S.C. Johnson & Son Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

S.C. Johnson & Son Bundle

S.C. Johnson & Son, a family-owned giant in household cleaning and consumer goods, navigates a complex competitive landscape. Their strong brand loyalty and diverse product portfolio offer some resilience against intense rivalry. However, the ever-present threat of new entrants, particularly agile DTC brands, demands continuous innovation and cost management.

The bargaining power of buyers, both large retailers and individual consumers, significantly influences pricing and product development. Suppliers also wield considerable influence, especially for key raw materials, necessitating strategic sourcing and long-term partnerships. The threat of substitute products, while historically lower in this sector, is growing with the rise of eco-friendly and DIY alternatives.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore S.C. Johnson & Son’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Suppliers of basic chemicals, plastics, and cardboard to S.C. Johnson & Son typically hold low bargaining power. These materials are largely undifferentiated commodities, allowing the company to source from numerous global suppliers. For instance, the global market for plastic resins, a key input, was projected to exceed 700 million metric tons in 2024, ensuring ample supply. This high competition among suppliers keeps procurement costs in check and significantly reduces S.C. Johnson's dependence on any single entity.

The bargaining power of specialized chemical and fragrance providers is notably high for S.C. Johnson & Son. Brands like Glade and Method heavily rely on proprietary scents and innovative chemical formulations from a limited pool of expert suppliers. This dependency grants these specialized firms significant leverage in pricing and contract negotiations. For instance, the global fragrance and flavor market, valued at over $30 billion in 2024, is dominated by a few key players, underscoring this concentrated supplier power.

Suppliers of innovative and sustainable packaging solutions hold moderate to high bargaining power over S.C. Johnson & Son. As S.C. Johnson actively pursues its 2025 sustainability goals, which include making 100% of its plastic packaging recyclable, reusable, or compostable, it increases its reliance on a limited pool of specialized suppliers. These suppliers offer advanced technological capabilities for materials like post-consumer recycled (PCR) plastics, with S.C. Johnson aiming for 30% PCR globally by 2025. Consequently, these unique and eco-friendly packaging providers can command premium prices, impacting S.C. Johnson's operational costs in 2024 as it invests in these solutions.

Dependence on Buyer Volume

The vast operational scale of S.C. Johnson significantly reduces the bargaining power of many of its suppliers. Suppliers often rely heavily on the substantial order volumes provided by global manufacturers like S.C. Johnson, which reported over $12 billion in estimated revenue in 2024. This dependency provides S.C. Johnson considerable leverage to negotiate highly favorable terms, pricing, and payment schedules for raw materials and packaging. The company’s large procurement needs mean that losing S.C. Johnson as a client could severely impact a supplier's revenue.

- S.C. Johnson's estimated 2024 revenue exceeded $12 billion, highlighting its immense purchasing power.

- Suppliers are highly dependent on these large order volumes, limiting their ability to dictate terms.

- This strong buyer position enables S.C. Johnson to secure competitive pricing and favorable delivery.

Supply Chain and Geopolitical Factors

Global supply chain complexity and volatility significantly empower suppliers who can guarantee reliability. Geopolitical events, such as the ongoing Red Sea disruptions in early 2024 impacting global shipping routes, elevate the bargaining power of suppliers with stable operations and resilient logistics networks. S.C. Johnson must actively manage these risks to ensure a consistent supply of crucial materials for its global manufacturing. In 2024, companies are increasingly diversifying sourcing to mitigate such vulnerabilities.

- Global supply chain volatility, evidenced by 2024 shipping cost fluctuations, increases supplier leverage.

- Geopolitical conflicts, like those impacting 2024 trade routes, highlight the value of resilient suppliers.

- S.C. Johnson must mitigate supply risks to ensure consistent material flow for its products.

- Reliable suppliers with stable logistics command greater bargaining power in uncertain 2024 markets.

