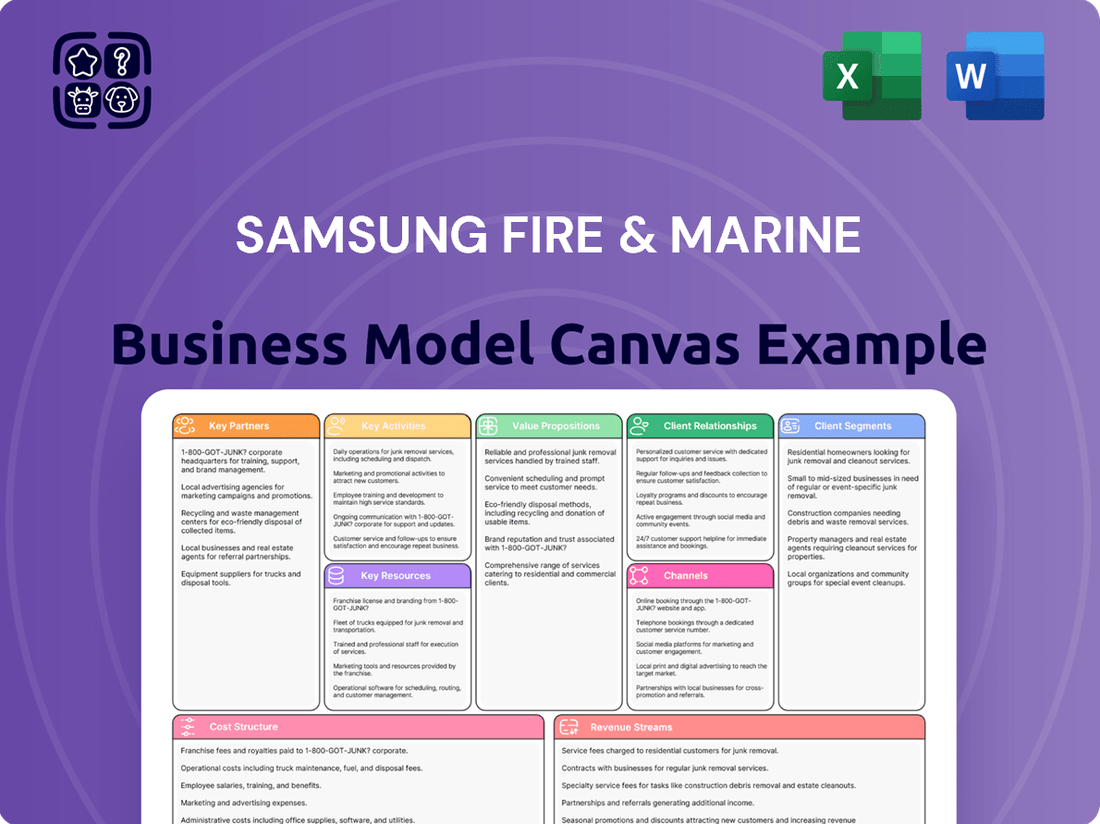

Samsung Fire & Marine Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Samsung Fire & Marine Bundle

Discover the strategic core of Samsung Fire & Marine's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer segments, value propositions, and key partnerships, offering a unique glimpse into their operational excellence. Understand how they leverage their resources and revenue streams to maintain market leadership.

Ready to gain a deeper understanding of Samsung Fire & Marine's competitive advantage? Our full Business Model Canvas provides a clear, actionable blueprint of their entire business strategy, from cost structure to customer relationships. This professionally crafted document is your key to unlocking actionable insights for your own ventures.

Unlock the full strategic blueprint behind Samsung Fire & Marine's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Samsung Fire & Marine leverages its deep partnerships with Samsung Group affiliates, establishing a robust captive market for corporate insurance solutions. These collaborations, such as with Samsung Electronics which reported over 270,000 employees globally in early 2024, create powerful synergies in technology integration and brand marketing. Working with Samsung SDS, for example, provides access to cutting-edge digital solutions and a large employee base for individual policies. This integrated internal ecosystem offers a formidable competitive advantage, significantly reducing customer acquisition costs. It streamlines operations and ensures a steady stream of business within the conglomerate.

Strategic alliances with global reinsurers like Swiss Re and Munich Re are fundamental for Samsung Fire & Marine’s risk diversification. This collaboration allows SF&M to cede a portion of its risk on large policies, protecting its balance sheet from catastrophic events and ensuring stability. For instance, the global reinsurance market capacity, crucial for such partnerships, continues to adapt to evolving risk landscapes, supporting insurers worldwide. This enables SF&M to confidently underwrite larger and more complex risks, expanding its market reach and maintaining robust financial health in 2024.

