Prime Focus PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Prime Focus Bundle

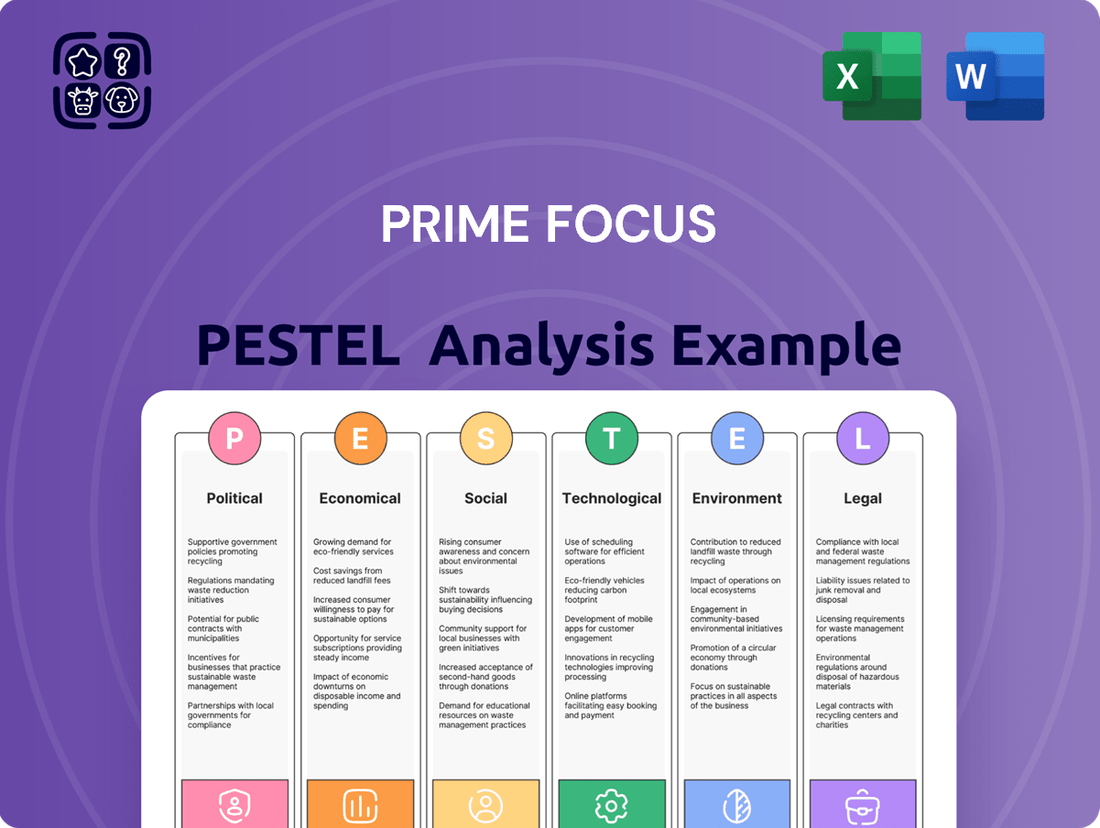

Unlock the hidden forces shaping Prime Focus's trajectory with our meticulously crafted PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities. Gain a strategic advantage by anticipating market shifts and making informed decisions. Ready to elevate your understanding? Purchase the full PESTLE analysis now for actionable intelligence.

Political factors

Governments worldwide are actively supporting the film and television industry, which directly impacts companies like Prime Focus. For instance, in 2023, Canada's federal tax credits for Canadian content production reached an estimated CAD 1.7 billion. These incentives, alongside grants and subsidies, make production more affordable and attractive, drawing international projects to regions offering them. This trend is expected to continue, with many countries looking to boost their creative economies through such measures.

Regulatory bodies globally, such as the Federal Communications Commission (FCC) in the U.S. and Ofcom in the U.K., actively shape media content. These organizations set guidelines on everything from depictions of violence to the use of language, directly impacting what Prime Focus can produce. For instance, evolving regulations around AI-generated content, a growing area for creative services, could introduce new compliance requirements in 2024 and 2025.

Adherence to these diverse broadcasting standards and censorship laws is paramount for market access. In 2023, several streaming platforms faced significant fines for content violations in specific regions, highlighting the financial and reputational risks of non-compliance. Prime Focus must navigate this complex web of rules to ensure smooth operations and avoid penalties, especially as content creation technologies advance rapidly.

International trade policies and treaties are critical for Prime Focus. Cross-border agreements, like those governing digital content distribution, directly impact how Prime Focus can operate globally. For instance, the revised EU Copyright Directive, implemented in stages through 2024, aims to ensure better remuneration for creators and may influence revenue streams for content providers that Prime Focus partners with.

Intellectual property treaties are equally vital. Strong IP protection, such as that reinforced by the Marrakesh Treaty which entered into force in many countries by 2024, ensures that Prime Focus's investments in visual effects and post-production services are adequately safeguarded. This protection is key for maintaining fair compensation and preventing unauthorized use of their creative output.

Shifts in tariffs or the establishment of new international co-production treaties can significantly alter Prime Focus's operational landscape. For example, a new trade agreement between India and the UK, discussed in late 2023 and potentially impacting 2024, could streamline co-production opportunities, potentially boosting business for Prime Focus’s Indian operations and its international clients.