S.C. Johnson navigates varied supplier power; basic commodity providers like plastic (global market projected over 700M metric tons in 2024) hold low leverage due to ample supply. Conversely, specialized fragrance and sustainable packaging suppliers command higher power, given limited options for proprietary scents (global fragrance market over $30B in 2024) and eco-friendly solutions. S.C. Johnson's immense 2024 revenue (over $12B) often reduces overall supplier bargaining power, though global supply chain volatility in 2024 can empower reliable partners.

| Supplier Type | Bargaining Power | 2024 Context |

|---|---|---|

| Basic Commodities | Low | Plastic resin market >700M metric tons |

| Specialized Fragrance | High | Global market >$30B, concentrated |

| Sustainable Packaging | Moderate to High | S.C. Johnson 2025 PCR goal (30%) |

| Reliable Logistics | Increased by Volatility | Red Sea disruptions, shipping costs |

What is included in the product

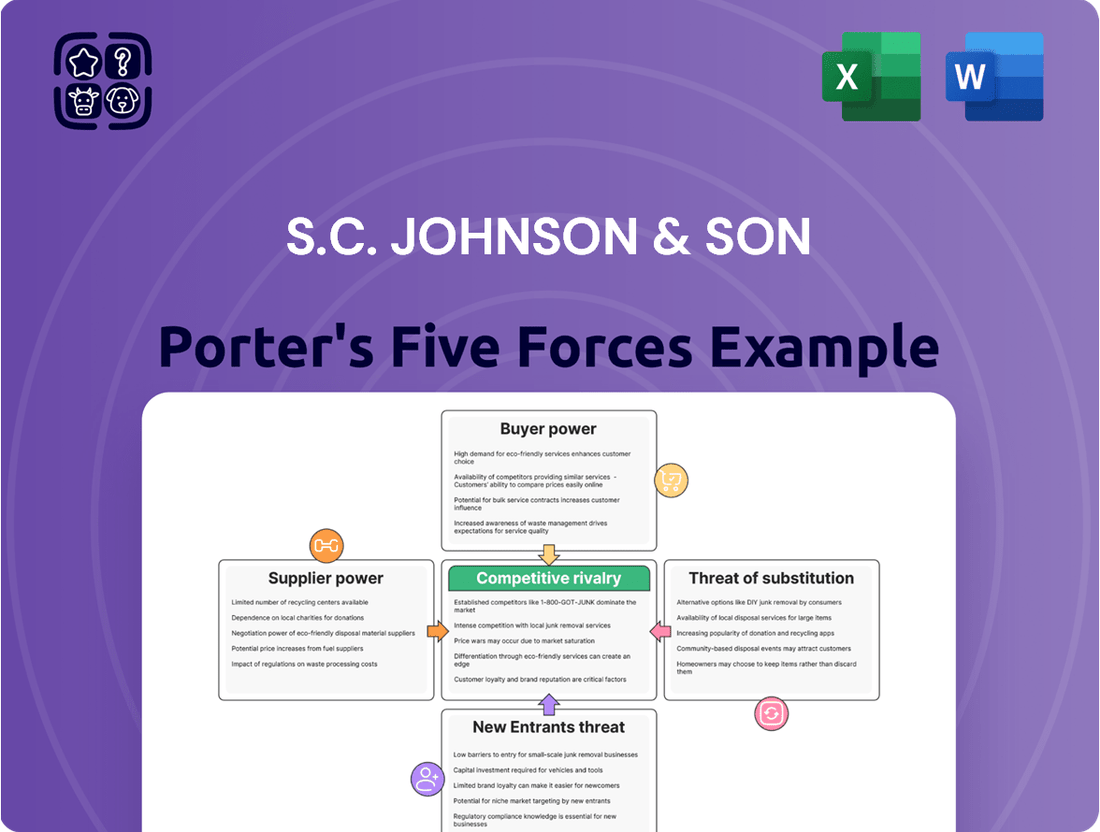

This analysis dissects the competitive landscape for S.C. Johnson & Son, examining the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its consumer packaged goods market.

Instantly assess competitive intensity with a visual breakdown of Porter's Five Forces, highlighting key threats and opportunities for S.C. Johnson & Son.

