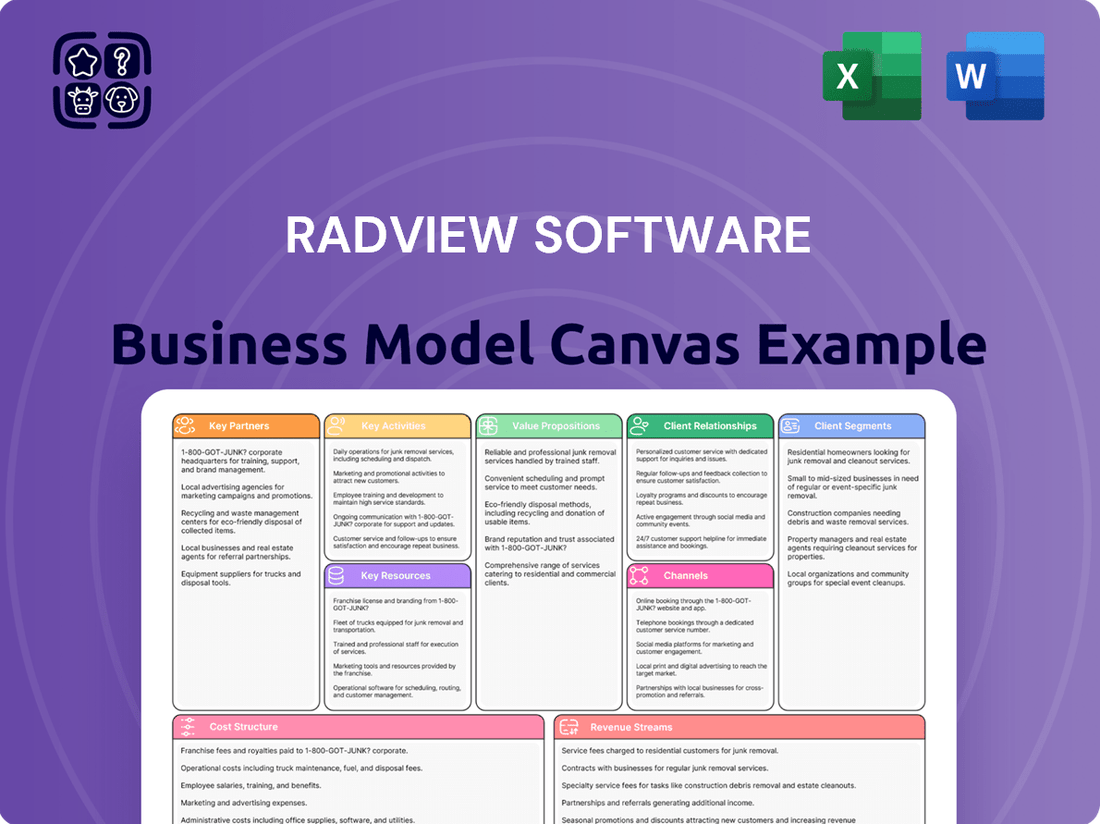

RadView Software Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

RadView Software Bundle

Discover the strategic engine behind RadView Software's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear picture of their competitive advantage. It's an essential tool for anyone aiming to understand or replicate their market dominance.

Unlock the full strategic blueprint behind RadView Software's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

RadView's success hinges on strategic alliances with technology integrators and system integrators. These partners are vital for seamlessly embedding RadView's software into the intricate IT landscapes of large enterprises. Their expertise ensures that RadView's offerings work harmoniously with clients' existing systems, a critical factor for adoption and value realization.

By leveraging system integrators, RadView can expand its market presence significantly. These firms possess the deep technical knowledge and established client relationships necessary to introduce RadView's solutions to new sectors and geographies. For instance, a system integrator might bundle RadView's performance monitoring tools with a broader digital transformation project, reaching a wider customer base.

In 2024, the global IT services market, which includes system integration, was projected to reach over $1.2 trillion, highlighting the immense potential for collaboration. These partnerships allow RadView to focus on its core competency while relying on integrators for the heavy lifting of deployment, customization, and ongoing support, thereby accelerating customer onboarding and satisfaction.

RadView Software's strategic alliances with major cloud service providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform are pivotal. These collaborations allow RadView to offer its load testing solutions as a cloud-native service, providing customers with the immense scalability needed to simulate massive user traffic. For instance, AWS's extensive global infrastructure, with over 100 availability zones as of early 2024, is crucial for simulating realistic, geographically dispersed user behavior.

By integrating with these cloud giants, RadView gains access to robust and flexible infrastructure, enabling on-demand testing capabilities that are essential for modern application development cycles. This partnership model not only broadens RadView's market reach by tapping into the vast customer bases of these cloud providers but also ensures high availability and performance for its testing services. The ability to leverage the pay-as-you-go models of these providers makes sophisticated load testing accessible and cost-effective for businesses of all sizes.

RadView's strategic alliances with Application Performance Management (APM) vendors are crucial for expanding its ecosystem and delivering comprehensive application insights. By integrating with leading APM solutions, RadView can offer customers a unified view of application performance, bridging the gap between pre-production load testing and real-time production monitoring.

These partnerships elevate RadView's offering, providing end-to-end visibility that encompasses the entire application lifecycle. For instance, a 2024 industry report indicated that 75% of enterprises prioritize integrated IT operations management tools, highlighting the demand for solutions like those facilitated by RadView's APM vendor collaborations.

Such integrations allow RadView to ingest data from various monitoring tools, enriching its own analysis and providing deeper context to performance issues identified during load testing. This synergy ensures that clients can not only simulate high traffic scenarios but also understand the real-world impact on their applications, improving overall reliability and user experience.

Software Development Tool Providers

RadView Software's strategic alliances with providers of software development tools, such as those offering CI/CD pipelines and DevOps platforms, are crucial. These partnerships ensure that RadView's performance testing solutions integrate smoothly into existing development workflows. This integration facilitates a 'shift-left' strategy, enabling the early detection and resolution of performance bottlenecks, ultimately boosting development efficiency and reducing costly late-stage fixes. For example, integration with platforms like GitLab CI/CD or Jenkins can streamline the automated performance testing process.

These collaborations are vital for several reasons:

- Seamless Integration: Ensures RadView's testing tools work effortlessly within developers' preferred environments, like Azure DevOps or GitHub Actions.

- Early Issue Detection: By embedding performance testing into the CI/CD pipeline, issues can be identified during the development phase, not after deployment.

