Punjab National Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Punjab National Bank Bundle

Navigate the complex external forces impacting Punjab National Bank. Our PESTLE analysis dissects the political landscape, economic shifts, and technological advancements that are crucial for strategic planning. Understand the social trends and environmental regulations affecting the banking sector. Gain a competitive edge by leveraging these insights.

Unlock actionable intelligence with our comprehensive PESTLE Analysis for Punjab National Bank. Discover how evolving political stability, economic growth, and technological innovation are shaping its operational environment. This ready-made report provides expert-level insights for investors and strategists. Buy the full version to get the complete breakdown instantly.

Political factors

As a state-owned enterprise, Punjab National Bank (PNB) operates under significant influence from government policies and strategic objectives. For instance, government-backed financial inclusion drives, such as the Pradhan Mantri Jan Dhan Yojana, directly impact PNB's customer acquisition and service delivery models. In 2023-24, PNB played a crucial role in disbursing loans under various government schemes, contributing to the nation's economic development goals.

These government directives extend to lending priorities, where PNB, like other public sector banks, is often guided to support sectors deemed vital for national growth. This can influence the bank's credit portfolio and risk appetite. The government's shareholding in PNB, which stood at approximately 73.10% as of March 31, 2024, underscores its substantial sway over the bank's strategic direction and operational mandates.

The political stability of the Indian government is a cornerstone for Punjab National Bank (PNB), directly impacting the consistency and predictability of its regulatory environment. A stable government, like the one re-elected in 2019 with a strong mandate, generally ensures continuity in policy and a predictable approach to banking regulations. This allows PNB to plan long-term strategies with greater confidence.

Conversely, shifts in political leadership or significant changes in policy direction can introduce uncertainty. For instance, a change in government might prompt reviews of existing banking laws, alter taxation policies affecting financial institutions, or modify the oversight mechanisms implemented by bodies like the Reserve Bank of India (RBI). PNB, like all banks, must remain agile to adapt to these potential shifts.

The RBI, while operating with a degree of autonomy, often finds its broader objectives shaped by the prevailing economic vision of the central government. In 2024, the government's focus on financial inclusion and digital banking initiatives, for example, directly influences the RBI's operational guidelines and PNB's strategic imperatives. This alignment ensures that regulatory frameworks support national economic goals.

As of mid-2024, India's banking sector continues to navigate a landscape influenced by government policies aimed at strengthening public sector banks, including recapitalization efforts and measures to improve governance. PNB, as a major public sector bank, benefits from and is subject to these overarching political and economic strategies, which aim for a more robust and efficient financial system.

Ongoing banking sector reforms, driven by government policy, are significantly reshaping the landscape for public sector banks like Punjab National Bank (PNB). A key focus is the consolidation of these institutions, aiming to create stronger, more efficient entities. For example, the amalgamation of Oriental Bank of Commerce and United Bank of India into PNB in April 2020 serves as a precedent for such strategic moves.

Addressing non-performing assets (NPAs) remains a critical reform area, directly impacting PNB's financial health and operational capacity. The Indian banking sector has seen substantial efforts to clean up balance sheets, with the gross NPA ratio for public sector banks declining to approximately 5.8% by March 2024, down from over 11% in March 2018, according to Reserve Bank of India data.

The proposed Banking Laws (Amendment) Bill, 2024, is designed to further strengthen governance and operational efficiency within the banking sector. Such legislative changes can influence PNB's capital structure, risk management practices, and its ability to compete effectively in an evolving market. These reforms are crucial for enhancing the overall stability and performance of the banking industry.

Geopolitical Climate and International Relations

The global geopolitical climate significantly influences Punjab National Bank (PNB). Shifts in international relations and major geopolitical events can indirectly impact PNB by affecting foreign investment flows into India and altering global trade policies. For instance, ongoing trade tensions or regional conflicts could dampen investor confidence, leading to reduced foreign direct investment, which in turn might affect credit growth and the overall economic environment in which PNB operates.

PNB's international presence, particularly through its subsidiary in the United Kingdom, makes it susceptible to global financial stability. Changes in international financial regulations or economic sanctions imposed on certain countries can directly impact cross-border transactions and the profitability of PNB's foreign operations. As of early 2025, the global economic outlook remains sensitive to geopolitical developments, with many analysts closely monitoring the impact of ongoing conflicts and potential trade realignments on international banking.

- Impact on Foreign Investment: Geopolitical instability can lead to capital flight from emerging markets, potentially reducing the influx of foreign capital into India, a key driver for banking sector growth.

- Trade Policy Shifts: Changes in international trade agreements or the imposition of tariffs can affect Indian businesses, impacting their financial health and their ability to service loans from PNB.

- Global Financial Stability: PNB's UK subsidiary, like other international banks, is exposed to risks arising from global financial market volatility, which is often exacerbated by geopolitical tensions.

- Cross-Border Transactions: Sanctions or political disputes between nations can disrupt international payment systems and currency exchange, creating operational challenges for banks like PNB involved in global finance.

