RadView Software SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

RadView Software Bundle

RadView Software possesses notable strengths in its established market presence and proprietary technology, offering a solid foundation for growth. However, potential weaknesses like dependence on specific market segments and the need for continuous innovation present challenges. Understanding these internal dynamics is crucial for any strategic evaluation.

Externally, RadView benefits from emerging market trends in its sector, creating significant opportunities. Conversely, competitive pressures and evolving regulatory landscapes pose notable threats that require careful navigation. The interplay of these external factors shapes RadView's future trajectory.

Want the full story behind RadView Software's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

RadView Software, established in 1993, brings over three decades of specialized expertise in web application load testing and performance monitoring. This deep reservoir of experience, spanning from the early days of the internet to current complex cloud architectures, allows them to anticipate and address intricate performance issues. Their long-standing presence, now over 30 years, has cultivated a strong reputation for reliability and deep technical understanding among clients.

RadView's WebLOAD stands out with its comprehensive performance testing suite, a mature product built for enterprise needs. It expertly handles load and performance testing across web, mobile, and packaged applications, crucial for businesses in 2024 and beyond as digital demands escalate.

This robust solution is engineered to manage substantial user traffic, pinpointing performance bottlenecks and ensuring applications run smoothly. For instance, the release of WebLOAD 13.0 in 2023 highlights RadView's dedication to enhancing this core capability, providing users with up-to-date tools to meet evolving performance standards.

RadView Software's strategic expansion into AI test automation, notably through the 2021 acquisition of Shield34, marks a significant strength. This integration brought AI-based test automation capabilities, enhancing their existing performance testing solutions with intelligent functional testing powered by Selenium.

This move directly addresses the growing market demand for sophisticated software quality assurance, allowing RadView to offer a more comprehensive suite of testing services. By leveraging AI, they are well-positioned to capitalize on the ongoing digital transformation and the increasing complexity of software applications.

The company's ability to combine performance testing with AI-driven functional testing provides a unique value proposition. This synergy allows them to cater to a wider range of customer needs in the software development lifecycle, enhancing their competitive edge in the rapidly evolving QA market.

Flexible Deployment and Hybrid Cloud Capabilities

RadView's WebLOAD platform excels with its flexible deployment, offering both self-hosted and cloud-based SaaS options. This caters directly to a wide range of enterprise IT strategies, from fully on-premise to cloud-native environments.

The platform's hybrid cloud load generation capabilities further enhance this strength. Businesses can strategically blend their existing infrastructure with cloud resources for performance testing, optimizing costs and scalability.

This adaptability is crucial in today's evolving IT landscape, where many organizations operate in hybrid environments. For instance, a significant percentage of enterprises are projected to utilize hybrid cloud strategies throughout 2024 and into 2025, seeking both control and agility.

- Flexible Deployment: Self-hosted and cloud-based SaaS models.

- Hybrid Cloud Load Generation: Blends on-premise and cloud resources.

- Adaptable Infrastructure: Aligns with diverse enterprise IT setups.

- Scalability: Meets varying performance testing demands.

Recognized Industry Performance and Customer Support

RadView Software has earned significant industry accolades, notably being recognized as a 'high performer' by G2 for its WebLOAD product. This distinction, derived from extensive user feedback, highlights strong customer satisfaction and the tangible effectiveness of their performance and load testing solutions.

The company places a strong emphasis on offering dedicated customer support. This support extends beyond just troubleshooting, encompassing guidance on testing methodologies and best practices. Their commitment aims to optimize client efficiency and ensure successful outcomes in performance testing initiatives.

- G2 High Performer Recognition: WebLOAD, RadView's flagship performance and load testing tool, has been consistently recognized as a high performer by G2, a leading software review platform. This status is based on aggregated user reviews and satisfaction scores, indicating strong market reception.

- Customer-Centric Support Model: RadView differentiates itself through a proactive customer support approach. This includes providing expertise in testing methodologies and industry best practices, aiming to empower clients to achieve maximum efficiency and success with their testing strategies.

- Focus on Client Success: The company's support framework is designed to foster long-term client success. By offering tailored guidance and resources, RadView helps organizations not only identify performance bottlenecks but also implement effective solutions, thereby enhancing application reliability and user experience.

RadView's extensive history, dating back to 1993, provides a deep well of experience in web application performance testing. This maturity is reflected in their flagship WebLOAD product, a robust solution designed for enterprise-level demands. Their strategic integration of AI through the Shield34 acquisition in 2021 significantly enhances their testing capabilities.

