Pure Storage Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Pure Storage Bundle

Understanding Pure Storage's product portfolio through the lens of the BCG Matrix is crucial for strategic growth. This analysis helps identify which offerings are driving market share and generating significant cash, and which require careful consideration for future investment or divestment. Get the full BCG Matrix to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Pure Storage's Evergreen//One for AI is a standout offering, positioned as a Star within its business portfolio, especially considering the explosive growth in artificial intelligence. This service is tailored to meet the demanding needs of AI workloads, such as those found in large GPU deployments and enterprise inference systems. Its focus on high-performance data storage makes it a perfect fit for this burgeoning market.

The AI market is experiencing unprecedented expansion, driving significant demand for specialized storage solutions. In 2024, the global AI market size was valued at an estimated $200 billion, with projections indicating continued robust growth. Evergreen//One for AI directly targets this opportunity, providing the necessary infrastructure for AI development and deployment.

FlashBlade//S, especially the S500 model, is a star in Pure Storage's portfolio, particularly due to its NVIDIA DGX SuperPOD certification. This positions it as a key player in the high-growth sectors of unstructured data, artificial intelligence (AI), and high-performance computing (HPC). Its design for massive scale-out and its performance capabilities for AI workloads are significant advantages in a booming market.

The company saw record Q1 sales for FlashBlade, a clear indicator of its strong market traction. This surge was directly fueled by the increasing demand for AI workloads and widespread adoption across various regions, reinforcing its star status.

Pure Storage's DirectFlash technology, particularly its secured design win with a top-four hyperscaler, firmly places it in the Star quadrant of the BCG matrix. This critical development signifies a major push to displace traditional hard disk drive (HDD) storage with advanced, high-performance flash infrastructure within massive hyperscale data centers. This transition is a substantial growth avenue for Pure Storage, targeting environments that demand both scalability and speed.

The strategic implementation of DirectFlash within these hyperscale environments is projected to generate significant revenue streams, with expectations pointing to substantial contributions by fiscal year 2027. For context, the global hyperscale data center market was valued at approximately $263.7 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of over 13% through 2030, highlighting the immense potential of this segment.

GenAI Pod Solutions

Pure Storage's GenAI Pod Solutions are positioned as Stars in the BCG matrix. This is a comprehensive, full-stack offering engineered to streamline the adoption of generative AI. It's essentially a ready-to-go platform built specifically for demanding AI workloads, significantly lowering the barriers to entry in terms of time, expense, and specialized knowledge. This strategic move directly addresses the explosive growth in the AI market, reflecting Pure Storage's commitment to leading in this transformative technology.

The GenAI Pod tackles the complexities of AI infrastructure, offering a simplified path for businesses. This product is designed to accelerate AI initiatives, making it an attractive proposition for a wide range of organizations. The market for AI infrastructure solutions is experiencing rapid expansion, with projections indicating substantial growth through 2024 and beyond.

- Market Demand: The global AI market is projected to reach over $200 billion in 2024, with significant investment in AI infrastructure.

- Product Strategy: Pure Storage's GenAI Pod addresses this demand by providing a pre-integrated, high-performance solution.

- Competitive Advantage: The turnkey nature of the GenAI Pod reduces deployment complexity and time-to-value for customers.

- Growth Potential: As AI adoption continues to surge, products like the GenAI Pod are expected to capture substantial market share.

Unified Data Management for Enterprise Data Cloud

Pure Storage's Enterprise Data Cloud, powered by Pure Fusion, is positioned as a Star in the BCG matrix, signifying high growth and a strong market position. This architecture aims to consolidate scattered data sources into a unified, virtualized data cloud. Its strategic importance is amplified by the escalating demand for efficient data management across diverse environments, including on-premises, public cloud, and hybrid setups. This is particularly crucial as AI adoption accelerates, requiring seamless data access and processing.

The Enterprise Data Cloud architecture directly tackles the complexities of modern data landscapes, offering a singular point of control and access. This innovation is designed to streamline operations and reduce data silos, a persistent challenge for many organizations. For instance, by 2024, the global data generated is projected to reach over 120 zettabytes, underscoring the immense need for unified management solutions.

