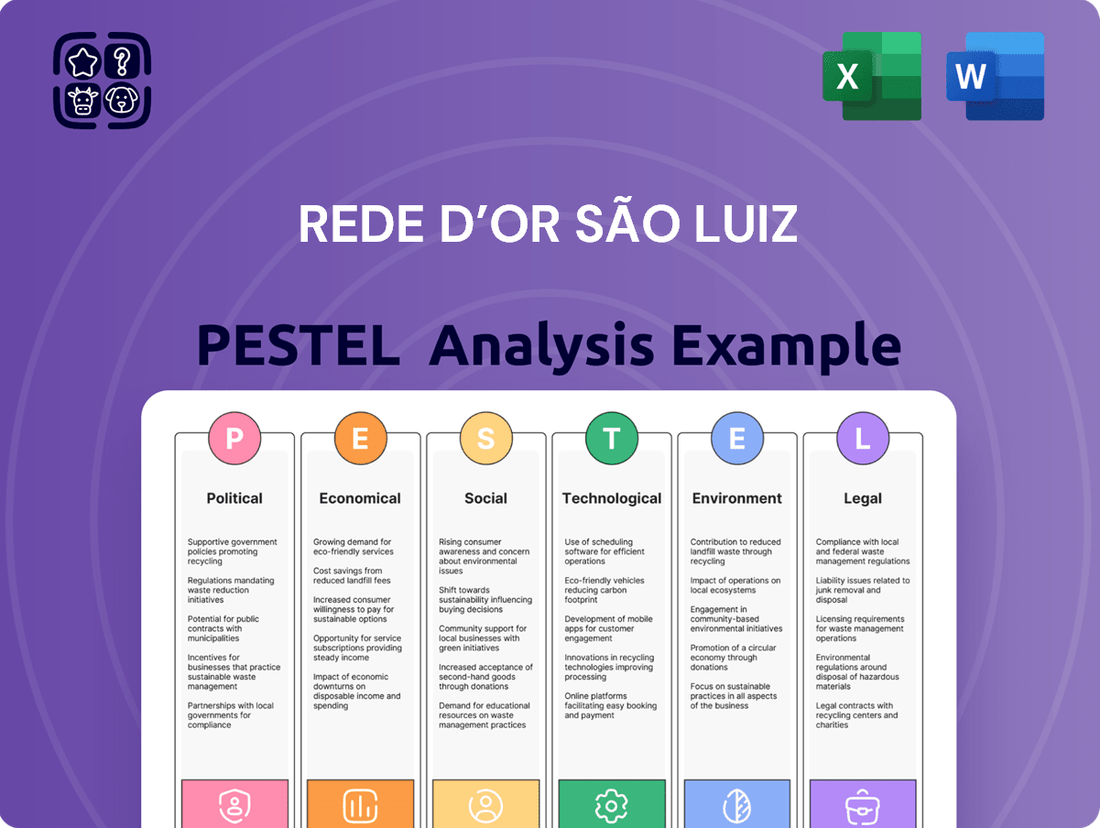

Rede D’Or São Luiz PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rede D’Or São Luiz Bundle

Navigate the complex external forces shaping Rede D’Or São Luiz's trajectory. Our PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental factors impacting this healthcare giant.

Understand how evolving healthcare regulations and government policies create both opportunities and challenges for Rede D’Or São Luiz. This critical insight is essential for strategic planning.

Explore the economic landscape, from inflation to consumer spending power, and how these elements influence the demand for private healthcare services offered by Rede D’Or São Luiz.

Discover the social shifts, such as an aging population and increased health consciousness, that are driving growth and requiring adaptation from Rede D’Or São Luiz.

Leverage our analysis of technological advancements in healthcare, from telemedicine to AI diagnostics, and how Rede D’Or São Luiz is positioned to capitalize on these innovations.

Gain a comprehensive view of the legal and environmental considerations that Rede D’Or São Luiz must address to ensure sustainable and compliant operations.

Equip yourself with actionable intelligence to make informed decisions. Download the full PESTLE Analysis of Rede D’Or São Luiz now and gain a significant competitive advantage.