Customers Bargaining Power

S.C. Johnson & Son primarily sells its products to powerful, concentrated retail buyers like Walmart, Target, Amazon, and leading supermarket chains, rather than directly to individual consumers. These retailers leverage their immense purchasing volumes, with Walmart alone reporting over $648 billion in net sales for fiscal year 2024, to demand significant price concessions and extended payment terms. Such concentrated buyer power allows these major distributors to exert considerable pressure, directly impacting S.C. Johnson's profit margins and requiring substantial promotional funding.

End consumers face very low switching costs for household products, meaning they can easily choose a competitor like Procter & Gamble or a private label store brand without significant financial or quality loss. This forces S.C. Johnson to heavily invest in brand loyalty, innovation, and marketing, with global advertising spending for household products reaching billions annually in 2024 to sway consumer choices. For instance, private label market share continues to grow, putting pressure on branded goods. The ease of switching gives the end consumer significant, albeit indirect, bargaining power.

The increasing quality and consumer acceptance of private label products significantly empower customers. Many perceive store brands as strong alternatives to national brands, often at a lower price point, with private label sales continuing to grow, reaching $228.6 billion in the U.S. in 2023. This trend intensifies price competition across consumer goods, pressuring S.C. Johnson & Son to constantly justify the value and innovation of its branded products. Consumers’ willingness to switch to cheaper, yet quality, store brands enhances their bargaining power.

Brand Loyalty and Differentiation

S.C. Johnson mitigates significant customer bargaining power through its portfolio of highly trusted brands, including Windex, Ziploc, and Raid. These brands have cultivated substantial brand equity over decades, fostering deep customer loyalty. This strong loyalty means consumers are less sensitive to price fluctuations, reducing the likelihood of switching to competing, lesser-known alternatives.

- In 2024, established household brands continue to command consumer preference, with brand trust being a key differentiator.

- S.C. Johnson's consistent product performance reinforces this loyalty, making switching costs for consumers effectively higher.

Price Sensitivity of End Consumers

End consumers show high price sensitivity for household items like those from S.C. Johnson & Son. Persistent inflation, with the US Consumer Price Index for all items increasing 3.3% year-over-year in May 2024, compels shoppers to seek value or delay non-essential purchases. This economic pressure empowers retailers, as they must offer competitive pricing to cater to these budget-conscious consumers. Consequently, brands face immense pressure to maintain affordability.

- In 2024, consumer spending on household necessities remains heavily influenced by price.

- Approximately 60% of consumers globally reported changing their shopping habits due to rising prices in early 2024.

- Retailers leverage this price sensitivity to negotiate better terms with manufacturers.

- The average US household spent an estimated $445 more per month in early 2024 to maintain the same standard of living as pre-inflation.

Major retailers like Walmart, with over $648 billion in fiscal year 2024 net sales, exert significant bargaining power on S.C. Johnson, demanding price concessions. End consumers, facing low switching costs and increasing private label acceptance (U.S. sales reaching $228.6 billion in 2023), also pressure prices due to high price sensitivity, with 60% of consumers globally changing habits due to rising prices in early 2024. However, S.C. Johnson’s strong brand loyalty for products like Windex mitigates some of this customer power.

| Buyer Type | Leverage Source | 2024 Impact |

|---|---|---|

| Large Retailers | Volume, Price Demands | High; Walmart’s $648B+ sales |

| End Consumers | Low Switching Costs, Price Sensitivity | Moderate; Private label growth, 60% consumers price-sensitive |

Full Version Awaits

S.C. Johnson & Son Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis for S.C. Johnson & Son details the competitive landscape, including the bargaining power of buyers, the threat of new entrants, the threat of substitutes, the intensity of rivalry among existing competitors, and the bargaining power of suppliers. You are previewing the final version—precisely the same document that will be available to you instantly after buying, offering a thorough understanding of the strategic forces shaping S.C. Johnson's market position.

Rivalry Among Competitors

The household consumer goods industry faces intense rivalry, dominated by a few massive multinational corporations. S.C. Johnson & Son competes directly with giants such as Procter & Gamble, which reported net sales of approximately $82 billion in fiscal year 2024, and Unilever, with 2023 turnover around €60 billion. These competitors, including Colgate-Palmolive and Reckitt, possess strong global brands, extensive financial resources, and vast distribution networks. Competition fiercely manifests across pricing strategies, product innovation, and significant marketing expenditures, like Procter & Gamble's over $8 billion in advertising spend in 2024.