Focus on Financial Inclusion

The Indian government's commitment to financial inclusion remains a significant political driver for Punjab National Bank (PNB). This focus encourages banks to extend their reach to previously unserved populations, often leveraging digital channels and government-backed programs. For instance, the Pradhan Mantri Jan Dhan Yojana (PMJDY) has been instrumental in onboarding millions into the formal banking system, with PNB actively participating in such initiatives.

PNB's strategy is increasingly influenced by these inclusion mandates. This can translate into expanded digital service offerings, tailored product development for rural and low-income segments, and potentially a strategic review of its physical branch presence to optimize reach and cost-effectiveness. The bank's customer acquisition efforts are also likely to align with government-driven financial literacy campaigns and outreach programs.

Key aspects of this political focus include:

- Expansion of Digital Channels: Government push for digital payments and banking services, like UPI, encourages PNB to invest in and promote its mobile banking and online platforms.

- Government Schemes: Active participation in schemes like PMJDY, Atal Pension Yojana, and Mudra Yojana can drive customer growth and asset diversification for PNB.

- Regulatory Support: Favorable regulatory frameworks and incentives for expanding services to underserved areas support PNB's financial inclusion efforts.

- Financial Literacy Initiatives: Government-led financial literacy campaigns can create a more informed customer base, boosting adoption of PNB's products and services.

Government policy remains a dominant force shaping Punjab National Bank's operations, particularly through initiatives aimed at financial inclusion and economic development. As a state-owned entity, PNB's strategic direction is closely aligned with national objectives, influencing its lending priorities and service delivery models.

The government's significant shareholding, approximately 73.10% as of March 31, 2024, grants it substantial oversight and the ability to steer PNB's strategic path. This political influence is evident in the bank's active participation in government-backed schemes designed to broaden access to financial services and stimulate economic growth across various sectors.

Ongoing reforms, such as the proposed Banking Laws (Amendment) Bill, 2024, aim to enhance governance and efficiency, directly impacting PNB's operational framework and competitive positioning. These legislative efforts underscore the government's commitment to strengthening the public sector banking system.

What is included in the product

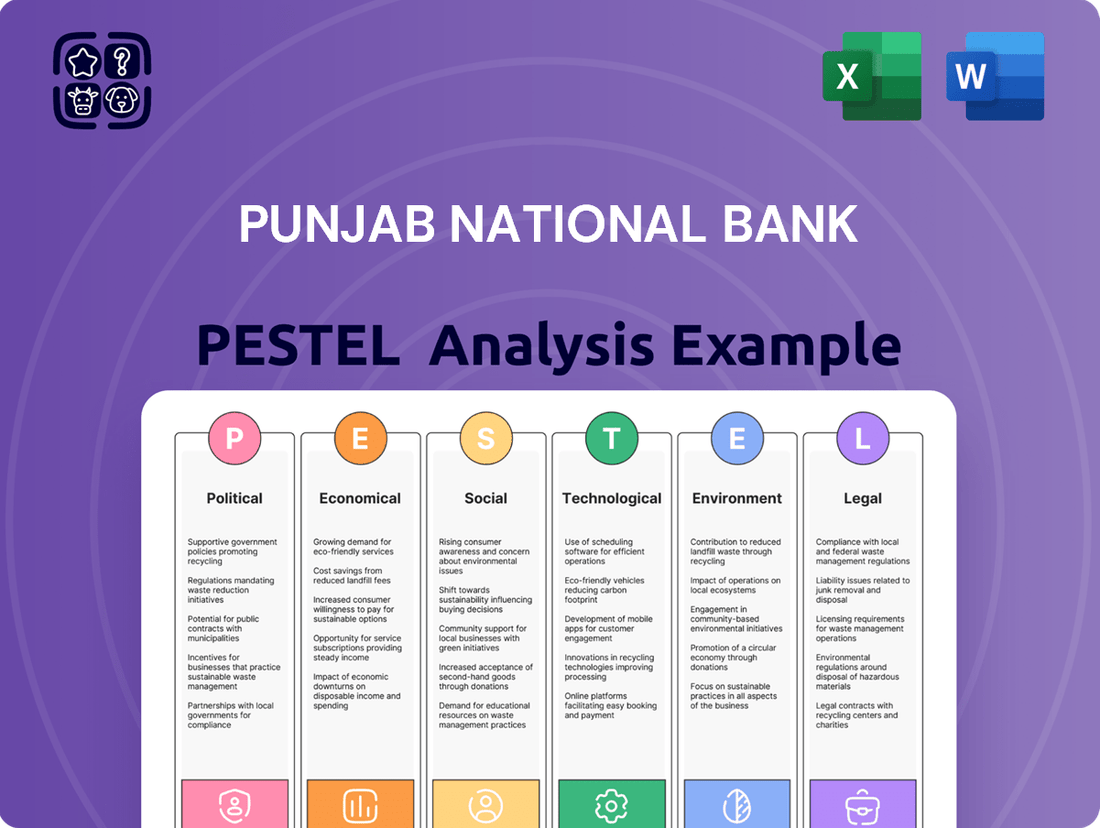

This PESTLE analysis for Punjab National Bank meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal forces shaping its operational landscape.

