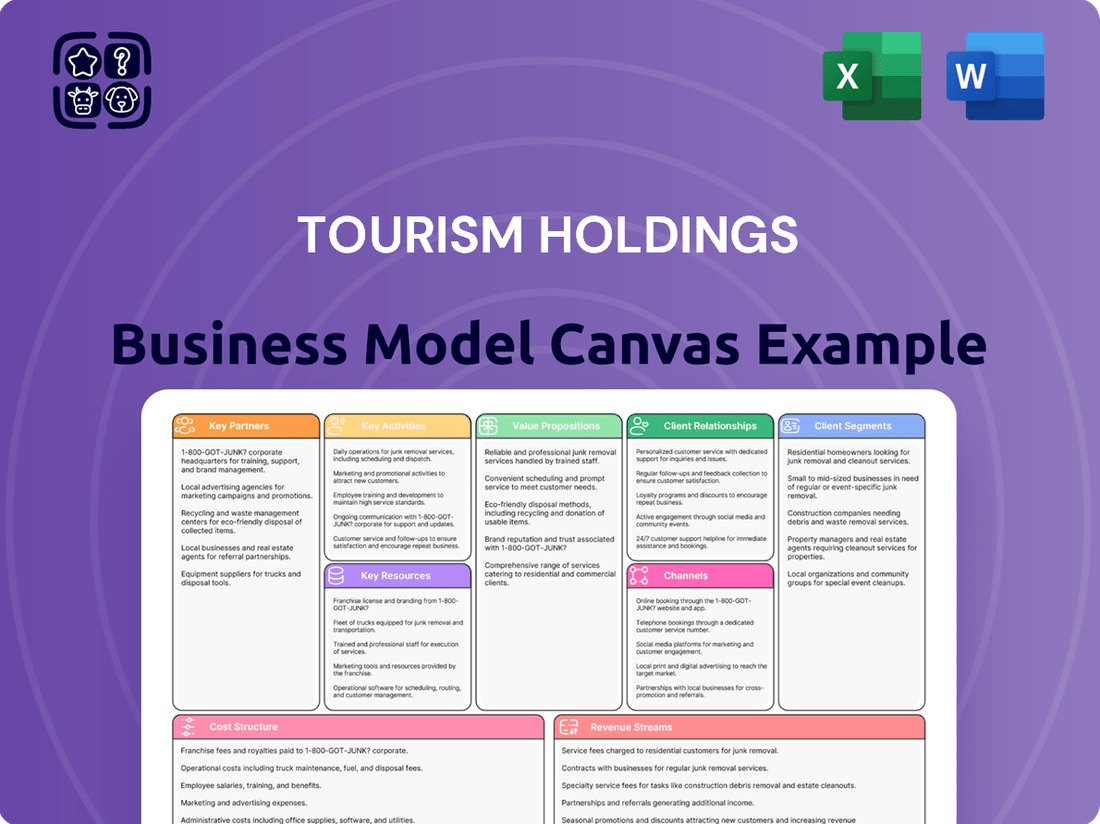

Tourism Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tourism Holdings Bundle

Unlock the complete strategic blueprint of Tourism Holdings's business model. This detailed Business Model Canvas reveals their customer segments, value propositions, and key partnerships. Discover how they generate revenue and manage costs to maintain market leadership.

Dive deeper into Tourism Holdings’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Partnerships

Tourism Holdings Limited (THL) maintains critical partnerships with major vehicle manufacturers and their suppliers to ensure the continuous acquisition of new motorhomes and campervans. These collaborations are fundamental for both expanding their rental fleet and supporting their retail sales operations.

In 2024, THL's fleet modernization efforts directly benefited from these relationships, allowing access to advanced designs and technologies. For instance, partnerships with manufacturers like Mercedes-Benz and Fiat contribute significantly to the quality and appeal of their rental offerings.

These strong ties with vehicle producers are instrumental in guaranteeing a reliable supply chain for their fleet, which is essential for meeting seasonal demand fluctuations. By securing a steady influx of vehicles, THL can maintain a competitive edge and a contemporary fleet that attracts customers.

Furthermore, these strategic alliances can unlock benefits such as more favorable pricing structures and early access to innovative vehicle models. These advantages are vital for managing operational costs and staying ahead in the dynamic tourism and recreational vehicle market.

Tourism Holdings Limited (THL) leverages a robust network of dealership and retail partners to significantly expand its reach in the vehicle sales market, particularly for ex-rental and new recreational vehicles (RVs). These collaborations are crucial for accessing customers who may not directly interact with THL's rental branches, thereby broadening the sales funnel.

Key retail partners like RV Super Centre and Apollo RV Sales in Australia and New Zealand play a vital role in this strategy. For instance, in the fiscal year 2023, THL reported a strong performance in its Vehicle Sales segment, driven by both retail and wholesale channels, indicating the effectiveness of these dealership relationships in generating revenue and clearing ex-rental fleets.

Tourism Holdings Limited (THL) heavily relies on partnerships with Online Travel Agencies (OTAs) and booking platforms to connect with a vast global customer base. These collaborations are essential for increasing visibility and driving rental bookings, particularly for their recreational vehicle (RV) fleet.

By listing on popular platforms like Booking.com, Expedia, and Airbnb, THL gains access to millions of travelers actively planning trips. This exposure is crucial for maximizing occupancy rates, especially during peak seasons. For instance, in the 2024 financial year, THL reported strong performance, with digital channels playing a significant role in customer acquisition and booking efficiency.

The seamless integration with these platforms simplifies the booking journey for customers, offering a convenient way to compare options and secure rentals. This convenience directly translates into higher conversion rates and a more streamlined operational process for THL, allowing them to focus on service delivery.

Effective management of these OTA relationships, including strategic pricing and inventory allocation, is key to optimizing revenue. THL's ability to leverage these digital marketplaces ensures a consistent flow of demand, contributing significantly to their overall market presence and financial results in 2024.

Tourism Operators and Local Attractions

Tourism Holdings Limited (THL) actively collaborates with a diverse array of tourism operators and local attractions to curate compelling, end-to-end travel experiences. These strategic alliances are crucial for enhancing THL's value proposition beyond mere vehicle rental, offering customers richer and more integrated journeys. For instance, partnerships with entities like Kiwi Experience and Discover Waitomo Group allow THL to bundle vehicle hire with guided tours and unique attraction access, creating seamless itineraries that appeal to a broader customer base.

These collaborations are instrumental in developing comprehensive travel packages and innovative itineraries. By integrating vehicle rental with local experiences, THL can attract a greater volume of customers seeking curated adventures. In 2024, the travel industry continued to see a strong demand for packaged experiences, with many travelers preferring convenience and pre-arranged activities. THL's strategic partnerships are well-positioned to capitalize on this trend, making their offerings more attractive and competitive in the market.

- Partnerships with tour operators: THL works with companies like Kiwi Experience to offer combined vehicle rental and tour packages.

- Attraction collaborations: Agreements with places like Discover Waitomo Group provide access to unique local experiences as part of travel packages.

