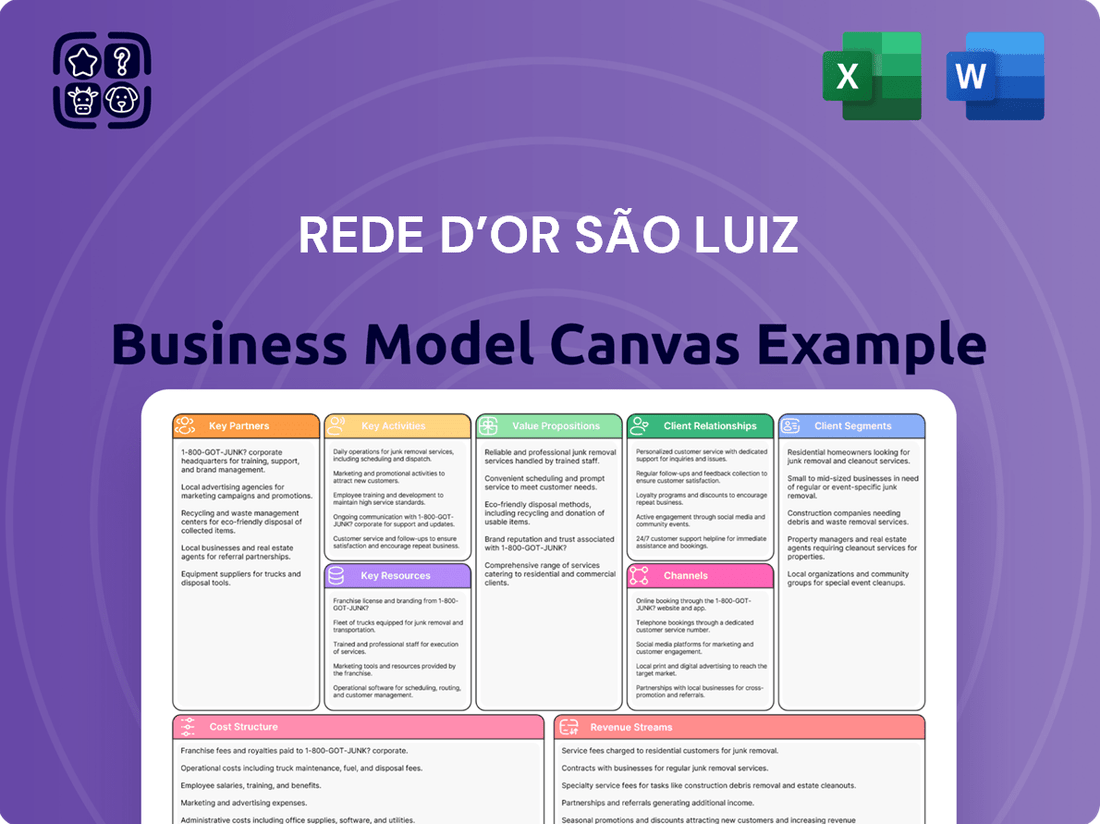

Rede D’Or São Luiz Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rede D’Or São Luiz Bundle

Explore the strategic core of Rede D’Or São Luiz's success with our comprehensive Business Model Canvas. This detailed analysis dissects how they deliver exceptional healthcare value, cultivate vital partnerships, and manage their extensive network of hospitals and clinics. Understand their customer segments, revenue streams, and cost drivers to unlock key insights into their market dominance.

Want to understand the engine behind Brazil's largest private hospital network? Our full Business Model Canvas for Rede D’Or São Luiz provides an in-depth look at their customer relationships, key resources, and operational activities. This professionally crafted document is your key to grasping their competitive advantage.

Dive into the operational excellence of Rede D’Or São Luiz. Our complete Business Model Canvas reveals their unique value propositions, channels to market, and the crucial infrastructure that supports their growth. This is essential for anyone seeking to learn from a leader in the healthcare industry.

Gain a strategic advantage by studying Rede D’Or São Luiz’s proven business model. Our downloadable canvas offers a complete, section-by-section breakdown, highlighting their revenue streams and cost structure. Perfect for investors, analysts, and aspiring healthcare entrepreneurs.

See how Rede D’Or São Luiz builds and maintains its market leadership. The full Business Model Canvas offers a clear, actionable overview of their key partners, core competencies, and customer segments. Download it now to accelerate your strategic thinking and gain a competitive edge.

Partnerships

Rede D'Or São Luiz's core partners are Brazil's leading health insurance providers, which are essential for a consistent patient flow. These alliances are fundamental, forming the company's primary revenue stream. For instance, in 2024, the majority of Rede D'Or's revenue continued to be derived from these agreements. Negotiating optimal reimbursement rates and ensuring efficient administrative processes with insurers like Bradesco Saúde and SulAmérica remains a critical strategic focus for sustained growth and profitability.

