Pierce PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Pierce Bundle

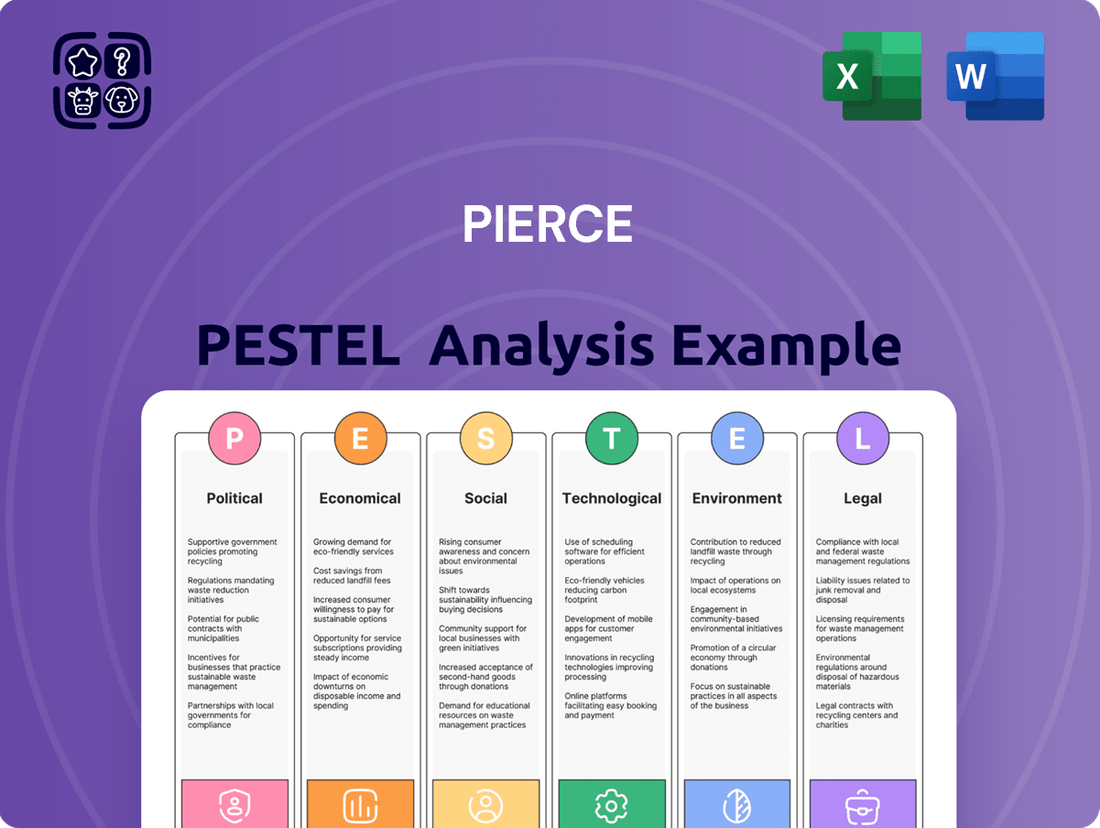

Navigate the complex external forces shaping Pierce's journey with our comprehensive PESTLE analysis. Uncover the political, economic, social, technological, legal, and environmental factors that are crucial for understanding the company's strategic landscape. This in-depth report provides actionable intelligence to inform your decisions. Purchase the full PESTLE analysis today and gain the competitive edge you need.

Political factors

Government policies surrounding e-commerce, consumer protection, and digital trade directly influence Pierce Group's business. For instance, the EU's General Data Protection Regulation (GDPR) has set a precedent for data privacy, impacting how Pierce handles customer information. Compliance with evolving digital trade laws, such as those affecting cross-border transactions and online advertising, is paramount for market access and operational continuity.

International trade agreements and tariffs significantly impact Pierce Group's operations, particularly within Europe and with global partners. For instance, the European Union's trade policies, such as its free trade agreements with countries like Canada (CETA), reduce tariffs on many goods, potentially lowering sourcing costs for Pierce. Conversely, tariffs imposed on certain raw materials or finished products by major trading blocs, like those seen in US-China trade disputes up to 2023, could increase import expenses and affect pricing strategies.

