Punjab National Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Punjab National Bank Bundle

Punjab National Bank (PNB) operates within a dynamic banking landscape where intense competition and evolving customer expectations shape its strategic direction. Understanding the forces at play, from the bargaining power of buyers to the threat of new entrants, is crucial for navigating this environment effectively. PNB faces significant pressure from existing players, while also needing to consider the potential disruption from fintech innovations.

The complete report reveals the real forces shaping Punjab National Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Punjab National Bank's (PNB) suppliers are primarily its depositors, who provide the crucial capital for its lending activities. While individual depositors typically exert little direct influence, their collective actions and the broader financial system's liquidity significantly shape the bank's cost of funds.

The interbank market and the Reserve Bank of India (RBI) are also vital suppliers of liquidity. For instance, in 2024, the RBI's repo rate adjustments directly influence the cost at which banks like PNB can access short-term funds, impacting their overall profitability and lending margins.

Technology and software providers hold significant sway over banks like Punjab National Bank. These specialized vendors supply essential core banking systems, digital transformation platforms, and robust cybersecurity measures. For instance, the global banking software market was valued at approximately $40 billion in 2023 and is projected to grow, highlighting the demand for these critical services.

The bargaining power of these suppliers can range from moderate to high. This is particularly true when banks utilize proprietary software or highly integrated systems, as the cost and complexity of switching to a new vendor can be substantial, often running into millions of dollars for large institutions.

Banks depend heavily on these technological advancements to ensure smooth operations, deliver excellent customer experiences, and maintain strict regulatory compliance. This reliance grants these tech and software providers considerable leverage in negotiations.

Skilled employees, especially in digital banking, risk management, and data analytics, are vital suppliers of human capital for Punjab National Bank. The intense demand for these specialized skills within India's expanding financial sector significantly enhances the bargaining power of potential and current employees. This means PNB must offer attractive compensation and robust career paths to secure and keep top performers.

Regulatory and Compliance Bodies

Regulatory and compliance bodies, such as the Reserve Bank of India (RBI) and the Ministry of Finance, wield significant influence over Punjab National Bank (PNB), acting as crucial shapers of its operational landscape. Their directives on capital requirements, lending practices, and digital security directly dictate PNB's operational strategies and associated compliance costs. For instance, the RBI's Basel III norms mandate specific capital adequacy ratios, impacting how much capital PNB must hold. Failure to comply with these regulations can result in substantial penalties, underscoring the potent bargaining power these entities possess.

The RBI's supervisory actions and pronouncements can dramatically affect a bank's profitability and strategic direction. For example, in 2023, the RBI continued its focus on robust risk management frameworks, which translates into increased compliance burdens for banks like PNB. This regulatory oversight is not static; it evolves with economic conditions and technological advancements, requiring continuous adaptation from financial institutions.

- RBI's Capital Adequacy Norms: Banks like PNB must maintain specific Capital to Risk-weighted Assets Ratios (CRAR), impacting lending capacity and profitability.

- Digital Security Mandates: Increased focus on cybersecurity by regulators necessitates significant investment in technology and compliance for data protection.

- Lending and Prudential Norms: RBI's guidelines on non-performing assets (NPAs) and provisioning directly influence PNB's asset quality management and financial health.

- Monetary Policy Impact: Interest rate decisions by the RBI directly affect PNB's net interest margins and borrowing costs.

Infrastructure and Service Providers

Suppliers of essential physical infrastructure and services, like real estate for branches, utilities, telecommunications, and security, hold a degree of bargaining power. While many of these services are largely commoditized, the need for specific prime locations or specialized security solutions can grant certain providers a moderate advantage. For instance, securing prime real estate in major metropolitan areas can involve competitive bidding, potentially increasing costs for Punjab National Bank.

The bank's reliance on consistent and reliable service delivery from these infrastructure providers necessitates careful relationship management. Long-term contracts are often in place to ensure operational continuity, mitigating the risk of service disruptions. For example, telecommunication providers are critical for digital banking services, and any interruption could significantly impact customer access and transactions.

