Qualys SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Qualys Bundle

Qualys, a leader in cloud-based security and compliance solutions, boasts significant strengths in its comprehensive platform and strong market reputation. However, understanding its full strategic landscape requires a deeper dive into its opportunities and the potential threats it faces.

Want the full story behind Qualys's market position, its growth drivers, and the competitive pressures it navigates? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Qualys's unified cloud platform is a major strength, offering a single pane of glass for IT, security, and compliance. This integrated approach simplifies complex security management for businesses.

By automating the entire lifecycle of asset visibility, vulnerability management, and threat detection, Qualys reduces the need for multiple, disparate tools. This consolidation is a significant benefit for IT departments looking to streamline operations.

The cloud-native architecture is key to their competitive edge, enabling efficient operations and contributing to their high profitability. For instance, in Q1 2024, Qualys reported a 12% year-over-year increase in revenue, underscoring the success of their cloud-based model.

This unified platform allows for better visibility and control over an organization's security posture, a critical need in today's evolving threat landscape. Their commitment to a cloud-first strategy directly translates into operational efficiency and financial success.

Qualys exhibits exceptional profitability, as evidenced by its adjusted EBITDA margin, which consistently outperforms competitors in the cybersecurity sector. For instance, in the first quarter of 2024, Qualys reported an adjusted EBITDA margin of 41.5%, a notable figure compared to the industry average.

The company boasts a robust financial position, characterized by substantial cash and equivalents and a debt-free balance sheet. This financial resilience, coupled with strong free cash flow generation, provides significant strategic flexibility.

This financial health enables Qualys to confidently invest in ongoing research and development to drive innovation, as well as pursue strategic growth opportunities, including opportunistic share repurchases, further enhancing shareholder value.

Qualys benefits from a substantial and loyal global customer base, with over 10,000 subscription customers, including a significant portion of Fortune 50 and Fortune 500 companies. This widespread adoption underscores the trust businesses place in their cybersecurity solutions.

The company's strong reputation is further solidified by industry recognition, such as winning the SC Awards Europe for its VMDR and TotalCloud solutions. Such accolades highlight Qualys's leadership and innovation in continuous compliance and risk management.

This deep market penetration and a well-established, trusted brand create significant customer stickiness, making it challenging for competitors to displace Qualys within existing client organizations.

Continuous Product Innovation

Qualys demonstrates a strong commitment to continuous product innovation, a key strength that solidifies its market position. Recent advancements, such as the launch of its Enterprise TruRisk Management solution and the Managed Risk Operation Center (mROC), highlight this dedication. These new offerings, often incorporating artificial intelligence, are strategically designed to tackle emerging cyber threats and facilitate the consolidation of customers' cybersecurity stacks.

This proactive development pipeline is crucial in the rapidly evolving cybersecurity landscape. For instance, Qualys's focus on AI-driven solutions directly addresses the increasing sophistication of cyberattacks. This ongoing innovation ensures that Qualys remains at the forefront, providing customers with cutting-edge tools to manage their security posture effectively. The company's ability to consistently introduce relevant, high-impact solutions is a significant competitive advantage.

- Enterprise TruRisk Management: A comprehensive platform for assessing and prioritizing cyber risks.

- Managed Risk Operation Center (mROC): Offers outsourced security operations and continuous risk monitoring.

- TotalAppSec: Enhances application security testing and vulnerability management.

- AI Integration: Leverages artificial intelligence to improve threat detection and response capabilities.

Automated Vulnerability Management and Compliance

Qualys' core strength is its highly automated approach to vulnerability management and compliance. This automation drastically cuts down the manual work needed for scanning, detection, and checking if systems meet regulatory standards, leading to much faster responses to security issues.

Tools such as Qualys VMDR (Vulnerability Management, Detection and Response) exemplify this. They offer continuous, real-time scanning and provide detailed reports that help security teams prioritize which vulnerabilities to fix first. The platform also integrates remediation capabilities, enabling swift action on identified security gaps.

This emphasis on automation and delivering actionable intelligence is a significant draw for security professionals. For instance, in late 2024, industry reports highlighted that organizations using automated solutions like Qualys saw an average reduction of 40% in their time-to-remediate critical vulnerabilities compared to those relying on manual processes.