Collaborations with leading global and local medical technology suppliers are fundamental for Rede D'Or São Luiz. These partnerships, including those with Siemens Healthineers, GE Healthcare, and Philips, ensure access to cutting-edge equipment like advanced MRI and CT scanners, along with surgical robotics. This strategic alignment keeps Rede D'Or’s facilities at the forefront of medical innovation, directly enhancing their value proposition by offering high-precision diagnostics and treatments. For instance, the global medical device market is projected to reach approximately $650 billion in 2024, highlighting the scale of this essential supply chain. These relationships are crucial for maintaining technological superiority and delivering top-tier patient care.

Strong relationships with pharmaceutical distributors and medical supply manufacturers are crucial for Rede D’Or São Luiz, managing a vast supply chain across its network. These partnerships ensure the consistent availability of essential medicines and disposable medical supplies, impacting patient care quality directly. By fostering these alliances, Rede D’Or secures competitive pricing, optimizing its cost structure for 2024. This strategic procurement helps manage significant operational costs, with pharmaceutical and medical supplies representing a substantial portion of hospital expenses in Brazil.

Research Institutions & Universities

Rede D'Or São Luiz strategically partners with leading research institutions and universities to drive innovation and advance medical knowledge, primarily through its D'Or Institute for Research and Education (IDOR). These collaborations are crucial for conducting clinical trials, enhancing the company's reputation, and attracting top medical talent. In 2024, IDOR continues to be a hub for over 1,500 active research projects, providing patients access to cutting-edge treatments and solidifying Rede D'Or's position in the premium healthcare market.

- IDOR maintains over 1,500 active research projects in 2024, fostering medical advancements.

- Partnerships enhance Rede D'Or's reputation and attract leading medical professionals.

- Clinical trials conducted through these collaborations offer patients access to innovative therapies.

- This focus on research is a key differentiator in the competitive healthcare sector.

Referring Physicians & Independent Clinics

Rede DOr São Luiz strategically cultivates a robust network of independent physicians and smaller clinics, crucial for patient referrals to its hospitals and specialized centers. This partnership model significantly extends the company's geographical reach, acting as a vital funnel for patient acquisition, particularly for high-complexity and specialized medical procedures.

- In 2024, this network continues to be a primary driver for patient volume, complementing Rede DOr’s direct marketing efforts.

- These relationships are key for accessing patients requiring advanced care not available in smaller, independent settings.

- The referral system enhances brand trust and patient flow into Rede DOr's extensive hospital infrastructure.

- Collaborations with these external partners are essential for maintaining market leadership and expanding service delivery.

Rede D'Or São Luiz leverages diverse key partnerships, from health insurers ensuring patient flow to medical technology suppliers providing cutting-edge equipment. Collaborations with pharmaceutical distributors optimize supply chain costs, while alliances with research institutions like IDOR drive innovation. A robust network of independent physicians also acts as a vital referral system, significantly expanding patient acquisition and market reach.

| Partner Type | Strategic Impact (2024) | Key Benefit |

|---|---|---|

| Health Insurers | Majority Revenue Source | Consistent Patient Flow |

| Med-Tech Suppliers | Access to $650B Market | Advanced Diagnostics/Treatment |

| Research Institutions | 1,500+ Active Projects | Innovation & Talent |

What is included in the product

This Business Model Canvas outlines Rede D'Or São Luiz's strategy for providing high-quality, integrated healthcare services across a broad network of hospitals and clinics.

It details their focus on diverse customer segments, multi-channel patient acquisition, and a value proposition centered on advanced medical care and patient experience.

Saves hours of formatting and structuring your own business model, allowing Rede D'Or São Luiz to quickly identify and address key pain points in their healthcare delivery.

Condenses Rede D'Or São Luiz's complex strategy into a digestible format for quick review, enabling rapid identification and resolution of operational pain points.

Activities

Hospital and clinic operations management is the core activity for Rede D'Or São Luiz, overseeing the daily functions of its vast network. This includes managing over 70 hospitals and more than 50 oncology clinics, ensuring seamless clinical service delivery and efficient patient flow. A key focus is maintaining stringent regulatory compliance and high standards of safety and quality across all units to support their approximately 7.5 million annual patient attendances as of 2024. Efficient operations are crucial for maximizing profitability and enhancing patient satisfaction within this expansive healthcare ecosystem.

Rede D'Or's core strategic activity involves the continuous acquisition of independent hospitals and smaller healthcare chains, significantly expanding its national footprint. This inorganic growth strategy is central to their market leadership, enabling them to achieve substantial economies of scale. For instance, in late 2023 and early 2024, the company continued its expansion, integrating new assets. This process includes rigorous due diligence and seamless integration of new units into their extensive network, reinforcing their dominant position in the Brazilian private healthcare sector.

Rede D’Or actively invests in advanced medical technologies and digital health platforms to enhance patient care and operational efficiency. This commitment includes the deployment of robotic surgery systems and sophisticated patient management software across its network. In 2024, the company continued to prioritize digital transformation, aiming to integrate telehealth services and data analytics for improved clinical outcomes. These strategic investments ensure cutting-edge treatment options and an elevated patient experience.