It identifies key external influences to inform strategic decision-making and foster proactive adaptation in the dynamic banking sector.

A Punjab National Bank PESTLE analysis offers a streamlined framework to identify and address external challenges, acting as a pain point reliever by providing clarity on market dynamics, regulatory shifts, and competitive pressures.

This analysis simplifies complex external factors into actionable insights, enabling PNB to proactively mitigate risks and capitalize on opportunities, thereby easing strategic planning and decision-making.

Economic factors

The Reserve Bank of India's (RBI) monetary policy decisions, especially those concerning interest rates, have a significant impact on Punjab National Bank's (PNB) financial performance. For example, a change in the repo rate directly influences the bank's cost of funds and the rates at which it lends money, thereby affecting its net interest margin (NIM) and overall profitability. As of early 2024, the repo rate has remained steady, but any future adjustments will be closely watched by PNB.

PNB's net interest income (NII) and NIM are crucial indicators of its operational efficiency and are directly tied to the prevailing interest rate environment. A rising interest rate scenario can put pressure on the bank's borrowing costs, while a falling rate environment can compress lending yields. The bank's ability to manage these fluctuations is key to maintaining healthy profitability in the 2024-2025 period.

High inflation in India, which saw the Consumer Price Index (CPI) averaging around 5.5% in early 2024, directly impacts Punjab National Bank (PNB). This persistent inflation erodes consumer and business purchasing power, making loan repayments more challenging and dampening the demand for new credit. PNB’s ability to grow its loan book and maintain healthy asset quality is therefore closely tied to these inflationary trends.

Conversely, a scenario where inflation moderates, for instance, if the CPI were to fall to the Reserve Bank of India's target of 4% by late 2024 or early 2025, would be beneficial. Such a cooling of inflationary pressures would likely stimulate credit demand as businesses and individuals regain confidence and disposable income, while also improving PNB's asset quality by reducing the risk of defaults.

India's Gross Domestic Product (GDP) growth is a critical indicator for Punjab National Bank's (PNB) performance. A strong economic expansion directly translates to increased borrowing needs across various sectors, boosting PNB's lending opportunities and overall revenue. For instance, India's GDP was projected to grow robustly in the fiscal year 2023-24, with estimates often hovering around 7% or higher by major economic bodies, indicating a favorable environment for credit expansion.

The anticipated continued economic development in India through 2025 suggests a sustained demand for banking services. This growth is expected to benefit PNB by increasing its loan portfolio in retail, corporate, and small and medium-sized enterprise (SME) segments. Analysts predict the Indian banking sector to be a key beneficiary of this economic upswing, with credit growth potentially reaching double digits in the coming years, a positive outlook for PNB's business volume.

Non-Performing Assets (NPAs) Management

The management of non-performing assets (NPAs) is a critical determinant of Punjab National Bank's (PNB) financial health, directly influencing its profitability and the strength of its capital base. High NPAs tie up capital that could otherwise be deployed for lending and investment, thereby hindering growth and potentially leading to losses.

PNB has demonstrated a positive trend in its asset quality, with a notable reduction in both gross and net NPAs during the fiscal year 2024-25. For instance, the bank's gross NPA ratio saw a decrease to approximately 5.75% by the end of FY2024-25, down from 6.95% at the close of FY2023-24. Similarly, the net NPA ratio improved to around 1.50% in FY2024-25, reflecting effective strategies for recovery and resolution.

These improvements are a testament to PNB's proactive approach in managing its loan portfolio. Key initiatives include strengthening credit appraisal processes, intensified recovery efforts, and strategic one-time settlements. The bank's focus on improving asset quality is crucial for enhancing its overall financial stability and unlocking its growth potential.

- Gross NPA Ratio: Declined to approximately 5.75% in FY2024-25 from 6.95% in FY2023-24.

- Net NPA Ratio: Reduced to around 1.50% in FY2024-25, indicating better recovery of bad loans.

- Recovery Mechanisms: PNB has implemented enhanced strategies for loan recovery and restructuring.

- Impact on Profitability: Lower NPAs directly contribute to improved net interest margins and overall profitability.

Credit Growth and Deposit Mobilization

Punjab National Bank's (PNB) capacity to expand its lending operations while attracting dependable, cost-effective deposits is fundamental to its financial health. Strong credit expansion, especially in consumer lending, signals robust economic activity and consumer confidence.

PNB's retail credit portfolio demonstrated significant growth, reaching a 16.5% year-on-year increase by the end of March 2025. This surge in retail lending is a positive indicator for the bank's performance and reflects a healthy demand for credit in the economy.

- Credit Growth: PNB's retail credit expansion of 16.5% year-on-year as of March-end 2025 highlights strong demand and the bank's ability to underwrite new loans.