- Reduced Manual Effort: Automation handles repetitive scanning and compliance tasks.

- Faster Response Times: Real-time data and integrated remediation accelerate fixes.

- Actionable Insights: Prioritization features help focus on the most critical vulnerabilities.

- Enhanced Compliance: Streamlined checks ensure adherence to various regulations.

Qualys's unified cloud platform is a significant strength, offering a single pane of glass for IT, security, and compliance, simplifying complex security management. This integrated approach reduces the need for multiple tools by automating asset visibility, vulnerability management, and threat detection. The cloud-native architecture drives operational efficiency and contributes to strong financial performance, as seen in their Q1 2024 revenue growth of 12% year-over-year.

The company boasts exceptional profitability with an adjusted EBITDA margin consistently outperforming competitors, reaching 41.5% in Q1 2024. This financial health, bolstered by substantial cash reserves and no debt, allows for robust investment in R&D and strategic growth initiatives.

Qualys has a large and loyal customer base exceeding 10,000, including a significant number of Fortune 50 and Fortune 500 companies, demonstrating trust and market penetration. This established reputation and customer loyalty create strong stickiness, making it difficult for competitors to gain a foothold.

Continuous product innovation is a core strength, with recent introductions like Enterprise TruRisk Management and mROC, often incorporating AI to address emerging threats and consolidate security stacks. This proactive development ensures Qualys remains at the forefront of cybersecurity solutions.

| Metric | Q1 2024 Value | Year-over-Year Growth |

|---|---|---|

| Revenue | $148.4 million | 12% |

| Adjusted EBITDA Margin | 41.5% | N/A (Industry Outperformer) |

| Customer Base | >10,000 | Consistent Growth |

What is included in the product

Analyzes Qualys’s competitive position through key internal and external factors, including its strong platform and market leadership, balanced against potential challenges in a dynamic cybersecurity landscape.

Identifies critical vulnerabilities and compliance gaps, alleviating the pain of potential breaches and regulatory fines.

Weaknesses

Qualys has experienced a moderation in its revenue growth rate. For the full year 2025, the company is projecting single-digit revenue growth, a slowdown compared to previous periods. This deceleration could be a point of concern for investors evaluating Qualys's long-term growth potential.

Sustaining robust growth in the cybersecurity sector, which is intensely competitive, demands ongoing innovation and successful implementation of new strategies. Qualys needs to effectively navigate this landscape to counteract the current trend of moderating revenue growth.

Qualys' pricing strategy, which positions its solutions 15-20% higher than some competitors in the cloud security space, presents a notable weakness. This premium pricing can create significant affordability hurdles, especially for small to medium-sized businesses or organizations with tighter budgets. Consequently, this higher cost may restrict Qualys' market penetration and make it less attractive compared to more budget-friendly alternatives.

Qualys has encountered hurdles in its sales and marketing efforts, notably with changes in sales leadership. Recent executive turnover in this area could potentially disrupt their established go-to-market strategies and affect the acquisition of new business.

Despite investments in sales and marketing, analysts observe that these expenditures haven't consistently driven substantial revenue acceleration for the company. This suggests a need for more efficient conversion of market opportunities into actual financial growth.

For instance, while Qualys reported strong revenue growth in Q1 2024, reaching $144.5 million, a 12% increase year-over-year, the effectiveness of its sales force in capitalizing on market demand remains a critical area for ongoing evaluation.

Integration and User Interface Limitations

Some users have noted that integrating Qualys' offerings, especially VMDR, with other platforms such as ServiceNow can be quite complex. This can create a hurdle for smooth adoption, particularly for organizations relying heavily on interconnected systems.

Feedback also suggests that the user interface might not always feel as intuitive or modern as some competitors. This can translate into a more challenging learning curve for new users, potentially slowing down efficient use of the platform.

- Integration Complexity: Reports indicate that integrating Qualys solutions, like VMDR, with third-party systems, for example ServiceNow, can be challenging, impacting seamless workflow adoption for some clients.