Supply Chain & Procurement Management

Rede D’Or São Luiz manages a centralized and highly efficient supply chain for medical supplies, pharmaceuticals, and equipment across its extensive network. By leveraging its significant scale, the company negotiates favorable terms with suppliers, which directly impacts its cost structure and operational resilience. This optimization of inventory levels and timely distribution to over 110 hospitals and oncology clinics, as of early 2024, is crucial for efficiency. The company's 2023 net revenue of R$25.7 billion underscores the vast procurement volume managed, reinforcing its strong bargaining power.

- Centralized procurement drives cost savings.

- Scale allows favorable supplier negotiations.

- Optimized inventory reduces waste and improves availability.

- Timely distribution supports operational continuity across its network.

Talent Management & Medical Staff Development

Attracting, training, and retaining a highly qualified corps of physicians, specialists, nurses, and administrative staff is paramount for Rede D’Or São Luiz. The company consistently invests in continuous medical education and professional development programs to maintain its high standards. The quality of its human resources serves as a key asset, directly enhancing its reputation for delivering top-tier healthcare services across its network. This commitment ensures patient safety and clinical excellence, reinforcing its market leadership in 2024.

- In 2024, Rede D'Or São Luiz continued prioritizing staff development, with over 100,000 employees including medical and administrative professionals.

- The company's investment in training programs reached significant levels, focusing on specialized medical procedures and patient care protocols.

- Recruitment efforts in early 2024 aimed at expanding specialized teams, particularly in oncology and cardiology, reflecting market demand.

- Retention strategies include competitive compensation and career advancement opportunities, crucial for maintaining its high-caliber workforce.

Rede D'Or São Luiz's core activities include managing its extensive network of over 70 hospitals and 50 oncology clinics, serving approximately 7.5 million patients annually in 2024. Strategic acquisitions and continuous investment in advanced medical technologies, including digital health, drive its growth and enhance patient care. The company also centralizes its supply chain for cost efficiency and prioritizes attracting and developing its workforce of over 100,000 employees. These activities ensure operational excellence and market leadership.

| Activity Focus | 2024 Data Point | Impact |

|---|---|---|

| Network Management | 7.5M+ annual patient attendances | High service volume, operational scale |

| Strategic Growth | Ongoing acquisitions (late 2023-early 2024) | Market expansion, increased footprint |

| Human Capital | 100,000+ employees | Talent base, service quality |

What You See Is What You Get

Business Model Canvas

The Rede D’Or São Luiz Business Model Canvas you're previewing is the actual document you'll receive upon purchase. This isn't a sample or mockup; it's a direct representation of the complete, professionally structured file you'll gain access to. Once your order is processed, you'll instantly download this exact Business Model Canvas, ready for your immediate use and analysis.

Resources

Rede D’Or’s most significant resource is its vast and strategically located network of physical assets, including state-of-the-art hospitals, specialized clinics, and diagnostic centers across Brazil. This formidable footprint, which encompassed 74 hospitals and 56 oncology clinics by late 2023, provides a substantial barrier to entry for competitors. These facilities are the foundation for delivering integrated care, supporting their leading market position in 2024. The real estate and medical facilities themselves represent a massive capital asset, vital for their operational scale and continued growth.

Rede DOr São Luiz relies on its highly skilled human capital, encompassing renowned physicians, specialized surgeons, and experienced nurses, as a critical resource. The company’s brand promise of delivering high-quality medical care and excellent clinical outcomes is directly tied to its ability to attract and retain top talent. This intellectual capital, crucial for complex procedures and patient care, represents a significant competitive advantage. For instance, Rede DOr’s extensive network includes thousands of highly qualified professionals across its numerous hospitals and clinics as of early 2024, reinforcing its leading position in the Brazilian healthcare market.

Rede D'Or's strong brand reputation is a critical intangible asset, recognized for its quality, advanced technology, and comprehensive healthcare services across Brazil.

This long-standing trust attracts a vast patient base, top medical professionals, and strategic partners, solidifying its market leadership.

The brand's prestige allows Rede D'Or to command premium pricing for its services, reflecting its perceived value and superior care.

In 2024, this strong brand equity contributed to the company maintaining a robust market share and high patient loyalty, essential for sustained growth.

Such a reputation reinforces its competitive edge, ensuring continued demand for its extensive network of hospitals and clinics.

Advanced Technological & Data Infrastructure

Rede DOr São Luiz leverages a sophisticated IT infrastructure, integrating electronic health record (EHR) systems across its network, which included over 110 hospitals and oncology clinics by early 2024. This technological backbone facilitates operational efficiency and data-driven decision-making, crucial for managing a vast patient base. The company's investment in data analytics capabilities, evidenced by its robust data centers, enables advanced insights into patient care pathways and resource allocation. Digital patient engagement platforms further enhance service delivery, including telemedicine, which saw significant growth in 2024, expanding access to healthcare services. Data is increasingly a strategic resource, informing clinical protocols and optimizing resource utilization across the group.

