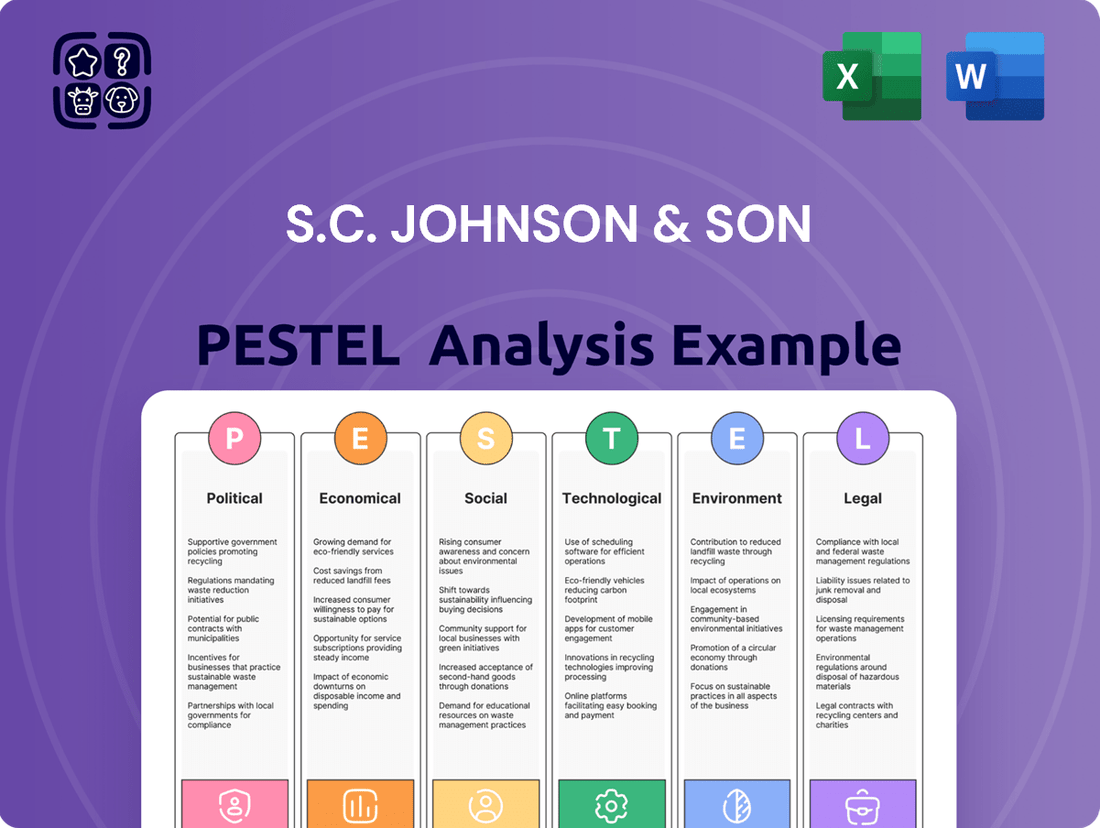

S.C. Johnson & Son PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

S.C. Johnson & Son Bundle

Discover how political stability, economic fluctuations, and evolving social attitudes are shaping S.C. Johnson & Son's global operations. Our PESTLE analysis delves into the technological advancements and environmental regulations impacting the household consumer goods sector. Understand the legal frameworks that influence product safety and marketing strategies. Gain a competitive edge by leveraging these critical external insights.

Ready to fortify your strategy against external pressures? Our comprehensive PESTLE analysis for S.C. Johnson & Son provides actionable intelligence on the forces driving change. Don't get left behind—download the full version now and equip yourself with the knowledge to anticipate market shifts and capitalize on emerging opportunities.

Political factors

As a global manufacturer, S.C. Johnson & Son's supply chain and profitability are directly impacted by international trade agreements and tariffs. Persistent US-China trade tensions and evolving EU regulations, such as the CBAM slated for full implementation by 2026, can significantly increase raw material costs for packaging and chemicals. This directly influences product pricing strategies and market competitiveness in key regions. The company must continually monitor and adapt to the evolving landscape of global trade, including potential new tariffs on imports, to mitigate risks and maintain its profit margins in 2024 and 2025.

