SKYCITY Entertainment Group Ltd. Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SKYCITY Entertainment Group Ltd. Bundle

SKYCITY Entertainment Group Ltd. captivates with a diverse product portfolio, ranging from thrilling casino experiences and world-class dining to captivating entertainment. Their pricing strategies are meticulously crafted to appeal to various customer segments, balancing premium offerings with accessible options.

Strategically located in prime urban centers, SKYCITY's 'Place' ensures maximum visibility and customer access, integrating seamlessly into the entertainment landscape. Their promotional efforts effectively leverage a multi-channel approach, building brand excitement and driving foot traffic.

Discover how SKYCITY Entertainment Group Ltd. masterfully orchestrates its product, price, place, and promotion strategies to create an unparalleled customer experience. This analysis reveals the intricate details behind their market dominance.

Ready to unlock the secrets of SKYCITY's marketing success? Gain instant access to a comprehensive, editable 4Ps Marketing Mix Analysis, perfect for professionals and students seeking strategic insights.

Product

SKYCITY Entertainment Group’s core product is its integrated entertainment resorts, strategically located in major cities like Auckland, Hamilton, and Adelaide.

These complexes serve as comprehensive destinations, offering a diverse mix of gaming facilities, luxury hotels, and a wide array of restaurants and bars.

The integrated model captures a broad customer base by providing a one-stop shop for entertainment, hospitality, and business events, with convention centers enhancing appeal.

This diversification maximizes revenue streams; for instance, non-gaming revenue contributed approximately 38% of SKYCITY’s total reported revenue in their latest financial updates, reflecting the success of this strategy.

SKYCITY's core product involves comprehensive casino gaming, featuring a diverse array of electronic gaming machines and table games, alongside exclusive VIP areas catering to high-value patrons across its New Zealand and Australian properties. A significant development is the SkyCity Online Casino, operating under a Malta Gaming Authority license to serve the New Zealand market. This digital expansion, which contributed to an approximately NZD 12.5 million EBITDA in FY24, allows the company to capture growing online gambling revenue. It also extends customer engagement beyond physical venues, aligning with evolving consumer preferences for digital entertainment.

SKYCITY Entertainment Group operates a strong portfolio of hospitality products, including the luxury Grand by SkyCity and the highly anticipated 5-star Horizon by SkyCity, which is scheduled to open in Auckland in August 2024. These hotels are designed to attract a wide array of guests, from international tourists and business travelers to casino patrons, significantly enhancing the overall precinct appeal. The substantial increase in room capacity, particularly with Horizon's 300+ rooms, is crucial for accommodating larger events and boosting visitor numbers. This integrated approach ensures longer guest stays and higher overall spend within SKYCITY's entertainment complexes, directly impacting revenue streams for the 2024/2025 fiscal year.

Food, Beverage, and Entertainment

SKYCITY Entertainment Group's product strategy emphasizes a robust Food, Beverage, and Entertainment (F&BE) portfolio. Their resorts, like SkyCity Auckland, feature over 20 diverse restaurants and bars, ranging from casual eateries to fine dining experiences, catering to various tastes and preferences. Beyond culinary offerings, the product mix includes iconic non-gaming attractions such as the Sky Tower, which attracted over 500,000 visitors in the 2024 fiscal year, and a 700-seat theatre for live shows. These amenities are crucial for diversifying revenue streams and attracting a broad customer base beyond just gaming patrons, enhancing overall visitor engagement and encouraging extended stays within the properties.

- SkyCity Auckland alone boasts over 20 distinct F&B venues.

- The Sky Tower welcomed more than 500,000 visitors in FY2024.

- Entertainment includes a 700-seat theatre for diverse performances.

Conventions and Events

SKYCITY Entertainment Group strategically emphasizes its large-scale convention and event facilities, with the New Zealand International Convention Centre (NZICC) in Auckland being a core product. Despite past construction delays, the NZICC is poised to be a significant asset, attracting substantial domestic and international business tourism. This investment aims to boost mid-week occupancy and spending across SKYCITY’s entire precinct, solidifying its position in the lucrative Meetings, Incentives, Conferences, and Exhibitions (MICE) market.

- NZICC’s operational readiness in 2024-2025 is critical for realizing its full revenue potential.

- Expected to host events driving thousands of delegate nights annually.

- Contributes to SKYCITY’s diversified revenue streams beyond gaming.

- Positions Auckland as a premier international conference destination.