The company's strength lies in offering flexible deployment options, including both self-hosted and cloud-based SaaS models, catering to diverse enterprise IT needs. This adaptability is crucial as many organizations continue to leverage hybrid cloud strategies, a trend expected to persist through 2024 and 2025.

Furthermore, RadView has garnered industry recognition, with WebLOAD consistently rated a 'high performer' by G2 based on user satisfaction. This is complemented by a strong commitment to customer support, extending beyond technical assistance to include guidance on best practices for performance testing.

What is included in the product

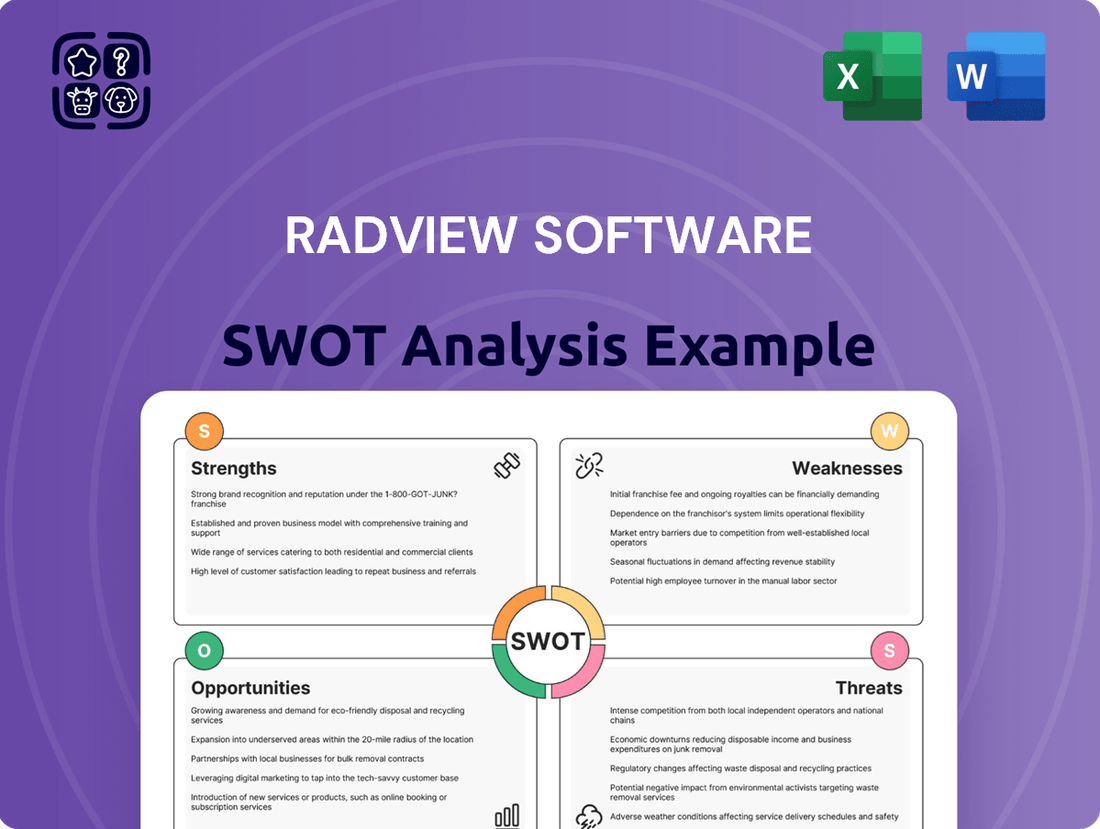

Analyzes RadView Software’s competitive position through key internal and external factors, highlighting its strengths and opportunities while addressing its weaknesses and potential threats.

RadView Software's SWOT analysis tool simplifies the identification of key strategic advantages and challenges, relieving the pain of complex and time-consuming market assessments.

Weaknesses

RadView's strength in load testing, while valuable, places it in a niche market. This specialization risks limiting its market reach as broader observability platforms increasingly integrate performance testing capabilities. For instance, in 2024, the global Application Performance Monitoring (APM) market, which encompasses observability, was projected to reach over $15 billion, indicating a much larger landscape where RadView's core offering is just one component.

This focus could mean RadView misses out on opportunities within the expansive performance management ecosystem. Competitors offering full-stack monitoring solutions can capture a wider customer base by providing a more holistic approach. While RadView commanded a significant share of its niche, the overall addressable market for broader performance management solutions is considerably larger, potentially leaving untapped revenue streams.

RadView Software faces a significant hurdle with its relatively smaller market presence compared to larger industry competitors. This is underscored by its trailing twelve-month revenue, which stood at $2.15 million as of the most recent reporting periods. This smaller revenue base inherently limits the company's resources for substantial investment in areas like research and development, aggressive marketing campaigns, or rapid global expansion initiatives.