Competition in the consumer packaged goods sector, where S.C. Johnson & Son operates, is incredibly fierce, especially in brand building and product innovation. Companies must continuously invest heavily in advertising to maintain brand recognition, with global advertising spending projected to exceed $1 trillion in 2024. Simultaneously, significant research and development investments are crucial for launching new and improved products that meet evolving consumer demands for efficacy and convenience. This constant need for substantial financial outlay creates a highly competitive environment, increasing operational costs for all players.

Competitive rivalry for S.C. Johnson extends significantly to private label offerings from major retailers. These store brands, like Walmart's Great Value or Target's Up&Up, directly challenge established brands on price, often at a 20% to 40% lower cost. Their quality has improved, allowing them to capture substantial market share; for instance, private label sales across household categories grew by nearly 10% in 2024. This aggressive price competition and quality improvement exert considerable downward pressure on pricing and profit margins for S.C. Johnson's product lines.

Mature Market and Slow Growth

The household cleaning and air care markets in developed regions are largely mature, exhibiting relatively slow growth rates. For instance, the global household cleaning market, valued at approximately $241.6 billion in 2023, is projected to see moderate single-digit CAGR through 2024. In such a slow-growth environment, companies like S.C. Johnson & Son must fight aggressively for market share, often resorting to intense price wars and promotional activities. This dynamic significantly elevates the level of competitive rivalry as firms battle for shelf space and consumer loyalty.

- Global household cleaning market estimated at $241.6 billion in 2023.

- Projected single-digit CAGR for household cleaning market through 2024.

- Intense competition leads to price wars and promotions among key players.

- Firms aggressively battle for retail shelf space and consumer attention.

Focus on Sustainability as a Competitive Edge

Competitive rivalry intensifies as companies increasingly leverage their environmental and social credentials. S.C. Johnson and its key competitors, like Procter & Gamble and Unilever, highlight their use of eco-friendly ingredients, recyclable packaging, and transparent ingredient disclosure to attract environmentally conscious consumers. Sustainability has become a crucial battleground for brand differentiation and market share, influencing consumer purchasing decisions. For instance, in 2024, consumer surveys continue to show a strong preference for brands demonstrating clear sustainability commitments, with a significant portion willing to pay more for such products.

- S.C. Johnson aims for 100% recyclable, reusable, or compostable plastic packaging by 2025, reflecting a major industry trend.

- Rivals like Unilever have committed billions to sustainable sourcing and reducing their environmental footprint by 2030.

- Consumer demand for sustainable products grew over 20% in 2024 across many household categories.

- Eco-labeling and certifications are critical competitive tools for transparency and trust in the market.

Competitive rivalry in the household consumer goods sector is exceptionally high, driven by dominant multinational corporations like Procter & Gamble ($82 billion net sales in FY2024) and Unilever (€60 billion turnover in 2023). S.C. Johnson faces intense competition across pricing, product innovation, and significant marketing expenditures, including over $8 billion in advertising by rivals in 2024. The rise of private label brands, which grew nearly 10% in 2024 and offer 20-40% lower prices, further intensifies rivalry, pressuring margins in a mature global household cleaning market valued at $241.6 billion in 2023.

| Competitor | 2024 Net Sales/Turnover | Key Competitive Strategy |

|---|---|---|

| Procter & Gamble | ~ $82 Billion (FY2024) | Extensive advertising ($8B+), R&D, global brands |

| Unilever | ~ €60 Billion (2023) | Brand building, sustainability, global distribution |

| Private Label Brands | Grew ~10% (2024) | Aggressive pricing (20-40% lower), quality improvement |

SSubstitutes Threaten

The most significant substitute threat to S.C. Johnson & Son stems from the high availability of private label or store brands. These products often closely mimic leading brand formulations and packaging, but are offered at a lower price point. For instance, private label sales in the U.S. grew by 5.7% in 2023, reaching $228.6 billion, indicating strong consumer adoption. As the quality perception of private labels has significantly risen, with many consumers finding them comparable, they present a highly viable and cost-effective alternative for a broad range of household product categories. This continued growth in private label market share directly pressures S.C. Johnson's pricing power and market position.

