ServiceTitan Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ServiceTitan Bundle

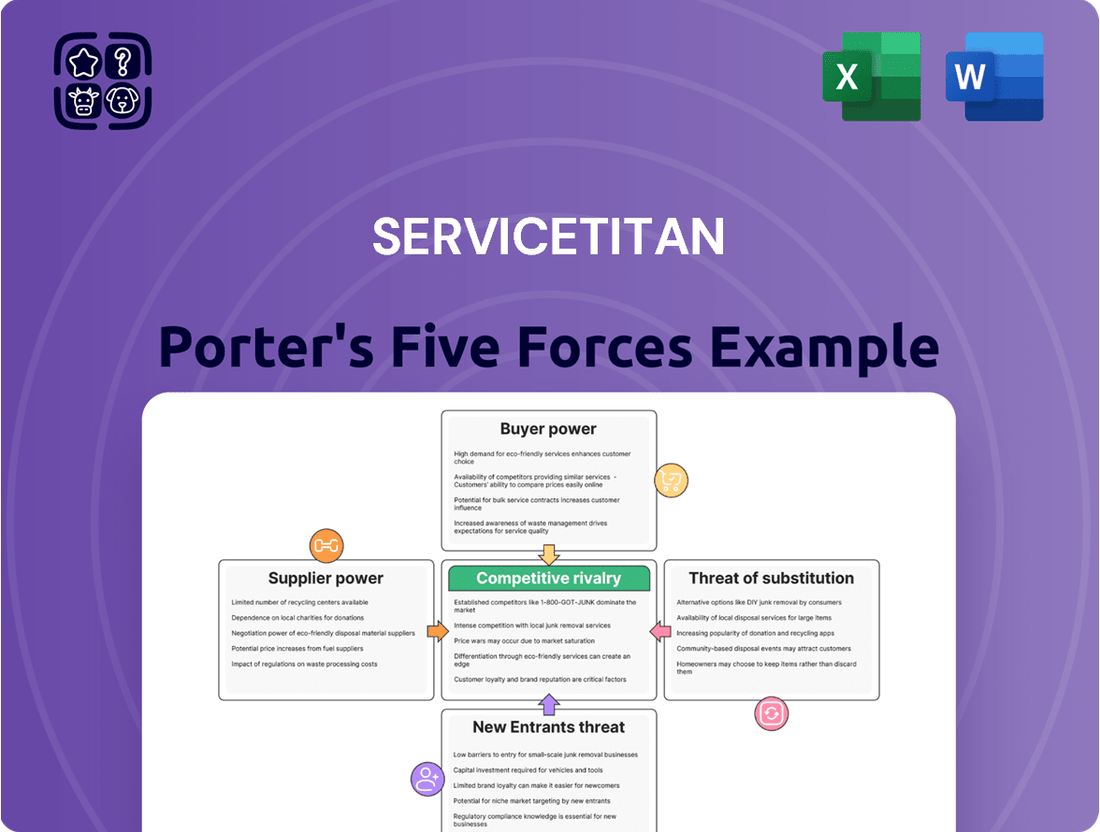

ServiceTitan operates in a dynamic market influenced by several key forces, as revealed by a Porter's Five Forces analysis. Understanding the bargaining power of buyers and the threat of substitutes is crucial for navigating this landscape. The intensity of rivalry among existing competitors and the bargaining power of suppliers also significantly shape ServiceTitan's strategic options. Furthermore, the threat of new entrants can disrupt market equilibrium.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore ServiceTitan’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

ServiceTitan's reliance on major cloud infrastructure providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform grants these suppliers considerable bargaining power. The highly concentrated nature of the cloud infrastructure market, with these few dominant players, means ServiceTitan has limited alternatives for its core operations.

The essential nature of these services for a large-scale software platform like ServiceTitan, coupled with the substantial switching costs involved in migrating data and applications, further bolsters the suppliers' leverage. For instance, in 2024, cloud computing spending globally was projected to reach over $600 billion, illustrating the immense scale and investment required to operate on these platforms, making unilateral shifts extremely challenging and costly.