Governments worldwide, including the EPA in the US and REACH in the EU, are intensifying scrutiny on chemicals like PFAS and phthalates in consumer goods, pushing for stricter limits by 2025. This forces S.C. Johnson to heavily invest in R&D, with projected industry spending on sustainable alternatives reaching over $5 billion globally by 2025. Public pressure, exemplified by consumer advocacy groups, significantly accelerates these regulatory shifts. Proactive reformulation and transparent communication are crucial for S.C. Johnson to maintain its brand integrity and market position amidst evolving compliance landscapes.

S.C. Johnson's growth strategy frequently involves expanding into dynamic emerging economies. However, these regions often present considerable political risks, including instability, varying levels of corruption, and unpredictable regulatory shifts impacting operations. For instance, the 2024 Global Peace Index highlights ongoing political volatility in numerous target markets, increasing operational uncertainty. The company must rigorously conduct political risk assessments and develop robust contingency plans to safeguard investments and personnel, ensuring the long-term viability of its international ventures amidst these challenges.

Governmental Sustainability Mandates

Governmental sustainability mandates increasingly influence S.C. Johnson, with policies like minimum recycled content in packaging and extended producer responsibility (EPR) schemes becoming widespread. These require substantial investment in sustainable packaging, such as the company's goal for 100% recyclable, reusable, or compostable packaging by 2025, and participation in recycling programs. Such compliance can elevate operational costs, yet it significantly enhances S.C. Johnson's reputation as an environmental leader, crucial for consumer trust. Navigating the diverse and evolving regulatory landscapes across jurisdictions, like the EU's Packaging and Packaging Waste Regulation, presents a persistent operational challenge.

- By 2025, S.C. Johnson aims for 100% of its plastic packaging to be recyclable, reusable, or compostable.

- The EU's Packaging and Packaging Waste Regulation (PPWR) sets new recycled content targets impacting global brands.

- EPR schemes are projected to cover over 70% of packaging waste globally by 2025.

Lobbying and Corporate Influence

As a major player in the consumer goods sector, S.C. Johnson & Son actively engages in lobbying to shape legislation impacting its operations, particularly regarding chemical safety and environmental policies. The company's political action committee, SC Johnson PAC, reported over $150,000 in contributions to federal candidates and committees through early 2024, demonstrating its sustained efforts. Influencing regulatory outcomes, especially on packaging and waste directives, is crucial for mitigating operational risks and ensuring compliance with evolving global standards.

- 2024 Political Action Committee (PAC) Contributions: SC Johnson PAC reported over $150,000 in federal contributions.

- Key Policy Areas: Focus on chemical safety regulations and environmental policies.

- Strategic Importance: Influencing legislation is vital for risk mitigation and competitive advantage.

- Global Regulatory Impact: Adaptability to international trade agreements and waste directives.

Global trade policies and tariffs, such as the EU's CBAM by 2026, significantly influence S.C. Johnson's supply chain costs and market competitiveness. Stricter chemical regulations, like those on PFAS by 2025, necessitate substantial R&D investments, projected to exceed $5 billion globally by 2025. Furthermore, governmental sustainability mandates, including EPR schemes covering over 70% of packaging waste by 2025, drive operational changes and lobbying efforts. Navigating these evolving political landscapes, including emerging market risks, is crucial for sustained profitability and brand integrity.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Trade Policies | Supply Chain Costs | EU CBAM by 2026 |

| Chemical Regulations | R&D Investment | $5B+ global R&D by 2025 |

| Sustainability Mandates | Operational Changes | EPR schemes cover 70%+ by 2025 |

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing S.C. Johnson & Son's global operations and strategic decision-making.

A concise PESTLE analysis for S.C. Johnson & Son that highlights key external factors, offering a clear roadmap to navigate challenges and identify opportunities for growth.

Economic factors

Consumer spending and disposable income directly influence demand for S.C. Johnson's household products. As of early 2025, U.S. consumer spending growth is projected to moderate to around 2.0-2.5%, impacting categories from cleaning supplies to air care. In periods of economic expansion, like the steady growth seen through late 2024, consumers tend to purchase more premium offerings. However, a potential shift towards value-oriented purchasing, as seen in some CPG segments in Q4 2024, could steer consumers toward private-label alternatives. This dynamic directly affects S.C. Johnson's sales volume and market share across its diverse product portfolio.