Consumers increasingly opt for do-it-yourself cleaning solutions, utilizing common household ingredients like vinegar and baking soda. While not replacing all specialized products, these homemade alternatives can serve as effective substitutes for basic surface cleaners, impacting demand for manufactured goods. This trend is driven by cost-saving and sustainability concerns, with a noticeable rise in interest in natural alternatives. Additionally, consumers may use a single multi-purpose cleaner as a sufficient replacement for several specialized cleaning products, further reducing the market for specific S.C. Johnson offerings.

Consumers face virtually no financial or practical costs when switching from S.C. Johnson & Son products to substitutes. A household can easily opt for a store brand glass cleaner or a different manufacturer's food storage bags, with the perceived risk being minimal. This low barrier to switching, often just a few dollars difference in price, makes the threat from competitors and private labels significantly potent. Consumers frequently experiment with alternatives, as evidenced by the consistent market share of private label household cleaning products, which remained robust through 2024, indicating high willingness to switch.

Brand Loyalty as a Mitigating Factor

S.C. Johnson's formidable brand equity and long-standing reputation for quality significantly diminish the threat posed by substitute products. Consumers, having built trust in the efficacy and safety of household names like Windex, Pledge, and Raid, exhibit strong reluctance to switch to unproven alternatives. This deep-rooted loyalty, cultivated over decades, acts as a substantial barrier that less-established substitutes find incredibly challenging to overcome. For instance, in 2024, brand trust remains a primary driver for consumer purchasing decisions in the household goods sector.

- S.C. Johnson's brands, including Windex and Pledge, maintained high consumer trust metrics in 2024, reinforcing loyalty.

- The established efficacy of products like Raid reduces the perceived value of generic pest control substitutes.

- Brand recognition built over many years consistently translates into repeat purchases, limiting substitute adoption.

- Consumer hesitation to switch from trusted cleaning and home care brands remains a key factor in market stability.

Refill and Concentrate Models

S.C. Johnson is proactively addressing the threat of substitutes by innovating its own product lines, particularly through concentrated refills and dissolvable pods. These eco-friendly options, such as their Windex and Method concentrate lines, directly substitute the need for consumers to purchase new plastic bottles, aligning with growing environmental consciousness. This strategic move not only appeals to eco-conscious consumers, who are increasingly prioritizing sustainability in 2024, but also effectively retains them within the S.C. Johnson brand ecosystem. By offering these alternative delivery methods, the company transforms a potential external threat into a significant internal opportunity for market share retention and growth.

- In 2024, the global refillable packaging market is valued at over $35 billion, showing strong consumer interest.

- S.C. Johnson's concentrate offerings can reduce plastic waste by up to 80% per purchase compared to ready-to-use products.

- Consumer surveys in 2024 indicate over 60% of consumers are willing to pay more for sustainable products.

- The company's focus on refill models helps reinforce brand loyalty among environmentally aware consumers.

The threat of substitutes for S.C. Johnson & Son is significant, fueled by the widespread availability of lower-priced private label brands and the growing trend of DIY cleaning solutions. Consumers face very low switching costs, making it easy to opt for these alternatives. However, S.C. Johnson's robust brand equity, with products like Windex maintaining high consumer trust in 2024, provides a strong defense. Their strategic innovation in concentrated refills also helps retain market share.

| Category | 2023 Value | 2024 Trend |

|---|---|---|

| Private Label Sales (US) | $228.6 Billion | Continued Robust Growth |

| Refillable Packaging Market | $35 Billion+ | Strong Consumer Interest |

| Consumer Trust (Household Goods) | High | Primary Purchase Driver |

Entrants Threaten

The high cost of establishing a brand capable of competing with S.C. Johnson's iconic lines like Glade, Ziploc, or Raid presents a formidable barrier. New entrants face immense challenges against decades of consumer trust, built through substantial marketing investments. Major players in the consumer packaged goods sector, including S.C. Johnson, have collectively invested billions in brand building over many years. For instance, top CPG companies routinely allocate over 8-12% of their revenue to marketing and advertising, a trend continuing into 2024. A new company would need to overcome this deeply ingrained brand loyalty, which often requires an investment far exceeding typical startup capital.

