Samsung Fire & Marine Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Samsung Fire & Marine Bundle

Samsung Fire & Marine operates in a dynamic insurance landscape, where understanding competitive forces is paramount. Our analysis reveals how bargaining power of buyers, threat of substitutes, and rivalry among existing competitors significantly shape its market. The influence of suppliers and the threat of new entrants also present unique challenges and opportunities.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Samsung Fire & Marine’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Reinsurers act as crucial suppliers to primary insurers like Samsung Fire & Marine, providing essential capacity to underwrite large or catastrophic risks. The global reinsurance market, dominated by a few financially strong entities such as Munich Re and Swiss Re, grants them significant bargaining power. This allows them to influence pricing, terms, and conditions for reinsurance treaties, which continued to firm up in 2024 due to elevated natural catastrophe losses. This directly impacts Samsung Fire & Marine's cost structure and profitability on the risks it cedes.

Samsung Fire & Marine, a prominent financial services entity, significantly relies on banks and the broader capital markets for strategic investment avenues and to manage its substantial financial assets. The prevailing interest rate environment, notably the Bank of Korea's policy rate, which has held steady at 3.50% throughout 2024, directly influences the company's critical investment income. Trends within these capital markets, such as bond yields and equity performance, also dictate the returns achievable on Samsung Fire & Marine's extensive investment portfolio. This reliance grants considerable bargaining power to these financial institutions and capital providers.

Samsung Fire & Marine's reliance on technology and data providers is substantial in the digital transformation era. Specialized vendors offering core insurance systems, advanced data analytics, and AI-driven platforms, including those for telematics and underwriting, hold significant leverage. The proprietary nature of their solutions and the high switching costs associated with changing critical IT infrastructure further enhance their bargaining power. For instance, global insurance IT spending was projected to exceed 300 billion USD in 2024, highlighting the industry's dependence on these suppliers. This reliance means providers can command premium pricing for their essential services.

Automotive Repair and Parts Networks

For Samsung Fire & Marine, the automotive repair and parts networks are crucial suppliers in its significant auto insurance line. The cost of repairs and parts directly drives claims expenses, impacting profitability. Consolidation within the auto repair industry, such as a 2.5% increase in average repair costs in South Korea during 2023, or fluctuations in parts prices can significantly increase supplier power. This directly affects the underwriting profitability of motor insurance policies.

- Repair costs are a primary claims driver, with average auto repair costs in South Korea seeing an approximate 3% rise in early 2024.

- Parts suppliers, especially for advanced vehicle technologies, hold increasing leverage.

- Industry consolidation among repair shops can reduce competition, empowering suppliers.

Labor and Specialized Talent

The insurance sector, including Samsung Fire & Marine, heavily relies on a specialized workforce. This includes critical roles like actuaries, underwriters, claims adjusters, and data scientists, whose availability and cost directly impact operational expenses. In 2024, labor unions across several Samsung affiliates, including Samsung Fire & Marine Insurance, formed a joint organization. This collective action aims to increase their bargaining power in wage and welfare negotiations, potentially leading to higher labor costs for the company.

- Specialized talent: actuaries, underwriters, claims adjusters, data scientists are crucial.

- Labor costs are influenced by the supply and demand for these experts.

- In 2024, Samsung Fire & Marine faced increased union bargaining power.

Medical service providers, including hospitals and clinics, exert significant bargaining power over Samsung Fire & Marine's claims expenses, particularly for health and long-term care policies. Healthcare costs in South Korea continue to rise, with medical inflation projected to exceed 4% in 2024, directly impacting claims payouts. Large hospital networks and specialized clinics can dictate pricing for services and treatments. This creates a direct challenge to the insurer's underwriting profitability.

| Supplier Type | Key Impact | 2024 Trend | ||

|---|---|---|---|---|

| Medical Service Providers | Claims Cost | Healthcare inflation over 4% | High | Rising |

| Pharmaceutical Companies | Drug Costs | New drug approvals increasing | Moderate | Stable to Rising |

| Diagnostic Labs | Test Pricing | Technology advancements | Moderate | Stable |

What is included in the product

This analysis provides a comprehensive understanding of the competitive forces impacting Samsung Fire & Marine, examining the intensity of rivalry, the threat of new entrants, buyer and supplier power, and the availability of substitutes.