- Real Estate: Costs for prime branch locations can fluctuate based on market demand, impacting operational expenses.

- Utilities: While generally stable, increases in energy prices can affect the bank's overhead. In 2023, India's average electricity prices saw a slight increase, impacting businesses nationwide.

- Telecommunications: Reliable connectivity is paramount for digital banking, giving major telecom providers some leverage.

- Security Services: Specialized security needs for sensitive data centers or high-risk branches can empower specific providers.

The bargaining power of suppliers for Punjab National Bank is a nuanced aspect, primarily influenced by depositors, technology providers, and regulatory bodies. While individual depositors hold minimal sway, their collective behavior and overall market liquidity, influenced by the RBI's monetary policies in 2024, significantly impact PNB's funding costs.

Technology and software vendors, critical for core banking and digital services, possess considerable leverage due to the high switching costs and specialized nature of their offerings, as seen in the global banking software market valued at approximately $40 billion in 2023. Similarly, skilled employees in specialized financial roles command strong bargaining power, compelling PNB to offer competitive compensation to attract and retain talent.

Regulatory entities, particularly the Reserve Bank of India, exert substantial influence through mandates like capital adequacy norms and digital security requirements, directly shaping PNB's operational strategies and compliance expenditures. The RBI's evolving supervisory actions, such as its 2023 focus on risk management, impose ongoing compliance burdens and necessitate strategic adaptation by banks.

| Supplier Type | Influence Level | Key Considerations |

| Depositors | Moderate (Collective) | Market liquidity, RBI monetary policy (e.g., 2024 repo rate changes) |

| Technology Providers | High | Switching costs, proprietary systems, demand for digital transformation (Global market ~ $40B in 2023) |

| Skilled Employees | High | Demand for specialized skills (digital banking, analytics), competitive compensation |

| Regulatory Bodies (RBI) | Very High | Capital adequacy norms, digital security mandates, lending practices, evolving compliance (e.g., Basel III) |