- Deposit Mobilization: The bank's focus on attracting stable, low-cost deposits is crucial for funding this credit growth and managing its net interest margins.

- Economic Indicator: Healthy credit and deposit growth for PNB suggests underlying economic vitality and positive market sentiment.

- Financial Performance: The interplay between lending and deposit-taking directly impacts PNB's profitability and overall financial stability.

Economic growth in India remains a primary driver for Punjab National Bank's (PNB) business. With India's GDP projected to grow at a healthy pace through 2025, PNB can anticipate increased demand for its lending products across all segments, from retail to corporate. This economic expansion directly fuels PNB's revenue streams and supports its asset growth targets.

The Reserve Bank of India's monetary policy, particularly its stance on interest rates, significantly impacts PNB's profitability. While the repo rate has been stable in early 2024, any shifts will affect the bank's net interest margins. Furthermore, inflation levels, with CPI around 5.5% in early 2024, influence credit demand and asset quality, making careful management of these economic factors crucial for PNB.

| Economic Factor | Indicator/Trend | Impact on PNB |

|---|---|---|

| GDP Growth | Projected robust growth (around 7% for FY24) | Increased lending opportunities, higher revenue |

| Inflation (CPI) | Averaging 5.5% in early 2024 | Potential pressure on credit demand and asset quality |

| Interest Rates (Repo Rate) | Stable in early 2024, subject to change | Directly affects Net Interest Margin (NIM) |

| Credit Growth | Retail credit up 16.5% YoY (March 2025) | Positive for business volume and profitability |

Same Document Delivered

Punjab National Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Punjab National Bank delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. You'll gain a clear understanding of the external forces shaping PNB's strategic landscape, enabling informed decision-making. What you see is precisely what you will download, offering immediate value for your strategic planning needs.

Sociological factors

India's massive and varied population, particularly its youthful demographic, coupled with accelerating urbanization, creates a dual-edged sword for Punjab National Bank (PNB). The growing urban centers fuel a strong demand for sophisticated banking products and digital solutions, a key growth area for PNB.

Conversely, a substantial rural population necessitates PNB to focus on financial inclusion initiatives, offering accessible and relevant banking services to underserved areas. As of 2023, over 35% of India's population resides in urban areas, a figure projected to rise, highlighting the evolving consumer landscape PNB must navigate.

Successfully adapting to these demographic and urbanization trends is paramount for PNB's continued market penetration and sustained growth. This involves developing strategies that cater to both the digitally-savvy urban dweller and the financially underserved rural segment.

Financial literacy significantly influences how Indians engage with banking services, particularly digital offerings. A low level of understanding can hinder the adoption of new products, even those designed for convenience. For instance, while India's digital payment transaction volume reached an estimated 100 billion in FY23, a substantial portion of the population still relies on traditional methods due to a lack of financial awareness.

Punjab National Bank (PNB) must proactively address this by boosting financial awareness. This goes beyond simply opening accounts; it means educating customers on how to effectively utilize banking services, including digital platforms, for their financial well-being. Initiatives like PNB's financial inclusion drives aim to bridge this gap, but continued investment is crucial to foster deeper engagement and move customers towards meaningful financial participation.

The increasing digital adoption in India, with smartphone penetration reaching over 70% by late 2024, is reshaping consumer banking expectations. Punjab National Bank (PNB) faces a surge in demand for seamless online account management, mobile-first banking solutions, and instant credit facilities. This shift necessitates PNB to prioritize user-friendly digital platforms and agile loan processing to cater to a tech-savvy demographic increasingly valuing convenience and speed in their financial interactions.

Social Responsibility and Inclusivity

As a public sector bank, Punjab National Bank (PNB) faces significant expectations regarding its social responsibility, particularly in promoting financial inclusion. This commitment is crucial for maintaining public trust and its reputation. PNB's efforts to reach underserved populations and support government initiatives directly impact its societal standing.

PNB actively participates in government-led financial inclusion campaigns. For instance, under the Pradhan Mantri Jan Dhan Yojana (PMJDY), PNB had opened over 16.5 million accounts by March 31, 2024, demonstrating its role in bringing unbanked individuals into the formal financial system. This focus on inclusivity is not just a social imperative but also a strategic element for long-term growth and brand loyalty.

The bank’s commitment extends to supporting various welfare schemes. By providing access to credit and financial services for small businesses, farmers, and women entrepreneurs, PNB contributes to equitable economic development. This aligns with broader societal goals of poverty reduction and improved living standards across India.

- Financial Inclusion Initiatives: PNB's PMJDY account openings, exceeding 16.5 million by early 2024, highlight its dedication to bringing more citizens into the banking fold.

- Government Scheme Support: The bank actively implements schemes like the Pradhan Mantri Mudra Yojana, facilitating access to credit for micro and small enterprises.

- Social Impact: PNB's operations are closely linked to its ability to foster economic growth and provide equitable financial opportunities, thereby enhancing its social license to operate.

