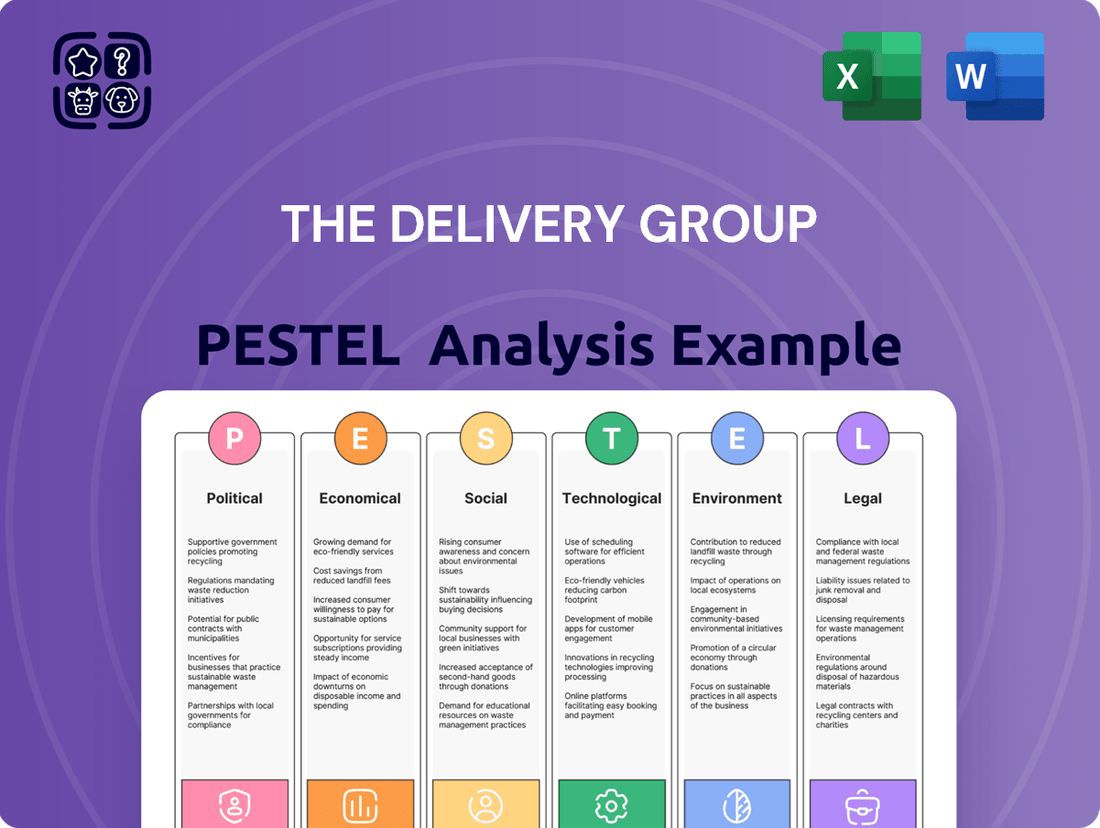

The Delivery Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Delivery Group Bundle

Navigate the complex external landscape affecting The Delivery Group with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and evolving social trends are shaping the delivery sector. Gain critical insights into technological advancements and environmental regulations that impact operations and future growth. Our meticulously researched analysis provides actionable intelligence to inform your strategic decisions.

Don't get left behind by external forces impacting The Delivery Group's market. Our PESTLE analysis offers a deep dive into the political, economic, social, technological, legal, and environmental factors at play. Empower yourself with the knowledge to anticipate challenges and capitalize on opportunities. Purchase the full version for immediate access to this vital strategic resource.

Political factors

The UK postal sector is actively navigating substantial regulatory shifts, notably Ofcom's planned reforms to the Universal Service Obligation (USO) for Royal Mail, set to take effect from July 2025. These adjustments will modify delivery frequencies for Second Class mail and update performance benchmarks for both First and Second Class services, with the stated goal of securing the financial viability of the universal postal service.

These impending changes directly influence downstream access providers such as The Delivery Group, as they reshape the fundamental infrastructure and service standards governing the wider postal ecosystem. For instance, the reduction in delivery frequency for Second Class mail, a key element of the reform, will necessitate operational adjustments for companies relying on this service for their own delivery networks.

Brexit continues to significantly alter trade logistics between the UK and the EU. Businesses face ongoing challenges with increased administrative work, complex customs paperwork, and higher shipping expenses. These factors directly impact the efficiency and cost-effectiveness of moving goods.

The fallout from Brexit has notably affected UK goods trade with the EU. Exports, in particular, have experienced substantial declines, painting a picture of a more challenging landscape for companies engaged in the international distribution of mail and parcels. For instance, UK exports to the EU fell by 14.1% in Q1 2021 following the full implementation of the trade deal.

Addressing these trade frictions and simplifying border processes remains a critical area of political and economic discussion. The ongoing dialogue highlights the desire for more streamlined operations and reduced bureaucratic hurdles for businesses operating within the UK-EU trade corridor.

