ServiceTitan Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ServiceTitan Bundle

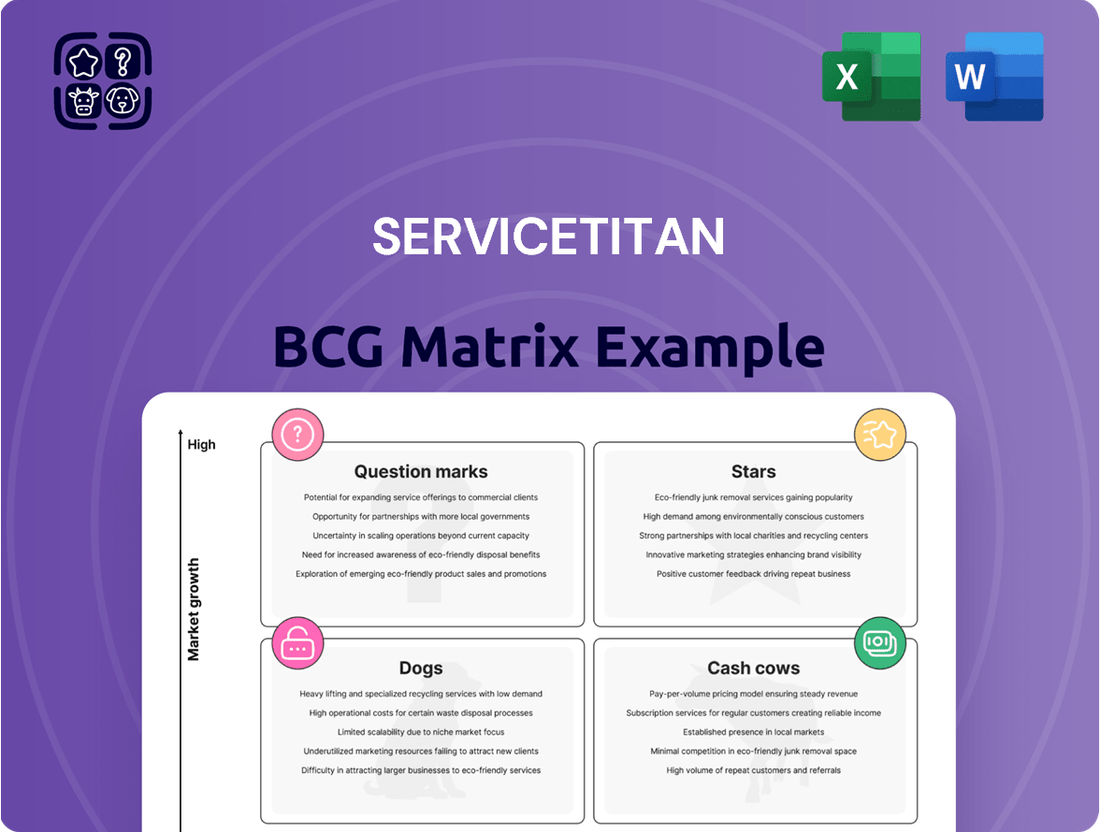

Unlock the strategic potential of ServiceTitan's product portfolio with our comprehensive BCG Matrix analysis.

Discover which ServiceTitan offerings are true market leaders (Stars), which reliably generate significant revenue (Cash Cows), which are underperforming (Dogs), and which hold exciting future promise but require investment (Question Marks).

This detailed breakdown will equip you with the clarity needed to make informed decisions about resource allocation and future product development.

Ready to move beyond this insightful preview and gain a complete strategic roadmap?

Purchase the full ServiceTitan BCG Matrix report to access in-depth analysis, actionable insights, and a clear path to optimizing your investments.

Don't miss out on the opportunity to leverage this powerful tool for competitive advantage.

Stars

ServiceTitan's core Field Service Management platform is a definite Star. Its cloud-based foundation, handling scheduling, dispatching, and CRM, is a major reason for its success in the booming field service software market. This sector is expected to see robust growth, with projections indicating a compound annual growth rate of 13.3% from 2024 to 2025. The market is anticipated to reach $9.07 billion by 2029, underscoring the significant demand for efficient service management solutions.

ServiceTitan consistently holds a leading position, especially for larger home service companies. This strong market share in a high-growth industry firmly places its foundational platform in the Star quadrant of the BCG matrix. The platform’s ability to manage essential operations like scheduling and customer relationships is critical for businesses looking to scale and improve efficiency in this dynamic market.