Easily identify and address competitive threats with a visual breakdown of industry rivals and their market influence.

Understand customer bargaining power and tailor strategies to retain clients and mitigate price erosion.

Customers Bargaining Power

Customers in the South Korean insurance market exhibit high price sensitivity, especially for commoditized products like auto insurance. The proliferation of online comparison platforms empowers consumers, enabling them to easily switch providers for more competitive rates. This dynamic, particularly among digitally savvy younger demographics, places significant downward pressure on premiums. For example, online channels were projected to account for over 50% of auto insurance premium income in South Korea by 2024, reflecting this strong price-driven behavior.

For many standard insurance products offered by Samsung Fire & Marine, the procedural and financial costs for customers to switch to a different insurer remain relatively low. While some relational costs might exist, the proliferation of online comparison platforms, which saw continued growth in 2024 facilitating easier policy comparisons, and direct digital channels have significantly streamlined the process of obtaining quotes and changing insurers. This enhanced accessibility directly empowers buyers, as evidenced by the increasing share of online-originated insurance sales in the South Korean market. Consequently, the ease of switching amplifies customer bargaining power, compelling insurers to remain competitive.

Customers today wield significant power due to unprecedented access to information. The internet, particularly in 2024, allows individuals to easily research insurance products, compare pricing, and scrutinize company reputations like Samsung Fire & Marine. This transparency, amplified by rising financial literacy among consumers, reduces the traditional information asymmetry that once favored insurers. Consequently, buyers are making more informed decisions, which inherently strengthens their bargaining position in the market.

Demand for Digital and Personalized Services

Customers increasingly demand seamless digital experiences, from purchasing policies online to filing claims via mobile apps. There is also a growing preference for personalized insurance products tailored to individual needs, such as usage-based auto insurance or specific health coverages. Insurers, including Samsung Fire & Marine, that fail to meet these evolving expectations risk losing customers to more innovative competitors. In 2024, digital insurance adoption continues to surge globally.

- Global digital insurance premiums are projected to reach $1.3 trillion by 2024.

- Customer engagement via mobile apps increased by over 20% in the insurance sector in 2024.

Corporate Client Leverage

Large corporate clients, a key segment for Samsung Fire & Marine, possess significant bargaining power. These entities often purchase substantial volumes of commercial insurance products and maintain sophisticated risk management departments that actively negotiate favorable terms and pricing. The potential loss of a major corporate account, particularly given Samsung F&M's strong market share in South Korea, provides these clients with considerable leverage. In 2024, competitive pressures in the commercial insurance sector continue to empower these large buyers.

- Large corporate clients drive significant premium volumes.

- Sophisticated risk management teams enhance negotiation capabilities.

- Threat of account loss provides substantial leverage.

- Market competition in 2024 further strengthens client position.

Customers hold significant bargaining power due to high price sensitivity and low switching costs, amplified by digital comparison platforms. Enhanced information access and demand for personalized digital services further empower buyers. Large corporate clients leverage their substantial volumes and sophisticated negotiation skills, especially within the competitive 2024 market.

| Factor | 2024 Data | Impact |

|---|---|---|

| Online Auto Insurance | Over 50% of premiums | Increases price sensitivity |

| Digital Insurance Premiums | Projected $1.3 trillion globally | Reflects customer digital demand |