ServiceTitan relies on specialized third-party software components and integrations, such as payment gateways or unique API connections. If these specialized components are critical to ServiceTitan's core functionality and lack readily available alternatives, these suppliers can wield significant bargaining power. For instance, a unique integration that streamlines a complex workflow for ServiceTitan’s users might command higher pricing or more favorable terms due to its indispensability.

The availability of top-tier software engineers, data scientists, and product managers is absolutely vital for ServiceTitan's ability to innovate and expand. These skilled individuals are the engine behind new features and platform improvements.

When the market for these specialized tech roles becomes highly competitive, the bargaining power of these professionals naturally increases. This can translate into higher salary expectations and more significant hurdles for companies like ServiceTitan to overcome during the hiring process.

In 2024, the demand for AI and machine learning specialists, crucial for ServiceTitan's data analytics capabilities, saw average salaries climb. For instance, senior AI engineers in major tech hubs could command packages exceeding $200,000 annually, reflecting the intense competition for this talent.

This elevated bargaining power of suppliers, in this case, the skilled talent pool, directly impacts ServiceTitan's operational costs and its capacity to scale its development teams efficiently. Managing recruitment and retention in such a dynamic talent market is a key strategic consideration.

Data and Analytics Providers

The bargaining power of data and analytics providers for companies like ServiceTitan can be significant if they offer unique or proprietary datasets crucial for market insights, AI model training, or advanced analytics features. This exclusivity can create a dependency, especially if switching providers is costly or disruptive.

- High Switching Costs: Integrating new data sources into existing workflows, especially those involving AI and complex analytics, can involve substantial time and financial investment.

- Data Uniqueness and Quality: Providers with demonstrably superior or exclusive data sets, like specialized industry benchmarks or real-time market feeds, can command higher prices and terms.

- Concentration of Providers: If only a few providers offer the specific data ServiceTitan needs, their collective bargaining power increases.

- Impact on AI Models: The quality and breadth of data are directly linked to the performance of AI models. ServiceTitan's reliance on data for AI-driven features means data providers have leverage.

For instance, in 2024, the market for business intelligence and data analytics software continued to grow, with companies increasingly prioritizing data-driven decision-making. Providers offering specialized datasets that enhance predictive capabilities or provide granular insights into the home services sector could therefore exert considerable influence.

Marketing and Sales Channel Partners

Marketing and sales channel partners, while not directly supplying software components, can exert influence over ServiceTitan's operations. If ServiceTitan relies heavily on a limited number of partners for crucial lead generation or co-marketing initiatives, these partners can negotiate terms that affect ServiceTitan's customer acquisition costs or ability to reach new markets.

This reliance can translate into bargaining power, especially if these partners possess unique market access or specialized marketing capabilities that are difficult for ServiceTitan to replicate internally. The terms of these partnerships, including revenue sharing or lead qualification criteria, can therefore impact ServiceTitan's profitability and growth trajectory.

- Dependence on Key Partners: ServiceTitan's reliance on a small group of channel partners for a significant portion of its new customer acquisition grants those partners leverage.

- Impact on Costs and Reach: Partner demands regarding commission rates or marketing exclusivity can directly affect ServiceTitan's customer acquisition cost and its overall market penetration strategies.

- Integration and Co-Marketing Influence: Partners offering integration services or engaging in co-marketing campaigns can influence the perceived value and adoption rate of ServiceTitan's platform.

- Strategic Importance: The strategic importance of these partners in ServiceTitan's go-to-market strategy amplifies their bargaining power.

The bargaining power of suppliers for ServiceTitan is a significant factor in its operational landscape. Key suppliers, including cloud infrastructure providers and specialized talent, hold considerable leverage due to market concentration, high switching costs, and the essential nature of their offerings.