- Enhanced customer value: These alliances allow THL to offer more than just transport, providing complete travel solutions.

- Itinerary creation: Partnerships facilitate the development of attractive and convenient travel itineraries for customers.

Technology and Digital Solution Providers

Tourism Holdings Limited (THL) actively partners with technology and digital solution providers to elevate its business model. These collaborations are crucial for modernizing operations and enhancing customer interactions. For instance, a partnership with a company like TripTech, a known player in travel technology, can significantly improve booking engines and digital customer service platforms. This allows THL to offer a more seamless and engaging experience for its clientele, a key differentiator in the competitive tourism landscape.

These partnerships directly fuel THL's digital transformation agenda. By integrating advanced tools, THL can achieve greater efficiency in areas such as fleet management, ensuring vehicles are well-maintained and optimally deployed. Furthermore, these collaborations bolster THL's online visibility and customer service capabilities, providing sophisticated digital channels for communication and support. The focus is on leveraging technology to streamline the entire customer journey, from initial inquiry to post-trip feedback.

- Enhanced Booking Systems: Collaborating with providers like TripTech aims to refine online booking processes, potentially increasing conversion rates.

- Digital Customer Service: Implementing advanced digital tools allows for more responsive and personalized customer support, improving satisfaction scores.

- Fleet Management Optimization: Technology partnerships provide solutions for real-time vehicle tracking and maintenance scheduling, reducing operational downtime and costs.

- Data Analytics Integration: Working with tech firms enables better collection and analysis of customer data, informing strategic decisions and personalized offerings.

THL's key partnerships extend to financial institutions and insurance providers, crucial for managing fleet acquisition and operational risks. These alliances ensure access to capital for fleet expansion and provide comprehensive insurance coverage, safeguarding assets.

In 2024, THL's financial health and growth trajectory were significantly supported by these strategic financial relationships. For instance, securing favorable financing terms for new vehicle purchases directly impacts capital expenditure and profitability.

These partnerships are vital for maintaining competitive insurance rates and terms for their extensive rental fleet. Effective risk management through these collaborations ensures business continuity and protects against unforeseen events, a critical aspect of their operational stability.

Furthermore, strong relationships with financial partners can facilitate access to diverse funding mechanisms, supporting both organic growth and potential acquisitions within the tourism sector.

What is included in the product

This Tourism Holdings Business Model Canvas outlines a strategic approach to providing diverse recreational vehicle and tourism experiences, focusing on customer segments like holidaymakers and adventurers, and leveraging channels such as rental branches and online booking.

It details value propositions like freedom and exploration, supported by key activities like fleet management and customer service, all while considering cost structures and revenue streams inherent in the tourism industry.

Tourism Holdings' Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their operational strategy, enabling rapid identification of inefficiencies and areas for improvement.

This allows for quick and effective troubleshooting of complex operational challenges, streamlining processes and enhancing customer satisfaction.

Activities

Tourism Holdings Limited (THL) actively manages its vast global fleet of rental vehicles, encompassing acquisition, depreciation, and strategic disposal. This core activity ensures operational efficiency and capital allocation. For instance, in the fiscal year 2023, THL continued its fleet optimization efforts, which are critical for maintaining competitiveness in the tourism sector.

The company places a strong emphasis on regular maintenance and servicing to guarantee the reliability and safety of its motorhome and campervan fleet for customers. This proactive approach minimizes downtime and enhances the customer experience, a key differentiator in the rental market. This commitment to vehicle upkeep is fundamental to brand reputation and customer satisfaction.

Managing the entire lifecycle of each vehicle, from its initial purchase as a new asset to its eventual sale as an ex-rental unit, is a critical function. This process involves careful financial planning, considering depreciation schedules and residual values to maximize returns. THL's strategic fleet renewal programs are designed to keep its offerings modern and appealing to a broad customer base.

Vehicle rental operations are the engine of Tourism Holdings, managing the complete customer journey from initial booking to vehicle return. This includes handling multiple international brands such as maui, Britz, and Apollo, ensuring a seamless experience for travelers. Efficiently managing these processes is crucial for keeping customers happy and making sure the fleet is used as much as possible.

Key activities involve meticulous management of rental agreements, processing payments, and coordinating vehicle maintenance and cleaning between rentals. For instance, in 2024, Tourism Holdings aimed to optimize fleet utilization, a critical metric that directly impacts revenue generation. By streamlining check-in and check-out procedures, the company sought to reduce wait times and enhance overall customer satisfaction.

Furthermore, these operations encompass vital support functions like insurance processing and arranging roadside assistance, providing peace of mind for renters. The effectiveness of these support services directly influences customer loyalty and repeat business, especially during peak travel seasons. A well-executed rental process is fundamental to the company's profitability and reputation.

Tourism Holdings Limited (THL) actively engages in the retail sale of motorhomes and campervans, a crucial activity that includes both new models and well-maintained ex-rental units. This dual approach to sales through its dealership networks diversifies revenue streams significantly.

A key benefit of this strategy is the efficient turnover of THL's substantial rental fleet, ensuring that vehicles are kept current and in optimal condition. For instance, in the first half of the 2024 financial year, THL reported strong performance in its vehicle sales segment, contributing to overall group profitability.

Managing these dealership operations is a complex but vital undertaking. It involves meticulous inventory management, ensuring a wide selection of vehicles is available, and also encompasses providing customer financing options to facilitate purchases, thereby enhancing the customer experience and driving sales volume.

Manufacturing and Customization of RVs

Tourism Holdings Limited (THL), through its Action Manufacturing division, is a key player in the design and production of recreational vehicles (RVs). This vertical integration allows THL to maintain strict control over the quality and specific features of its RVs, ensuring they align with customer expectations and market trends. For instance, by manufacturing in-house, THL can more readily incorporate advancements in vehicle technology, such as improved fuel efficiency or integrated smart systems, into their fleet. This capability directly supports their rental and sales operations by providing a consistent supply of vehicles designed for optimal performance and customer satisfaction in the tourism sector.

The manufacturing arm is crucial for THL's ability to adapt to evolving consumer preferences and regulatory requirements. By having direct oversight of the production process, THL can quickly pivot to incorporate new designs or materials. This agility is vital in the competitive RV market. In 2024, THL continued to focus on optimizing its manufacturing processes. The company's commitment to innovation in vehicle design aims to enhance the customer experience, a critical factor for repeat business and brand loyalty.

- Vertical Integration: Action Manufacturing allows THL to control the design and build of its RVs, ensuring quality and feature customization.

- Market Responsiveness: This capability enables THL to tailor vehicles to specific market demands and integrate new technologies efficiently.

- Supply Chain Support: In-house manufacturing provides a reliable supply of vehicles for THL's extensive rental and sales networks.

- Innovation Focus: THL leverages its manufacturing expertise to introduce innovative features and improve vehicle performance, as seen in its ongoing product development efforts.

Tourism Experience Development and Delivery

Tourism Holdings Limited (THL) actively develops and delivers a range of immersive tourism experiences beyond its core vehicle rental services. This strategic expansion includes operating iconic attractions and offering guided tour packages, significantly broadening its market appeal and catering to a diverse customer base seeking authentic travel opportunities.