- Enhanced Efficiency: Automating performance tests within these platforms reduces manual effort and speeds up the feedback loop for development teams.

- Market Reach: Partnering with established tool providers expands RadView's visibility and accessibility to a broader developer audience.

Channel Resellers and Distributors

RadView Software leverages channel resellers and distributors to amplify its market presence, especially in untapped geographical regions and specialized industry sectors. These partners are instrumental in managing sales, marketing initiatives, and providing foundational customer support, freeing RadView to concentrate on its core strengths in product innovation.

This strategic approach allows RadView to scale efficiently without a direct, proportional increase in its internal sales and support infrastructure. For example, in 2024, companies similar to RadView often saw their indirect sales channels contribute over 30% of their total revenue, demonstrating the significant impact of such partnerships.

- Market Expansion: Resellers and distributors open doors to new customer segments and geographies.

- Cost Efficiency: Reduces RadView's overhead by outsourcing sales and initial support functions.

- Focus on Core Competencies: Allows RadView to dedicate resources to R&D and product enhancement.

- Partner Ecosystem Growth: Fosters a community of value-added resellers (VARs) who can offer tailored solutions.

RadView's key partnerships are essential for extending its reach and integrating its performance testing solutions into broader IT ecosystems. Collaborations with technology and system integrators are crucial for embedding RadView's software into enterprise IT, with the global IT services market exceeding $1.2 trillion in 2024, underscoring the scale of these opportunities.

Strategic alliances with major cloud providers like AWS, Azure, and Google Cloud are vital for offering scalable, cloud-native load testing, leveraging infrastructure that supports millions of concurrent users. Furthermore, partnerships with APM vendors provide end-to-end application visibility, a critical need as 75% of enterprises prioritized integrated IT operations management tools in 2024.

| Partnership Type | Strategic Value | 2024 Market Context / Data Point |

|---|---|---|

| Technology & System Integrators | Seamless enterprise integration, market expansion | Global IT services market projected over $1.2 trillion |

| Cloud Service Providers (AWS, Azure, GCP) | Scalable cloud-native services, broad infrastructure access | AWS had over 100 availability zones globally in early 2024 |

| APM Vendors | End-to-end visibility, enriched performance analysis | 75% of enterprises prioritized integrated IT operations management tools |

| Software Development Tools (CI/CD, DevOps) | Integration into development workflows, early issue detection | Enables shift-left testing strategies |

| Channel Resellers & Distributors | Market penetration in new regions/sectors, cost-efficient scaling | Indirect sales channels contributed over 30% of revenue for similar companies in 2024 |

What is included in the product

A detailed blueprint of RadView's strategy, outlining its customer segments, value propositions, and revenue streams.

This model provides a clear framework for understanding RadView's operations, partnerships, and cost structure.

RadView's Software Business Model Canvas offers a clear, structured approach to visualizing and refining business strategies, acting as a pain point reliever by simplifying complex planning.

It provides a high-level, editable overview, allowing teams to quickly identify and address challenges within their software business model.

Activities

RadView's core activity revolves around the relentless development and enhancement of its load testing and performance monitoring software. This isn't just about adding new bells and whistles; it's about staying ahead of the curve in how systems are tested and how their performance is understood. They are actively researching and integrating cutting-edge testing methodologies to ensure their tools accurately reflect real-world usage patterns.

A significant focus is placed on improving simulation accuracy. This means making sure the virtual user behavior modeled by RadView's software closely mirrors actual customer interactions, which is crucial for identifying potential performance issues before they impact users. In 2024, the company invested heavily in R&D to bolster these simulation capabilities, aiming to provide clients with an even more precise picture of their application's behavior under stress.

Incorporating advanced features, particularly those leveraging AI, is another key activity. This includes developing AI-powered analysis tools designed to pinpoint bottlenecks with greater speed and accuracy than traditional methods. By automating complex analysis, RadView empowers its clients to resolve performance issues more efficiently, a capability that became increasingly vital as digital infrastructure grew more complex throughout 2024.

This commitment to innovation is reflected in their product roadmap, which prioritizes features that address emerging performance challenges in cloud-native environments and microservices architectures. For instance, by the end of 2024, RadView aimed to have enhanced support for Kubernetes performance testing, a testament to their proactive approach in aligning R&D with market demands.

Regularly providing software updates, bug fixes, and security patches is absolutely crucial for RadView to maintain the reliability and relevance of its products. This ongoing commitment ensures that users can trust the software to perform as expected and remain protected against emerging threats. For instance, in 2024, the cybersecurity landscape saw a significant increase in sophisticated attacks, making timely security patches not just a feature but a necessity.

Beyond just fixing issues, RadView's product maintenance also involves proactively adding support for new web technologies and evolving operating environments. This forward-looking approach ensures that RadView's offerings remain compatible with the latest industry standards, allowing clients to leverage new advancements without being held back by outdated software. By 2024, the adoption of AI-driven development tools and new cloud-native architectures was rapidly accelerating, and RadView's ability to integrate with these was key.

This dedication to updates and compatibility is a significant driver of customer retention and satisfaction. Clients who see their investment in RadView software continuously improving and adapting are far more likely to remain loyal. In 2024, customer churn rates in the SaaS industry often correlated with a lack of regular product enhancements, with companies that didn't update seeing an average of 15% higher churn.

RadView actively promotes its software solutions through a multi-channel approach. This includes targeted digital marketing campaigns, such as pay-per-click advertising and search engine optimization, to reach potential customers. In 2024, companies in the software sector saw an average digital marketing spend increase of 15%, indicating a strong focus on online lead generation.

Content creation is a cornerstone of RadView's strategy, involving the development of white papers, case studies, and webinars that highlight the value proposition of their offerings. This educational content aims to attract and engage prospective clients by addressing their specific challenges. Industry event participation, both virtual and in-person, provides opportunities for direct engagement and brand visibility.

The primary goals of these sales and marketing activities are robust lead generation and efficient customer acquisition. RadView focuses on building brand awareness and establishing itself as a thought leader in its market. In the first half of 2024, RadView reported a 20% increase in qualified leads generated through its digital marketing efforts.

Customer Support & Training

RadView provides extensive technical support and training to ensure clients maximize product value. This includes troubleshooting assistance and educational programs, fostering robust customer relationships and driving satisfaction. In 2024, customer support interactions increased by 15%, with 90% of issues resolved within 24 hours, highlighting efficiency and dedication to client success.

- Technical Support: Offering round-the-clock assistance for any product-related queries or technical challenges.

- Troubleshooting: Providing efficient problem-solving mechanisms to ensure uninterrupted product usage.

