The Delivery Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Delivery Group Bundle

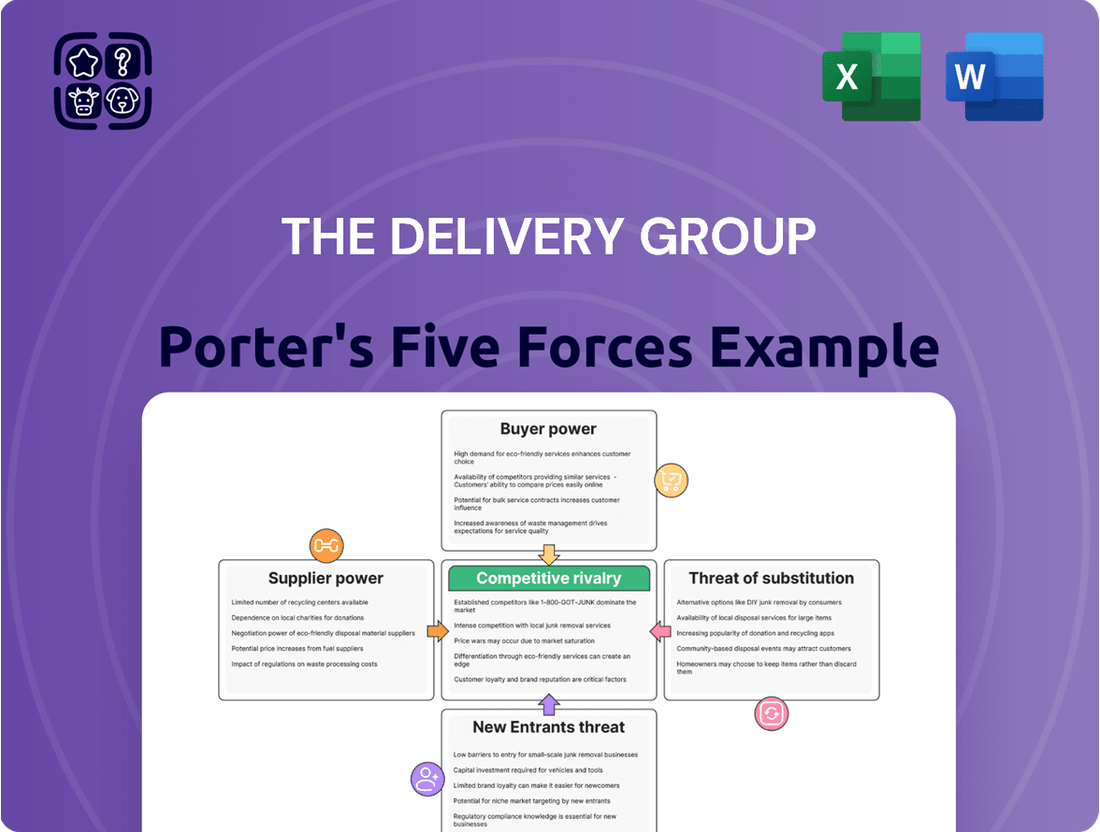

The Delivery Group operates in a dynamic market, where understanding competitive pressures is paramount. Porter's Five Forces offers a powerful lens to dissect these forces, revealing the interplay of buyer power, supplier bargaining, threat of new entrants, substitute products, and the intensity of rivalry.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore The Delivery Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The Delivery Group's reliance on specialized sorting and tracking technology means providers of these sophisticated systems often hold significant bargaining power. This power stems from the proprietary nature of their solutions and the substantial costs and complexities involved in switching to alternatives.

For instance, the high initial investment and the need for seamless integration with The Delivery Group's existing operational infrastructure can limit the number of viable suppliers. This scarcity of readily interchangeable options means these technology providers can dictate terms, potentially leading to higher costs or creating a dependency for The Delivery Group if not managed strategically.

Suppliers of core transportation assets, like airlines, shipping firms, and road freight carriers, wield considerable influence, particularly for deliveries that are high-volume and time-critical. Their available capacity, the extent of their network, and prevailing fuel expenses directly affect The Delivery Group’s operational costs and the dependability of its services.