- Unified Access: Enables seamless data retrieval and management across on-premise, public cloud, and hybrid infrastructures.

- AI Enablement: Provides a foundational data layer crucial for accelerating AI initiatives and data-intensive workloads.

- Market Relevance: Addresses a critical industry need for simplified, scalable, and efficient data operations in an increasingly complex data ecosystem.

- Growth Potential: Leverages the significant market shift towards cloud-native architectures and the pervasive influence of AI.

Pure Storage's Evergreen//One for AI, FlashBlade//S, and GenAI Pod Solutions are all categorized as Stars in the BCG matrix. These offerings are characterized by high market growth and a strong competitive position, driven by the booming AI sector. Evergreen//One for AI caters to demanding AI workloads, while FlashBlade//S, with its NVIDIA DGX SuperPOD certification, excels in unstructured data and AI. The GenAI Pod Solutions provide a comprehensive, full-stack approach to accelerate generative AI adoption.

The Enterprise Data Cloud, powered by Pure Fusion, also shines as a Star. It addresses the critical need for unified data management across hybrid environments, a necessity for accelerating AI initiatives. This solution leverages the increasing complexity of data landscapes and the pervasive influence of AI to offer a scalable and efficient data operations platform.

| Product/Solution | BCG Quadrant | Key Drivers | Market Growth Context |

|---|---|---|---|

| Evergreen//One for AI | Star | High-performance storage for AI workloads, GPU deployments, enterprise inference. | Global AI market valued at $200 billion in 2024, experiencing rapid expansion. |

| FlashBlade//S (e.g., S500) | Star | NVIDIA DGX SuperPOD certification, unstructured data, AI, HPC. | Record Q1 sales for FlashBlade, fueled by AI workload demand. |

| GenAI Pod Solutions | Star | Full-stack, pre-integrated solution for generative AI adoption. | Addresses explosive growth in the AI market, simplifying AI infrastructure. |

| Enterprise Data Cloud (Pure Fusion) | Star | Unified data access across hybrid environments, AI enablement. | Global data generation projected to exceed 120 zettabytes by 2024. |