The cost of essential raw materials for S.C. Johnson & Son, including petroleum-based chemicals and plastics, remains subject to significant market volatility. For instance, crude oil prices, impacting plastic derivatives, saw notable fluctuations in early 2024, influencing manufacturing expenses. These shifts directly affect the company's cost of goods sold and overall profit margins. Effective procurement strategies and hedging instruments are crucial for S.C. Johnson to mitigate these price risks, ensuring stable product pricing for consumers amidst an estimated 5-7% year-over-year increase in certain chemical inputs projected for 2025.

S.C. Johnson & Son’s extensive global presence means currency exchange rate volatility significantly impacts its financial performance. Fluctuations, particularly with a strong US dollar as seen in early 2024, can reduce the value of international sales and profits when translated back into USD, affecting reported earnings. For instance, a 1% shift in major currency pairs against the dollar could alter millions in revenue. This necessitates sophisticated hedging strategies and diligent financial management to mitigate the adverse effects on its global operations and profitability.

Inflationary Pressures on Costs

Rising inflation significantly impacts S.C. Johnson's operational costs, including wages, transportation, and energy. With US inflation projected around 2.8% for 2024 and 2.5% for 2025, the company faces decisions on absorbing these higher expenses, which could reduce profit margins, or passing them to consumers via price increases, risking sales volume. Managing profitability while maintaining affordability remains a critical challenge. For instance, average hourly earnings growth around 3.9% in Q1 2024 directly affects labor costs.

- Global supply chain disruptions continue to pressure freight costs into 2025, impacting product distribution budgets.

- Energy price volatility, particularly for petroleum-based inputs, directly influences manufacturing and logistics expenses.

- Labor market tightness in 2024-2025 necessitates competitive wage adjustments, raising personnel costs.

- Raw material price increases, driven by broader inflation, directly elevate production outlays for household goods.

Interest Rate Environment

As a privately held entity, S.C. Johnson & Son's access to capital for growth and strategic initiatives is significantly influenced by the prevailing interest rate environment. Higher interest rates, such as the Federal Funds Rate holding above 5.25% in late 2024, directly increase the cost of borrowing for new investments. This elevated cost can deter the company from funding large-scale projects like new manufacturing facilities or significant technological upgrades. Managing its capital structure effectively is crucial to navigate these financing costs and support its long-term strategic objectives.

- The average corporate borrowing cost for investment-grade bonds exceeded 5.5% in mid-2024.

- Higher rates impact the valuation of potential acquisitions by increasing the discount rate for future cash flows.

- S.C. Johnson's debt service costs would rise with new or refinanced debt in a high-interest environment.

Economic factors significantly influence S.C. Johnson & Son, with consumer spending growth projected to moderate to 2.0-2.5% in 2025, potentially shifting demand to value offerings. Operational costs are pressured by raw material increases, estimated at 5-7% for chemical inputs in 2025, alongside labor cost rises (3.9% Q1 2024). High interest rates, with the Federal Funds Rate above 5.25% in late 2024, increase borrowing expenses, while currency volatility impacts international earnings.

| Economic Factor | 2024 Data | 2025 Projection |

|---|---|---|

| US Consumer Spending Growth | ~2.5% | 2.0-2.5% |

| Raw Material Cost Increase (Chemicals) | Varies | 5-7% |

| US Inflation Rate | ~2.8% | ~2.5% |

What You See Is What You Get

S.C. Johnson & Son PESTLE Analysis

The preview shown here is the exact S.C. Johnson & Son PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, with no surprises regarding its comprehensive PESTLE breakdown.

The content and structure of this S.C. Johnson & Son PESTLE Analysis shown in the preview is the same document you’ll download after payment.

What you’re previewing here is the actual, professionally structured S.C. Johnson & Son PESTLE Analysis file—fully ready to download immediately after purchase.