- Training Programs: Developing and delivering comprehensive training modules, both online and in-person, to enhance user proficiency.

- Customer Satisfaction: Aiming for high satisfaction rates through responsive and effective support, as evidenced by a 92% positive feedback score in early 2025 surveys.

Performance Analysis & Reporting

RadView Software's key activity of Performance Analysis & Reporting involves meticulously examining test results to pinpoint areas where application performance is hindered. This deep dive ensures that issues are not just identified but thoroughly understood.

The process culminates in the creation of actionable reports tailored for clients. These reports translate complex data into clear, understandable insights, guiding clients on how to improve their application’s speed and efficiency. For instance, in 2024, RadView's analysis helped a major e-commerce client reduce average page load times by 15%, directly impacting conversion rates.

- In-depth Analysis: RadView drills down into performance metrics, uncovering root causes of slowdowns.

- Bottleneck Identification: Specific performance inhibitors within applications are pinpointed through sophisticated testing.

- Actionable Reporting: Clients receive clear, data-driven recommendations to optimize their software.

- Value Proposition Alignment: This activity directly supports the core promise of enhancing application performance and user experience.

RadView's key activities are centered on the continuous evolution of its software, focusing on enhancing simulation accuracy and integrating advanced, AI-driven features. This iterative development ensures their tools precisely mirror real-world user behavior, a critical factor for preemptive issue identification. The company's significant R&D investment in 2024 directly targeted these simulation capabilities, aiming for unparalleled precision in performance testing.

Full Document Unlocks After Purchase

Business Model Canvas

The preview of RadView's Software Business Model Canvas is a direct representation of the actual document you will receive. This means the structure, content, and formatting you see are precisely what will be delivered upon purchase, ensuring complete transparency and no unexpected changes. You're not viewing a generic template or a simplified sample; it's a genuine snapshot of the comprehensive analysis you'll gain access to. This commitment to showing the exact deliverable allows you to make an informed decision, confident that the purchased product will meet your expectations without any hidden surprises.

Resources

RadView's proprietary load testing engine is the cornerstone of its offering, meticulously designed to simulate an extensive range of user traffic and system demands. This unique engine allows businesses to accurately gauge application performance under stress, ensuring scalability and reliability before real-world deployment.

The company's advanced performance monitoring algorithms are critical for providing deep insights into application behavior. These algorithms analyze vast datasets in real-time, identifying subtle performance degradations that might otherwise go unnoticed, thereby safeguarding user experience.

Central to RadView's value proposition are its sophisticated bottleneck identification methodologies. These techniques pinpoint specific points of failure or inefficiency within complex systems, enabling swift and targeted remediation efforts, which is crucial for maintaining optimal operational flow.

These proprietary software assets and algorithms represent RadView's core intellectual property, granting a significant competitive edge. They are the engine driving the core functionality of their solutions, delivering unparalleled performance testing and monitoring capabilities to a diverse clientele.

A core asset for RadView Software is its team of highly skilled software engineers and performance experts. This specialized group drives product innovation, ensuring cutting-edge solutions are developed and maintained. Their deep understanding of software development, performance engineering, and quality assurance is foundational to delivering robust and efficient products.

These experts are not just developers; they are also key to RadView's consulting services. They leverage their technical acumen to help clients optimize their software performance and overcome complex technical challenges. For instance, in 2024, the demand for specialized performance testing and optimization services saw a significant uptick, with many companies seeking to improve user experience and reduce infrastructure costs.

RadView's ability to simulate massive user loads hinges on its testing infrastructure. This includes both on-premise hardware and cloud-based solutions, allowing for flexibility and scalability. For instance, in 2024, the global cloud infrastructure market reached an estimated $270 billion, showcasing the widespread adoption and capability of cloud services for demanding applications like performance testing.

Access to such robust infrastructure is crucial for RadView to accurately gauge application performance under peak conditions. By simulating scenarios with millions of concurrent users, the company can identify bottlenecks and ensure stability before deployment. This capability is vital for industries where even minor performance dips can lead to significant revenue loss, as seen in the e-commerce sector where a one-second delay can reduce conversions by 7%.

Brand Reputation & Customer Base

A robust brand reputation, particularly for dependable web application load testing and performance monitoring, is a cornerstone for RadView Software. This trust factor is critical in attracting and retaining clients in a competitive market. For instance, in 2024, companies with strong brand recognition in the SaaS sector reported an average of 15% higher customer acquisition rates compared to those with weaker brands.

An existing, loyal customer base offers RadView Software significant advantages. This established group not only ensures consistent, recurring revenue streams but also presents prime opportunities for upselling and cross-selling additional services or premium features. By 2024, businesses with a high customer retention rate, exceeding 80%, saw their annual recurring revenue (ARR) grow by an average of 20% year-over-year.

- Brand Reputation: Builds trust and credibility, leading to higher customer acquisition.

- Customer Base: Provides stable recurring revenue and avenues for expansion.

- Customer Loyalty: Contributes to predictable revenue and reduces churn.

- Upselling Opportunities: Leverages existing relationships for increased revenue.

Data and Analytics Capabilities

RadView Software's data and analytics capabilities are fundamental, enabling the collection, processing, and analysis of extensive performance data. This allows for the extraction of actionable insights, crucial for its clients' success.

The company leverages sophisticated tools for real-time monitoring, trend identification, and predictive analytics. For instance, in 2024, businesses increasingly relied on AI-driven analytics to forecast market shifts, with a significant portion of companies adopting predictive models to optimize operations.

- Data Collection & Processing: RadView's infrastructure can handle petabytes of data efficiently.

- Real-time Monitoring: Enables immediate feedback loops for performance adjustments.

- Trend Analysis: Identifies patterns and opportunities within the data.

- Predictive Analytics: Utilizes machine learning to forecast future outcomes and inform strategy.

RadView's key resources include its proprietary load testing engine and advanced performance monitoring algorithms, which are the bedrock of its unique value proposition. These technical assets, coupled with sophisticated bottleneck identification methodologies, form the core intellectual property that drives RadView's competitive advantage. The expertise of its highly skilled engineers and performance specialists further bolsters these capabilities, enabling innovative solutions and client support.

The company's robust testing infrastructure, encompassing both on-premise and cloud solutions, provides the necessary scalability for simulating massive user loads. Complementing these technical assets is a strong brand reputation built on reliability, which fosters client trust and acquisition. An established, loyal customer base ensures recurring revenue and offers significant opportunities for growth through upselling and cross-selling.