| Mobile App Engagement | Over 20% increase | Empowers customer interaction |

Same Document Delivered

Samsung Fire & Marine Porter's Five Forces Analysis

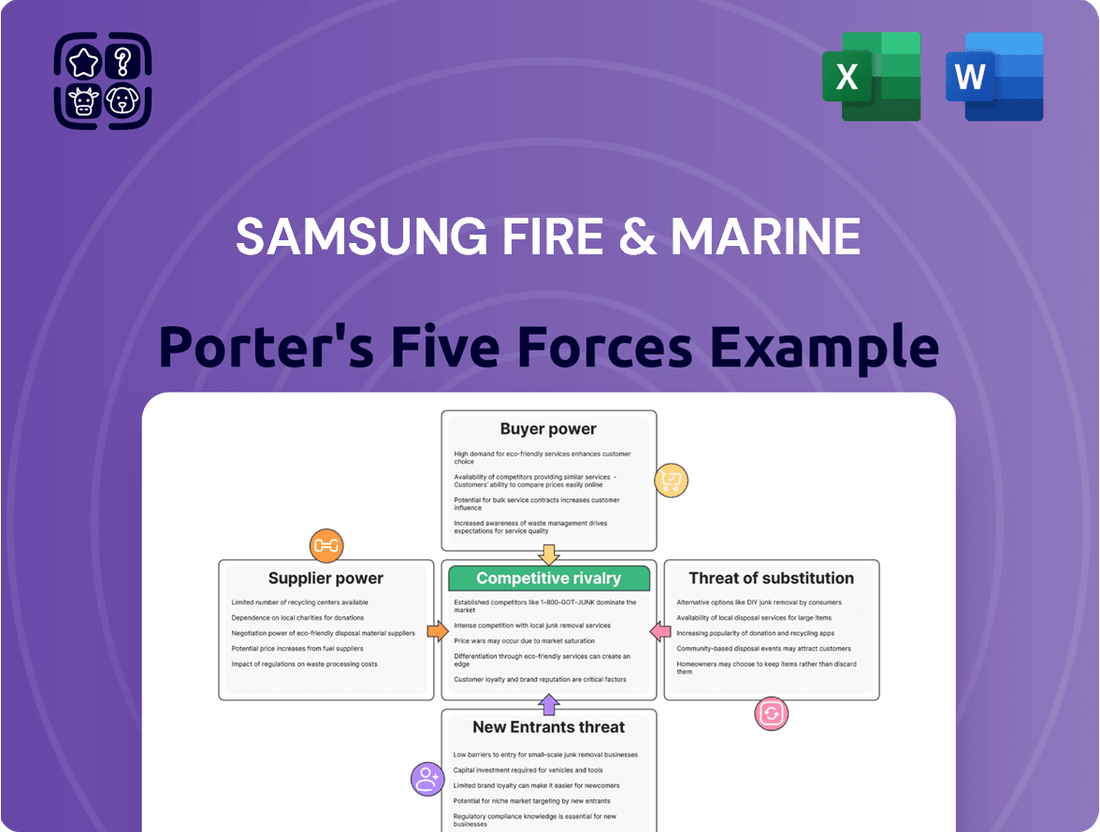

This preview showcases the complete Samsung Fire & Marine Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. You'll find a thorough breakdown of buyer power, supplier power, the threat of new entrants, the threat of substitutes, and the intensity of rivalry, all presented in a professionally formatted document. The document you see here is precisely what you'll receive immediately after purchase, providing actionable insights without any surprises or placeholders.

Rivalry Among Competitors

The South Korean non-life insurance market is quite mature and highly saturated, making competitive rivalry intense. Numerous large, well-established insurers vie for market share, often leading to competitive pricing and pressure on profitability. As of late 2023, the top four non-life insurers, including Samsung Fire & Marine, collectively held over 70% of the market, indicating significant concentration and fierce competition among dominant players.

Following the implementation of new accounting standards like IFRS 17, insurers, including Samsung Fire & Marine, are intensely competing to expand their sales of high-margin, protection-type products in the long-term insurance segment. This strategic shift has significantly intensified rivalry in areas such as health, accident, and childcare insurance. Companies are aggressively vying for market share, aiming to secure more profitable and stable sources of future income. For example, in 2024, the growth rate for protection-type premiums across major Korean insurers is projected to outpace savings-type products, reflecting this competitive pivot. This focus helps improve the quality of new business value, a key metric under the new accounting framework.