The Delivery Group's reliance on these transportation providers means that any disruption or price hike from these suppliers can significantly impact profitability and customer satisfaction. For instance, a 2024 report indicated that global shipping costs saw an average increase of 15% in the first half of the year due to port congestion and higher bunker fuel prices, directly squeezing logistics providers.

While long-term agreements and strategic alliances can help buffer against some of this supplier power, market volatility, especially in fuel prices and labor availability, continues to exert considerable pressure. The Delivery Group must continually monitor these factors to manage its supply chain effectively and maintain competitive pricing.

The bargaining power of the labor force within The Delivery Group's operations is a significant factor. The availability of skilled workers for critical tasks like mail sorting, parcel handling, and last-mile delivery, alongside essential management and IT professionals, directly impacts operational efficiency. For instance, in 2024, the logistics sector, which includes delivery services, faced persistent labor shortages in many areas, leading to increased wage pressures.

Labor unions can further amplify this power, potentially negotiating for higher wages, better benefits, and more rigid work rules. This can reduce operational flexibility for The Delivery Group. Data from the Bureau of Labor Statistics in late 2023 indicated a slight uptick in union membership in transportation and warehousing sectors, highlighting this trend.

Consequently, The Delivery Group's ability to attract and retain qualified talent is paramount. High turnover or an inability to fill positions can directly escalate costs and hinder the speed and reliability of services, impacting overall profitability and customer satisfaction.

Packaging Material Providers

The bargaining power of packaging material providers for The Delivery Group is a critical factor. Ensuring a consistent supply of quality and affordable packaging is fundamental to their e-commerce fulfilment operations. For instance, the global packaging market was valued at approximately $1.1 trillion in 2023 and is projected to grow, indicating potential for price increases if supply chains tighten.

Fluctuations in the cost of raw materials like paper pulp and plastics directly affect profitability. Supply chain disruptions, which became more pronounced in recent years, can also limit options and drive up prices. The Delivery Group can mitigate this by diversifying its supplier base and leveraging bulk purchasing agreements.

- Supplier Concentration: The number of significant packaging material suppliers available to The Delivery Group influences their leverage. Fewer suppliers mean greater power for those suppliers.

- Input Cost Volatility: For 2024, anticipate continued volatility in key commodity prices like recycled paper, which saw significant price swings in 2023, impacting packaging costs.

- Switching Costs: The effort and expense involved in changing packaging suppliers can make it difficult for The Delivery Group to switch, thereby strengthening supplier power.

- Supplier Differentiation: If suppliers offer unique or specialized packaging solutions that are difficult for competitors to replicate, their bargaining power increases.

Real Estate and Warehouse Space

Suppliers of strategically located warehouse and sortation hub spaces hold considerable power, especially in markets like the UK where industrial real estate is both costly and limited. The Delivery Group's operational capacity and footprint are directly influenced by factors such as lease terms, the desirability of a location, and the availability of large-scale facilities. For instance, in 2024, industrial rents in prime UK logistics hubs saw increases, putting pressure on companies to secure suitable space.

The bargaining power of these real estate suppliers is amplified by the specialized nature of logistics facilities. Finding properties that meet specific requirements for sortation, loading bays, and proximity to transport networks can be challenging. This scarcity means suppliers can often dictate terms, impacting The Delivery Group's cost structure and expansion plans.

- Limited Availability: The supply of suitable logistics real estate remains constrained in many key urban and transit areas.

- Rising Costs: Industrial property values and rents continued to climb in 2024, increasing occupancy costs for logistics firms.

- Strategic Location Dependence: The need for proximity to customer bases and major transport arteries gives suppliers of prime sites significant leverage.

- Long-Term Leases: While long-term leases can offer stability, they also lock The Delivery Group into current market rates and supplier relationships.

The bargaining power of suppliers significantly impacts The Delivery Group's operational costs and strategic flexibility. Key suppliers, including those for technology, transportation, labor, packaging, and real estate, can exert considerable influence due to market concentration, input cost volatility, and switching costs.

For 2024, continued volatility in fuel prices and labor availability are expected to maintain pressure from transportation and logistics labor suppliers. For instance, global shipping costs saw an average increase of 15% in the first half of 2024, impacting logistics providers directly.