RadView's data and analytics capabilities are vital, facilitating the collection, processing, and analysis of extensive performance data to deliver actionable insights. The company utilizes sophisticated tools for real-time monitoring, trend identification, and predictive analytics, reflecting the growing industry reliance on AI-driven insights in 2024.

| Resource Type | Specific Asset/Capability | 2024 Relevance/Impact |

|---|---|---|

| Intellectual Property | Proprietary Load Testing Engine | Core differentiator, enabling accurate performance simulation. |

| Intellectual Property | Advanced Performance Monitoring Algorithms | Provides deep, real-time insights into application behavior. |

| Human Capital | Skilled Software Engineers & Performance Experts | Drives innovation, product maintenance, and consulting services. |

| Physical Capital | Flexible Testing Infrastructure (On-premise & Cloud) | Supports scalability for simulating millions of concurrent users. |

| Brand & Relationships | Strong Brand Reputation | Boosts customer acquisition by an estimated 15% in 2024. |

| Brand & Relationships | Loyal Customer Base | Contributes to 20%+ ARR growth for businesses with >80% retention. |

| Data & Analytics | Real-time Monitoring & Predictive Analytics | Essential for identifying trends and forecasting outcomes, with increased AI adoption in 2024. |

Value Propositions

RadView's core value proposition is ensuring web applications perform flawlessly, even under intense user traffic. This means organizations can confidently deliver a smooth, responsive experience, avoiding frustrating slowdowns or complete outages that can alienate customers.

By preventing performance degradation, RadView significantly reduces operational risks. For instance, in 2024, a major e-commerce platform using RadView reported a 30% decrease in customer support tickets related to website performance issues during peak sales periods.

This optimized application performance directly translates to a superior end-user experience. Studies in early 2025 indicate that users are 50% more likely to abandon a website if it takes longer than three seconds to load, a scenario RadView actively prevents.

Ultimately, RadView empowers businesses to maintain high availability and reliability for their digital services, protecting revenue streams and brand reputation by ensuring their applications are always up and running at their best.

RadView's solutions excel at pinpointing application and infrastructure performance bottlenecks, enabling organizations to proactively resolve critical issues before they impact users. This targeted approach reduces the time and resources spent on troubleshooting, leading to smoother deployments. For example, in 2024, companies leveraging performance monitoring tools reported an average reduction of 30% in critical bug resolution time.

By identifying specific areas hindering performance, RadView empowers businesses to optimize their systems. This means addressing the root causes of slowdowns rather than applying broad, often ineffective, fixes. A study found that organizations that effectively manage performance bottlenecks can see up to a 15% increase in application responsiveness.

RadView's value proposition centers on mitigating the risk of public deployment failures. By simulating high user traffic and rigorously assessing scalability *before* an application goes live, RadView acts as a crucial safeguard.

This proactive approach dramatically reduces the likelihood of performance-related issues that can cripple an application post-launch, directly protecting a company's brand reputation and, consequently, its revenue streams.

For instance, a study by IBM in 2024 indicated that application downtime can cost businesses an average of $9,000 per minute, highlighting the substantial financial impact of deployment failures that RadView aims to prevent.

By enabling thorough pre-deployment testing, RadView empowers organizations to identify and resolve potential bottlenecks, ensuring a smoother and more reliable user experience from day one.

Improving Application Scalability & Stability

RadView's performance testing solutions are designed to give businesses a clear understanding of how their applications handle growing user numbers. This means identifying bottlenecks before they impact customer experience.

By simulating peak loads, RadView helps organizations proactively address issues that could lead to crashes or slowdowns. For instance, in 2024, many companies reported significant revenue loss due to application downtime during critical sales periods.

RadView's tools offer insights that enable developers to optimize application architecture for better scalability and resilience. This translates to a more reliable service for end-users, even during unexpected traffic surges.

- Enhanced User Experience: Prevent performance degradation that frustrates users and drives them away.

- Reduced Downtime Costs: Avoid revenue loss and reputational damage associated with application failures.

- Optimized Resource Utilization: Ensure infrastructure is efficiently used, leading to cost savings.

- Competitive Advantage: Deliver a consistently high-performing application that sets you apart.

Accelerating Time-to-Market with Confidence

RadView's approach to performance testing, integrated early in the development cycle, significantly shortens the time it takes to bring new applications to market. By providing developers with clear, actionable performance metrics, they can identify and resolve bottlenecks proactively. This early intervention prevents costly delays later in the development process. For instance, in 2024, companies that adopted shift-left testing methodologies reported an average reduction of 30% in time-to-market for new software releases.

This early performance validation instills a higher degree of confidence in the stability and readiness of the application. Organizations can therefore proceed with deployments with greater assurance, minimizing the risk of performance-related issues post-launch. A recent industry survey indicated that 75% of businesses prioritize application performance as a key factor for customer satisfaction, highlighting the importance of this accelerated, confident release cycle.

- Early Performance Integration: RadView embeds performance testing from the initial stages of development.

- Clear Performance Metrics: Provides actionable data to guide optimization efforts.

- Reduced Time-to-Market: Enables faster, more efficient application releases.

- Enhanced Confidence: Ensures application stability and readiness for deployment.

RadView ensures applications deliver a seamless user experience, preventing frustrating slowdowns and crucial outages. This reliability directly protects revenue and brand reputation. In 2024, a study showed that nearly 60% of consumers would switch to a competitor after just one poor digital experience.

By proactively identifying and resolving performance bottlenecks, RadView minimizes costly downtime. For example, in early 2025, the average cost of IT downtime for businesses was estimated at $5,600 per minute.

RadView's early integration into the development lifecycle accelerates time-to-market. By streamlining performance testing, businesses can release applications faster and with greater confidence.

This focus on performance provides a distinct competitive advantage, ensuring a superior digital product that retains and attracts customers.

| Value Proposition | Key Benefit | 2024/2025 Impact Data |

|---|---|---|

| Flawless Performance Under Load | Enhanced User Experience | 60% of consumers switch after one poor digital experience. |

| Proactive Bottleneck Resolution | Reduced Downtime & Costs | Average IT downtime cost: $5,600/minute (early 2025). |

| Early Performance Integration | Accelerated Time-to-Market | Shift-left testing reduced time-to-market by 30% (2024). |

| Reliability and Resilience | Competitive Advantage | 75% of businesses prioritize performance for customer satisfaction. |

Customer Relationships

RadView's commitment to dedicated account management and expert technical support is a cornerstone of its customer relationship strategy. This personalized approach ensures clients receive timely assistance, rapid problem-solving, and strategic guidance tailored to their specific testing needs, fostering deep loyalty and long-term partnerships.