The Digital Markets, Competition and Consumers Act 2024 (DMCCA), set to be fully enacted by April 2025, represents a significant shift in consumer protection, directly affecting how e-commerce and delivery businesses operate. This new framework targets deceptive practices such as drip pricing, where additional fees are added late in the checkout process, and the proliferation of fake online reviews, demanding greater transparency in pricing and more reliable methods for handling customer feedback.

Under the DMCCA, the Competition and Markets Authority (CMA) is granted substantially increased direct enforcement capabilities. This means the CMA can more proactively investigate and penalize companies found in breach of consumer protection laws. The legislation also introduces the possibility of considerable financial penalties for non-compliance, creating a strong incentive for businesses to adhere to the new standards.

Government Vision for Post Office Network

The UK government has detailed its strategic direction for the Post Office network, aiming for financial sustainability and continued provision of vital services over the next decade. This vision, spanning the next 5 to 10 years, impacts the broader postal ecosystem, including downstream access operators like The Delivery Group, by shaping public perception and the operational environment.

The government is actively evaluating the future needs of the Post Office network, considering potential adjustments to the number of branches. As of early 2024, the Post Office network comprises over 10,000 branches, a significant national asset. Any changes to its structure could indirectly affect competitive dynamics and service availability within the postal sector.

- Government's 5-10 year vision: Focus on essential services and financial stability for the Post Office.

- Impact on downstream access: Public perception and operational landscape are influenced by the Post Office network's health.

- Network review: Government is assessing branch numbers and potential adjustments.

- Current scale: Over 10,000 Post Office branches operate across the UK.

Political Pressure on Trade Facilitation

Political pressure is mounting on the UK government to refine its trade facilitation measures. Efforts are underway to address post-Brexit trade frictions, with business organizations like Logistics UK actively lobbying for simplified border procedures. These calls are particularly focused on reducing the burden of Sanitary and Phytosanitary (SPS) controls, which have demonstrably increased red tape and led to delays for specific imports and exports.

The ongoing dialogue highlights a clear push for more efficient international trade processes. For instance, in 2024, the UK government announced plans to further digitize customs procedures, aiming to cut processing times by up to 50% for certain goods. This political drive to streamline cross-border e-commerce fulfilment is expected to yield significant improvements in delivery times and reduce operational costs for businesses engaged in international trade.

- Lobbying for SPS Simplification: Business groups are actively pushing for reduced complexity in Sanitary and Phytosanitary checks to ease trade flow.

- Digital Customs Initiatives: The UK government is investing in digital solutions to automate and speed up customs clearance processes.

- Post-Brexit Trade Friction Reduction: Political will is directed towards mitigating the trade barriers that emerged following the UK's departure from the EU.

The regulatory landscape for the UK postal sector is undergoing significant transformation, particularly with Ofcom's planned reforms to the Universal Service Obligation (USO) from July 2025. These changes will affect delivery frequencies and performance benchmarks, aiming to ensure the long-term financial health of the universal postal service, which in turn impacts downstream providers like The Delivery Group.

Brexit continues to create trade frictions between the UK and the EU, leading to increased administrative burdens, complex customs procedures, and higher shipping costs. This has demonstrably impacted UK exports to the EU, which saw a 14.1% drop in Q1 2021, highlighting the ongoing challenges for international distribution services.

The Digital Markets, Competition and Consumers Act 2024 (DMCCA), effective by April 2025, enhances consumer protection by targeting practices like drip pricing and fake reviews, demanding greater transparency from e-commerce and delivery businesses. The Competition and Markets Authority (CMA) gains expanded enforcement powers, including substantial financial penalties for non-compliance.

The UK government's 5-10 year strategy for the Post Office network focuses on financial sustainability and essential service provision, influencing the broader postal ecosystem. As of early 2024, over 10,000 Post Office branches operate, and any structural adjustments could alter competitive dynamics within the sector.

Political efforts are focused on easing post-Brexit trade, with lobbying for simplified Sanitary and Phytosanitary (SPS) controls to reduce red tape and delays. Initiatives like the planned digitization of customs procedures, aiming for up to a 50% reduction in processing times for certain goods in 2024, signal a strong political drive towards more efficient cross-border e-commerce fulfilment.

What is included in the product

This PESTLE analysis thoroughly examines the political, economic, social, technological, environmental, and legal factors impacting The Delivery Group, providing a comprehensive understanding of the external landscape.

It offers actionable insights and forward-looking perspectives to help stakeholders identify opportunities and mitigate risks within the evolving market.

Provides a concise version of The Delivery Group's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, streamlining strategic discussions.

Economic factors

The UK e-commerce market is on a strong growth trajectory, with online sales expected to represent a substantial share of total retail expenditure by 2025. This ongoing consumer preference for digital purchasing fuels the need for effective parcel delivery and e-fulfilment services.

