Sagentia Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sagentia Group Bundle

Uncover the Sagentia Group's strategic landscape with our comprehensive SWOT analysis. We've identified key strengths like their deep scientific expertise and innovation capabilities, alongside critical opportunities in emerging technology sectors. This high-level overview hints at the detailed insights that await.

Want the full story behind Sagentia Group's competitive advantages, potential threats, and untapped growth avenues? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Sagentia Innovation's primary strength lies in its position as a global consultancy focused on science, product, and technology innovation. This broad expertise allows them to offer a comprehensive suite of services across a wide array of industries, fostering a unique ability to cross-pollinate ideas and solutions between sectors. For instance, advancements in medical device technology can inspire novel approaches in consumer electronics or industrial automation, a synergy that drives differentiated client outcomes.

Their diversified service portfolio is a significant advantage, enabling Sagentia Innovation to engage with clients in critical and often high-growth markets. These include the demanding medical sector, the fast-paced consumer goods market, robust industrial applications, and specialized areas like defense and aviation. This multi-market presence not only spreads risk but also builds a deep well of experience and best practices that can be applied across their client base, enhancing their value proposition.

Sagentia Group excels by providing end-to-end support for the innovation lifecycle, a crucial strength for clients aiming to bring new ideas to market efficiently. This means they can assist from the initial spark of a concept all the way through research and development, detailed product design, engineering, and finally, the complex journey of commercialization.

This comprehensive, full-service model is a significant advantage, as it allows clients to work with a single, integrated partner rather than juggling multiple external vendors. This integration can streamline processes, reduce coordination overhead, and ensure a more cohesive development path, ultimately saving time and resources throughout the product development journey.

By guiding clients through every stage, Sagentia's methodology is designed to foster the creation of novel products and services. Furthermore, it aids in enhancing existing offerings and tackling difficult technical hurdles. For instance, in 2024, companies that adopted integrated innovation strategies reported an average of 15% faster time-to-market for new products compared to those using fragmented approaches.

Sagentia Innovation's core strength lies in its profound technical and scientific acumen, setting it apart from broader consultancies. This deep science ethos means they meticulously evaluate and analyze challenges from the ground up, tackling highly intricate technical problems with a first-principles approach. For example, their work in the medical device sector often involves navigating complex biological systems and material science, where this rigorous scientific grounding is paramount.

This scientific depth, when fused with keen market understanding, empowers Sagentia to deliver exceptionally effective and well-informed solutions. Their ability to translate complex scientific insights into commercially viable strategies has been a consistent driver of client success, particularly in emerging technology fields where understanding both the science and the market is critical for innovation.

Strong Financial Backing from Parent Company

Being a part of Science Group plc offers Sagentia Innovation significant advantages, including robust financial support and a keen awareness of market demands, encompassing both manufacturing and sales aspects. This affiliation ensures Sagentia Innovation has the necessary resources to pursue its strategic objectives and maintain stable operations. As of December 31, 2024, Science Group plc demonstrated strong financial health with a trailing 12-month revenue of $141 million, further solidified by its market capitalization of $324 million as of July 11, 2025. This backing provides a solid foundation for growth and innovation.

- Financial Stability: Sagentia Innovation leverages the substantial financial resources of its parent company, Science Group plc.

- Market Insight: Benefit from Science Group plc's deep understanding of commercial realities, including manufacturing and sales processes.

- Resource Allocation: Access to capital enables Sagentia Innovation to invest in research, development, and strategic initiatives.

- Parent Company Performance: Science Group plc's reported trailing 12-month revenue of $141 million (as of December 31, 2024) and a market capitalization of $324 million (as of July 11, 2025) underscore this strong backing.

Client IP Ownership and Reputation

Sagentia Innovation's commitment to client IP ownership is a cornerstone of its business model, ensuring clients retain full control over their innovations. This policy builds significant trust, leading to repeat business and strong, enduring relationships within the innovation consulting sector.

Their reputation is further bolstered by consistent industry recognition. For instance, Sagentia Innovation has been a recipient of the highly coveted Red Dot: Best of the Best award multiple times, underscoring their design and innovation excellence. This acclaim validates their expertise and distinguishes them in a crowded market.

- Client IP Ownership: All intellectual property developed belongs exclusively to the client.