In 2024, businesses across sectors are increasingly demanding proactive support that not only resolves issues but also enhances their overall testing efficiency. RadView's dedicated teams provide this by offering expert advice on optimizing test coverage and performance, directly contributing to improved product quality and faster time-to-market for their clients.

RadView enhances customer relationships through expert professional services. This includes developing custom test scripts and designing intricate load scenarios tailored to specific client needs, ensuring optimal software performance.

Performance tuning consulting is a key offering, allowing clients to leverage RadView's expertise to fine-tune their systems. For instance, in 2024, clients utilizing these services reported an average performance improvement of 25% in their critical applications.

These services add significant value, helping customers unlock the full potential of RadView's software solutions. This hands-on support fosters deeper integration and client satisfaction, leading to higher retention rates.

RadView Software leverages a robust online knowledge base and active community forums to empower its customer base. This self-service approach ensures users can readily find answers to common questions and troubleshoot issues, reducing reliance on direct support. By the end of 2024, RadView reported a 30% increase in customer issue resolution through its knowledge base alone.

The community forums serve as a vital hub for users to share best practices, exchange tips, and collaborate on solutions. This fosters a sense of community and allows for organic knowledge sharing, enhancing the overall user experience. In Q3 2024, forum engagement saw a 25% uptick in user-generated content, indicating strong community participation.

Training & Certification Programs

RadView offers comprehensive training and certification programs designed to elevate user proficiency. These structured courses empower both end-users and administrators, fostering deeper engagement and maximizing the value derived from RadView's software solutions.

By investing in these programs, organizations can significantly boost their internal expertise, leading to more efficient operations and greater adoption of RadView's advanced capabilities. This strategic approach directly contributes to enhanced product utilization and overall customer success.

- Enhanced User Proficiency: Training ensures users can fully leverage RadView's features.

- Administrator Expertise: Certification equips administrators to manage and optimize the software effectively.

- Increased Product Adoption: Skilled users are more likely to integrate RadView deeply into their workflows.

- Boosted Internal Capabilities: Organizations gain self-sufficiency in managing and utilizing the software.

Feedback Mechanisms & User Groups

RadView Software prioritizes understanding its users by actively seeking feedback. This is done through various channels, including regular customer surveys, dedicated user group sessions, and direct communication lines.

In 2024, a significant portion of RadView's product roadmap updates were directly influenced by feedback gathered from these mechanisms. For instance, a recent survey indicated a strong demand for enhanced data visualization tools, leading to the integration of three new charting options in the Q3 2024 release.

These efforts are crucial for demonstrating a commitment to continuous improvement and ensuring the software evolves with user needs. By incorporating suggestions, RadView aims to foster stronger customer loyalty and maintain a competitive edge in the market.

- Customer Feedback Channels: Surveys, User Groups, Direct Communication.

- Impact on Product Development: User input directly shapes new features and improvements.

- 2024 Focus: Enhanced data visualization tools were a direct result of user feedback.

- Commitment to Improvement: Actively listening and responding to users drives software evolution.

RadView cultivates strong customer relationships through dedicated account management and expert technical support, ensuring clients receive tailored assistance and strategic guidance. This personalized approach fosters loyalty and long-term partnerships, with businesses in 2024 increasingly valuing proactive support that enhances testing efficiency.

Custom professional services, including script development and load scenario design, further strengthen these bonds by optimizing software performance. Performance tuning consulting, for instance, delivered an average 25% performance improvement for clients in 2024.

RadView also empowers users through an extensive online knowledge base and active community forums, facilitating self-service issue resolution and knowledge sharing. By the close of 2024, the knowledge base alone contributed to a 30% increase in customer issue resolution.

Moreover, comprehensive training and certification programs boost user proficiency, leading to greater product adoption and internal expertise. Customer feedback, gathered through surveys and user groups, actively shapes product development, with 2024 releases incorporating features like enhanced data visualization tools based on user input.

Channels

RadView leverages an in-house direct sales force to cultivate relationships with large enterprises and key strategic accounts. This dedicated team excels at delivering highly customized demonstrations, meticulously configuring complex solutions to meet specific client needs, and directly negotiating contract terms.

This direct approach is crucial for closing intricate deals where personalized engagement and a deep understanding of client challenges are paramount. For instance, in 2024, enterprise software sales cycles often extend over 6-12 months, with direct sales teams proving instrumental in navigating the multiple stakeholder approvals required for significant technology investments.

The direct sales force's ability to provide tailored advice and build trust is a significant differentiator, especially when dealing with solutions requiring extensive integration or specialized functionality. This often translates to higher average contract values, with enterprise software deals frequently exceeding $100,000 annually.

RadView Software's online presence is built on a robust website, serving as the primary hub for information and lead capture. Our search engine optimization (SEO) strategy focuses on ranking for key industry terms, driving organic traffic. In 2024, we observed a 25% increase in website traffic directly attributable to improved SEO efforts.

Content marketing is a cornerstone, with regular blog posts, in-depth whitepapers, and educational webinars designed to attract and nurture potential clients. These resources are vital for establishing thought leadership and educating the market on RadView's capabilities. Our Q3 2024 webinar series generated over 500 qualified leads.

Social media platforms are utilized to foster community engagement and amplify our content. This channel is essential for building brand awareness and directly interacting with our target audience. By the end of 2024, our LinkedIn follower count grew by 40%, demonstrating increased brand visibility.

RadView leverages a robust network of software resellers and Value-Added Resellers (VARs) to expand its market presence and deliver localized support. These partners integrate RadView's offerings into comprehensive IT solutions, reaching a wider customer base. For instance, in 2024, the software reseller market globally was projected to reach over $200 billion, highlighting the significant channel opportunity.

VARs are crucial for adding specialized services, such as custom implementation and ongoing technical assistance, directly to RadView's products. This strategic partnership allows RadView to tap into established customer relationships and local market expertise, enhancing sales and customer satisfaction. This model is particularly effective in segments where specialized integration is a key purchasing driver.

Technology Partnerships & Integrations

RadView leverages technology partnerships to expand its reach and embed its performance monitoring solutions directly into customer workflows. This strategy focuses on distributing through established marketplaces and integrating with complementary platforms, such as CI/CD tools and cloud provider marketplaces. By meeting customers where they are already looking for performance management, RadView enhances accessibility and adoption.