What is included in the product

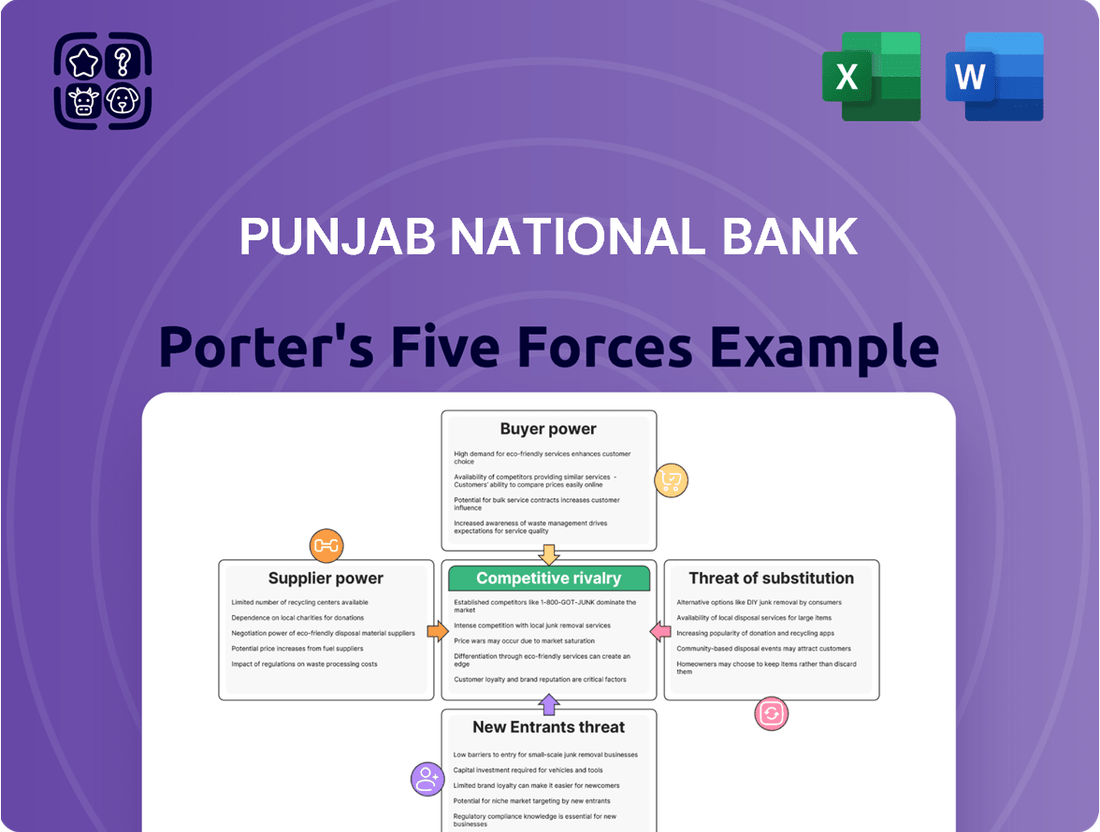

This analysis tailors Porter's Five Forces to Punjab National Bank, examining the intensity of rivalry, threat of new entrants, bargaining power of buyers and suppliers, and the threat of substitutes within the Indian banking sector.

Instantly identify competitive pressures impacting Punjab National Bank with a clear, visual representation of each Porter's Five Forces, enabling targeted strategies to alleviate strategic pain points.

Customers Bargaining Power

Customers of Punjab National Bank (PNB) wield considerable bargaining power. This is largely due to the vast array of banking choices available in India. From individual savers to major corporations, consumers can select from numerous public sector banks, private sector banks, and newer small finance banks, all competing for their business.

The ease with which customers can switch between banks significantly amplifies their bargaining power. In 2023, India's banking sector saw continued growth in digital transactions, with the Unified Payments Interface (UPI) alone processing over 117 billion transactions, a 58% increase from 2022. This digital infrastructure, coupled with lower switching costs, allows customers to readily compare offerings and move their accounts if they find more attractive interest rates or superior service elsewhere.

Punjab National Bank, like other public sector banks, faces significant customer bargaining power due to the commoditized nature of many banking products. Savings accounts, fixed deposits, and basic loans are largely undifferentiated, making customers highly sensitive to price.

Customers frequently switch banks based on the best interest rates for deposits and loans, or the lowest fees for services. This competitive pressure necessitates PNB offering attractive pricing, which can strain profitability if not balanced with superior service or other value-added offerings.

For instance, in early 2024, the Reserve Bank of India's repo rate adjustments directly influenced deposit and lending rates across the banking sector, highlighting customer focus on these pricing elements.

The bargaining power of customers has surged due to widespread access to financial information. Comparison websites and mobile apps allow customers to easily evaluate PNB's products against competitors, driving demands for better rates and services. In 2024, for instance, the average user spent over 20 minutes per session on financial comparison sites, actively seeking the best deals, a clear indicator of heightened customer leverage.

This digital empowerment means customers can quickly identify and switch to more competitive banking solutions. PNB must therefore focus on enhancing its digital platforms and customer service, as exemplified by its 2023 investment of INR 500 crore in digital transformation initiatives, to maintain its customer base amidst this increased transparency and choice.

Large Corporate and Institutional Clients

Large corporate and institutional clients hold significant bargaining power with Punjab National Bank (PNB). Their substantial transaction volumes and potential for broad, multi-product relationships allow them to negotiate more favorable terms on loans, treasury services, and other financial products. PNB needs to carefully balance offering competitive rates and services to these high-value clients with maintaining its own profitability.

For instance, in FY24, PNB reported a significant portion of its credit portfolio was with large corporates, indicating their importance to the bank's revenue. These clients can leverage their market position and the availability of alternative banking partners to demand better pricing and customized solutions.

- High Volume Transactions: Large clients, by their nature, conduct a greater volume of business, giving them leverage in negotiations.

- Multi-Product Relationships: The ability to bring multiple business lines, such as deposits, loans, and foreign exchange, to a bank strengthens their bargaining position.