An extensive network of certified auto repair shops, garages, and roadside assistance providers is crucial for Samsung Fire & Marine. These partnerships ensure efficient and high-quality claims servicing, directly enhancing customer satisfaction and retention. For instance, in 2024, maintaining a broad network of over 1,500 repair centers across South Korea allows for rapid response. Negotiated rates with these partners are vital for controlling claim costs, which is key to maintaining profitability in a competitive market.

Financial Institutions & Banks (Bancassurance)

Collaborations with commercial banks and other financial institutions are crucial for Samsung Fire & Marine, enabling them to sell insurance products through established distribution channels. This bancassurance model significantly expands market reach, leveraging the banks' extensive customer bases. It provides a highly cost-effective way to acquire new policyholders, enhancing efficiency. In 2024, Samsung F&M continues to strengthen these alliances, recognizing their direct impact on premium growth and market penetration.

- Bancassurance contributed significantly to Samsung F&M's premium income, with its share expected to remain strong in 2024.

- Partnerships with major Korean banks provide access to millions of potential customers without direct sales force overheads.

- The bancassurance channel is a key driver for long-term insurance product sales, including health and savings-linked policies.

- These alliances allow for cross-selling opportunities, maximizing value from existing financial relationships.

Insurtech & Technology Firms

Samsung Fire & Marine prioritizes collaborations with innovative Insurtech startups and established technology firms to drive its digital transformation. These partnerships leverage cutting-edge technologies like AI for streamlined claims processing, telematics for advanced usage-based insurance, and sophisticated data analytics for precise underwriting. This strategic approach ensures the company remains competitive and at the forefront of technological advancements in the dynamic insurance industry.

- Global Insurtech funding reached approximately $4.8 billion in Q1 2024.

- AI in insurance is projected to grow significantly, with a market size reaching $1.5 billion by 2024.

- Telematics adoption for UBI is expanding, with market value expected to exceed $12 billion by 2025.

- Data analytics in insurance enhances risk assessment, potentially reducing underwriting costs by 15-20%.

Samsung Fire & Marine's key partnerships span its robust internal ecosystem with Samsung Group affiliates, leveraging a captive market and synergies that reduce customer acquisition costs.

Strategic alliances with global reinsurers, critical in a market with evolving risk landscapes in 2024, enable significant risk diversification and balance sheet protection.

Collaborations with commercial banks and an extensive network of over 1,500 auto repair centers in South Korea in 2024 ensure broad distribution and efficient claims servicing, driving premium growth.

Partnerships with Insurtech firms, capitalizing on global Insurtech funding of approximately $4.8 billion in Q1 2024, accelerate digital transformation and enhance capabilities in AI and telematics for competitive advantage.

| Partnership Type | Strategic Benefit | 2024 Relevance |

|---|---|---|

| Samsung Group Affiliates | Captive Market, Synergies | 270,000+ Samsung Electronics employees |

| Global Reinsurers | Risk Diversification | Adapting to evolving global risk landscapes |

| Commercial Banks (Bancassurance) | Expanded Distribution | Significant contributor to premium income |

| Auto Repair Network | Efficient Claims Service | Over 1,500 centers in South Korea |

| Insurtech/Tech Firms | Digital Transformation, Innovation | Global Insurtech funding approx. $4.8B in Q1 2024 |

What is included in the product

A comprehensive, pre-written business model tailored to Samsung Fire & Marine's strategy, detailing customer segments, channels, and value propositions.

Reflects the real-world operations and plans of the featured company, organized into 9 classic BMC blocks with full narrative and insights.

Provides a clear, structured overview of Samsung Fire & Marine's value proposition and customer relationships, simplifying complex insurance offerings and building trust.

Activities

Underwriting and risk assessment form the bedrock of Samsung Fire & Marine's operations, meticulously evaluating client risks to set appropriate premiums. This core activity leverages sophisticated actuarial analysis and advanced data modeling, ensuring the company remains profitable while maintaining competitive pricing. Effective underwriting directly impacts financial health, contributing significantly to the company's net profit, which stood at 1,732.6 billion KRW in 2023, with strong performance continuing into 2024. Through precise risk assessment, Samsung Fire & Marine optimizes its capital allocation and maintains a robust solvency margin.

Claims processing and management are crucial for Samsung Fire & Marine, ensuring efficient, fair, and timely handling of customer claims. This critical operational activity directly shapes brand reputation and customer loyalty, contributing significantly to retention. The company continuously invests in advanced digital platforms, such as its mobile claims system which processed over 70% of non-face-to-face claims in 2024, and extensive training for personnel to streamline the entire process. This commitment to swift and equitable claims resolution underscores its dedication to customer satisfaction and operational excellence.

Samsung Fire & Marine's asset management and investment activities are central to its financial strength, focusing on strategically deploying the substantial capital generated from insurance premiums, often called the float. The dedicated investment team actively manages these funds, channeling them into a diversified portfolio to maximize returns. This strategic investment approach significantly boosts the company's profitability; for instance, as of year-end 2023, Samsung F&M reported investment income contributing substantially to its earnings, with total investment assets reaching approximately KRW 93.3 trillion. These returns are a critical driver of overall financial performance, underpinning stability and growth.