ServiceTitan is aggressively pushing into AI with solutions like Titan Intelligence, SalesPro, and Contact Center Pro, showcasing their commitment to innovation. These tools, prominently featured at Pantheon 2024 and discussed in 2025 industry analyses, aim to significantly boost sales performance and enhance customer interactions.

This strategic focus on AI aligns perfectly with the booming Field Service Management (FSM) software market, where artificial intelligence is a key driver of expansion. ServiceTitan’s investment in these areas demonstrates their intent to lead in this high-growth segment.

ServiceTitan is aggressively expanding its footprint beyond residential services into the commercial and construction verticals. This strategic move, exemplified by the April 2024 acquisition of Convex, signals a high-growth, high-market-share approach in these new, substantial markets.

The company's ambition is to replicate its established success in residential services by targeting large segments within commercial and construction, aiming for dominant market share. This expansion is a clear indicator of their strategy to diversify and capture significant growth opportunities.

ServiceTitan's Q1 2025 financial performance highlights the positive impact of these investments, with management reporting that these initiatives are continuing to yield strong results. This suggests the company's strategy in commercial and construction is off to a promising start.

Integrated Payments and Fintech Offerings

ServiceTitan's integrated payments and broader FinTech offerings represent a significant growth engine, demonstrating strong market traction. As of 2024, these usage-based FinTech revenues constituted a substantial 25% of ServiceTitan's total revenue. This rapid expansion underscores their leadership in this segment, driven by a strategic focus on simplifying financial workflows for contractors.

The company's ability to potentially double its implied 'take rate' on transactions highlights the immense scalability and profitability of these FinTech solutions. This positions integrated payments and FinTech as a key area where ServiceTitan clearly leads, offering considerable value to its user base and driving future revenue streams.

- Rapid Growth: ServiceTitan's FinTech offerings are experiencing accelerated adoption and revenue generation.

- Significant Revenue Contribution: By 2024, usage-based FinTech revenue accounted for 25% of the company's total revenue.

- Strategic Importance: Streamlining contractor financial operations is a core focus, driving the success of these integrated solutions.

- Profitability Potential: The opportunity to double the implied 'take rate' on transactions points to strong future profitability.

Strategic Partnerships and Marketplace Integrations

ServiceTitan's strategic partnerships and marketplace integrations firmly place it in the Star quadrant of the BCG matrix. The company actively cultivates alliances, exemplified by its collaboration with SRS Distribution announced in November 2024 and Cobalt Service Partners in April 2025. These collaborations, alongside a thriving marketplace of over 100 third-party applications, significantly broaden ServiceTitan's ecosystem and market penetration.

These strategic moves enhance ServiceTitan's value proposition by offering a more comprehensive and integrated suite of solutions to its customers. By connecting with key players in the industry and providing access to a wide array of specialized software, ServiceTitan solidifies its market leadership and fuels continued growth.

- Strategic Partnerships: Collaborations like those with SRS Distribution (November 2024) and Cobalt Service Partners (April 2025) expand ServiceTitan's network and service offerings.

- Marketplace Ecosystem: A robust marketplace featuring over 100 third-party apps allows customers to customize and enhance their ServiceTitan experience.

- Expanded Reach and Solutions: These integrations and partnerships increase ServiceTitan's addressable market and provide more complete solutions to field service businesses.

- Dominant Market Position: By building a comprehensive ecosystem, ServiceTitan reinforces its position as a leader, driving customer loyalty and attracting new users.

ServiceTitan's core Field Service Management (FSM) platform is a clear Star, dominating a high-growth market. The FSM sector is projected to reach $9.07 billion by 2029, with a robust 13.3% CAGR between 2024 and 2025.

Their aggressive push into AI, with products like Titan Intelligence and SalesPro, further solidifies their Star status. This focus is critical as AI is a major growth driver in FSM software.

Expansion into commercial and construction verticals, bolstered by the April 2024 acquisition of Convex, positions these new segments as Stars. Q1 2025 results indicate these initiatives are performing well.

Integrated payments and FinTech are also Stars, contributing a significant 25% of ServiceTitan's total revenue as of 2024. This segment shows immense scalability with the potential to double its take rate.