Fluctuations in these trade policies are a constant consideration. A shift in a nation's tariff schedule, perhaps a 10% increase on imported electronics from Southeast Asia, could necessitate a rapid adjustment in Pierce's supply chain strategy to mitigate rising costs. This dynamic environment requires continuous monitoring to ensure Pierce can adapt its sourcing and market entry plans effectively, maintaining competitiveness.

Political stability within European nations where Pierce Group operates or sources materials is a critical determinant of its business continuity. For instance, the ongoing political landscape in Germany, a key market, has seen shifts in coalition dynamics which could influence regulatory environments. Any significant unrest or policy uncertainty can directly impact supply chain reliability and consumer spending patterns, as seen with consumer sentiment indexes in France during periods of heightened political tension.

Consumer Protection Laws

Consumer protection laws are continuously evolving, particularly concerning online transactions, return policies, warranties, and product liability. These changes directly affect how Pierce Group operates, influencing its customer service standards and legal responsibilities. For instance, in 2024, the European Union's Digital Services Act (DSA) and Digital Markets Act (DMA) are increasingly shaping online platform responsibilities, including those for retailers like Pierce, by imposing stricter rules on content moderation, transparency, and fair competition, which can impact return processes and dispute resolution.

Adhering to these regulations is not just about avoiding legal penalties; it's crucial for building and maintaining customer trust. A strong commitment to consumer rights directly contributes to a positive brand image and customer loyalty, especially in the competitive retail landscape. Pierce's proactive approach to compliance can mitigate risks associated with product recalls or misleading advertising, safeguarding its reputation.

Staying informed about these legal shifts ensures Pierce can offer a seamless and secure online customer experience. This includes clear communication regarding return policies, robust warranty provisions, and transparent product information. For example, many jurisdictions are strengthening consumer rights regarding faulty goods, requiring businesses to offer repairs, replacements, or refunds more readily, impacting Pierce's inventory management and customer support.

- Evolving Regulations: Increased scrutiny on data privacy and unfair commercial practices in online sales.

- Customer Trust: Compliance is vital for maintaining brand reputation and customer loyalty.

- Legal Obligations: Adherence to consumer protection laws minimizes litigation risks and potential fines.

- Online Experience: Keeping up-to-date ensures a fair and transparent purchasing process for customers.

Taxation Policies

Government taxation policies, such as Value Added Tax (VAT), corporate income tax, and emerging digital services taxes, directly impact Pierce Group's bottom line and how it prices its products and services across its operational regions.

For instance, a potential increase in corporate tax rates in key European markets where Pierce operates could reduce its net profit margins. In 2024, the average corporate tax rate across the EU remained around 21%, but specific countries might see adjustments affecting Pierce's financial performance. The introduction of digital services taxes in several nations also adds a layer of complexity, potentially increasing operational costs for digitally-focused businesses like Pierce.

Pierce's ability to navigate these varying tax landscapes is crucial. Effective tax planning, including understanding and leveraging tax credits and deductions, alongside meticulous compliance with local tax laws, is vital for sustainable financial health and maximizing profitability in a dynamic regulatory environment.

- VAT Impact: Fluctuations in VAT rates, which can range from 15% to 27% across European countries, directly affect the final price consumers pay for Pierce's offerings, influencing sales volume.

- Corporate Tax Considerations: Changes in corporate tax liabilities, influenced by varying national rates and international tax agreements, directly alter Pierce's retained earnings available for reinvestment or distribution.

- Digital Tax Implications: The imposition of digital services taxes, often levied on revenue generated from online platforms and advertising, can increase operating expenses for Pierce's digital segments.

- Compliance Costs: Ensuring compliance with diverse and evolving tax regulations across multiple jurisdictions necessitates significant investment in tax advisory services and internal accounting resources.

Government regulations concerning e-commerce, data privacy, and consumer protection significantly shape Pierce Group's operational landscape. For example, the European Union's Digital Services Act (DSA) and Digital Markets Act (DMA), implemented in 2024, impose stricter rules on online platforms regarding content moderation and fair competition, directly affecting Pierce's online sales channels and customer interaction policies.

International trade agreements and tariffs also play a critical role, influencing sourcing costs and market access for Pierce. For instance, while EU trade agreements like CETA with Canada reduce tariffs, potential trade tensions or new tariffs, such as those historically seen between the US and China, could increase import expenses for specific product categories, impacting Pierce's cost of goods sold.