Workforce Demographics and Talent Management

Punjab National Bank's (PNB) workforce demographics are crucial for its adaptability. As of March 31, 2024, PNB had a total of 93,820 employees. The bank’s ability to integrate new technologies and meet evolving market needs is directly tied to the age distribution and skill sets within this large employee base. A younger, tech-savvy workforce can accelerate digital transformation, while experienced personnel in risk management are vital for navigating complex financial landscapes.

Attracting and retaining top talent, especially in specialized fields like cybersecurity, data analytics, and digital banking, presents a significant sociological challenge for PNB. The competition for skilled professionals is intense, and PNB must offer competitive compensation, robust training programs, and a positive work environment to secure and keep these essential employees. Success in these areas directly impacts the bank's capacity for innovation and customer service excellence.

- Employee Base: PNB had 93,820 employees as of March 31, 2024, reflecting a substantial human capital pool.

- Digital Skills Gap: A key challenge is ensuring a sufficient number of employees possess up-to-date digital and analytical skills.

- Talent Retention: PNB faces ongoing pressure to retain employees, particularly those with expertise in high-demand areas like fintech and risk assessment.

- Attracting New Talent: The bank must appeal to younger generations entering the workforce who prioritize innovation and career development.

Sociological factors significantly shape Punjab National Bank's operational landscape, influencing customer behavior and employee dynamics. India's demographic shifts, with increasing urbanization and a youthful population, demand PNB to innovate in digital banking while simultaneously ensuring financial inclusion for rural populations. As of 2023, over 35% of India's population lived in urban areas, a trend expected to continue, signaling a growing demand for sophisticated banking solutions.

Financial literacy remains a critical consideration, with a significant portion of the population requiring education on effectively utilizing banking services, particularly digital platforms. Despite India's digital payment transaction volume reaching an estimated 100 billion in FY23, a gap persists due to low financial awareness, necessitating PNB's continued investment in financial literacy programs to foster deeper customer engagement.

PNB's extensive workforce, numbering 93,820 employees as of March 31, 2024, presents both opportunities and challenges. The bank must focus on upskilling employees in digital competencies and data analytics to meet evolving market demands, while also attracting and retaining talent in competitive fields like fintech and cybersecurity to drive innovation and service excellence.

Technological factors

Punjab National Bank (PNB) is experiencing a significant shift as digital banking adoption accelerates across India. The widespread use of mobile banking apps, internet banking, and the Unified Payments Interface (UPI) is fundamentally changing how customers interact with financial services. By the end of 2024, UPI transactions were projected to reach over 130 billion, highlighting the immense growth in digital payments.

To remain competitive, PNB must prioritize ongoing investment and innovation in its digital offerings. This includes enhancing the user experience of its mobile and internet banking platforms to ensure they are not only secure but also intuitive and easy to navigate. Meeting the increasing customer expectation for round-the-clock access to banking services is paramount.

Fintech companies present a dual challenge and opportunity for Punjab National Bank (PNB). While they introduce competition, they also offer avenues for strategic alliances. PNB can partner with these agile firms to integrate specialized services, streamline payment processing, and elevate customer interaction.

The Indian Banking-as-a-Service (BaaS) market is experiencing significant expansion, with projections indicating robust growth through 2025. This burgeoning market underscores the considerable potential for PNB to forge lucrative collaborations with fintech innovators, thereby enhancing its service offerings and market reach.

With the ongoing digital transformation in banking, cybersecurity and data protection have become paramount. Punjab National Bank (PNB), like all financial institutions, faces escalating threats such as phishing, ransomware, and sophisticated data breaches. Protecting sensitive customer information is not just a regulatory requirement but a critical factor in maintaining public trust and operational integrity.

PNB needs to continually strengthen its cybersecurity posture by implementing advanced threat detection systems and robust security frameworks. Reports indicate that the Indian financial sector is particularly vulnerable, with cyberattacks on banks showing an upward trend. For instance, in 2023, the Reserve Bank of India reported a significant increase in cyber incidents affecting financial entities, highlighting the urgency for proactive defense mechanisms.

Artificial Intelligence (AI) and Machine Learning (ML) Integration

Punjab National Bank (PNB) is increasingly integrating Artificial Intelligence (AI) and Machine Learning (ML) to boost its operations. These technologies are vital for streamlining processes, offering personalized customer experiences, and strengthening fraud detection and credit risk analysis.

PNB can harness AI/ML to automate routine tasks, anticipate customer requirements, and deliver customized financial products, thereby enhancing both customer satisfaction and internal efficiency. For instance, by Q3 2024, PNB reported a significant increase in the adoption of digital channels, with AI-powered chatbots handling a substantial portion of customer queries, leading to faster resolution times.

The bank is focusing on several key AI/ML applications:

- Enhanced Operational Efficiency: Automating back-office processes, such as data entry and document verification, frees up human resources for more complex tasks.

- Personalized Customer Service: AI algorithms analyze customer data to offer tailored product recommendations and proactive support, improving engagement.