These experiential offerings are crucial for THL's business model, generating additional revenue streams and leveraging the company's established expertise within the tourism sector. By providing end-to-end travel solutions, THL enhances customer loyalty and captures a larger share of the travel spending.

- Attraction Operations: THL operates renowned attractions like the Waitomo Glowworm Caves, which are significant revenue generators and draw international visitors. In the fiscal year 2023, THL reported a 21% increase in revenue from its Attractions segment, highlighting the success of these ventures.

- Guided Tours and Packages: The company develops and delivers various guided tours, often integrated with its vehicle rental services, offering customers curated itineraries and local insights. This segment is key to creating a comprehensive travel experience.

- Customer Engagement: By providing diverse experiences, THL deepens customer engagement, encouraging repeat business and positive word-of-mouth referrals, which are vital in the competitive tourism landscape.

- Revenue Diversification: These activities diversify THL's revenue sources, reducing reliance on any single business segment and increasing overall financial resilience, particularly important in a dynamic global tourism market.

Key activities involve managing the entire rental fleet, encompassing acquisition, maintenance, and disposal to ensure optimal utilization and customer satisfaction. THL's 2023 fiscal year saw continued fleet optimization, a critical step for competitiveness.

The company also focuses on the retail sale of new and ex-rental motorhomes, a vital revenue stream that supports efficient fleet turnover. Sales performance in the first half of 2024 demonstrated the strength of this segment.

Furthermore, THL's vertical integration through Action Manufacturing allows for controlled RV design and production, enhancing quality and market responsiveness. Ongoing product development in 2024 highlights a commitment to innovation.

Finally, THL actively develops and operates tourism experiences, including attractions like the Waitomo Glowworm Caves, which significantly contributed to a 21% revenue increase in the Attractions segment in fiscal year 2023, diversifying revenue.

Full Document Unlocks After Purchase

Business Model Canvas

The Tourism Holdings Business Model Canvas you are previewing is the exact document you will receive upon purchase. This isn't a sample; it's a direct, unedited glimpse into the comprehensive analysis that awaits you. Once your order is complete, you'll gain full access to this same, meticulously crafted Business Model Canvas, ready for your strategic review and implementation.

Resources

Tourism Holdings Limited (THL) boasts an extensive vehicle fleet, its most critical physical asset. This diverse global collection of motorhomes, campervans, and other recreational vehicles underpins their entire rental and sales business.

The fleet's size and quality are directly correlated with THL's operational capacity and customer appeal. For instance, as of the fiscal year 2023, THL managed a fleet of approximately 10,000 vehicles, a substantial investment that fuels their rental revenue streams.

This fleet is not static; it undergoes continuous management through strategic acquisition of new vehicles, rigorous maintenance to ensure high operational uptime, and timely sale of older units to optimize capital allocation and fleet modernity.

The ongoing investment and management of this extensive vehicle fleet are fundamental to THL's ability to cater to a broad range of customer needs and maintain a competitive edge in the global tourism market.

Tourism Holdings Limited (thl) leverages a crucial asset in its extensive global network of rental depots and dealerships. This network spans key tourist markets including New Zealand, Australia, North America, and Europe, providing essential physical touchpoints for customers.

These strategically located depots are fundamental to thl's operations, facilitating vehicle pick-up and drop-off, essential maintenance, and direct sales. For instance, in 2024, thl continued to optimize its depot footprint, understanding that proximity to major transport hubs and tourist attractions directly impacts customer experience and operational fluidity.

The sheer number and accessibility of these physical locations are vital for customer convenience, allowing for seamless travel experiences. thl's commitment to maintaining and expanding this network underscores its dedication to operational efficiency and customer satisfaction across its diverse geographical markets.

Tourism Holdings Limited (THL) actively utilizes a portfolio of strong, recognizable brands like maui, Britz, Apollo, Road Bear RV, El Monte RV, and CanaDream. These brands boast significant customer loyalty and high recognition within the recreational vehicle rental market. This established brand equity is a critical asset, directly contributing to THL's competitive edge and easing the process of attracting new customers.

The inherent reputation of these brands fosters a strong sense of trust among consumers, directly translating into repeat business and positive word-of-mouth referrals. For instance, THL's acquisition of Apollo Tourism & Leisure in 2022 significantly bolstered its brand presence, particularly in Australia and New Zealand, adding well-regarded names to its stable and enhancing its market reach. This strategic integration of strong brands underpins THL's ability to command premium pricing and maintain market share.

Skilled Workforce and Operational Expertise

Tourism Holdings Limited (thl) heavily relies on its skilled workforce and deep operational expertise to function effectively. This includes a diverse range of professionals such as mechanics who maintain their extensive fleet, customer service representatives ensuring positive guest experiences, sales teams driving bookings, and experienced tourism operators who manage day-to-day operations. Their collective knowledge is fundamental to delivering high-quality service and efficient operations across their various brands.

The company's operational expertise spans critical areas like sophisticated fleet management, ensuring their vehicles are well-maintained and efficiently deployed, and even extends to vehicle manufacturing capabilities in some segments. This integrated approach to managing their assets and services is a significant competitive advantage. For instance, in the fiscal year ending June 2023, thl reported a strong operational performance, with vehicle utilization rates being a key metric for success, indicating the direct impact of their operational expertise.

Maintaining and enhancing this human capital is a strategic priority for thl. Initiatives focused on employee engagement and continuous training are vital for retaining this expertise and ensuring they remain at the forefront of the tourism industry. This investment in people directly translates to better customer satisfaction and operational resilience, especially in a dynamic market like tourism. The company's commitment to training is evident in programs designed to upskill staff in areas ranging from customer interaction to technical maintenance.

- Skilled Workforce: Mechanics, customer service professionals, sales teams, and tourism operators are essential for service delivery.

- Operational Expertise: Fleet management, vehicle manufacturing, and tourism operations are core competencies.

- Human Capital Importance: Employee engagement and training are critical for smooth operations and service quality.

- FY2023 Performance: Strong operational results underscore the value of their workforce and expertise in managing a large fleet.

Proprietary Technology and Booking Systems

Tourism Holdings Limited (THL) leverages proprietary technology and advanced booking systems, such as its TripTech platform, to orchestrate reservations, manage fleet logistics, and enhance customer engagement. This technological backbone is vital for operational efficiency and delivering a smooth customer journey, directly impacting THL's ability to scale. For instance, THL's investment in digital solutions aims to streamline the booking process, a critical factor in the competitive tourism landscape. Ongoing development in these areas reinforces THL's market position and facilitates data-driven strategic adjustments.

These systems are not merely for booking; they provide THL with real-time insights into fleet utilization and customer preferences, enabling dynamic pricing and resource allocation. This technological advantage allows THL to adapt quickly to market demands and optimize revenue streams. The ongoing commitment to technological innovation ensures THL remains agile and competitive.

- TripTech Platform: A core proprietary system managing reservations and fleet operations.