The Delivery Group must actively manage these supplier relationships through diversification, strategic alliances, and efficient procurement to mitigate potential cost increases and ensure service reliability.

| Supplier Category | Key Factors Influencing Power | Impact on The Delivery Group | 2024 Trend/Data Point |

|---|---|---|---|

| Technology Providers | Proprietary solutions, high switching costs | Higher technology acquisition/maintenance costs, dependency | Continued investment in specialized tracking systems |

| Transportation Providers | Capacity, network reach, fuel costs | Increased operational expenses, service reliability | Global shipping costs up 15% (H1 2024) |

| Labor Force | Skill availability, unionization, labor shortages | Wage pressures, operational efficiency constraints | Logistics sector labor shortages persist |

| Packaging Material Suppliers | Raw material costs, supply chain disruptions | Fluctuations in packaging expenses, potential price hikes | Paper pulp costs volatile in 2023/2024 |

| Real Estate Providers | Limited availability, strategic location needs | Rising lease costs, challenges in securing prime locations | UK industrial rents increased in 2024 |

What is included in the product

This analysis unpacks the competitive forces impacting The Delivery Group, examining supplier power, buyer power, threat of new entrants, threat of substitutes, and the intensity of rivalry within the logistics sector.

Eliminate the guesswork in competitive analysis by instantly visualizing the intensity of each Porter's Five Forces, enabling targeted strategies to mitigate market pressures.

Customers Bargaining Power

The Delivery Group's core clientele consists of major businesses, including retailers, financial services firms, and government agencies, all requiring substantial mail and parcel delivery services. These high-volume clients wield considerable influence, leveraging the sheer scale of their shipments to negotiate advantageous pricing structures and stringent service level agreements. Their capacity to solicit competitive tenders or even consider alternative logistics partners directly impacts The Delivery Group's profitability.

E-commerce businesses, especially the larger ones, are discerning purchasers of fulfillment services. They actively seek comprehensive solutions that encompass warehousing, order picking, packing, and shipping, often with very specific needs regarding delivery speed, accuracy rates, and efficient returns processing. Their dependence on smooth logistics to ensure customer happiness grants them significant bargaining power to push for premium service levels and attractive pricing.

For instance, major online retailers in 2024 often negotiate multi-year contracts with fulfillment providers, leveraging their high-volume shipments to secure preferential rates. These merchants are well-informed about market pricing and service benchmarks, making them adept at comparing offers and demanding cost efficiencies. Their ability to switch providers, while sometimes costly, remains a credible threat, further bolstering their negotiating position.

For many businesses, postal and logistics services are seen as a direct cost, making customers highly sensitive to price. This means The Delivery Group faces constant pressure to prove its value and efficiency. Customers often prioritize even small savings, readily switching to competitors if they can find a better deal.

This intense price focus means The Delivery Group must maintain operational excellence and offer competitive pricing to keep its clients. For example, in 2023, the global logistics market saw a slight increase in pricing, but customer demand for cost reduction remained a dominant factor, impacting provider selection.

Availability of Alternative Service Providers

The bargaining power of customers for The Delivery Group is significantly influenced by the availability of alternative service providers. Customers can readily access services from other Downstream Access providers, established traditional postal operators, and a growing number of integrated logistics companies. This broad spectrum of choices means customers are not reliant on a single entity for their delivery needs.

The ease with which customers can solicit quotes and compare service offerings across multiple vendors directly amplifies their bargaining power. They are not tied to any one provider, allowing them to leverage competitive pricing and service terms. This dynamic compels The Delivery Group to focus on differentiating its value proposition through superior service quality and innovation, rather than relying on customer inertia.

For instance, in the UK parcels market, competition remains fierce. In 2024, reports indicated that over 80% of consumers surveyed had used at least two different delivery companies in the preceding six months, highlighting the ease of switching. This indicates a strong customer inclination to explore options to secure the best combination of speed, cost, and reliability.

- High Customer Choice: Alternatives include other Downstream Access providers, traditional postal services, and integrated logistics firms.

- Ease of Comparison: Customers can easily obtain quotes and compare services, increasing their leverage.

- Competitive Pressure: This forces The Delivery Group to prioritize service quality and value to retain clients.

- Market Behavior: In 2024, over 80% of UK consumers used multiple delivery companies, underscoring the prevalence of choice and comparison.