While the overall pace of online sales growth might be moderating, the increasing average order value signifies a robust and resilient market for delivery providers. For instance, by the end of 2024, online retail sales in the UK are anticipated to reach approximately £120 billion, a figure that continues to climb year on year.

The logistics sector in 2024 and 2025 continues to grapple with significant economic pressures stemming from escalating operational costs. Inflationary trends are driving up wage expectations for drivers and warehouse staff, a critical component of delivery services. For instance, the US Bureau of Labor Statistics reported average hourly earnings for transportation and warehousing workers rose by approximately 4.5% in early 2024 compared to the previous year, directly impacting labour expenses for delivery companies.

Fluctuating fuel prices remain a persistent challenge, directly impacting the cost of transportation for The Delivery Group. As of mid-2024, global crude oil prices have shown volatility, with Brent crude averaging around $80-$90 per barrel, a significant increase from pre-pandemic levels. This makes budgeting and pricing extremely difficult for companies relying on extensive vehicle fleets for their operations.

These rising costs directly squeeze profit margins for delivery and fulfilment businesses. Companies are forced to either absorb these increases, impacting their bottom line, or pass them on to consumers through higher shipping fees, potentially affecting demand. The need for continuous efficiency improvements, such as route optimization software and electric vehicle adoption, becomes paramount to mitigate these economic headwinds.

Despite a general cooling in the UK's overall labour market, the logistics industry is still grappling with significant skills gaps, especially for critical roles like HGV drivers and warehouse staff. This persistent demand fuels upward pressure on wages.

Increased employer costs are a direct consequence, highlighted by the rise in the National Living Wage and National Insurance contributions. For instance, the National Living Wage increased to £11.44 per hour for those aged 21 and over from April 2024.

To combat these challenges, logistics firms are increasingly prioritizing skills-based recruitment and implementing robust retention programs. These strategies aim to secure and keep essential talent in a competitive environment.

Investment in Logistics Infrastructure

Major players in logistics and e-commerce are channeling significant capital into infrastructure and automation. This is driven by the economic need to boost efficiency and expand capacity. For instance, the global logistics market size was valued at approximately $9.3 trillion in 2023 and is projected to reach $13.1 trillion by 2029, showcasing robust growth and investment potential.

The Delivery Group's own investment in new trailer types exemplifies this industry-wide trend. Such capital expenditures are crucial for meeting escalating demand and refining service levels. This strategic move by The Delivery Group indicates a strong belief in the sustained economic expansion of the logistics sector.

- Increased Demand: E-commerce growth fuels the need for enhanced logistics networks.

- Automation Adoption: Investments in technology are key to operational improvements.

- Infrastructure Expansion: Building and upgrading facilities is a priority for many firms.

- Economic Confidence: Such investments signal positive outlooks for future market performance.

Cross-Border Trade and Economic Resilience

While domestic e-commerce growth in the UK has seen a slight moderation, cross-border transactions are on the rise, signaling international markets as a significant avenue for expansion for UK retailers. In 2024, UK e-commerce exports are projected to grow, with particular strength anticipated in categories like apparel and electronics. This trend underscores the increasing importance of global markets for revenue generation.

For The Delivery Group, this evolving landscape presents a dual challenge and opportunity. Adapting to the intricate demands of international logistics, including customs regulations, varying shipping times, and diverse payment methods, is paramount. However, these complexities also create a strong demand for specialized e-fulfilment services designed to support global trade, offering a clear pathway for business growth.

The ability to effectively navigate these international complexities is directly linked to sustained economic performance and competitive advantage. For instance, UK businesses exporting goods in 2024 faced an average of 3-5 days delay due to customs processing in key European markets, highlighting the need for streamlined solutions.

- Cross-border e-commerce growth: International markets are increasingly vital for UK retailers as domestic growth moderates.

- Logistical adaptation: The Delivery Group must enhance capabilities to manage complex international shipping, customs, and regulations.

- E-fulfilment opportunities: There is significant potential to expand services catering to businesses engaged in global e-commerce.

- Economic resilience factor: Proficiently handling international trade complexities is key to maintaining and improving economic performance.

The economic landscape in 2024 and 2025 presents a mixed bag for The Delivery Group. While e-commerce continues to expand, driving demand, the sector faces significant cost pressures. Inflation, particularly in wages and fuel, is a major concern, impacting operational expenses and profit margins. For example, the average hourly earnings for transportation and warehousing workers saw a rise of around 4.5% in early 2024. This necessitates a focus on efficiency and strategic investment to maintain competitiveness.

The UK logistics sector is experiencing a dual trend of increasing demand and rising costs. The continued growth of e-commerce, with online sales expected to form a substantial portion of retail by 2025, ensures a strong market for delivery services. However, this is coupled with inflationary pressures on wages, with the National Living Wage increasing to £11.44 per hour from April 2024 for those 21 and over. Fluctuating fuel prices, with Brent crude averaging $80-$90 per barrel mid-2024, further squeeze operational budgets.