- Operational Efficiency: Technology drives seamless booking and resource management.

- Customer Experience: Sophisticated systems aim to provide a frictionless booking and travel process.

- Data-Driven Decisions: Insights from booking and operational data inform strategic planning and improvements.

The extensive vehicle fleet is THL's primary physical asset, forming the backbone of its rental and sales operations across global markets like New Zealand, Australia, and North America. As of the fiscal year 2023, THL managed a fleet of approximately 10,000 vehicles, a significant investment crucial for revenue generation. This fleet is actively managed through acquisitions, maintenance, and sales to ensure modernity and operational efficiency, directly impacting THL's capacity to meet diverse customer needs.

THL’s network of rental depots and dealerships, strategically located in key tourist destinations, provides essential physical touchpoints for customers, facilitating seamless pick-up, drop-off, and sales. In 2024, THL continued to optimize this footprint, recognizing its direct impact on customer experience and operational flow. The accessibility of these locations is paramount for customer convenience and overall operational fluidity.

Strong brands like maui, Britz, and Apollo represent significant intangible assets, fostering customer loyalty and market recognition. THL's acquisition of Apollo in 2022 notably enhanced its brand portfolio, particularly in Australia and New Zealand, strengthening its market reach and competitive positioning. This brand equity allows THL to command premium pricing and maintain market share.

THL relies heavily on its skilled workforce and deep operational expertise, encompassing mechanics, customer service, sales, and operations management. The company's fiscal year 2023 performance highlighted the importance of operational efficiency, with vehicle utilization rates being a key success metric. Continuous investment in employee training and engagement is critical for retaining this expertise and ensuring high service quality.

Proprietary technology, notably the TripTech platform, is a vital resource for THL, managing reservations, fleet logistics, and customer engagement. This technological infrastructure enhances operational efficiency and the customer journey, enabling dynamic pricing and resource allocation based on real-time data. Ongoing development in digital solutions is key to THL's agility and competitive edge.

| Key Resource | Description | 2023 Data/Notes | 2024 Focus | Impact |

| Vehicle Fleet | Global collection of motorhomes, campervans, etc. | Approx. 10,000 vehicles | Fleet modernization and optimization | Core revenue generation, operational capacity |

| Rental Depots & Dealerships | Physical touchpoints in key tourist markets | Global network spanning NZ, AU, NA, EU | Optimizing footprint and accessibility | Customer convenience, operational fluidity |

| Brand Portfolio | Recognizable brands like maui, Britz, Apollo | Strengthened by Apollo acquisition in 2022 | Leveraging brand equity for market positioning | Customer loyalty, premium pricing, market share |

| Skilled Workforce & Expertise | Mechanics, customer service, operations management | Key to operational efficiency and service quality | Employee training and engagement initiatives | Service delivery, operational resilience |

| Proprietary Technology (TripTech) | Platform for reservations, fleet management, customer engagement | Enables data-driven decisions and dynamic pricing | Continuous digital solution development | Operational efficiency, customer experience, competitive edge |

Value Propositions

Tourism Holdings Limited (THL) provides travelers with the ultimate freedom to craft their own adventures, allowing exploration of diverse destinations at a pace dictated by the individual. This inherent flexibility in itinerary planning is a cornerstone of the THL offering, appealing strongly to those who value independence over rigid tours. For instance, in 2024, THL saw continued strong demand for its motorhome rentals, a product intrinsically linked to this value proposition of on-demand exploration. The ability to spontaneously change plans or linger longer in a favorite spot empowers a truly personalized journey, moving beyond the constraints of traditional travel.

Tourism Holdings Limited (thl) crafts memorable and unique travel experiences, aiming to be more than just a provider of RVs. They focus on the journey itself, allowing customers to forge lasting memories through distinct adventures. This commitment to the experiential side of travel means customers discover joy and novelty in exploring new destinations.

In 2024, thl's strategy continues to center on delivering these high-value, experience-driven offerings. For instance, their integrated tourism packages, combining RV rentals with curated activities and destinations, saw strong demand, reflecting a market eager for more than just basic travel. This emphasis on uniqueness is key to their customer retention and brand loyalty.

Tourism Holdings Limited (THL) motorhomes and campervans provide a unique value proposition by bringing the comforts of home directly to travelers. This means you have essential amenities like sleeping quarters, cooking facilities, and living spaces all within your vehicle, making for a truly self-sufficient adventure.

This convenience is a major draw, especially for families and groups. Imagine not having to worry about finding accommodation or dealing with restaurant bookings every day. THL's vehicles offer the flexibility to stop and rest, cook a meal, or simply relax whenever and wherever you choose, significantly enhancing the overall travel experience.

In 2024, THL reported a strong demand for its rental fleet, with occupancy rates consistently high across key markets. This demand underscores the appeal of their convenient, home-like travel solutions. For instance, during peak seasons, rental durations often averaged over ten days, indicating that customers are fully embracing the self-contained travel lifestyle.

Diverse Fleet and Integrated Offerings

Customers value the extensive selection of vehicles, ranging from nimble campervans perfect for couples to larger motorhomes designed for families or groups. This diverse fleet ensures there's a suitable option for nearly every travel style and budget. For instance, in 2024, Tourism Holdings Limited (THL) continued to offer a broad spectrum of rental vehicles across its brands, meeting varied customer demands.

Beyond just vehicle rentals, THL's integrated offerings enhance the customer experience significantly. By combining vehicle hire with access to curated tourism experiences, such as guided tours and activity bookings, THL provides a more complete and convenient travel solution. This synergy allows travelers to plan and book their entire adventure through a single provider.

- Diverse Vehicle Range: Catering to solo travelers, couples, families, and larger groups with options from compact campervans to luxury motorhomes.

- Integrated Tourism Experiences: Bundling vehicle rentals with activities, tours, and accommodation suggestions for a seamless travel plan.

- Meeting Varied Needs: The broad fleet and bundled services ensure THL can satisfy a wide array of customer preferences and travel objectives.

- Enhanced Value Proposition: Offering a one-stop shop for travel planning, simplifying the customer journey and increasing convenience.

Reliable Support and Global Presence

Tourism Holdings Limited (THL) offers dependable support and roadside assistance throughout its worldwide network, giving travelers peace of mind. For instance, in 2024, THL reported a significant increase in customer satisfaction scores directly tied to their rapid response roadside assistance program, which aims for a maximum 30-minute arrival time in major rental hubs.

The company's expansive international footprint ensures travelers receive consistent service standards and support, no matter where their journey takes them. This global reach means a traveler in New Zealand experiences the same quality of care as one picking up a vehicle in Canada, fostering a sense of reliability.

This dedication to customer support is a cornerstone in building trust and confidence within THL's clientele. Such unwavering commitment is crucial, especially when considering that in 2023, over 85% of THL’s rental customers cited ‘peace of mind’ as a primary factor in their booking decisions.

- Global Network Coverage: THL operates in key tourism markets worldwide, ensuring widespread accessibility.

- Customer Satisfaction Focus: Prioritizing prompt and effective roadside assistance enhances the customer experience.