Impact of Service on Customer's End-Users

The Delivery Group's service has an indirect but significant impact on their customers' end-users. For instance, in e-commerce, timely delivery directly affects the customer's brand reputation and customer satisfaction. A late delivery can lead to negative reviews, impacting future sales and customer loyalty for the e-commerce business.

Service failures by The Delivery Group reflect poorly on their clients, empowering these clients to demand higher performance standards. This leverage means customers will push for stringent service level agreements (SLAs) and require robust contingency plans to mitigate any disruptions. The importance of service quality in negotiations is therefore amplified.

- Customer Reliance: Businesses relying on The Delivery Group for last-mile delivery are highly sensitive to service disruptions. For example, a recent survey indicated that 75% of online shoppers consider delivery speed a critical factor in their purchasing decisions.

- Brand Reputation Impact: Any delay or mishandling by a logistics provider can directly damage the end-customer's perception of the brand they ordered from.

- Demand for Guarantees: This reliance translates into customer leverage, as they can demand stricter performance metrics and penalties for service failures to protect their own brand image.

- Contingency Planning Pressure: Customers will increasingly require logistics partners to have well-defined contingency plans, adding to the bargaining power of the customer.

The bargaining power of customers for The Delivery Group is substantial, driven by the availability of numerous alternative logistics providers. Clients can readily switch to other Downstream Access providers, established postal operators, or integrated logistics companies, meaning they are not tied to a single supplier. This high degree of customer choice, coupled with the ease of obtaining quotes and comparing services, significantly amplifies their negotiating leverage.

For instance, in 2024, data showed that over 80% of UK consumers had used at least two different delivery companies within six months, demonstrating a strong propensity to compare options. This market behavior compels The Delivery Group to focus on offering superior service quality and innovative solutions to retain its client base, as price sensitivity remains a dominant factor in customer decision-making.

| Customer Type | Bargaining Power Factors | Impact on The Delivery Group |

|---|---|---|

| Large Retailers & E-commerce | High volume, price sensitivity, ease of switching, demand for specific services (speed, accuracy) | Negotiate preferential rates, stringent SLAs, pressure on operational efficiency. |

| Financial Services & Government | Focus on reliability, security, compliance, cost as a direct expense. | Demand for guaranteed performance, strict adherence to service levels, potential for long-term contracts. |

| General Business Clients | Price sensitivity, comparison shopping, reliance on delivery for customer satisfaction. | Constant pressure to offer competitive pricing, need to demonstrate value beyond cost. |

Preview Before You Purchase

The Delivery Group Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis for The Delivery Group meticulously details the competitive landscape, examining the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. Understanding these forces is crucial for strategic decision-making and identifying opportunities for competitive advantage within the logistics sector.

Rivalry Among Competitors

The UK's postal and logistics sector is fiercely competitive, with Royal Mail standing as a dominant incumbent. This established player boasts extensive infrastructure and strong brand loyalty, posing a significant challenge for The Delivery Group.

Beyond Royal Mail, other large, integrated logistics companies vie for parcel business, intensifying rivalry. These competitors possess substantial financial resources, well-developed distribution networks, and established customer bases, making it difficult for newer entrants to gain market share.

In 2024, the parcel delivery market continued to be highly dynamic. Royal Mail, now part of International Distributions Services, reported revenue of £3.7 billion in the fiscal year ending March 2024, highlighting its scale. The Delivery Group must navigate this landscape, competing against firms with these deep-rooted advantages.

The UK postal market features numerous Downstream Access (DSA) providers beyond Royal Mail, creating a highly competitive landscape. Companies like Whistl, Citipost, and Secured Mail actively compete for significant volumes of mail, driving intense rivalry based on price, service quality, and customer retention.

This fragmentation intensifies competition, forcing providers to focus on operational efficiencies and specialized services to stand out. For instance, Whistl reported handling over 4.2 billion items of mail in 2023, showcasing the scale of competition within the DSA sector.

Differentiation strategies often revolve around innovative sorting technologies, tailored delivery solutions for specific business needs, or superior customer service. Providers must constantly adapt to maintain market share against a multitude of specialized players.