Sociological factors

Consumers increasingly demand clean, natural products, shunning harsh chemicals due to heightened health awareness and a desire for ingredient transparency. This trend is significant, with the global natural and organic personal care market projected to reach over $28 billion by 2025. S.C. Johnson must innovate, reformulating products to meet this demand, as evidenced by their 2024 ingredient transparency efforts. Clearly communicating ingredient safety is crucial for maintaining consumer trust and market share in this evolving landscape.

Heightened global awareness of health and hygiene, particularly following recent public health crises, continues to drive strong demand for cleaning and disinfecting products. The global household cleaning products market is projected to reach over $300 billion by 2025, reflecting this sustained emphasis. This presents a significant market opportunity for S.C. Johnson & Son, leveraging brands like Windex and Scrubbing Bubbles. The company can capitalize by emphasizing the proven efficacy of its portfolio in maintaining a healthy home environment, aligning with consumer priorities for safety and cleanliness.

Modern consumers are increasingly making purchasing decisions based on a company's ethical and social practices. By early 2025, over 70% of global consumers are expected to prioritize brands demonstrating strong social responsibility. S.C. Johnson's long-standing commitment as a family company, alongside its B Corp certification for brands like Mrs. Meyer's Clean Day, directly appeals to this demographic. This focus on fair labor and community engagement can drive significant brand loyalty and differentiate S.C. Johnson in a competitive market.

Changing Household Structures and Lifestyles

Demographic shifts, including the rise in single-person households and increasing urbanization, significantly influence consumer product needs. By 2025, projections indicate continued growth in single-person households across developed nations, impacting demand for smaller product sizes and specialized solutions. This leads to a greater demand for convenient, easy-to-use, and time-saving solutions for household chores, reflecting busier lifestyles. S.C. Johnson must continually adapt its product development and marketing to align with these evolving consumer needs and living arrangements, focusing on innovation in convenience.

- Single-person households are projected to represent over 28% of US households by 2025, necessitating adaptable product formats.

- Global urbanization trends continue, with over 56% of the world's population living in urban areas as of 2024, driving demand for space-efficient and multi-functional products.

- The market for convenient household cleaning products is expanding, aligning with consumers seeking efficient solutions due to time constraints.

Influence of Social Media and Online Reviews

Consumer opinions and purchasing decisions are heavily influenced by social media, online reviews, and digital influencers, shaping brand perception. A positive or negative viral post can significantly impact a brand like S.C. Johnson's reputation and sales, with 78% of consumers checking online reviews before purchasing home care products in 2024. S.C. Johnson must actively manage its online presence, engage with consumers on digital platforms, and be responsive to feedback. This proactive approach is crucial, as 62% of Gen Z consumers use social media for product discovery. Maintaining a strong digital reputation directly correlates with market share and consumer trust in the evolving 2025 landscape.

- 78% of consumers check online reviews before purchasing home care products as of 2024.

- 62% of Gen Z consumers utilize social media for product discovery and brand interaction in 2025.

Sociological factors increasingly shape consumer behavior, with a strong demand for natural and ethically produced goods; by 2025, over 70% of global consumers are expected to prioritize socially responsible brands. Heightened health awareness drives significant growth in the household cleaning market, projected to reach over $300 billion by 2025. Furthermore, demographic shifts like the rise of single-person households, expected to exceed 28% of US households by 2025, necessitate adaptable product formats and convenience. Online reviews and social media also critically influence purchasing, with 78% of consumers checking reviews before buying home care products in 2024.

| Sociological Trend | 2024/2025 Data Point | Impact for S.C. Johnson |

|---|---|---|

| Ethical Consumption | >70% prioritize socially responsible brands by 2025 | Drives brand loyalty; appeals to B Corp certification |

| Health & Hygiene Focus | Global household cleaning market >$300B by 2025 | Sustained demand for cleaning and disinfecting products |

| Demographic Shifts | >28% US households single-person by 2025 | Need for smaller, convenient, adaptable product formats |

| Digital Influence | 78% check online reviews before purchase (2024) | Crucial for online reputation and digital engagement |

Technological factors

Technological advancements in chemistry and materials science are crucial for developing more effective, sustainable, and convenient products for S.C. Johnson. This includes innovations like concentrated refills and plant-based ingredients, addressing a consumer demand for eco-friendly options, with the global green chemicals market projected to reach over $150 billion by 2025. Furthermore, smart delivery systems, such as app-controlled air fresheners, enhance user experience and product differentiation. To maintain market leadership, S.C. Johnson must prioritize R&D, with industry leaders often allocating 3-5% of revenue to innovation. This investment ensures the continuous introduction of new, differentiated products that meet evolving consumer preferences.

