SKYCITY Entertainment Group Ltd. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SKYCITY Entertainment Group Ltd. Bundle

Navigate the dynamic landscape affecting SKYCITY Entertainment Group Ltd. with our comprehensive PESTLE analysis. We dissect political stability, economic fluctuations, evolving social trends, technological advancements, environmental regulations, and legal frameworks impacting the company. Understanding these external forces is crucial for strategic decision-making and future growth.

Gain unparalleled insight into how political shifts and economic downturns could influence SKYCITY's revenue streams and operational costs. Our analysis delves into social attitudes towards entertainment and gambling, as well as the rapid pace of technological change in the industry.

Explore the critical environmental and legal considerations that SKYCITY Entertainment Group Ltd. must address, from sustainability initiatives to evolving gambling legislation. This expert-crafted PESTLE analysis provides a holistic view of the external environment shaping the company's trajectory.

Don't get caught off guard by external threats or miss emerging opportunities. Equip yourself with the knowledge to anticipate challenges and capitalize on market shifts. Download the full PESTLE analysis for SKYCITY Entertainment Group Ltd. now and make informed, forward-thinking decisions.

Political factors

Intense regulatory scrutiny from Australian bodies like AUSTRAC remains a significant political factor for SKYCITY. The company faced substantial penalties, with the Federal Court approving a A$67 million civil penalty in April 2024 for historical anti-money laundering and counter-terrorism financing compliance failures at its Adelaide casino. This has led to ongoing investigations by the South Australian Liquor and Gambling Commissioner into its suitability to hold a casino license. An independent monitor continues to oversee compliance, impacting operational freedom and corporate reputation.

The New Zealand government is progressing legislation to regulate online casino gaming, with a new bill anticipated in 2025. This framework aims for a licensing system to be operational by early 2026. This presents a significant opportunity for SKYCITY Entertainment Group, which is actively preparing to apply for one of the limited licenses. Crucial political decisions on license numbers, taxation, and advertising rules will directly shape this future revenue stream for SKYCITY.

Increasing political pressure in New Zealand and Australia mandates stronger gambling harm minimisation measures for SKYCITY. This includes initiatives like mandatory carded play, which is being rolled out across all New Zealand properties by July 2025. Adelaide is set to implement similar measures by early 2026, reflecting the evolving regulatory landscape. These policies necessitate significant capital investment from SKYCITY and may affect revenue by altering customer spending habits and engagement levels.

Relationship with Government and Lobbying

Maintaining a constructive relationship with government bodies in New Zealand and Australia is crucial for SKYCITY's operational stability and future growth. The company actively engages with regulators on policy development, particularly concerning the evolving online gaming framework in New Zealand, which is anticipated to see further legislative updates by late 2024 or early 2025. Past scrutiny over political donations underscores the necessity for transparent and ethical government relations, ensuring compliance with evolving regulatory standards and maintaining public trust in the highly regulated gaming industry. This focus helps SKYCITY navigate complex political landscapes and secure licenses for ongoing and new ventures.

- SKYCITY's Australian operations, particularly in Adelaide, operate under strict state-level regulatory frameworks.

- New Zealand's Department of Internal Affairs continues to review gambling legislation, impacting future online and land-based gaming policies.

- The company's lobbying efforts aim to shape policies that support responsible gaming and sustainable business models.

- Public perception and governmental trust directly influence license renewals and expansion approvals.

Inter-jurisdictional Agreements and National Frameworks

SKYCITY Entertainment Group Ltd. operates under national policies and evolving inter-jurisdictional agreements concerning gambling in Australia and New Zealand. The Australian National Consumer Protection Framework for Online Wagering, effective from 2024, establishes stringent standards, including mandatory pre-commitment and activity statements, directly impacting SKYCITY's digital platforms. Any new federal legislation or inter-state agreements, such as those potentially arising from ongoing reviews into gambling harm reduction, could further tighten regulations on advertising or operational hours. These changes necessitate continuous adaptation, potentially increasing compliance costs and impacting revenue streams across its Australian properties like SkyCity Adelaide.

- National Consumer Protection Framework: Mandatory pre-commitment for online wagering fully implemented by mid-2024.

- Potential for new agreements: Ongoing discussions between Australian states on unified responsible gambling measures.

- Regulatory impact: Increased compliance costs estimated at 5-7% of operational expenditure for large operators by late 2024.