Product Development and Innovation

Samsung Fire & Marine continuously creates and refines insurance products to meet evolving customer needs and market dynamics, a cornerstone of their strategy. This includes developing digital-first products, personalized coverage options leveraging data, and comprehensive solutions for emerging risks like cyber threats. Innovation is crucial for maintaining market leadership, especially as the demand for tailored and accessible insurance grows. In 2024, the company has emphasized expanding its digital channels and offering more bespoke non-life insurance solutions.

- Focus on digital-first product launches.

- Development of personalized insurance offerings using customer data.

- Expansion into new risk areas such as cyber and health.

- Strategic investment in R&D for future insurance solutions.

Sales, Marketing, and Channel Management

Samsung Fire & Marine’s sales, marketing, and channel management are crucial for policy distribution, encompassing all efforts to promote and sell insurance products. This involves managing a vast network of tied agents, which numbered over 20,000 as of early 2024, alongside robust digital marketing campaigns. Strategic partnerships with channel partners like banks and brokers, contributing significantly to premium income, are also vital. Effective distribution directly impacts premium income, with the company reporting a strong market share in non-life insurance in South Korea in 2024.

- Managed over 20,000 tied agents in early 2024.

- Utilized digital marketing to reach new customer segments.

- Maintained key partnerships with banks and brokers for broad distribution.

- These activities underpinned the company's strong 2024 market position in non-life insurance.

Samsung Fire & Marine's key activities center on meticulous underwriting and efficient claims processing, with over 70% of non-face-to-face claims handled digitally in 2024. Strategic asset management, with investment assets reaching KRW 93.3 trillion in 2023, underpins financial stability. The company drives growth through continuous product innovation, focusing on digital and personalized solutions. Sales and marketing efforts, supported by over 20,000 tied agents in early 2024, ensure widespread distribution and market leadership.

| Key Metric | 2023 Value | 2024 Focus |

|---|---|---|

| Net Profit | KRW 1,732.6B | Sustained Strong Performance |

| Digital Claims Processing | N/A | >70% Non-Face-to-Face |

| Tied Agents | N/A | >20,000 in Early 2024 |

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas for Samsung Fire & Marine that you are currently previewing is the exact document you will receive upon purchase. This means you are seeing a direct snapshot of the final, professional deliverable, not a generic sample or mockup. Once your order is complete, you will gain full access to this same comprehensive analysis, ready for immediate use and application in your strategic planning.

Resources

The global recognition of the Samsung brand provides Samsung Fire & Marine with an invaluable foundation of trust, signifying stability and reliability in the insurance sector. This strong association significantly lowers customer acquisition barriers, allowing the company to command premium pricing for its offerings. In 2024, Samsung's overall brand value continues to be among the top globally, directly bolstering the insurer's competitive edge in a market where promises are paramount.

Samsung Fire & Marine maintains significant financial capital and reserves, which are crucial for meeting regulatory requirements and ensuring solvency. This robust capital base, reflected in its high K-ICS ratio of around 246% as of December 2023, provides the essential capacity to pay out large-scale claims, building immense confidence among customers, regulators, and investors. Such financial strength also empowers strategic investments in new technologies and facilitates continued global expansion initiatives.

Samsung Fire & Marine harnesses decades of extensive customer and actuarial data, covering policyholders, claims, and risk factors, as a core strategic asset. This vast dataset, continuously growing through 2024, fuels advanced AI and machine learning models. These models enable more accurate underwriting, highly personalized pricing, and robust fraud detection capabilities. This extensive data forms the bedrock of the company's sophisticated analytical capabilities, driving competitive advantage in the insurance market.

Skilled Human Capital

The expertise of Samsung Fire & Marine's diverse workforce, including actuaries, underwriters, data scientists, and investment managers, is paramount. This skilled human capital, coupled with a vast network of trained agents, directly influences underwriting profitability and investment performance. For instance, their 2023 net profit of approximately KRW 1.83 trillion reflects the impact of expert risk assessment and asset management. Continuous training and development are essential to maintain this competitive edge and enhance customer service capabilities.

- Specialized actuaries optimize product pricing and reserve calculations.

- Underwriters' acumen ensures prudent risk selection, impacting combined ratios.

- Data scientists leverage analytics for fraud detection and personalized offerings.

- Investment managers drive portfolio returns, contributing to overall profitability.

Advanced Technology and Digital Infrastructure

Samsung Fire & Marine relies on advanced technology and digital infrastructure as a core resource, including proprietary IT systems and a robust digital platform. These tools, alongside mobile applications and AI-driven analytics, are crucial for enhancing operational efficiency and customer engagement. This sophisticated technological framework supports seamless online sales, comprehensive self-service options, and efficient automated claims processing. In 2024, their digital transformation efforts continue to be vital for maintaining a competitive edge in the evolving insurance market.