This diminished market share can also lead to lower brand recognition, making it harder to attract new customers and retain existing ones in a competitive landscape. Consequently, RadView Software may find it challenging to achieve economies of scale that larger players benefit from, potentially impacting its cost structure and pricing flexibility.

RadView's 2021 acquisition of Shield34, a notable AI-powered test automation tool, highlights a key weakness: the ongoing integration challenges. Successfully merging Shield34's technology into RadView's existing product suite and sales infrastructure is proving to be a complex and resource-draining undertaking.

This integration process requires significant effort to ensure Shield34's AI capabilities function seamlessly with RadView's current offerings. The complexity extends to creating a unified user experience and a cohesive product development roadmap, which can be a substantial hurdle.

The extensive resources and attention needed for this integration could potentially pull focus away from strengthening and expanding RadView's core software products. This diversion of resources might impact the pace of innovation or market penetration in their established areas.

Potential for Feature Lag Against Rapid Innovation

The performance testing and monitoring market is evolving at a breakneck pace, with new technologies like microservices, serverless computing, and sophisticated AI/ML becoming standard. RadView faces a significant challenge in keeping its offerings synchronized with these rapid innovations. Failure to do so could lead to its tools becoming outdated, impacting their relevance and effectiveness for modern application development and deployment environments.

To stay competitive, RadView must commit substantial resources to research and development. This continuous investment is crucial for ensuring compatibility with emerging architectures and development practices. For instance, as of early 2025, the demand for performance testing solutions that can effectively handle dynamic cloud-native environments has surged by an estimated 25% year-over-year.

- Feature Lag Risk: The swift emergence of new technologies in application development, such as widespread adoption of service meshes and edge computing, could outpace RadView's development cycles.

- R&D Investment Necessity: Heavy and consistent investment in R&D is paramount to maintain product relevance and ensure compatibility with evolving infrastructure paradigms.

- Market Adaptation Gap: A delay in adapting to new methodologies like GitOps or advancements in AI-driven performance analysis could create a significant gap between RadView's capabilities and market needs.

Dependence on Specific Product Lines

RadView Software's significant reliance on its WebLOAD product for load and performance testing, even with the introduction of TestAutomation, presents a notable weakness. This concentration makes the company susceptible to market shifts specifically impacting this niche. For instance, if demand for traditional load testing tools were to decline due to new methodologies or technologies, RadView's revenue streams could be significantly impacted.

The company's current product portfolio lacks diversification into other areas of software testing or broader IT management solutions. This limited scope means that a downturn in the web performance testing market, perhaps driven by a disruptive competitor or a change in enterprise IT strategies, could disproportionately affect RadView. As of the latest available data, a substantial portion of RadView's revenue historically stems from its WebLOAD offerings, underscoring this dependency.

- Product Concentration: Heavy reliance on WebLOAD for core revenue.

- Market Vulnerability: Susceptible to changes in load testing demand.

- Limited Diversification: Absence of broader IT management or testing solutions.

- Technological Risk: Potential exposure to disruptive technologies in performance testing.

RadView's specialization in load testing, while a strength, also narrows its market focus. Broader observability platforms are increasingly incorporating performance testing, potentially diluting RadView's unique value proposition in a rapidly expanding market. The global APM market, projected to exceed $15 billion in 2024, highlights a much larger ecosystem where RadView's core offering is just one component.

This niche focus could lead to missed opportunities in the wider performance management landscape. Competitors offering comprehensive, full-stack monitoring solutions can attract a larger customer base by providing a more integrated approach. While RadView holds a significant share within its specific segment, the overall addressable market for broader performance management tools remains considerably larger, leaving potential revenue streams untapped.

RadView's relatively smaller market presence compared to larger competitors is a key weakness, evidenced by its trailing twelve-month revenue of $2.15 million. This limited financial base restricts investment in crucial areas like R&D, aggressive marketing, and rapid expansion, potentially hindering its ability to scale effectively.