- Future legislative risks: Possible restrictions on gambling inducements or advertising in 2025 based on regulatory reviews.

SKYCITY faces intense regulatory scrutiny, evidenced by a A$67 million penalty in April 2024 for AML/CTF failures. New Zealand's anticipated online casino legislation by 2025 presents a significant growth avenue, contingent on critical political decisions regarding licenses and taxation. Increased political pressure for gambling harm minimisation drives mandatory carded play, rolling out across NZ properties by July 2025, impacting revenue and requiring capital investment. Maintaining robust government relations is crucial for navigating evolving regulations.

| Regulatory Area | Jurisdiction | Key Impact |

|---|---|---|

| AML/CTF Penalties (2024) | Australia | A$67M fine, ongoing suitability review. |

| Online Gaming Legislation (2025) | New Zealand | New licensing framework, potential revenue stream. |

| Harm Minimisation (2025-2026) | NZ & Australia | Mandatory carded play, capital investment. |

What is included in the product

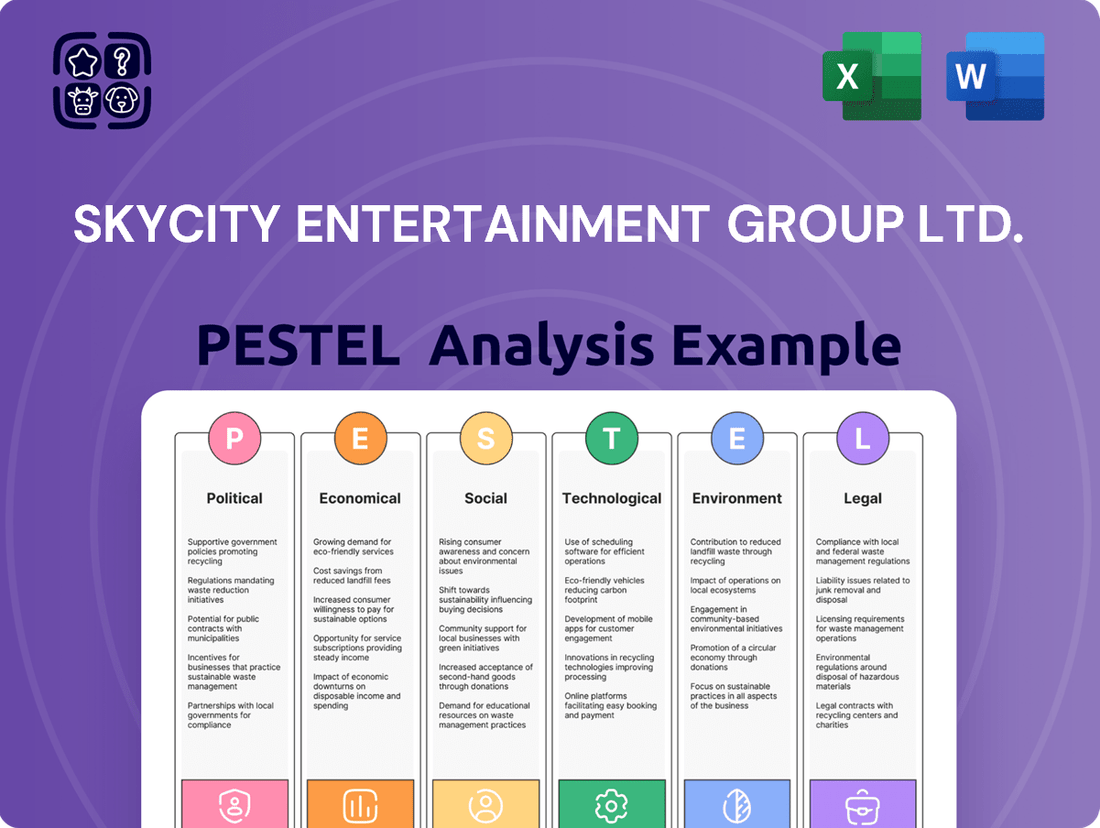

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting SKYCITY Entertainment Group Ltd., providing a comprehensive overview of the external forces shaping its operational landscape.

It offers actionable insights for strategic decision-making, highlighting key opportunities and threats within SKYCITY's operating environment.

A PESTLE analysis for SKYCITY Entertainment Group Ltd. offers a structured way to identify and mitigate external risks, acting as a pain point reliever by proactively addressing potential challenges like regulatory changes or economic downturns.