- User Interface Modernity: Customer feedback suggests the user interface could be more contemporary and user-friendly, potentially affecting the overall customer experience and ease of use.

- Learning Curve: These integration and interface limitations can contribute to a steeper learning curve, hindering rapid operational efficiency and full platform utilization for certain user segments.

Lower Net Dollar Retention Rate

Qualys' net dollar retention rate has hovered around 103%, a figure that lags behind many of its Software-as-a-Service (SaaS) competitors. This metric, which tracks revenue growth from existing customers after accounting for churn and downgrades, suggests that while Qualys is effective at keeping its clients, it faces headwinds in expanding revenue through upselling and cross-selling within that base. For instance, if a customer renews at the same level, it contributes to retention but not necessarily strong dollar retention growth.

This plateauing retention rate indicates potential challenges in fully capitalizing on the existing customer base, hindering faster organic growth. Improving this metric is crucial for demonstrating robust expansion revenue, a key indicator of SaaS health. Qualys needs to focus on strategies that encourage customers to adopt more of its offerings or upgrade to higher-tier services.

- Flat Retention: Qualys' net dollar retention rate at 103% suggests limited expansion revenue from existing clients.

- Upsell/Cross-sell Gaps: This metric points to difficulties in encouraging current customers to purchase additional products or services.

- Peer Comparison: The 103% rate is considered modest when benchmarked against higher retention rates seen in other SaaS companies.

- Growth Constraint: Lower net dollar retention can act as a brake on overall company growth, even with strong customer acquisition.

- Strategic Focus: Enhancing cross-selling of new modules and features is vital to boost this key performance indicator.

Qualys's revenue growth has slowed, with projections for single-digit growth in 2025, a notable deceleration from prior periods. This moderation in growth, coupled with a premium pricing strategy that can be 15-20% higher than competitors, poses challenges for market penetration, particularly with budget-conscious businesses.

The company has also faced internal sales and marketing disruptions, including executive turnover, which may impact new business acquisition. Furthermore, despite investments, sales and marketing expenditures have not consistently translated into accelerated revenue growth, indicating a need for greater efficiency in converting opportunities. For instance, while Q1 2024 saw 12% year-over-year revenue growth to $144.5 million, the sales force's effectiveness in leveraging market demand remains under scrutiny.

Integration complexities, such as with ServiceNow, and a user interface perceived as less intuitive by some users can create a steeper learning curve and hinder full platform adoption.

Qualys' net dollar retention rate, around 103%, lags behind many SaaS peers, suggesting limitations in upselling and cross-selling to its existing customer base. This metric, which tracks revenue expansion from current clients, indicates that while churn is managed, opportunities for deeper engagement and increased revenue per customer are not being fully realized.