- Negotiation of Terms: This power translates into the ability to negotiate lower interest rates on loans or better fees for services.

- Competitive Pressure: PNB faces pressure from other banks and financial institutions vying for these lucrative relationships, further empowering these clients.

Emergence of Fintech and Niche Players

The proliferation of FinTech and niche financial service providers significantly amplifies customer bargaining power against traditional banks like Punjab National Bank. These agile entities offer specialized, often more user-friendly, alternatives for payments, lending, and investment management, directly challenging incumbent banks on specific service fronts. For instance, by 2024, the global FinTech market was valued at over $2.4 trillion, demonstrating the substantial shift towards these alternative platforms.

This competitive landscape forces established players to innovate and improve their digital offerings and customer service to retain market share. Customers benefit from a wider array of choices, moving beyond the traditional banking ecosystem. This increased competition means customers can more easily switch providers or demand better terms and services, thereby enhancing their leverage.

- FinTech Market Growth: The global FinTech market's substantial growth underscores the increasing customer adoption of alternative financial solutions.

- Service Diversification: FinTechs offer specialized services, allowing customers to pick and choose best-in-class solutions rather than relying on a single bank for all needs.

- Digital Enhancement Pressure: Traditional banks are compelled to invest heavily in digital transformation to match the convenience and user experience offered by FinTechs.

- Customer Choice Expansion: The emergence of these players broadens customer options, directly increasing their bargaining power through a more competitive marketplace.

Customers of Punjab National Bank (PNB) possess significant bargaining power, driven by the sheer volume of banking options available in India. The competitive landscape, featuring public sector banks, private players, and specialized financial institutions, allows customers to easily compare and switch for better rates and services.

The ease of switching, facilitated by digital advancements like UPI which processed over 117 billion transactions in 2023, means customers can readily move their accounts. This digital infrastructure empowers individuals and businesses to demand more competitive pricing and enhanced service from PNB.

The commoditized nature of basic banking products like savings accounts and loans makes customers highly sensitive to price differentials. For example, Reserve Bank of India repo rate adjustments in early 2024 directly impacted lending and deposit rates across the sector, highlighting this sensitivity.

Financial information accessibility further bolsters customer leverage. In 2024, consumers spent considerable time on financial comparison sites, actively seeking superior deals, compelling PNB to invest in digital transformation, such as its INR 500 crore investment in 2023, to retain its customer base.

Preview the Actual Deliverable

Punjab National Bank Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders, detailing Punjab National Bank's competitive landscape through Porter's Five Forces. You'll gain a comprehensive understanding of the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within the Indian banking sector. This analysis is crucial for strategic decision-making and competitive positioning.

Rivalry Among Competitors

Punjab National Bank (PNB) operates in an intensely competitive Indian banking landscape. It faces robust rivalry from both public sector peers and agile private sector institutions. For instance, in the fiscal year 2023-24, PNB reported total business of ₹22.86 lakh crore, a figure that highlights the sheer scale of operations within this competitive arena.

Public sector banks such as State Bank of India, with its vast branch network and long-standing reputation, and Bank of Baroda, also a significant player, directly challenge PNB on traditional strengths like accessibility and perceived stability. These banks leverage their extensive reach and historical customer trust to maintain market share.

Conversely, private sector banks like HDFC Bank, ICICI Bank, and Axis Bank are formidable competitors, aggressively innovating in digital banking, customer service, and product offerings. Their focus on technological advancement and customer-centricity allows them to attract a growing segment of the market, putting pressure on PNB to enhance its own digital capabilities and service standards.

Punjab National Bank operates in a highly fragmented banking market, characterized by a vast number of competitors. This includes dominant public sector banks, dynamic private sector banks, specialized small finance banks, and numerous cooperative banks, all vying for customer attention and market share. This intense competition across deposits, loans, and other financial services means PNB must constantly innovate its product offerings and service delivery. The sheer volume of players necessitates a strong focus on differentiation and leveraging its extensive branch network and digital capabilities to sustain its competitive standing.