S.C. Johnson's adoption of automation and robotics significantly boosts manufacturing efficiency and product quality, while enhancing worker safety in facilities worldwide. These advanced technologies streamline production processes, potentially reducing operational costs by over 15% and increasing output volume by 20% by late 2024. Continued investment in smart factory technologies, such as AI-driven predictive maintenance and collaborative robots, is crucial for the company to maintain its competitive edge and innovate in the consumer goods sector through 2025.

The rapid growth of e-commerce, projected to reach over $7.4 trillion globally by 2025, offers S.C. Johnson new direct channels to consumers and valuable purchasing data. Developing a robust direct-to-consumer (DTC) strategy can enhance brand loyalty and create a significant new revenue stream, especially as online sales for household goods continue to expand. The company must optimize its product formulations and packaging for online shipment, which could reduce damage rates that average 10-15% for consumer goods. Efficient logistics for direct shipping are crucial to manage costs and ensure timely delivery, supporting increased online consumer spending.

Data Analytics and Consumer Insights

Advanced data analytics and artificial intelligence offer S.C. Johnson deep insights into evolving consumer behavior and preferences, crucial for 2024/2025 market strategies. By analyzing vast datasets from sales, social media, and market research, the company can refine product development, optimize marketing campaigns, and set competitive pricing strategies. This data-driven approach is essential for maintaining a strong market position and fostering innovation in the dynamic consumer goods sector.

- Global consumer data insights are projected to drive over $70 billion in marketing technology spending by 2025.

- AI-powered demand forecasting can reduce inventory costs by 15-30% for CPG companies.

- Personalized marketing, enabled by analytics, can boost conversion rates by up to 20% in 2024.

Digital Marketing and Brand Engagement

Digital marketing technologies, including social media advertising and influencer partnerships, are transforming consumer engagement. S.C. Johnson can leverage these tools to articulate its brand story, emphasizing its sustainability initiatives, which are increasingly important to consumers, with 70% of global consumers prioritizing sustainable brands in 2024. Personalized campaigns using AI-driven insights can enhance resonance, critical as digital ad spending is projected to reach $740 billion globally by 2025. An effective digital strategy is vital for reaching modern consumers effectively.

- Global digital ad spending is projected to exceed $740 billion by 2025, highlighting the shift in marketing investment.

- Approximately 70% of global consumers in 2024 prefer brands demonstrating strong sustainability commitments.

- Engagement rates on social media platforms remain high, with platforms like TikTok seeing over a billion active users in 2024.

Technological factors empower S.C. Johnson through product innovation, manufacturing efficiency, and enhanced consumer engagement. Advances in green chemistry and smart delivery systems, alongside automation, are crucial for new product development and operational cost reduction by over 15% in 2024. The rapid expansion of e-commerce, projected to reach $7.4 trillion globally by 2025, necessitates robust DTC strategies. Data analytics and AI-driven insights, with marketing tech spending exceeding $70 billion by 2025, are vital for personalized marketing and optimizing supply chains.

| Technological Area | Impact for SCJ | 2024/2025 Data Point |

|---|---|---|

| Product Innovation | Sustainable solutions | Green chemicals market >$150B by 2025 |

| Manufacturing | Efficiency & cost reduction | Operational costs down >15% by late 2024 |

| E-commerce & DTC | Market access & revenue | Global e-commerce >$7.4T by 2025 |

| Data Analytics & AI | Consumer insights & marketing | Marketing tech spending >$70B by 2025 |

Legal factors

S.C. Johnson & Son is subject to stringent product liability and consumer protection laws, mandating product safety for consumer use. The company faces significant litigation risks and potential reputational damage if products cause harm, with class-action settlements often exceeding millions in the consumer goods sector. Rigorous testing and clear labeling are crucial to mitigate these risks. Adherence to global safety regulations, such as those from the U.S. Consumer Product Safety Commission, is paramount. This compliance protects their market position and consumer trust.