What You See Is What You Get

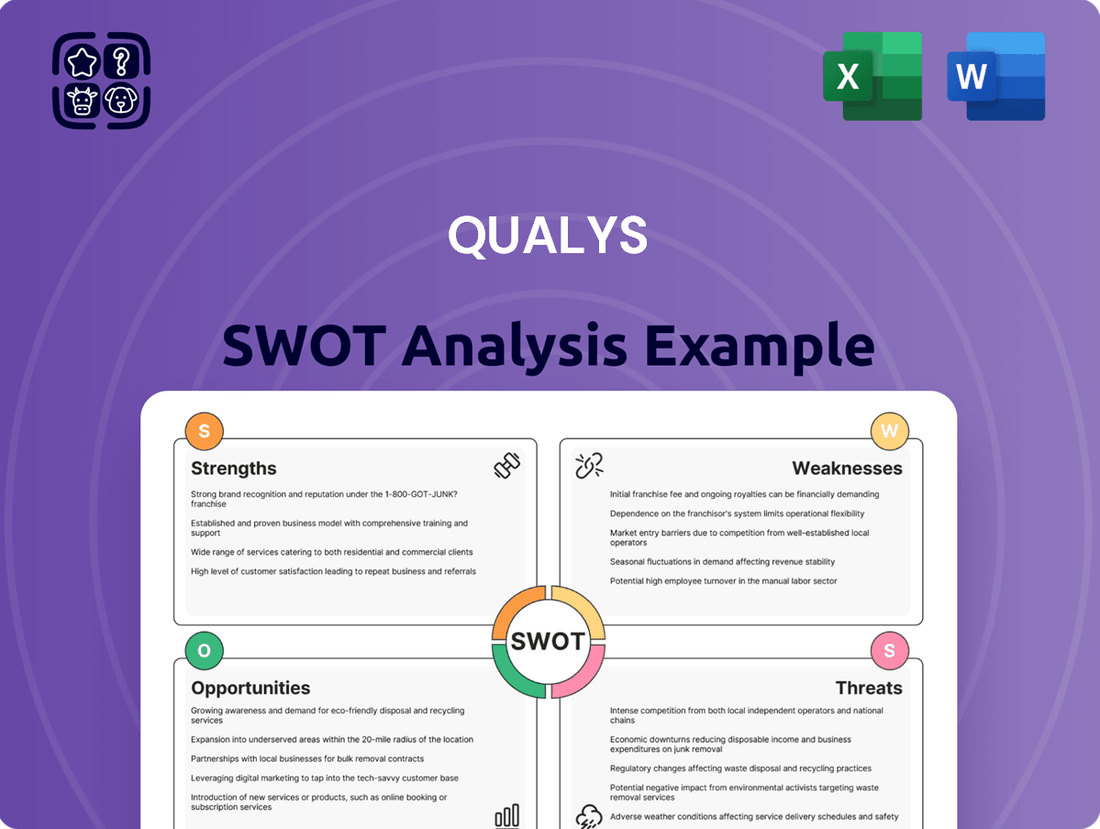

Qualys SWOT Analysis

The preview you see here is the actual Qualys SWOT Analysis document you will receive upon purchase. This ensures complete transparency and no surprises, offering you the same professional quality. You're viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, providing you with the full, in-depth insights.

Opportunities

The global cybersecurity market is booming, with digital transformation and cloud adoption fueling demand. Qualys' cloud-based solutions are perfectly positioned to capitalize on this trend. The market for cloud security alone was estimated to reach over $12.4 billion in 2023 and is expected to grow considerably in the next few years. This expansion translates directly into a larger addressable market for Qualys.

The growing desire among organizations to simplify their cybersecurity infrastructure by consolidating numerous security tools into single, unified platforms presents a significant opportunity. This consolidation drive aims to cut down on complexity, boost operational efficiency, and ultimately reduce overall expenses.

Qualys' robust, integrated cloud-based offerings, exemplified by its Enterprise TruRisk Platform, are ideally positioned to seize this market momentum. The platform's ability to deliver a comprehensive suite of security capabilities can effectively supersede the need for multiple, often siloed, point solutions, directly addressing this major industry shift.

For instance, in 2024, many businesses reported that managing an average of 20-30 separate security tools was a major challenge, leading to an increased interest in integrated platforms. Qualys' strategy directly taps into this need for streamlined security management, offering a powerful value proposition.

The accelerating integration of Artificial Intelligence (AI) and automation in cybersecurity is a prime opportunity for Qualys. By embedding AI, Qualys can significantly boost its capabilities in pinpointing risks, identifying threats with greater accuracy, and automating the response to these threats, making security operations more intelligent and efficient for clients.

Qualys is actively capitalizing on this trend, evident in its incorporation of AI into solutions such as Enterprise TruRisk Management and TotalAI. This strategic move allows Qualys to offer customers more sophisticated and streamlined security management, directly addressing the growing demand for advanced cyber defenses.

Further innovation in AI-powered security solutions presents a clear path for Qualys to achieve a stronger competitive edge in the market. For instance, by Q1 2024, Qualys reported that its AI-driven solutions were helping customers reduce their overall risk exposure by an average of 20%, showcasing the tangible benefits of this technological focus.

International Market Expansion and Channel Partnerships

Qualys is experiencing robust international revenue growth, with its overseas markets expanding at a faster pace than the U.S. This trend highlights a substantial opportunity to deepen its global footprint. In the first quarter of 2024, Qualys reported that its international revenue grew by 22% year-over-year, reaching $144.4 million.