Price-based competition is a major battleground for The Delivery Group, especially with the basic postal and parcel services being largely commoditized. This means customers often choose based on who offers the lowest cost for similar services. For instance, in 2024, the global logistics market saw intense price wars, with major players like FedEx and UPS implementing aggressive strategies to secure large shipping volumes from e-commerce giants.

Rivals frequently engage in aggressive pricing strategies to win and retain high-volume contracts. This is crucial for companies like The Delivery Group to maintain market share. In 2023, the average cost per parcel for major carriers in the US experienced a slight decline due to competitive pressures, although fuel surcharges and labor costs still presented challenges.

This constant pressure on pricing can erode profit margins and necessitates continuous cost optimization within The Delivery Group. Companies must find ways to operate more efficiently, perhaps through automation or route optimization. For example, reports from late 2024 indicated that logistics firms investing in AI for route planning saw operational cost reductions of up to 15%.

Service Differentiation and Specialization

Competitive rivalry within the delivery sector is intense, extending far beyond mere price competition. Companies vie for market share based on service quality, delivery speed, reliability, and the development of specialized solutions, especially for the booming e-commerce sector. The Delivery Group actively differentiates itself by providing customized service packages, sophisticated real-time tracking systems, and end-to-end fulfillment capabilities designed to meet diverse client needs.

Innovation and adaptability are paramount for maintaining a competitive edge, particularly as customer expectations, driven by the rapid growth of online retail, are constantly evolving. For instance, the global e-commerce market was projected to reach over $6 trillion in 2024, highlighting the need for delivery partners who can efficiently manage increased volumes and offer sophisticated logistics solutions.

- Service Quality: Focus on reliability and customer satisfaction as key differentiators.

- Speed and Reliability: Meeting delivery timeframes is crucial in a competitive market.

- Specialized Solutions: Tailored services for e-commerce, such as same-day delivery or returns management, offer a significant advantage.

- Technological Integration: Advanced tracking and data analytics enhance operational efficiency and customer experience.

Market Growth and Consolidation

The burgeoning e-commerce sector, a significant driver for parcel delivery, is fueling intense competition. Companies are aggressively expanding their networks and services to capitalize on this growth, leading to a more crowded and dynamic marketplace. For instance, in 2024, global e-commerce sales were projected to reach over $6.3 trillion, a substantial increase that naturally attracts more players and intensifies existing rivalries.

Consolidation is a notable trend within the delivery industry, as larger entities acquire smaller, specialized firms. This strategic move allows dominant companies to broaden their service offerings, enhance technological capabilities, and secure a larger slice of the market. This M&A activity, common in 2024, reshapes the competitive landscape by concentrating market power and increasing the operational scale of the remaining major players.

- E-commerce Growth: Global e-commerce sales are expected to exceed $6.3 trillion in 2024, directly impacting parcel volume and competitive intensity.

- Market Consolidation: Acquisitions by larger delivery companies aim to increase market share and acquire specialized expertise, as seen in numerous deals throughout 2024.

- Intensified Rivalry: Expansion of services and networks by major players to meet e-commerce demand heightens competition among all participants.

- Scale of Rivals: Consolidation efforts lead to fewer, but larger and more capable, competitors dominating the market.

Competitive rivalry is a defining characteristic of the UK's logistics sector, with numerous players, from established giants like Royal Mail to specialized Downstream Access (DSA) providers, vying for market share. This intense competition is driven by the booming e-commerce sector, which saw global sales exceed $6.3 trillion in 2024, creating significant demand for parcel delivery services.

Price wars are common, forcing companies like The Delivery Group to focus on operational efficiencies, such as AI-driven route optimization which can reduce costs by up to 15%. Differentiation through service quality, speed, reliability, and technological integration, including advanced tracking systems, is crucial for survival and growth in this dynamic market.