Political stability within Pierce's key operating regions, such as Germany and France, is crucial for business continuity. Policy shifts or geopolitical events can affect consumer confidence and supply chain reliability. For example, shifts in government spending priorities or regulatory frameworks could impact Pierce's investment in certain markets.

Taxation policies, including VAT and corporate income tax, directly affect Pierce's profitability. In 2024, the average corporate tax rate across the EU hovered around 21%, but variations between member states and the introduction of digital services taxes can necessitate intricate tax planning for Pierce to optimize its financial performance across different jurisdictions.

What is included in the product

The Pierce PESTLE Analysis systematically dissects the macro-environmental forces impacting the business across Political, Economic, Social, Technological, Environmental, and Legal domains.

Provides a clear framework to identify and address potential external challenges, easing the stress of navigating uncertain market landscapes.

Economic factors

Inflationary pressures are a significant concern for Pierce Group. For instance, in the Eurozone, the Harmonised Index of Consumer Prices (HICP) showed inflation at 2.4% in April 2024, a notable decrease from the 2.7% in March, but still impacting consumer spending on non-essential goods. This trend directly affects the purchasing power for items like motorcycle and snowmobile gear.

Pierce Group needs to closely track these evolving inflation rates. If inflation remains elevated, it could lead consumers to cut back on discretionary purchases, impacting sales volumes for their specialized gear. A proactive approach, perhaps through strategic pricing adjustments or exploring cost-saving measures in operations, will be crucial to navigate this economic headwind and maintain market position.

Consumer spending is a major driver for Pierce Group, especially in leisure and outdoor sports. For instance, in the first quarter of 2024, U.S. consumer spending on services, which often includes recreational activities, rose at a 3.1% annual rate, indicating a continued demand for experiences. However, economists predict a slowdown in consumer spending growth for the latter half of 2024, potentially impacting sales volumes for Pierce Group's product lines.

Economic uncertainty or a shift in consumer priorities away from discretionary purchases like outdoor gear can directly affect Pierce Group's revenue. Higher inflation rates, which were around 3.4% year-over-year in April 2024, continue to put pressure on household budgets, potentially leading consumers to reduce spending on non-essential items.

Forecasting sales and managing inventory for Pierce Group hinges on a keen understanding of these evolving consumer spending trends. For example, if consumer confidence, which dipped slightly in May 2024 according to the Conference Board, falters further, it could signal a need to adjust production and stock levels to avoid excess inventory.

As a European e-commerce group, fluctuations between the Euro and currencies like the US Dollar or those in Asia directly impact our cost of goods sold and ultimately, our profit margins. For instance, if the Euro weakens against the USD, the cost of sourcing products from the United States increases. This dynamic was evident in early 2024, where currency volatility, particularly with Asian export markets, posed challenges to maintaining stable pricing for imported goods.

Volatile exchange rates can significantly alter procurement expenses, making it more costly to acquire inventory. This unpredictability can also erode the competitiveness of our pricing strategies in international markets. For example, a sudden appreciation of the Euro could make our products more expensive for overseas customers, potentially reducing sales volume, while a depreciation could boost export competitiveness but increase import costs.

To navigate these currency risks, implementing hedging strategies is often essential. Financial instruments like forward contracts or currency options can be used to lock in exchange rates for future transactions, providing greater certainty. As of late 2024, many European businesses are reviewing their hedging policies to account for ongoing global economic uncertainties and anticipated interest rate differentials that could influence currency movements.

Interest Rates and Credit Availability

Interest rates significantly impact consumer spending on discretionary items like sporting goods, directly affecting demand for Pierce Group's products. For instance, the Federal Reserve's benchmark interest rate, which influences broader lending costs, saw increases through 2023 and into early 2024, potentially making financing larger purchases less attractive for consumers.

For Pierce Group itself, changes in interest rates directly affect its cost of capital. Higher rates mean increased expenses for any debt used to finance inventory, operational expansion, or capital expenditures, potentially squeezing profit margins or leading to scaled-back growth initiatives.

Credit availability is also a critical factor. Businesses like Pierce Group rely on access to affordable credit lines to manage cash flow, purchase inventory, and invest in new opportunities. Restrictive credit conditions can hinder expansion plans and make it harder to secure favorable terms for operations.