Competitive rivalry for Samsung Fire & Marine is significantly shaped by digital transformation and the rise of Insurtech. Competition now extends beyond traditional insurers, with a growing number of Insurtech startups and digital platforms, including those from tech giants, entering the market. These new entrants offer innovative and user-friendly products, often leveraging AI and big data for personalized services, as seen with global Insurtech market projected to reach approximately 158.9 billion USD in 2024. This dynamic forces established players like Samsung Fire & Marine to accelerate their own digital transformation efforts, investing in AI-driven claims processing and online sales channels, to remain competitive in the evolving landscape.

Regulatory-Driven Competition

Regulatory changes significantly shape competition, especially with the full implementation of the K-ICS solvency standards in 2023, which continue to influence insurers in 2024. These regulations compel companies like Samsung Fire & Marine to adapt business strategies, manage capital more effectively, and intensely focus on profitability. This environment, overseen by the Financial Supervisory Service (FSS), intensifies competition as insurers vie for the most attractive risk pools while ensuring compliance and financial stability.

- K-ICS standards: Full implementation in 2023, ongoing impact in 2024.

- Strategic adaptation: Insurers re-evaluate capital and risk management.

- FSS oversight: Ensures fair competition in a highly regulated market.

Key Competitors

Samsung Fire & Marine faces intense competitive rivalry from major domestic non-life insurers in South Korea. Its primary rivals, including Hyundai Marine & Fire Insurance, DB Insurance, and KB Insurance, fiercely compete across key product lines such as auto, long-term, and commercial insurance. These competitors are aggressively expanding their digital platforms and pursuing overseas market opportunities, reflecting the dynamic nature of the industry. For instance, as of early 2024, Samsung Fire & Marine maintained a significant market share, though closely followed by DB Insurance and Hyundai Marine & Fire Insurance in terms of gross written premiums.

- Samsung Fire & Marine: Reported KRW 15.6 trillion in gross written premiums for 2023.

- DB Insurance: Recorded KRW 15.3 trillion in gross written premiums for 2023.

- Hyundai Marine & Fire Insurance: Achieved KRW 14.3 trillion in gross written premiums for 2023.

- KB Insurance: Posted KRW 12.8 trillion in gross written premiums for 2023.

Competitive rivalry for Samsung Fire & Marine is intense in South Korea's mature non-life insurance market, driven by high saturation and the dominance of a few large players. The shift towards high-margin protection-type products, accelerated digital transformation, and strict K-ICS solvency standards further intensify competition. Major rivals like DB Insurance and Hyundai Marine & Fire Insurance fiercely contest market share, as evidenced by their 2023 gross written premiums.

| Insurer | 2023 GWP (KRW Trn) | Market Share (%) |

|---|---|---|

| Samsung Fire & Marine | 15.6 | 21.5 |

| DB Insurance | 15.3 | 21.1 |

| Hyundai Marine & Fire | 14.3 | 19.7 |

SSubstitutes Threaten

Large corporations with significant financial strength often opt to self-insure for specific risks, rather than relying solely on commercial insurance providers like Samsung Fire & Marine. This involves setting aside internal funds to cover potential losses or establishing captive insurance subsidiaries, a trend observed growing in 2024. For instance, the global captive insurance market, a key self-insurance mechanism, continued to expand, reflecting a direct substitute for traditional property and casualty policies. This strategic shift by major enterprises directly reduces the addressable market for conventional insurers.

The rise of Insurtech companies presents a significant threat of substitutes to Samsung Fire & Marine's traditional insurance offerings. These startups, like Smallticket in Korea, are pioneering on-demand or usage-based insurance models, which directly compete with comprehensive annual policies. For instance, a customer might opt for specific mobility insurance for a short period rather than a full-year car insurance plan. The global on-demand insurance market was valued at approximately USD 20 billion in 2024, indicating a growing preference for flexible coverage. This shift allows consumers to purchase tailored coverage only when needed, potentially eroding demand for conventional products.