In 2024, the dominance of major cloud providers like AWS, Azure, and Google Cloud means ServiceTitan faces limited alternatives, amplifying supplier power. Furthermore, the intense competition for specialized tech talent, with AI specialists commanding salaries over $200,000 annually, underscores the leverage these professionals possess.

Data and analytics providers with unique datasets also exert influence, as their information is critical for ServiceTitan's AI development. Similarly, marketing and sales channel partners can negotiate favorable terms if ServiceTitan depends heavily on them for customer acquisition.

| Supplier Type | Factors Influencing Bargaining Power | 2024 Data/Impact |

|---|---|---|

| Cloud Infrastructure Providers | Market Concentration, High Switching Costs, Essential Service | Global cloud spending projected over $600 billion; limited alternatives for large platforms. |

| Specialized Talent (e.g., AI Engineers) | High Demand, Scarce Skills, Competitive Market | Senior AI engineers in tech hubs earning >$200,000 annually; impacts recruitment costs and scaling. |

| Data & Analytics Providers | Data Uniqueness/Quality, Dependence for AI, Switching Costs | Growing BI market; specialized data enhances predictive capabilities, increasing provider influence. |

| Marketing/Sales Channel Partners | Dependence for Customer Acquisition, Unique Market Access | Partners can influence customer acquisition cost and market penetration strategies through negotiation. |

What is included in the product

ServiceTitan's Porter's Five Forces Analysis reveals the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the field service management software market.

Instantly visualize competitive pressures with a dynamic, interactive spider chart, allowing for rapid identification and mitigation of key threats.

Customers Bargaining Power

ServiceTitan's customer base is characterized by its fragmentation, encompassing a wide array of home service businesses. This means that individual customers, whether small or large, typically lack substantial individual bargaining power.

The sheer number of diverse clients means that the departure of any single customer, or even a small group, would not significantly disrupt ServiceTitan's revenue streams or market position. For instance, in 2024, ServiceTitan continued to expand its reach across numerous trades, serving tens of thousands of businesses, underscoring the distributed nature of its customer base.

ServiceTitan's customers face high switching costs, significantly reducing their bargaining power. Once a home service business integrates ServiceTitan into its operations, the expenses and complexities involved in migrating data, retraining staff on a new system, and the potential disruption to ongoing business activities are considerable. These factors deter businesses from switching providers based solely on minor price differences, as the true cost of migration can easily outweigh perceived savings.

ServiceTitan's platform is so central to a contractor's business, handling everything from booking jobs to managing customer relationships, that it becomes incredibly difficult to switch. This deep integration means that for many of its roughly 8,000 customers as of early 2024, the software isn't just a tool, it's a core part of their operational DNA.

The value proposition is clear: efficiency gains and revenue enablement. For instance, by streamlining scheduling and dispatch, ServiceTitan helps contractors reduce downtime and maximize technician utilization, directly impacting profitability. This critical nature makes customers less likely to push hard on price, as disrupting these vital functions could be far more costly than a small increase in subscription fees.

Consider the impact on a plumbing company. If ServiceTitan is managing all their incoming calls, scheduling appointments, and tracking job progress, the cost of replacing that system and retraining staff would be substantial. The perceived indispensability of these features significantly dampens the bargaining power of individual customers.

Price Sensitivity of SMBs

Small to medium-sized businesses (SMBs) within the home services sector often contend with slimmer profit margins, making them inherently more price-sensitive. When evaluating solutions like ServiceTitan, these businesses will scrutinize the cost against the perceived value, especially when compared to simpler or more budget-friendly competitors.

This price sensitivity is amplified as SMBs weigh the comprehensive features of ServiceTitan against their operational budgets. For instance, in 2024, many home service businesses reported that software subscriptions represented a significant portion of their overhead, leading them to seek the best return on investment.

- SMBs often operate on tighter margins, increasing their price sensitivity.

- Comparison with lower-cost alternatives influences purchasing decisions.

- The perceived value proposition of comprehensive software is key for SMBs.