What is included in the product

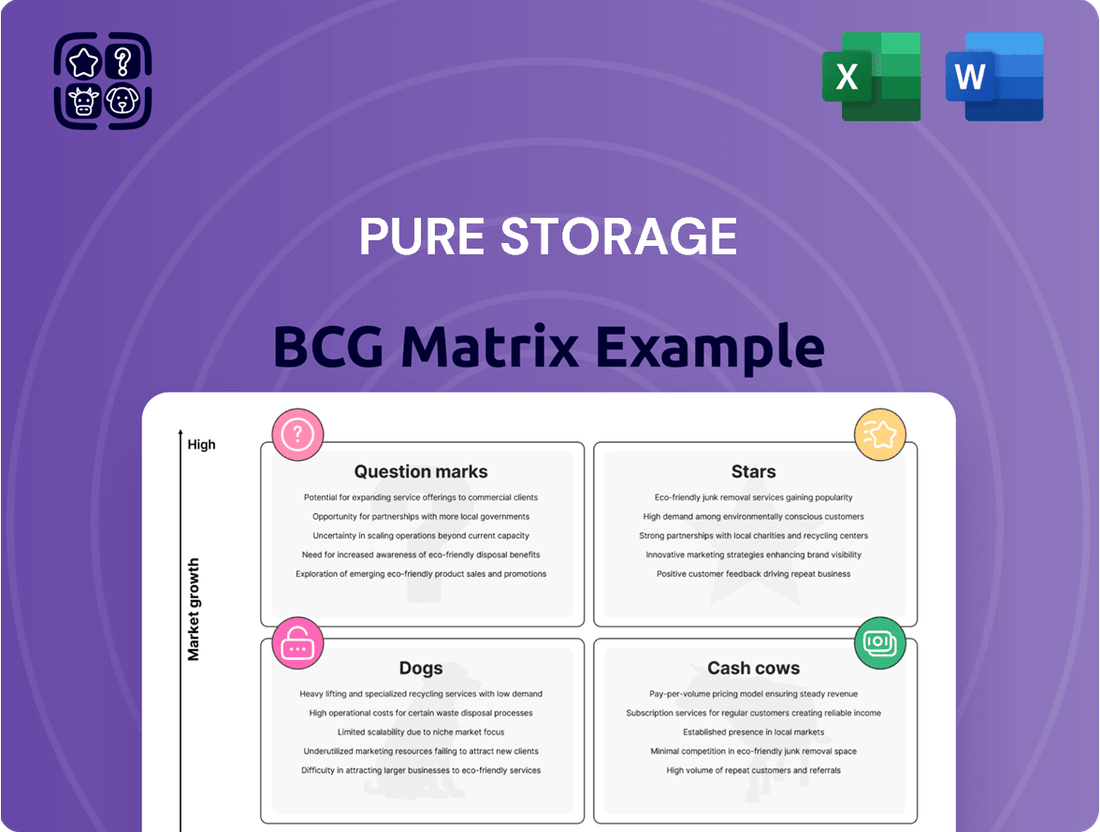

The Pure Storage BCG Matrix analyzes its product portfolio by market share and growth rate.

It strategically guides investment decisions for Stars, Cash Cows, Question Marks, and Dogs.

The Pure Storage BCG Matrix provides a clear, one-page overview of business units, alleviating the pain of strategic uncertainty.

Cash Cows

The FlashArray//X is a foundational, enterprise-grade all-flash storage solution for Pure Storage, clearly positioned as a Cash Cow. It's designed for demanding, mission-critical applications that require exceptional performance and minimal latency.

With a strong and established market share in the mature primary storage segment, FlashArray//X consistently delivers significant and reliable revenue streams for Pure Storage. This product line represents a mature offering in a stable market, allowing the company to leverage its existing customer base and infrastructure.

Pure Storage's Evergreen//Forever Subscription model clearly positions itself as a Cash Cow within the BCG Matrix. This strategy combines the familiar storage acquisition approach with a subscription service that guarantees ongoing hardware and software enhancements.

This continuous upgrade path provides Pure Storage with highly predictable recurring revenue streams. Existing customers are drawn to the protection of their long-term investments and the seamless, non-disruptive nature of the upgrades.

In fiscal year 2024, Pure Storage reported strong performance in its subscription services, which directly benefits from the Evergreen//Forever model. The company's total revenue for FY24 reached $2.8 billion, a notable increase from the previous year, with subscription services playing a vital role in this growth. This segment demonstrates the maturity and reliable income generation characteristic of a cash cow.

Pure1, Pure Storage's cloud-based management platform, functions as a Cash Cow within its BCG Matrix. It generates value by offering crucial operational insights, predictive analytics, and proactive support for Pure Storage's installed product base, thereby strengthening customer loyalty and retention.

While Pure1 doesn't directly generate standalone revenue, its role in enhancing customer experience significantly bolsters Pure Storage's recurring revenue streams. This recurring revenue is primarily derived from support and services contracts tied to the company's deployed hardware and software solutions.

In 2024, Pure Storage reported a significant increase in its subscription services revenue, a segment directly benefiting from the enhanced customer stickiness provided by platforms like Pure1. This growth underscores the indirect but substantial financial contribution of such platforms to the company's overall profitability and market stability.

FlashArray//C and FlashArray//E

FlashArray//C and FlashArray//E represent Pure Storage's strategic move into the "Cash Cows" quadrant of the BCG Matrix. These all-flash storage solutions are specifically engineered for capacity-optimized workloads, directly challenging traditional hard disk drive (HDD) storage with superior performance and cost-effectiveness.

Their strong market traction, especially within price-sensitive segments, highlights a significant market share in the cost-efficiency-focused all-flash arena. This indicates a mature product line that generates consistent and reliable revenue for Pure Storage, much like a well-established cash cow.