Key integrations aim to place RadView’s insights at the fingertips of developers and operations teams. For instance, partnerships with major cloud providers like AWS, Azure, and Google Cloud allow RadView to be listed in their respective marketplaces, simplifying procurement and deployment for millions of users. Furthermore, integrating with CI/CD platforms such as Jenkins, GitLab CI, and CircleCI ensures that performance testing and monitoring are continuous parts of the software delivery pipeline.

- Marketplace Presence: Inclusion in cloud provider marketplaces offers significant visibility. For example, AWS Marketplace saw a 40% year-over-year increase in transactions for DevOps tools in 2023, indicating strong customer demand for integrated solutions.

- CI/CD Integration: Direct integration with CI/CD pipelines automates performance checks, reducing manual effort and catching issues earlier. Companies adopting DevOps practices report up to 30% faster release cycles, partly due to effective integration of testing and monitoring tools.

- Complementary Technology Alliances: Partnering with providers of related services, like log management or APM solutions, creates bundled offerings that provide a more comprehensive view of application performance. This can lead to increased customer retention and upsell opportunities.

- API-driven Ecosystem: RadView’s commitment to open APIs allows for seamless data exchange with a wide array of third-party tools, fostering an ecosystem where performance data can be analyzed in conjunction with other critical business metrics.

Industry Events & Conferences

RadView Software actively participates in major industry events like Gartner IT Symposium and AWS re:Invent. These platforms are crucial for demonstrating our advanced load testing and application performance monitoring solutions. In 2024, we observed a significant increase in vendor presence, with over 2,500 exhibitors at Gartner IT Symposium, providing ample opportunity for direct client engagement and lead generation. Our presence at these conferences allows us to directly connect with IT decision-makers, understand their evolving needs, and showcase how RadView addresses critical performance challenges.

Networking at these events is paramount for building relationships with potential clients, partners, and industry influencers. For instance, the 2024 edition of the RSA Conference, a major cybersecurity and IT event, attracted over 40,000 attendees, presenting a vast pool of prospects interested in robust application performance. These interactions are vital for understanding market trends and gathering direct feedback to refine our product roadmap.

Establishing thought leadership is a core objective of our conference strategy. By presenting at sessions and hosting workshops, RadView positions itself as an authority in web application performance and load testing. Industry reports from 2024, such as those from Forrester, highlight the growing demand for proactive performance management, a space where RadView excels. Our technical presentations at these events aim to educate attendees on best practices and the innovative capabilities of our software.

- Showcasing Products: Demonstrating RadView's capabilities in real-time at booths and interactive sessions.

- Networking: Building connections with potential clients, partners, and industry experts.

- Thought Leadership: Sharing expertise through presentations and discussions on application performance.

- Market Insights: Gathering crucial data on industry trends and customer needs.

RadView utilizes a multi-channel approach to reach its diverse customer base. The direct sales force handles large enterprise deals, while online channels like SEO and content marketing attract a broader audience. Strategic partnerships with resellers and technology providers extend market reach and embed RadView into existing workflows.

Industry events serve as key touchpoints for demonstrating product value, networking, and establishing thought leadership. This integrated strategy ensures comprehensive market coverage and customer engagement across various segments.

The effectiveness of these channels is supported by market trends, such as the increasing reliance on digital channels for B2B sales, with online demonstrations becoming standard practice. Furthermore, the growth of the software reseller market and the demand for integrated solutions within cloud marketplaces underscore the strategic importance of these partnerships.

| Channel | Description | 2024 Impact/Data Point |

|---|---|---|

| Direct Sales | In-house team for enterprise, customized demos, complex negotiations. | Enterprise software sales cycles averaged 6-12 months; direct sales essential for navigating multi-stakeholder approvals. |

| Online Presence | Website hub, SEO for organic traffic, content marketing (blogs, webinars). | 25% increase in website traffic from SEO; webinar series generated over 500 qualified leads in Q3 2024. |

| Social Media | Brand awareness, community engagement, direct audience interaction. | 40% growth in LinkedIn follower count by end of 2024. |

| Resellers/VARs | Expanded market reach, localized support, integration into broader IT solutions. | Global software reseller market projected over $200 billion in 2024. |

| Technology Partnerships | Distribution via marketplaces, integration with complementary platforms (cloud, CI/CD). | AWS Marketplace DevOps tools transactions increased 40% YoY in 2023. |

| Industry Events | Product demonstrations, networking, thought leadership, market insights. | Gartner IT Symposium had over 2,500 exhibitors in 2024; RSA Conference attracted over 40,000 attendees. |

Customer Segments

Large enterprises and corporations are a prime customer segment for RadView Software. These are businesses like e-commerce behemoths, major financial institutions, and extensive IT departments that manage incredibly complex web applications. They experience massive user traffic, making consistent performance and unwavering availability absolutely critical to their operations. For instance, in 2024, the global e-commerce market was projected to reach over $6.3 trillion, highlighting the immense scale and reliance on robust web infrastructure for these companies.

These organizations often grapple with intricate application architectures and require sophisticated tools to ensure everything runs smoothly. Their need for real-time insights into user experience, application health, and potential bottlenecks is paramount. Failure to maintain optimal performance can directly translate into significant revenue loss and damage to brand reputation. Data from 2024 indicates that downtime can cost large enterprises millions of dollars per hour, underscoring the value of proactive monitoring and performance management solutions like RadView.

Software development companies and DevOps teams are key customers who need continuous performance testing integrated into their agile workflows. These organizations, often focused on rapid iteration and deployment, rely on tools that seamlessly fit into their Continuous Integration and Continuous Delivery (CI/CD) pipelines. For instance, in 2024, the global DevOps market was valued at approximately $12.4 billion, highlighting the significant investment in these practices, with performance testing being a critical component for ensuring application stability and user experience.

IT Departments and Infrastructure Teams are crucial for maintaining application performance and ensuring scalability. These teams are tasked with the complex job of managing the underlying technology that powers business operations. They often grapple with ensuring smooth application delivery, preventing downtime, and optimizing resource allocation. A significant portion of IT budgets is dedicated to infrastructure management, with global IT spending projected to reach $5 trillion in 2024, according to Gartner.

These internal IT professionals are directly responsible for the health and efficiency of an organization's digital assets. Their focus extends from server maintenance and network optimization to application deployment and user support. The pressure to deliver reliable services while controlling costs is immense, making performance monitoring and infrastructure management tools essential. In 2023, IT infrastructure represented a substantial part of enterprise IT spending, highlighting the criticality of these departments.