Punjab National Bank (PNB) faces intense competitive rivalry driven by a constant race for product and service innovation. Banks are aggressively developing new offerings and digital solutions to capture and hold customer attention, making the pace of technological advancement and service improvement remarkably swift. For instance, in 2023, PNB reported a 14.7% year-on-year growth in its digital transactions, reflecting the broader industry trend.

This innovation race spans a wide spectrum, from sophisticated mobile banking applications and streamlined digital lending platforms to highly personalized wealth management services. Competitors are continuously introducing features designed to enhance customer experience and convenience. PNB's commitment to investing in its digital infrastructure is crucial to not only keep pace with these rivals but also to effectively meet the ever-changing expectations of its customer base.

Aggressive Pricing and Marketing Strategies

Punjab National Bank (PNB) faces intense rivalry from other public sector banks, private banks, and newer fintech players, all vying for customer deposits and loan business. This competition frequently manifests as aggressive pricing, with institutions offering attractive interest rates on savings accounts and various loan products. For instance, in early 2024, several banks were seen offering personal loan interest rates starting as low as 8.5%, directly challenging PNB's existing offerings.

Beyond pricing, banks invest heavily in marketing and branding to capture market share and foster customer loyalty. PNB must counter extensive advertising campaigns and promotional offers from competitors, which can include fee waivers on digital transactions or special reward programs. This constant pressure on margins necessitates strategic promotional activities and a clear value proposition to differentiate PNB in a crowded marketplace.

- Aggressive Pricing: Competitors often undercut each other on interest rates for loans and deposits to attract customers.

- Marketing and Branding: Significant investment in advertising and brand building is crucial for customer acquisition and retention.

- Fee Waivers: Many banks offer reduced or waived fees on various services to entice new account holders.

- Competitive Pressure: PNB must strategically respond to these tactics to maintain its market position and profitability.

Regulatory Landscape and Consolidation

The Indian banking sector is heavily regulated, with the Reserve Bank of India (RBI) setting the rules for operations, capital adequacy, and customer protection. Recent government initiatives, like the consolidation of public sector banks (PSBs), significantly reshape the competitive intensity. For instance, the amalgamation of Oriental Bank of Commerce and United Bank of India into Punjab National Bank (PNB) in 2020, creating India's second-largest PSB, exemplifies this trend. While this consolidation reduces the sheer number of entities, it simultaneously births larger, more powerful competitors with increased market share and enhanced financial muscle, demanding strategic adaptation from PNB.

This regulatory push towards consolidation directly impacts the competitive rivalry by creating fewer, but larger, players. PNB, as a result of its own consolidation, now competes with other merged entities and large private banks. The ongoing focus on digital transformation and financial inclusion, driven by regulatory mandates, further intensifies competition as banks invest heavily in technology to offer seamless customer experiences and reach wider demographics. For example, the government's push for digital payments, as evidenced by the Unified Payments Interface (UPI) transaction volume soaring past 100 billion in 2023, means banks must innovate rapidly to stay relevant.

- Regulatory Oversight: The RBI's stringent regulations govern all aspects of banking, influencing pricing, product development, and market entry.

- Bank Consolidation Impact: The merger of PSBs, like the one that formed the current PNB, creates larger entities, altering the competitive dynamics by increasing concentration.

- Digital Transformation Mandates: Regulatory encouragement of digital banking and payment systems forces all banks, including PNB, to invest in technology, intensifying rivalry in the digital space.

- Evolving Competitive Landscape: PNB must continuously adapt its strategies to navigate the evolving structure of the Indian banking industry shaped by these regulatory shifts and consolidation efforts.

Punjab National Bank (PNB) faces intense competitive rivalry from public sector banks, private sector banks, and emerging fintech players. This rivalry is characterized by aggressive pricing strategies, with competitors often offering lower interest rates on loans and deposits to attract customers. For instance, in early 2024, competitive personal loan rates were observed starting as low as 8.5%.