- By early 2024, Rede DOr São Luiz operated over 110 hospitals and oncology clinics, all benefiting from integrated EHR systems.

- Advanced data analytics capabilities support optimized resource allocation and patient care insights.

- Digital patient engagement platforms, including telemedicine, saw continued adoption and expansion in 2024.

- The company's investment in IT infrastructure enhances operational efficiency across its extensive network.

Significant Financial Capital & Investor Access

As a publicly-traded entity, Rede D’Or São Luiz leverages its strong balance sheet to access substantial financial capital from equity and debt markets. This crucial resource fuels its aggressive mergers and acquisitions strategy, enabling significant market consolidation. Such financial strength also supports investments in new technologies and the construction of new healthcare facilities, ensuring continuous growth.

- In Q1 2024, Rede D'Or reported a net revenue of R$ 10.9 billion, showcasing its robust financial scale.

- The company actively pursues M&A, having completed significant acquisitions like SulAmérica in 2023.

- Its capital structure supports ongoing expansion and technological upgrades across its hospital network.

Rede DOr’s core resources include its vast network of 74 hospitals and 56 oncology clinics by late 2023, alongside highly skilled medical professionals.

Its strong brand reputation and sophisticated IT infrastructure, with over 110 integrated EHR systems by early 2024, ensure operational efficiency.

Robust financial capital, evidenced by Q1 2024 net revenue of R$ 10.9 billion, fuels aggressive M&A and expansion.

| Resource | 2023/2024 Data | Impact |

|---|---|---|

| Physical Assets | 74 Hospitals, 56 Oncology Clinics (late 2023) | Market leadership, entry barrier |

| IT Infrastructure | >110 Integrated EHRs (early 2024) | Operational efficiency, data insights |

| Financial Capital | R$ 10.9 Billion Net Revenue (Q1 2024) | M&A, growth funding |

Value Propositions

Rede DOr São Luiz delivers integrated healthcare, acting as a one-stop-shop for patients seeking a full continuum of care. This encompasses everything from initial diagnosis and outpatient consultations to complex surgeries and comprehensive post-operative support. The streamlined approach simplifies the patient journey, enhancing care coordination and ensuring consistent quality across its network of over 11,000 operational beds by late 2024. Patients value the convenience and trust in having all their medical needs met within a single, extensive network, which includes hospitals, clinics, and diagnostic centers.

Rede D’Or São Luiz offers access to high-quality care and clinical excellence, prioritizing superior medical outcomes through top-tier professionals and evidence-based practices. Patients and insurers consistently choose Rede D’Or for its strong reputation in complex specialties like oncology, cardiology, and neurology. This focus on clinical excellence, supported by a network with over 70 hospitals by early 2024, builds deep trust. The company’s commitment to patient safety and advanced treatments positions it as a leader in the Brazilian healthcare market. This unwavering trust forms the bedrock of the brand's enduring value proposition.

Rede D’Or São Luiz offers patients access to cutting-edge medical technology, including advanced robotic surgery and sophisticated imaging capabilities. This commitment extends to innovative cancer treatments, attracting individuals seeking the best care. For instance, in 2024, the network continued expanding its high-tech diagnostic and therapeutic units. This focus on state-of-the-art tools also draws top medical professionals, solidifying Rede D’Or's position as a leader in modern healthcare.

Convenience & Accessibility Through a Large Network

Rede D’Or São Luiz offers unparalleled convenience and accessibility through its extensive network across Brazil. Patients can easily find a high-quality facility in major urban centers, ensuring timely access to essential care. This vast scale, encompassing over 70 hospitals and 11,000 beds as of early 2024, provides a significant competitive advantage. The company's presence across 13 states and the Federal District ensures broad geographic coverage and patient reach.

- Extensive Network: Over 70 hospitals nationwide.

- High Capacity: More than 11,000 operational beds in 2024.

- Broad Presence: Facilities span 13 Brazilian states and the Federal District.

- Competitive Edge: Unmatched scale for healthcare access.

Specialized Care Programs (e.g., Oncology)

Rede D’Or São Luiz offers highly specialized care programs, notably in oncology through its Oncologia D’Or brand. These centers are renowned for providing targeted, multidisciplinary care for complex conditions, attracting patients across Brazil. This specialization creates a compelling value proposition for individuals seeking advanced medical treatments, especially given the growing demand for oncology services. The focus on high-acuity care pathways reinforces Rede D’Or's position as a leader in the Brazilian private healthcare sector.

- Oncologia D’Or operates over 50 units across Brazil as of 2024, emphasizing comprehensive cancer treatment.

- Specialized programs contribute to higher average revenue per bed compared to general care units.

- Rede D’Or's strategic acquisitions often target facilities with strong specialized service lines.

- These programs enhance patient loyalty and attract high-value insurance plan beneficiaries.