- Enhanced Trust: This policy fosters deep client trust and encourages long-term partnerships.

- Industry Recognition: Awards like Red Dot: Best of the Best highlight their superior innovation capabilities.

- Credibility Boost: Prestigious accolades solidify their reputation as a leading innovation consultancy.

Sagentia Group's primary strength is its comprehensive, end-to-end innovation lifecycle support, guiding clients from concept to commercialization. This integrated approach streamlines development, reducing time and costs, a critical advantage in bringing new products to market swiftly. For example, companies employing such integrated strategies saw an average 15% faster time-to-market in 2024.

Their deep scientific and technical expertise allows them to tackle complex challenges with a first-principles approach, particularly valuable in sectors like medical devices. This scientific rigor, combined with market understanding, leads to effective, commercially viable solutions. Sagentia's commitment to client IP ownership further builds trust and fosters long-term relationships.

Leveraging the financial backing of Science Group plc, with a reported trailing 12-month revenue of $141 million (as of December 31, 2024) and a market capitalization of $324 million (as of July 11, 2025), provides Sagentia Innovation with stability and resources for strategic initiatives. This affiliation also grants access to crucial market insights, enhancing their ability to navigate manufacturing and sales realities.

Industry recognition, such as multiple Red Dot: Best of the Best awards, validates Sagentia's excellence in design and innovation, distinguishing them in the competitive consultancy landscape and reinforcing their credibility.

What is included in the product

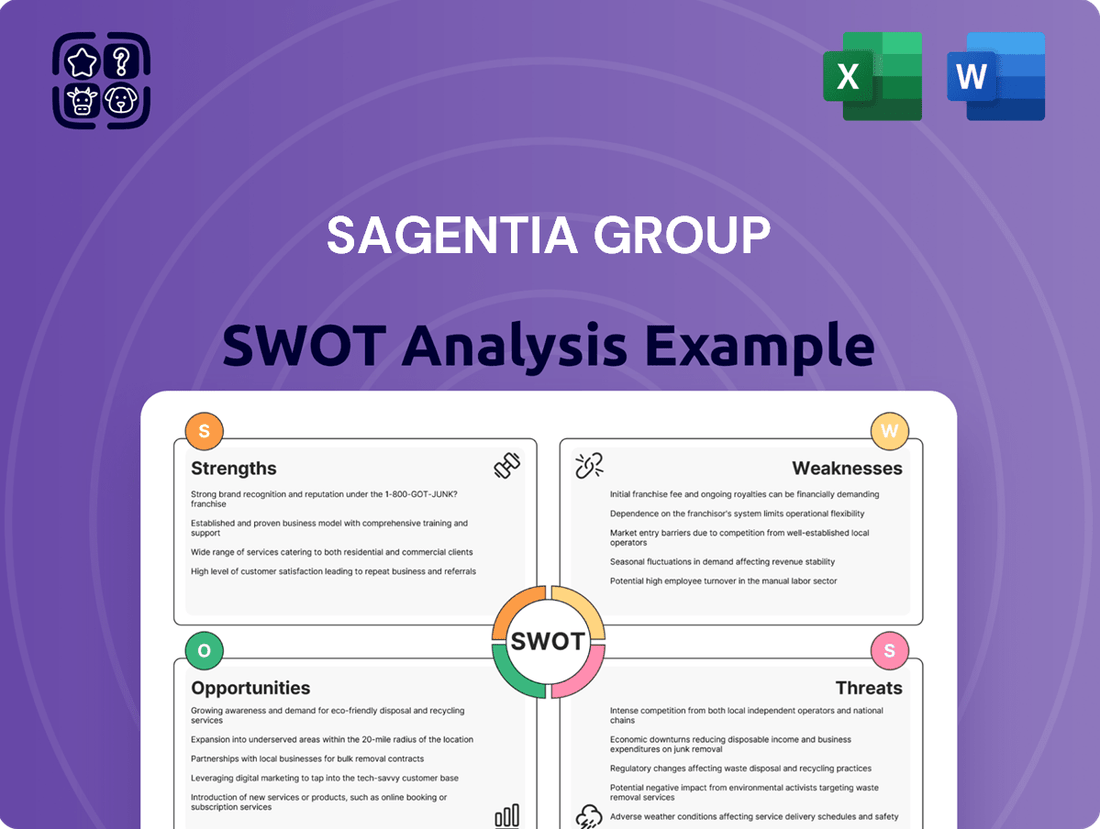

Delivers a strategic overview of Sagentia Group’s internal and external business factors, highlighting their strengths, weaknesses, opportunities, and threats.