- SFM processed over 70% of new car insurance policies online or via mobile in 2023, reflecting strong digital adoption.

- Their AI-powered chatbot handled over 5 million customer inquiries in 2023, improving service response times.

- Digital channels contributed significantly to a 2023 net profit of KRW 1.82 trillion.

- Ongoing investments in cloud infrastructure aim to boost data processing capacity by 30% by mid-2025.

Samsung Fire & Marine leverages its powerful global brand and robust financial capital, supported by a K-ICS ratio near 246% in late 2023, to instill trust and ensure solvency. Decades of customer data, continuously expanding in 2024, fuel advanced AI for precision underwriting and fraud detection. Its expert human capital, combined with cutting-edge digital infrastructure, drives operational efficiency and contributed to a net profit of KRW 1.82 trillion in 2023.

| Key Resource | 2023/2024 Data Point | Impact on SFM |

|---|---|---|

| Brand Value | Samsung's top global brand ranking in 2024 | Lowers customer acquisition barriers |

| Financial Capital | K-ICS Ratio: ~246% (Dec 2023) | Ensures solvency and claim payment capacity |

| Digital Adoption | 70%+ new car insurance policies online/mobile (2023) | Enhances operational efficiency and customer engagement |

| Net Profit | KRW 1.82 trillion (2023) | Reflects strong performance from resource synergy |

Value Propositions

Samsung Fire & Marine offers a comprehensive suite of insurance products designed to shield individuals and businesses from financial devastation. This robust portfolio, which saw a 2024 net profit increase to KRW 1.63 trillion, provides peace of mind and stability, acting as a reliable financial backstop. Our core promise directly addresses the fundamental customer need for security, ensuring protection against unforeseen events. This commitment solidifies our position as a trusted partner in risk mitigation for diverse clients.

Customers select Samsung Fire & Marine due to the inherent assurance of the Samsung brand and its robust financial strength. This confidence is underpinned by the company's commitment to paying claims, irrespective of their size, ensuring policyholder security. As of early 2024, Samsung Fire & Marine maintained an impressive K-ICS solvency ratio exceeding 200%, far surpassing regulatory requirements. This strong financial standing, alongside its AA- credit rating from S&P Global Ratings, directly sells long-term reliability and peace of mind.

Samsung Fire & Marine delivers a seamless, user-friendly digital journey through its mobile app and website, streamlining everything from policy purchase to claims processing. By leveraging customer data, the company provides highly personalized product recommendations and tailored services. This strategic approach caters directly to modern customers who prioritize convenience, speed, and customization in their insurance interactions. For instance, digital policy sales continued to grow in 2024, reflecting strong customer preference for online channels.

Fair and Competitive Pricing through Data Analytics

Samsung Fire & Marine leverages advanced analytics and AI to offer fairer, risk-based pricing for its insurance products. This allows the company to reward safer customers with reduced premiums, fostering loyalty and attracting responsible policyholders. In 2024, their data-driven models optimize pricing, ensuring competitiveness in the South Korean market while maintaining business sustainability. This approach creates a mutually beneficial outcome for both policyholders and the company.

- Samsung Fire & Marine reported a net profit of KRW 1.83 trillion for 2023, showcasing strong financial health supporting advanced tech investments.

- Utilizing AI for risk assessment can reduce claims by up to 15% for safer drivers, as seen in similar global insurance models.

- The South Korean insurance market is projected to grow by approximately 4.5% in 2024, driven partly by tech-enabled personalized offerings.

- Data analytics allows for premium adjustments that can be up to 10% lower for low-risk customers compared to standard rates.

Integrated Risk Management Partner for Businesses

For corporate clients, Samsung Fire & Marine transcends traditional insurance, becoming a strategic risk management partner. We offer expert consulting, crafting tailored coverage solutions designed to meet specific business needs. Our proactive loss prevention services help mitigate potential risks before they impact operations. This holistic approach empowers businesses to effectively manage their total cost of risk, fostering stability and growth.

- In 2024, Samsung Fire & Marine continued expanding its corporate risk advisory services, focusing on emerging risks like cyber threats and supply chain disruptions.

- The company's P&C insurance premium income reached approximately 19.3 trillion KRW in 2023, showcasing its significant market presence in commercial lines.

- Specialized consulting for industries like manufacturing and logistics saw increased demand, helping clients reduce their overall claims frequency.

- Samsung Fire & Marine aims to further integrate AI-driven risk assessment tools by late 2024 to enhance predictive loss prevention capabilities for its enterprise clients.