- Software costs are a notable overhead for many home service businesses in 2024.

Availability of Alternative Solutions

Customers often have a range of alternative solutions available, impacting their bargaining power. This includes less integrated software like QuickBooks for accounting or Salesforce for customer relationship management, alongside entirely manual processes.

The existence of competing field service management platforms also grants customers leverage. If ServiceTitan's features or pricing don't precisely match a customer's requirements or budget, they can explore these other options.

- Broad Software Ecosystem: Customers can piece together solutions using best-of-breed applications for specific functions, reducing reliance on a single integrated platform.

- Manual Process Viability: For some smaller businesses, manual tracking and scheduling might still be a cost-effective, albeit less efficient, alternative.

- Competitive Landscape: The presence of numerous field service management software providers means customers can shop around for the best value proposition.

- Integration Costs: The cost and complexity of integrating ServiceTitan with existing systems can be a factor, potentially driving customers towards more easily integrated or standalone solutions.

ServiceTitan's customer base is highly fragmented, meaning individual businesses have limited sway. In 2024, with tens of thousands of diverse clients across various trades, the departure of any single customer has a negligible impact on ServiceTitan's overall revenue or market standing. This broad customer base significantly dilutes individual bargaining power.

Switching costs are a major deterrent for ServiceTitan's clients, effectively capping their bargaining power. The effort and expense involved in migrating data, retraining staff, and potential operational disruptions make businesses hesitant to switch providers, even for minor price concessions. For many of ServiceTitan's approximately 8,000 customers as of early 2024, the platform is deeply embedded in their daily operations, making the cost of change prohibitive.

While SMBs are price-sensitive due to tighter margins, the value ServiceTitan delivers in efficiency and revenue enablement often outweighs cost concerns. In 2024, many home service businesses acknowledged software subscriptions as a significant overhead but prioritized ROI. The core functionalities of ServiceTitan, like optimizing scheduling, reduce technician downtime and boost profitability, making customers less inclined to negotiate aggressively on price.

Customers do have alternatives, ranging from piecing together best-of-breed software to manual processes, which offers some leverage. The competitive field service management market also provides options, allowing customers to compare features and pricing. However, the high integration costs and operational centrality of ServiceTitan's platform for many users in 2024 still limit their ability to exert significant bargaining power.

What You See Is What You Get

ServiceTitan Porter's Five Forces Analysis

This preview showcases the complete ServiceTitan Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the HVAC, plumbing, and electrical services software market. You're viewing the actual, professionally formatted document that will be immediately available for download upon purchase, ensuring you receive the exact, ready-to-use insights without any alterations or omissions. This comprehensive analysis meticulously details the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry among existing competitors, providing actionable intelligence for strategic decision-making.

Rivalry Among Competitors

The field service management (FSM) software market is moderately competitive. ServiceTitan faces rivals such as Jobber, Housecall Pro, and Thryv, alongside many smaller, specialized providers and larger enterprise resource planning (ERP) systems that offer FSM modules. This variety means ServiceTitan must consistently innovate to stand out.

ServiceTitan stands out by offering a robust, all-encompassing platform designed for larger home service businesses, boasting deep integrations and sophisticated analytics. This focus on comprehensive functionality and advanced data capabilities sets it apart from competitors.

The competitive landscape sees rivals vying for market share by emphasizing different aspects. Some focus on aggressive pricing strategies, while others highlight specific features, user-friendliness, or cater to niche service verticals.

This diverse approach fuels intense competition, particularly around the breadth and depth of features offered. For instance, while ServiceTitan might emphasize its end-to-end solution for plumbing, HVAC, and electrical sectors, a competitor might focus solely on scheduling for small landscaping businesses.

ServiceTitan's commitment to continuous innovation, including AI-powered insights and expanded integrations with accounting software and marketing platforms, further strengthens its differentiation. As of early 2024, the company continues to invest heavily in R&D to maintain its edge in this dynamic market.