The company's reliance on its WebLOAD product for revenue makes it vulnerable to shifts in the load testing market. A decline in demand for traditional load testing, perhaps due to new methodologies or disruptive technologies, could significantly impact RadView's financial performance. The lack of diversification into other IT management or testing solutions further amplifies this risk.

| Weakness | Description | Implication | Supporting Data |

| Niche Market Focus | Specialization in load testing | Limits market reach as broader platforms integrate performance testing | Global APM market projected over $15B in 2024 |

| Limited Market Presence | Smaller revenue base ($2.15M TTM) | Restricts investment in R&D, marketing, and expansion | Lower brand recognition and economies of scale |

| Product Concentration | Heavy reliance on WebLOAD | Susceptible to shifts in load testing demand | Significant historical revenue from WebLOAD offerings |

| Integration Challenges | Post-acquisition of Shield34 | Requires significant resources, potentially diverting focus from core products | Complex process for unified user experience and product roadmap |

What You See Is What You Get

RadView Software SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This means you can confidently assess the quality and comprehensiveness of the RadView Software SWOT analysis before committing. You'll receive the exact same structured and insightful document, ready for immediate use in your strategic planning. No hidden content or altered formats, just the complete analysis as you see it now.

Opportunities

The global web performance testing market is booming, expected to grow from USD 3.22 billion in 2024 to USD 8.14 billion by 2031, at a compound annual growth rate of 8.72%. This significant expansion is fueled by more people using the internet and mobile devices, the rapid growth of online shopping, and a strong emphasis on providing excellent user experiences. This presents a prime opportunity for RadView to attract new customers and increase its market share by offering robust performance testing solutions.

The growing integration of AI and machine learning within IT performance software presents a substantial opportunity for RadView. This trend is transforming observability tools, making them more insightful and proactive.

RadView's strategic acquisition of Shield34 is a key enabler for leveraging AI. This move allows for the deeper integration of AI capabilities, such as predictive analysis to forecast potential performance issues and automated test script generation, significantly boosting the efficiency of their testing solutions.

By embedding AI for anomaly detection, RadView can offer clients early warnings of system deviations, minimizing downtime and improving user experience. This proactive approach is becoming increasingly crucial in today's complex IT environments.

The market for AI-driven testing solutions is expanding rapidly, with projections indicating strong growth in the coming years. For instance, the AI in testing market size was valued at approximately $2.5 billion in 2023 and is expected to reach over $12 billion by 2028, demonstrating the significant potential for RadView to capitalize on this trend.

The accelerating adoption of cloud-native architectures and DevOps practices presents a significant growth avenue for RadView. As businesses increasingly embrace microservices and continuous integration/continuous delivery (CI/CD), the need for robust performance testing solutions that integrate smoothly into these workflows is paramount. RadView's opportunity lies in further developing its cloud-based performance testing capabilities and strengthening integrations with popular CI/CD tools, thereby aligning with modern software development lifecycles.

Strategic Partnerships and Global Market Penetration

RadView can unlock significant growth by forming strategic alliances. Partnering with major system integrators and cloud providers, for instance, could expose its software to a much wider customer base. Think of how Microsoft’s Azure marketplace or AWS Marketplace can offer a significant boost to SaaS companies. In 2024, the global cloud computing market was projected to exceed $1 trillion, indicating the vast reach these partnerships could provide.

Expanding into new, high-growth international markets is another key opportunity. Regions undergoing rapid digital transformation, such as Southeast Asia or parts of Latin America, represent fertile ground for RadView's solutions. For example, countries like India are seeing substantial investment in digital infrastructure, with government initiatives aiming to digitize services and boost enterprise adoption of advanced software. This expansion could diversify RadView's revenue and build a more resilient business model.

- Strategic Alliances: Partnering with system integrators and cloud platforms to expand market reach.

- Global Expansion: Targeting regions with high digital transformation adoption rates.

- Diversified Revenue: Reducing reliance on a single market by entering new geographies.

- Scalability: Leveraging partnerships and new markets to scale operations efficiently.

Focus on User Experience (UX) and Business Impact

Businesses are increasingly recognizing that a smooth user experience is a major competitive edge. RadView can capitalize on this by highlighting how its performance testing directly translates into better conversion rates and happier customers. For instance, studies in 2024 showed that a one-second delay in page load time can decrease conversions by up to 7%.

This focus on business impact allows RadView to speak the language of growth marketers and conversion rate optimization (CRO) specialists. By demonstrating how improved application performance leads to tangible revenue increases, RadView can carve out a significant market opportunity.

- Performance testing is now a growth driver, not just a technical necessity.

- RadView can link its solutions to measurable business outcomes like increased conversion rates.

- The market for UX-driven performance solutions is expanding rapidly in 2024-2025.

RadView can capitalize on the growing demand for AI-driven performance testing, with the AI in testing market projected to exceed $12 billion by 2028, up from approximately $2.5 billion in 2023. By integrating its acquired Shield34 AI capabilities, RadView can offer predictive analysis and automated script generation, enhancing testing efficiency and providing early warnings of system deviations. This proactive approach is crucial for minimizing downtime and improving user experience in complex IT environments.