Investment in automation and infrastructure is a key economic response to these challenges. Major logistics players are channeling significant capital into improving efficiency and expanding capacity, reflecting confidence in the sector's long-term growth. The global logistics market, valued at approximately $9.3 trillion in 2023, is projected to reach $13.1 trillion by 2029. This drive for efficiency is crucial for mitigating rising operational costs and meeting evolving customer expectations.

Cross-border e-commerce is emerging as a significant growth area, offering new opportunities for The Delivery Group. While domestic e-commerce growth may be moderating, international trade volumes are increasing. Adapting to the complexities of global logistics, including customs and varying shipping times, is essential. For instance, UK businesses exporting in 2024 faced average customs delays of 3-5 days in key European markets, highlighting the need for specialized, efficient solutions.

| Economic Factor | 2024/2025 Outlook | Impact on The Delivery Group | Key Data Point | Strategic Implication |

| Inflation & Wages | Elevated, with continued upward pressure on labour costs | Increased operational expenses, potential margin squeeze | National Living Wage £11.44/hr (from Apr 2024) | Focus on retention, efficiency gains, automation |

| Fuel Prices | Volatile, with potential for sustained higher levels | Higher transportation costs, impact on pricing strategy | Brent Crude avg. $80-$90/barrel (mid-2024) | Route optimization, fleet efficiency, EV adoption |

| E-commerce Growth | Continued, though potentially moderating domestic growth | Sustained demand for delivery and fulfilment services | UK online sales substantial share by 2025 | Capacity expansion, service diversification |

| Cross-border Trade | Increasing importance for UK retailers | Opportunity for specialized international logistics services | Customs delays (3-5 days avg. for UK exports) | Develop expertise in customs, international compliance |

Preview Before You Purchase

The Delivery Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for The Delivery Group provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the business. You'll gain valuable insights into the external forces shaping the delivery industry and its strategic implications for The Delivery Group.

Sociological factors

UK consumers are becoming incredibly discerning about delivery, demanding speed, ease, and clarity whether they shop online or in-store. They expect a seamless experience, mirroring the convenience they find in other aspects of their digital lives.

The desire for instant gratification is shaping delivery preferences, with mobile shopping further accelerating this trend. This means logistics companies must offer more adaptable and quicker services to keep pace with evolving consumer habits.

Meeting these rising expectations is paramount for businesses aiming for customer loyalty. For instance, in 2024, studies indicated that over 60% of online shoppers consider delivery speed a key factor in their purchasing decisions, and a further 45% are willing to pay more for same-day delivery options.

Failure to adapt to these elevated demands can lead to lost sales and a damaged brand reputation. In a highly competitive market, a superior delivery experience is no longer a bonus; it's a fundamental requirement for customer retention and business success.

Consumers increasingly demand transparency from delivery services, prioritizing clear pricing and reliable delivery windows. For instance, a 2024 survey indicated that 78% of online shoppers consider accurate delivery estimates crucial for their purchasing decisions. This heightened expectation is partly driven by new consumer protection regulations enacted in late 2024, which mandate clearer communication regarding shipping costs and delivery timelines.

Building and maintaining consumer trust is paramount for delivery companies. This involves showcasing authentic customer reviews and implementing robust security measures to protect personal data. In 2025, industry reports show a direct correlation between high trust scores and customer retention, with companies exhibiting greater transparency experiencing a 15% lower churn rate compared to their less open counterparts.

The logistics workforce faces a significant demographic challenge, with a substantial portion of Heavy Goods Vehicle (HGV) drivers being 50 years or older. This age profile signals a potential future shortage as a growing number of experienced drivers approach retirement age.

While certain skills shortages within the logistics sector have shown signs of easing, attracting and retaining talent remains a persistent hurdle. To address this, the industry must focus on making logistics roles more appealing and establishing them as stable, attractive career paths.

For instance, in the UK, figures from early 2024 indicated that around 20% of HGV drivers were over 50, highlighting the impending retirement wave. Efforts to boost new driver recruitment saw some success, with the number of qualified drivers increasing, but the overall retention rate still lags behind the need for a consistent workforce.

Shifting Employee Priorities

The UK labour market is seeing a significant shift in what employees value. Flexibility, a better work-life balance, and clear salary information are becoming paramount. This is particularly relevant for the logistics sector, which often requires rigid schedules.

To attract and keep skilled workers, logistics companies need to acknowledge and respond to these changing priorities. Offering more flexible working options, where operationally possible, and ensuring pay is competitive are key strategies. For instance, reports from early 2024 indicated that over 60% of UK employees would consider leaving a job if it negatively impacted their work-life balance.

These evolving employee expectations directly influence how logistics firms recruit and structure their operations. Companies that fail to adapt may struggle with recruitment, leading to increased operational costs and potential service disruptions. Data from late 2023 showed a noticeable rise in job applications specifying a preference for remote or hybrid working models, even in sectors not traditionally associated with such arrangements.