Political factors

Government initiatives, like the Brazilian Health Ministry's 2024 push for increased local pharmaceutical production, significantly shape the healthcare landscape. Policies fostering public-private partnerships (PPPs) offer Rede D'Or opportunities for expansion, though navigating regulatory complexities remains a challenge. The political environment's stability and robust legislation, crucial for attracting substantial investment, influence Rede D'Or's strategic planning and operational predictability for 2025. This ensures a more consistent framework for private health operators.

The Brazilian healthcare sector operates under stringent oversight from the National Agency for Supplementary Health (ANS) and the Brazilian Health Regulatory Agency (ANVISA). ANVISA's 2024-2025 Regulatory Agenda alone lists 172 topics, directly influencing Rede D'Or's extensive operations, especially regarding medicines and health products. Continuous adaptation is essential for Rede D'Or, as shifts in regulatory frameworks, such as those governing clinical trials and the approval of new medical technologies, demand constant vigilance. This dynamic regulatory landscape necessitates proactive compliance and strategic planning.

The funding and operational performance of Brazil's public Unified Health System (SUS) indirectly influence private healthcare providers like Rede D'Or São Luiz. For 2025, a projected 6.2% increase in the SUS budget might subtly shift patient flow and competitive dynamics. Nevertheless, persistent structural weaknesses within the public system often compel patients to seek private healthcare. This trend consistently benefits private operators, including Rede D'Or, by driving demand for their services.

'Judicialização' of Health

The growing phenomenon of 'judicialização' of health, where patients sue for treatment access, poses significant financial and legal risks. This trend costs the Brazilian Ministry of Health and private insurers, including Rede D'Or's SulAmérica, billions annually; in 2023 alone, health lawsuits surged by over 20% in Brazil. Supreme Federal Court (STF) rulings, like the ongoing debates on drug coverage for non-SUS listed medications, set critical precedents impacting operational costs and service offerings for healthcare providers.

- Legal costs from 'judicialização' for the Ministry of Health exceeded R$ 7 billion in 2023.

- Private health insurers, including SulAmérica, face a 15-20% increase in judicialized claims year-over-year.

- STF decisions on drug coverage directly influence Rede D'Or's procurement and formulary management.

Political Stability and Investor Confidence

Brazil's political stability is crucial for attracting foreign and domestic investment into the healthcare sector, directly impacting companies like Rede D'Or. A predictable political climate fosters long-term strategic planning and supports significant expansion projects, such as Rede D'Or's projected R$2.5 billion in capital expenditures for organic growth in 2024. Conversely, political uncertainty can erode investor confidence and dampen overall economic conditions, influencing healthcare spending and the sector's growth trajectory. For instance, the B3 stock market's performance, a key indicator of investor sentiment, heavily relies on perceived political stability.

- Rede D'Or's 2024 organic growth capex is expected to reach R$2.5 billion, relying on a stable investment climate.

- Investor confidence in Brazil's healthcare sector is closely tied to the government's fiscal policies and regulatory consistency.

- The B3 index, reflecting market sentiment, often reacts to shifts in Brazil's political landscape, influencing healthcare stock valuations.

Government policies, including the 2024 push for local pharma production and public-private partnerships, directly shape Rede D'Or's growth avenues. Regulatory bodies like ANVISA, with 172 topics on its 2024-2025 agenda, heavily influence operational compliance. Political stability and the 2025 SUS budget increase impact investor confidence and patient flow. The rising 'judicialização' of health, with 2023 lawsuits surging over 20%, poses significant legal and financial risks.

| Factor | Description | 2024/2025 Data |

|---|---|---|

| Regulatory Impact | ANVISA Regulatory Agenda | 172 topics (2024-2025) |

| Public Health Funding | SUS Budget Increase | 6.2% projected (2025) |

| Judicialization Costs | Health Lawsuits Surge | >20% increase (2023) |

| Investment Climate | Rede D'Or Capex | R$2.5 billion (2024) |

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors impacting Rede D'Or São Luiz, detailing its position within the political, economic, social, technological, environmental, and legal landscapes.