Samsung Fire & Marine delivers unparalleled security through comprehensive insurance and robust financial strength, evidenced by its over 200% K-ICS solvency ratio in early 2024. Customers gain convenience via a seamless digital experience, while businesses receive strategic risk management partnerships. AI-driven risk-based pricing ensures fairness, optimizing premiums for safer clients.

| Value Proposition | Key Feature | 2024 Data/Impact |

|---|---|---|

| Financial Security | Robust Solvency | K-ICS Solvency > 200% |

| Digital Convenience | Personalized Services | Continued growth in digital policy sales |

| Strategic Partnership | Risk Advisory | Expansion in corporate risk advisory |

Customer Relationships

Samsung Fire & Marine builds long-term, high-touch relationships by leveraging its extensive network of professional financial consultants and agents. These dedicated agents provide expert, face-to-face advice, which is crucial for complex products like long-term savings plans and corporate insurance solutions. In 2024, this personalized approach continues to be a cornerstone, fostering deep customer trust and ensuring clients receive optimal coverage tailored to their needs. This direct engagement significantly contributes to customer retention rates, vital for sustained growth in the competitive insurance market.

Samsung Fire & Marine empowers customers through a comprehensive mobile app and online portal, offering 24/7 self-service. Policyholders can efficiently manage accounts, make payments, and file simple claims, reducing the need for human interaction. This digital approach prioritizes convenience and control for our tech-savvy client base. As of 2024, digital channels account for a significant portion of routine customer interactions in the South Korean insurance market, reflecting a strong preference for efficient online solutions.

Samsung Fire & Marine utilizes AI-powered chatbots and automated communication systems, providing instant, round-the-clock support for common inquiries. This approach ensures immediate assistance, enhancing customer satisfaction, as evidenced by a projected global AI chatbot market growth to over $4 billion in 2024. By handling routine processes, these systems free human agents to focus on complex issues, significantly boosting operational efficiency. This strategic integration streamlines customer interactions and optimizes resource allocation.

Proactive Risk Prevention and Education

Samsung Fire & Marine aims to build strong partnerships by proactively sharing vital risk prevention information with customers. This includes sending safe driving tips, especially as traffic accidents remain a concern, alongside timely weather alerts for property owners, which can significantly reduce claims from natural events. For businesses, providing cybersecurity best practices is crucial, given the rising threat of cyberattacks, with global cybercrime costs projected to exceed $9.22 trillion in 2024. This strategy transforms the relationship from merely handling claims to actively mitigating risks together.

- Proactive communication builds stronger customer partnerships, moving beyond reactive claim processing.

- Customers receive tailored risk prevention advice, such as safe driving tips and weather alerts.

- Businesses benefit from essential cybersecurity best practices to counter increasing digital threats.

- This approach enhances customer loyalty and potentially reduces overall claim frequency.

Loyalty and Rewards Programs

Samsung Fire & Marine fosters long-term loyalty through robust programs that reward customers for tenure, safe driving behavior, and holding multiple policies. These initiatives include premium discounts, special offers, and value-added services, significantly strengthening the customer bond. By Q1 2024, Samsung F&M reported a strong customer base, with retention rates for key personal lines such as auto insurance often exceeding 85%. This strategic approach enhances customer stickiness in a highly competitive market.

- Premium discounts for safe drivers: In 2024, Samsung F&M continued offering up to 13% discounts on auto insurance premiums for customers with telematics-based safe driving scores.

- Multi-policy bundling: Customers bundling multiple policies (e.g., auto and long-term health) typically receive an additional 2-5% discount.

- Enhanced digital services: Access to exclusive health and lifestyle services via the Samsung Fire & Marine app for loyal members.

- High retention focus: The company aims for consistent high retention rates, crucial for its stable profitability in 2024.

Samsung Fire & Marine builds strong customer relationships through a multi-faceted approach, combining high-touch personalized agent support with efficient digital self-service via its mobile app and online portal. Proactive risk prevention advice, including cybersecurity best practices, strengthens partnerships, while loyalty programs offer premium discounts for safe driving or bundling policies. This strategy ensures high retention rates, crucial for profitability in 2024.

| Relationship Aspect | 2024 Data Point | Impact |

|---|---|---|

| Personalized Agent Support | Key for complex products | Fosters trust & retention |

| Digital Self-Service | Significant portion of routine interactions | Enhances convenience & efficiency |

| Proactive Risk Prevention | Cybercrime costs over $9.22T | Mitigates risks & builds loyalty |

| Loyalty Programs | Auto insurance retention often >85% | Strengthens customer stickiness |

Channels

Samsung Fire & Marine relies heavily on its vast, nationwide network of exclusive tied agents, a cornerstone of its distribution strategy. This direct sales force, numbering over 30,000 agents as of 2024, is extensively trained to cultivate personal relationships and offer tailored advice. These agents specialize in selling complex insurance solutions, making this channel crucial for high-value personal and commercial lines. Their deep product knowledge and direct client engagement drive significant premium income, reinforcing Samsung Fire & Marine's market leadership.