Established leaders like S.C. Johnson & Son benefit significantly from vast economies of scale in their production and distribution networks. Their extensive manufacturing capabilities allow for a substantially lower cost per unit compared to potential new entrants. This efficiency, coupled with a robust global supply chain, enables S.C. Johnson to maintain competitive pricing and strong profit margins. For instance, in 2024, their operational scale continues to be a formidable barrier, making it exceptionally challenging for smaller, newer companies to match their cost structure and market reach.

Gaining access to the well-established distribution channels controlled by major retailers poses a significant hurdle for new entrants. Retailers, like Walmart or Target, operate with finite shelf space and prioritize stocking proven, high-volume consumer packaged goods from established suppliers such as S.C. Johnson & Son. A new brand would struggle to secure the broad retail placement necessary to reach a mass market, especially considering the competitive retail landscape where existing players dominate categories. For example, in 2024, securing prime shelf space requires substantial slotting fees or proven sales velocity, which new companies lack.

High Capital Investment for R&D and Manufacturing

Entering the consumer goods market demands significant capital outlay for research and development to engineer effective products and for establishing large-scale manufacturing facilities. S.C. Johnson consistently prioritizes innovation, investing heavily to maintain its competitive edge and product superiority. These substantial upfront capital expenditures create a formidable barrier, making it exceptionally difficult for potential new competitors to enter and challenge established players. Such high entry costs deter many aspiring businesses.

- In 2024, the consumer packaged goods sector continues to see high R&D spending, often exceeding 3% of revenue for leading firms.

- Establishing a new manufacturing plant for consumer goods can require hundreds of millions of dollars.

- S.C. Johnson leverages its century-long history and brand recognition built on consistent product development.

- The need for global distribution networks further amplifies initial investment requirements for new entrants.

Niche Market and E-commerce Opportunities

New entrants find opportunities in niche segments, such as premium or eco-friendly cleaning products, rather than the mass market. The rise of e-commerce and direct-to-consumer (DTC) sales models significantly lowers entry barriers for new brands. This allows smaller, targeted players to bypass traditional retail channels and reach consumers directly. The global market for eco-friendly cleaning products, for instance, is projected to grow substantially, reaching an estimated value of over $11 billion by 2024.

- The global e-commerce market for household care products continues to expand, with projected growth rates exceeding 9% in 2024.

- DTC models reduce startup costs by eliminating reliance on large retail distribution networks.

- Consumer demand for specialized, sustainable, and organic cleaning solutions has seen a consistent uptick in 2024.

- New brands can achieve rapid market penetration through digital marketing strategies and social media engagement.

The threat of new entrants to S.C. Johnson & Son is generally low due to high brand loyalty, significant capital requirements for R&D and marketing, and established distribution networks.

Economies of scale in production and access to prime retail shelf space further raise the entry barriers for mass-market competition.

However, niche segments and direct-to-consumer digital models offer some entry points for specialized or eco-friendly brands.

Despite these avenues, challenging S.C. Johnson's deep market penetration and financial strength remains a substantial hurdle.

| Barrier Type | Impact Level | 2024 Data Point |

|---|---|---|

| Brand Equity | High | Top CPG firms spend 8-12% revenue on marketing. |

| Economies of Scale | High | Lower unit costs for established players. |

| Distribution Access | High | Prime shelf space requires proven sales velocity. |

| Capital Outlay | High | New plants can exceed $100M; R&D over 3% revenue. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for S.C. Johnson & Son is built upon a robust foundation of data from industry-specific market research reports, extensive company financial filings (including annual reports and SEC filings), and insights from leading business intelligence platforms like IBISWorld and Statista.

We also incorporate information from trade publications, competitor press releases, and consumer behavior studies to provide a comprehensive understanding of the competitive landscape, supplier power, buyer bargaining power, threat of substitutes, and threat of new entrants.