S.C. Johnson & Son's global operations face a complex web of environmental laws, governing air and water emissions, waste disposal, and handling of hazardous materials. These regulations are increasingly stringent, necessitating continuous investment in advanced pollution control technologies and robust compliance management systems. For instance, the European Union's 2025 Green Deal initiatives could significantly impact product formulations and manufacturing processes. Failure to adhere to these evolving standards, like those from the US EPA or international bodies, can lead to substantial penalties; major corporations have faced fines exceeding $10 million for environmental breaches in recent years. This regulatory landscape demands proactive adaptation to avoid legal action and safeguard brand reputation.

S.C. Johnson & Son's robust portfolio of brand names like Glade, Windex, and Ziploc, alongside its product innovations, represents significant intellectual property assets. Protecting these trademarks and patents from infringement is crucial for maintaining the company's competitive edge and brand identity in the global consumer goods market. In 2024, the legal landscape continues to see increased vigilance against counterfeiting, with global losses from counterfeit goods estimated to reach over $2 trillion annually. S.C. Johnson actively monitors markets for unauthorized reproductions and takes decisive legal action to safeguard its intellectual property rights, ensuring its distinct market position.

Advertising Standards and Truth-in-Advertising Laws

S.C. Johnson & Son's advertising claims face rigorous scrutiny under global truth-in-advertising laws, necessitating all marketing communications to be factually accurate and substantiated. Compliance is vital to prevent significant fines and legal action, such as the Federal Trade Commission's (FTC) ongoing enforcement in the U.S. against deceptive practices. Maintaining consumer trust, especially regarding environmental claims, is paramount in the competitive household goods market.

- In 2024, the FTC continued its focus on greenwashing, impacting companies like S.C. Johnson.

- Global advertising standards, including those in the EU and Asia-Pacific, require localized compliance efforts for product claims.

- Penalties for misleading advertising can exceed millions of dollars, alongside severe reputational damage.

- Consumer watchdogs actively monitor brand messaging, leading to increased legal challenges for unsubstantiated claims.

Labor and Employment Laws

As a global employer operating across numerous countries in 2024 and 2025, S.C. Johnson & Son must meticulously comply with diverse labor and employment laws. These regulations encompass critical areas such as minimum wage standards, working hours, and comprehensive workplace safety protocols, which are increasingly stringent globally. Ensuring non-discrimination and providing mandated employee benefits are also paramount, reflecting evolving legal landscapes and social expectations. The company's commitment to a fair and respectful work environment is continuously scrutinized against these complex and dynamic international legal frameworks.

- Global operations necessitate adherence to distinct national labor codes, from the U.S. Fair Labor Standards Act to EU directives.

- Workplace safety regulations, like OSHA standards in the US or similar EU agency guidelines, require continuous investment and compliance updates.

- Evolving non-discrimination laws, including those related to AI in hiring, impact recruitment and retention strategies in 2024-2025.

- Compliance with employee benefits legislation, such as leave policies and social security contributions, varies significantly by country.

S.C. Johnson & Son faces a complex legal landscape, with product liability, environmental, and labor laws demanding strict compliance. Protecting intellectual property like Glade and Ziploc is crucial against over $2 trillion in annual global counterfeit losses. The company navigates evolving advertising scrutiny, including 2024 FTC greenwashing efforts, and diverse global employment regulations to avoid penalties and safeguard reputation.

| Legal Factor | Key Impact | 2024-2025 Relevance | ||

|---|---|---|---|---|

| Product Liability | Litigation risks, reputational damage | Class-action settlements exceeding millions | Consumer Safety Commission adherence | Rigorous testing |

| Intellectual Property | Competitive edge, brand identity | Global losses from counterfeiting over $2 trillion annually | Active monitoring for infringement | Patents & Trademarks |

| Environmental Compliance | Fines, operational costs | EU 2025 Green Deal, US EPA standards | Fines exceeding $10 million for breaches | Pollution control investment |

Environmental factors

S.C. Johnson, as a major packaged goods producer, faces intense scrutiny regarding its plastic footprint. The company is pressured by consumers and regulators to reduce plastic waste and integrate circular economy principles. By 2025, S.C. Johnson aims for 100% recyclable, reusable, or compostable plastic packaging and to triple post-consumer recycled plastic use. Success in these 2024-2025 initiatives is vital for its brand reputation and long-term sustainability.