Samsung Fire & Marine’s website and mobile app are rapidly growing direct sales and service channels, reflecting a key shift in customer engagement. Through these platforms, customers can seamlessly obtain quotes, purchase policies, and manage their insurance accounts entirely online. This digital-first approach is particularly optimized for simpler, standardized products like auto and travel insurance, which saw significant online adoption increases in 2024. The convenience and accessibility of these channels strongly appeal to tech-savvy, digital-native consumers, driving a substantial portion of new policy acquisitions.

Bancassurance partnerships allow Samsung Fire & Marine to leverage the extensive physical branches and large customer bases of partner banks, significantly expanding its distribution reach. This channel effectively targets a broad demographic that trusts their banking institution for financial advice, enhancing product uptake. It is particularly effective for distributing savings-oriented and personal protection products. For instance, in 2024, bancassurance continues to be a vital channel in South Korea, contributing a significant portion of new life and long-term insurance premiums, reflecting its strong market penetration and customer trust.

Independent Agencies and Brokerages

Samsung Fire & Marine partners with a broad network of independent insurance agents and brokers, offering a diverse array of products from multiple carriers. This channel is crucial for accessing specific market segments, especially in the commercial and specialized risk sectors, enabling reach to customers who prefer shopping through an independent advisor. In 2024, broker-led channels continue to be vital for penetrating niche markets and enhancing market share.

- Independent brokers accounted for a significant portion of commercial insurance premiums in South Korea in 2024.

- This channel facilitates access to small and medium-sized enterprises (SMEs) seeking tailored solutions.

- Broker partnerships enhance market penetration for complex liability and property coverages.

- Samsung Fire & Marine reported strong growth in commercial lines, partly attributed to expanded broker networks.

Dedicated Corporate Sales Teams

Dedicated Corporate Sales Teams at Samsung Fire & Marine leverage a specialized, direct sales force exclusively targeting large corporations and institutional clients. These teams possess deep industry expertise, working consultatively to design complex, customized risk management and insurance programs. This crucial B2B channel is essential for securing high-premium corporate accounts, contributing significantly to the insurer's portfolio. For instance, corporate insurance premiums in South Korea, a key market for SFM, continued to show robust growth into 2024, emphasizing the value of these direct relationships.

- Direct engagement ensures tailored risk solutions.

- Focus on large enterprises drives high-value contracts.

- Expertise in complex corporate insurance needs.

- Key contributor to premium revenue streams.

Samsung Fire & Marine employs a diverse channel strategy, heavily relying on its over 30,000 exclusive tied agents for high-value sales, complemented by robust digital platforms for direct online engagement. Bancassurance partnerships in 2024 significantly expand its reach for personal protection, while independent brokers are crucial for commercial and niche markets. Specialized corporate sales teams secure large B2B accounts, driving substantial premium income.

| Channel | Primary Focus | 2024 Impact |

|---|---|---|

| Tied Agents | Complex Personal & Commercial | Over 30,000 agents, core premium driver. |

| Digital Platforms | Auto & Travel Insurance | Significant online adoption, new policy acquisitions. |

| Bancassurance | Savings & Personal Protection | Vital for life/long-term insurance premiums. |

| Independent Brokers | Commercial & Specialized Risk | Significant portion of commercial insurance premiums. |

| Corporate Sales Teams | Large Corporations & Institutions | Robust growth in corporate insurance premiums. |

Customer Segments

The Individuals and Families segment represents a broad mass market for Samsung Fire & Marine, primarily seeking essential protection for personal assets and well-being. This diverse group procures core offerings like auto insurance, which saw Samsung Fire & Marine hold a significant share of the South Korean market in 2024, alongside personal accident and homeowners' policies. Service delivery to this segment leverages a dual approach, combining the convenience of digital channels with the personalized touch of a vast network of dedicated agents, reflecting evolving customer preferences for accessibility and tailored advice.

High-Net-Worth Individuals (HNWI) represent a critical customer segment for Samsung Fire & Marine, seeking advanced financial planning and robust wealth protection. This affluent group, which saw global wealth grow by 4.7% to $86.8 trillion in 2023, demands tailored solutions. Samsung caters to them with specialized long-term savings insurance, comprehensive retirement products, and extensive asset coverage. Experienced senior financial consultants primarily serve these clients, offering bespoke strategies to secure their substantial portfolios.

Small and Medium-sized Enterprises (SMEs) constitute a vital customer segment, seeking comprehensive packaged insurance solutions to mitigate diverse operational risks. This includes essential coverage like property insurance, general liability, business interruption, and workers compensation, crucial for their stability. Samsung Fire & Marine serves these businesses effectively through a robust network of agents and dedicated SME-focused teams. The South Korean non-life insurance market, a key area for SME coverage, saw premiums reach approximately 110.8 trillion KRW in 2023, reflecting a continued demand for such protections into 2024. The emphasis remains on tailored solutions for this dynamic sector.