Beyond pricing, banks invest heavily in marketing and digital innovation to gain an edge. PNB must counter extensive advertising and promotional offers, such as fee waivers on digital transactions, to maintain its market share and customer loyalty. The ongoing digital transformation mandates, like the surge in UPI transactions exceeding 100 billion in 2023, further intensify this competition, pushing PNB to continually enhance its technological offerings and customer service standards.

| Key Competitive Factors | PNB's Position/Response | Competitor Actions | Market Impact |

| Pricing Aggression | Needs to balance competitive rates with profitability | Offering lower interest rates on loans and deposits | Pressure on net interest margins |

| Digital Innovation | Investing in digital platforms and services | Developing advanced mobile apps and digital lending | Customer migration to digital channels |

| Marketing & Branding | Active promotional campaigns and brand building | Extensive advertising and loyalty programs | Customer acquisition and retention challenges |

| Product Diversification | Expanding service offerings | Introducing specialized financial products | Need for continuous product development |

SSubstitutes Threaten

Non-Banking Financial Companies (NBFCs) present a substantial threat to Punjab National Bank (PNB) by offering specialized financial services, often with more agile processes. These entities provide diverse loan products, investment guidance, and asset financing, frequently with more accommodating terms and faster approvals compared to traditional banks. This flexibility allows consumers to seek alternatives for specific financial requirements, potentially diverting business and revenue away from PNB.

In 2023, the NBFC sector in India saw significant growth, with total assets managed by NBFCs reaching approximately INR 38.8 lakh crore, as reported by the Reserve Bank of India. This expansion highlights their increasing market penetration and their capacity to compete with banks like PNB for market share in areas such as retail lending and housing finance. Their ability to innovate and tailor products to niche segments makes them a formidable competitive force.

FinTech companies and digital wallets pose a significant threat by offering faster and more accessible payment and lending solutions. For instance, the Unified Payments Interface (UPI) in India, which Punjab National Bank (PNB) is part of, processed over 12 billion transactions in Q4 2023 alone, showcasing the scale of digital adoption. These platforms often bypass traditional banking infrastructure, directly impacting PNB's transaction fees and customer engagement.

Mobile wallets and peer-to-peer lending platforms are increasingly popular, providing convenient alternatives for everyday transactions and small credit needs. This shift erodes PNB's traditional revenue from these services. The rapid growth in digital lending, with many FinTechs offering quick approvals, directly competes with PNB's personal loan segments, forcing a strategic re-evaluation of digital capabilities.

For savvy investors, both individuals and businesses, using brokerage firms and online platforms to directly access capital markets presents a significant alternative to traditional bank offerings. Instead of opting for bank-issued fixed deposits or relying on a bank's wealth management advice, these investors can channel their funds directly into stocks, bonds, or various investment funds. This trend siphons away potential deposit growth and advisory fees that might otherwise benefit Punjab National Bank.

In 2023, the Indian direct equity market saw significant retail participation, with the number of active Demat accounts exceeding 100 million, demonstrating a strong preference for direct investment channels. This indicates a substantial segment of the market is bypassing traditional banking products for potentially higher returns or greater control, directly impacting PNB's ability to attract and retain investment capital.

Government Schemes and Post Office Savings

Government-backed savings schemes and the extensive network of post office savings instruments present a significant threat of substitution for Punjab National Bank. These options, offering perceived safety and often competitive interest rates, attract retail depositors, particularly in rural and semi-urban areas. For instance, the Public Provident Fund (PPF) and National Savings Certificates (NSC) provide tax benefits and stable returns, drawing funds that might otherwise be deposited with banks. The trust associated with government guarantees makes these alternatives highly appealing.

PNB must actively compete with the inherent trust and widespread accessibility of these government-backed alternatives. The post office network, in particular, has a reach that can be difficult for even large banks to match, especially in remote locations. This accessibility means customers have convenient options for their savings, potentially reducing the flow of new deposits into PNB’s branches.

- Post Office Savings Schemes: Offer a safe haven for retail savings, often with government backing.

- Government-Backed Schemes: Including PPF and NSC, provide attractive tax benefits and stable returns.