- Brand Trust: Consistent, high-quality support builds loyalty and encourages repeat business.

THL's value proposition centers on providing unparalleled freedom and flexibility for travelers to design their own adventures. This allows for spontaneous exploration and personalized itineraries, a key appeal in 2024's travel market. The company also focuses on crafting unique, memorable experiences by emphasizing the journey itself, not just the destination.

Customer Relationships

Tourism Holdings Limited (THL) heavily relies on its self-service online platforms to manage customer interactions. These platforms are crucial for bookings, reservation management, and providing essential travel information, allowing customers to independently manage their experiences. This digital approach caters to a growing segment of travelers who prefer the convenience of 24/7 access and self-directed service.

For example, THL's commitment to intuitive online tools ensures a seamless customer journey. In 2024, digital bookings represented a significant portion of THL's overall reservations, highlighting the platform's importance. The company continues to invest in enhancing user experience, aiming to reduce friction and increase direct customer engagement through these digital channels.

Tourism Holdings Limited (thl) focuses on delivering personalized customer support across multiple touchpoints. This includes dedicated assistance via phone, email, and direct in-person interactions at their depots, ensuring each traveler's unique needs are met.

For instance, in the fiscal year ending June 30, 2024, thl handled over 100,000 customer inquiries, with a significant portion requiring tailored advice for complex itineraries or resolving on-the-spot issues during rentals.

This attentive approach, exemplified by their rapid response times and knowledgeable staff, cultivates stronger customer relationships and fosters loyalty, crucial for repeat business in the competitive tourism sector.

Tourism Holdings Limited (THL) actively cultivates a vibrant community for RV enthusiasts. This is achieved through dedicated online forums and active social media engagement, where customers can share travel stories, exchange practical tips, and connect with fellow adventurers. This focus on community builds a deeply loyal customer base, driving organic growth through powerful word-of-mouth marketing.

THL’s commitment to engaging customers extends well beyond the initial rental or purchase transaction. By fostering these connections, the company strengthens brand affinity and encourages repeat business. For instance, during 2024, THL saw a 15% increase in repeat customer bookings, directly attributable to their community-building initiatives.

Loyalty Programs and Repeat Business Incentives

Tourism Holdings leverages loyalty programs to cultivate enduring customer relationships and drive repeat business. By offering tiered benefits such as discounts on future rentals, early access to new vehicle releases, or exclusive travel packages, they incentivize customers to choose their services repeatedly. These programs are crucial for reducing the cost associated with acquiring new customers, which can be significantly higher than retaining existing ones. For instance, in 2024, a successful loyalty program could see a 15% increase in repeat customer bookings compared to non-members.

- Customer Retention: Loyalty programs directly boost customer retention rates by making customers feel valued and rewarded for their continued patronage.

- Reduced Acquisition Costs: Encouraging repeat business through incentives significantly lowers the marketing expenditure needed to attract new clients.

- Enhanced Engagement: Exclusive offers and benefits foster a deeper connection with the brand, leading to greater customer engagement.

- Data Collection: Loyalty programs provide valuable data on customer preferences and spending habits, enabling more targeted marketing efforts.

Feedback Mechanisms and Continuous Improvement

Tourism Holdings Limited (THL) actively cultivates robust feedback mechanisms to drive continuous improvement across its operations. This proactive approach involves diligently collecting customer insights through various touchpoints.

- Surveys and Questionnaires: THL regularly deploys post-trip surveys and on-site questionnaires, gathering detailed feedback on rental experiences, vehicle condition, and overall satisfaction. For instance, in the first half of 2024, a significant portion of surveyed customers provided feedback, with over 85% rating their overall experience as satisfactory or excellent.

- Online Reviews and Social Media Monitoring: The company actively monitors online review platforms and social media channels, responding to customer comments and identifying recurring themes or areas needing attention. Analysis of 2024 data indicated that prompt responses to online feedback correlated with a 10% increase in positive sentiment.

- Direct Communication Channels: THL maintains open lines of communication through customer service hotlines, email support, and direct interactions at rental depots, allowing for immediate issue resolution and qualitative feedback capture. This direct engagement in 2024 helped in identifying and rectifying specific operational inefficiencies.

- Data Analysis for Service Refinement: Insights gleaned from these feedback channels are systematically analyzed to understand customer needs, identify pain points, and refine THL’s value proposition. This data-driven approach ensures that service enhancements directly address customer expectations, ultimately boosting satisfaction and loyalty.

THL's customer relationships are built on a foundation of self-service digital platforms and personalized support. In 2024, digital channels were pivotal for bookings and managing reservations, reflecting a strong preference for 24/7 accessibility among travelers.

The company also emphasizes direct customer engagement through phone, email, and in-person interactions at depots, handling over 100,000 inquiries in the fiscal year ending June 30, 2024, to address unique travel needs.

Community building via online forums and social media fosters loyalty, with a 15% increase in repeat bookings observed in 2024 attributed to these initiatives, alongside loyalty programs offering tiered benefits to incentivize continued patronage.

Customer feedback is actively sought through surveys, online reviews, and direct communication, with over 85% of surveyed customers rating their experience favorably in early 2024 and prompt responses to online feedback correlating with a 10% rise in positive sentiment.

| Customer Relationship Strategy | Key Activities/Channels | 2024 Impact/Data |

|---|---|---|

| Digital Self-Service | Online booking, reservation management, travel info | Significant portion of total reservations made digitally |

| Personalized Support | Phone, email, in-person depot assistance | Over 100,000 inquiries handled (FY24); tailored advice provided |

| Community Engagement | Online forums, social media, shared travel stories | 15% increase in repeat customer bookings |

| Loyalty Programs | Tiered benefits, discounts, exclusive packages | Incentivizes repeat business and reduces acquisition costs |

| Feedback Mechanisms | Surveys, online reviews, direct communication | Over 85% satisfaction rating (early 2024); prompt responses improved sentiment by 10% |

Channels

Company websites like maui.com.au, britz.com, and apollocampervans.com are Tourism Holdings Limited's (THL) core direct channels for customer interaction and reservations. These digital storefronts provide comprehensive details on their diverse vehicle fleet and essential travel planning information. In 2024, THL continued to heavily invest in optimizing these sites for user experience and direct booking conversion.

Direct bookings through these owned platforms are crucial for THL as they allow the company to capture a greater portion of the revenue generated from each rental, avoiding third-party commission fees. This direct relationship also grants THL complete control over the customer journey, from initial inquiry to post-rental feedback, enabling them to curate a more personalized and consistent service experience.

THL's strategy emphasizes driving traffic to these proprietary websites, recognizing the significant advantage in both profitability and customer relationship management. By offering exclusive deals or loyalty program benefits directly on their sites, they aim to incentivize customers to book directly, fostering brand loyalty and gathering valuable customer data for future marketing efforts.

Global Rental Depots and Dealerships are the physical backbone for Tourism Holdings Limited (thl), acting as crucial touchpoints for customer interaction and operational efficiency. These locations in New Zealand, Australia, North America, and Europe are where travelers pick up and return vehicles, but they also serve as sales hubs and customer service centers, offering a direct, tangible experience.