The home services sector is experiencing a robust expansion driven by increasing digitalization, which directly fuels the market for field service management (FSM) software. This growth, while potentially easing competition for existing market share, simultaneously intensifies the battle for new customer acquisition and greater market penetration.

In 2024, the global FSM software market was valued at approximately $3.8 billion, with projections indicating a compound annual growth rate (CAGR) of around 12% through 2029. This rapid expansion means companies like ServiceTitan are vying for a larger piece of a growing pie, leading to aggressive marketing and sales efforts to onboard new businesses.

While the overall market expansion is positive, it also means that established players and new entrants are aggressively competing for the attention and business of the millions of home service companies globally. This creates a dynamic environment where innovation and customer acquisition strategies are paramount for sustained success.

Customer Switching Costs

High customer switching costs in the Field Service Management (FSM) software sector significantly shape competitive dynamics. This means companies like ServiceTitan focus more on attracting new clients rather than trying to lure away customers already embedded with a competitor. In 2024, the FSM market continued to mature, with many businesses having already invested in and integrated their chosen software solutions, making the transition process more daunting.

This focus on new customer acquisition intensifies competition in marketing and sales. Businesses must clearly articulate their unique value proposition and demonstrate tangible benefits from the outset to win over prospects. For instance, a company might highlight how a new FSM system can reduce dispatch times by an average of 15%, a compelling statistic for potential adopters.

- Customer Loyalty: High switching costs foster strong customer loyalty, making it challenging for new entrants to gain market share.

- Acquisition Focus: Competitors concentrate their resources on marketing, sales, and product differentiation to attract new users.

- Value Demonstration: The emphasis is on showcasing superior initial value, such as improved operational efficiency or cost savings, to win over prospective clients.

- Industry Inertia: The significant investment in integration and training for existing FSM systems creates inertia, reinforcing the preference for acquisition over poaching.

Strategic Acquisitions and Partnerships

Competitive rivalry in the field service management software sector, which includes players like ServiceTitan, is significantly shaped by strategic acquisitions and partnerships. Companies actively pursue mergers and acquisitions to bolster their market position, acquire cutting-edge technology, or broaden their suite of services, thereby intensifying competition. For instance, in 2023, a notable trend was the continued consolidation within the SaaS industry, with private equity firms actively investing in and acquiring established players, often integrating them into larger platforms to offer more comprehensive solutions. This strategic maneuvering can quickly alter the competitive landscape, creating larger, more formidable entities.

These strategic moves directly impact the intensity of competition by consolidating market share and enhancing the capabilities of acquiring companies. For example, a company acquiring a competitor with specialized features, like advanced dispatching or customer relationship management tools, can suddenly offer a more robust package than its rivals. This can force other companies to either accelerate their own development or seek similar strategic alliances to remain competitive. The drive for market dominance through M&A is a constant factor, pushing innovation and service expansion as companies strive to capture greater market share.

- Consolidation through M&A: The field service management software market saw continued consolidation in 2023, driven by private equity interest and strategic tuck-in acquisitions by larger players.

- Market Share Gains: Acquisitions allow companies to rapidly increase their customer base and market share, creating more significant competitive threats.

- Technology and Service Expansion: Mergers often bring new technologies or service verticals under one roof, enabling integrated offerings that competitors may struggle to match.

- Partnership Ecosystems: Beyond direct acquisitions, companies are forming strategic partnerships with complementary software providers, creating integrated ecosystems that enhance value for customers and present a united front against rivals.