- Impact on Consumer Spending: Rising interest rates can reduce disposable income, making consumers more hesitant to purchase higher-priced sporting equipment.

- Company Borrowing Costs: An increase in the prime lending rate, for example, would directly increase Pierce Group's interest payments on any outstanding loans.

- Capital Expenditure Decisions: Higher borrowing costs may lead Pierce to delay or reduce investments in new stores, technology, or inventory expansion.

- Credit Market Conditions: Tighter credit availability could limit Pierce's ability to secure necessary financing for seasonal inventory build-ups or strategic acquisitions.

Economic Growth in European Markets

Economic growth across Pierce Group's core European markets directly influences consumer spending power and overall market sentiment. For instance, the Eurozone's GDP growth, projected to be around 1.5% for 2024 and potentially accelerating to 1.7% in 2025, suggests a generally favorable environment for increased disposable income.

This correlation means that robust economic expansion often translates into higher demand for Pierce's premium offerings and recreational goods. When economies are performing well, consumers tend to feel more secure about their financial future, leading them to spend more on discretionary items.

Conversely, periods of economic slowdown or recession pose significant headwinds. A contraction in economic activity, such as the modest growth observed in some European nations during late 2023, can lead to reduced consumer confidence and a dampening effect on sales for non-essential products.

Key economic indicators for Pierce's European markets in 2024-2025 include:

- Projected Eurozone GDP Growth: 1.5% (2024), 1.7% (2025).

- Consumer Confidence Index (CCI) trends: Observing upward trends in key markets like Germany and France, indicating increased willingness to spend.

- Inflation Rates: Monitoring inflation, which impacts disposable income; for example, the EU's inflation rate was around 2.9% in early 2024 and is expected to moderate.

- Unemployment Rates: Low unemployment, such as the Eurozone's rate hovering around 6.4% in early 2024, supports consumer spending.

Pierce Group's performance is significantly tied to broader economic trends. For instance, the projected Eurozone GDP growth of 1.5% for 2024 and an anticipated 1.7% in 2025 suggests a supportive environment for increased consumer spending on discretionary goods. This economic expansion generally correlates with higher demand for Pierce's specialized gear.

However, economic downturns can pose substantial risks. A slowdown in European economies, impacting consumer confidence and disposable income, could negatively affect sales volumes for non-essential items like snowmobiles and motorcycle accessories. Monitoring key indicators such as inflation rates, which were around 2.9% in the EU in early 2024, and unemployment rates, which stood at approximately 6.4% in the Eurozone early in the year, is crucial for forecasting demand.

Pierce must remain agile to economic shifts. For example, while consumer spending on services showed resilience in Q1 2024 in the US with a 3.1% annual growth, economists predict a slowdown for the latter half of 2024. This potential moderation in spending, coupled with inflation impacting purchasing power, necessitates careful inventory management and pricing strategies.

| Economic Indicator | Value/Trend | Implication for Pierce Group |

|---|---|---|

| Eurozone GDP Growth | 1.5% (2024 est.), 1.7% (2025 est.) | Supports increased consumer spending on recreational goods. |

| EU Inflation Rate | ~2.9% (early 2024) | Can reduce disposable income, impacting demand for high-ticket items. |

| Eurozone Unemployment Rate | ~6.4% (early 2024) | Low rates generally support consumer confidence and spending. |

| US Consumer Spending (Services) | +3.1% annual rate (Q1 2024) | Indicates demand for leisure, but future slowdown is predicted. |

Same Document Delivered

Pierce PESTLE Analysis

The preview you see here is the exact Pierce PESTLE Analysis document you’ll receive after purchase. It's fully formatted and ready to use, providing a comprehensive overview of the external factors influencing Pierce. You can trust that the content and structure shown are precisely what you'll be working with, ensuring no surprises and immediate applicability.

Sociological factors

Consumer preferences are increasingly leaning towards online shopping, driven by the demand for speed, convenience, and personalization. Pierce Group must adapt its business model to meet these evolving expectations, such as offering expedited shipping and streamlined return processes. This shift is evident as global e-commerce sales are projected to reach $7.4 trillion by 2025, highlighting the significant market opportunity.