Strategic partnerships, such as the November 2024 deal with SRS Distribution and the April 2025 collaboration with Cobalt Service Partners, along with a marketplace of over 100 apps, also classify as Stars. This ecosystem approach expands reach and reinforces market leadership.

| Category | BCG Matrix Quadrant | Key Drivers | 2024 Data/Projections |

|---|---|---|---|

| Core FSM Platform | Star | Market Leadership, High Growth Sector | FSM Market: $9.07B by 2029, 13.3% CAGR (2024-2025) |

| AI & New Solutions | Star | Innovation, Market Demand for AI | Featured at Pantheon 2024, analyzed in 2025 |

| Commercial & Construction | Star | Market Expansion, Strategic Acquisitions | Convex Acquisition (April 2024), Positive Q1 2025 Results |

| Integrated Payments/FinTech | Star | Revenue Contribution, Scalability | 25% of Total Revenue (2024), Potential to Double Take Rate |

| Partnerships & Marketplace | Star | Ecosystem Growth, Expanded Offerings | SRS Distribution (Nov 2024), Cobalt Service Partners (Apr 2025), 100+ Apps |

What is included in the product

This ServiceTitan BCG Matrix overview details each product's position.

It offers strategic guidance for investing, holding, or divesting.

A clear, visual ServiceTitan BCG Matrix provides a one-page overview, easing the pain of deciphering complex business unit performance.

Cash Cows

ServiceTitan's established CRM and scheduling modules are its undisputed cash cows. These core functionalities, which manage customer interactions and streamline job dispatch, have captured a dominant market share in the home services sector.

These mature features, integral to ServiceTitan's operating system for trades businesses, consistently generate high-margin subscription revenue. Their reliability and deep integration mean they require less investment in aggressive marketing compared to newer, emerging products.

As of early 2024, ServiceTitan reported serving over 8,000 trades businesses, a testament to the foundational strength of these modules. This widespread adoption underscores their role as a stable revenue generator, underpinning the company's overall financial health.

ServiceTitan's offerings for residential HVAC, plumbing, and electrical contractors are a prime example of a cash cow within its business portfolio. This established market segment benefits from ServiceTitan's deep penetration and a strong competitive moat, leading to impressive customer loyalty.

The company's success here is underscored by its exceptional retention metrics, with net dollar retention exceeding 110% for Q4 FY2025 and gross retention surpassing 95% for the entirety of FY2025.

These figures highlight a mature market where ServiceTitan has solidified its leadership position, consistently generating substantial and dependable cash flow for the organization.

ServiceTitan's integrated data reporting and analytics tools function as a cash cow within their ecosystem. These features provide invaluable insights to existing customers, driving efficiency and informing strategic decisions. For instance, in 2023, ServiceTitan reported that businesses using their platform saw an average of a 20% increase in revenue per technician, a testament to the actionable data provided.

Customer Support and Professional Services

ServiceTitan's customer support and professional services, representing about 4% of its overall revenue, function as a cash cow. While professional services might have tighter margins because of investments in customer success teams, they are critical for seamless onboarding and client satisfaction.

This focus on customer success is vital for maintaining high retention rates, which in turn drives recurring subscription revenue from ServiceTitan's substantial customer base.

- Professional Services Revenue: Approximately 4% of ServiceTitan's total revenue.

- Key Role: Essential for onboarding, implementation, and ongoing client satisfaction.

- Margin Consideration: Margins can be lower due to investments in customer success.

- Strategic Importance: Drives high customer retention and continued subscription revenue.

Existing Customer Base and Subscription Revenue

ServiceTitan's existing customer base represents a significant cash cow, primarily due to its substantial and loyal following. As of January 31, 2025, the company boasts approximately 9,500 active customers, a testament to its market penetration and customer satisfaction. This large installed base fuels a predictable and robust stream of subscription revenue, the backbone of its recurring income model.

The platform's subscription revenue constitutes a dominant 71% of ServiceTitan's total revenue, underscoring its strength as a cash-generating asset. This high percentage indicates a successful transition to and reliance on a software-as-a-service (SaaS) model, which is inherently favorable for consistent cash flow. Such a strong recurring revenue component provides financial stability and allows for reinvestment into growth initiatives.

ServiceTitan's commitment to customer success is a key driver behind its high retention rates. This focus ensures that customers remain engaged with the platform, leading to sustained revenue generation from this established base. High retention minimizes churn and maximizes the lifetime value of each customer, further solidifying the existing customer base as a prime cash cow.

- Customer Base: ~9,500 active customers as of January 31, 2025.

- Revenue Contribution: Platform subscription revenue accounts for 71% of total revenue.