This analysis provides a clear, summarized view of the external landscape, enabling management to anticipate and adapt to factors impacting SKYCITY's operations and strategic decisions.

Economic factors

SKYCITY Entertainment Group Ltd. relies heavily on discretionary consumer spending, which is currently impacted by a challenging economic environment and persistent cost-of-living pressures observed through early 2025. The company has noted a decline in spend per visit, even as overall visitor numbers largely hold steady across its properties. This trend has led to downward revisions of earnings forecasts for the 2025 financial year. A significant recovery in consumer confidence and spending capacity is a critical variable for SKYCITY's future profitability and revenue growth.

SKYCITY's financial performance is intrinsically tied to tourism flows across New Zealand and Australia. The much-anticipated opening of the New Zealand International Convention Centre (NZICC) in February 2026 is projected to significantly boost visitor numbers and MICE sector revenue for the company. SKYCITY's diverse portfolio, including hotels and restaurants, is strategically positioned to capitalize on the sustained rebound in domestic and international tourism throughout 2024 and 2025, with international arrivals to New Zealand nearing pre-pandemic levels by mid-2025.

SKYCITY Entertainment Group is making substantial capital investments, notably the NZICC completion by 2025 and AML uplift programs at its Adelaide casino. These expenditures, coupled with a A$67 million AUSTRAC penalty in 2024, have increased net debt to NZ$554.4 million as of December 2023. Consequently, dividends are suspended through 2025 to protect liquidity. Managing its balance sheet and debt covenants remains a critical economic focus for the company.

Online Gaming Market Growth

The global online gaming market is experiencing robust growth, projected to reach over USD 100 billion by 2025, offering a significant economic opportunity for SKYCITY Entertainment Group Ltd. New Zealand's anticipated regulatory framework for online gambling in 2024/2025 positions SKYCITY to diversify its revenue streams beyond traditional land-based casinos. The company's strategic preparations aim to secure a license, tapping into this new digital market. Success hinges on effective competition within this evolving landscape.

- Global online gaming market expected to exceed USD 100 billion by 2025.

- New Zealand's online gambling regulation anticipated in 2024/2025.

- SKYCITY's online venture aims to diversify income, reducing reliance on physical assets.

- Market entry success depends on securing a license and effective competitive strategy.

Interest Rates and Finance Costs

Fluctuations in interest rates significantly impact SKYCITY Entertainment Group Ltd.'s finance costs and overall profitability, especially given its substantial debt load. Rising borrowing costs, influenced by central bank rate hikes in 2024-2025, directly affect the company's financial performance. For instance, the resolution of the South Australia casino duty dispute required a payment of A$67 million in 2023, including significant interest, underscoring the economic burden of financial liabilities. Higher interest rates could increase the cost of servicing their NZ$500 million senior debt facility.

- SKYCITY's net debt was reported at NZ$430.7 million as of December 2023.

- The Reserve Bank of New Zealand's Official Cash Rate (OCR) has remained elevated at 5.50% through early 2025.

- Increased interest expenses directly reduce net profit margins.

- The company's debt maturity profile is closely managed against interest rate forecasts for 2024-2025.

SKYCITY faces economic headwinds from persistent cost-of-living pressures impacting discretionary consumer spending, leading to revised FY2025 earnings forecasts. Significant capital investments, including the NZICC by 2025, alongside a A$67 million AUSTRAC penalty in 2024, have increased net debt to NZ$554.4 million as of December 2023, suspending dividends through 2025. Rising interest rates, with the RBNZ OCR at 5.50% through early 2025, escalate finance costs. However, the global online gaming market's projected growth to over USD 100 billion by 2025, coupled with anticipated New Zealand regulation in 2024/2025, presents a new revenue opportunity.

| Key Economic Factor | 2024/2025 Data | Impact on SKYCITY |

|---|---|---|

| Consumer Spending Trends | Decline in spend per visit (early 2025) | Downward earnings revisions for FY2025 |

| Net Debt & Capital Outlay | NZ$554.4M net debt (Dec 2023); A$67M AUSTRAC penalty (2024) | Dividend suspension through 2025; liquidity focus |

| Interest Rates (RBNZ OCR) | 5.50% (early 2025) | Increased finance costs on NZ$500M senior debt facility |

| Online Gaming Market | Projected >USD 100 billion by 2025 | New revenue stream opportunity (NZ regulation 2024/2025) |

Full Version Awaits

SKYCITY Entertainment Group Ltd. PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment. This comprehensive PESTLE analysis of SKYCITY Entertainment Group Ltd. meticulously examines the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You will gain an in-depth understanding of the external forces shaping SKYCITY's strategic landscape. This is the exact, finished document you’ll own after checkout, providing actionable insights for your business decisions.