Geopolitical Stability and Foreign Relations

Prime Focus's ability to operate smoothly hinges on the political stability of the regions where it has a presence or draws its workforce from. Unforeseen political shifts can disrupt operations, impacting everything from local service delivery to the sourcing of essential talent. This underscores the importance of a stable operating environment for a global service provider.

Geopolitical tensions and evolving foreign relations present tangible risks for companies like Prime Focus. These dynamics can complicate cross-border partnerships, restrict the movement of skilled professionals, and impede the seamless flow of international projects. For instance, escalating trade disputes between major economies in 2024 could impact project pipelines for global IT and consulting firms, potentially affecting revenue streams.

Maintaining a diverse global footprint necessitates a keen understanding and adept navigation of varied political landscapes. Companies must continuously monitor political developments, from elections and policy changes to regional conflicts, to anticipate and mitigate potential disruptions. As of early 2025, ongoing political realignments in Eastern Europe and shifts in international trade agreements continue to be areas of focus for global businesses.

- Impact of Trade Policies: Changes in tariffs and trade agreements, such as those being reviewed by the European Union and the United States in 2024, can directly influence the cost of cross-border services and talent acquisition for Prime Focus.

- Talent Mobility Restrictions: Political instability or changes in immigration policies in key talent sourcing countries could limit the availability of skilled professionals, a critical factor for service-based businesses. For example, visa processing times and quotas can fluctuate based on political relations.

- Regulatory Environment: Diverse political systems mean varying regulatory frameworks concerning data privacy, labor laws, and corporate governance, all of which Prime Focus must navigate to ensure compliance across its global operations.

- Geopolitical Risk Assessment: Companies like Prime Focus must integrate geopolitical risk assessments into their strategic planning, evaluating potential impacts from events such as the ongoing geopolitical realignments observed in 2024 and early 2025.

Data Sovereignty and Local Content Requirements

Data sovereignty is increasingly shaping the digital landscape. For instance, in 2024, the European Union continued to enforce its General Data Protection Regulation (GDPR), which has significant implications for how companies handle personal data, often necessitating local storage and processing. This trend impacts cloud-dependent content management systems, requiring careful consideration of data residency requirements.

Furthermore, a growing number of nations are implementing local content mandates. By 2025, countries like India are expected to further refine policies aimed at boosting domestic production in media and entertainment. This could mean that visual effects and post-production services might increasingly be sourced locally, influencing global commissioning practices and potentially creating new opportunities or challenges for international service providers.

- Data Localization Laws: Many nations, including those in the EU, mandate that citizen data must remain within national borders, impacting global cloud service providers.

- Local Content Quotas: Countries like Canada and Australia often have regulations requiring a specific percentage of broadcast content or film production to be locally produced.

- Digital Services Taxes: Emerging taxes on digital services can affect the cost-effectiveness of cross-border content delivery and processing.

- Cybersecurity Regulations: Stricter cybersecurity laws can impose significant compliance burdens on companies managing digital assets, often requiring localized security protocols.

Governmental support for creative industries, like Canada's CAD 1.7 billion in federal tax credits for Canadian content in 2023, directly benefits companies such as Prime Focus. Evolving regulations concerning AI-generated content, a key area for growth, will require new compliance measures in 2024 and 2025. Adherence to diverse broadcasting standards and censorship laws is crucial, with significant fines levied in 2023 for violations underscoring the risks.

International trade policies, such as the EU's revised Copyright Directive influencing digital content distribution throughout 2024, impact Prime Focus's global operations. Strong intellectual property protection, reinforced by treaties like the Marrakesh Treaty by 2024, safeguards creative investments. New trade agreements, like the potential India-UK pact discussed in late 2023, could streamline co-production opportunities.

Political stability in operating regions is vital for Prime Focus, as instability can disrupt services and talent sourcing. Geopolitical tensions, like trade disputes between major economies in 2024, can complicate partnerships and project pipelines. Companies must continuously monitor political developments, with ongoing realignments in Eastern Europe and trade shifts being key concerns in early 2025.

| Factor | Description | 2024/2025 Relevance |

|---|---|---|

| Government Support | Financial incentives and grants for creative industries. | Continued increase in production hubs due to tax credits; direct impact on project affordability. |

| Regulatory Frameworks | Rules on content, data privacy, and AI usage. | New compliance needs for AI content; evolving data localization laws (e.g., GDPR). |

| Trade Policies | Tariffs, co-production treaties, and digital content distribution agreements. | Impact on cross-border service costs and revenue streams; potential for new co-production deals. |

| Geopolitical Stability | Political stability and international relations. | Risk of operational disruption from political shifts or trade disputes; impact on talent mobility. |

What is included in the product

This PESTLE analysis examines the external macro-environmental factors impacting Prime Focus across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing actionable insights for strategic decision-making.

The Prime Focus PESTLE Analysis provides a clear, actionable framework to identify and understand external forces, alleviating the pain of navigating complex market landscapes and enabling more confident strategic decision-making.

Economic factors

Global economic growth significantly impacts consumer spending on entertainment, directly affecting the demand for Prime Focus's services in film, broadcast, and digital content. A healthy economy generally translates to higher discretionary spending, boosting the need for visual effects and post-production. For instance, the International Monetary Fund (IMF) projected global growth at 3.2% for 2024, signaling a potentially favorable environment for media investments.