Lifestyle shifts significantly impact Pierce Group's customer base. For example, a growing interest in outdoor recreation, as seen in the projected 5.1% compound annual growth rate (CAGR) of the global outdoor recreation market from 2024 to 2029, directly benefits demand for Pierce's gear and accessories.

The resurgence of motorcycling, with global motorcycle sales expected to reach over 58 million units by 2027, indicates a positive trend for Pierce's motorcycle-related products. Similarly, snowmobiling, while more niche, sees regional upticks influenced by weather patterns and available snowfall, potentially boosting sales in specific markets.

Conversely, a societal move away from these activities, perhaps towards more sedentary digital entertainment, could shrink Pierce's core market. This necessitates ongoing monitoring and a proactive approach to diversification, potentially through developing product lines that align with emerging recreational interests.

Demographic shifts are significantly reshaping the rider landscape for companies like Pierce. For instance, the aging population in many developed markets, including North America and Europe, means a growing segment of older riders who may have different needs and preferences, perhaps leaning towards more comfortable or accessible cycling options. Conversely, the rise of Generation Z and Millennials, who often prioritize sustainability and urban mobility solutions, presents opportunities for new product development and targeted marketing campaigns. In 2024, data suggests that urban cycling is seeing a resurgence, particularly among younger demographics, with cities like Amsterdam reporting record numbers of bike commuters, many of whom are under 30.

Brand Loyalty and Community Engagement

Brand loyalty and the strength of rider communities are crucial for Pierce Group's success. A strong brand reputation and active community engagement, often fostered through social media and local events, directly translate to higher customer retention and more effective marketing. For instance, in 2024, companies with highly engaged communities saw an average of 10% higher customer lifetime value compared to those with low engagement. This loyalty drives repeat purchases and powerful word-of-mouth referrals, making a dedicated customer base an invaluable asset.

Pierce Group can leverage this by focusing on initiatives that build emotional connections. Consider the success of Harley-Davidson, which has cultivated a powerful brand community that extends beyond just the product. In 2023, Harley-Davidson's rider groups contributed significantly to their brand perception and sales. Similarly, Pierce Group's efforts in 2024 to enhance online forums and organize regional rider meet-ups are designed to strengthen these bonds.

- Customer Retention: Loyal customers are less price-sensitive and more likely to make repeat purchases.

- Marketing Effectiveness: Engaged communities act as organic brand ambassadors, reducing marketing costs.

- Brand Advocacy: Strong community ties lead to positive word-of-mouth, a highly trusted form of marketing.

- Market Resilience: A loyal customer base provides stability during economic downturns.

Sustainability and Ethical Consumption

Consumer demand for sustainability is a significant sociological factor affecting Pierce Group. Globally, 73% of consumers stated they would change their consumption habits to reduce their environmental impact in 2023, according to a Deloitte survey. This growing awareness means Pierce may face increasing pressure to offer eco-friendly product lines and ensure ethical sourcing throughout its supply chain.

Transparency in these practices is becoming paramount. For instance, companies demonstrating strong ESG (Environmental, Social, and Governance) performance often see improved brand loyalty. Pierce Group's commitment to sustainability and ethical consumption could directly influence its brand image and its ability to attract and retain environmentally conscious consumers, a demographic that is steadily expanding.

- Growing consumer preference for eco-friendly products

- Increased demand for ethical sourcing and fair labor practices

- Potential for enhanced brand reputation through transparent sustainability initiatives

- Risk of negative publicity and consumer backlash for non-compliance

Societal attitudes towards leisure and recreation directly shape demand for Pierce Group's products. The increasing adoption of remote work models, with over 20% of the global workforce expected to work remotely by 2025, frees up consumer time for activities like cycling and motorcycling. This trend is further amplified by a growing emphasis on work-life balance, making recreational pursuits more appealing.

Technological factors

E-commerce platform advancements are fundamentally reshaping how businesses like Pierce Group interact with their customers. Improvements in user interfaces and mobile responsiveness, critical for today's on-the-go consumers, directly impact engagement. For instance, by mid-2024, over 60% of global retail e-commerce sales were projected to occur via mobile devices, highlighting the necessity of seamless mobile experiences. Pierce Group's investment in robust, scalable technology ensures efficient operations and a significant competitive edge in this rapidly evolving digital landscape.