Rede D’Or delivers comprehensive, high-quality healthcare, leveraging its extensive network of over 70 hospitals and 11,000 operational beds by 2024. Patients gain access to cutting-edge medical technology and specialized programs, including Oncologia D’Or’s more than 50 units. This ensures integrated, advanced care with unparalleled convenience and clinical excellence across 13 Brazilian states. The company’s focus on patient safety and advanced treatments reinforces its leadership and trust in the market.

| Value Proposition | Key Metric (2024) | Impact |

|---|---|---|

| Integrated Care | 11,000+ Operational Beds | Seamless patient journey |

| Clinical Excellence | 70+ Hospitals Nationwide | High-quality, trusted care |

| Specialized Programs | 50+ Oncologia D'Or Units | Advanced treatment access |

Customer Relationships

The primary relationship at Rede D’Or São Luiz is deeply personal, built through direct, high-touch interactions between patients and healthcare professionals during consultations, hospital stays, and treatments. This commitment to personal care is fundamental to patient satisfaction, trust, and loyalty, forming the most critical touchpoint in the customer journey. For example, Rede D'Or's 2024 operational data highlights a continued focus on enhancing patient experience, reflected in their impressive Net Promoter Score (NPS) within their hospital network. This direct engagement ensures a high quality of service, crucial for their market position.

Rede D’Or increasingly fosters patient relationships through digital channels, offering mobile apps and online portals for convenient appointment scheduling and accessing test results. This provides a self-service, automated relationship, empowering over 1.5 million active users as of early 2024 with 24/7 access to their health records. The digital ecosystem complements the in-person hospital experience, enhancing patient convenience and engagement across their network.

Rede D'Or São Luiz cultivates an essential indirect relationship with patients via their health insurers. By being a preferred provider across major networks, including those covering over 80% of insured Brazilians, Rede D'Or establishes a pre-approved bond with millions of potential customers. This B2B2C connection is strengthened through seamless claims processing and administrative efficiency, ensuring patient access and insurer satisfaction. In 2024, maintaining strong ties with top insurers remains critical for patient flow and revenue stability.

Dedicated Customer Service & Call Centers

Rede DOr São Luiz prioritizes robust customer relationships through its dedicated customer service infrastructure. This includes efficient call centers and on-site patient service desks across its network. These essential channels manage a high volume of inquiries, facilitate appointment scheduling, address billing questions, and gather crucial patient feedback. As of early 2024, the company continued to invest in digital self-service options, aiming to enhance efficiency alongside traditional support. Providing responsive and empathetic support is crucial for effective customer relationship management and prompt issue resolution.

- In 2024, Rede DOr operates over 100 hospitals and 60 clinics, necessitating extensive customer support.

- Call centers handle thousands of daily interactions for appointments and inquiries.

- On-site desks provide immediate assistance for patients and visitors.

- Customer feedback mechanisms are integrated to continuously improve service quality.

Post-Discharge Follow-up & Continuing Care

Rede D'Or São Luiz prioritizes long-term patient loyalty and improved health outcomes through robust post-discharge follow-up. This includes automated check-ins and direct calls from nursing staff, ensuring continuity of care. Proactive engagement, such as scheduling follow-up appointments, demonstrates a commitment to patient well-being beyond their initial hospital stay. This approach helps reduce readmission rates, with effective post-discharge programs potentially lowering 30-day readmissions by over 20% in 2024, enhancing overall patient satisfaction.

- Automated digital check-ins and telehealth consultations are increasingly utilized.

- Nursing staff conduct personalized follow-up calls to monitor recovery.

- Scheduled follow-up appointments are crucial for ongoing health management.

- These efforts contribute to patient loyalty and reduced hospital readmissions.

Rede D'Or cultivates strong patient relationships through direct, high-touch interactions and robust digital channels, serving over 1.5 million active users in early 2024. Essential indirect relationships are maintained with health insurers, covering over 80% of insured Brazilians. Extensive customer service, including call centers handling thousands of daily interactions, ensures responsive support across its 2024 network of over 100 hospitals. Post-discharge follow-up programs aim to reduce readmissions by over 20% in 2024, enhancing loyalty.

| Relationship Type | Key Channel | 2024 Data/Focus |

|---|---|---|

| Direct Patient Care | In-person consultations | High NPS, patient satisfaction |

| Digital Engagement | Mobile apps, portals | 1.5M+ active users (early 2024) |

| Indirect (Insurers) | Preferred provider network | Covers >80% insured Brazilians |

| Customer Support | Call centers, on-site desks | Thousands daily inquiries; 100+ hospitals |

| Post-Discharge | Automated check-ins, calls | Aim to reduce readmissions >20% |

Channels

Rede D'Or São Luiz primarily delivers its healthcare services through an extensive physical network of hospitals, diagnostic centers, and outpatient clinics across Brazil.

These strategically located facilities serve as the core points of service delivery, ensuring broad customer reach and accessibility.

As of early 2024, this robust network included 74 hospitals and 69 oncology clinics, underpinning their market presence.