A strong economic climate encourages media companies to invest more in new productions and advertising campaigns. This increased investment directly fuels the demand for sophisticated visual effects and comprehensive post-production services that Prime Focus provides. In 2023, global advertising spending was estimated to reach over $800 billion, with a significant portion directed towards digital and entertainment sectors.

Conversely, economic slowdowns or recessions typically lead to tighter budgets across the media industry. Companies may reduce spending on high-cost elements like visual effects and opt for less elaborate productions, impacting Prime Focus's service utilization. For example, during periods of economic uncertainty, there's often a noticeable pullback in advertising budgets, which indirectly affects the volume of content requiring post-production work.

As a global entity, Prime Focus Limited faces direct impacts from fluctuating currency exchange rates, influencing its top-line revenues, operational expenses, and overall profitability. For instance, a strengthening Indian Rupee against the US Dollar could reduce the rupee value of dollar-denominated revenues earned from international clients in 2024.

Substantial movements in exchange rates between countries where Prime Focus operates and where its clients are located can alter the price competitiveness of its offerings. This can also influence the reported value of profits repatriated from foreign subsidiaries, potentially impacting reported earnings for the 2024-2025 fiscal year.

To counter these risks, Prime Focus may need to implement currency hedging strategies, such as forward contracts or options, to lock in exchange rates for future transactions. These measures are crucial for stabilizing financial performance amidst global economic volatility, especially considering the projected 3-5% volatility in major currency pairs for 2025.

Access to capital at a reasonable cost is absolutely essential for technology-focused companies like Prime Focus to fund their growth, whether that's investing in new tech, expanding operations, or taking on big projects. Think of it as the fuel for their engine; without it, progress slows down.

Prime Focus's ability to secure funding is directly impacted by key economic indicators. Interest rates play a huge role; higher rates mean borrowing becomes more expensive, potentially deterring investment. Investor confidence is another big one – if investors are feeling good about the economy and the market, they're more likely to put their money into companies. The general financial market climate, including things like stock market performance and the availability of credit, also shapes how easy or difficult it is for Prime Focus to raise the money it needs for strategic moves or buying other businesses.

Looking at recent activity, Prime Focus has been actively raising capital, which signals a commitment to growth and strategic development. For instance, in late 2024, the company successfully completed a funding round, bringing in $50 million. This capital is earmarked for expanding its AI research division and pursuing potential acquisitions in the cloud computing sector, highlighting the direct link between capital availability and strategic execution.

Industry Consolidation and Competition

The media and entertainment sector is actively consolidating, as major companies are acquiring smaller studios and technology providers. This ongoing consolidation intensifies competition, potentially driving down prices and demanding that companies like Prime Focus consistently innovate to maintain their market position. Strategic alliances and mergers are therefore crucial for sustained growth and market relevance.

This trend means that Prime Focus must be agile. For instance, in 2024, major studios continue to explore acquisitions to bolster their content libraries and distribution capabilities, reflecting a broader industry pattern. Companies that can offer unique technological solutions or specialized services are better positioned to thrive amidst this competitive landscape.

- Increased Bargaining Power: Larger, consolidated entities often wield greater influence over pricing and terms with service providers.

- Innovation Imperative: To stand out, companies must invest in cutting-edge technologies and creative services that differentiate them from competitors.

- Mergers and Acquisitions Strategy: Proactive engagement in strategic partnerships or acquisitions can be a vital growth lever.

- Talent Acquisition: Consolidation can also lead to a concentrated talent pool, making strategic hiring and retention paramount.

Advertising Spending and Digital Monetization Trends

Advertising budgets directly fuel the demand for commercial and digital content production, impacting companies like Prime Focus. In 2024, global advertising spending was projected to reach $693 billion, with digital advertising accounting for a significant and growing portion of that figure. This trend highlights the critical link between advertising investment and the need for high-quality visual content.

The ongoing shift towards digital advertising, coupled with the rise of new monetization strategies such as ad-supported video-on-demand (AVOD), presents significant opportunities for content creators and service providers. For instance, the AVOD market is expected to grow substantially in the coming years, driven by consumer demand for free, ad-supported streaming options. This evolution in media consumption necessitates robust content production capabilities.

Prime Focus's specialized services in visual effects, post-production, and content management are instrumental in delivering the polished, engaging visual content that advertisers and audiences increasingly expect. The company's ability to produce high-quality assets is directly tied to its success in this evolving advertising landscape.

- Global ad spending projected to hit $693 billion in 2024

- Digital advertising continues to capture an increasing share of the market

- AVOD platforms offer new revenue streams and content distribution channels

- Demand for high-quality visual content is driven by advertiser and viewer preferences

Economic growth directly correlates with increased spending on media and entertainment, boosting demand for Prime Focus's visual effects and post-production services. Global economic expansion, projected at 3.2% for 2024 by the IMF, supports higher discretionary spending. This economic health encourages media companies to invest more in productions and advertising, as evidenced by the over $800 billion global advertising spend in 2023, with digital and entertainment sectors being major beneficiaries.