Competitive rivalry in the field service management (FSM) software market is characterized by a mix of well-funded incumbents and emerging players, all vying for a share of a rapidly growing industry. ServiceTitan faces direct competition from companies like Jobber and Housecall Pro, which offer similar integrated solutions, as well as broader ERP systems that include FSM modules. The market is dynamic, with competitors differentiating themselves through feature sets, pricing, and specialization in niche service verticals. As of early 2024, the global FSM software market was valued at approximately $3.8 billion, with a projected CAGR of around 12% through 2029, underscoring the intense pursuit of new customers.

| Competitor | Key Differentiators | Target Market Focus | Approximate Market Presence (Early 2024) |

|---|---|---|---|

| ServiceTitan | End-to-end platform, advanced analytics, AI capabilities | Larger home service businesses (HVAC, plumbing, electrical) | Leading market share in its segment |

| Jobber | User-friendliness, mobile-first design, affordability | Small to medium-sized service businesses | Significant and growing user base |

| Housecall Pro | Integrated booking, payments, and CRM | Residential service contractors | Strong presence in the contractor market |

| Thryv | All-in-one business management, marketing tools | Small businesses across various service industries | Broad SMB reach |

SSubstitutes Threaten

Many smaller or less technologically advanced home service businesses still rely on manual scheduling, paper-based invoicing, and basic spreadsheets for operations. This represents a low-cost, albeit highly inefficient, substitute that ServiceTitan aims to replace with its integrated platform.

These manual processes, while familiar, are significant threats. For example, a 2024 survey indicated that over 30% of small businesses still primarily use spreadsheets for financial tracking, highlighting the prevalence of these manual substitutes. This reliance leads to increased errors, wasted time, and a lack of real-time data visibility, all of which ServiceTitan's comprehensive software directly addresses.

The threat of substitutes for integrated Field Service Management (FSM) platforms like ServiceTitan comes from businesses cobbling together disparate generic software. Instead of a unified solution, companies might opt for separate Customer Relationship Management (CRM) tools, accounting software, and project management applications. For instance, a business could use Salesforce for customer interactions, QuickBooks for financials, and Asana for task tracking.

This approach necessitates manual integration and data transfer between these systems, creating inefficiencies and potential data silos. While individual generic software solutions might appear cheaper initially, the cumulative cost of multiple subscriptions and the labor involved in managing them can offset these savings. The market for generic business software is vast, with many established players offering specialized functions.

For extremely large home service businesses, creating their own custom software is a potential substitute. These in-house solutions can be designed to fit very specific workflows. However, the substantial investment in development, coupled with continuous upkeep and the absence of specialized field service management (FSM) functionalities, often renders this approach less practical and less appealing for most.

Less Comprehensive FSM Solutions

Competitors offering less comprehensive Field Service Management (FSM) solutions present a significant threat of substitutes. These alternatives often come with lower price points, making them attractive to businesses that don't require the full, advanced feature set that ServiceTitan provides.

For instance, smaller businesses or those in niche service industries might find that a more basic FSM software meets their core needs for scheduling, dispatching, and invoicing without the added cost of ServiceTitan's extensive integrations and advanced analytics. This can lead to a migration of customers who perceive these simpler solutions as a better value proposition.

The market for FSM software is diverse, with many players targeting different segments. Some platforms focus on specific trades, offering tailored modules rather than an all-encompassing suite. This modularity allows businesses to pay only for the functionalities they actually use, directly competing with ServiceTitan's integrated approach.

- Lower Price Point: Competitors offering basic FSM at a lower cost can attract budget-conscious businesses.

- Modular Offerings: Specialized or modular FSM software allows businesses to select only needed features.

- Niche Market Focus: Solutions tailored to specific trades can appeal more strongly to those businesses than a generalist platform.

- Value Perception: Businesses not needing advanced features may view simpler, cheaper alternatives as a better overall value.

Outsourcing Field Service Functions

The threat of substitutes for field service management software like ServiceTitan arises from the potential to outsource certain operational functions. Companies might opt to delegate tasks such as call center management, scheduling, or even specific types of repairs to specialized third-party providers.

This outsourcing trend can diminish the perceived necessity for a fully integrated, in-house software solution. For instance, a plumbing company could contract out its customer booking and appointment setting to a virtual assistant service, bypassing the need for ServiceTitan's robust scheduling module for that specific function. This approach allows businesses to focus on core competencies while leveraging external expertise for non-critical operations.