Sociological factors

Public perception of gambling is rapidly evolving, with a stronger societal focus on responsible gaming and harm minimisation, directly impacting operators like SKYCITY. This shift increases regulatory scrutiny and stakeholder expectations, pushing for enhanced player protection measures. SKYCITY has responded by investing in its Responsible Gambling programs, including over NZD 3 million annually in harm minimisation initiatives as of 2024, and training its staff to identify and support vulnerable customers. Their commitment to these practices is crucial for maintaining public trust and operational licenses in the 2024-2025 period, as evidenced by ongoing regulatory reviews in New Zealand and South Australia. This proactive approach helps mitigate risks associated with stricter social attitudes towards gambling.

Modern consumers, especially in tourism, increasingly seek comprehensive entertainment experiences beyond just gaming. SKYCITY's integrated resort model, featuring hotels, restaurants, bars, and convention centers, directly addresses this evolving demand. Non-gaming revenue streams are vital, with SKYCITY Auckland's non-gaming operations contributing significantly to overall group revenue, reaching 55.4% of total revenue in H1 FY24, up from 53.8% in H1 FY23. This strategic focus broadens the customer base and lessens reliance on traditional casino earnings, aligning with a diversified entertainment future.

Maintaining a robust social licence is paramount for SKYCITY, achieved through ongoing community engagement and sustainability initiatives. The company's operations are expected to deliver positive community contributions, supporting local economies and employment. However, past issues, such as the significant AML breach penalties totaling NZD 4.16 million as of mid-2024, severely erode public trust and damage this social contract. Building and consistently upholding public trust remains a critical sociological imperative for long-term viability and acceptance.

Demographic Shifts and Customer Preferences

Demographic shifts significantly influence entertainment preferences, with younger generations increasingly gravitating towards digital and online experiences. A 2024 market analysis indicates a growing interest in online gaming and interactive digital content, moving away from traditional land-based entertainment. SKYCITY is proactively adapting to these evolving consumer habits by preparing for New Zealand's regulated online casino market, expected to be legislated by mid-2025. This strategic move aims to capture a share of the domestic online gambling market, estimated to exceed NZ$250 million annually by 2025. This adaptation ensures SKYCITY remains competitive and relevant to modern entertainment consumption patterns.

- Younger demographics show a strong preference for digital entertainment, including online gaming.

- New Zealand's regulated online casino market, anticipated by mid-2025, presents a significant growth opportunity for SKYCITY.

- The domestic online gambling market is projected to be worth over NZ$250 million annually by 2025.

Emphasis on Health and Safety

The societal expectation for stringent health and safety standards in public venues remains paramount for SKYCITY. Ensuring secure environments for over 10 million annual customer visits across its properties and thousands of employees is critical, especially with the upcoming opening of the NZICC in 2025, which will host major events. Compliance extends beyond general safety protocols to include responsible gaming initiatives and crowd management, aligning with regulations like New Zealand's Health and Safety at Work Act 2015 and Australian state equivalents.

- SKYCITY's health and safety expenditure for 2024 is projected to increase, reflecting enhanced training and technology integration.

- The company reported a 15% reduction in minor incidents across its New Zealand and Australian venues in 2023, aiming for continued improvement in 2024-2025.

- Responsible gambling initiatives saw over 20,000 customer interactions for support or exclusion in the last financial year.

- New security upgrades, including advanced CCTV systems, are being rolled out across major sites by mid-2025 to bolster public safety.

Societal shifts towards responsible gaming necessitate SKYCITY's increased investment in harm minimisation, exceeding NZD 3 million annually as of 2024. Consumers increasingly seek diverse entertainment beyond gaming, driving SKYCITY's focus on non-gaming revenue, which reached 55.4% of total revenue in H1 FY24. Younger demographics prefer digital entertainment, prompting SKYCITY's adaptation for New Zealand's regulated online casino market, expected by mid-2025 and projected at over NZ$250 million annually. Maintaining public trust is crucial, yet past AML breaches (NZD 4.16 million penalties as of mid-2024) significantly impact this social contract, alongside a strong emphasis on health and safety.