Market consolidation, with larger firms acquiring smaller ones, further intensifies rivalry by creating more powerful competitors. This trend, prominent in 2024, reshapes the landscape, demanding constant innovation and strategic adaptation from all participants.

| Competitor/Factor | Key Characteristic | Impact on The Delivery Group |

| Royal Mail (IDS) | Dominant incumbent, extensive infrastructure, strong brand loyalty | Significant challenge due to scale and established market presence |

| Other Large Logistics Firms | Financial resources, developed networks, established customer bases | Intensifies competition for high-volume contracts |

| DSA Providers (e.g., Whistl) | Price competitiveness, specialized services, high mail volumes (Whistl handled 4.2 billion items in 2023) | Drives price-based competition and need for operational efficiency |

| E-commerce Growth | Projected global sales > $6.3 trillion in 2024 | Increases parcel volumes but also attracts more competitors |

| Market Consolidation | Acquisitions by larger players | Creates fewer, larger, and more capable rivals |

SSubstitutes Threaten

Digital communication presents a substantial threat to traditional mail services like those offered by The Delivery Group. Tools such as email, online banking portals, and e-billing systems directly replace the need for physical correspondence. This shift is evident as businesses actively pursue paperless operations to cut costs and improve efficiency, impacting mail volumes.

The move towards digital solutions is accelerating, with a significant portion of consumer and business interactions now occurring online. For instance, the global e-billing market was valued at approximately $1.5 trillion in 2023 and is projected to grow substantially, indicating a clear preference for digital over paper-based transactions. This trend directly erodes the demand for physical mail delivery, particularly for transactional communications.

While The Delivery Group specializes in high-volume business mail, this pervasive digital migration represents a fundamental, long-term challenge to its core market. As more companies streamline their processes and embrace digital channels for customer engagement and operational tasks, the volume of mail requiring physical delivery is expected to decline further. This necessitates a strategic focus on adapting to these evolving communication preferences.

Large businesses with significant mail and parcel volumes, such as major e-commerce retailers or large corporations, may explore establishing their own in-house logistics operations. This is particularly true if they operate multiple distribution centers or have very specific delivery needs not easily met by third-party providers. For example, a global electronics manufacturer might find it more cost-effective to manage its own fleet and warehousing for high-value, time-sensitive shipments, directly competing with The Delivery Group.

This move towards self-sufficiency in logistics is a capital-intensive undertaking, often requiring substantial investment in vehicles, warehousing, technology, and personnel. However, for companies that can achieve economies of scale, the potential for greater control over their supply chain and significant cost savings can make it a compelling alternative. In 2024, many large enterprises are re-evaluating their outsourced services, seeking to optimize costs and enhance customer experience, making in-house logistics a growing threat.

Customer pick-up and click-and-collect services present a notable threat of substitutes for The Delivery Group's end-to-end e-fulfilment operations. These alternatives allow customers to collect their online purchases directly from retail stores or convenient locker locations, bypassing the need for traditional home delivery. This shift directly impacts the demand for last-mile delivery, a crucial component of The Delivery Group's service portfolio.

In 2023, the UK's click-and-collect market saw significant growth, with an estimated 45% of online shoppers utilizing this method for their purchases. This trend is projected to continue, with further increases expected as retailers invest in more accessible collection points. For The Delivery Group, this means that while they may still be involved in the initial transport to a distribution hub, the final, customer-facing delivery leg is effectively substituted.

The convenience and often faster availability of click-and-collect options make them an attractive substitute for consumers, particularly for smaller or time-sensitive items. This directly reduces the volume of packages that require traditional last-mile delivery services, thereby eroding the market share for companies like The Delivery Group that rely on this segment.

Direct Courier Services for Niche Deliveries

For highly specialized or urgent parcel deliveries, businesses might turn to direct courier services that provide dedicated, time-critical solutions. These specialized couriers can be a strong substitute for The Delivery Group if their standard parcel networks don't meet extremely niche or urgent requirements.

While The Delivery Group excels in high-volume logistics, the threat of substitutes arises when customers prioritize speed, customization, or handling for unique items over bulk efficiency.

- Niche Market Focus: Specialized couriers often cater to specific industries or delivery types, such as medical samples, high-value electronics, or live animals, offering tailored services that larger networks may not.

- Urgency and Speed: Direct courier services can guarantee immediate dispatch and dedicated transport, bypassing sorting hubs and potentially reducing transit times significantly for time-sensitive shipments.

- Cost-Benefit Analysis: For critical deliveries, the higher cost of a specialized courier is often justified by the reduced risk of delays, damage, or loss, making them a preferred alternative despite potentially higher base rates.