- Increased Demand for Flexibility: A significant portion of the UK workforce now actively seeks flexible working arrangements, impacting recruitment in logistics.

- Work-Life Balance as a Priority: Employees are increasingly prioritizing personal well-being, pushing employers to re-evaluate traditional working hours and demands.

- Salary Transparency Expectations: A growing number of job seekers expect open communication about salary ranges early in the hiring process.

- Impact on Talent Acquisition: Logistics companies must adapt their employment packages and operational models to meet these shifting employee priorities and remain competitive in the talent market.

Growth in Logistics Sector Job Accessibility

The logistics and warehousing sector in the UK is experiencing a notable upswing in job accessibility, even as overall job vacancies have seen a decline. This growth is particularly evident in roles that offer competitive remuneration, signaling a positive shift in the sector's employment landscape.

A key driver behind this trend is the increase in the national living wage, which has elevated wages within logistics. This has helped to rebrand the sector, moving away from its historical perception of being low-paid. It's now increasingly viewed as a stable and attractive career option for a wider pool of job seekers.

For instance, in early 2024, the Office for National Statistics reported that while headline vacancy rates were softening, logistics roles continued to see demand. This is partly attributed to the sector's resilience and its essential function in the economy. The average salary in warehousing and logistics has also seen a steady increase, making it a more viable option for individuals seeking career progression.

- Increased Demand: Logistics and warehousing roles remain in high demand, contrasting with broader UK job market trends.

- Wage Growth: The sector is offering more competitive salaries, partly due to rises in the national living wage.

- Improved Perception: The industry is shedding its low-paid image, becoming a more appealing career path.

- Accessibility: This job growth makes the sector more accessible to a diverse range of individuals looking for stable employment.

Sociological factors significantly shape delivery expectations and workforce dynamics in the UK. Consumers increasingly demand speed, transparency, and flexibility, with over 60% of online shoppers in 2024 citing delivery speed as crucial. Simultaneously, the logistics workforce faces demographic shifts, with a notable percentage of HGV drivers over 50, presenting a future challenge for talent acquisition and retention.

Technological factors

The UK fulfilment sector is rapidly adopting AI and robotics, with an estimated 85% of warehouses expected to be automated by 2030. This surge is a direct response to persistent labour shortages and the ever-increasing demands of e-commerce. Companies are investing heavily as automation offers substantial cost savings and efficiency gains.

AI-driven systems are now the norm for core warehouse operations such as sorting, picking, and inventory tracking. This technological shift is not just about efficiency; it's about remaining competitive in a market that prioritizes speed and accuracy.

Major postal operators, like Royal Mail, have significantly upgraded their infrastructure by investing in advanced automated parcel hubs and high-speed sortation systems. For instance, Royal Mail's £400 million investment in automation, including new hubs in Daventry and Peterborough, has substantially increased its processing capacity, handling millions of parcels daily.

These technological advancements are crucial for boosting processing capacity and efficiency, allowing for faster handling of increasing parcel volumes. This directly supports the growing consumer demand for rapid delivery services, such as next-day delivery, which is a key component of modern logistics.

The Delivery Group, operating in high-volume mail and parcel distribution, directly benefits from these industry-wide technological leaps. Adapting to and integrating these advancements is essential for the company to maintain its competitive edge and effectively meet the evolving demands of the market.

Technological advancements are significantly boosting efficiency and customer satisfaction in the delivery sector. Enhanced digital tracking and the integration of the Internet of Things (IoT) are providing unprecedented visibility into the movement and condition of goods.

Royal Mail, a prime example, has deployed digital tracking tags on its containers. These tags offer real-time data, monitoring not only location but also critical environmental factors like humidity and temperature. This granular data allows for proactive management and ensures goods remain in optimal condition throughout transit.

Furthermore, Royal Mail has enhanced its customer-facing technology by updating its mobile app. Customers can now easily submit proof of postage requests directly through the app, streamlining a previously more cumbersome process. These digital improvements translate to greater transparency and tighter operational control for delivery services, directly benefiting end-users.

AI for Predictive Analytics and Optimization

Artificial intelligence is becoming a game-changer in logistics, particularly for predictive analytics and optimizing operations. Companies are using AI to forecast demand with greater accuracy, which in turn helps them manage inventory more efficiently. For instance, a report from McKinsey in early 2024 indicated that AI adoption in supply chain management could unlock $1.4 trillion to $2 trillion in value globally, with a significant portion driven by improved forecasting and optimization.

This predictive capability allows businesses to anticipate customer demand spikes, leading to reduced storage costs and more streamlined operations. By knowing what's coming, logistics providers can better allocate resources, minimize waste, and ensure products are available when and where they are needed. This proactive approach is crucial in today's fast-paced market.

Furthermore, AI is revolutionizing route optimization and tackling the complexities of last-mile delivery. AI algorithms can analyze real-time traffic data, weather conditions, and delivery schedules to map out the most efficient routes. This results in quicker deliveries, lower fuel consumption, and ultimately, more cost-effective operations for delivery companies.