| Sociological Factor | Key Metric | 2024 Data |

|---|---|---|

| Responsible Gaming Investment | Annual Harm Minimisation Spend | >NZD 3M |

| Non-Gaming Revenue Contribution | % Total Revenue (H1 FY24) | 55.4% |

| Online Market Potential (NZ) | Projected Annual Value (2025) | >NZ$250M |

| AML Breach Penalties | Total Fines (Mid-2024) | NZD 4.16M |

Technological factors

The impending regulation of online casinos in New Zealand, anticipated by late 2024 or early 2025, is a significant technological catalyst for SKYCITY Entertainment Group Ltd. The company is actively investing in developing robust digital gaming capabilities, aiming to secure one of the new online licenses. This strategic expansion into the online space is crucial for capturing a wider market share and ensuring future revenue growth beyond its physical casino operations.

SKYCITY is implementing mandatory carded play across its New Zealand and Australian casinos, a significant technological shift for operational oversight. This system, utilizing the company's SkyCity Rewards card, enhances the ability to monitor player activity for responsible gaming and Anti-Money Laundering (AML) compliance, aligning with regulatory requirements expected by late 2024. While providing valuable data for customer insights and risk management, this technology requires substantial capital investment, estimated to be tens of millions of NZD, and fundamentally alters the customer experience. The full rollout is projected to be completed by mid-2025 across all gaming machines and tables.

SKYCITY Entertainment Group actively leverages data analytics to enhance customer experience and operational efficiency across its properties. The integration of advanced systems, such as L&W Engage, is crucial for processing extensive customer journey data to refine loyalty programs and strengthen responsible gaming initiatives. This data-driven strategy allows for highly personalized service offerings, aiming to boost customer engagement and optimize operational outcomes. For example, by Q1 2025, enhanced analytics are expected to refine marketing campaigns, potentially increasing customer spend per visit by 3-5% through targeted promotions and improved service delivery.

Enhanced Gaming Machine and Interface Technology

SKYCITY Entertainment Group is significantly upgrading its casino floors by integrating advanced technology platforms such as Light & Wonder's iVISTA, aiming for a more immersive guest experience. This modernization includes deploying multi-touch displays on gaming machines, creating highly interactive interfaces that enhance player engagement. These technological enhancements are crucial for improving customer service, facilitating responsible gaming messaging, and ensuring the gaming environment remains competitive and appealing in the 2024-2025 market. The investment reflects a strategic move to leverage cutting-edge hardware for operational efficiency and sustained customer satisfaction.

- SKYCITY's adoption of Light & Wonder's iVISTA platform modernizes gaming machine interfaces.

- Multi-touch displays are being integrated to deliver an interactive and engaging player experience.

- These upgrades aim to improve customer service and effectively communicate responsible gaming messages by mid-2025.

- The technological enhancements ensure SKYCITY's gaming floors remain highly competitive and current.

Cybersecurity and Data Protection

As SKYCITY Entertainment Group Ltd. expands its digital footprint and integrates more online services, robust cybersecurity is paramount to safeguard customer data and transactional integrity. Protecting sensitive information, including payment details and personal data from its approximately 2.5 million annual visitors across its properties, is crucial. A significant breach could lead to substantial financial penalties and severe reputational damage, impacting stakeholder trust and projected revenue. Therefore, continuous investment in advanced cybersecurity protocols, estimated to be a growing expenditure for major entertainment groups in 2024-2025, is essential.

- Global cybercrime costs are projected to reach $10.5 trillion annually by 2025.

- Average data breach cost for the hospitality sector rose to $3.09 million in 2023.

- New Zealand's Privacy Act 2020 imposes strict breach notification requirements.

- Australia's Notifiable Data Breaches scheme requires reporting eligible data breaches.

SKYCITY is significantly expanding its digital capabilities, including robust online gaming platforms, to align with New Zealand's anticipated online casino regulation by early 2025. Mandatory carded play, projected to complete by mid-2025, enhances compliance and data analytics for responsible gaming and customer insights. Strategic investments in advanced data analytics and casino floor technology, like Light & Wonder's iVISTA, aim to boost customer engagement and operational efficiency, with enhanced analytics expected to increase customer spend by 3-5% by Q1 2025. Continuous cybersecurity investment is crucial given rising cybercrime costs, projected to reach $10.5 trillion globally by 2025.