- Revenue Model: Predictable recurring revenue from subscriptions.

- Key Strength: High customer retention driven by a focus on customer success.

ServiceTitan's core CRM and scheduling modules are robust cash cows, boasting significant market share in the home services industry. These mature, reliable features require minimal investment, consistently generating high-margin recurring revenue and supporting the company's financial stability.

The platform's success is evident in its widespread adoption; by early 2024, ServiceTitan served over 8,000 trades businesses. This strong customer base, particularly within HVAC, plumbing, and electrical sectors, demonstrates deep market penetration and loyalty, further cementing these modules as dependable revenue streams.

These cash-generating assets benefit from exceptional customer retention, with net dollar retention exceeding 110% and gross retention surpassing 95% for FY2025. This indicates that existing customers are not only staying but also expanding their use of ServiceTitan's services, driving consistent and growing cash flow.

| ServiceTitan Cash Cow Metrics | FY2025 (Q4) | FY2025 (Full Year) |

| Net Dollar Retention | >110% | |

| Gross Retention | >95% | |

| Active Customers (Jan 31, 2025) | ~9,500 | |

| Subscription Revenue % of Total | ~71% |

Preview = Final Product

ServiceTitan BCG Matrix

The ServiceTitan BCG Matrix preview you are currently viewing is the identical, fully functional document you will receive immediately after completing your purchase. This ensures transparency and confidence, as you can assess the quality and comprehensive nature of the strategic analysis before committing. Rest assured, there are no hidden watermarks, incomplete sections, or demo content; it is a polished, ready-to-deploy resource designed for immediate strategic application.

Dogs

Within ServiceTitan's platform, deprecated or underutilized legacy features can be viewed as "Dogs" in the BCG matrix. These are functionalities that, while perhaps once valuable, now have a low market share and are in a low-growth segment of the platform's evolution. For instance, older reporting modules that haven't been enhanced with AI-driven insights or integrated with newer customer engagement tools might fall into this category.

Such features often require ongoing maintenance resources but contribute minimally to new revenue streams or enhanced customer satisfaction. By mid-2024, it's estimated that a significant portion of software platforms see a percentage of their feature set falling into this underperforming tier, often due to the rapid pace of technological advancement and the cost of consistently updating every module.

Highly niche, non-integrated point solutions within ServiceTitan's portfolio would likely represent its Dogs quadrant. Imagine a specialized software for, say, antique pipe organ repair, that doesn't connect with ServiceTitan's core offerings for plumbing or HVAC. Such a product would likely have low market share and limited growth potential, requiring significant, often unprofitable, investment to sustain.

These isolated tools would struggle to attract users because they don't offer the comprehensive, integrated experience that is ServiceTitan's strength. Without synergy with the main platform, these point solutions would be expensive to develop and market relative to their meager returns. For instance, a standalone scheduling tool for a very obscure trade might see only a handful of specialized businesses adopt it.

ServiceTitan's business model thrives on providing a holistic solution for trades businesses. Therefore, it's less probable that they would heavily invest in or long-term support highly niche, non-integrated offerings. By 2024, the company's focus remained on expanding its integrated suite, making these isolated tools a strategic challenge to maintain.

Ineffective or outdated marketing campaigns are a concern for any business, and ServiceTitan is no exception. If a particular campaign isn't adapting to current market trends or utilizing the platform's advancements, like its AI capabilities, it could be considered a Dog. These campaigns would drain marketing resources without delivering significant returns. For instance, a campaign from 2023 that solely relied on generic email blasts without personalization or segmentation would likely fall into this category if it continued into 2024 without updates. ServiceTitan's focus on AI-driven marketing in 2024 aims to prevent such scenarios by ensuring campaigns are more targeted and efficient.

Underperforming Acquired Technologies Prior to Integration

When ServiceTitan acquires companies, such as the strategic move to acquire Convex, there's a potential for past integrations to not fully meet expectations. If these previously acquired technologies haven't been seamlessly integrated or haven't delivered the anticipated return on investment, their less optimized parts could be viewed as underperforming assets within the broader ServiceTitan portfolio. These represent investments that, at least initially, haven't captured significant market share or driven substantial growth within the company's existing service ecosystem.

ServiceTitan's core strategy aims to prevent this scenario by prioritizing smooth transitions and robust integration processes. The company's success hinges on its ability to absorb acquired technologies effectively, ensuring they contribute positively to the overall value proposition. For instance, if an acquired software component fails to gain traction among ServiceTitan's user base, it might not achieve the high growth and market share typically associated with "Stars" or "Cash Cows" in a BCG matrix analysis.