Key impacts of AI in logistics include:

- Enhanced Demand Forecasting: AI models can predict demand fluctuations with up to 20% greater accuracy compared to traditional methods, as suggested by industry analyses in 2024.

- Optimized Inventory Management: Leading logistics firms are seeing a reduction in stockouts by 15-25% through AI-powered inventory control.

- Improved Route Efficiency: AI-driven route optimization has been shown to cut delivery times and mileage by 10-15%, leading to significant cost savings.

- Streamlined Last-Mile Deliveries: AI solutions are reducing delivery exceptions and improving on-time delivery rates, a critical factor for customer satisfaction.

Investment in Modern Fleet Technology

Logistics firms, including The Delivery Group, are significantly boosting their investments in cutting-edge fleet technology. This trend is driven by the need to optimize operations and maintain a competitive edge in the rapidly evolving distribution landscape. For instance, custom-designed trailers are becoming standard, incorporating reinforced structures for greater durability and advanced visual aids for enhanced safety and efficiency.

These technological upgrades are not just about capacity; they’re fundamentally about reliability and security. Electronically controlled safety locks are being integrated to protect high-value cargo and ensure compliance with stringent regulations. Such advancements are crucial for both regional deliveries and extensive nationwide distribution networks, directly impacting the bottom line through reduced damage and improved delivery times.

The financial commitment to fleet modernization is substantial. Reports from late 2024 indicate that major logistics players are allocating upwards of 15-20% of their capital expenditure towards fleet upgrades and technology integration. This focus on advanced features, like improved aerodynamic designs and lighter materials, also contributes to fuel efficiency, a critical factor given fluctuating energy prices.

- Fleet Modernization Investment: Logistics companies are increasing capital expenditure on fleet technology by 15-20% in 2024-2025.

- Trailer Enhancements: Custom trailers now feature reinforced structures, advanced visual aids, and electronic safety locks.

- Operational Benefits: These technologies aim to maximize capacity, improve durability, and ensure operational reliability.

- Efficiency Gains: Focus on fuel efficiency through aerodynamic designs and lighter materials is a key driver for investment.

Technological advancements are reshaping the delivery sector, with AI and robotics driving significant efficiency gains. By 2025, the UK fulfillment sector is expected to see widespread automation, with 85% of warehouses potentially automated by 2030, a trend accelerated by e-commerce growth and labor shortages.

AI's role in logistics extends to predictive analytics, enhancing demand forecasting accuracy by up to 20% as of early 2024. This precision helps optimize inventory, reducing stockouts by an estimated 15-25% for leading firms.

Furthermore, AI is critical for optimizing delivery routes, cutting transit times and mileage by 10-15%. This focus on efficiency is also reflected in fleet modernization, with companies investing 15-20% more in advanced trailer technology and fuel-efficient designs in 2024-2025.

| Technology Area | Key Advancement | Impact on Delivery Sector | 2024-2025 Data Point |

|---|---|---|---|

| Automation | Robotics and AI in Warehousing | Increased efficiency, reduced labor costs | 85% of UK warehouses projected for automation by 2030 |

| AI & Analytics | Predictive Demand Forecasting | Optimized inventory, reduced stockouts | Up to 20% improvement in forecasting accuracy |

| Route Optimization | AI-driven route planning | Reduced delivery times and mileage | 10-15% reduction in delivery times/mileage |

| Fleet Technology | Modernized trailers, fuel efficiency | Enhanced durability, safety, and operational cost savings | 15-20% increase in capital expenditure on fleet upgrades |

Legal factors

The Digital Markets, Competition and Consumers Act 2024 (DMCCA), effective April 2025, introduces stringent consumer protection measures in the UK. This legislation targets deceptive practices such as drip pricing and fake reviews, imposing significant penalties.

The Competition and Markets Authority (CMA) now possesses direct enforcement authority, capable of levying fines up to 10% of a company's global annual turnover. For The Delivery Group, this necessitates a thorough review of its operations and those of its clients to ensure full compliance with these enhanced regulations. Failure to comply could result in substantial financial penalties, impacting profitability and market reputation.

Ofcom has significantly reformed the Universal Service Obligation (USO) for Royal Mail, with key changes taking effect in July 2025. These reforms permit a reduction in the delivery frequency of Second Class letters, shifting away from the previous daily delivery requirement. This regulatory adjustment is set to reshape the competitive environment for downstream access (DSA) postal services.

The Delivery Group must now navigate a new operational reality shaped by these USO reforms. Adapting to potentially altered service standards and evolving network dynamics will be crucial for maintaining efficiency and competitiveness. Such changes could influence The Delivery Group's cost structures and strategic network planning, particularly for mail distribution operations.