Offers a structured framework to identify and address strategic weaknesses, alleviating concerns about missed opportunities.

Weaknesses

While operating under Science Group plc, Sagentia Innovation is flagged by some business intelligence sources as an unfunded entity. This suggests a potential dependence on its parent for capital, which could constrain its ability to pursue independent growth initiatives or quickly expand without strategic alignment from Science Group plc.

This financial structure might mean Sagentia Innovation's investment capacity is directly tied to Science Group plc's broader capital allocation decisions. For instance, if Science Group plc prioritizes other divisions, Sagentia Innovation's access to funding for ambitious projects could be restricted. This was a point of discussion in early 2024 financial analyses of the parent company.

Sagentia Innovation faces a crowded playing field in the global consulting sector, with numerous firms, including large, established players, vying for market share. This intense competition can lead to pricing pressures, requiring constant innovation to stand out and making it harder to win and keep clients.

Sagentia Innovation's reliance on client R&D spending presents a significant weakness. A substantial portion of their income is tied to how much their clients are willing to invest in new product development and innovation. For instance, if major clients, like those in the fast-paced tech sector, experience economic pressures in 2024-2025, they might scale back their R&D budgets, directly impacting Sagentia's project flow.

Scalability Challenges in Specific Sectors

Sagentia Group may encounter scalability hurdles in sectors like agri-tech. The agri-tech sector experienced a notable funding contraction in 2024, with reports indicating a significant drop in venture capital investment compared to previous years. Traditional venture capital models often struggle with the extended timelines required to validate hard-tech innovations in agriculture, creating a mismatch that could impede the scaling of specific projects or client engagements. This financial and temporal misalignment presents a tangible risk to growth prospects within this specialized area.

Key factors contributing to these scalability challenges include:

- Funding Contraction: Agri-tech saw a downturn in investment in 2024, impacting available capital for scaling innovations.

- Longer Development Cycles: Hard-tech solutions in agriculture require extensive testing and validation, often exceeding typical venture capital return horizons.

- Misaligned Investment Models: Traditional VC funding structures are not always suited to the patient capital needs of agricultural technology development.

Need for Continuous Adaptation to Rapid Technological Change

Sagentia Innovation's core business hinges on staying ahead of the curve in technology. This means a significant and ongoing commitment to research and development is crucial. For instance, as of early 2024, companies in the R&D sector are allocating an average of 15-20% of their revenue to innovation initiatives to remain competitive.

The rapid advancement of fields like artificial intelligence, quantum computing, and advanced materials presents a constant challenge. If Sagentia Innovation doesn't adapt swiftly, their current expertise and the solutions they offer could quickly become outdated. This could diminish their market standing and ability to attract new clients seeking cutting-edge capabilities.

Consider these specific areas of rapid change:

- Artificial Intelligence: The pace of AI development, from generative models to specialized algorithms, demands continuous learning and integration.

- Advanced Materials: Breakthroughs in areas like nanotechnology and sustainable materials require constant evaluation and application.

- Biotechnology and Healthtech: Rapid progress in gene editing, personalized medicine, and medical devices necessitates agile adaptation.

- Software and Digitalization: Evolving software architectures, cybersecurity threats, and the expansion of IoT mean constant updates to digital solutions.

Sagentia Innovation's dependence on its parent, Science Group plc, might limit its independent strategic maneuvers and capital access, as seen in early 2024 financial discussions. This can restrict its ability to pursue growth opportunities without parental approval, potentially slowing down expansion initiatives.

The firm operates in a highly competitive global consulting market, facing established players that can exert pricing pressure. This necessitates continuous innovation to maintain differentiation and secure client contracts, a challenge exacerbated by economic uncertainties that might affect client R&D spending in 2024-2025.

Scalability issues, particularly in sectors like agri-tech, pose a significant hurdle. Agri-tech experienced a funding contraction in 2024, with venture capital struggling to align with the long development cycles typical for agricultural innovations. This mismatch between funding models and project timelines, as observed in 2024, impedes growth in these specialized areas.