S.C. Johnson's global manufacturing and supply chain operations, spanning over 100 countries, contribute to greenhouse gas emissions. The company aims to achieve net-zero emissions by 2040, building on its 2023 achievement of 80% renewable energy use across its global factories. Investing in energy efficiency and optimizing logistics further supports their carbon footprint reduction efforts. Demonstrating tangible progress, like their 75% reduction in GHG emissions intensity since 2000, is crucial for meeting stakeholder expectations and mitigating climate-related risks in 2024-2025.

Water is a critical resource for S.C. Johnson & Son's global manufacturing and product formulation. The company has committed to reducing water use, evidenced by its 2025 goal to reduce water withdrawal by 10% from its 2017 baseline, with significant progress noted by early 2024. This includes robust wastewater treatment to ensure high standards before discharge, minimizing environmental impact. In water-stressed regions, S.C. Johnson implements advanced conservation programs, such as optimizing cleaning processes and investing in closed-loop systems, to safeguard local water resources.

Sustainable Sourcing of Raw Materials

S.C. Johnson's commitment to environmental stewardship extends to its raw material sourcing, addressing significant impacts from palm oil, fragrances, and paper products. The company prioritizes ensuring these materials are sourced sustainably and responsibly, actively working to prevent deforestation and environmental harm. This necessitates robust transparency and traceability across its complex global supply chain, a critical focus for 2024 and 2025.

- S.C. Johnson aims for 100% RSPO certified sustainable palm oil by 2025, with progress reported annually.

- Over 90% of its paper and pulp packaging materials are certified by recognized forestry programs as of early 2024.

- The company is investing in advanced traceability technologies to monitor raw material origins in real-time.

- Partnerships with NGOs and industry groups are crucial for driving broader supply chain improvements.

Biodegradability and the Environmental Impact of Products

S.C. Johnson actively addresses the end-of-life environmental impact of its products, a key concern for sustainability. The company is significantly investing in research and development to create more biodegradable formulas, aiming for a lower impact on aquatic ecosystems. This includes developing products with plant-based ingredients to ensure they break down safely in the environment after use. Such initiatives are crucial as consumer demand for eco-friendly solutions continues to rise.

- S.C. Johnson aims for 90% of its plastic packaging to be reusable, recyclable, or compostable by 2025.

- The company has been recognized on the 2024 CDP Climate Change A List, highlighting its environmental efforts.

- A significant portion of its product portfolio, including brands like Windex, now features plant-based or biodegradable ingredients.

S.C. Johnson actively addresses environmental concerns, aiming for 100% recyclable, reusable, or compostable plastic packaging and tripling post-consumer recycled plastic use by 2025. The company targets a 10% reduction in water withdrawal by 2025 from its 2017 baseline and seeks 100% RSPO certified palm oil by 2025. With over 90% certified paper in early 2024 and a 2024 CDP Climate Change A List recognition, their 2024-2025 initiatives emphasize reducing emissions, optimizing water use, and ensuring sustainable raw material sourcing.

| Metric | 2024/2025 Target | Current Status (Early 2024) |

|---|---|---|

| Plastic Packaging Recyclability | 100% reusable/recyclable/compostable by 2025 | Progressing towards target |

| Water Withdrawal Reduction | 10% by 2025 (from 2017 baseline) | Significant progress noted |

| Certified Palm Oil | 100% RSPO certified by 2025 | Reported annually |

| Certified Paper Materials | N/A | Over 90% certified |

| GHG Emissions Intensity | Net-zero by 2040 | 75% reduction since 2000 |

PESTLE Analysis Data Sources

Our S.C. Johnson PESTLE Analysis is built on data from reputable sources like the U.S. Environmental Protection Agency, the European Chemicals Agency, and global economic indicators from the IMF and World Bank. We also incorporate insights from market research firms and industry-specific publications to ensure comprehensive coverage of political, economic, social, technological, legal, and environmental factors.