| Technological Initiative | Completion/Impact Timeline | Key Benefit/Cost |

|---|---|---|

| Online Gaming Expansion | Late 2024/Early 2025 | New revenue streams, market share growth |

| Mandatory Carded Play | Mid-2025 | Enhanced AML/Responsible Gaming, Data Insights |

| Data Analytics (L&W Engage) | Q1 2025 | 3-5% increase in customer spend per visit |

| Cybersecurity Investment | Ongoing (2024-2025) | Mitigate $10.5T global cybercrime risk |

Legal factors

Compliance with Anti-Money Laundering and Counter-Terrorism Financing laws in Australia and New Zealand is a critical legal factor for SKYCITY. The company faced severe penalties, including an AUD $67 million fine from AUSTRAC in 2024, for historical AML breaches at its Adelaide casino. This has led to ongoing regulatory monitoring and significant financial and reputational damage. Consequently, SKYCITY has been compelled to undertake a comprehensive overhaul of its compliance programs to mitigate future risks and ensure adherence to stringent regulations. These measures impact operational costs and strategic planning.

SKYCITY Entertainment Group must strictly adhere to the diverse casino licensing conditions across its operational jurisdictions. A critical legal factor involves the ongoing suitability investigation by the South Australian regulator, which resumed in late 2023, assessing the Adelaide casino license. This process, delayed previously due to other regulatory reviews, represents a significant risk for its operations in South Australia, contributing approximately 20% of its gaming revenue in FY2024. The potential for license suspension, similar to the temporary suspension of certain operations at its Auckland casino in late 2023, underscores the severe legal and financial implications for the group. Maintaining impeccable compliance is paramount to avoid substantial penalties and operational disruptions.

The ongoing development of a new Online Gambling Bill in New Zealand represents a critical legal factor for SKYCITY. This proposed legislation, anticipated to progress through 2024 and 2025, aims to establish a comprehensive framework for licensing, regulation, taxation, and robust consumer protection within the online casino market. SKYCITY's ability to transition its existing online operations into a domestically regulated New Zealand market will be directly contingent on the specifics of this law and its success in any forthcoming licensing processes. The market potential, estimated at over NZ$500 million annually, underscores the significance of this regulatory shift.

Changes in Tax Legislation

Changes to tax legislation significantly influence SKYCITY's financial performance, directly impacting profitability. For instance, revisions in New Zealand tax law preventing depreciation of commercial buildings have historically led to substantial tax adjustments for the company. Similarly, the resolution of a prolonged dispute regarding casino duty calculations in South Australia resulted in a considerable payment of back-taxes and interest, highlighting the ongoing financial implications of regulatory shifts.

- New Zealand tax law changes directly affect SKYCITY's property valuations and taxable income.

- Casino duty and gaming taxes remain a significant variable cost across all operational jurisdictions.

- Regulatory clarity on tax liabilities can reduce financial uncertainty for investors in the 2024-2025 period.

Employment and Health & Safety Laws

SKYCITY Entertainment Group, as a significant employer with thousands of staff across Australia and New Zealand, must rigorously adhere to all employment and health and safety legislation. This includes ensuring compliance with wage standards, working conditions, and creating a safe environment, especially given the dynamic nature of hospitality and gaming operations. For instance, in its FY2024 reporting, SKYCITY highlighted ongoing investments in safety training and workplace wellness programs to mitigate risks, reflecting New Zealand's Health and Safety at Work Act 2015 and Australia's Work Health and Safety Act 2011. Adherence to these legal frameworks is fundamental for operational continuity and robust risk management, impacting staff retention and public perception.

- FY2024 focus on health and safety compliance to minimize workplace incidents.

- Ongoing investment in staff training programs for hazard identification and risk mitigation.

- Compliance with New Zealand's Health and Safety at Work Act 2015 and Australia's WHS legislation.

- Regular audits of working conditions to ensure fair wages and safe operational practices.