The rapid pace of technological evolution, including AI and advanced materials, requires constant adaptation. Failure to update expertise swiftly, given that R&D-focused companies in early 2024 were investing 15-20% of revenue into innovation, risks rendering Sagentia's current offerings obsolete and diminishing its market appeal.

Same Document Delivered

Sagentia Group SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're viewing a genuine excerpt from the complete Sagentia Group SWOT analysis. Upon purchasing, you will unlock the full, detailed report, providing comprehensive insights into the company's strategic positioning. This preview ensures transparency and allows you to assess the quality before committing.

Opportunities

The rapid expansion of Artificial Intelligence (AI) is a major opportunity, especially within the MedTech sector. AI is revolutionizing diagnostics, personalizing treatments, and speeding up research and development. For Sagentia Innovation, this means a growing demand for their expertise in developing AI-powered medical devices and solutions.

Digital health and telemedicine continue their strong upward trajectory, opening new doors for Sagentia. The increasing reliance on remote patient monitoring, virtual consultations, and digital therapeutics creates fertile ground for innovation. This allows Sagentia to expand its service portfolio by developing cutting-edge digital health platforms and connected medical technologies.

The global AI in healthcare market was valued at an estimated $15.4 billion in 2023 and is projected to reach $187.9 billion by 2030, growing at a CAGR of 43.3% according to some reports. Similarly, the digital health market is expected to grow significantly, with projections suggesting it will surpass $600 billion by 2026, highlighting the vast potential for companies like Sagentia to capitalize on these trends.

The growing demand for advanced fluid handling systems, particularly for cooling in energy-intensive GenAI data centers, presents a significant opportunity. This sector saw substantial investment in 2024, with global data center construction spending projected to reach over $300 billion by 2027, much of which will require sophisticated cooling solutions.

Furthermore, heightened regulatory scrutiny and public concern over PFAS chemicals are driving innovation in filtration and containment technologies within fluid handling. Companies offering safer, compliant alternatives are poised for growth in this evolving landscape.

Concurrently, the agricultural sector is experiencing a critical labor shortage, directly fueling the need for agri-tech automation. The global agricultural robotics market is expected to grow from approximately $4.7 billion in 2023 to over $10 billion by 2028, indicating strong demand for solutions that boost efficiency and farmer profitability.

These emerging markets in fluid handling and agri-tech automation offer substantial growth potential for Sagentia Group, aligning with their expertise in developing technologically advanced solutions for critical industries.

Strategic investments in sectors like MedTech, which experienced a notable surge in venture and private equity funding throughout 2024, are reshaping R&D landscapes. This financial injection is fostering new development models where companies are increasingly opting to outsource non-core research and development activities to specialized third-party consultancies.

This growing reliance on external expertise presents a significant opportunity for Sagentia Innovation. Their established service model, focused on providing deep technical consulting and product development support, is perfectly positioned to capitalize on this trend, potentially driving increased demand for their specialized capabilities.

For instance, reports indicate that by late 2024, a significant percentage of MedTech companies were actively exploring or already engaged in outsourcing specific R&D functions, aiming to accelerate innovation cycles and manage costs more effectively. This shift directly benefits firms like Sagentia that possess the niche skills and experience required to deliver high-quality outsourced R&D solutions.

Focus on Patient-Centred and Women's Health Innovations

The medical sector is seeing a significant shift towards patient-centered care, with new government initiatives increasingly spotlighting areas like women's health and healthy aging. This focus is directly influencing where investment dollars are flowing, creating a fertile ground for innovation. For Sagentia Innovation, this trend presents a substantial opportunity to align its development and commercialization efforts with these high-growth segments. For example, the UK government's commitment to improving women's health services, including significant investment in research, signals a clear market direction. Globally, the market for women's health is projected to reach over $65 billion by 2027, underscoring the commercial potential.

Sagentia Innovation can capitalize on this by developing bespoke solutions that address the specific needs of these patient populations. This strategic alignment could lead to the creation of novel medical devices, digital health platforms, or diagnostic tools. The emphasis on healthy aging, in particular, is driven by an aging global population; by 2050, the number of people aged 65 and over is expected to more than double, presenting a vast market for age-related health solutions. This creates a clear pathway for Sagentia to leverage its expertise in product development to meet these evolving healthcare demands.