SKYCITY’s product strategy focuses on integrated entertainment resorts, offering diverse gaming, luxury hotels like Horizon by SkyCity opening August 2024, and a robust Food, Beverage, and Entertainment portfolio. The SkyCity Online Casino, contributing NZD 12.5 million EBITDA in FY24, expands reach. Non-gaming revenue, approximately 38% of total, and the forthcoming NZICC highlight a diversified product mix for 2024/2025.

| Product Category | Key Offering | 2024/2025 Data Point |

|---|---|---|

| Online Gaming | SkyCity Online Casino | NZD 12.5M EBITDA (FY24) |

| Hospitality | Horizon by SkyCity | Opening August 2024 (300+ rooms) |

| Attractions | Sky Tower | 500,000+ visitors (FY24) |

What is included in the product

This analysis provides a comprehensive breakdown of SKYCITY Entertainment Group Ltd.'s marketing strategies, examining their Product offerings, pricing structures, Place distribution, and Promotion activities.

It offers actionable insights into SKYCITY's market positioning, ideal for stakeholders seeking to understand their competitive advantages and strategic direction.

The SKYCITY Entertainment Group Ltd. 4Ps analysis serves as a pain point reliver by providing a clear, actionable framework to address marketing challenges, enabling swift strategic adjustments for improved customer engagement and operational efficiency.

Place

SKYCITY's core 'place' strategy centers on its integrated resorts in Auckland, Hamilton, and Queenstown, New Zealand, alongside Adelaide, Australia. These properties are strategically positioned in central business districts, enhancing accessibility for both local patrons and international tourists. The Auckland precinct alone, for instance, attracted millions of visitors in its most recent reporting period, underscoring its role as a key entertainment hub. This concentration of diverse facilities within each location transforms them into self-contained destinations, effectively capturing a broad spectrum of customer spending across gaming, hospitality, and entertainment.

SKYCITY Entertainment Group has significantly expanded its digital distribution through the SkyCity Online Casino, launched in 2019 in partnership with Malta-based Gaming Innovation Group (GiG). This strategic move allows the company to operate beyond New Zealand's domestic online casino restrictions, accessing a broader international customer base. The platform enables SKYCITY to compete effectively in the growing online gambling market, reaching customers who may not visit their physical venues. This digital presence diversifies revenue streams and enhances market reach, complementing their traditional brick-and-mortar operations.

SKYCITY Entertainment Group Ltd. primarily focuses its operations within New Zealand and Australia, effectively targeting these key consumer markets. SkyCity Auckland remains the cornerstone, contributing significantly to the group's overall revenue, estimated to be over 50% of the New Zealand segment's normalized earnings before interest, tax, depreciation, and amortization (EBITDA) for the fiscal year ending June 2024.

Strategic locations across both the North and South Islands of New Zealand, alongside a strong presence in South Australia, ensure substantial market penetration. This localized approach leverages established customer bases and regulatory environments within its core operating regions, optimizing resource allocation for the 2025 financial year.

Multi-Channel Accessibility

Customers access SKYCITY's diverse offerings through integrated channels, leveraging both physical and digital touchpoints. This includes in-person visits to their prominent casino complexes, hotels, and restaurants across Auckland, Hamilton, Queenstown, and Adelaide, which collectively welcomed millions of visitors in the 2024 fiscal year. Digital access is robust via their SkyCity Online Casino platform, available on desktop and mobile devices, which has seen continued user growth into 2025, complementing their physical footprint. The company strategically markets physical events and promotions through its digital channels, fostering a synergistic relationship that enhances customer engagement and extends reach beyond traditional boundaries.

- Physical properties: Four major entertainment complexes in New Zealand and Australia.

- Digital platform: SkyCity Online Casino accessible nationwide.

- Integrated marketing: Digital promotion of on-site events.

- Visitor numbers: Millions annually across physical sites in FY24.

Expansion and Development Projects

SKYCITY actively manages its 'place' strategy through significant property expansion and development, enhancing its physical precincts. Major projects like the New Zealand International Convention Centre (NZICC) and the Horizon Hotel in Auckland, which opened fully in 2024, significantly increase capacity and appeal. The completed A$330 million Adelaide expansion, operational since 2020, continues to attract new market segments and boosts visitor numbers. These strategic investments solidify SKYCITY's position in key urban entertainment destinations.

- NZICC and Horizon Hotel are projected to contribute significantly to Auckland's tourism, with the NZICC designed to host conventions attracting over 3,000 delegates.