- Cost Leadership: FlashArray//C and //E offer compelling economics, often matching or beating HDD pricing for equivalent capacity while delivering flash performance.

- Market Share Dominance: These products have captured substantial share in segments prioritizing density and value, signaling a strong position.

- Steady Revenue Generation: They provide a stable and predictable income stream due to their widespread adoption and ongoing demand for efficient storage.

- Customer Adoption: Pure Storage reported significant growth in its capacity-focused products, with the //C and //E arrays driving much of this expansion. For instance, in fiscal year 2024, Pure Storage saw substantial growth in its subscription services revenue, a portion of which is directly attributable to the adoption of these cost-effective arrays.

Traditional Support and Professional Services

Pure Storage's traditional support and professional services for its established customer base are a strong Cash Cow. These offerings are designed to keep Pure Storage solutions running smoothly, maintained, and optimized, which translates into a steady stream of high-margin, recurring revenue for the company. In 2023, Pure Storage reported that its subscription services, which encompass support and its Evergreen subscription model, represented a significant portion of its revenue, demonstrating the profitability of these mature offerings.

These services are crucial for maintaining high levels of customer satisfaction and loyalty. They also capitalize on Pure Storage's well-regarded brand name within the enterprise storage sector. For instance, customer retention rates are typically very high for these support contracts, reinforcing their Cash Cow status.

- High Profitability: Services generate strong margins due to lower incremental costs compared to new product sales.

- Recurring Revenue: Support contracts provide predictable income, enhancing financial stability.

- Customer Retention: Essential services foster loyalty and reduce churn among existing clients.

- Brand Leverage: Pure Storage's reputation supports premium pricing for these mature offerings.

Pure Storage's FlashArray//X, a robust enterprise-grade all-flash storage solution, is a prime example of a Cash Cow. It commands a significant share in the mature primary storage market, consistently generating substantial and dependable revenue streams.

The Evergreen//Forever Subscription model also operates as a Cash Cow, providing Pure Storage with highly predictable recurring revenue. This model ensures ongoing hardware and software enhancements, appealing to customers who value long-term investment protection and seamless upgrades.

FlashArray//C and FlashArray//E, designed for capacity-optimized workloads, have secured strong market positions by offering cost-effective all-flash solutions. Their success in price-sensitive segments highlights their role as reliable revenue generators for the company.

Traditional support and professional services for its established customer base are also firmly in the Cash Cow quadrant. These offerings, crucial for maintaining customer satisfaction and loyalty, contribute a steady stream of high-margin, recurring revenue.

| Product/Service | BCG Quadrant | Key Characteristics | FY24 Relevance |

|---|---|---|---|

| FlashArray//X | Cash Cow | Mature market, high market share, stable revenue | Foundation of enterprise storage, drives consistent income |

| Evergreen//Forever Subscription | Cash Cow | Predictable recurring revenue, customer retention | Significant contributor to FY24 revenue growth |

| FlashArray//C & //E | Cash Cow | Capacity-optimized, cost-effective, growing adoption | Drove substantial expansion in FY24, strong market traction |

| Support & Professional Services | Cash Cow | High margins, recurring revenue, customer loyalty | Key driver of profitability and customer stickiness |

Preview = Final Product

Pure Storage BCG Matrix

The Pure Storage BCG Matrix preview you're examining is the identical, fully realized document you'll receive upon purchase. This means no watermarks, no placeholder text, and no altered content – just the complete, professionally formatted analysis ready for immediate strategic application.

What you see here is the definitive Pure Storage BCG Matrix report that will be delivered to you after your purchase is complete. This preview accurately represents the final product, ensuring you receive a comprehensive and actionable analysis without any hidden modifications or incomplete sections.

Rest assured, the Pure Storage BCG Matrix preview you are currently viewing is precisely the document you will download after completing your purchase. It's a complete, unedited, and professionally prepared strategic tool, ready to be integrated into your business planning and decision-making processes.

Dogs

Older generations of Pure Storage’s FlashArray hardware and software, while still supported, are no longer the focus of active sales or promotion. These systems, though they may still bring in revenue from existing support contracts, operate within a low-growth market segment. Pure Storage is strategically guiding customers towards their newer, more efficient platforms, recognizing the limited future upside for these older models.