- Growing Investment in Women's Health: The global women's health market is expanding rapidly, with significant funding directed towards research and development.

- Healthy Aging Market Potential: An aging global demographic fuels demand for innovations supporting healthy aging and age-related conditions.

- Government Support and Initiatives: Policy changes and government funding are actively encouraging advancements in patient-centered and specialized health areas.

- Opportunity for Tailored Solutions: Sagentia can develop and commercialize products specifically designed to meet the unique needs of women and aging populations.

Demand for Sustainability-Driven Innovation

The global push for sustainability is creating a significant market opportunity. Companies are increasingly prioritizing environmental, social, and governance (ESG) factors, with a growing demand for innovative solutions. For example, the sustainable materials market is projected to reach $238.2 billion by 2027, indicating substantial growth. Sagentia Innovation is well-positioned to assist clients in developing products and processes that meet these evolving sustainability goals, leveraging their science-led R&D capabilities.

This trend translates into a direct need for specialized expertise in areas like circular economy principles, renewable energy integration, and eco-friendly material science. Businesses are actively seeking partners to navigate complex regulatory landscapes and to gain a competitive edge through green innovation. In 2024, sustainability-linked bonds, a key indicator of this focus, saw issuance levels that continued to climb, reflecting corporate commitment. Sagentia can help clients by:

- Developing novel sustainable materials and components.

- Designing energy-efficient processes and products.

- Implementing circular economy strategies for waste reduction.

- Providing R&D support for achieving specific ESG targets.

The increasing focus on personalized medicine, particularly in areas like oncology and rare diseases, presents a significant opportunity. Advancements in genomics and diagnostics are driving demand for tailored therapeutic solutions. Sagentia Innovation can leverage its expertise to develop innovative diagnostic tools and drug delivery systems that cater to these specific patient needs.

The burgeoning field of digital therapeutics (DTx) offers another avenue for growth. As healthcare systems increasingly adopt virtual care models, the demand for evidence-based software interventions to manage, prevent, or treat medical conditions is soaring. Sagentia Innovation's capabilities in software development and integration position it well to contribute to this rapidly expanding market.

The global digital therapeutics market was valued at approximately $4.2 billion in 2023 and is projected to grow substantially, with some estimates reaching over $14 billion by 2026, at a compound annual growth rate of around 30%. This rapid expansion underscores the considerable potential for companies specializing in this area.

The global market for oncology drugs alone was valued at over $200 billion in 2023 and is expected to continue its strong growth trajectory, fueled by advancements in targeted therapies and immunotherapies. Similarly, the rare disease drug market is also experiencing significant investment and innovation.

Threats

Global economic uncertainties, particularly the risk of a recession in major markets, present a substantial threat. For instance, a projected slowdown in the UK economy, with GDP forecasts ranging from 0.5% to 1.5% for 2024, could trigger an ‘economic squeeze’ for many businesses. This often translates into companies cutting back on discretionary spending, including long-term innovation and R&D projects.

This directly impacts Sagentia Innovation, as its core business model thrives on clients committing resources to forward-thinking development. A contraction in R&D budgets, a common response during economic downturns, means fewer companies will be able to fund the kind of advanced, exploratory work Sagentia specializes in. For example, if a significant portion of Sagentia's client base operates in sectors highly sensitive to economic cycles, like automotive or consumer electronics, a downturn could severely limit project pipeline.

Sagentia Innovation faces a fiercely competitive consulting arena, characterized by a multitude of players ranging from nimble specialists to major, globally recognized firms. This crowded market, particularly within the technology and innovation consulting sector, means Sagentia must constantly prove its unique value proposition. For instance, in 2024, the global market for IT services, which includes consulting, was projected to reach over $1.3 trillion, highlighting the sheer scale of competition.

Such intense rivalry inevitably translates into significant pricing pressures. Companies like Sagentia must offer highly specialized expertise or innovative approaches to justify their fees and avoid being outbid on projects. Failure to differentiate can lead to lower profit margins and a struggle to secure new business, directly impacting overall market share and financial performance.