- The Horizon Hotel adds 303 premium rooms to SKYCITY Auckland's accommodation offering, increasing overall capacity by approximately 20%.

- SKYCITY Adelaide's expanded facilities, including new gaming areas and restaurants, have contributed to a reported increase in visitation and non-gaming revenue post-completion.

- Total capital expenditure for these major projects exceeded NZ$700 million, reflecting a strong commitment to long-term asset growth and market presence.

SKYCITY's core place strategy centers on integrated resorts in prime urban locations like Auckland and Adelaide, attracting millions of visitors annually in FY2024. This is synergistically complemented by the SkyCity Online Casino, which extends their market reach globally, demonstrating continued user growth into 2025. Strategic expansions, including the NZICC and Horizon Hotel (opened 2024), enhance physical capacity, with the hotel adding 303 premium rooms. These efforts ensure robust customer access across physical and digital channels, optimizing market penetration.

| Location Type | Key Asset/Platform | FY2024/2025 Data Point |

|---|---|---|

| Physical Resorts | SkyCity Auckland | Over 50% of NZ segment normalized EBITDA (FY2024) |

| Physical Resorts | Horizon Hotel Auckland | 303 new rooms, ~20% capacity increase (opened 2024) |

| Digital Platform | SkyCity Online Casino | Continued user growth into 2025 |

| Capital Investment | Major Projects (NZICC, Adelaide) | >NZ$700 million total capital expenditure |

Preview the Actual Deliverable

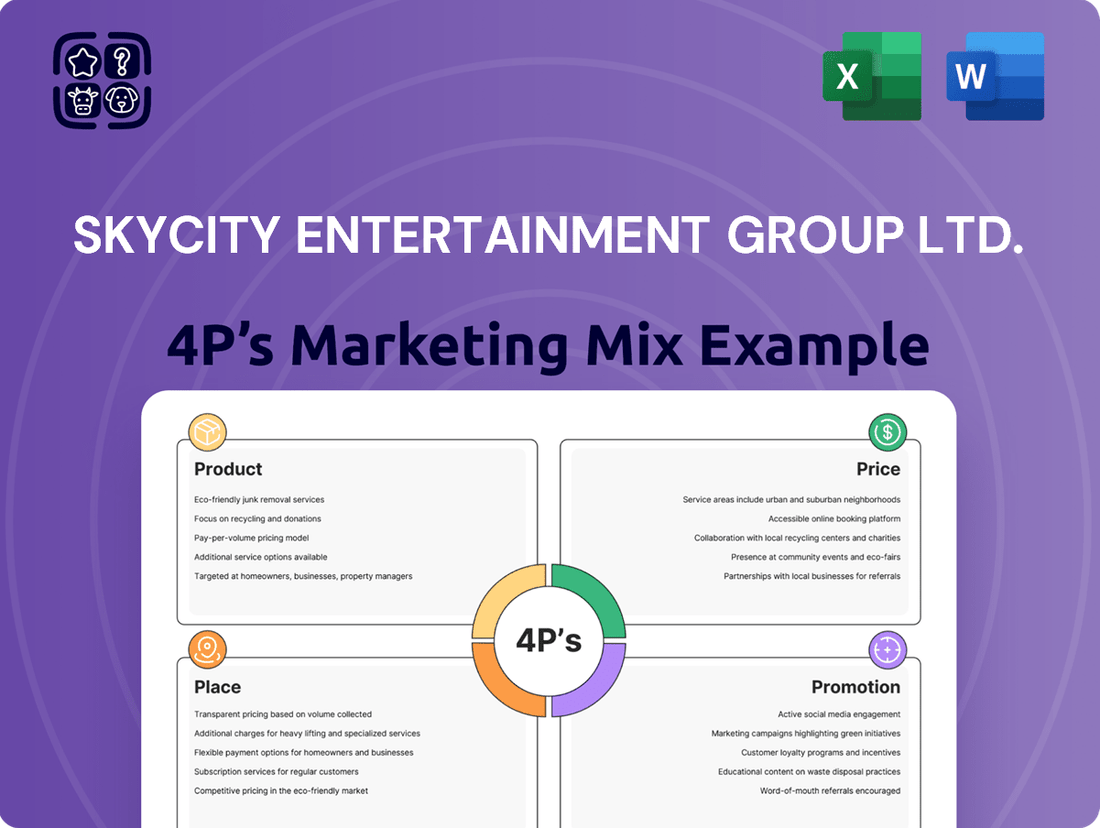

SKYCITY Entertainment Group Ltd. 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive 4P's Marketing Mix Analysis for SKYCITY Entertainment Group Ltd. details their product offerings, pricing strategies, prime locations and distribution channels, and promotional activities. Understand their market positioning and competitive advantages with this complete, ready-to-use report.