- Improved Risk Management: ML models are being deployed to more accurately assess credit risk and detect fraudulent transactions in real-time, minimizing potential losses.

- Data-Driven Decision Making: AI provides advanced analytics on market trends and customer behavior, enabling more informed strategic planning.

Blockchain and Emerging Technologies

Blockchain technology, though still in its early stages, holds significant promise for transforming banking. Its ability to bolster security, increase transparency, and improve efficiency in areas like international payments and trade finance is noteworthy. For Punjab National Bank (PNB), staying abreast of these advancements and exploring their integration is crucial for maintaining a competitive edge in the rapidly evolving digital financial landscape.

The global blockchain in banking market was valued at USD 512.3 million in 2023 and is projected to grow substantially. PNB should actively investigate how blockchain can streamline its back-office operations and customer-facing services, potentially reducing costs and enhancing customer trust through immutable transaction records.

- Security Enhancement: Blockchain’s cryptographic nature can significantly reduce fraud and cyber threats in banking transactions.

- Operational Efficiency: Applications in cross-border payments and trade finance can speed up settlement times and reduce intermediaries.

- Transparency: Shared ledgers provide a clear audit trail, improving regulatory compliance and reducing disputes.

- Cost Reduction: Automating processes and eliminating manual checks can lead to substantial operational cost savings for PNB.

The increasing reliance on digital platforms necessitates robust cybersecurity measures for PNB, as cyberattacks on Indian banks saw a notable rise in 2023 according to the RBI. PNB's strategic focus on AI and ML, evidenced by its Q3 2024 report showing increased chatbot adoption for customer queries, aims to enhance efficiency and customer experience. Furthermore, exploring blockchain technology, with the global market valued at USD 512.3 million in 2023, offers PNB avenues for improved security and operational efficiency in areas like cross-border payments.

Legal factors

Punjab National Bank (PNB) operates under the Reserve Bank of India's (RBI) comprehensive regulatory umbrella. This framework dictates crucial aspects like prudential norms, capital adequacy ratios, and asset classification standards. For instance, as of March 2024, PNB's Capital Adequacy Ratio (CAR) stood at 14.08%, well above the regulatory minimums set by the RBI, ensuring a buffer against financial shocks.

Adherence to these evolving regulations, including the frequent issuance of Master Directions and updated guidelines by the RBI, is non-negotiable for PNB's sustained stability and operational soundness. These directives ensure fair practices and protect depositors' interests. The RBI's focus on digital lending guidelines, for example, impacts how banks like PNB offer and manage their digital loan products.

Punjab National Bank (PNB) must strictly adhere to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations to prevent financial crimes and safeguard its reputation. Non-compliance can lead to significant penalties and reputational damage, impacting customer trust and market standing.

The Reserve Bank of India (RBI) regularly updates these norms, requiring PNB to maintain robust systems for customer due diligence, transaction monitoring, and suspicious activity reporting. For instance, the RBI's Master Direction on KYC issued in 2016 and subsequent circulars emphasize a risk-based approach to customer onboarding and ongoing monitoring.

In 2023, the Financial Action Task Force (FATF) continued its global push for stronger AML/CFT measures, influencing national regulations that PNB must follow. Penalties for non-compliance can include substantial fines; for example, in 2022, several Indian banks faced penalties for KYC lapses, highlighting the rigorous enforcement of these rules.

The Digital Personal Data Protection Act, 2023, significantly shapes Punjab National Bank's (PNB) operations in its increasingly digital landscape. This legislation mandates stringent requirements for how PNB collects, processes, and stores customer data, impacting everything from account opening to transaction processing.

PNB must implement advanced data security protocols and maintain transparent data handling policies to adhere to these privacy mandates. Failure to comply could result in substantial penalties, affecting customer trust and the bank's financial standing, with potential fines reaching up to INR 250 crore for certain contraventions.

The bank is actively investing in cybersecurity infrastructure and employee training to ensure compliance, recognizing that safeguarding sensitive customer information is paramount for maintaining its reputation and operational integrity in the competitive banking sector.

Banking Laws (Amendment) and Other Legislative Changes

Recent legislative amendments, like the proposed Banking Laws (Amendment) Bill, 2024, are poised to significantly reshape the operational and governance landscape for public sector banks, including PNB. These changes are critical for PNB to integrate into its strategic planning and internal policy frameworks.

PNB will need to ensure its practices are in full compliance with evolving legal mandates. This includes adapting to new regulations concerning mergers, acquisitions, and the appointment and oversight of statutory auditors, all of which directly impact financial reporting and corporate governance.

- Banking Laws (Amendment) Bill, 2024: Focuses on strengthening regulatory oversight and improving corporate governance in public sector banks.

- Impact on Mergers: Amendments may streamline or alter the approval processes for bank mergers, potentially affecting PNB's inorganic growth strategies.

- Auditor Appointments: New provisions could introduce stricter criteria or oversight mechanisms for the selection and performance of statutory auditors.

- Governance Structure: Legislative changes often aim to enhance board independence and accountability, requiring PNB to review and potentially update its internal governance structures.