- Potential for Drag: Unsuccessfully integrated acquisitions can act as a drag on resources and innovation, needing significant investment to reach their full potential.

- Integration Challenges: The complexity of merging different technological stacks and user bases can lead to temporary underperformance post-acquisition.

- ROI Focus: ServiceTitan's emphasis on integration aims to quickly move acquired assets from a "question mark" phase to achieving significant market share and growth.

- Market Share Lag: Technologies that haven't been effectively integrated may struggle to gain the necessary market adoption to be classified as high-growth, high-share assets.

Segments with Intense Price-Based Competition for Small Businesses

ServiceTitan, known for its comprehensive, premium software, faces intense price-based competition in segments targeting very small businesses. These smaller operations are often more sensitive to cost, making them prime targets for competitors offering more basic, affordable solutions.

For instance, platforms like Housecall Pro and Jobber have established a strong foothold by emphasizing affordability, catering to contractors who may not require the full suite of advanced features ServiceTitan provides. While ServiceTitan typically aims for larger, more established contractors, a strategy focused on aggressively capturing the smallest, most price-sensitive market segments could prove to be a low-return endeavor.

Consider the market landscape in 2024: many small home service businesses operate with tight margins. A significant portion might view ServiceTitan's pricing as prohibitive when simpler, cheaper alternatives can manage their core needs like scheduling and basic invoicing. Data from industry reports in early 2024 indicated that many businesses with fewer than five employees prioritized cost-effectiveness in their software choices, often opting for solutions priced under $100 per month.

This price sensitivity highlights a key challenge for ServiceTitan in these specific market niches. The value proposition of advanced features might not outweigh the immediate cost savings offered by competitors.

- Market Saturation: The segment for very small home service businesses is highly saturated with software providers.

- Price Sensitivity: Many businesses with minimal staff prioritize lower monthly costs over extensive feature sets.

- Competitor Dominance: Companies like Housecall Pro and Jobber have successfully captured market share by focusing on affordability for this demographic.

- Resource Allocation: Investing heavily in acquiring the smallest, most price-conscious customers may offer a lower return on investment compared to targeting larger, more established businesses.

Within ServiceTitan's extensive platform, features that are no longer actively developed or are seldom used by its customer base can be classified as "Dogs." These are functionalities that, despite potentially having served a purpose historically, now hold a low market share and operate within a low-growth segment of the company's product evolution. An example could be an older version of a customer portal that hasn't been updated with modern communication tools or data analytics.

Such legacy features often demand ongoing maintenance and support expenditures but contribute very little to new revenue generation or significant improvements in customer experience. By mid-2024, it's a common industry observation that a portion of software offerings across various sectors fall into this underperforming category, largely due to the rapid pace of technological advancement and the inherent costs associated with consistently updating every module.

Highly specialized, standalone software solutions that are not integrated into ServiceTitan's core ecosystem would likely represent its Dogs. Consider a niche software designed exclusively for, perhaps, vintage car restoration, which doesn't connect with ServiceTitan's primary services for residential trades. Such a product would invariably possess a low market share and limited growth prospects, necessitating considerable, often unprofitable, investment to remain operational.

These isolated tools struggle to attract a substantial user base because they fail to offer the unified, integrated experience that is a cornerstone of ServiceTitan's value proposition. Without synergy with the main platform, these point solutions become costly to develop and market relative to their minimal returns. For instance, a standalone dispatch tool for a very obscure trade might only attract a handful of highly specialized businesses.

ServiceTitan's business strategy centers on delivering a comprehensive, all-in-one solution for trades businesses. Consequently, it is improbable that the company would allocate significant resources or provide long-term support for highly niche, non-integrated offerings. Throughout 2024, the company's strategic focus remained on expanding its integrated suite, posing a strategic challenge for the maintenance of these isolated tools.

Ineffective or outdated marketing initiatives can be a concern for any business, and ServiceTitan is no exception. If a specific campaign fails to adapt to current market dynamics or leverage the platform's advancements, such as its AI capabilities, it might be considered a Dog. These campaigns can consume marketing resources without yielding substantial returns. For example, a campaign from 2023 that relied solely on generic email blasts, lacking personalization or segmentation, would likely fall into this category if it persisted into 2024 without updates. ServiceTitan's 2024 emphasis on AI-driven marketing aims to mitigate such scenarios by ensuring campaigns are more targeted and efficient.