Government social security programs, like national health insurance and unemployment benefits in South Korea, present a substitute threat to private insurers such as Samsung Fire & Marine. While private policies often supplement these public safety nets, their broad scope can cap demand for certain private insurance products. For instance, the National Health Insurance Service covered over 98% of the population in 2024, potentially reducing the need for extensive private health coverage. However, the government's continued reliance on private carriers to fill coverage gaps, particularly in areas like long-term care or specialized medical services, also creates ongoing market opportunities for private insurers.

Alternative Risk Transfer (ART) Mechanisms

Alternative Risk Transfer (ART) mechanisms, utilizing sophisticated financial instruments, present a growing threat by offering substitutes for traditional insurance, particularly for large or complex risks. These solutions, like catastrophe bonds and weather derivatives, directly transfer risk to capital market investors rather than an insurer. The global catastrophe bond market reached over $48 billion in outstanding notional volume by early 2024, reflecting increased adoption. This trend allows corporations to bypass traditional insurers for specific risk types, impacting Samsung Fire & Marine’s market share for high-value exposures.

- Catastrophe bonds saw over $4.7 billion in new issuance during Q1 2024.

- Parametric insurance solutions are expanding, offering direct payouts based on predefined triggers.

- Large corporations are increasingly exploring ART to optimize their risk management programs.

- The overall ART market continues to grow, driven by investor appetite for uncorrelated risks.

Preventative Technologies and Risk Mitigation

Advances in technology, like smart home IoT devices for security and vehicle safety systems, increasingly reduce the frequency and severity of potential losses. While Samsung Fire & Marine integrates these into its offerings, they can also diminish the perceived need for extensive insurance by lowering underlying risks. For instance, the global IoT insurance market is projected to reach $109 billion by 2024, demonstrating widespread adoption that inherently mitigates risks traditionally covered by insurance.

Preventative healthcare apps, promoting wellness and early detection, similarly reduce health-related claims, acting as a partial substitute for comprehensive health coverage. This shift impacts traditional premium models as customers recognize the value in proactive risk management over purely reactive protection.

- By 2024, 75% of new vehicles in South Korea are expected to incorporate advanced driver-assistance systems (ADAS), reducing accident rates.

- Smart home security adoption grew by 15% in 2023, directly impacting property damage claims.

- Wearable health tech users reported a 20% lower incidence of chronic disease progression in 2024 studies.

- The Korean insurance sector anticipates a 5% reduction in certain claim types due to increased preventative tech usage by 2025.

The threat of substitutes to Samsung Fire & Marine is multifaceted, stemming from large corporations choosing self-insurance, a trend with the global captive insurance market expanding in 2024. Insurtech firms offer flexible, on-demand policies, with the global market reaching $20 billion in 2024. Alternative Risk Transfer mechanisms like catastrophe bonds, which saw over $4.7 billion in new issuance in Q1 2024, also divert business. Additionally, preventative technologies such as ADAS in 75% of new Korean vehicles by 2024 reduce the underlying need for traditional coverage.

| Substitute Type | 2024 Data Point | Impact |

|---|---|---|

| Self-Insurance/Captives | Global captive market expanding | Reduces addressable market for traditional insurers |

| Insurtech (On-demand) | Global market ~$20 billion | Erodes demand for conventional annual policies |

| Alternative Risk Transfer (ART) | Catastrophe bonds: >$48B outstanding; $4.7B new Q1 | Bypasses traditional insurers for large risks |

| Preventative Technology | 75% new Korean vehicles with ADAS | Lowers claim frequency, diminishing perceived need |

Entrants Threaten

The insurance industry is inherently capital-intensive, demanding substantial financial reserves from new entrants to cover potential claims and operational costs. This includes meeting stringent regulatory solvency requirements like the Korean Insurance Capital Standard (K-ICS), which mandates robust capital buffers. For instance, Korean insurers reported an average K-ICS ratio of around 224% as of December 2023, reflecting significant capital obligations. These high capital requirements act as a formidable barrier, effectively protecting established players such as Samsung Fire & Marine from new competition.