Consumer Protection Laws and Grievance Redressal

Consumer protection laws are a significant legal factor for Punjab National Bank (PNB). These regulations mandate that PNB establish strong grievance redressal systems and maintain clear, transparent terms for all its offerings. This ensures customers are treated fairly and their complaints are addressed promptly, which is vital for fostering and retaining customer confidence. For instance, the Banking Ombudsman Scheme, implemented by the Reserve Bank of India (RBI), provides a framework for resolving customer complaints against banks.

PNB must adhere to various statutes that safeguard consumer rights within the financial services sector. These legal obligations include providing accurate product information, ensuring fair contract terms, and offering accessible complaint resolution channels. Failure to comply can result in penalties and reputational damage. The RBI's Master Direction on Grievance Redressal and Dispute Resolution, updated regularly, sets the benchmark for such mechanisms. In the fiscal year 2023-24, banks collectively resolved over 2.5 million customer complaints through various channels, highlighting the scale of these operations.

- Legal Mandate for Grievance Redressal: PNB is legally bound to have effective mechanisms for addressing customer complaints, as stipulated by the RBI's guidelines.

- Transparency in Product Terms: Regulations require clear and understandable terms and conditions for all financial products and services offered by PNB.

- Customer Fair Treatment: Laws ensure that PNB treats its customers equitably and prevents unfair or deceptive practices.

- RBI's Role: The Reserve Bank of India actively oversees compliance with consumer protection laws, including the Banking Ombudsman Scheme, to ensure fair banking practices.

Punjab National Bank (PNB) operates under the stringent regulatory framework of the Reserve Bank of India (RBI), which mandates adherence to prudential norms, capital adequacy, and asset classification. For instance, PNB's Capital Adequacy Ratio was reported at 14.08% as of March 2024, demonstrating compliance with RBI directives and maintaining a robust financial position.

The bank must also comply with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, crucial for preventing financial crimes and maintaining trust; non-compliance can lead to significant penalties, as evidenced by past instances of banks facing fines for KYC lapses.

Furthermore, the Digital Personal Data Protection Act, 2023, imposes strict requirements on data handling, with potential fines up to INR 250 crore for contraventions, necessitating PNB's investment in cybersecurity and data privacy protocols.

Consumer protection laws, including the Banking Ombudsman Scheme, require PNB to maintain effective grievance redressal systems and transparent product terms, ensuring fair treatment of customers; in FY 2023-24, banks resolved over 2.5 million customer complaints.

Environmental factors

Punjab National Bank (PNB) faces growing demands from regulators, investors, and the public to embed Environmental, Social, and Governance (ESG) principles into its core operations and lending activities. This push signifies a broader trend in the financial sector towards sustainable and responsible banking practices.

To address this, PNB is actively working on developing and disclosing a comprehensive ESG policy. This policy will articulate the bank's commitment to environmental stewardship, social responsibility, and sound corporate governance, demonstrating a proactive approach to meeting stakeholder expectations.

Aligning with industry-wide sustainability goals, PNB, like many other public sector banks in India, is exploring and setting net-zero targets. For instance, the Indian banking sector aims to achieve net-zero emissions by 2040, a significant undertaking requiring substantial investment in green financing and operational efficiency improvements.

Punjab National Bank (PNB) faces significant environmental challenges from climate change. These include physical risks like damage to bank assets or increased loan defaults due to extreme weather events, such as the devastating floods impacting parts of India in 2023. Transition risks also loom, as government policies and market shifts towards a low-carbon economy could devalue loans to carbon-intensive industries.

PNB is actively exploring green financing opportunities to navigate these risks and tap into growing sustainable markets. For instance, the bank is focused on increasing its lending to renewable energy projects and sustainable infrastructure development. India's renewable energy sector, particularly solar and wind power, has seen substantial growth, with significant investments projected through 2025 and beyond, presenting a clear avenue for PNB's green portfolio expansion.

Punjab National Bank (PNB) is increasingly integrating the United Nations' Sustainable Development Goals (SDGs) into its core business strategy. This alignment reflects a growing global expectation for financial institutions to contribute to broader societal objectives beyond profit. For instance, PNB's focus on financial inclusion, a key SDG, saw its Jan Dhan accounts reach over 15 million by early 2024, demonstrating a commitment to wider economic participation.

PNB's operational footprint is also being scrutinized for its environmental impact, pushing the bank to adopt greener practices in its branches and data centers. This includes initiatives aimed at reducing energy consumption and waste, aligning with SDG 13 (Climate Action). While specific 2024/2025 data on PNB's direct emissions reduction targets is still emerging, the industry trend clearly indicates a push towards measurable environmental performance improvements.

Furthermore, PNB's lending decisions are being influenced by sustainability criteria, with a growing emphasis on financing projects that support environmental protection and social well-being. This strategic shift ensures that PNB’s financial activities actively contribute to goals like SDG 7 (Affordable and Clean Energy) and SDG 9 (Industry, Innovation and Infrastructure). The bank's continued support for renewable energy projects, for example, is a tangible manifestation of this commitment.