When ServiceTitan acquires companies, as seen with the strategic acquisition of Convex, there's a potential for legacy integrations to not fully meet expectations. If previously acquired technologies have not been seamlessly integrated or have not delivered the anticipated return on investment, their less optimized components could be viewed as underperforming assets within the broader ServiceTitan portfolio. These represent investments that, at least initially, have not captured significant market share or driven substantial growth within the company's existing service ecosystem.

ServiceTitan's core strategy is designed to prevent this scenario by prioritizing smooth transitions and robust integration processes. The company's success is contingent on its ability to effectively absorb acquired technologies, ensuring they contribute positively to the overall value proposition. For instance, if an acquired software component fails to gain traction among ServiceTitan's user base, it may not achieve the high growth and market share typically associated with Stars or Cash Cows in a BCG matrix analysis.

- Potential for Drag: Unsuccessfully integrated acquisitions can act as a drag on resources and innovation, needing significant investment to reach their full potential.

- Integration Challenges: The complexity of merging different technological stacks and user bases can lead to temporary underperformance post-acquisition.

- ROI Focus: ServiceTitan's emphasis on integration aims to quickly move acquired assets from a "question mark" phase to achieving significant market share and growth.

- Market Share Lag: Technologies that haven't been effectively integrated may struggle to gain the necessary market adoption to be classified as high-growth, high-share assets.

ServiceTitan, recognized for its comprehensive, premium software, encounters intense price-based competition within market segments targeting very small businesses. These smaller operations are typically more sensitive to cost, making them attractive targets for competitors offering more basic, affordable solutions.

For instance, platforms like Housecall Pro and Jobber have secured a strong market presence by emphasizing affordability, catering to contractors who may not require the full spectrum of advanced features that ServiceTitan offers. While ServiceTitan typically targets larger, more established contractors, a strategy focused on aggressively capturing the smallest, most price-sensitive market segments could prove to be a low-return endeavor.

Consider the market landscape in 2024: many small home service businesses operate with tight margins. A significant portion may view ServiceTitan's pricing as prohibitive when simpler, cheaper alternatives can manage their core needs like scheduling and basic invoicing. Data from industry reports in early 2024 indicated that many businesses with fewer than five employees prioritized cost-effectiveness in their software choices, often opting for solutions priced under $100 per month.

This price sensitivity highlights a key challenge for ServiceTitan in these specific market niches. The value proposition of advanced features might not outweigh the immediate cost savings offered by competitors.

- Market Saturation: The segment for very small home service businesses is highly saturated with software providers.

- Price Sensitivity: Many businesses with minimal staff prioritize lower monthly costs over extensive feature sets.

- Competitor Dominance: Companies like Housecall Pro and Jobber have successfully captured market share by focusing on affordability for this demographic.

- Resource Allocation: Investing heavily in acquiring the smallest, most price-conscious customers may offer a lower return on investment compared to targeting larger, more established businesses.

Question Marks

ServiceTitan's TI Assist, showcased at Pantheon 2024, exemplifies their move into advanced AI-powered analytics and predictive insights. This represents a high-growth, rapidly evolving segment of technology where market adoption is still nascent.

While the potential is significant, ServiceTitan's current market share in these specialized AI functionalities is still being established. The company is in the early stages of cultivating demand for these cutting-edge tools.

Substantial investment is necessary to educate the contractor market about the benefits and practical applications of TI Assist. Driving widespread usage requires overcoming potential adoption hurdles and demonstrating clear ROI.

Expanding into new, less mature geographic markets presents a classic Question Mark for ServiceTitan within the BCG framework. While North America is a stronghold, venturing into regions with lower current market share but high growth potential necessitates significant investment in adapting the platform, building local support, and establishing brand recognition. This is a strategic pivot that carries inherent risk due to the uncertainty of immediate returns.

ServiceTitan’s 2019 establishment of an office in Armenia demonstrates an initial step towards internationalization, suggesting a willingness to explore beyond its core North American base. However, replicating its success in these nascent markets will require tailored approaches, including localized pricing, language support, and understanding unique regulatory landscapes. This strategic move aims to capture future market share in areas where competition may be less entrenched but where the path to profitability is less clear.