The outsourcing market for customer service and technical support functions has seen significant growth. In 2023, the global outsourcing market was valued at over $10 billion, with a substantial portion dedicated to customer-facing operations that overlap with field service management needs.

- Reduced need for comprehensive software: Outsourcing can address specific operational needs, potentially lowering the demand for all-in-one field service platforms.

- Focus on core competencies: Businesses can concentrate on their primary service delivery rather than managing ancillary functions.

- Cost-effectiveness: Specialized third-party providers may offer services at a lower cost than maintaining in-house capabilities.

- Market growth: The expanding outsourcing sector indicates a growing willingness among businesses to delegate service-related operations.

The threat of substitutes for ServiceTitan is moderate, primarily stemming from less sophisticated software solutions and manual processes still prevalent in the industry. While generic software suites can be pieced together, they often lack the specialized functionality and seamless integration that ServiceTitan offers.

Many smaller home service businesses continue to rely on spreadsheets and manual scheduling, representing a low-cost, albeit inefficient, substitute. For example, a 2024 industry survey revealed that over 30% of small businesses still primarily use spreadsheets for financial tracking, underscoring the persistence of these manual alternatives.

Competitors offering more basic or modular Field Service Management (FSM) solutions at lower price points also pose a threat. These alternatives might appeal to businesses with simpler operational needs, as they can avoid the costs associated with ServiceTitan's comprehensive feature set.

| Substitute Type | Description | Key Characteristics | Impact on ServiceTitan |

|---|---|---|---|

| Manual Processes | Spreadsheets, paper invoices, manual scheduling | Low cost, inefficient, error-prone | Addresses core need but lacks advanced capabilities |

| Generic Software Bundles | CRM, accounting, project management tools used separately | Requires manual integration, data silos, potentially high cumulative cost | Less efficient and integrated than a unified FSM platform |

| Basic/Modular FSM Software | Competitors with lower price points and fewer features | Cost-effective for basic needs, potentially less robust | Attracts budget-conscious or niche market segments |

| In-house Custom Software | Proprietary solutions developed by large businesses | Highly tailored, significant development and maintenance costs | Less practical for most businesses due to cost and lack of FSM specialization |

Entrants Threaten

Developing a sophisticated, comprehensive cloud-based software platform akin to ServiceTitan demands significant upfront capital. This includes substantial investments in research and development, building out robust cloud infrastructure, and establishing a strong sales and marketing presence. For instance, companies in the SaaS sector often see R&D expenses representing 15-25% of revenue, and building a comparable platform would require millions, if not tens of millions, in initial funding.

ServiceTitan enjoys significant advantages from economies of scale. As its customer base expands, the costs associated with software development, robust customer support, and advanced data analytics are spread across more users, leading to lower per-user expenses. This cost efficiency makes it difficult for smaller, newer companies to match ServiceTitan's pricing or service levels.

Moreover, ServiceTitan is cultivating powerful network effects. Imagine a future marketplace within ServiceTitan where contractors can easily find and engage with each other, or where best practices and industry insights are shared. These interconnected benefits make the platform increasingly valuable as more users join, creating a substantial barrier for any new entrant trying to offer a comparable, integrated solution.

ServiceTitan has cultivated a powerful brand image and deep customer loyalty in the home services sector, built on years of reliable performance and a complete suite of solutions. New competitors must overcome this entrenched trust, a significant barrier to market entry.

This strong brand recognition directly impacts the threat of new entrants by making it difficult for them to attract and retain customers who are already satisfied with ServiceTitan's established reputation. For instance, a new platform would need substantial marketing investment to even begin to rival ServiceTitan's current market presence.

Access to Distribution Channels and Market Penetration

For new companies entering the field service management software market, gaining access to distribution channels and achieving market penetration presents a significant hurdle. Building an effective sales, marketing, and distribution network to reach the often fragmented and traditional home services sector requires substantial financial outlay and considerable time. This means new players face difficulties in efficiently acquiring customers without making large investments in their sales teams and digital marketing efforts.