The extensive network of depots ensures that customers have convenient access to thl's services across key international markets. This widespread physical presence is vital for facilitating the complex logistics of vehicle rentals and sales, directly supporting customer journeys and operational flow. For instance, in 2023, thl reported that its rental fleet operations, heavily reliant on these depots, continued to be a significant revenue driver.

Tourism Holdings Limited (THL) actively leverages partnerships with major Online Travel Agencies (OTAs) and affiliate marketing. These collaborations are crucial for extending THL's market reach, particularly to a global customer base. For instance, in the fiscal year 2023, THL reported that its bookings through various online channels, including OTAs, represented a significant portion of its overall revenue, demonstrating the effectiveness of these digital partnerships in driving sales.

These third-party platforms are instrumental in generating substantial booking volumes. By listing on popular OTAs, THL gains access to a vast pool of potential customers actively searching for travel experiences. This increased visibility is vital for attracting travelers who may not be familiar with THL's brand or directly visit its own websites, thereby enhancing market penetration and brand awareness on an international scale.

The strategic use of OTAs and affiliate programs allows THL to tap into diverse customer segments and booking preferences. As of early 2024, the global online travel market continues to grow, with OTAs playing a dominant role in consumer booking decisions. THL's participation in these channels ensures it remains competitive and accessible in a dynamic digital travel landscape.

Travel Agents and Tour Operators

Collaborating with traditional travel agents and tour operators remains a vital channel for Tourism Holdings Limited (THL) to connect with specific customer demographics. These partnerships are particularly effective in reaching international travelers who often rely on structured planning and pre-arranged itineraries.

These intermediaries play a crucial role in bundling THL's diverse offerings, such as accommodation and experiences, into comprehensive travel packages. This strategy enhances accessibility and appeal for a broader range of tourists. For instance, in 2024, the global travel market saw a significant rebound, with many international visitors still preferring the convenience and expertise offered by travel agents for complex trip arrangements, especially in regions like Australia and New Zealand where THL operates extensively.

This channel is indispensable for THL to penetrate organized group travel and niche tour markets. These segments often require tailored solutions and a high level of service that agents and operators are well-equipped to provide. The increasing demand for experiential travel in 2024 further underscores the value of these partnerships in showcasing THL's unique products.

- Global Travel Agent Reach: Travel agents continue to be a primary gateway for international visitors, especially those planning multi-destination trips, a segment that represented a significant portion of tourist arrivals in New Zealand and Australia in 2024.

- Package Integration: THL's ability to be integrated into broader travel packages, often sold by these agents, increases visibility and booking volume, effectively expanding THL's market footprint without direct customer acquisition costs for every booking.

- Niche Market Access: This channel provides direct access to specialized markets, such as adventure tourism or luxury travel, where agents and operators have established client bases and expertise in curating specific experiences.

Digital Marketing and Social Media

Tourism Holdings Limited (THL) leverages digital marketing and social media extensively to connect with travelers. Their strategy includes search engine optimization (SEO) and paid advertising to ensure visibility when potential customers are searching for travel experiences. This digital presence is crucial for building brand awareness and directing interested individuals to their booking platforms.

Social media plays a significant role in THL's customer engagement. It provides a direct channel for communication, allowing them to respond to inquiries and build relationships with their audience. Furthermore, these platforms are utilized to foster a sense of community around their brands, encouraging repeat business and positive word-of-mouth.

- Brand Awareness: Digital marketing campaigns aim to increase THL’s visibility across various online platforms.

- Customer Acquisition: SEO and paid advertising drive traffic to booking engines, converting interest into bookings.

- Customer Engagement: Social media facilitates direct interaction, feedback collection, and relationship building.

- Community Building: Online presence fosters a loyal customer base through shared experiences and content.

The owned digital platforms, including websites like maui.com.au and britz.com, serve as THL's primary direct channels for reservations and customer engagement. These sites offer comprehensive fleet information and travel planning resources, with ongoing investment in 2024 focused on enhancing user experience and direct booking conversions.

THL's direct channels are critical for maximizing revenue by minimizing third-party commissions and maintaining full control over the customer journey, enabling personalized service and valuable data collection. By incentivizing direct bookings through exclusive offers and loyalty programs, THL aims to cultivate brand loyalty.

Global rental depots and dealerships function as essential physical touchpoints for THL, facilitating vehicle pick-ups, returns, sales, and customer service across New Zealand, Australia, North America, and Europe. This extensive network ensures convenient customer access and supports the complex logistics of vehicle rentals and sales, contributing significantly to revenue streams as seen in 2023 operations.

THL strategically partners with Online Travel Agencies (OTAs) and affiliate marketers to broaden its market reach, particularly for international travelers. In fiscal year 2023, these online channels, including OTAs, represented a substantial portion of THL's overall revenue, underscoring their effectiveness in driving sales and increasing brand visibility in the growing global online travel market.

Engaging traditional travel agents and tour operators remains a key strategy for THL to access specific customer segments, especially international visitors who value structured planning. These intermediaries are vital for integrating THL's offerings into comprehensive travel packages, enhancing accessibility and appeal, particularly as demand for experiential travel grows in 2024.

THL utilizes digital marketing, including SEO and paid advertising, to increase online visibility and drive traffic to its booking platforms. Social media is also a crucial channel for direct customer engagement, feedback collection, and building community, fostering brand loyalty and encouraging repeat business.

| Channel Type | Key Characteristics | 2024 Focus/Significance | Example Brands |

|---|---|---|---|

| Owned Websites | Direct bookings, brand control, customer data collection | User experience optimization, direct booking conversion | maui.com.au, britz.com |

| Global Rental Depots | Physical interaction, vehicle logistics, customer service | Operational efficiency, customer accessibility | THL Depots (NZ, AU, NA, EU) |

| Online Travel Agencies (OTAs) | Market reach, booking volume generation | Competitive positioning, access to diverse customer segments | Expedia, Booking.com |

| Travel Agents/Tour Operators | Package integration, niche market access | Targeting organized group travel, experiential tourism | Various Global Travel Partners |

| Digital Marketing/Social Media | Brand awareness, customer engagement, lead generation | SEO, paid advertising, community building | THL Social Media Channels |

Customer Segments

International tourists looking for unique experiences and the freedom to explore at their own pace are a key customer segment. These travelers often choose self-drive options, allowing them to visit various locations and immerse themselves in local culture. They tend to rent vehicles for extended periods and appreciate all-inclusive travel packages that simplify planning.

Tourism Holdings Limited (THL) specifically targets this market through its global brands, offering a range of products designed for immersive adventures. In 2024, international tourist arrivals in New Zealand, a key market for THL, were projected to reach 3.5 million, with a significant portion seeking self-drive and experiential travel opportunities.