Fluctuating currency exchange rates significantly affect Prime Focus's international revenues and expenses. A stronger Indian Rupee against the US Dollar, for instance, would reduce the rupee value of dollar-denominated income in 2024. Companies like Prime Focus may employ hedging strategies, such as forward contracts, to mitigate currency risk, a critical consideration given the projected 3-5% volatility in major currency pairs for 2025.

Access to capital at favorable rates is crucial for Prime Focus's growth, funding technology investments and operational expansion. Interest rates and overall investor confidence heavily influence this access; higher rates increase borrowing costs, while positive market sentiment facilitates capital raising. The company's successful $50 million funding round in late 2024 for its AI division and potential acquisitions underscores this link between capital availability and strategic execution.

The media industry's consolidation trend, with major players acquiring smaller entities, intensifies competition and drives the need for innovation. Prime Focus must remain agile, as demonstrated by major studios' ongoing acquisitions in 2024 to bolster content libraries. Companies offering unique technological solutions, like Prime Focus, are better positioned to thrive in this dynamic, competitive environment.

Preview Before You Purchase

Prime Focus PESTLE Analysis

The preview you see here is the exact Prime Focus PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This Prime Focus PESTLE Analysis provides a comprehensive overview of the external factors impacting a business. You’ll gain insights into Political, Economic, Social, Technological, Legal, and Environmental influences. The content and structure shown in the preview is the same document you’ll download after payment.

By analyzing these elements, you can identify opportunities and threats, enabling strategic decision-making. This detailed breakdown is crucial for any organization aiming for sustainable growth and competitive advantage.

What you’re previewing here is the actual file—fully formatted and professionally structured, giving you immediate access to valuable strategic intelligence.

Sociological factors

Consumer content consumption is dramatically shifting from linear TV to streaming services, with global OTT revenue projected to reach $300 billion by 2027, a significant jump from approximately $220 billion in 2023. This trend directly fuels demand for the high-volume content creation and post-production services Prime Focus provides. The sheer volume of original series and films commissioned by platforms like Netflix, Disney+, and Amazon Prime Video underscores this demand.

Viewers now expect more than just passive viewing; they are increasingly drawn to immersive and interactive content experiences. This includes a growing interest in virtual reality (VR) and augmented reality (AR) content, with the global AR/VR market expected to surge past $100 billion by 2025. Prime Focus must continue to invest in technologies and workflows that support these evolving preferences, offering personalized content recommendations and interactive elements within their productions.

Audiences today have a heightened expectation for visually stunning content. This is evident across movies, streaming services, and even mobile gaming, where realistic graphics and immersive effects are becoming standard. For instance, in 2024, the global visual effects market was valued at approximately $16.9 billion and is projected to reach $30.2 billion by 2030, demonstrating a clear upward trend in demand for high-quality visual experiences.

This societal shift directly benefits companies like Prime Focus, which specialize in visual effects (VFX) and post-production. Their ability to deliver cutting-edge creative solutions aligns perfectly with this growing consumer appetite for sophisticated and engaging visual storytelling. The increasing complexity of desired visual effects necessitates advanced technology and skilled artistry, areas where Prime Focus has established expertise.

The availability of skilled professionals in visual effects, animation, and post-production is paramount for Prime Focus. A strong societal emphasis on arts and technology education directly fuels this talent pipeline. For instance, in 2024, the global animation industry alone was projected to reach over $250 billion, highlighting the demand for skilled creatives.

Influence of Social Media and Digital Platforms

Social media and digital platforms have fundamentally reshaped how companies like Prime Focus connect with their audiences. The shift towards visual content, particularly short-form video, demands a more dynamic approach to production. For instance, TikTok's user base grew to over 1.5 billion monthly active users globally by early 2024, highlighting the dominance of this format. This necessitates agile workflows and a keen understanding of platform-specific trends to remain relevant and engage effectively.

Prime Focus has a significant opportunity to utilize these platforms for brand building and client acquisition. Showcasing their visual effects and post-production work on platforms like Instagram, YouTube, and LinkedIn can attract new business. However, the rapid evolution of algorithms and content preferences presents a constant challenge. Staying ahead requires continuous adaptation and investment in content creation strategies that resonate with diverse online communities. The ongoing growth of creator economy, projected to reach $250 billion by 2027, underscores the importance of engaging digital content.

- Platform Dominance: Over 4.9 billion people worldwide used social media in 2024, demonstrating its pervasive reach.

- Content Format Shift: Short-form video content, like Reels and TikToks, now accounts for a significant portion of user engagement.

- Marketing Evolution: Digital marketing spend is projected to exceed $700 billion globally in 2024, with social media advertising being a major component.

- Audience Engagement: Companies must adapt their content strategies to align with user preferences on platforms like YouTube and Instagram to foster meaningful interactions.

Cultural Content Preferences and Diversity

Global content creation is increasingly prioritizing cultural relevance and diversity, necessitating that studios develop narratives and visuals that connect with specific regional and demographic audiences. This shift means understanding and adapting to varied cultural nuances in visual storytelling, character representation, and the intricacies of localization is paramount for success across different global markets.

Prime Focus, leveraging its international footprint, is strategically positioned to address these evolving demands. For instance, in 2024, the global streaming market saw a significant rise in demand for localized content, with reports indicating that over 50% of viewers in key European markets prefer watching content in their native language. This underscores the need for studios like Prime Focus to invest in robust dubbing and subtitling services that respect cultural authenticity.