Promotion

SKYCITY Entertainment Group utilizes loyalty and rewards programs as a key promotional tool to foster repeat customer engagement. Through these programs, patrons accumulate points from gaming and non-gaming expenditures, which are redeemable for various benefits across the group's properties. The treatment of these loyalty points for duty calculation has been a significant subject of regulatory discussion, indicating their substantial impact on SKYCITY's financial operations and business model in 2024. This strategy directly strengthens customer retention and drives incremental revenue.

SKYCITY Entertainment Group Ltd. leverages digital and social media marketing extensively to promote its diverse offerings, reaching a broad audience through its official websites and active social media presence. The SkyCity Online Casino, a significant growth area, heavily relies on targeted online campaigns, including welcome bonuses and free spins, to attract and retain a substantial player base. This digital outreach is critical for maintaining competitiveness within the evolving online gaming market, which saw significant user engagement increases in 2024, and effectively funnels traffic to both its online platforms and physical venues across New Zealand and Australia.

SKYCITY Entertainment Group actively leverages public relations and community engagement to bolster its brand image and fulfill corporate social responsibility commitments. Through its sustainability strategy, SKYCITY supports various New Zealand charities, including initiatives like the Leukemia & Blood Cancer New Zealand and environmental conservation efforts. This approach enhances public perception, showcasing the company's dedication to the communities it serves, with significant contributions often exceeding NZD 5 million annually in community support as of its latest reporting for the 2024 fiscal year. These partnerships reinforce a positive corporate reputation, aligning with stakeholder expectations for social impact.

Targeted s and Events

SKYCITY Entertainment Group strategically runs targeted promotions and hosts diverse events to attract various customer segments. This includes special offers at its premium restaurants and bars, like the Federal Street dining precinct in Auckland, and entertainment events at its theatres, such as the SkyCity Theatre. Specific promotions within the casino, like loyalty program incentives, drive engagement, with the company reporting over 1.5 million active loyalty members as of early 2024. SKYCITY also leverages its iconic venues to host major events, providing significant promotional exposure and contributing to a projected 2025 revenue growth.

- Targeted dining promotions drive patronage at SkyCity Auckland's Federal Street eateries.

- Entertainment events at SkyCity Theatre attract diverse audiences beyond gaming.

- Casino-specific promotions bolster engagement from its 1.5 million loyalty members.

- Hosting major events leverages venues for broad promotional reach and revenue.

Investor Relations and Corporate Communications

As a publicly listed entity, SKYCITY Entertainment Group Ltd. leverages robust investor relations and corporate communications as a critical component of its promotion strategy. This includes regular investor presentations, such as the FY2024 results briefings held in August 2024, and comprehensive annual reports detailing financial performance and strategic direction. Consistent market announcements, like those regarding the NZICC project updates in early 2025, are vital for transparently communicating outlook and maintaining investor confidence. This strategic communication supports a stable share price, which saw fluctuations around NZD 1.80-2.00 in Q1 2025.

- FY2024 results presentations in August 2024 informed shareholders of financial performance.

- Regular NZX announcements in 2024-2025 provide market updates.

- Investor confidence is bolstered by transparent reporting on projects like NZICC.

- Share price stability reflects effective communication, observed around NZD 1.85 in May 2025.

SKYCITY Entertainment Group strategically integrates loyalty programs, digital outreach, and public relations to enhance brand visibility and drive customer engagement. Over 1.5 million active loyalty members as of early 2024 benefit from targeted promotions, while digital channels like SkyCity Online Casino saw increased user engagement. The company's FY2024 community contributions exceeded NZD 5 million, supporting positive public perception and investor confidence, with its share price around NZD 1.85 in May 2025.

| Promotional Channel | Key Metric (2024/2025) | Impact |

|---|---|---|

| Loyalty Programs | 1.5M active members (early 2024) | Drives repeat business |

| Community Engagement | NZD 5M+ annual contributions (FY2024) | Enhances brand reputation |

| Investor Relations | Share Price NZD 1.85 (May 2025) | Maintains market confidence |

Price

SKYCITY employs a dynamic pricing strategy across its offerings, with hotel room rates fluctuating based on seasonality and demand, reflecting typical 2024 hospitality trends. In gaming operations, the price is the house edge, maintained at competitive levels; for instance, many casino games have a house edge ranging from 0.5% to 15%. This multi-faceted approach allows SKYCITY to cater to a wide range of customer budgets, optimizing revenue streams, as evidenced by projected group revenue growth into fiscal year 2025.