The potential rewards of successfully penetrating these untapped markets are substantial, offering diversification and long-term revenue streams. Yet, the upfront capital expenditure for localization, marketing, and sales infrastructure can be considerable. ServiceTitan must carefully weigh the projected growth rates against the cost of market entry and the competitive intensity it anticipates encountering in these emerging territories.

Emerging IoT and smart home integrations represent a potential Stars category for ServiceTitan. The global smart home market was valued at approximately $84.2 billion in 2023 and is projected to reach $200 billion by 2030, indicating substantial growth.

ServiceTitan's ability to manage these connected devices within the home services sector could unlock significant new revenue streams. However, the company's current market share in this specific niche is likely nascent, necessitating considerable investment in research, development, and market penetration to capitalize on this high-growth area.

Specialized Offerings for New Niche Trades

ServiceTitan is venturing into specialized software for niche trades, moving beyond its core HVAC, plumbing, electrical, and roofing markets. This expansion targets segments with unique operational needs and significant untapped growth potential. For instance, in 2024, the demand for specialized software solutions in areas like pest control and garage door repair saw a notable uptick, with companies in these sectors actively seeking platforms to streamline operations and improve customer service.

These new verticals are currently in their early stages for ServiceTitan, meaning they represent a low market share. However, the potential for high growth is substantial if the company can successfully penetrate these emerging markets. By 2025, analysts project that the total addressable market for field service software in these specialized trades could reach billions, driven by increasing digitalization and the need for efficiency.

- High Growth Potential: Niche trades offer significant growth opportunities as ServiceTitan diversifies its offerings.

- Low Market Share: Current market share in these new segments is minimal, reflecting the early stage of development.

- Unique Workflows: Specialized software addresses the distinct operational requirements of trades like pest control or locksmith services.

- Market Penetration Focus: Success hinges on ServiceTitan's ability to establish a strong foothold and capture market share in these nascent areas.

Advanced Automation and Autonomous Operations Features

Advanced automation and nascent autonomous operations, particularly those leveraging AI beyond current dispatch and scheduling capabilities, represent a prime example of ServiceTitan's potential 'question mark' positioning within a BCG matrix framework. These are truly cutting-edge technologies, holding immense future growth potential, but they currently exhibit low market penetration. Significant research and development investment is a prerequisite for their successful implementation.

ServiceTitan's strategic priorities clearly emphasize innovation and expansion, often involving the layering of 'stacking S-curves' to drive sustained growth. This forward-looking approach positions the company to capitalize on these advanced features as they mature. For instance, AI-powered predictive maintenance, which anticipates equipment failures before they occur, is a nascent area with substantial future revenue opportunities, estimated to grow significantly in the coming years.

- AI-Driven Predictive Analytics: Implementing AI to forecast customer demand with greater accuracy, optimizing technician allocation and inventory management.

- Autonomous Workflow Optimization: Developing systems that can automatically adjust schedules and routes in real-time based on unforeseen events, minimizing downtime.

- Robotic Process Automation (RPA): Automating repetitive back-office tasks, such as data entry and invoice processing, freeing up human capital for higher-value activities.

- Emerging IoT Integration: Connecting smart devices within client homes or businesses to gather data that can inform proactive service interventions.

ServiceTitan's exploration into new, less mature geographic markets fits the 'Question Mark' quadrant of the BCG matrix. These regions present high growth potential but currently hold a low market share for the company, necessitating significant investment to establish a presence and drive adoption.

The expansion into specialized software for niche trades also exemplifies a Question Mark. While these segments offer substantial growth opportunities, ServiceTitan's market share is minimal, requiring strategic investment to penetrate and gain traction.

Advanced automation and nascent autonomous operations, particularly those leveraging AI beyond current dispatch and scheduling, represent another area where ServiceTitan is likely a Question Mark. These cutting-edge technologies have high future growth potential but currently low market penetration, demanding substantial R&D investment.

| Category | Market Growth | Relative Market Share | ServiceTitan's Position | Strategic Implication |

|---|---|---|---|---|

| New Geographic Markets | High | Low | Question Mark | Requires investment to build presence and gain share. |

| Niche Trade Software | High | Low | Question Mark | Focus on market penetration and tailored solutions. |

| Advanced AI/Automation | High | Low | Question Mark | Significant R&D needed to capitalize on future growth. |

BCG Matrix Data Sources

Our ServiceTitan BCG Matrix is constructed using robust data, including internal company performance metrics, market share analysis, and industry growth forecasts to provide strategic insights.