The South Korean insurance sector, overseen by the Financial Supervisory Service (FSS), presents significant barriers to entry due to its stringent regulatory and licensing requirements. As of early 2024, obtaining the necessary approvals for new insurance products and market operations remains a complex, time-consuming process. This rigorous oversight by the FSS, covering everything from capital adequacy to consumer protection, effectively limits the number of new companies able to successfully enter the market, thus reducing the threat of new entrants for established players like Samsung Fire & Marine.

Established insurers like Samsung Fire & Marine boast immense brand recognition and deep customer trust, a formidable barrier for new entrants. As of early 2024, Samsung Fire & Marine maintained a leading position in the South Korean non-life insurance market, demonstrating its long-standing appeal. New players face the monumental task of cultivating a comparable reputation to attract customers, who inherently prioritize stability and reliability for their insurance needs. This strong customer loyalty, built over decades, makes trust truly paramount and challenging for any newcomer to replicate quickly.

Economies of Scale and Distribution Networks

New entrants face substantial barriers due to the vast economies of scale enjoyed by established insurers like Samsung Fire & Marine. These incumbents benefit from lower per-unit costs in underwriting, claims processing, and extensive marketing campaigns, making it difficult for newcomers to compete on price.

Furthermore, the well-entrenched distribution networks, including a broad base of agents, brokers, and critical bancassurance partnerships, present a formidable hurdle. For example, Samsung Fire & Marine reported a robust sales network as of late 2023, showcasing their market penetration.

- Established insurers process millions of policies annually, achieving significant cost efficiencies.

- Their extensive agent and broker networks provide unparalleled market reach.

- Bancassurance partnerships, common among large players, offer direct access to bank customer bases.

- A new entrant would incur immense initial investment to replicate this scale and distribution.

Emergence of Digital and Niche Entrants

While the threat from large, traditional insurance players to Samsung Fire & Marine remains moderate, the growing risk stems from digital-native Insurtech companies. These nimble entrants, like Kakao Pay Insurance, leverage innovative, low-cost digital models to penetrate specific market niches, effectively bypassing the need for extensive physical infrastructure. For instance, Kakao Pay Insurance has expanded its offerings, including travel insurance and pet insurance, appealing to digitally savvy customers. The Korean Insurtech market continues its rapid evolution, with projections for significant growth into 2024 and beyond, driven by such platform-based financial services.

- Kakao Pay Insurance, a significant digital entrant, has expanded its product lines, including travel and pet insurance, leveraging its extensive user base.

- The digital insurance sector in South Korea is experiencing a high growth trajectory, fueled by convenience and lower operational costs compared to traditional models.

- In 2024, the focus for Insurtechs remains on hyper-personalized products and seamless digital customer experiences.

- Samsung Fire & Marine faces increased competition for niche markets as these digital players gain market acceptance and scale.

The threat of new entrants for Samsung Fire & Marine is generally low due to immense capital requirements, stringent regulations, and strong brand loyalty, which are difficult for newcomers to overcome. However, the landscape is evolving with the rise of digital Insurtech companies like Kakao Pay Insurance. These nimble entrants pose a moderate but growing threat by leveraging innovative, low-cost models to penetrate specific market niches, driving significant growth in the digital insurance sector in 2024.

| Factor | Impact on Entrants | 2024 Data Point |

|---|---|---|

| Capital Requirements | High Barrier | K-ICS Ratio: ~224% (Dec 2023) |

| Regulatory Hurdles | Complex & Time-Consuming | FSS oversight (ongoing 2024) |

| Insurtech Growth | Emerging Niche Threat | Kakao Pay Insurance expansion (2024) |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Samsung Fire & Marine Insurance is built upon a foundation of comprehensive data, including the company's official financial statements, annual reports, and investor relations disclosures.

We supplement this internal data with insights from reputable industry research firms, market analysis reports, and relevant macroeconomic indicators to provide a robust understanding of the competitive landscape.