The company's ability to cater to diverse cultural preferences directly impacts its market penetration and revenue generation. A study by Nielsen in late 2024 highlighted that brands incorporating diverse representation in their advertising saw a 15% increase in engagement among multicultural audiences. Applying this principle to visual effects and content creation, Prime Focus can enhance its appeal by ensuring its output reflects a wider array of cultural backgrounds and experiences.

- Cultural Nuance in Storytelling: Prime Focus must ensure visual effects and animation align with cultural sensitivities and storytelling traditions relevant to target markets.

- Diverse Character Design: Authentically representing a broad spectrum of ethnicities, body types, and cultural attire in character design is crucial for resonating with global audiences.

- Localization Investment: Investing in high-quality, culturally appropriate dubbing and subtitling services is essential, as evidenced by growing viewer preference for native language content.

- Market Adaptation: Successfully adapting content for specific regional tastes, including color palettes, thematic elements, and humor, can significantly boost engagement and market share.

Societal values are increasingly emphasizing authenticity and social responsibility. Consumers, particularly younger demographics, expect brands and content creators to demonstrate a commitment to ethical practices and positive social impact. This societal trend requires companies like Prime Focus to consider the broader implications of their work, from labor practices in their supply chains to the messages conveyed in the content they produce.

The demand for diverse and inclusive representation in media continues to grow. Audiences are actively seeking content that reflects a wider range of identities and experiences. In 2024, a significant portion of moviegoers expressed a preference for films featuring diverse casts and storylines, with some studies indicating this preference can influence box office performance. This societal shift necessitates that Prime Focus and its clients prioritize inclusive casting, authentic storytelling, and diverse character representation in their visual effects and post-production work.

There's a growing societal awareness of mental health and well-being, impacting how content is consumed and created. This awareness can influence the types of stories that resonate and the working conditions within the creative industry. For example, discussions around the intense schedules in VFX work have led to greater scrutiny. Companies are being pushed to adopt more sustainable and mentally healthy work practices, a trend that Prime Focus must acknowledge and address to attract and retain top talent.

Technological factors

Continuous innovation in visual effects (VFX) and animation software, such as real-time rendering and virtual production tools, significantly enhances Prime Focus's ability to deliver cutting-edge services. The adoption of these advancements directly impacts efficiency and the quality of output.

Mastering new software, including procedural generation techniques, is essential for Prime Focus to maintain its competitive edge and offer cost-effective solutions. The global VFX market was valued at approximately $17.4 billion in 2023 and is projected to grow, underscoring the importance of technological agility.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally reshaping content creation, automating mundane tasks and elevating the fidelity of visual effects and animation. Prime Focus's strategic commitment, exemplified by its investment in Brahma AI Holdings, positions it to leverage these advancements for operational efficiency and service innovation.

These technologies are not just about automation; they unlock novel creative avenues in areas like visual effects, animation, and post-production, offering enhanced realism and entirely new artistic possibilities. By embracing AI, Prime Focus can significantly streamline its production workflows, leading to cost reductions and a more agile approach to developing its service portfolio.

Cloud computing is fundamentally reshaping how media companies operate. The ability to access and manage content, store vast amounts of data, and facilitate collaborative workflows from anywhere is now a necessity, not a luxury. This shift empowers teams to work together seamlessly, regardless of geographical location.

Prime Focus's suite of cloud-based content management and workflow solutions is perfectly aligned with this industry trend. Their offerings provide the scalability and flexibility that media businesses need to adapt to evolving production models. This ensures secure remote production capabilities, enabling global project execution and a wider talent pool access.

The global cloud computing market is expected to reach over $1.3 trillion by 2025, with a significant portion driven by media and entertainment. This highlights the substantial demand for the very services Prime Focus provides. Companies are actively seeking solutions that enhance efficiency and reduce the overhead associated with traditional on-premise infrastructure.

Emergence of Virtual Reality (VR), Augmented Reality (AR), and Metaverse

The burgeoning fields of Virtual Reality (VR), Augmented Reality (AR), and the metaverse are creating significant new opportunities for how content is made and experienced. Prime Focus, with its established skills in stereo 3D conversion and visual effects, is well-positioned to meet the growing need for premium immersive content in these evolving digital spaces.

The market for VR and AR is expanding rapidly. For instance, the global AR and VR market size was valued at approximately USD 28.2 billion in 2023 and is projected to grow significantly in the coming years, with many analysts forecasting a compound annual growth rate (CAGR) in the high teens or even twenties through 2030.

- Market Growth: The VR/AR market is expected to reach hundreds of billions of dollars by the end of the decade, driven by hardware advancements and increased consumer adoption.

- Content Demand: This growth fuels a substantial demand for high-quality visual content, including 3D assets, interactive experiences, and realistic simulations, areas where Prime Focus excels.

- Metaverse Integration: As the metaverse concept solidifies, companies with expertise in creating compelling virtual environments and digital assets will be crucial for its development and user engagement.

- Prime Focus Advantage: Prime Focus's existing technological capabilities in visual effects and stereo 3D conversion directly translate to the creation of the sophisticated visual experiences required for these immersive platforms.