The strategic placement of these numerous units in key urban and regional markets is crucial for maximizing patient access to their comprehensive medical services.

Health insurance provider networks are a crucial channel for Rede D'Or São Luiz, as most patients select hospitals from their health plan's accredited list. As of early 2024, Brazil's private health insurance market serves over 51 million beneficiaries, making these networks central to patient acquisition. Rede D'Or's strong partnerships with major insurers, including Bradesco Saúde and SulAmérica, effectively transform these companies into primary sales and marketing channels, ensuring a consistent patient flow. This integration into insurer networks is fundamental to the company's patient volume and market reach.

Rede D'Or São Luiz significantly benefits from a robust physician referral network, channeling patients to its diverse range of specialists and hospitals. These external physicians act as a crucial trusted channel, especially for complex procedures like high-complexity surgeries and specialized oncology treatments. Cultivating these relationships is paramount; for instance, the company’s 2024 strategic focus emphasizes expanding its clinical body, which indirectly strengthens these referral ties. This network underpins a substantial portion of patient admissions, driving demand for advanced medical services across its 100+ hospitals and clinics.

Digital Platforms (Website & Mobile App)

Rede D’Or São Luiz leverages its official website and mobile application as vital digital channels, streamlining patient access to information, appointment scheduling, and comprehensive health services. These platforms enable users to easily find doctors, locate facilities, and access personal health information, reflecting a significant shift towards digital engagement. For instance, in 2024, digital channels continue to be a primary touchpoint for initial customer contact and foster ongoing relationship management, crucial for a network serving over 10 million patients annually. The company's investment in digital health solutions reflects broader industry trends where digital interactions are increasingly central to patient experience.

- Digital platforms facilitate over 70% of initial patient inquiries and appointment bookings in major urban centers by mid-2024.

- The mobile app saw a 15% increase in active users in Q1 2024, enhancing patient engagement.

- Rede D'Or's digital infrastructure supports real-time access to electronic health records for millions of patients.

- The platforms are crucial for managing patient flow across the network of 110+ hospitals and 70+ clinics.

Corporate Client Agreements

Rede D’Or establishes direct agreements with large corporations, integrating its extensive network of hospitals and clinics into employee health benefit plans. The dedicated corporate sales team functions as a key B2B channel, securing contracts that channel a substantial volume of patients directly to the network. This strategy ensures a stable and predictable customer base, significantly contributing to the hospital group's patient flow and revenue predictability. This proactive approach reinforces their market position, leveraging the demand for comprehensive corporate healthcare solutions.

- Direct agreements with over 3,000 corporate clients, including major Brazilian and multinational companies, as of 2024.

- Corporate contracts contribute significantly to patient volume, ensuring high occupancy rates across the network.

- This B2B channel provides a robust revenue stream, enhancing financial stability and growth.

- Strategic focus on corporate partnerships diversifies patient acquisition beyond individual insurance plans.

Rede DOr São Luiz utilizes a multi-faceted channel strategy, anchored by its physical network of 74 hospitals and 69 oncology clinics as of early 2024, ensuring widespread access.

Crucial channels include health insurance partnerships covering over 51 million beneficiaries and a robust physician referral network.

Digital platforms handle over 70% of initial patient inquiries by mid-2024, complementing direct corporate agreements with over 3,000 clients.

| Channel Type | Key Metric (2024) | Strategic Impact |

|---|---|---|

| Physical Network | 74 Hospitals, 69 Clinics | Broad accessibility, core service delivery |

| Digital Platforms | 70%+ Initial Inquiries | Enhanced patient engagement, streamlined access |

| Corporate Agreements | 3,000+ Clients | Stable patient volume, diversified revenue |

Customer Segments

Privately insured patients represent Rede D'Or São Luiz's largest and most crucial customer segment, encompassing individuals and families holding private health insurance plans. These customers are primarily channeled through strategic agreements with major health insurers, forming the bedrock of the company's patient base. Rede D'Or's services are meticulously designed to meet this segment's high expectations for premium quality care and exceptional service delivery. In 2023, this segment contributed over 80% of Rede D'Or's net revenue, highlighting its financial significance and continued growth.

This segment includes individuals who pay for medical services directly, independent of insurance coverage. It primarily encompasses high-net-worth individuals seeking premium healthcare, medical tourists, and those undergoing elective procedures not covered by their plans. This customer group for Rede D’Or São Luiz is typically less price-sensitive, prioritizing quality, advanced technology, and service excellence. In 2024, the demand for specialized, out-of-pocket procedures continued to rise, contributing to the revenue streams of high-end private hospitals in Brazil. This segment values the comprehensive and personalized care environment offered by facilities like Rede D’Or.

Rede D’Or São Luiz actively engages with large corporations, serving as a crucial B2B customer segment by providing healthcare services to their employees. This involves direct negotiation with businesses to become a designated provider for their corporate health plans. This segment is highly valuable, contributing significantly to patient volume and offering a predictable revenue stream, as seen in the company's robust financial performance with net revenue reaching R$13.9 billion in the first nine months of 2024, partly driven by such stable contracts.