These legacy FlashArrays represent a classic example of a potential cash cow or, more accurately, a declining product in the BCG matrix. While they still contribute revenue, the investment required for their continued support diverts resources that could be allocated to high-growth areas. For instance, by the end of fiscal year 2024, Pure Storage reported strong growth in its Evergreen subscriptions, underscoring the shift towards newer, more capable offerings.

Niche or Underperforming Legacy Integrations fall into the Dogs quadrant of the BCG matrix for Pure Storage. These are integrations or partnerships that haven't gained much traction or strategic importance. For instance, if a legacy integration was developed for a specific, now-declining industry segment, it would likely fit here.

These offerings might still consume maintenance and development resources, diverting attention from more promising areas. Their market penetration is low, and they are not contributing significantly to Pure Storage's overall growth or competitive positioning. For example, an integration targeting a market that has shrunk by 15% year-over-year by 2024 would be a strong candidate for this category.

The strategic value of these legacy integrations may have eroded as newer, more impactful solutions and partnerships have emerged. They represent a drain on resources without a clear path to future growth or market leadership. Pure Storage needs to carefully evaluate whether to divest, discontinue, or invest minimal resources to maintain these integrations.

Pure Storage's portfolio might include early-stage, non-core R&D projects that, while innovative, failed to gain market adoption. These internal ventures, often exploring speculative technologies in low-growth segments, represent investments that didn't yield commercial success. For instance, a hypothetical internal project in a niche data compression algorithm might have been technically sound but ultimately bypassed by broader industry shifts.

Specific Geographic Markets with Limited Growth

Specific geographic markets with limited growth, within Pure Storage's BCG Matrix, represent areas where the company faces significant hurdles in expanding its market presence. These could be smaller, niche regions or specific urban centers where competition is particularly fierce, stifling growth potential. For instance, while Pure Storage has a strong global presence, certain emerging markets in 2024 might still show nascent adoption rates for its all-flash storage solutions, leading to lower revenue contributions compared to more mature markets.

These underperforming regions may not be generating the expected returns on investment, prompting a strategic review of resource allocation. The company needs to carefully weigh the cost of continued investment against the realistic growth prospects in these markets. In 2023, for example, while overall revenue grew, certain European sub-regions may have experienced flatter growth trajectories due to localized economic conditions or entrenched legacy storage providers.

- Limited Market Share: Pure Storage might hold a smaller percentage of the total addressable market in these specific geographies.

- Intense Competition: Established competitors or aggressive new entrants could be a major factor hindering Pure Storage's expansion.

- Stagnant or Declining International Revenue: In some instances, revenue from these specific international markets might be flat or even showing a slight decline year-over-year as of early 2024.

- Re-evaluation of Investment: The company is likely assessing whether to maintain, reduce, or divest its presence in these low-growth areas to optimize its global strategy.

Discontinued or Phased-Out Product Features

Discontinued or phased-out product features represent components of Pure Storage's portfolio that are no longer actively developed or supported. These might include specific functionalities or integrations that saw limited customer adoption or became obsolete due to rapid technological advancements. For instance, older versions of certain management interfaces or specialized data reduction algorithms that were superseded by more efficient technologies could fall into this category. While not entire products, these elements are investments that no longer drive significant market share or revenue growth for Pure Storage.

These phased-out features are typically placed in the Dogs quadrant of the BCG Matrix. They require ongoing maintenance and support, consuming resources without generating substantial returns. Pure Storage, like many tech companies, strategically reviews its offerings to focus on areas with higher growth potential. In 2023, Pure Storage reported a total revenue of $2.8 billion, a 5% increase year-over-year, highlighting their focus on core, high-growth areas.

- Limited Market Share: Features with minimal customer uptake represent a small or declining market share.

- Low Growth Prospects: Obsolescence or lack of innovation means these features have little to no potential for future growth.

- Resource Drain: Continued support and maintenance divert resources from more promising product lines.