- Rural and Semi-Urban Reach: The post office network's extensive presence makes these alternatives highly accessible.

- Competitive Interest Rates: These schemes can offer interest rates comparable to or exceeding those offered by commercial banks.

Peer-to-Peer (P2P) Lending Platforms

Peer-to-peer (P2P) lending platforms present a growing threat to traditional banks like Punjab National Bank (PNB). These platforms connect lenders directly with borrowers, often for smaller loan amounts or specific market segments that traditional banks might overlook. This disintermediation offers an alternative for both investment and borrowing, potentially siphoning off business from PNB's personal and small business loan offerings.

The P2P lending sector, though still developing in India, is gaining traction. For instance, by the end of 2023, several P2P platforms reported significant growth in loan disbursals, with some indicating a year-on-year increase of over 30%. This indicates a growing comfort level among consumers with these alternative financing channels.

PNB faces competition from P2P platforms in several key areas:

- Personal Loans: P2P platforms can offer faster processing and potentially more competitive rates for unsecured personal loans, especially for individuals with less established credit histories.

- Small Business Loans: Start-ups and small enterprises might find P2P lending a more accessible source of capital than traditional bank loans.

- Investment Alternatives: For individuals seeking higher yields on their savings, P2P lending offers an alternative to traditional fixed deposits, directly impacting PNB's deposit base.

As regulatory frameworks mature and consumer awareness increases, the substitutability offered by P2P lending is likely to grow. This necessitates that PNB continually evaluates its product offerings and customer service to remain competitive in a rapidly evolving financial landscape.

The threat of substitutes for Punjab National Bank (PNB) is significant, stemming from various non-traditional financial service providers and investment avenues. These substitutes often offer greater flexibility, speed, or specialized services that can attract PNB’s customer base. For example, the increasing popularity of FinTech platforms and digital wallets provides faster payment solutions, directly impacting PNB's transaction-based revenues.

Furthermore, direct access to capital markets through brokerage firms and online investment platforms serves as a potent substitute for traditional bank offerings like fixed deposits and wealth management services. The substantial growth in retail participation in the Indian equity market, with over 100 million active Demat accounts by 2023, underscores this trend. This shift diverts investment capital and advisory fee opportunities away from PNB.

Government-backed savings schemes, such as those offered through post offices, also pose a considerable threat. These schemes, often perceived as safer and providing competitive, tax-advantaged returns, attract a significant portion of retail savings, particularly in underserved areas. This directly competes with PNB’s core deposit-gathering activities.

Entrants Threaten

The threat of new entrants in India's banking sector, impacting entities like Punjab National Bank, remains considerably low. This is primarily due to the stringent regulatory landscape established by the Reserve Bank of India (RBI).

Securing a universal banking license involves meeting substantial capital adequacy requirements, which as of early 2024, often necessitate billions of Indian Rupees. Furthermore, applicants must navigate a rigorous eligibility assessment and a protracted, multi-stage approval process, making entry exceptionally challenging.

These robust regulations are intentionally in place to uphold the nation's financial stability and safeguard the interests of depositors, effectively creating a high barrier to entry for any prospective new banking institutions.

Establishing a bank on the scale of Punjab National Bank necessitates enormous capital. This isn't just about meeting regulatory capital adequacy ratios, which for large Indian banks often mean significant Tier 1 capital, but also about building the physical and digital backbone. Think of the costs associated with a vast branch network, advanced IT systems, and robust cybersecurity. For instance, in 2023, Indian banks invested billions of dollars in digital transformation initiatives, a figure expected to grow.

The sheer scale of these upfront investments acts as a formidable barrier. Newcomers must contend with setting up extensive physical infrastructure, like the thousands of branches PNB operates, and sophisticated digital platforms capable of handling millions of transactions daily. These infrastructure demands, coupled with the need for a substantial, skilled workforce, create a high entry cost that deters many potential competitors.

Existing banks, particularly large public sector institutions such as Punjab National Bank (PNB), have cultivated deep-rooted brand trust and customer loyalty over many years. Newcomers must contend with the significant hurdle of building credibility and securing customer faith when competing against established entities that already command extensive customer bases.