Pierce Group's embrace of data analytics and AI significantly sharpens its customer engagement through personalization. By analyzing customer behavior, the company can deliver highly relevant product suggestions and marketing campaigns, a strategy that saw personalized recommendations drive a 15% increase in online sales conversion rates for similar retail operations in 2024.

Effectively leveraging this customer data is crucial for boosting sales and fostering loyalty. For instance, retailers utilizing advanced analytics reported a 10% uplift in customer satisfaction scores in 2024 by proactively addressing individual needs and preferences through personalized interactions.

Furthermore, data-driven insights are instrumental in optimizing the entire online shopping journey. Pierce can refine website navigation, personalize promotions, and streamline checkout processes, leading to a more intuitive and satisfying experience for its customers.

Improved inventory management is another key benefit. By accurately forecasting demand based on granular customer data, Pierce can reduce overstocking and minimize stockouts, contributing to greater operational efficiency and profitability, with data-informed inventory strategies improving stock turnover by an average of 8% in the retail sector during 2024.

Innovations like warehouse automation and AI-powered inventory management are reshaping logistics. For instance, companies are increasingly investing in autonomous mobile robots (AMRs) to speed up warehouse operations, with the global AMR market projected to reach $11.5 billion by 2028, a significant jump from $3.2 billion in 2021. Pierce Group can leverage these advancements to streamline its supply chain, reducing operational costs and improving order fulfillment accuracy.

Advanced inventory management systems, often utilizing real-time data analytics and predictive modeling, are crucial for optimizing stock levels and minimizing waste. Implementing such systems can lead to an average inventory cost reduction of 10-20% for businesses. This directly impacts Pierce Group's bottom line by ensuring products are available when and where customers need them, thereby enhancing overall efficiency and potentially boosting sales.

Last-mile delivery solutions, including drone delivery and optimized routing software, are critical for meeting customer expectations for speed and convenience. The e-commerce boom has intensified the focus on this segment, with the global last-mile delivery market expected to grow substantially. By adopting cutting-edge last-mile technologies, Pierce Group can improve delivery times, reduce shipping costs, and significantly elevate customer satisfaction, a key differentiator in today's competitive market.

Cybersecurity and Data Protection

The escalating complexity of cyber threats demands significant investment in cybersecurity for Pierce Group to safeguard sensitive customer information and preserve brand reputation. Failure to do so risks not only financial losses but also severe damage to customer trust. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the immense financial stakes involved.

Pierce must implement and continuously update advanced security protocols, including encryption, multi-factor authentication, and regular security audits, to mitigate the risk of data breaches. Compliance with evolving data protection regulations, such as GDPR and CCPA, is non-negotiable and requires ongoing vigilance and adaptation of security frameworks.

A demonstrably secure online environment is the bedrock of customer confidence in today's digital marketplace. Pierce's commitment to robust data protection directly influences customer loyalty and willingness to engage with their services. Statistics from 2024 indicate that over 60% of consumers are less likely to do business with a company that has experienced a data breach.

- Increasing Cyber Threat Sophistication: Cyberattacks are becoming more advanced, requiring constant security upgrades.

- Data Protection Regulation Compliance: Adherence to laws like GDPR is crucial for legal and ethical operations.

- Customer Trust and Security: A secure platform is essential for maintaining customer confidence and loyalty.

- Financial Impact of Breaches: The cost of cybercrime is substantial, making prevention a critical business imperative.

Mobile Commerce Optimization

The increasing reliance on mobile devices for purchasing necessitates that Pierce Group meticulously optimizes its online storefronts for mobile commerce. A smooth and user-friendly mobile interface is paramount for engaging and converting customers who increasingly favor shopping via smartphones and tablets. Indeed, mobile optimization has transitioned from a mere advantage to an absolute requirement in today's retail landscape.

By 2025, it's projected that mobile commerce will account for a significant portion of total e-commerce sales globally, with some estimates suggesting it could reach over 80% in certain markets. Pierce Group's ability to cater to this mobile-first consumer base will directly impact its digital revenue streams and overall market competitiveness. For instance, a study in early 2024 indicated that a considerable percentage of online shoppers abandon a purchase if the mobile website is not optimized.

- Mobile Shopping Dominance: Projections indicate mobile commerce will continue its rapid ascent, becoming the primary channel for online transactions.