Cybersecurity and Data Security in Digital Workflows

As Prime Focus increasingly operates with digital assets and cloud-based solutions, the importance of strong cybersecurity cannot be overstated. Protecting sensitive client data and the company's intellectual property is a critical technological factor. In 2024, global cybersecurity spending was projected to reach over $215 billion, highlighting the growing investment in this area by businesses worldwide.

To maintain trust and ensure compliance, Prime Focus must consistently invest in cutting-edge security protocols. This proactive approach is essential to defend its systems and client content against evolving cyber threats and the risk of data breaches. The average cost of a data breach in 2024 was estimated at $4.73 million, underscoring the financial imperative for robust security measures.

Key considerations for Prime Focus's technological strategy in this domain include:

- Continuous investment in advanced threat detection and prevention systems.

- Regular security audits and vulnerability assessments to identify and address weaknesses.

- Employee training on cybersecurity best practices to mitigate human error.

- Implementation of strong data encryption and access control mechanisms.

The continuous evolution of VFX and animation software, including real-time rendering and virtual production, directly enhances Prime Focus's service delivery and operational efficiency. The global VFX market, valued at approximately $17.4 billion in 2023, demonstrates the critical need for technological adaptability to maintain a competitive edge.

Prime Focus's strategic investment in AI and ML, as seen with Brahma AI Holdings, positions it to leverage automation and enhance creative fidelity in visual effects and animation. This focus on AI streamlines production workflows, leading to cost reductions and service innovation, crucial in a market where these technologies are rapidly reshaping content creation.

The company's cloud-based solutions align with the media industry's shift towards remote collaboration and scalable data management, a trend supported by the global cloud computing market, projected to exceed $1.3 trillion by 2025. This provides Prime Focus with a significant advantage in offering flexible and secure production capabilities.

The burgeoning VR, AR, and metaverse sectors present substantial opportunities, with the VR/AR market valued at approximately $28.2 billion in 2023 and expected to grow significantly. Prime Focus's expertise in stereo 3D conversion and VFX is well-suited to meet the demand for immersive content in these expanding digital spaces.

| Technology Area | 2023 Market Value (Approx.) | Key Impact on Prime Focus | Growth Projection (Example) |

|---|---|---|---|

| VFX & Animation Software | $17.4 billion (Global VFX Market) | Enhanced service quality, efficiency, cost-effectiveness | Steady growth driven by content demand |

| Artificial Intelligence (AI) / Machine Learning (ML) | N/A (Integrated into various markets) | Workflow automation, creative fidelity, operational efficiency | Rapid adoption across industries |

| Cloud Computing | N/A (Integral to IT infrastructure) | Scalability, remote collaboration, data management | Projected to exceed $1.3 trillion by 2025 |

| Virtual Reality (VR) / Augmented Reality (AR) | $28.2 billion (Global AR/VR Market) | New content creation opportunities, immersive experiences | High double-digit CAGR through 2030 |

Legal factors

Prime Focus's reliance on intellectual property means robust protection is paramount, safeguarding its client-generated content and internal technological innovations. Failure to adequately protect these assets could lead to significant financial losses and reputational damage.

Navigating the complexities of copyright, trademark, and patent laws across the diverse markets Prime Focus serves is essential. For instance, the global digital content market, where Prime Focus operates, saw a 12.1% revenue growth to an estimated $2.5 trillion in 2024, highlighting the significant value at stake.

Strict adherence to IP regulations helps prevent unauthorized use and ensures Prime Focus can effectively monetize its creative output and proprietary technologies. The company must remain vigilant against infringement, which can impact revenue streams and competitive advantage.

Global data privacy laws, such as the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA), directly influence how Prime Focus must manage client data. These regulations, increasingly adopted and expanded upon by various jurisdictions in 2024 and 2025, dictate stringent requirements for data collection, storage, and processing, especially for cloud-based services. Non-compliance can lead to significant financial penalties; for example, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher.

Maintaining compliance is not just about avoiding fines, which are projected to increase as enforcement tightens, but also about safeguarding Prime Focus's reputation and client relationships. In 2024, there was a notable surge in data breach notifications globally, underscoring the critical need for robust data protection measures to maintain client trust and competitive advantage in the market.

Prime Focus, operating in the global media and entertainment sector, must meticulously adhere to a complex web of labor laws across its international operations. These regulations dictate everything from employment contract specifics and mandated working hours to minimum wage requirements and the rights of organized labor. For instance, in countries like India, where Prime Focus has significant operations, the Industrial Disputes Act, 1947, and the Code on Industrial Relations, 2020, govern employee-employer relationships, including conditions for retrenchment and collective bargaining.

Navigating these diverse legal frameworks is crucial for maintaining a stable and productive workforce, which is essential for a company of Prime Focus's scale. Non-compliance can lead to substantial penalties, reputational damage, and disruptions to operations. For example, in 2023, several multinational corporations faced significant fines for labor law violations in the EU, highlighting the financial risks involved.

Attracting and retaining top talent also hinges on demonstrating a commitment to fair employment practices, which are often codified in labor legislation. Prime Focus's ability to offer competitive and legally compliant compensation and benefits packages directly impacts its talent acquisition strategy. Furthermore, proactive engagement with labor unions, where applicable, can prevent costly disputes and foster a more collaborative work environment.