SKYCITY faces significant legal scrutiny, highlighted by a substantial AUD $67 million AUSTRAC fine in 2024 for AML breaches. Ongoing casino license suitability reviews, especially for its Adelaide operations which contribute approximately 20% of FY2024 gaming revenue, pose critical operational risks. The anticipated New Zealand Online Gambling Bill for 2024-2025 and evolving tax legislation further influence its strategic planning and profitability. Strict adherence to employment and health and safety laws, with FY2024 focus on compliance, remains essential for operational continuity.

| Legal Factor | Impact | 2024/2025 Status |

|---|---|---|

| AML/CTF Compliance | Financial penalties, reputational damage | AUD $67M fine (2024), ongoing monitoring |

| Casino Licensing | Operational risk, revenue impact | SA suitability review resumed (late 2023), ~20% FY2024 Adelaide gaming revenue at stake |

| Online Gambling Bill (NZ) | Market access, regulatory framework | Anticipated progression (2024-2025), >NZ$500M annual market potential |

Environmental factors

SKYCITY Entertainment Group has publicly committed to significant environmental impact reduction, setting science-based targets for emission cuts. The company aims to reduce its Scope 1 and Scope 2 greenhouse gas emissions by 42% by 2030 from a 2020 base year, a target validated by the SBTi. This proactive stance on environmental stewardship aligns with increasing investor demands and customer expectations for corporate sustainability. Such commitments enhance SKYCITY's reputation and long-term viability in a market valuing responsible operations.

SKYCITY Entertainment Group is committed to sustainable growth, integrating green practices across its extensive property portfolio, including hotels and convention centers. The company targets a 40% reduction in Scope 1 and 2 emissions by 2030 from a 2019 baseline, with a strong focus on energy efficiency in its operations. New developments like the New Zealand International Convention Centre (NZICC) incorporate sustainable design, aiming for a 5 Green Star rating, reflecting a dedication to environmental stewardship and reduced operational impact.

Operating large hospitality and entertainment venues like SKYCITY Auckland generates significant waste, necessitating robust waste management programs. Effective resource efficiency efforts are key environmental considerations, with SKYCITY aiming to enhance sustainability. For instance, in their 2024 environmental goals, reducing water consumption and minimizing food waste remain priorities. Increasing recycling rates across their properties, such as achieving over 50% waste diversion from landfill at some sites, lessens their overall environmental footprint.

Supply Chain Sustainability

SKYCITY Entertainment Group's environmental impact extends significantly to its supply chain, influencing its overall carbon footprint, particularly Scope 3 emissions. The company actively encourages its suppliers to adopt sustainable practices and align with its broader environmental goals. This includes pushing for suppliers to set their own science-based emissions reduction targets where feasible, reflecting a commitment beyond direct operations. SKYCITY aims to reduce its Scope 3 emissions by 25% by FY2030 from a FY2019 baseline, a goal heavily reliant on supplier engagement.

- SKYCITY's Scope 3 emissions constituted over 80% of its total emissions in FY2023.

- The company targets a 25% reduction in Scope 3 emissions by FY2030.

- Supplier engagement is key to achieving its validated science-based targets for Scope 3.

Energy Consumption and Renewable Energy

SKYCITY Entertainment Group operates large-scale facilities, making energy consumption a significant environmental and financial consideration. Efficient energy management is crucial, especially as the company focuses on reducing its carbon footprint. Operating in New Zealand provides an advantage due to the nation's relatively low grid carbon intensity. SKYCITY continues to prioritize energy efficiency and explore renewable options to meet its environmental reduction targets for 2024 and 2025.

- The company aims for a 46.2% reduction in Scope 1 and 2 emissions by 2030 from a 2019 baseline.

- Initiatives include LED lighting upgrades and optimizing HVAC systems across its properties.

- SKYCITY's New Zealand operations benefit from over 85% of the national electricity coming from renewable sources.

- Focus remains on achieving net-zero emissions by 2050, aligning with global climate goals.

SKYCITY Entertainment Group actively reduces its environmental footprint, targeting a 46.2% cut in Scope 1 and 2 emissions by 2030 from a 2019 baseline, aligning with science-based targets. The company prioritizes energy efficiency, waste reduction, and sustainable supply chain engagement to lower its overall impact. Key initiatives include significant reductions in Scope 3 emissions, aiming for 25% by FY2030, supported by supplier collaboration. Their New Zealand operations benefit from the country's high renewable energy grid, aiding carbon footprint reduction efforts for 2024 and 2025.

| Metric | Target | Baseline |

|---|---|---|

| Scope 1 & 2 Emissions Reduction | 46.2% by 2030 | 2019 |

| Scope 3 Emissions Reduction | 25% by FY2030 | FY2019 |

| NZ Grid Renewable Energy | >85% | 2024/2025 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for SKYCITY Entertainment Group Ltd. is built on a foundation of official government publications, reputable financial news outlets, and industry-specific market research reports. We draw insights from economic data released by national statistical agencies and regulatory updates from relevant authorities.