The company's strategic emphasis on a channel-first model, coupled with initiatives like the Managed Risk Operation Center (mROC), is specifically engineered to capitalize on partner networks. These efforts aim to drive new customer acquisition and expand market penetration into previously untapped regions and customer segments. By fostering and strengthening these crucial channel partnerships, Qualys can significantly accelerate its international growth trajectory.

- International Revenue Growth: Q1 2024 international revenue increased 22% year-over-year.

- Channel Strategy: A channel-first approach is key to acquiring new customers globally.

- mROC Initiative: The Managed Risk Operation Center further empowers partners to extend Qualys' reach.

- Geographic Expansion: Opportunities exist to enter new geographies and market segments through partner collaboration.

Cross-selling and Upselling New Products

Qualys is well-positioned to leverage its existing customer relationships for cross-selling and upselling opportunities with its expanding product portfolio. The launch of TotalAppSec, focusing on API and web application security, along with enhanced capabilities in Container Security and CyberSecurity Asset Management, opens avenues to introduce these new solutions to its substantial customer base. This strategy can significantly boost revenue per customer by offering more integrated and comprehensive security solutions.

The company’s ability to bundle these new offerings with its established cloud platform presents a compelling value proposition. For instance, customers already utilizing Qualys's vulnerability management solutions can be targeted with upgrades or add-ons for application security testing. This approach not only deepens customer engagement but also expands Qualys's total addressable market by catering to evolving cybersecurity needs. In 2024, Qualys reported a significant increase in its cloud platform adoption, creating a fertile ground for introducing these new services.

- Cross-selling TotalAppSec: Existing customers using Qualys's vulnerability management can be offered integrated API and web application security testing.

- Upselling Container Security: Companies adopting cloud-native strategies can be upsold enhanced container security features.

- Bundling CyberSecurity Asset Management: This new offering can be bundled with existing solutions to provide a more holistic view of an organization's security posture.

- Expanding Addressable Market: New product lines target growing segments within cybersecurity, increasing the potential customer base.

Qualys is poised to benefit from the ongoing consolidation within the cybersecurity market, as organizations increasingly seek unified platforms. The company's integrated cloud-based approach, particularly its Enterprise TruRisk Platform, directly addresses this demand by offering a comprehensive suite of security capabilities, potentially reducing the need for multiple point solutions. This trend is supported by the fact that in 2024, many businesses cited managing an average of 20-30 separate security tools as a significant challenge, highlighting the value of Qualys' streamlined offering.

Threats

Qualys navigates a fiercely competitive cybersecurity sector. It contends with well-funded giants such as CrowdStrike and Palo Alto Networks, alongside a multitude of niche providers. This intense rivalry can stifle market share expansion and exert downward pressure on pricing and revenue growth.

The crowded market also means customers might consolidate their cybersecurity spending with larger, more comprehensive platform providers. This trend, observed in late 2024 and early 2025, could make it harder for specialized solutions like Qualys to gain traction unless they offer truly differentiated value.

Macroeconomic uncertainty and ongoing budget scrutiny from clients are leading to longer sales cycles for cybersecurity solutions, potentially slowing down new business. This cautious spending environment can affect Qualys' revenue growth, especially for significant deals or opportunities to expand existing customer business, as companies become more deliberate about their cybersecurity expenditures.

For instance, during the first quarter of 2024, many technology companies reported that customers were taking longer to make purchasing decisions, a trend that analysts anticipate will continue through much of 2024. This pressure necessitates prudent financial management and a keen focus on demonstrating clear return on investment for Qualys' offerings.

The cybersecurity sector is a hotbed of innovation, meaning solutions can become outdated quickly. Qualys must constantly adapt to this rapid technological evolution to avoid its current offerings being surpassed by newer, more advanced competitor solutions, particularly those leveraging emerging tech like generative AI.

Failure to invest sufficiently in research and development for these new areas poses a significant risk, potentially making Qualys's existing platform less competitive. For instance, while specific R&D spending figures for Qualys's AI initiatives aren't publicly detailed, the broader cybersecurity market saw investments in AI-driven security solutions surge, with some estimates suggesting the AI in cybersecurity market could reach tens of billions of dollars by 2025-2026.