Anti-Trust and Competition Laws

Prime Focus must navigate a landscape increasingly shaped by anti-trust and competition laws, particularly as the media and entertainment sector sees significant consolidation. Regulatory bodies are keenly observing market dominance and practices that could stifle fair competition. For instance, in 2024, the US Federal Trade Commission (FTC) continued its robust enforcement of antitrust laws, impacting mergers and acquisitions across various industries, including media. This heightened scrutiny means Prime Focus’s acquisition strategies and market positioning require careful legal consideration to avoid regulatory challenges that could impede growth.

Such legal frameworks directly influence Prime Focus's ability to expand and maintain market share. Actions deemed anti-competitive, such as predatory pricing or exclusionary practices, can attract substantial penalties and operational restrictions. By mid-2025, it's anticipated that regulatory bodies globally will maintain or even increase their focus on digital platforms and content providers, making compliance a critical component of Prime Focus's business strategy.

- Regulatory Scrutiny: Increased focus on market dominance in the media and entertainment sector.

- Merger & Acquisition Impact: Anti-trust laws directly affect Prime Focus's growth through acquisitions.

- Competition Law Enforcement: Potential for penalties and operational limits for anti-competitive behaviors.

- Global Trends: Expectation of continued, or intensified, regulatory oversight on digital media by mid-2025.

Content Licensing and Distribution Agreements

The legal frameworks surrounding content licensing and distribution are paramount for Prime Focus's clientele, directly influencing the demand for their services. As of early 2025, the global digital content market continues to evolve rapidly, with streaming services accounting for a significant portion of revenue, estimated to reach over $100 billion annually by 2025. Navigating these complex agreements, particularly with emerging monetization strategies and the proliferation of over-the-top (OTT) platforms, is crucial for the entire industry's health.

Changes in copyright law and royalty payment structures, especially concerning digital rights management and international distribution, directly impact how content creators and distributors operate. For instance, the ongoing discussions around fair compensation for artists and rights holders in the streaming era highlight the dynamic legal landscape. This legal environment necessitates constant adaptation from businesses relying on content for their operations.

- Evolving Streaming Royalties: Legal battles and new legislation in 2024-2025 are reshaping royalty payouts for music and video streaming, impacting content licensing fees and distribution revenue models.

- Digital Rights Management (DRM): The legal enforceability and interoperability of DRM technologies remain a key concern for content protection and distribution channels, affecting how content is shared and monetized.

- International Licensing Complexity: Cross-border content licensing agreements are subject to varying national laws, creating a complex web of compliance requirements for global distributors.

- AI and Content Creation: Emerging legal questions around copyright ownership and licensing for AI-generated content are beginning to surface, posing new challenges for the industry's future.

Legal factors significantly shape Prime Focus's operational landscape, particularly concerning intellectual property rights and data privacy. The company’s substantial reliance on client-generated content and proprietary technology necessitates stringent protection against infringement, a growing concern in the digital realm where global digital content revenue reached an estimated $2.5 trillion in 2024. Adherence to global data privacy laws, such as GDPR and CCPA, is critical, with penalties for non-compliance potentially reaching 4% of global annual revenue, underscoring the financial implications of maintaining robust data security measures.

Environmental factors

The media and entertainment sector, including post-production giants like Prime Focus, is under increasing pressure to address its environmental impact. Energy consumption from vast data centers, sprawling studio complexes, and frequent travel for shoots and post-production all contribute to a significant carbon footprint.

For Prime Focus, with its global operations in visual effects and post-production, this scrutiny translates into a strategic imperative to adopt more sustainable practices. The company's extensive use of digital workflows and rendering farms, while essential for its services, also represents a substantial area for energy efficiency improvements.

Industry-wide, there's a growing push towards utilizing renewable energy sources to power studios and data centers. Optimizing digital workflows to reduce data transfer and storage needs, alongside investing in energy-efficient hardware, are becoming critical steps for companies like Prime Focus to lower their environmental impact.

By 2024, the industry saw a growing commitment to net-zero targets, with major studios and production companies setting ambitious goals. For instance, the BBC pledged to be carbon neutral by 2030, a commitment that influences its entire supply chain, including post-production partners.

The energy demands of digital infrastructure are a growing concern, particularly for companies like Prime Focus that leverage cloud-based services. These services, essential for content management and rendering, rely heavily on data centers, which are significant energy consumers. For instance, global data center energy consumption was estimated to be around 1% of total global electricity usage in 2023, a figure projected to rise with increasing digital activity.

Prime Focus's business model, which includes providing and utilizing these cloud-based solutions, places a direct emphasis on energy efficiency. The company's commitment to sustainability would involve investing in and adopting energy-efficient hardware and software for its data operations. This focus is becoming increasingly critical as environmental regulations and corporate social responsibility expectations evolve.

Furthermore, sourcing renewable energy for data centers presents a key opportunity for Prime Focus to mitigate its environmental footprint. Many tech companies are actively pursuing power purchase agreements for solar and wind energy to power their operations. By transitioning to renewable sources, Prime Focus can reduce its carbon emissions and align with the global push towards a greener digital economy.