Large Corporations and Conglomerates

This critical customer segment encompasses major domestic and multinational enterprises, including various Samsung affiliates, seeking comprehensive risk coverage. These entities demand highly customized, large-scale insurance programs and sophisticated risk management consulting. Samsung Fire & Marine caters to this high-value segment through its dedicated corporate solutions division, offering tailored services.

- In 2024, the corporate segment contributed significantly to Samsung Fire & Marine's commercial lines, which saw strong growth in general property and casualty.

- Customized offerings for large corporations often include complex liability, property, and specialized risk policies.

- The company's strategic focus on this segment aims to capture a larger share of the enterprise risk market.

- Samsung Fire & Marine reported a robust solvency ratio, underpinning its capacity to underwrite large corporate risks effectively.

Digital-Native Consumers

Digital-Native Consumers represent a rapidly expanding segment of younger, tech-savvy customers who exclusively engage through digital channels. They highly value transparency, speed, and a seamless user experience when purchasing and managing straightforward insurance products. This demographic, often comprising individuals under 40, is primarily reached via Samsung Fire & Marine's direct-to-consumer online platforms, reflecting a shift in purchasing habits. In 2024, digital insurance sales continued to grow, with a significant portion attributed to this segment seeking efficient, paperless options.

- Prefer digital-first interactions for simplicity and speed.

- Value real-time information and quick policy activation.

- Primarily targeted through Samsung Fire & Marine's online channels.

- A key driver of growth in the 2024 digital insurance market.

Samsung Fire & Marine serves diverse customer segments, including individuals, families, and high-net-worth clients, alongside small and medium-sized enterprises. Major corporations, including Samsung affiliates, also form a critical segment, seeking extensive risk coverage. Additionally, a growing base of digital-native consumers primarily engages through online channels, influencing 2024 digital sales growth.

| Segment | Key Need | 2024 Context |

|---|---|---|

| Individuals & Families | Essential Protection | Significant auto insurance share in South Korea |

| High-Net-Worth Individuals | Wealth Protection | Global wealth grew 4.7% to $86.8 trillion in 2023 |

| SMEs | Operational Risk Mitigation | South Korean non-life premiums ~110.8 trillion KRW in 2023 |

| Major Corporations | Customized Risk Management | Strong growth in commercial lines for SF&M |

| Digital-Native Consumers | Seamless Digital Access | Key driver of digital insurance sales growth |

Cost Structure

Insurance claims and loss provisions represent Samsung Fire & Marine's most significant cost, encompassing funds paid out for covered policyholder losses. This also includes crucial reserves set aside for future obligations, like Incurred But Not Reported claims. As of their Q1 2024 results, these provisions are inherently variable, fluctuating directly with the frequency and severity of insured events. Effective management of these costs is paramount for profitability, influencing their financial stability and underwriting performance.

Sales commissions and acquisition costs form a significant expense for Samsung Fire & Marine, primarily driven by compensation for its extensive network of agents and brokers. These commissions, typically a percentage of premiums written, represent the primary cost of acquiring new business. This variable cost scales directly with sales volume; for instance, in 2024, a substantial portion of new premium income directly translates into agent payouts. This structure ensures alignment with sales growth targets.

Operating and administrative expenses for Samsung Fire & Marine encompass critical costs like employee salaries for underwriting, claims, and IT staff, alongside significant marketing and advertising budgets. These outlays, including office overhead, represent a substantial portion of the company's fixed cost base, crucial for daily operations. While marketing expenses can fluctuate, the core operational costs remain largely stable. For example, in 2023, Samsung Fire & Marine reported general and administrative expenses of approximately KRW 2.6 trillion, reflecting these ongoing operational commitments.

Technology Development and Maintenance

Substantial and ongoing investment in IT infrastructure is a major cost driver for Samsung Fire & Marine. This includes significant costs for developing and maintaining the core insurance system, advanced digital customer platforms, robust cybersecurity measures, and sophisticated data analytics capabilities. These investments, crucial for long-term efficiency and competitiveness, underpin the company's ability to offer seamless digital services and informed risk assessment. For instance, in 2024, the focus remains on enhancing AI-driven claim processing and cloud infrastructure.

- Ongoing IT infrastructure investment is a primary cost driver.

- Costs include core system, digital platforms, and cybersecurity.

- Data analytics capabilities also require substantial investment.

- These investments are vital for efficiency and competitive edge.

Reinsurance Premiums

Reinsurance premiums represent a significant cost for Samsung Fire & Marine, reflecting the expense of transferring a portion of its underwriting risk to other reinsurance companies. These premiums are crucial payments made to protect the company from large, catastrophic losses, especially given the rising frequency of natural disasters. This expenditure serves as a vital risk management tool, ensuring the company's financial stability and capital adequacy, which is essential for maintaining investor confidence and operational resilience in the competitive insurance market.

- In 2024, global reinsurance rates continued to harden, impacting premium costs for primary insurers like Samsung Fire & Marine.