The UK's labour market continues to see legislative shifts that directly affect businesses like The Delivery Group. For instance, the National Living Wage is scheduled to increase to £11.44 per hour for those aged 21 and over from April 2024, a significant rise that will impact payroll expenses. Adjustments to National Insurance contributions also play a role in overall employment costs, necessitating careful budgeting.

The Delivery Group must navigate these evolving employment laws to maintain compliance. This includes staying abreast of changes related to working hours, holiday pay, and dismissal procedures. Failing to adapt can lead to penalties and reputational damage, especially in a sector already grappling with labour shortages.

Managing the financial implications of these changes is crucial. With the sector facing persistent difficulties in attracting and retaining staff, increased wage costs can exacerbate operational pressures. The Delivery Group needs robust financial planning to absorb these rising personnel expenses while remaining competitive.

Data Privacy and Security Regulations

The Delivery Group must maintain unwavering compliance with data privacy and security regulations like the General Data Protection Regulation (GDPR) in 2024-2025. This is particularly crucial as the company handles sensitive customer information within its e-commerce fulfillment operations. Failing to do so can lead to significant fines, with GDPR penalties reaching up to 4% of annual global turnover or €20 million, whichever is higher.

The evolving consumer protection landscape, emphasizing transparency, further amplifies the need for The Delivery Group to demonstrate robust data handling and security protocols. This includes clear communication about data usage and strong safeguards against breaches. For instance, a 2024 report indicated that data breaches cost the average company $4.45 million globally, a figure The Delivery Group must actively mitigate.

- GDPR Compliance: Continued adherence to GDPR, requiring explicit consent and secure data storage for customer information.

- Consumer Protection Transparency: Aligning data practices with new consumer protection regimes that demand greater openness in data handling.

- Cybersecurity Investment: Ongoing investment in advanced cybersecurity measures to prevent data breaches and protect sensitive information.

- Data Breach Costs: Awareness of the substantial financial and reputational impact of data breaches, estimated at millions of dollars annually.

Brexit-related Customs and Border Compliance

The ongoing implementation of Brexit-related import controls and customs declarations creates a complex legal environment for logistics firms like The Delivery Group. New requirements for health certifications and entry summary declarations for EU imports, phased in throughout 2024, demand meticulous compliance to prevent costly delays and penalties. Failure to adhere to these evolving border regulations can significantly impact international service efficiency and profitability.

For instance, the introduction of the Import Control System (ICS2) for goods entering the EU from July 2024 requires detailed safety and security data to be submitted before arrival. This adds a layer of legal and administrative burden. The Delivery Group must invest in robust systems and training to ensure accurate and timely submissions, directly affecting their operational costs and customer satisfaction metrics.

- Phased Implementation: EU import controls, including health certifications, are being rolled out progressively through 2024, requiring continuous adaptation.

- Customs Declarations: Increased complexity in customs procedures for goods moving between the UK and EU necessitates precise legal and administrative handling.

- Health Certification: New rules mandate specific health certifications for certain EU imports, adding a significant compliance hurdle for logistics providers.

- ICS2 Compliance: The EU's Import Control System (ICS2) requires advanced data submission, impacting international freight movements from mid-2024 onwards.

The UK's Digital Markets, Competition and Consumers Act 2024 (DMCCA), effective April 2025, introduces significant consumer protection measures, including penalties of up to 10% of global annual turnover for non-compliance, impacting The Delivery Group and its clients.

Ofcom's reforms to the Universal Service Obligation (USO) for Royal Mail, effective July 2025, allow for reduced delivery frequency of Second Class letters, potentially reshaping the competitive landscape for downstream access (DSA) postal services and influencing The Delivery Group's network strategies.

The National Living Wage increase to £11.44 per hour from April 2024 directly affects payroll expenses for The Delivery Group, necessitating careful financial planning to manage rising personnel costs in a challenging labour market.

Environmental factors

The UK logistics sector, including prominent companies like Royal Mail, is demonstrating a strong commitment to Net-Zero targets. Royal Mail, for instance, has set a goal to achieve Net-Zero by 2040, supported by interim objectives for 2030. This reflects a broader industry-wide push for decarbonization.

This escalating focus on sustainability places significant pressure on delivery companies to actively reduce their carbon emissions. Operational models are increasingly being re-evaluated to incorporate greener practices and technologies. The Delivery Group must therefore ensure its strategies are in sync with these overarching industry sustainability objectives.

The logistics industry is rapidly shifting towards electrification and alternative fuels. By the end of 2023, the UK saw over 1 million electric vehicles registered, with a growing portion of these in commercial fleets. Companies like Royal Mail are leading the charge, operating the UK's largest electric van fleet, demonstrating a clear industry direction.

Biofuels, such as Hydrotreated Vegetable Oil (HVO), are also gaining traction as a way to decarbonize existing diesel fleets. Royal Mail has significantly increased its use of biofuels, highlighting their role in immediate emissions reduction. For The Delivery Group, embracing these green technologies is becoming crucial to meet evolving sustainability expectations and regulatory pressures.