- Strategic Realignment: Phasing out underperforming features allows for a sharper focus on strategic growth areas.

Pure Storage's "Dogs" in the BCG matrix represent legacy products, niche integrations, or underperforming geographic markets that consume resources without significant growth potential. These could include older FlashArray models or specific features that have seen limited adoption and are not central to the company's current growth strategy. For example, a specific software integration that targets a rapidly shrinking market segment would likely be classified as a Dog.

These elements often require ongoing maintenance but offer little return on investment, diverting capital from more promising areas. By the end of fiscal year 2024, Pure Storage saw substantial growth in its Evergreen subscriptions, indicating a strategic shift towards newer, more modern offerings, leaving less focus on legacy components.

Pure Storage's strategy involves carefully managing these "Dog" assets, potentially by minimizing support costs, divesting, or discontinuing them altogether. This allows for a more efficient allocation of resources towards their "Stars" and "Question Marks," which are expected to drive future revenue and market leadership. In 2023, Pure Storage reported a total revenue of $2.8 billion, showing a 5% year-over-year increase, which reflects a focus on its core, high-growth product lines.

These underperforming areas might include specific geographic markets where Pure Storage faces intense competition or where market adoption of all-flash storage solutions remains nascent. For instance, while the company has a strong global footprint, certain emerging markets in 2024 might still exhibit lower revenue contributions compared to more established regions, making them candidates for the Dogs quadrant.

Question Marks

Pure Cloud Block Store, when positioned for emerging public cloud environments where Pure Storage's market share is still building, fits the Question Mark quadrant of the BCG Matrix. This is particularly true given the strong growth in hybrid and multi-cloud strategies, where Pure's specific foothold in certain public cloud ecosystems might be in its early stages.

The demand for cloud-native solutions continues to accelerate, with the global cloud computing market projected to reach over $1.3 trillion by 2025. However, Pure's penetration within these burgeoning public cloud platforms may require substantial investment to capture a meaningful market share.

For instance, while adoption of cloud-native technologies is broadly increasing, the specific adoption rates of third-party storage solutions like Pure Cloud Block Store within newer or rapidly expanding public cloud providers can vary. This necessitates strategic marketing and sales efforts, alongside product development, to establish a strong presence and compete effectively.

New specialized AI/ML data pipeline solutions represent a nascent but rapidly expanding segment. Pure Storage is investing in these areas, recognizing the high-growth potential of AI/ML. While market share in these niche, emerging sub-segments is currently low, substantial development and market adoption efforts are underway.

The AI/ML market is projected for significant expansion, with some estimates suggesting it could reach hundreds of billions of dollars by the late 2020s. Pure Storage's focus on these specialized data pipelines aims to capture a portion of this growth. However, the competitive landscape is evolving quickly, requiring continuous innovation and strategic partnerships.

Pure Storage's early investments in edge computing storage solutions position it in a high-growth but nascent market. This strategic exploration acknowledges the burgeoning need for data processing closer to its origin. The edge computing market, projected to reach $200 billion by 2027 according to some industry forecasts, presents a significant opportunity for Pure Storage to develop specialized offerings.

Currently, Pure Storage's market share in this developing segment is likely modest, reflecting its early-stage involvement. Capturing a substantial position will necessitate significant strategic investment in research, development, and go-to-market strategies. This aligns with the characteristics of a question mark in the BCG matrix, indicating potential but requiring careful resource allocation.

Next-Generation High-Capacity DirectFlash Modules (e.g., 300TB DFM)

The anticipated launch of next-generation, high-capacity DirectFlash Modules (DFMs), like the projected 300TB DFM in 2025, positions Pure Storage within the Question Mark quadrant of the BCG Matrix. These advanced modules are designed to meet escalating data storage needs, a critical factor in today's data-intensive environments. Their introduction aims to solidify Pure Storage's market leadership by offering unparalleled storage density, a key differentiator in a competitive landscape.