It provides actionable insights and forward-looking perspectives to aid strategic decision-making and identify potential opportunities and threats for the organization.

A concise Rede D'Or São Luiz PESTLE analysis that highlights key external factors, serving as a pain point reliever by providing clarity and focus for strategic decision-making.

This analysis offers a streamlined view of the external environment impacting Rede D'Or São Luiz, acting as a pain point reliever by simplifying complex influences for effective strategic planning.

Economic factors

Brazil's economic growth, projected to moderate to 2.2% in 2025, directly influences healthcare spending and affordability for Rede D'Or. A resilient domestic economy with robust demand has historically supported the private healthcare market, including hospital services. However, a significant slowdown could dampen household consumption, a primary driver of growth in the sector. This moderation in GDP expansion requires Rede D'Or to monitor consumer capacity for private health services closely.

High inflation, projected at 3.9% for Brazil in 2024, significantly raises the cost of Rede D'Or's imported medical supplies and curtails consumer purchasing power.

The central bank's monetary tightening policy, with the Selic rate currently at 10.50%, directly impacts Rede D'Or's borrowing costs for essential expansion and investment projects.

This elevated interest rate environment increases financial expenses, potentially hindering new hospital acquisitions or technology upgrades.

Projections for a more controlled inflation rate of 3.5% in 2025 could offer some financial relief and stabilize operational costs for the company.

Rising healthcare costs are a significant economic pressure globally, with Brazil experiencing this trend acutely, impacting the entire healthcare supply chain. Insurers face increasingly high Medical Loss Ratios, often exceeding 85% by early 2025 for some plans, typically leading to higher premiums for beneficiaries. Rede D'Or's substantial scale, demonstrated by its network of over 70 hospitals and 11,000 beds across Brazil, provides a crucial advantage in managing these escalating costs through bulk purchasing and operational efficiencies, bolstering its competitive position.

Employment and Income Levels

A robust Brazilian labor market, characterized by rising real wages, significantly boosts private health plan enrollment, a highly valued employee benefit. The low unemployment rate, projected around 7.8% for 2024, directly correlates with an increase in Brazilians opting for private health coverage. These employment trends critically impact the beneficiary base for Rede D'Or's SulAmérica insurance division, enhancing its market penetration and revenue streams. For instance, private health plan beneficiaries in Brazil reached approximately 51.2 million by early 2025.

- Brazilian unemployment rate projected around 7.8% for 2024.

- Private health plan beneficiaries reached ~51.2 million by early 2025.

Investment and M&A Activity

The healthcare sector continues to experience robust M&A activity and investment, propelled by ongoing consolidation trends. Rede D'Or is strategically pursuing significant organic expansion, with a planned investment of R$7.5 billion by 2028, underscoring confidence in the market's long-term prospects. The attractiveness of acquisitions has notably shifted, leading to a greater focus on organic growth due to the evolving valuation of existing commercial agreements.

- Healthcare M&A remains strong, driven by consolidation.

- Rede D'Or targets R$7.5 billion organic investment by 2028.

- Shift towards organic growth due to commercial agreement valuations.

Brazil's moderating economic growth, projected at 2.2% for 2025, impacts private healthcare demand, while 2024 inflation at 3.9% and a 10.50% Selic rate elevate operational and borrowing costs. A robust labor market, with 2024 unemployment at 7.8%, boosts private health plan enrollment, reaching 51.2 million beneficiaries by early 2025. Rede D'Or's R$7.5 billion organic investment by 2028 counters rising healthcare costs and capitalizes on market consolidation.

| Economic Indicator | 2024 Projection | 2025 Projection |

|---|---|---|

| Brazil GDP Growth | ~2.9% | 2.2% |

| Brazil Inflation (IPCA) | 3.9% | 3.5% |

| Selic Rate (Current) | 10.50% | Declining |

| Unemployment Rate | 7.8% | ~7.5% |

| Private Health Beneficiaries | ~50.8 M | ~51.2 M (early 2025) |

| Rede D'Or Organic Investment | R$7.5B by 2028 |

Full Version Awaits

Rede D’Or São Luiz PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This PESTLE analysis of Rede D’Or São Luiz delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the healthcare giant. It provides a comprehensive overview of the external forces shaping their operations and strategy.