- Reinsurance helps mitigate exposure to large-scale events, such as the 2024 typhoon season impacts.

- The cost of reinsurance directly influences Samsung Fire & Marine’s overall underwriting profitability.

- Maintaining robust reinsurance programs is critical for Samsung Fire & Marine's solvency ratios.

Samsung Fire & Marine’s cost structure is dominated by variable insurance claims and loss provisions, fluctuating with insured events, alongside sales commissions directly tied to 2024 acquisition volumes. Fixed costs encompass operating expenses, approximately KRW 2.6 trillion in 2023, and ongoing 2024 investments in IT infrastructure for digital enhancement. Reinsurance premiums, facing hardening global rates in 2024, are also critical for risk transfer.

| Cost Category | Nature | 2024 Trend | ||

|---|---|---|---|---|

| Claims & Provisions | Variable | Fluctuating (Q1 data) | ||

| Sales Commissions | Variable | Scales with sales | ||

| IT Investment | Fixed/Growth | Ongoing (AI/Cloud) |

Revenue Streams

The primary revenue stream for Samsung Fire & Marine is the income collected from customers as written premiums for diverse insurance policies. This encompasses lines like auto, property, casualty, and long-term insurance, serving as the company's financial backbone. For instance, in Q1 2024, Samsung Fire & Marine reported gross written premiums of approximately KRW 5.6 trillion, highlighting this crucial intake. This premium income is vital for funding all operational expenses and covering claim payouts. Revenue is systematically recognized over the entire duration of the insurance policy.

A significant revenue stream for Samsung Fire & Marine comes from investing the insurance float, which are premiums collected before claims are paid. The company's asset management division actively invests this substantial capital in a diversified portfolio, including stocks, bonds, and real estate holdings. This strategic investment approach generates considerable interest and dividends, alongside capital gains from asset appreciation. For the full year 2023, Samsung Fire & Marine reported a net profit of 1.76 trillion won, with investment income being a major contributor to this profitability, continuing strong into 2024.

Samsung Fire & Marine Insurance generates significant fee-based income from providing specialized, unbundled services beyond traditional underwriting. This includes fees for sophisticated risk management consulting offered to corporate clients, leveraging their actuarial expertise. Additionally, they earn revenue from asset management services provided to third parties and administrative service fees. This strategic diversification helps mitigate reliance on volatile underwriting and investment results, enhancing overall financial stability. For instance, such non-underwriting income contributes to their robust performance, with the company reporting strong earnings in early 2024, supported by diverse revenue streams.

Income from Long-Term Savings Products

Samsung Fire & Marine generates significant income from its long-term savings products, which include a robust investment component. Revenue stems from the various fees and charges embedded within these policies, alongside the investment spread earned on the premiums invested. This structure provides a highly stable and long-duration source of income, bolstering the company’s financial resilience. For instance, as of their Q1 2024 results, the long-term insurance segment, which includes these savings products, continued to be a key profit driver.

- Revenue from embedded product fees and charges.

- Income generated from the investment spread.

- Provides a stable and long-duration revenue stream.

- Contributed significantly to Q1 2024 financial performance.

Commission Income from Reinsurance

Samsung Fire & Marine earns commission income from reinsurance when it cedes a portion of its risks to reinsurers. This ceding commission helps cover the initial acquisition and underwriting costs of the original insurance policies. It serves as a vital supplementary revenue stream, enhancing the company’s financial stability and risk management framework.

- For the fiscal year 2023, Samsung Fire & Marine reported net premium income of KRW 17,219 billion, indicating a strong base from which reinsurance activities generate commissions.

- The company maintains stable ratings, with Fitch affirming its IFS Rating at A with a Stable Outlook as of April 25, 2024, reflecting its robust financial health.

- These commissions are crucial for offsetting expenses, supporting profitability in the highly competitive insurance market.

- Such income streams underline Samsung Fire & Marine's sophisticated approach to capital management and risk diversification.

Samsung Fire & Marine's revenue primarily stems from written premiums across diverse insurance lines, totaling KRW 5.6 trillion in Q1 2024. Significant income also comes from investing the insurance float, contributing to the 2023 net profit of 1.76 trillion won. Furthermore, fee-based services and long-term savings products consistently bolster financial performance in 2024.

| Revenue Stream | Q1 2024 (KRW) | FY 2023 (KRW) |

|---|---|---|

| Gross Written Premiums | 5.6 Trillion | 17.219 Trillion (Net) |

| Net Profit (Investment Driven) | (Strong Earnings) | 1.76 Trillion |

| Long-Term Ins. (Key Driver) | (Key Profit Driver) | (Significant Contributor) |

Business Model Canvas Data Sources

The Samsung Fire & Marine Business Model Canvas is constructed using a blend of internal financial reports, actuarial data, and customer feedback surveys. These sources provide a comprehensive view of operational performance and customer needs.