental companies, increasing the substitutability for consumers.

THL's key strategy to counter this threat lies in differentiation. They offer access to a modern, professionally maintained fleet of vehicles, a significant advantage over the variable condition and maintenance of privately owned or peer-to-peer rentals.

By providing this reliable and hassle-free experience, THL aims to appeal to customers who value convenience and wish to avoid the significant upfront costs, ongoing maintenance, insurance, and depreciation associated with private vehicle ownership.

Impact of Economic Conditions on Discretionary Travel

Economic downturns, marked by rising inflation and waning consumer confidence, directly impact discretionary spending, including travel. This can lead travelers to opt for more budget-friendly alternatives or shorter trips, presenting a substitute threat to businesses like Tourism Holdings Limited (THL) that offer premium motorhome rentals. For instance, if consumers perceive a significant increase in the cost of living, they may postpone or scale back their holiday plans, favoring local or lower-cost activities over extended motorhome adventures.

This shift in consumer priorities can significantly affect demand for THL's services. When the economy tightens, consumers often re-evaluate their spending, and travel, especially longer or more elaborate trips, can be an easy category to cut back on. This pressure from substitute travel options, such as cheaper car rentals, budget airlines, or even staying closer to home, directly challenges THL's market position.

THL itself has acknowledged these economic headwinds. In its 2024 financial reporting, the company noted that prevailing market factors, likely including economic uncertainty and inflationary pressures, could delay the anticipated recovery in travel demand and consequently impact profit growth. This admission underscores the sensitivity of the motorhome rental sector to broader economic conditions and the persistent threat posed by alternative travel choices.

- Inflationary Pressures: Rising inflation in 2024 has increased the cost of fuel, accommodation, and daily living expenses, making extended motorhome holidays less affordable for many.

- Consumer Confidence: Global consumer confidence indices, which saw fluctuations throughout 2024, directly correlate with discretionary spending on non-essential items like leisure travel. A dip in confidence often leads to reduced bookings.

- Substitute Travel Costs: The relative cost of substitute travel options, such as budget car rentals or package holidays, compared to motorhome rentals, influences consumer choices. If substitutes become significantly cheaper, they draw demand away.

- Shorter Holiday Trends: Economic uncertainty encourages shorter, more localized holidays, which may not require the extensive planning or cost associated with a long-distance motorhome rental.

Emerging Technologies and Virtual Tourism

While still in its early stages, the threat of substitutes for physical travel, particularly from emerging technologies like virtual reality (VR) and advanced digital tourism, presents a long-term consideration for Tourism Holdings Limited (THL). These technologies could, in the future, offer immersive experiences that partially replace the need for actual travel for specific consumer segments. For instance, the global VR market was valued at approximately USD 28.2 billion in 2023 and is projected to grow significantly, indicating increasing consumer engagement with virtual experiences.

More immediate substitutes are found in digital tools that improve the planning and execution of non-RV travel. Enhanced online booking platforms, sophisticated itinerary planners, and augmented reality (AR) applications that enrich on-site experiences could divert potential customers who might otherwise opt for an RV holiday. THL's strategic investment in travel technology, through initiatives like Triptech, is therefore a critical component of its strategy to remain competitive and relevant amidst this evolving digital landscape.

The potential impact of these substitutes is amplified by changing consumer preferences towards convenience and digital integration. In 2024, traveler reliance on digital platforms for booking and information has continued to climb, with a significant percentage of travel arrangements made online.

- Technological Advancement: Continued improvements in VR/AR technology offer increasingly realistic and engaging virtual travel experiences.

- Digital Enhancement: Sophisticated digital tools for travel planning and on-site augmentation can reduce the perceived need for traditional travel elements.

- Consumer Adoption: Growing consumer comfort and spending on digital and virtual experiences indicate a potential shift in leisure priorities.

- THL's Mitigation: Investments in travel technology are essential to adapt and offer integrated digital solutions alongside physical travel.

The threat of substitutes for Tourism Holdings Limited (THL) remains significant, stemming from a wide array of alternative leisure and travel options. Traditional accommodations like hotels, alongside the burgeoning home-sharing market, continue to present compelling alternatives, especially for shorter trips or for travelers prioritizing specific amenities. For instance, the global hotel market's projected value exceeding $1.1 trillion in 2024 underscores its enduring appeal and broad reach as a substitute.

| Substitute Category | Examples | Key Differentiators from Motorhome Rental | Market Relevance (2024) |

|---|---|---|---|

| Traditional Accommodation | Hotels, Motels, Resorts | Predictable service, on-site amenities (pools, restaurants), daily housekeeping | Global market > $1.1 trillion |

| Home-Sharing Platforms | Airbnb, Vrbo | Potentially lower cost, local immersion, unique property types | Significant growth in user base and bookings |

| Package Tours & Cruises | All-inclusive resorts, cruise lines | Hassle-free planning, bundled services, fixed itineraries | Strong demand for all-inclusive experiences |

| Personal Vehicle Use | Owning a car or RV | No rental fees, flexibility in usage, personal comfort | High penetration of personal vehicle ownership |

| Budget Travel Options | Budget airlines, hostels, car rentals | Lower cost focus, shorter trip suitability | Increasing demand during economic uncertainty |

Entrants Threaten

The threat of new companies entering the global motorhome rental sector is significantly dampened by the substantial capital needed to build a competitive fleet. Acquiring even a modest fleet of modern motorhomes, along with essential operational infrastructure like depots and maintenance facilities, represents a considerable financial hurdle, often running into millions of dollars.

For instance, a startup looking to establish a presence comparable to established players would need to invest heavily in vehicle procurement. The average cost of a new motorhome can range from $75,000 to over $200,000 depending on size and amenities. This high upfront cost acts as a powerful deterrent, limiting the pool of potential new entrants to those with significant financial backing.