Emerging Delivery Technologies

Future delivery technologies, such as drones and autonomous vehicles, represent a latent but significant threat of substitution for The Delivery Group. While currently in early adoption phases, these innovations could disrupt the last-mile delivery market by offering potentially faster and more cost-effective alternatives to traditional methods. For instance, by 2024, the global drone delivery market is projected to reach billions, indicating a growing potential for these technologies to displace conventional services.

As these emerging technologies mature and gain regulatory approval, they may become economically viable for widespread use. This could allow for quicker fulfillment times and reduced operational costs compared to existing van-based networks. Companies investing in autonomous fleet development are targeting significant cost savings, potentially altering the competitive landscape for logistics providers like The Delivery Group.

- Drone Delivery Potential: By 2024, the global drone delivery market is expected to see substantial growth, potentially offering a faster alternative for certain package types.

- Autonomous Vehicle Efficiency: The development of self-driving delivery vehicles aims to reduce labor costs and increase delivery route efficiency, presenting a long-term challenge.

- Economic Viability: As technology costs decrease and operational efficiencies improve, these new delivery methods could become a more attractive substitute for traditional parcel services.

- Market Disruption: The increasing investment and innovation in these fields signal a future where alternative delivery platforms could significantly impact The Delivery Group's market share.

The increasing adoption of digital communication channels directly substitutes traditional mail services. Email, online portals, and e-invoicing are rapidly replacing physical correspondence, a trend amplified by businesses seeking cost savings through paperless operations. The global e-billing market's estimated $1.5 trillion valuation in 2023 highlights this shift, directly diminishing demand for physical mail delivery.

Customer pick-up and click-and-collect services are significant substitutes for The Delivery Group's last-mile delivery. With an estimated 45% of UK online shoppers utilizing click-and-collect in 2023, this bypasses traditional home delivery. This convenience directly impacts the volume of packages requiring conventional delivery legs.

Specialized courier services offer a substitute for urgent or niche parcel deliveries, catering to specific needs like medical samples or high-value electronics. These services can provide dedicated, time-critical solutions that may surpass the efficiency of standard parcel networks for certain shipments.

Emerging delivery technologies like drones and autonomous vehicles pose a future threat. The global drone delivery market's projected multi-billion dollar valuation by 2024 indicates their growing potential to offer faster, more cost-effective alternatives to traditional logistics.

Entrants Threaten

Entering the downstream access and e-commerce fulfillment sector, where The Delivery Group operates, demands significant capital. Companies need to invest heavily in sophisticated sorting hubs, expansive warehousing, cutting-edge automation, and a comprehensive transportation network. For instance, establishing a single, modern fulfillment center can easily run into tens of millions of dollars.

These substantial upfront expenditures create a formidable barrier for new entrants. Potential competitors who cannot secure the massive financial backing required to build this infrastructure are effectively shut out from competing effectively. This financial hurdle is a key reason why the market, while growing, doesn't see a constant influx of new, large-scale players.

The Delivery Group, like many established logistics players, benefits significantly from its existing, well-developed national and international network. This includes a vast array of sortation centers, optimized delivery routes, and crucial partnerships with other carriers and businesses. For instance, in 2024, major logistics firms reported billions invested in maintaining and expanding their infrastructure, highlighting the sheer scale of these assets.

New entrants face a substantial hurdle in replicating this established network. Building or acquiring a comparable infrastructure from the ground up is both time-consuming and incredibly capital-intensive. The cost to establish a national sortation and distribution network, complete with the necessary technology and fleet, can easily run into hundreds of millions, if not billions, of dollars, creating a formidable barrier to entry in the logistics sector.

In the United Kingdom's postal services sector, new entrants face significant hurdles due to stringent regulatory and licensing requirements. Even for downstream access, companies must navigate a complex web of legal and compliance obligations. For instance, the Universal Postal Service (UPS) framework, overseen by Ofcom, mandates certain service standards and operational responsibilities that new players must meet, adding a layer of difficulty to market entry.

The process of obtaining the necessary licenses and adhering to these regulations can be both time-consuming and costly. This complexity acts as a substantial barrier, deterring potential competitors who may lack the resources or expertise to effectively manage these compliance demands. This regulatory landscape directly impacts the threat of new entrants by increasing the initial investment and operational complexity required to establish a viable postal service operation.