While Prime Focus operates mainly in digital services, its connection to film and broadcast production means it's indirectly impacted by waste from physical sets, props, and costumes. The broader industry's push for sustainability influences client demands and sets new standards for production processes. For example, the UK film industry alone generated an estimated 1.5 million tonnes of CO2 equivalent in 2022, with waste management being a significant contributor, highlighting the growing pressure for greener practices.

These industry-wide initiatives for waste reduction, recycling, and eco-friendly set design are becoming crucial. They shape how clients expect productions to be managed, pushing for more environmentally conscious approaches throughout the entire workflow. As a result, companies like Prime Focus need to be aware of and potentially adapt to these evolving sustainability benchmarks, even if their core business is digital.

Regulatory Pressure for Environmental Sustainability

Governments globally are intensifying their focus on environmental sustainability, leading to a surge in regulatory pressure that will inevitably touch the media production industry. For instance, the European Union's Green Deal, aiming for climate neutrality by 2050, includes ambitious targets for reducing greenhouse gas emissions and promoting a circular economy, which could influence energy consumption and waste management practices in production studios.

Prime Focus, like other players in the sector, must anticipate and adapt to these evolving environmental standards. This includes proactively implementing measures for energy efficiency in its facilities and exploring more sustainable sourcing for materials used in its productions. Failure to align could result in compliance costs or reputational damage.

The trend is clear: stricter emissions targets and waste reduction mandates are becoming the norm.

- Increased scrutiny on carbon footprints: Media companies may face pressure to report and reduce emissions from operations, including travel and studio energy usage.

- Waste management mandates: Regulations on recycling and disposal of production materials, from set construction to digital waste, are likely to tighten.

- Sustainable sourcing requirements: There could be growing pressure to use eco-friendly materials and supply chains for physical production elements.

- Energy efficiency incentives and penalties: Governments might offer incentives for adopting renewable energy or penalize high energy consumption in studios.

Client and Investor Demand for Green Practices

Clients and investors increasingly expect companies to operate with environmental responsibility. This trend is accelerating, with a significant portion of global assets under management now considering ESG factors. For Prime Focus, showcasing its dedication to sustainable practices can significantly boost its brand image, attracting clients who value eco-conscious partners and appealing to investors prioritizing strong ESG performance.

The demand for green practices is translating into tangible financial benefits. A 2024 report indicated that companies with robust ESG strategies often outperform their peers, with investors increasingly allocating capital towards sustainable investments. This shift means Prime Focus's commitment could unlock new funding avenues and strengthen existing relationships.

- Growing Investor Focus: Global ESG assets are projected to reach over $50 trillion by 2025, highlighting a substantial pool of capital seeking sustainable investments.

- Client Preference: Surveys consistently show that a majority of consumers and business clients prefer to engage with companies demonstrating strong environmental commitment.

- Reputational Advantage: Positive environmental performance can lead to enhanced brand loyalty and a stronger competitive position in the market.

- Risk Mitigation: Proactive environmental management can reduce regulatory and operational risks, contributing to long-term stability.

The media and entertainment industry, including post-production services like those offered by Prime Focus, faces increasing pressure to minimize its environmental footprint. Energy consumption from data centers, studios, and travel contributes significantly to carbon emissions. Proactive adoption of sustainable practices is therefore a strategic imperative.

Companies are increasingly prioritizing renewable energy sources for their operations and optimizing digital workflows for energy efficiency. By 2024, many major studios and production companies had set net-zero targets, influencing their entire supply chains. The energy demands of digital infrastructure, particularly cloud-based services, are a growing concern, with global data center energy consumption estimated to be around 1% of total global electricity usage in 2023, a figure expected to rise.

The industry is also addressing waste management, with initiatives focusing on recycling and eco-friendly set design becoming crucial. The UK film industry alone generated an estimated 1.5 million tonnes of CO2 equivalent in 2022, with waste management being a significant contributor. Governments globally are intensifying their focus on environmental sustainability, leading to stricter regulations and mandates for emissions reduction and waste management.

Clients and investors are increasingly favoring companies with strong environmental, social, and governance (ESG) performance. Global ESG assets are projected to exceed $50 trillion by 2025, indicating a substantial capital pool seeking sustainable investments. This trend means that Prime Focus's commitment to sustainability can enhance its brand image, attract eco-conscious clients, and appeal to investors prioritizing ESG factors.

| Environmental Factor | Impact on Prime Focus | Industry Trend/Data |

|---|---|---|

| Energy Consumption | High energy use in data centers and rendering farms. | Global data center energy use ~1% of global electricity in 2023; projected to rise. |

| Carbon Footprint | Operations contribute to overall industry emissions. | UK film industry CO2e estimated at 1.5 million tonnes in 2022. |

| Waste Management | Indirect impact from physical production elements. | Growing industry focus on recycling and eco-friendly set design. |

| Regulatory Pressure | Need to comply with evolving environmental standards. | EU Green Deal aiming for climate neutrality by 2050. |

| Investor & Client Demand | Opportunity for competitive advantage through ESG. | Global ESG assets projected >$50 trillion by 2025. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of publicly available data from government bodies, international organizations, and reputable financial institutions. This ensures that every insight into political, economic, social, technological, legal, and environmental factors is grounded in credible, up-to-date information.