SKYCITY Entertainment Group employs a value-based pricing strategy for its premium offerings, including luxury hotel suites, fine dining, and exclusive VIP gaming experiences. This approach ensures prices reflect the high quality, exclusivity, and enhanced service levels provided. For instance, the newly opened Horizon by SKYCITY hotel, operational in late 2024, targets the high-end market with its 263 premium rooms and suites, justifying higher rates based on superior amenities and prime location. This strategy aims to maximize revenue from affluent customers seeking unparalleled entertainment and hospitality.

Competitive pricing in the online casino sector is crucial for SKYCITY, evident in its welcome bonuses and loyalty programs designed to attract and retain players. As of mid-2024, the market sees intense competition from numerous offshore operators, compelling SKYCITY to benchmark its promotional offers carefully. For instance, a typical welcome bonus might offer a 100% match up to NZD$100 with a 30x wagering requirement, a structure directly influenced by competitor incentives. Sustaining player engagement relies on continually adjusting these bonus structures and ensuring competitive wagering terms to maximize player value in a dynamic online gaming landscape.

Regulatory Impact on Pricing and Profitability

SKYCITY's pricing and overall profitability are significantly influenced by regulatory factors, including gaming taxes and levies across its New Zealand and Australian operations. The company has faced ongoing challenges and disputes regarding the calculation of casino duties, such as the approximately NZ$41.6 million accrued in prior periods for its Auckland casino, directly impacting its cost structure and net revenue. Furthermore, increased compliance costs related to anti-money laundering (AML) and host responsibility initiatives, estimated to be in the millions annually, also pressure margins, influencing what the company must earn from its priced services to maintain financial health. These regulatory burdens necessitate strategic adjustments to pricing models and operational efficiencies to offset rising expenses and safeguard returns.

- NZ Casino Duty Dispute: SKYCITY has faced disputes over casino duty calculations, impacting historical and current financial performance.

- AML Compliance Costs: Significant ongoing investments are required for anti-money laundering compliance, increasing operational overhead.

- Host Responsibility Programs: Mandatory host responsibility initiatives incur additional costs, influencing service pricing.

- Gaming Levies Impact: Various gaming taxes and levies directly reduce net revenue, affecting overall profitability margins.

Suspension of Dividends to Manage Financial Position

SKYCITY Entertainment Group has suspended dividend payments for fiscal years 2024 and 2025. This decision, driven by a challenging financial environment and significant capital expenditure, aims to preserve cash and maintain a robust financial position. While not a direct consumer price, this move reflects the company's cost pressures and investment priorities, impacting shareholder returns. SKYCITY anticipates resuming dividend payments in FY26 as part of its prudent financial management.

- Dividends suspended for FY24 and FY25.

- Decision driven by capital expenditure and financial environment.

- Aims to preserve cash and maintain financial position.

- Expected resumption of dividends in FY26.

SKYCITY employs dynamic pricing for hotels, adjusting rates based on 2024 demand, and maintains a competitive house edge in gaming, typically 0.5% to 15%. Its value-based strategy targets premium segments like the new Horizon hotel, operational late 2024 with 263 rooms, justifying higher rates. Online gaming offers, like a 100% match up to NZD$100 with 30x wagering, are competitively benchmarked. Regulatory costs, including a NZ$41.6 million casino duty dispute and ongoing AML compliance, significantly influence overall profitability.

| Category | Metric | 2024 Data/Status |

|---|---|---|

| Gaming Pricing | Typical House Edge Range | 0.5% to 15% |

| Online Gaming | Common Welcome Bonus (Example) | 100% match up to NZD$100 (30x wagering) |

| Hotel Pricing | Horizon by SKYCITY Rooms (Late 2024) | 263 premium rooms/suites |

| Regulatory Impact | NZ Casino Duty Dispute Accrued | NZ$41.6 million |

| Financial Health | Dividend Status | Suspended for FY24 & FY25 |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for SKYCITY Entertainment Group Ltd. is grounded in a comprehensive review of their official corporate communications, including annual reports, investor presentations, and press releases. We also incorporate data from their official websites, ticketing platforms, and relevant industry publications to capture their product offerings, pricing strategies, distribution channels, and promotional activities.