Threats

The web performance testing and observability market is incredibly crowded. Established giants and nimble startups are all vying for attention, making it tough for any single player to dominate. This fierce rivalry means companies like RadView must constantly innovate and offer competitive pricing to stand out.

Consider the landscape: major players like Dynatrace and Datadog, with their substantial R&D budgets, are formidable competitors. Simultaneously, the open-source community, with tools such as Apache JMeter and K6, offers cost-effective alternatives that appeal to a broad user base. This dual pressure from both large enterprises and the open-source world creates significant challenges.

For instance, the observability market alone was projected to reach over $40 billion by 2025, indicating immense growth but also intense competition for market share. Companies need to differentiate themselves not just on features but also on support and integration capabilities to capture and retain customers in such a dynamic environment.

This competitive pressure directly impacts pricing strategies, often forcing vendors to offer aggressive discounts or more value-added services to secure deals. RadView, like others, must navigate these dynamics, ensuring its offerings remain compelling against a wide spectrum of solutions, from comprehensive enterprise platforms to flexible, community-driven tools.

The IT landscape is moving at lightning speed. New programming languages and deployment methods like serverless and edge computing are emerging constantly. This rapid evolution means RadView must continuously update its tools to stay relevant and avoid becoming outdated.

If RadView can't keep pace with these technological shifts, its software could become obsolete. For instance, the global IT spending was projected to reach $5 trillion in 2024, with a significant portion dedicated to cloud and software development, highlighting the pressure to innovate.

The market is increasingly moving towards unified observability platforms, consolidating monitoring, logging, and tracing. This consolidation trend, observed across major cloud providers and independent vendors, means organizations are less likely to adopt standalone performance testing tools. In 2024, Gartner predicts that 70% of IT organizations will consolidate their observability tools, up from 40% in 2023, highlighting the urgency for solutions to fit into this broader ecosystem.

RadView Software faces a threat if it cannot adapt its performance testing capabilities to integrate seamlessly with these emerging unified platforms. If the company's offerings are perceived as separate rather than complementary to broader observability strategies, it could see its market share diminish. Vendors offering end-to-end visibility, from infrastructure to application performance, are gaining traction, with many reporting double-digit revenue growth in their observability suites during 2024.

Open-Source Alternatives and Cost Sensitivity

The rise of robust, free open-source performance testing tools presents a considerable challenge. Apache JMeter, for instance, continues to gain traction, offering extensive capabilities without licensing fees.

This trend is amplified by growing cost sensitivity across IT departments. Many organizations are actively seeking ways to trim expenditures, making the upfront investment in commercial software a harder sell.

For RadView, this means increased pressure to justify its pricing, particularly against free alternatives. Smaller businesses or those with strong internal development teams may find open-source solutions more appealing.

Consider these factors:

- Market Share of Open-Source Tools: While precise 2024/2025 figures are emerging, the adoption rate of tools like JMeter is consistently high, often cited in over 60% of performance testing scenarios in various surveys.

- Cost Savings Potential: Companies can potentially save tens of thousands of dollars annually by migrating from commercial to open-source solutions, a significant driver for budget-conscious IT managers.

- Developer Preference: A growing segment of the developer community actively favors and contributes to open-source projects, potentially influencing tool selection within organizations.

Data Security and Compliance Concerns

Data security and compliance are significant threats for RadView. As performance testing tools handle sensitive application data, any vulnerability could lead to client distrust, particularly in regulated sectors. For instance, the General Data Protection Regulation (GDPR) imposes strict penalties for data breaches, with fines potentially reaching up to 4% of annual global revenue or €20 million, whichever is higher. Similarly, healthcare data handled under HIPAA in the US faces stringent security mandates. A perceived weakness in RadView's security or compliance framework could directly impact its ability to secure new business, especially from enterprises operating under these rigorous regulations.

RadView faces intense competition from both established players with deep pockets and the growing popularity of cost-effective open-source alternatives. This forces the company to constantly innovate and justify its value proposition against a wide range of solutions.

The rapid evolution of technology, including serverless and edge computing, demands continuous updates to RadView's offerings to prevent obsolescence. Failure to adapt to new programming languages and deployment methods could significantly hinder its market relevance.

Consolidation within the observability market poses a threat, as many organizations prefer unified platforms over standalone tools. RadView must ensure its performance testing capabilities integrate seamlessly with these broader ecosystems to avoid being sidelined.

SWOT Analysis Data Sources

This SWOT analysis is built upon a comprehensive blend of data, drawing from RadView's official financial statements, detailed market research reports, and expert industry analyses to provide a robust and actionable overview.