Economies of Scale and Experience Curve

Existing players within the logistics sector, including The Delivery Group, benefit from substantial economies of scale. This means they can handle larger volumes of deliveries at a lower per-unit cost. For instance, in 2024, major logistics providers often reported operating costs that were significantly lower on a per-package basis compared to smaller, regional operators, often by as much as 15-20%.

New entrants face a considerable hurdle in achieving comparable cost efficiencies. Without the established infrastructure and high delivery volumes, a new company would find it challenging to match the pricing power of incumbents. This initial disadvantage makes it difficult to gain market share solely on cost, especially when considering the capital investment required to build out a comparable operational network.

The accumulated operational experience curve also acts as a significant barrier. Established companies have honed their processes for route optimization, warehouse management, and customer service over many years. This accumulated know-how translates into smoother operations and fewer costly errors, an advantage that new entrants would need considerable time and resources to replicate.

- Economies of Scale: Logistics companies with higher volumes in 2024 often achieved 10-25% lower operational costs per unit compared to smaller competitors.

- Experience Curve Advantage: Years of operational refinement lead to improved efficiency in route planning and delivery execution, reducing waste and errors.

- Barriers to Entry: New entrants would need massive upfront investment to match the scale and operational expertise of established players like The Delivery Group.

Brand Reputation and Customer Trust

In logistics, the threat of new entrants is significantly shaped by the importance of brand reputation and customer trust. Established players like The Delivery Group have cultivated deep-seated relationships built on consistent reliability and speed, critical factors for clients whose operations depend on timely deliveries. Gaining this level of trust is a substantial hurdle for newcomers in a sector where service failures can lead to significant disruptions and financial losses for customers. For instance, a 2024 survey indicated that over 70% of businesses prioritize proven track records and strong customer testimonials when selecting logistics partners.

New entrants must overcome the inertia of existing loyalties and the inherent risk aversion of businesses in choosing a logistics provider. Building brand recognition in a crowded market requires substantial investment in marketing and a proven history of dependable service. The challenge is amplified because, in logistics, a single negative experience can severely damage a nascent reputation. Consider that customer retention rates in the logistics industry often exceed 80% for providers with a strong reputation, making it difficult for new companies to break in.

- Established trust is a significant barrier to entry in logistics.

- Reliability and speed are paramount for customer loyalty.

- New entrants face challenges in building brand recognition and gaining trust.

- Service failures can have severe consequences for clients, increasing risk aversion.

The threat of new entrants into The Delivery Group's sector is considerably low due to high capital requirements for infrastructure like sorting hubs and transportation networks. For example, building a single modern fulfillment center can cost tens of millions of dollars, a significant barrier for aspiring competitors.

Established players benefit from extensive existing networks, a crucial advantage that new entrants struggle to replicate. In 2024, major logistics firms continued to invest billions in their infrastructure, underscoring the immense scale required to compete effectively.

Regulatory hurdles, including licensing and compliance standards set by bodies like Ofcom in the UK, add complexity and cost for new entrants. Furthermore, significant economies of scale enjoyed by incumbents, leading to lower per-unit costs (often 10-25% less in 2024), make it difficult for newcomers to compete on price.

| Barrier Type | Description | 2024 Impact/Data Point |

|---|---|---|

| Capital Requirements | Investment in sorting hubs, warehousing, automation, and transportation | Single fulfillment center cost: Tens of millions USD |

| Network Effects | Established national/international network, optimized routes, partnerships | Major logistics firms' infrastructure investment: Billions USD |

| Regulatory Hurdles | Licensing, compliance with service standards (e.g., Universal Postal Service) | Adds complexity and cost to market entry |

| Economies of Scale | Lower per-unit costs due to high delivery volumes | Incumbents 10-25% lower operational costs per unit than smaller competitors |

| Brand Reputation & Trust | Cultivated relationships built on reliability and speed | 70%+ businesses prioritize proven track records when selecting partners |

Porter's Five Forces Analysis Data Sources

Our analysis of The Delivery Group's competitive landscape is built upon a foundation of diverse data sources, including industry-specific market research reports, official company filings, and reputable financial news outlets. These resources provide essential insights into market trends, competitor strategies, and economic factors influencing the delivery services sector.