Consider the challenges in customer acquisition. For example, in 2024, customer acquisition costs (CAC) in the software-as-a-service (SaaS) industry, which includes field service management tools, can range from $1,000 to $5,000 or even higher, depending on the target market and marketing strategies employed. New entrants must overcome this barrier to compete effectively.

- High Customer Acquisition Costs: New entrants often face CAC that can exceed several thousand dollars per customer, making it difficult to achieve profitability quickly.

- Established Relationships: Existing players like ServiceTitan have built strong relationships with a vast customer base, creating a significant barrier for newcomers to penetrate.

- Brand Recognition: Building brand awareness and trust in a competitive market requires sustained marketing investment, which can be prohibitive for startups.

- Channel Partnerships: Securing partnerships with industry associations or complementary service providers is crucial but challenging for new companies lacking established credibility.

Regulatory and Compliance Complexity

The home services sector faces significant regulatory hurdles that can deter new entrants. These include varying state and local licensing, insurance mandates, and compliance with consumer protection laws. For instance, in 2024, states like California continued to refine contractor licensing requirements, making it more challenging for unestablished businesses to operate legally. Furthermore, data privacy regulations, such as GDPR and CCPA, add complexity for any company handling customer information, requiring robust security measures and clear consent protocols.

Navigating these compliance landscapes represents a substantial upfront investment in legal counsel and operational infrastructure. New entrants must allocate resources to understand and adhere to these rules, creating a barrier to entry that established players have already overcome. The financial burden of ensuring compliance, particularly with evolving data security standards, can be prohibitive for smaller startups aiming to compete with seasoned companies like ServiceTitan.

- Licensing and Permits: Requirements vary significantly by trade and locality, demanding detailed knowledge and adherence.

- Data Privacy: Compliance with regulations like CCPA and GDPR impacts how customer data is collected, stored, and used.

- Payment Processing: Adhering to PCI DSS standards for secure transactions adds another layer of complexity.

- Consumer Protection: Laws regarding warranties, service guarantees, and advertising must be carefully followed.

The threat of new entrants in the field service management software market is generally low due to substantial barriers. These include high capital requirements for platform development, the need to achieve economies of scale, and the significant challenge of overcoming ServiceTitan's established brand loyalty and network effects. Furthermore, high customer acquisition costs, regulatory complexities, and the difficulty in securing distribution channels all contribute to making market entry formidable for new players in 2024.

| Barrier to Entry | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | Significant investment needed for R&D, infrastructure, and sales/marketing. | Prohibitive for many startups. | SaaS R&D typically 15-25% of revenue; platform development can cost millions. |

| Economies of Scale | Lower per-user costs for established players due to widespread adoption. | Makes it hard for new entrants to match pricing or service levels. | Not directly quantifiable without ServiceTitan's internal data, but industry trend favors larger players. |

| Network Effects | Increasing platform value with more users (e.g., marketplaces, shared best practices). | Creates a sticky ecosystem that is difficult to replicate. | ServiceTitan's user base fosters a community that is hard for newcomers to build. |

| Brand Loyalty & Relationships | Years of reliable service build strong customer trust. | New entrants struggle to attract customers away from established providers. | ServiceTitan's deep penetration in the home services market signifies strong loyalty. |

| Customer Acquisition Cost (CAC) | High expenses to acquire new customers in the competitive SaaS landscape. | Slows down profitability and market penetration for new entrants. | SaaS CAC in 2024 can range from $1,000 to $5,000+. |

| Regulatory Compliance | Navigating licensing, insurance, data privacy (e.g., CCPA, GDPR), and consumer protection laws. | Requires substantial investment in legal and operational infrastructure. | Evolving data privacy laws and state-specific licensing add complexity. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for ServiceTitan leverages data from industry-specific market research reports, competitor financial filings, and customer feedback platforms. This blend provides a comprehensive view of industry rivalry, new entrant threats, and the bargaining power of suppliers and buyers.