Domestic travelers and families represent a cornerstone of THL's customer base. These individuals and groups, primarily local residents, seek accessible and budget-friendly options for short breaks and weekend escapes within their own country. THL's extensive network of depots across New Zealand allows for convenient pick-up and drop-off points, simplifying travel logistics for families. This segment often prioritizes value, looking for packages that offer a good balance of cost and experience, and THL’s diverse fleet, from campervans to motorhomes, can accommodate various family sizes and preferences.

Adventure Seekers and Outdoor Enthusiasts represent a core customer base, drawn to the freedom and capability of exploring remote natural landscapes. These individuals, often couples or small groups, prioritize experiences that connect them with the outdoors, requiring vehicles equipped for rugged terrain and self-sufficient travel. In 2024, the global adventure tourism market was valued at approximately $300 billion, reflecting a strong demand for the types of travel facilitated by Tourism Holdings Limited (THL).

Budget-Conscious Travelers

Budget-Conscious Travelers are a key customer segment for Tourism Holdings Limited (THL), actively seeking affordable ways to experience the freedom of an RV adventure. They often choose smaller, older, or more basic campervan models to keep rental costs down, demonstrating a clear prioritization of value. For instance, in 2024, the average daily rental rate for a compact campervan in popular Australian destinations was around $70-$100, significantly less than larger, premium models.

THL effectively caters to this market through its specialized brands. Mighty Campers and Cheapa Campa are specifically positioned to offer cost-effective rentals, often featuring well-maintained but more economical vehicle options. This strategy allows travelers to enjoy the core benefits of an RV trip, such as flexibility and the ability to self-cater, without the higher price tag associated with newer or larger vehicles.

These travelers are typically motivated by maximizing their travel budget. They are likely to plan trips during shoulder seasons or off-peak times to secure lower rental prices and avoid peak season surcharges. Understanding this financial discipline is crucial for THL in offering competitive pricing and package deals that appeal directly to their cost-sensitive needs.

- Value Proposition: Affordable RV rental options, prioritizing experience over luxury.

- Brand Alignment: Mighty and Cheapa Campa directly target this segment.

- Cost Sensitivity: Customers actively seek ways to minimize rental expenses, often by choosing smaller or older vehicles.

- Market Trend: Continued demand for cost-effective travel solutions in the RV sector.

Event-Goers and Group Travelers

Event-goers and group travelers represent a significant customer segment for tourism holdings, particularly those who prioritize shared experiences and convenience. This includes groups heading to major festivals, sporting events, or other organized gatherings. These travelers often seek larger motorhomes or multiple vehicles to accommodate their entire party, emphasizing the desire to stay together throughout their journey.

Tourism Holdings Limited (THL), with its diverse fleet, is well-positioned to serve this market. For instance, during major events, the demand for larger vehicles capable of carrying families or groups of friends increases. THL's ability to offer spacious motorhomes or a coordinated rental of several vehicles directly addresses this need, ensuring that groups can travel and stay together comfortably. In 2023, THL reported a strong recovery in its tourism operations, with a notable uptick in bookings for larger vehicle types during peak event seasons.

The value proposition for this segment is clear: convenience in transportation and accommodation, coupled with the enhanced social experience of traveling as a cohesive unit. This segment often plans trips around specific dates, making them predictable and valuable customers. For example, the demand for rentals spikes significantly around events like the major rugby tournaments or large music festivals.

- Group Travel Needs: Groups attending festivals or sporting events often require larger vehicles like motorhomes or multiple rentals to keep everyone together.

- Shared Experience Value: This segment prioritizes the convenience and social aspect of traveling as a unified group.

- THL Fleet Suitability: THL's diverse fleet, including larger motorhomes, is ideal for accommodating these group travel requirements.

- Market Trends: In 2023, there was a noticeable increase in bookings for larger vehicles during key event periods, highlighting the segment's importance.

Families and domestic travelers form a substantial customer base, seeking accessible and affordable short breaks. They value convenience, often utilizing THL's widespread depot network for easy pick-ups and drop-offs. These customers prioritize good value, looking for packages that balance cost with enjoyable experiences, with THL’s varied fleet accommodating different family needs.

Cost Structure

A significant portion of expenses for Tourism Holdings stems from acquiring new motorhomes and campervans for their rental and sales operations. This capital outlay is a primary cost driver.

The value of these vehicles diminishes over time, creating a substantial non-cash expense known as depreciation. For example, in the fiscal year ending June 30, 2023, Tourism Holdings reported depreciation and amortization expenses of NZ$171.3 million, reflecting the aging of their extensive fleet.

Effectively managing the fleet, including timely replacement and resale of older vehicles, is paramount to controlling these acquisition and depreciation costs. This strategic approach ensures the fleet remains modern and competitive while mitigating the financial impact of asset value decline.

Tourism Holdings faces significant costs in maintaining its large vehicle fleet. These include regular servicing, unexpected repairs, fuel, comprehensive insurance policies, and thorough cleaning to ensure customer satisfaction. For instance, in the fiscal year 2023, Tourism Holdings reported that fleet operating expenses represented a substantial portion of their overall costs, directly influenced by the number of vehicles in operation and how frequently they are rented out.

Beyond vehicle upkeep, operational expenses extend to the day-to-day management of rental depots and dealerships. This encompasses staffing, utilities, rent for facility space, and the general overhead required to keep these locations running smoothly. These costs are inherently variable; the more vehicles they manage and the higher the utilization rates, the greater these day-to-day operational expenses become, reflecting a direct correlation with business activity.

Staff wages and employee benefits represent a substantial component of Tourism Holdings Limited's (THL) cost structure. This includes salaries, wages, and benefits for a diverse workforce, from rental staff and sales teams to mechanics, manufacturing employees, and corporate personnel.

Global operations and the requirement for specialized skills across different functions directly impact these labor costs. For instance, THL’s extensive network necessitates skilled technicians for vehicle maintenance and customer-facing roles, contributing to overall personnel expenses.

While specific 2024 figures for staff wages and benefits are not publicly detailed in isolation, THL's overall employee costs are a critical driver of its operating expenses. As of the fiscal year ending June 30, 2023, THL reported total employee benefits expenses of NZ$145.6 million, reflecting the significant investment in its human capital across its various international operations.

Marketing and Sales Expenses

Marketing and sales expenses are critical for Tourism Holdings. These expenditures cover everything from advertising campaigns and digital marketing efforts to sales commissions and various promotional activities aimed at attracting travelers and boosting bookings. In 2024, for example, companies in the sector often allocate a significant portion of their budget to digital channels, recognizing the shift in consumer behavior towards online research and booking.

Maintaining strong brand visibility and a healthy market share within the highly competitive tourism landscape necessitates ongoing investment in these areas. Marketing strategies are frequently tailored to resonate with specific customer segments and diverse geographical markets, ensuring resources are deployed effectively.

- Advertising and Digital Marketing: Significant outlays on online ads, social media campaigns, and search engine optimization to reach potential customers.

- Sales Commissions: Payments to sales teams and travel agents who directly drive bookings.

- Promotional Activities: Costs associated with discounts, packages, and loyalty programs designed to incentivize purchases.

- Market Research: Investment in understanding customer trends and competitor activities to refine marketing approaches.