Established brand recognition and trust act as significant barriers to entry for new players in the tourism and vehicle rental sector. Companies like Tourism Holdings Limited (THL), which owns prominent brands such as maui, Britz, and Apollo, have cultivated strong customer loyalty over years of operation. For instance, THL reported a net profit after tax of NZ$35.7 million for the first half of its 2024 financial year, demonstrating its solid market performance and the trust consumers place in its offerings.

New entrants would need to invest heavily in marketing and build a reputation for reliability and service quality, which takes considerable time and resources. The inherent customer preference for established, trusted brands in a service-oriented industry like tourism means that newcomers face an uphill battle to gain market share. This established trust is a direct result of consistent service delivery and a proven track record, making it a formidable hurdle for any aspiring competitor.

Newcomers face significant hurdles due to the sheer operational complexity inherent in global vehicle rental. Managing vast fleets, intricate logistics, and maintenance across diverse regions requires specialized knowledge and robust systems. For instance, in 2024, major rental companies often manage fleets exceeding tens of thousands of vehicles, each needing constant tracking, servicing, and repositioning, a task daunting for any new entrant without established infrastructure.

The steep learning curve and the need for substantial upfront investment in technology and physical assets create a high barrier. Established players like Tourism Holdings Limited (THL) have spent years refining their booking platforms, customer service protocols, and supply chain efficiencies. This accumulated expertise and the resulting economies of scale in purchasing and operations are difficult for new entrants to replicate quickly, impacting their ability to compete on price and service quality.

Regulatory and Compliance Hurdles

The tourism industry, especially for companies like Tourism Holdings, faces substantial regulatory and compliance barriers. These include varying national and international laws governing travel, safety, and environmental impact. For instance, in 2024, countries continue to update their travel advisories and operational permits, requiring constant adaptation and investment from existing players and making entry difficult for newcomers.

Licensing and insurance are particularly demanding. New entrants must secure a multitude of licenses for different operational regions and types of tourism activities. The need for extensive, high-value insurance coverage, especially for large fleets of vehicles or specialized equipment, represents a significant capital outlay. This financial burden, coupled with the complexity of legal navigation, deters many potential new competitors from entering the market.

- Significant Capital Investment: Securing necessary licenses and insurance for a tourism operation, particularly one involving vehicle fleets, requires substantial upfront capital, acting as a major deterrent for new entrants.

- Complex Legal Frameworks: Navigating diverse and evolving regulatory landscapes across multiple operating jurisdictions demands specialized legal expertise and ongoing compliance efforts, adding to operational costs and complexity for new businesses.

- Stringent Safety and Environmental Standards: Meeting rigorous safety protocols and environmental regulations, often mandated by government bodies, necessitates investment in training, equipment, and sustainable practices, creating a higher barrier to entry.

Access to Distribution Channels and Market Access

Established players in the tourism holdings sector, such as Tourism Holdings Limited (THL), have invested heavily in building robust global distribution networks. These networks encompass direct booking websites, strategic partnerships with major online travel agencies (OTAs), and established relationships with tour operators worldwide. For instance, THL's extensive network allows it to reach a broad spectrum of potential customers efficiently.

New entrants face a significant hurdle in replicating or gaining access to these well-developed distribution channels. Securing favorable terms with dominant OTAs or forging partnerships with established tour operators can be challenging and costly. This lack of immediate market access severely limits a new competitor's ability to attract a wide customer base and gain market share against incumbents with proven reach.

- Established Global Networks: THL and similar operators possess deep-rooted partnerships with OTAs and tour operators, offering immediate access to millions of potential customers.

- High Barrier to Entry: New entrants must overcome the cost and time required to build comparable distribution systems or negotiate access with dominant players.

- Limited Market Reach: Without established channels, new companies struggle to achieve the necessary visibility and customer acquisition rates to compete effectively.

The threat of new entrants for Tourism Holdings is considerably low due to the massive capital required to establish a competitive motorhome fleet and operational infrastructure. For example, a new motorhome can cost upwards of $75,000, making fleet acquisition a multi-million dollar endeavor for any startup aiming to rival established players.

Established brands like those under THL, such as maui and Britz, command significant customer loyalty, making it difficult for newcomers to gain traction. THL's strong market performance, evidenced by its NZ$35.7 million net profit after tax in H1 2024, highlights the trust and brand equity it has built, a factor new entrants cannot easily replicate.

Operational complexities, including managing vast fleets and intricate logistics across diverse regions, present another substantial barrier. In 2024, major rental operators often manage fleets in the tens of thousands, requiring sophisticated systems and expertise that are time-consuming and costly for new entities to develop.

Regulatory hurdles, licensing, and extensive insurance requirements further increase the barriers to entry. Navigating varied international laws and securing high-value insurance for large vehicle fleets demands considerable financial resources and legal acumen, deterring many potential competitors.

| Barrier Type | Description | Impact on New Entrants | Example Data/Fact (2024) |

| Capital Investment | Cost of acquiring vehicles and infrastructure | Very High | New motorhome cost: $75,000 - $200,000+ |

| Brand Reputation | Customer trust and loyalty to existing brands | High | THL's H1 2024 Net Profit: NZ$35.7 million |

| Operational Complexity | Fleet management, logistics, maintenance | High | Major operators manage 10,000+ vehicles |

| Regulatory & Legal | Licensing, insurance, compliance | High | Varying international travel and safety laws |

Porter's Five Forces Analysis Data Sources

Our Tourism Holdings Porter's Five Forces analysis is built upon a foundation of robust data, including publicly available annual reports, industry-specific market research from firms like IBISWorld, and government tourism statistics. This blend ensures a comprehensive understanding of the competitive landscape.