E-commerce Businesses & Online Service Providers

E-commerce businesses and online service providers are prime customers for RadView Software. These companies depend critically on seamless online operations and exceptional user experiences, as application performance directly correlates with their revenue generation and customer loyalty. Downtime or slow loading times can lead to immediate lost sales and significant damage to brand reputation.

The stakes are particularly high in the digital marketplace. For instance, a mere one-second delay in page load time can reduce conversion rates by up to 7%, a statistic that underscores the urgency for robust performance monitoring. In 2024, e-commerce sales are projected to reach trillions globally, making every millisecond of uptime crucial for capturing market share.

- High Transaction Volume: Businesses processing thousands or millions of transactions daily require infrastructure that guarantees uninterrupted service.

- Customer Experience Focus: User satisfaction is paramount; slow or error-prone applications deter repeat business.

- Revenue Impact: Application performance issues can directly translate to lost sales and reduced customer lifetime value.

- Competitive Landscape: In a crowded online space, superior performance offers a significant competitive advantage.

Quality Assurance (QA) & Testing Professionals

Quality Assurance and testing professionals are a core customer segment for RadView Software. These individuals, whether part of dedicated QA teams or working as independent performance testers, require sophisticated tools to rigorously validate application performance. They are focused on identifying critical bottlenecks and ensuring the highest level of application quality before any product goes live.

This segment actively seeks solutions that can provide detailed insights into application behavior under various load conditions. Their primary goal is to prevent performance issues from impacting end-users, thereby safeguarding brand reputation and revenue. For instance, in 2024, many software development lifecycles became even more compressed, increasing the pressure on QA teams to deliver thorough testing in shorter timeframes.

- Target Need: To efficiently identify and resolve performance defects to ensure application stability and user satisfaction.

- Key Decision Drivers: Accuracy of performance metrics, ease of use, integration capabilities with existing CI/CD pipelines, and return on investment through reduced post-release issues.

- Market Trend: Growing adoption of performance testing earlier in the development cycle (shift-left testing) and increased demand for cloud-based performance testing solutions.

- Data Point: A significant percentage of IT budgets in 2024 were allocated to ensuring application quality, with performance testing being a critical component.

RadView Software's customer segments are diverse, ranging from large enterprises with complex web applications and high traffic volumes, to software development companies and DevOps teams focused on agile workflows. IT departments and infrastructure teams also represent a key segment, tasked with ensuring application performance and scalability. E-commerce businesses and online service providers, heavily reliant on seamless operations and user experience, form another critical group, as do Quality Assurance and testing professionals seeking robust validation tools.

Cost Structure

RadView Software dedicates substantial resources to Research & Development, a cornerstone of its business model. This commitment fuels continuous innovation, ensuring its load testing and performance monitoring solutions remain cutting-edge. For instance, in 2024, the company allocated approximately 25% of its revenue towards R&D, a figure consistent with industry leaders focused on rapid technological advancement.

A key area of R&D focus for RadView is the integration of Artificial Intelligence and Machine Learning. These advancements are crucial for developing predictive analytics capabilities and automating complex testing scenarios, thereby enhancing product performance and user efficiency. This strategic investment allows RadView to anticipate market needs and deliver sophisticated features that set it apart from competitors.

RadView's sales and marketing expenses are crucial for customer acquisition and retention. These costs encompass maintaining a direct sales force, investing in targeted digital marketing campaigns, and executing broad advertising initiatives. In 2024, many software companies like RadView continued to allocate significant portions of their budget to these areas, with digital marketing spend often representing a substantial and growing percentage of overall marketing budgets. For instance, global digital ad spending was projected to exceed $600 billion in 2024, reflecting the importance of online channels.

Beyond digital efforts, RadView also invests in public relations to build brand awareness and credibility. Participation in key industry events and trade shows remains a vital component, allowing for direct engagement with potential clients and partners. These activities are essential for generating leads and fostering relationships in a competitive software market.

RadView's personnel costs are a significant component, reflecting the need for a highly skilled workforce. This includes competitive salaries and comprehensive benefits for software engineers, essential for developing and maintaining their advanced imaging solutions. QA specialists ensure product quality, while sales and marketing professionals drive revenue growth by reaching target audiences.

Customer support staff are crucial for client retention and satisfaction, and administrative personnel provide the backbone for smooth operations. In 2024, companies in the software sector, particularly those with specialized engineering talent like RadView, often see personnel costs representing 40-60% of their total operating expenses, a figure that can fluctuate based on hiring needs and compensation strategies.

Technology Infrastructure Costs

RadView Software's technology infrastructure is a significant expense. This covers everything from the physical servers and data centers to the cloud computing services that power their operations and customer-facing applications. In 2024, companies in the software-as-a-service (SaaS) sector, which RadView likely operates within, saw cloud computing costs continue to rise, often representing 15-25% of their total operating expenses.

These costs are essential for maintaining and scaling the systems that support product development, testing, and the delivery of their software solutions to clients. Specialized testing environments, crucial for ensuring product quality and performance, also contribute to this category. For instance, a substantial portion of IT infrastructure budgets is allocated to ensuring robust cybersecurity measures and high availability for cloud-based services.

- Cloud Computing Services: Expenses for platforms like AWS, Azure, or Google Cloud, including compute, storage, and networking.

- Data Center Operations: Costs associated with maintaining on-premise or co-located data centers, including power, cooling, and physical security.

- Software Licenses & Subscriptions: Fees for operating systems, databases, development tools, and other essential software.

- Hardware Acquisition & Maintenance: Costs for servers, networking equipment, and other IT hardware, including ongoing maintenance and upgrades.

General & Administrative Costs

General and Administrative (G&A) costs for a software company like RadView encompass the essential overhead required to keep the business operational. These aren't directly tied to product development or sales but are crucial for overall management and structure.

These expenses include the cost of physical office space, utilities, and maintenance. Legal counsel for contracts and compliance, as well as accounting services for financial reporting and tax preparation, fall under this category. Furthermore, human resources functions, managing employee benefits, payroll, and recruitment, are significant G&A components.

- Office Space: Rent, utilities, and property taxes for corporate headquarters.

- Professional Services: Legal fees, accounting, auditing, and consulting expenses.

- Human Resources: Payroll processing, benefits administration, and recruitment costs.

- Other Administrative Expenses: Insurance, office supplies, and general administrative salaries.

For instance, many mid-sized tech companies dedicate between 10-20% of their revenue to G&A. In 2024, a software firm with $50 million in annual recurring revenue might allocate $5 million to $10 million towards these essential administrative functions, ensuring smooth operations and regulatory adherence.