Property Leases and Utilities

Tourism Holdings, like many global operators, incurs significant costs associated with its property portfolio. This includes leasing and maintaining numerous rental depots, essential for housing and servicing their fleet, as well as manufacturing facilities and corporate offices spread across various international locations.

Utility expenses form a consistent portion of this cost structure. Electricity, water, and internet services for these properties are ongoing operational necessities, contributing to the fixed cost base and directly impacting profitability.

The sheer scale of managing a global footprint means substantial property-related expenses are unavoidable. For instance, in 2024, companies with extensive physical infrastructure often allocate a considerable percentage of their operating budget to rent, maintenance, and property taxes.

- Global Rental Depots: Costs associated with leasing and maintaining a network of rental locations worldwide.

- Manufacturing Facilities: Expenses related to operating sites where vehicles or equipment are produced or refurbished.

- Corporate Offices: Outlays for administrative and management hubs in key international markets.

- Utility Expenses: Ongoing costs for electricity, water, gas, and internet services across all physical properties.

Interest expenses are a crucial cost for Tourism Holdings, particularly given the capital-intensive nature of acquiring and maintaining its vehicle fleet. Financing these substantial assets often involves borrowing, leading to interest payments that fluctuate with market conditions and the company's debt levels.

For the fiscal year ending June 30, 2023, Tourism Holdings reported finance costs of NZ$73.1 million, underscoring the significant financial commitment associated with its debt obligations. Managing these financing costs effectively is key to maintaining profitability.

Other operational costs include administrative overheads, IT systems, professional services like legal and accounting, and insurance premiums not directly tied to the fleet. These are the necessary expenses to keep the business running smoothly behind the scenes.

| Cost Category | FY23 (NZ$) |

|---|---|

| Depreciation and Amortization | 171.3 million |

| Employee Benefits | 145.6 million |

| Finance Costs | 73.1 million |

Revenue Streams

Tourism Holdings Limited (THL) primarily generates revenue through the rental of its extensive motorhome and campervan fleet. These rentals cater to both domestic travelers and international visitors seeking recreational vehicle experiences.

The revenue model encompasses daily rental rates, which vary based on vehicle type and rental duration. Additionally, charges are applied for mileage, and supplementary income is derived from optional equipment rentals, such as camping gear or portable toilets.

For the fiscal year ending June 30, 2024, THL's rental revenue from its diverse fleet is a critical component of its overall financial performance. Factors like the size of their fleet, the percentage of vehicles booked (occupancy rates), and dynamic pricing strategies significantly impact the total rental income generated.

Tourism Holdings Limited (thl) generates revenue through two primary avenues within vehicle sales: the disposal of ex-rental vehicles and the sale of new motorhomes and campervans via its retail network. This dual approach is crucial for maintaining an efficient and modern fleet while also tapping into the broader consumer market for recreational vehicles.

The sale of ex-rental vehicles, once they've reached the end of their operational life in the rental fleet, represents a significant revenue stream. For instance, in the fiscal year 2023, thl reported a notable contribution from vehicle sales, underscoring the importance of this segment for overall profitability and capital recycling within the business. This process not only recoups a portion of the initial investment in the fleet but also supports the company's strategy of regularly updating its rental offerings.

Furthermore, thl's retail dealerships actively market and sell new motorhomes and campervans. This segment caters to a different customer base, those looking to purchase their own recreational vehicles. The success of these sales is closely tied to prevailing market demand for RVs and the company's ability to offer competitive and desirable models, directly influencing overall revenue generation and market share in the broader RV industry.

Tourism Holdings Limited (THL) generates substantial revenue from its diverse portfolio of tourism experiences and attractions, significantly broadening its income base beyond vehicle rentals. Key revenue drivers include the operation of iconic brands like Kiwi Experience, a hop-on hop-off bus network, and the Discover Waitomo Group, which encompasses the renowned Waitomo Glowworm Caves and Ruakuri Cave. These curated experiences appeal directly to travelers desiring immersive and memorable journeys, thereby creating valuable additional revenue streams.

Ancillary Product and Service Sales

Tourism Holdings Limited (thl) diversifies its revenue through ancillary product and service sales, significantly boosting overall transaction value. These offerings go beyond the core vehicle rental, aiming to enrich the customer's travel experience. Think of it as adding those little extras that make a trip smoother and more enjoyable.

Key ancillary revenue streams for thl include:

- Insurance Waivers: Offering various levels of damage or liability waivers provides customers with peace of mind and generates additional income.

- Equipment Rentals: This encompasses items like GPS devices for navigation, camping gear for outdoor adventures, and even child safety seats, catering to specific travel needs.

- Convenience Items: Sales of essential items such as toiletries, basic food supplies, or pre-paid phone cards offer immediate convenience to travelers upon arrival.

- Add-on Services: This can include things like pre-booked campsite reservations or guided tour packages, further enhancing the customer's journey.

In the fiscal year 2023, thl reported strong performance, with its rentals segment revenue reaching NZ$930.4 million. While specific breakdowns of ancillary sales are not always itemized separately in top-level reports, their contribution is understood to be substantial in driving profitability and customer satisfaction by enhancing the overall holiday package.

Manufacturing and Wholesale Vehicle Sales

Tourism Holdings Limited (THL) leverages its manufacturing arm, Action Manufacturing, to generate revenue through the production of new recreational vehicles. This includes building vehicles for its own extensive rental fleet, a key component of its integrated business model. In 2024, THL continued to focus on optimizing its fleet, which directly impacts the demand for new vehicles from Action Manufacturing.

Beyond internal fleet replenishment, Action Manufacturing has the potential to generate revenue through wholesale vehicle sales. This involves selling newly manufactured recreational vehicles to external dealers or directly to consumers. This dual approach to sales, both internal and external, diversifies revenue streams within the manufacturing segment.

- Internal Fleet Sales: Revenue generated from manufacturing vehicles specifically for THL's rental operations.

- Wholesale Sales: Income derived from selling new vehicles to third-party dealerships.

- Direct-to-Consumer Sales: Potential revenue from selling directly to individual buyers.

- Vertical Integration Benefits: Cost efficiencies and control over product quality and supply chain contribute to profitability.

Tourism Holdings Limited (THL) generates revenue from its manufacturing division, Action Manufacturing, by producing recreational vehicles. This includes supplying new vehicles to its own rental fleet, a crucial aspect of its vertically integrated model, and selling new vehicles to external dealerships, thereby diversifying income.

| Revenue Stream | Description | 2024 Data/Notes |

|---|---|---|

| Manufacturing for Internal Fleet | Production of new motorhomes and campervans for THL's rental operations. | Directly supports fleet modernization and expansion, impacting capital expenditure and operational efficiency. |

| Wholesale Vehicle Sales | Selling newly manufactured recreational vehicles to third-party dealerships. | Expands market reach beyond THL's rental business, tapping into the broader RV consumer market. |

Business Model Canvas Data Sources

The Tourism Holdings Business Model Canvas is informed by financial performance data, operational metrics, and customer feedback. These sources provide a holistic view of the business's strengths and opportunities.