You’ll gain insights into how regulatory changes, economic fluctuations, and evolving societal expectations influence Rede D’Or São Luiz’s market position.

The document is meticulously structured to offer actionable intelligence for strategic decision-making.

Sociological factors

Brazil is undergoing a significant demographic shift, with its elderly population projected to expand considerably by 2025.

By that year, over 37 million Brazilians are expected to be aged 60 or older, driving a substantial increase in healthcare service demand.

This demographic trend specifically elevates the need for chronic disease management and specialized geriatric care.

Consequently, this creates a robust market opportunity for private healthcare providers like Rede D'Or São Luiz to expand their services and capacity.

Growing health consciousness among Brazilian consumers significantly impacts healthcare demand. By early 2025, an estimated 72% of Brazilians actively seek preventive health measures, shifting from a treatment-focused to a prevention-focused mindset. This trend boosts demand for services beyond traditional care, including wellness therapies and personalized nutrition. The Brazilian wellness market is projected to expand by over 11% annually through 2025, creating opportunities for diversified health offerings.

Urbanization in Brazil, projected to reach 88% by 2025, fosters a growing awareness of healthier lifestyles among higher-income populations, boosting demand for preventive wellness. Concurrently, this trend contributes to a rise in lifestyle diseases like obesity, affecting over 20% of Brazilian adults, and diabetes, impacting more than 10%.

This dual effect creates a significant market for Rede D’Or São Luiz, driving demand for both specialized medical treatments and an expanding array of preventive health services to address these evolving health needs.

Consumer Preferences for Digital Health

Brazilian consumers are increasingly embracing digital healthcare solutions, valued for their convenience and accessibility. The adoption of telemedicine and mobile health apps is growing rapidly, especially for managing chronic diseases, with telehealth consultations seeing significant growth, projected to exceed 100 million in Brazil by 2025. This shift compels providers like Rede D'Or to invest heavily in and expand their digital platforms, aligning with patient demand for integrated virtual care.

- Brazilian telehealth market is forecast to reach approximately $2.5 billion by 2025.

- Over 70% of Brazilian internet users have shown interest in using digital health services.

- Wearable device adoption for health monitoring is projected to increase by 15% annually through 2025.

- Rede D'Or reported a 40% increase in digital appointment bookings in late 2024.

Demand for Quality and Humanized Care

Patients and their families increasingly expect high-quality, humanized care, which is a key differentiator for providers like Rede D'Or São Luiz. The company emphasizes this by focusing on highly qualified teams and a positive patient experience, extending beyond technical excellence to encompass hospitality and patient-centered service. This commitment is vital as patient satisfaction scores become more influential in healthcare choices.

- In 2024, patient experience metrics, including net promoter scores (NPS), are critical for hospital reputation.

- Rede D'Or's 2023-2024 investments in digital patient platforms aim to streamline access and improve communication.

- The Brazilian private healthcare market sees continuous demand for personalized care models.

The increasing focus on social equity and access to quality healthcare significantly influences patient choices and regulatory scrutiny in Brazil. By 2025, public pressure for equitable access to advanced medical services is expected to intensify, impacting private providers. This trend encourages healthcare companies to demonstrate social responsibility and widen their service accessibility. Public-private partnerships in healthcare are also projected to grow by 8% annually through 2025.

| Factor | Trend | 2025 Projection |

|---|---|---|

| Aging Population | Increased demand for geriatric care | Over 37 million Brazilians aged 60+ |

| Health Consciousness | Shift to preventive care | 72% Brazilians seeking preventive measures |

| Digital Health Adoption | Growth in telemedicine | Telehealth consultations to exceed 100 million |

Technological factors

Brazilian healthcare providers, including Rede D'Or, are rapidly integrating AI and big data analytics to revolutionize patient care and operational efficiency. AI tools are increasingly used for advanced diagnostic imaging analysis, personalizing treatment protocols, and streamlining revenue cycle management to mitigate financial losses, which can exceed 10% in some traditional systems. Rede D'Or strategically leverages these technologies to uphold its benchmark in technical quality and clinical outcomes, aiming for a competitive edge in the evolving market.