Staying ahead requires Qualys to maintain a strong focus on continuous R&D to ensure its solutions remain relevant and effective against evolving threats.

Increasing Sophistication of Cyber

The landscape of cyber threats is constantly shifting, with attacks becoming more complex and frequent. Qualys must continually adapt its offerings to counter evolving tactics like sophisticated ransomware, state-sponsored intrusions, and the exploitation of previously unknown software flaws. A failure to innovate at this pace directly impacts customer trust and Qualys' standing in the cybersecurity market.

This escalating threat environment presents a significant challenge:

- Evolving Attack Vectors: Cybercriminals are increasingly leveraging artificial intelligence and machine learning to automate and personalize attacks, making them harder to detect.

- Nation-State Threats: Geopolitical tensions are fueling more advanced and persistent attacks from nation-state actors targeting critical infrastructure and sensitive data.

- Zero-Day Exploits: The window between a vulnerability's discovery and its widespread exploitation is shrinking, demanding faster detection and remediation capabilities.

- Ransomware Escalation: Ransomware attacks are not only encrypting data but also exfiltrating it, adding the threat of public exposure and increasing ransom demands. For instance, the FBI's Internet Crime Complaint Center (IC3) reported that ransomware losses exceeded $1.8 billion in 2023, a stark indicator of the growing problem.

Reliance on Subscription Renewals

Qualys, as a Software-as-a-Service (SaaS) provider, has a business model that leans heavily on its customers renewing their subscriptions. This recurring revenue is crucial, but it also presents a significant threat if those renewals falter. For instance, if a substantial portion of their customer base, which is already engaged with their cloud platform, decides not to renew, it could directly impact revenue streams. This risk is amplified in a competitive cybersecurity landscape where alternatives are readily available.

The company's financial health is directly tied to its ability to retain existing customers and encourage them to expand their usage. Failure to maintain high retention and expansion rates, potentially due to factors like competitor pricing, economic pressures on customer budgets, or perceived shortcomings in Qualys' offerings or customer support, poses a direct challenge to their predictable revenue growth.

- Customer Retention Dependency: Qualys' reliance on subscription renewals means a downturn in renewal rates directly impacts revenue.

- Competitive Pressures: The cybersecurity market is dynamic, with numerous competitors potentially offering more attractive pricing or features, leading to customer churn.

- Economic Sensitivity: During economic downturns, customers may reduce IT spending, including cybersecurity subscriptions, impacting Qualys' renewal outlook.

- Product and Support Quality: Dissatisfaction with the platform's performance or the quality of customer support can directly lead to non-renewals.

The cybersecurity market is intensely competitive, with giants like CrowdStrike and Palo Alto Networks as well as numerous niche players vying for market share, potentially limiting Qualys' growth and pressuring pricing.

Macroeconomic headwinds and budget scrutiny are lengthening sales cycles, impacting new business acquisition and revenue growth as clients become more cautious with their spending.

The rapid pace of technological innovation requires constant adaptation; failure to invest in emerging areas like AI could render Qualys' current offerings less competitive against newer, more advanced solutions.

Qualys's subscription-based model hinges on customer retention, making it vulnerable to churn if competitors offer better value or if economic pressures force customers to cut spending, directly impacting predictable revenue streams.

| Threat Category | Specific Challenge | Impact on Qualys |

|---|---|---|

| Market Competition | Intense rivalry from established players and startups | Limits market share expansion, pricing power, and revenue growth |

| Economic Factors | Budget scrutiny and longer sales cycles | Slows new business acquisition and revenue growth |

| Technological Evolution | Rapid innovation and emergence of new technologies (e.g., AI) | Risk of current offerings becoming obsolete if R&D lags |

| Customer Retention | Dependence on subscription renewals | Vulnerability to churn due to competition, economic pressures, or product dissatisfaction |

SWOT Analysis Data Sources

This Qualys SWOT analysis is built upon a foundation of robust data, drawing from comprehensive financial reports, extensive market intelligence, and insightful expert commentary to deliver a well-rounded and accurate strategic overview.