Bridging this trust gap and altering established customer habits demands considerable investment in time, strategic planning, and extensive marketing campaigns. For instance, as of the fiscal year ending March 31, 2024, PNB reported a customer base exceeding 120 million, highlighting the scale of loyalty new entrants must challenge.

Economies of Scale and Experience Curve

Incumbent banks like Punjab National Bank (PNB) leverage substantial economies of scale, enabling them to spread fixed costs over a larger operational base. This translates into lower per-unit costs for services, technology adoption, and risk management, making it difficult for new entrants to compete on price. For instance, PNB's vast branch network and extensive digital infrastructure provide significant cost advantages that a startup would find prohibitively expensive to replicate.

The experience curve effect is another critical barrier. Established players have honed their operational processes, customer service, and regulatory compliance over many years. This accumulated knowledge, or learning curve, allows them to operate more efficiently and with fewer errors than newcomers. Navigating the complex regulatory landscape of the Indian banking sector requires deep expertise, which new entrants would need considerable time and resources to develop.

- Economies of Scale: PNB's large asset base and customer network allow for cost efficiencies in operations, technology, and risk management that are difficult for new entrants to match.

- Experience Curve: Years of experience in managing complex banking operations and regulatory frameworks provide a significant advantage to incumbent banks like PNB.

- Capital Requirements: The substantial capital needed to establish a new bank and meet regulatory solvency norms acts as a formidable barrier.

- Brand Loyalty: Established banks often benefit from strong brand recognition and customer loyalty, making it challenging for new players to attract a significant customer base.

Intense Competition from Existing Players

Even if a new entrant navigates the significant regulatory and capital barriers to entry in the Indian banking sector, they would immediately confront a highly competitive landscape dominated by numerous well-established public and private sector banks. For instance, as of March 2024, India had over 120 scheduled commercial banks, a substantial number of which are large, experienced entities with extensive branch networks and established customer bases.

Existing players, including Punjab National Bank, are likely to defend their market share vigorously. This defense often involves aggressive pricing strategies, such as offering competitive interest rates on loans and deposits, and a continuous stream of product innovation. Banks are also heavily focused on customer retention through loyalty programs and enhanced digital services. For example, in FY2023-24, public sector banks collectively reported a net profit of INR 1,07,088 crore, indicating their strong operational performance and ability to compete effectively.

- High Market Saturation: India's banking sector is characterized by a large number of players, making it difficult for new entrants to gain significant market share quickly.

- Aggressive Competitive Tactics: Established banks employ pricing, product differentiation, and customer service to deter new competition.

- Customer Loyalty and Brand Recognition: Long-standing banks benefit from established customer trust and brand recognition, which are hard for newcomers to replicate.

- Regulatory Hurdles: Stringent regulations and capital requirements act as significant barriers, increasing the cost and complexity of entry.

The threat of new entrants for Punjab National Bank (PNB) is low due to high capital requirements, stringent RBI regulations, and the need for extensive infrastructure. For example, obtaining a banking license in India involves substantial capital, often in the billions of Rupees, and a lengthy approval process, making it difficult for new players to enter the market as of early 2024.

Established banks like PNB benefit from significant economies of scale and an experience curve advantage, meaning they have lower per-unit costs and honed operational efficiencies. PNB's vast branch network and digital infrastructure, serving over 120 million customers as of FY24, represent massive upfront investments that deter newcomers.

Brand loyalty and customer trust are also major barriers, as new entrants must overcome years of established relationships. Aggressive competition from over 120 scheduled commercial banks in India, as of March 2024, with incumbent players defending market share through pricing and innovation, further solidifies this low threat.

Porter's Five Forces Analysis Data Sources

Our Punjab National Bank Porter's Five Forces analysis is built upon data from the bank's annual reports, investor presentations, and filings with the Reserve Bank of India. We also incorporate insights from reputable financial news outlets and industry-specific publications covering the Indian banking sector.