Telemedicine and digital health platforms are experiencing robust growth, significantly expanding access to care, particularly in remote areas. The COVID-19 pandemic accelerated this trend, with government investments continuing to support digital health infrastructure expansion. Rede D'Or has heavily invested in unifying its digital platforms to create a seamless patient experience, with online appointments comprising a substantial portion of their total consultations, projected to exceed 35% by late 2024.

Rede D’Or São Luiz maintains Brazil’s most extensive robotic surgery infrastructure, deploying advanced robotic systems across numerous hospitals by early 2025. This technology significantly enhances surgical precision, leading to patient benefits like reduced hospital stays, often decreasing by 20-30% for specific procedures, and quicker recovery times. The company continually invests in specialized training programs for its medical staff, ensuring over 500 physicians are proficient in utilizing this cutting-edge equipment. This commitment reinforces Rede D’Or’s standing as a leader in healthcare innovation and advanced surgical care in Latin America.

Advanced Medical Devices and Diagnostics

The demand for advanced diagnostic and surgical tools in Brazil is rapidly increasing, driven by a national focus on early disease management and precision medicine. The integration of artificial intelligence into medical devices significantly improves diagnostic accuracy and operational efficiency, reflecting a key technological shift. Rede D'Or's strategic investments balance infrastructure expansion with cutting-edge medical technology, which can constitute up to 50% of the cost for premium facilities. This ensures their hospitals remain at the forefront of patient care, aligning with projected Brazilian medical device market growth towards $7.5 billion by 2025.

- Brazilian medical device market projected to reach $7.5 billion by 2025.

- AI integration enhances diagnostic precision in medical imaging and analysis.

- Advanced medical technology can comprise 50% of premium facility costs.

- Focus on early disease management drives demand for sophisticated tools.

Healthcare IT and Interoperability

Significant investments are channeled into healthcare IT, including Electronic Health Records (EHR) and advanced hospital management systems, aiming to enhance data management and patient outcomes. Brazil's hybrid healthcare system presents a major hurdle, as achieving full interoperability between public and private systems remains a persistent challenge. Rede D'Or is actively addressing this by migrating to a single, integrated digital platform, with IT investments projected to exceed R$500 million for 2024-2025 to streamline operations and improve data flow across its network of over 100 hospitals.

- Brazil's healthcare IT market is forecast to grow annually by 12% through 2025.

- Interoperability gaps affect over 60% of data exchanges in the Brazilian health sector.

- Rede D'Or's unified platform aims to integrate over 80,000 employees and 10 million annual patient visits.

Rede D'Or heavily invests in AI, big data, and Brazil's largest robotic surgery network, enhancing diagnostics and treatment precision. Telemedicine adoption is expanding access, with online appointments projected to exceed 35% by late 2024. The company is unifying its digital platforms with over R$500 million in IT investments for 2024-2025, addressing interoperability challenges in Brazil's growing healthcare IT market. These advancements position Rede D'Or at the forefront of medical technology, aligning with the Brazilian medical device market's projected growth to $7.5 billion by 2025.

| Technology Area | Rede D'Or Metric (2024/2025) | Market Trend (2024/2025) |

|---|---|---|

| Telemedicine & Digital Health | >35% online appointments (late 2024) | Robust growth, increased access |

| Robotic Surgery | Most extensive infrastructure by early 2025 | 20-30% reduced hospital stays |

| Healthcare IT Investment | >R$500 million (2024-2025) | Brazil IT market 12% annual growth |

Legal factors

Brazil's new Clinical Trial Regulation, Law No. 14,874/2024, enacted in 2024, significantly streamlines the approval process for human subject research. This legislation replaces the cumbersome dual-approval system, fostering a more predictable legal environment. Such clarity is expected to attract increased investment and clinical research activity to the country. For Rede D'Or, this provides a much clearer operational framework for its research institute, IDOR, potentially accelerating its clinical trials and development pipeline.