Investing in electric vehicles and biofuels aligns with broader environmental goals and can lead to long-term cost savings through reduced fuel expenses and potential tax incentives. As of early 2025, the total cost of ownership for EVs in fleet operations is increasingly competitive with traditional internal combustion engine vehicles, especially considering the rising price of fossil fuels.

Logistics firms like The Delivery Group are increasingly focused on cutting Scope 3 emissions. This involves smarter route planning and swapping high-emission transport, like domestic air freight, for more eco-friendly options such as road and ferry services. For instance, the European transport sector, responsible for a significant portion of global emissions, is seeing a push towards rail and maritime for freight, aiming to shift millions of tons of CO2 annually.

The Delivery Group's commitment to operational efficiency directly supports this broader supply chain decarbonization effort. By streamlining distribution networks, they reduce the overall carbon footprint associated with moving goods. In 2024, many logistics companies reported investments in electric vehicles and alternative fuels, with some targeting a 20% reduction in Scope 3 emissions by 2030.

Waste Reduction and Circular Economy Initiatives

The logistics sector is increasingly prioritizing waste reduction and embracing circular economy models. This involves actively minimizing waste produced throughout operations and aiming for significant diversion from landfills. For example, in 2024, many leading logistics firms reported diverting over 75% of their operational waste from landfill through enhanced recycling and composting programs.

Supporting customer-driven circularity is a growing imperative. This includes developing efficient systems for product returns, facilitating their refurbishment for resale, or managing their recycling. Companies are investing in reverse logistics capabilities to handle these processes effectively, recognizing them as key components of environmental stewardship and customer loyalty.

Key initiatives in this area include:

- Optimizing packaging: Reducing the amount of material used and opting for recyclable or biodegradable options.

- Reverse logistics: Streamlining the process of collecting and processing returned goods for reuse or recycling.

- Waste-to-energy programs: Partnering with facilities to convert non-recyclable waste into energy.

- Product lifecycle management: Working with clients to design products and supply chains that minimize waste from inception to end-of-life.

Consumer Demand for Sustainable Deliveries

Consumers are increasingly prioritizing environmentally friendly delivery methods, pushing businesses towards greener operational strategies. A significant portion of consumers, for instance, report being willing to wait longer for deliveries if it means a reduced carbon footprint, a trend observed in various market surveys throughout 2024 and projected to intensify into 2025.

Companies that can effectively showcase reduced carbon emissions per package and offer tangible green delivery alternatives are poised to capture a competitive edge. For example, studies in late 2024 highlighted a 15% higher customer loyalty for brands demonstrating clear sustainability commitments in their logistics.

The Delivery Group's capacity to deliver environmentally conscious solutions will become a critical factor in securing and maintaining client relationships. By 2025, it’s anticipated that over 60% of B2B procurement decisions will incorporate sustainability metrics, directly impacting logistics providers.

- Growing consumer willingness to choose eco-friendly delivery options is a significant market driver.

- Businesses demonstrating lower carbon emissions per parcel gain a competitive advantage.

- The Delivery Group's sustainability offerings are crucial for client acquisition and retention.

- Market data from 2024 indicates a strong consumer preference for greener logistics solutions.

Environmental factors are increasingly shaping the logistics landscape, pushing companies like The Delivery Group towards sustainable practices. Consumer demand for eco-friendly options is a major driver, with studies in 2024 showing a significant willingness to wait longer for deliveries with a lower carbon footprint. This trend is expected to intensify into 2025, making a company's environmental performance a key differentiator.

The industry's shift towards electrification and biofuels is accelerating, with a notable increase in electric vehicle registrations in the UK, many of which are in commercial fleets. Companies are also focusing on reducing Scope 3 emissions through smarter routing and opting for lower-emission transport modes. By 2025, over 60% of B2B procurement decisions are anticipated to include sustainability metrics, directly impacting logistics providers.

Waste reduction and circular economy principles are also becoming paramount. Many logistics firms reported diverting over 75% of their operational waste from landfill in 2024. Initiatives like optimizing packaging, improving reverse logistics, and managing product lifecycles are crucial for meeting environmental goals and maintaining client relationships.

| Metric | 2024 Data/Trend | 2025 Outlook |

|---|---|---|

| Consumer Preference for Green Delivery | Significant willingness to wait for eco-friendly options | Expected intensification of preference |

| EVs in UK Commercial Fleets | Growing portion of over 1 million registered EVs | Continued strong growth |

| B2B Procurement Sustainability Metrics | Increasingly considered | Over 60% of decisions expected to include |

| Waste Diversion from Landfill | Over 75% reported by leading firms in 2024 | Continued focus on improvement |

PESTLE Analysis Data Sources

Our PESTLE Analysis for The Delivery Group is built on a robust foundation of data, drawing from official government publications, reputable industry analysis firms, and widely recognized economic indicators. This comprehensive approach ensures that every aspect, from regulatory changes to market trends, is informed by current and credible information.