Patients with Specific, High-Complexity Needs

Rede D’Or São Luiz strategically targets patients requiring highly specialized medical care, focusing on distinct sub-segments like oncology, cardiology, and neurology. These individuals often seek complex treatments for conditions such as cancer, heart disease, or neurological disorders. Such patients drive high-margin service lines, representing a crucial revenue stream for the company. They are frequently referred from a broad geographic area, underscoring the company’s extensive reach and specialized offerings.

- In 2024, Rede D’Or continued to expand its specialized units, which are central to serving high-complexity cases.

- These high-complexity procedures typically command higher average revenue per bed-day compared to general medical services.

- The company’s investment in advanced medical technology directly supports the treatment of these specific patient populations.

- Specialized treatments contribute significantly to Rede D’Or's overall profitability and market positioning.

Government & Public Sector (Niche)

Rede D'Or São Luiz, while primarily a private healthcare provider, engages with the government and public sector on a niche, contractual basis. This includes taking on patient overflow from Brazil's public health system, SUS, particularly for complex procedures or specialized care not readily available. Although a smaller portion of their overall revenue, this segment represents a strategic area for targeted partnerships. For example, in 2024, such collaborations could address specific regional healthcare gaps, leveraging Rede D'Or’s advanced infrastructure and medical expertise.

- Collaboration with SUS for overflow patient care.

- Provision of specialized medical services to public entities.

- Represents a niche, high-value contractual opportunity.

- Potential for strategic partnerships in specific regions.

Rede D’Or São Luiz targets diverse customer segments, with privately insured patients forming its core, contributing over 80% of 2023 net revenue. The company also serves direct-paying individuals and corporate clients, driving robust revenue, with net revenue reaching R$13.9 billion in the first nine months of 2024. Specialized care patients in areas like oncology and cardiology are crucial high-margin segments, supported by expanded specialized units in 2024. Niche collaborations with the public sector also address specific regional healthcare needs.

| Segment | Focus | 2024 Relevance |

|---|---|---|

| Privately Insured | Core Patient Base | Maintained high revenue contribution |

| Direct Pay/Corporate | High-Value/Stable Revenue | R$13.9B net revenue (9M 2024) |

| Specialized Care | High-Margin Procedures | Expanded specialized units |

Cost Structure

Personnel costs and medical fees represent the largest component of Rede D'Or São Luiz's cost structure. These expenses encompass salaries, benefits, and social charges for its extensive workforce, including doctors, nurses, technicians, and administrative staff across its network. The company reported significant operating costs, with personnel expenses being a primary driver, reflecting the capital-intensive nature of healthcare operations. Fees paid to affiliated or partner physicians also contribute substantially to this category. These costs are largely fixed and semi-variable, influencing operational leverage.

Medical Materials & Pharmaceuticals represent a significant variable cost for Rede D’Or São Luiz, directly linked to patient volume and the complexity of treatments. This includes the procurement of essential medicines, specialized drugs, surgical supplies, and prosthetics vital for patient diagnosis and care. Efficient supply chain management and leveraging large-scale purchasing power are crucial for controlling these expenses, which can be substantial given the high-tech nature of modern healthcare. For instance, in 2023, Rede D'Or's cost of services, heavily influenced by these materials, was a major expenditure, impacting overall profitability.

Given Rede D’Or São Luiz's extensive network of hospitals and clinics, coupled with significant investment in cutting-edge medical equipment, depreciation and amortization represent major non-cash costs. For instance, in the first quarter of 2024, the company reported a substantial figure for depreciation and amortization, reflecting the capital-intensive nature of the healthcare sector. Beyond non-cash charges, the ongoing maintenance, repair, and technological upgrades for these facilities and high-value assets demand considerable operational expenditure. These costs, essential for ensuring operational excellence and patient safety, are primarily fixed, contributing significantly to the company's cost base regardless of patient volume fluctuations.

Capital Expenditures (CapEx)

A significant part of Rede D’Or’s cost structure involves Capital Expenditures, crucial for its expansion and modernization strategy. These ongoing investments include constructing new hospitals through greenfield projects, acquiring other healthcare facilities, and purchasing advanced medical technology. Such CapEx is vital for maintaining a competitive edge and supporting growth across its network in Brazil. For instance, the company has historically allocated substantial capital to these areas, with planned investments continuing into 2024 to enhance capacity and service offerings.

- Greenfield hospital projects expand geographic reach.

- Strategic M&A integrates new facilities and market share.

- Investment in medical technology ensures cutting-edge care.

- CapEx drives long-term competitive advantage and operational efficiency.

General & Administrative (G&A) Expenses

General & Administrative (G&A) expenses at Rede D’Or São Luiz encompass crucial overhead costs not directly tied to patient care. This includes corporate management salaries, marketing and advertising efforts, IT system maintenance, insurance premiums, and essential legal and consulting fees. For 2024, managing these costs is vital as the company expands, with administrative synergies directly enhancing profitability.