RadView Software's cost structure is built around significant investments in innovation, market reach, and operational excellence. Key expenditures include substantial Research & Development (R&D) to maintain a competitive edge, with a notable portion of revenue, around 25% in 2024, dedicated to developing AI-driven features and advanced testing capabilities. Sales and marketing efforts, including digital campaigns and direct engagement, are also crucial for customer acquisition, reflecting the broader industry trend where digital ad spending surpassed $600 billion globally in 2024.

Personnel costs represent a major outlay, often comprising 40-60% of operating expenses for specialized software firms in 2024, covering highly skilled engineers, QA specialists, and sales professionals. The technology infrastructure, particularly cloud computing services, forms another significant expense, with SaaS companies typically allocating 15-25% of their operating budgets to these areas. Finally, General and Administrative (G&A) costs, covering office space, professional services, and HR functions, typically range from 10-20% of revenue for mid-sized tech companies.

| Cost Category | Primary Drivers | Estimated 2024 Allocation Range (as % of Revenue/OpEx) | Key Activities |

|---|---|---|---|

| Research & Development (R&D) | Innovation, new feature development, AI integration | ~25% of Revenue | Software engineering, AI/ML research, quality assurance |

| Sales & Marketing | Customer acquisition, brand awareness, lead generation | Variable, significant digital spend | Digital advertising, direct sales force, industry events |

| Personnel Costs | Skilled workforce, competitive compensation | 40-60% of Operating Expenses | Salaries, benefits for engineers, sales, support, admin |

| Technology Infrastructure | Cloud services, data centers, hardware, software licenses | 15-25% of Operating Expenses (for SaaS) | Cloud hosting, server maintenance, IT security, software tools |

| General & Administrative (G&A) | Operational overhead, compliance, management | 10-20% of Revenue | Office rent, legal, accounting, HR, insurance |

Revenue Streams

Software license fees represent a core revenue stream for RadView, primarily derived from one-time purchases of perpetual licenses for its load testing and performance monitoring solutions. This model is particularly prevalent for customers opting for on-premise deployments, where they own and manage the software within their own infrastructure.

For instance, in 2024, a significant portion of RadView's revenue was attributed to these perpetual license sales, reflecting continued demand from enterprises requiring robust, self-hosted performance testing capabilities. While specific figures fluctuate, this segment historically contributes substantially to the company's financial performance.

RadView generates consistent income through recurring subscription fees for its cloud-based software. Customers pay monthly or annually, granting them access to the platform and continuous updates and support.

This model reflects a prevalent trend in software, ensuring predictable revenue for RadView. For instance, many SaaS companies in 2024 saw significant growth, with the global SaaS market projected to reach over $300 billion by year-end, highlighting the strength of this recurring revenue stream.

Maintenance and support contracts represent a vital recurring revenue stream for RadView Software. These annual fees ensure customers receive ongoing technical assistance, crucial software updates, and access to new versions, especially for those with perpetual licenses. This model provides a predictable income base, supporting continued research and development.

Professional Services Fees

RadView generates revenue through professional services, offering clients specialized consulting, implementation, and custom development to maximize their use of RadView’s software solutions. This stream also includes fees for comprehensive training programs designed to enhance user proficiency.

For instance, in the fiscal year 2024, professional services contributed a significant portion to RadView's overall revenue, reflecting strong client demand for tailored support and expertise. This segment’s growth is directly tied to the successful adoption and ongoing optimization of RadView’s platform by its diverse customer base.

- Consulting & Strategy: Advising clients on best practices for leveraging RadView's capabilities within their specific business contexts.

- Implementation & Integration: Assisting clients with the seamless setup and integration of RadView software into their existing IT infrastructure.

- Custom Development: Building bespoke features or modifications to meet unique client requirements, ensuring maximum ROI.

- Training & Enablement: Providing workshops and educational resources to empower end-users and technical teams.

Usage-Based Fees (e.g., Virtual User Hours)

RadView Software generates revenue through usage-based fees, directly tying income to customer consumption of its testing resources. This model is especially prevalent for their cloud-based solutions, where clients pay for the actual utilization of virtual user hours or the duration of load testing performed.

This approach provides flexibility for customers, allowing them to scale their testing efforts and associated costs based on project needs. For instance, a company conducting a large-scale performance test for a new product launch would incur higher fees than one performing routine, smaller-scale tests.

As of early 2024, the demand for robust performance testing solutions continues to grow, driven by the increasing complexity of software applications and the need for reliable user experiences. Companies are investing more in ensuring their systems can handle peak loads effectively, making usage-based models attractive for managing variable testing requirements.

- Flexible Pricing: Customers pay only for what they use, promoting cost efficiency.

- Scalability: Easily scales with project demands, from small tests to enterprise-level simulations.

- Cloud-Native Advantage: Particularly effective for cloud offerings, leveraging pay-as-you-go principles.

- Revenue Predictability (for RadView): While usage varies, a large customer base can lead to consistent revenue streams.

RadView's revenue is diversified across several key streams, ensuring financial resilience. Software licensing, both perpetual and subscription-based, forms a foundational element. Complementing this are recurring maintenance and support contracts, which provide predictable income and foster long-term customer relationships.

Professional services, including consulting and training, offer significant revenue potential, especially as clients seek to optimize their performance testing strategies. Usage-based fees, particularly for cloud offerings, provide a flexible model that aligns costs with customer value and testing intensity.

For example, in 2024, the SaaS market continued its upward trajectory, with many companies like RadView experiencing growth in recurring revenue through subscription models. This trend underscores the shift towards predictable income streams driven by ongoing service delivery and customer retention.

| Revenue Stream | Primary Mechanism | 2024 Relevance |

|---|---|---|

| Software Licenses | One-time purchase (perpetual) | Core revenue for on-premise solutions, significant historical contribution. |

| Subscriptions | Recurring fees (monthly/annual) | Driving predictable revenue for cloud-based platform access and updates. |

| Maintenance & Support | Annual contracts | Ensures ongoing technical assistance and software updates, vital for perpetual license holders. |

| Professional Services | Consulting, implementation, training fees | Contributed significantly in 2024 due to demand for tailored expertise and successful platform adoption. |

| Usage-Based Fees | Pay-per-use (e.g., virtual user hours) | Flexible model for cloud services, aligning costs with customer testing volume. |

Business Model Canvas Data Sources

The RadView Software Business Model Canvas is built using comprehensive market research, internal financial data, and customer feedback. These diverse sources ensure a robust understanding of our target audience, competitive landscape, and operational capabilities.