The success of these high-capacity DFMs hinges on market acceptance and the ability to capture significant market share, which are currently uncertain. Pure Storage will need to invest heavily in marketing, sales enablement, and potentially further R&D to ensure these products resonate with customers and achieve their full potential. The company's ability to navigate this transition will be crucial for maintaining its growth trajectory.

- Market Uncertainty: The adoption rate and competitive response to 300TB DFMs are still developing, making their future market share a question mark.

- High Investment Required: Significant capital is needed for the development, manufacturing, and market introduction of these next-generation modules.

- Reinforcing Competitive Edge: The 300TB DFMs are intended to boost Pure Storage's advantage in the high-capacity storage market.

- Addressing Demand: These modules are crucial for meeting the growing demand for dense and efficient data storage solutions.

Strategic Partnerships for New Vertical Market Entry

Pure Storage might establish strategic partnerships to penetrate new vertical markets, such as healthcare or financial services, where its current market share is minimal. These ventures represent opportunities for significant growth but also carry risks associated with developing specialized solutions and building brand awareness from the ground up. For instance, a partnership with a leading cloud provider for HIPAA-compliant data solutions could accelerate entry into the healthcare sector.

These new vertical market entries are akin to Question Marks in the BCG matrix. They require significant investment to gain traction, as seen in Pure Storage's substantial R&D spending, which reached $714 million in fiscal year 2024. Success hinges on developing highly tailored offerings and effective go-to-market strategies. For example, a joint development agreement with a major automotive manufacturer for embedded storage solutions could be a strategic move.

Key considerations for these partnerships include:

- Market research and validation: Thoroughly assessing the potential demand and competitive landscape within the target vertical before committing resources.

- Technology alignment: Ensuring that Pure Storage's core technologies can be adapted or integrated to meet the specific requirements of the new market.

- Partnership structure: Defining clear roles, responsibilities, and revenue-sharing models with strategic partners to ensure mutual benefit and success.

- Sales and marketing enablement: Developing specialized sales channels and marketing campaigns to effectively reach and engage customers in the new vertical.

Pure Storage's advancements in high-capacity DirectFlash Modules, like the upcoming 300TB DFM in 2025, place it in the Question Mark category. These modules represent a significant technological leap, aiming to capture a larger share of the growing demand for dense storage solutions. However, their market acceptance and competitive impact are still unfolding, necessitating substantial investment.

The success of these next-generation modules depends on Pure Storage's ability to effectively market, sell, and support them, especially in capturing market share against established and emerging competitors. This strategic push into higher capacity points highlights the company's ambition to lead in a critical storage segment, but the outcome remains uncertain.

Investing in new vertical markets, such as specialized AI/ML data pipelines and edge computing, also positions Pure Storage within the Question Mark quadrant. These areas offer substantial growth potential, evidenced by the projected expansion of the AI market to hundreds of billions of dollars by the late 2020s and edge computing reaching $200 billion by 2027. However, Pure's current market share in these nascent segments is modest, demanding significant R&D and market development efforts.

Pure Storage's strategic partnerships aimed at entering new vertical markets, like healthcare or financial services, are also characteristic of Question Marks. These ventures require considerable investment to establish a foothold, as reflected in their substantial R&D spending, which was $714 million in fiscal year 2024. Success will depend on tailoring solutions and executing effective go-to-market strategies.

| Business Area | Market Growth | Market Share | BCG Quadrant | Strategic Focus |

|---|---|---|---|---|

| Pure Cloud Block Store (Emerging Public Cloud) | High | Low to Medium | Question Mark | Investment for market penetration, sales & marketing expansion |

| AI/ML Data Pipeline Solutions | Very High | Low | Question Mark | R&D investment, niche market development, partnerships |

| Edge Computing Storage | High | Low | Question Mark | Product innovation, strategic market entry, channel development |

| Next-Gen High-Capacity DFMs (e.g., 300TB) | High | Developing | Question Mark | Market acceptance, sales enablement, competitive differentiation |

| New Vertical Market Entries (e.g., Healthcare, Finance) | High | Low | Question Mark | Partnerships, tailored solutions, market validation |

BCG Matrix Data Sources

Our Pure Storage BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.