The need for continuous service differentiation is paramount. Sagentia must invest in R&D and talent development to stay ahead of emerging trends and client needs. In 2024, companies across various sectors were increasingly looking for consultants with deep expertise in AI, machine learning, and sustainable technology, areas where Sagentia already has a strong footing but must continually enhance.

The relentless march of technology, especially in fields like artificial intelligence and biotechnology, presents a significant challenge for Sagentia Innovation. Their core strength lies in staying ahead of these curves. For instance, in 2024, AI research publications saw a substantial increase, and the biotech sector continued its rapid innovation cycle, making continuous learning and adaptation absolutely critical.

If Sagentia Innovation fails to promptly refresh its knowledge base and adapt its service portfolio, its offerings risk becoming obsolete. This obsolescence directly impacts their value proposition to clients, potentially making their expertise less relevant in a fast-moving market.

Evolving Regulatory Landscape and Compliance Burdens

The evolving regulatory landscape presents a significant threat to Sagentia Group. For instance, the EU's proposed Green Claims Directive, aiming for greater transparency in environmental marketing, could necessitate substantial adjustments to how companies, including Sagentia's clients, substantiate their sustainability claims. Similarly, updated medical device regulations, like the EU MDR (Medical Device Regulation), which saw its full application date extended but remains a complex hurdle, demand rigorous compliance efforts that can prolong product development timelines and increase costs for innovation-focused businesses.

Navigating these complex and often changing regulatory environments is a core service for Sagentia Innovation, but it also introduces inherent risks. A misinterpretation or failure to adapt to new mandates can lead to project delays, increased expenditure, and potential reputational damage for both Sagentia and its clients. For example, the significant investment required to meet stringent data privacy regulations, such as GDPR, can divert resources from core R&D activities, impacting project velocity.

- Increased Compliance Costs: Companies are facing rising expenses to meet new regulatory standards, impacting R&D budgets.

- Extended Commercialization Timelines: New regulations can add months or even years to product launch schedules.

- Risk of Penalties: Non-compliance can result in substantial fines and legal challenges.

- Market Access Barriers: Stringent regulations in key markets can limit access for innovative products.

Client Retention and Project-Based Revenue Volatility

Sagentia Group, like many consultancies, faces a significant threat from client retention and the inherent volatility of project-based revenue. Securing a consistent pipeline of new projects and nurturing existing client relationships are crucial for stability. For instance, in the competitive consulting landscape of 2024-2025, a dip in client satisfaction or an inability to secure follow-on work can directly impact financial performance.

Furthermore, the risk of project delays or budget overruns poses a substantial threat. Such issues can lead to reputational damage, making it harder to win future business and retain current clients. A study of technology consulting firms in early 2025 indicated that overruns of 10% or more on project budgets correlated with a 20% decrease in repeat business from those clients.

- Project dependency: Reliance on a few key clients or a limited number of large projects increases vulnerability to individual client decisions or project cancellations.

- Client churn: Losing even a small percentage of clients can significantly disrupt revenue streams, especially if the client acquisition cost is high.

- Competitive pressures: Intense competition in the consulting market can lead to price wars and reduced margins, making it harder to maintain profitability and client loyalty.

- Economic downturns: During economic slowdowns, clients may reduce discretionary spending on consulting services, impacting project availability and revenue.

Intensifying competition within the innovation consulting sector, with global IT services projected to exceed $1.3 trillion in 2024, exerts considerable pricing pressure on firms like Sagentia. This necessitates continuous differentiation through specialized expertise and innovation to maintain profit margins and market share amidst a crowded marketplace.

Rapid technological advancements, particularly in AI and biotechnology, demand constant knowledge base refreshes and service portfolio adaptation to prevent obsolescence. Failure to do so risks diminishing Sagentia's value proposition to clients in a fast-evolving market.

The evolving regulatory landscape, exemplified by directives like the EU's Green Claims Directive and complex medical device regulations, introduces risks of project delays, increased costs, and potential reputational damage due to compliance challenges.

A significant threat stems from client retention and project-based revenue volatility. Factors like project overruns, client churn, and economic downturns can severely impact financial stability and future business acquisition.

SWOT Analysis Data Sources

This Sagentia Group SWOT analysis is built upon a robust foundation of data, including company financial filings, comprehensive market research reports, and the valuable perspectives of industry experts to deliver a well-rounded strategic overview.