Carbon Footprint Reduction Initiatives

Punjab National Bank (PNB), like many major financial institutions, is increasingly focused on reducing its environmental impact. This involves a concerted effort to lower its operational carbon footprint. For instance, PNB is exploring the adoption of renewable energy sources to power its numerous branches, aiming to decrease reliance on fossil fuels.

Furthermore, the bank is actively promoting digital banking services. This strategic shift not only enhances customer convenience but also significantly curtails paper consumption, a common contributor to carbon emissions in the banking sector. By encouraging online transactions and digital document management, PNB is actively working towards a more sustainable operational model.

PNB is also implementing energy-efficient practices across its infrastructure. This includes upgrading lighting systems, optimizing HVAC operations, and utilizing energy-saving technologies in its data centers and office buildings. These measures are crucial for long-term carbon footprint reduction.

In 2023, the banking sector in India, including PNB, saw a growing emphasis on Environmental, Social, and Governance (ESG) principles. While specific carbon reduction figures for PNB are still emerging, the trend indicates a commitment to these initiatives. For example, the Reserve Bank of India has been encouraging banks to integrate climate-related risk management into their operations, pushing for greater transparency and action on environmental factors.

- Renewable Energy Integration: PNB is evaluating the feasibility of installing solar panels at its branches and offices to harness clean energy.

- Digital Transformation Push: Encouraging digital transactions and paperless processes to minimize resource usage.

- Energy Efficiency Upgrades: Investing in modern, energy-saving equipment and infrastructure across its network.

- ESG Reporting Focus: Increasing transparency in reporting environmental performance and setting future reduction targets, aligning with broader industry trends and regulatory guidance.

Environmental Due Diligence in Lending

Punjab National Bank (PNB) is increasingly integrating environmental due diligence into its credit appraisal processes, particularly for large corporate and project financing. This focus is driven by a growing awareness of environmental risks and the need for sustainable development. For instance, by 2024, financial institutions globally are expected to face stricter regulatory scrutiny regarding their climate-related financial disclosures, impacting lending practices.

PNB must meticulously assess the environmental impact and associated risks of projects it finances. This includes evaluating factors like carbon emissions, water usage, waste management, and biodiversity impact. A robust due diligence framework ensures compliance with evolving environmental regulations, such as India's updated environmental impact assessment (EIA) norms, and safeguards the bank from potential liabilities.

By prioritizing environmental considerations, PNB not only mitigates risks but also aligns with global sustainability goals and enhances its corporate reputation. This proactive approach can lead to improved long-term financial performance by identifying environmentally sound projects and avoiding those with significant environmental liabilities.

- Regulatory Compliance: Adherence to evolving environmental laws and international agreements like the Paris Agreement.

- Risk Mitigation: Identifying and managing potential environmental liabilities and reputational damage from funding polluting projects.

- Sustainable Finance: Promoting green projects and contributing to India's renewable energy targets, which aim for 500 GW of non-fossil fuel energy capacity by 2030.

- Stakeholder Expectations: Meeting the increasing demand from investors, customers, and the public for environmentally responsible banking practices.

PNB is increasingly integrating environmental due diligence into its credit appraisal processes, particularly for large corporate and project financing, driven by growing awareness of environmental risks and the need for sustainable development. By 2024, financial institutions globally are expected to face stricter regulatory scrutiny regarding their climate-related financial disclosures, influencing lending practices.

The bank must meticulously assess the environmental impact and associated risks of projects it finances, including carbon emissions, water usage, and waste management. This robust due diligence framework ensures compliance with evolving environmental regulations, such as India's updated environmental impact assessment norms, and safeguards the bank from potential liabilities.

Prioritizing environmental considerations allows PNB to mitigate risks, align with global sustainability goals, and enhance its corporate reputation. This proactive approach can lead to improved long-term financial performance by identifying environmentally sound projects and avoiding those with significant environmental liabilities.

| Focus Area | PNB's Approach | Relevant Data/Targets (2024-2025 Focus) |

|---|---|---|

| Environmental Due Diligence | Integrating environmental risk assessment into credit appraisal for large projects. | Increased scrutiny on carbon footprint and resource management of financed projects. Expectation of stricter climate-related financial disclosures globally by 2024. |

| Regulatory Compliance | Adherence to evolving environmental laws and international agreements. | Compliance with India's updated Environmental Impact Assessment (EIA) norms. |

| Sustainable Finance | Promoting green projects and contributing to national renewable energy targets. | India's target of 500 GW non-fossil fuel energy capacity by 2030. PNB's continued support for renewable energy projects. |

PESTLE Analysis Data Sources

Our Punjab National Bank PESTLE Analysis draws from a robust dataset including Reserve Bank of India (RBI) publications, government economic reports, and reputable financial news outlets. We also incorporate data from international financial institutions and industry-specific research to ensure comprehensive coverage.