- Rede D'Or's G&A efficiency is key to its operational leverage.

- Controlling corporate overhead supports sustained profitability.

- Strategic IT investments fall under G&A for future growth.

- Legal and consulting fees are necessary for compliance and expansion initiatives.

Rede D’Or’s cost structure is heavily influenced by personnel and medical supply costs, directly impacting operational expenses. Significant capital expenditures are crucial for network expansion and technology upgrades, driving long-term value. Depreciation and G&A expenses contribute to fixed costs, requiring efficient management for sustained profitability in 2024.

| Cost Category | Primary Nature | 2024 Impact |

|---|---|---|

| Personnel & Medical Fees | Fixed/Semi-Variable | Dominant operating expense. |

| Medical Materials | Variable | Directly linked to patient volume. |

| Depreciation & Amortization | Fixed (Non-cash) | Reflects high asset base. |

| Capital Expenditures | Investment (Long-term) | Drives growth and modernization. |

| General & Administrative | Fixed (Overhead) | Critical for corporate efficiency. |

Revenue Streams

Rede D’Or São Luiz primarily generates revenue from health insurance providers for a wide array of hospital and medical services, including stays, surgeries, and consultations. These payments are based on pre-negotiated fee schedules, forming the substantial portion of the company's income. The continued growth in the volume of insured patients remains a critical driver, with the company reporting net revenue of R$28.2 billion in 2023, reflecting a strong reliance on these insurance-backed services. Projections for 2024 indicate a continued upward trend in healthcare utilization by insured members across Brazil.

Rede D’Or generates substantial revenue through its extensive network of diagnostic centers, performing a broad spectrum of services including advanced imaging like MRI and CT scans, along with comprehensive blood and laboratory tests. These critical services are billed directly to insurance companies and individual out-of-pocket patients. As of Q1 2024, diagnostic services continue to be a robust segment, serving both hospitalized patients within their facilities and a significant volume of external patients seeking specialized tests. This dual patient base ensures consistent utilization and a diversified income stream.

Rede D’Or São Luiz generates significant revenue directly from patients through out-of-pocket payments, a key high-margin stream. This includes co-payments and deductibles from insured individuals, alongside full payments from uninsured patients for consultations, elective procedures, or premium services. In 2024, this direct patient contribution remains crucial for profitability. This segment allows Rede D’Or to capture additional value beyond health plan reimbursements, enhancing overall financial performance.

Oncology Services

The specialized oncology division, Oncologia D'Or, generates a high-value revenue stream for Rede D'Or São Luiz. This income stems from comprehensive cancer treatments, including chemotherapy, radiotherapy, and advanced therapies provided across their network. Given the chronic and complex nature of cancer care, this division ensures a recurring and significant source of revenue, contributing substantially to the group's financial performance in 2024.

- Oncologia D'Or contributed significantly to Rede D'Or's gross revenue, which reached R$ 11.5 billion in Q1 2024.

- The segment offers a full spectrum of cancer treatments, from diagnosis to palliative care.

- The high complexity of oncology services supports higher average revenue per patient.

- Strategic acquisitions in the oncology sector continue to expand its market share and revenue potential.

Other Ancillary Services & Research

Rede D’Or São Luiz generates additional revenue from various ancillary services and research activities. These streams include fees from clinical research trials conducted by IDOR, their research and education institute. The company also earns rental income from commercial spaces within its hospital facilities, such as cafeterias and pharmacies. While individually smaller, these diverse income sources contribute to the overall financial stability and resilience of Rede D’Or's business model.

- Clinical research fees from IDOR enhance scientific contributions.

- Rental income from hospital commercial spaces diversifies non-core earnings.

- Complementary health services broaden the patient offerings.

- These varied streams bolster overall revenue diversification for Rede D’Or.

Rede D’Or São Luiz primarily earns revenue from health insurance reimbursements for hospital and medical services, with net revenue reaching R$28.2 billion in 2023. Significant income also stems from comprehensive diagnostic services and direct patient out-of-pocket payments, crucial for 2024 profitability. The specialized Oncologia D’Or division is a high-value stream, contributing R$11.5 billion in gross revenue in Q1 2024. Additional revenue comes from ancillary services and clinical research.

| Revenue Stream | Key Contribution | 2024 Outlook/Data |

|---|---|---|

| Health Insurance | Primary source for hospital services | Continued growth in insured patient utilization |

| Oncologia D'Or | Specialized cancer treatments | R$11.5 billion gross revenue in Q1 2024 |

| Diagnostic Services | Imaging and lab tests | Robust segment in Q1 2024 |

Business Model Canvas Data Sources

The Rede D'Or São Luiz Business Model Canvas is informed by comprehensive financial statements, patient demographic data, and extensive market research. These sources ensure a robust understanding of the healthcare landscape and operational realities.