The Brazilian General Data Protection Law (LGPD), fully effective since 2020, imposes strict rules on handling personal data, critically impacting Rede D’Or São Luiz due to its management of sensitive patient health information. Brazil's new clinical trial law, effective mid-2023, further emphasizes data protection, making sponsors responsible for data integrity and LGPD compliance. This regulatory environment necessitates robust data governance and enhanced cybersecurity measures across Rede D’Or's extensive network of over 110 hospitals and 70 oncology clinics. Non-compliance could lead to significant penalties, potentially reaching up to 50 million BRL per infraction, or 2% of the company's revenue in Brazil, underscoring the financial and reputational risks involved. Ensuring data privacy and security remains a top operational and strategic priority for 2024 and 2025.

Brazil's National Agency for Supplementary Health (ANS) is actively implementing a regulatory sandbox, expected to continue through 2025. This initiative allows for controlled experimentation of innovative business models, including prepaid health cards. The primary goal is to foster innovation and enhance efficiency within the healthcare sector, gathering essential data to inform future regulations. For Rede D'Or, this presents a valuable opportunity to test new service offerings in a supervised environment, potentially expanding its market share beyond the current 2024 projections. This regulatory flexibility could accelerate the introduction of novel patient-centric solutions.

ANVISA's Regulatory Agenda

ANVISA's 2024-2025 regulatory agenda presents crucial legal factors for Rede D’Or São Luiz, detailing numerous updates impacting the healthcare sector. This includes planned revisions to rules for Software as a Medical Device (SaMD) and requirements for e-labeling, which directly influence digital health offerings. Proactive monitoring of these changes is essential for Rede D’Or to ensure ongoing compliance and adapt its extensive service portfolio. The agenda’s clear outline offers predictability, allowing for strategic preparation and stakeholder engagement regarding upcoming regulatory shifts.

- ANVISA's regulatory agenda for 2024-2025 includes 87 planned regulatory actions.

- Revisions to SaMD rules directly affect over 1,500 registered medical software products in Brazil.

- New e-labeling requirements are projected to be finalized by Q3 2025.

Consumer Protection and Oversight

Regulators, primarily the ANS, are intensifying their focus on consumer protection within Brazil's supplementary healthcare sector, impacting Rede D'Or's operations.

The National Supplementary Health Agency (ANS) is actively refining its oversight model to more effectively manage consumer complaints, with a reported 128,000 complaints in 2023, and enforce penalties against health plan operators. This increased scrutiny demands high standards of service and transparency from Rede D'Or, particularly concerning its insurance division, SulAmérica. Compliance with these evolving regulations is crucial to avoid significant fines, which can reach R$1.5 million per infraction.

- ANS focuses on improving complaint resolution and penalty enforcement for health plans.

- Over 128,000 consumer complaints were recorded by the ANS in 2023, signaling high regulatory attention.

- Potential fines for non-compliance can reach R$1.5 million per infraction for operators like SulAmérica.

- Rede D'Or must maintain high service standards and transparency to meet heightened regulatory demands in 2024/2025.

Brazil's streamlined clinical trial regulations (Law 14,874/2024) boost research at IDOR, while strict LGPD compliance is critical for patient data, with potential fines reaching BRL 50 million per infraction. The ANS regulatory sandbox, continuing through 2025, allows testing new service models. ANVISA's 2024-2025 agenda, including 87 actions, mandates adaptation for digital health, and intensified ANS consumer protection, with 128,000 complaints in 2023, requires high service standards from SulAmérica to avoid R$1.5 million fines.

| Legal Factor | Key Impact | 2024/2025 Data Point |

|---|---|---|

| Clinical Trial Regulation | Streamlined approvals for IDOR | Law No. 14,874/2024 enacted |

| LGPD & Data Protection | High compliance for patient data | Up to BRL 50M fine or 2% revenue |

| ANS Oversight & Sandbox | New models, consumer protection | 128,000 complaints (2023), R$1.5M fine per infraction |

Environmental factors

Hospitals, including Rede D'Or's extensive network, generate substantial solid waste and liquid effluents, posing significant environmental challenges. Rede D'Or’s reported Scope 3 emissions, for instance, highlight operational waste as a primary contributor, underscoring the critical need for advanced management strategies. The company's Health, Safety, and Environment (HSE) policy actively targets minimizing waste production and promoting recycling across its units. Efforts continue to enhance waste diversion rates, aiming for improved sustainability metrics in 2024 and 2025.

Healthcare facilities are significant consumers of energy and water, making environmental impact reduction crucial for Rede D'Or. The company is actively integrating automated systems in new construction projects, like the 2024 expansion plans, to precisely control HVAC and reduce energy usage. Furthermore, Rede D'Or aims to transition a substantial portion of its units to renewable energy sources by 2025, aligning with broader sustainability goals and potentially reducing operational costs.

Rede D'Or has demonstrated a strong commitment to environmental sustainability, actively addressing climate change through concrete targets. The company aims for a significant 36% reduction in its Scope 1 and 2 greenhouse gas emissions by 2030, aligning with global climate action efforts. This proactive approach is further evidenced by its detailed sustainability reports, prepared using internationally recognized frameworks like GRI and SASB. Such transparency and dedication to carbon footprint reduction are crucial for enhancing corporate reputation and fostering positive stakeholder relations in the 2024-2025 business landscape.

Sustainable Building Practices

Rede D’Or São Luiz is actively integrating sustainability into its new hospital constructions, prioritizing energy and water efficiency, alongside enhanced safety protocols. For example, the Maternidade Star project was meticulously designed to meet stringent ESG criteria, reflecting a forward-looking commitment. This approach extends beyond merely retrofitting existing structures, demonstrating a strategic long-term vision for sustainable operations. Such initiatives are crucial as the company expands its footprint, ensuring new facilities align with evolving environmental standards.

- New hospital projects incorporate energy and water efficiency benchmarks.

- Maternidade Star project exemplifies ESG-compliant design and construction.

- Focus on safety protocols is integrated into sustainable building practices.

- Commitment extends to new builds, not just existing facility upgrades.

ESG Strategy and Reporting

The increasing global and local focus on Environmental, Social, and Governance (ESG) criteria significantly impacts healthcare providers like Rede D'Or São Luiz. Rede D'Or formalized its ESG strategy, publishing an annual Integrated Sustainability Report for transparency, with the latest available reflecting 2023 performance, guiding its 2024-2025 initiatives. The company utilizes a double materiality matrix to prioritize key areas, ensuring accountability. This commitment is vital for maintaining investor confidence and securing its social license to operate in the evolving market.

- Rede D'Or's Integrated Sustainability Report is published annually, detailing 2023 performance and setting directions for 2024-2025.

- The company employs a double materiality matrix to identify and manage its most significant ESG impacts.

- Global ESG investments are projected to continue growing, reaching significant figures by late 2024 or early 2025.

- Maintaining strong ESG performance is crucial for attracting capital from sustainability-focused funds.

Rede D'Or prioritizes environmental sustainability by targeting improved waste diversion rates and transitioning to renewable energy sources by 2025. New hospital constructions, like Maternidade Star, integrate energy and water efficiency, aligning with stringent ESG criteria. The company aims for a 36% reduction in Scope 1 and 2 emissions by 2030, reinforcing its commitment to climate action and transparent reporting for 2024-2025.

| Environmental Aspect | Rede D'Or 2024-2025 Focus | Target/Metric |

|---|---|---|

| Waste Management | Enhanced waste diversion | Improved recycling rates |

| Energy Consumption | Renewable energy transition | Substantial unit portion by 2025 |

| Emissions Reduction | Scope 1 & 2 GHG reduction | 36% by 2030 |

PESTLE Analysis Data Sources

Our Rede D'Or São Luiz PESTLE Analysis is constructed using a robust blend of data from official Brazilian government agencies, reputable financial institutions, and leading healthcare industry publications. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.