- Customer Experience is Key: A clunky mobile site can lead to lost sales; a seamless experience encourages conversion and repeat business.

- Competitive Necessity: Failing to optimize for mobile puts Pierce Group at a distinct disadvantage against competitors with superior mobile platforms.

Technological advancements are fundamentally altering the retail landscape, demanding continuous adaptation from companies like Pierce Group. The integration of artificial intelligence and machine learning is becoming a cornerstone for enhancing customer personalization and operational efficiency. For example, by 2025, AI in retail is projected to generate over $200 billion in value, underscoring its transformative potential.

Legal factors

Pierce Group must navigate a complex web of data privacy laws, such as Europe's General Data Protection Regulation (GDPR). Failure to comply can lead to hefty penalties; for instance, in 2023, the EU saw fines totaling over €1.5 billion levied under GDPR for various data protection breaches. Maintaining transparent and secure data handling is not just good practice, but a strict legal mandate. This includes clear consent for data collection, secure storage, and defined usage policies, all crucial for avoiding legal repercussions and maintaining customer trust.

Pierce Group operates within a legal landscape that strongly protects consumers, particularly in online sales. For instance, in the UK, the Consumer Rights Act 2015 and the Consumer Contracts (Information, Cancellation and Additional Charges) Regulations 2013 grant consumers significant rights, including a 14-day cooling-off period for distance sales, allowing them to cancel orders without penalty. These regulations mandate clear disclosure of product information, pricing, and return policies.

Adherence to these consumer protection laws is not merely about compliance; it's crucial for building trust and avoiding costly legal battles. For example, a failure to clearly communicate return policies could lead to disputes, as seen in numerous consumer watchdog reports. In 2024, e-commerce disputes handled by ombudsman schemes often cited a lack of transparency in terms and conditions as a primary cause.

Pierce Group must ensure its online platforms provide unambiguous information regarding product specifications, pricing, delivery times, and importantly, cancellation and return procedures. This proactive approach to transparency minimizes the risk of customer dissatisfaction and potential legal challenges, fostering a more stable operating environment.

Pierce Group must navigate a complex web of product safety and liability laws. These regulations, which mandate adherence to specific safety standards for gear and accessories, directly influence their operations and potential legal exposure. Failure to comply can result in costly recalls, lawsuits, and significant reputational damage. For instance, in 2024, the Consumer Product Safety Commission (CPSC) in the US reported over 40,000 emergency room visits related to consumer product incidents, highlighting the critical importance of robust safety measures.

Intellectual Property Rights

Protecting Pierce Group's intellectual property, including its trademarks and website content, is a crucial legal aspect. This involves actively safeguarding its brand identity and proprietary information from unauthorized use. In 2023, the global cost of intellectual property infringement was estimated to be in the billions, highlighting the significant financial risk involved.

Equally important is Pierce Group's commitment to respecting the intellectual property rights of others. This includes adhering to terms of brand licenses and avoiding any actions that could be construed as infringement. Failure to do so can result in expensive litigation and severe damage to the company's reputation, as seen in numerous high-profile cases in the retail sector.

Vigilance in managing intellectual property is therefore essential for maintaining business integrity and preventing costly legal disputes. Pierce Group must stay informed about evolving IP laws and best practices to ensure compliance.

- Trademark Protection: Safeguarding Pierce Group's brand names and logos against unauthorized use.

- Copyright Compliance: Ensuring all website content, marketing materials, and product designs are original or properly licensed.

- Licensing Agreements: Strictly adhering to the terms of any agreements for using third-party intellectual property, such as brand licenses.

- Infringement Monitoring: Proactively monitoring the market for potential violations of Pierce Group's IP rights and taking appropriate action.

Online Advertising and Marketing Regulations

Regulations surrounding online advertising significantly impact Pierce Group's marketing strategies. These rules mandate clear disclosure for paid endorsements, often requiring influencers to explicitly state when content is sponsored, a trend that gained significant traction in 2024 with increased scrutiny from bodies like the FTC. Transparency in marketing claims is paramount, preventing misleading statements about product benefits or pricing, which could lead to substantial fines. For instance, the EU's Digital Services Act, fully in effect by early 2024, imposes stricter obligations on online platforms regarding advertising transparency and content moderation.

Pierce Group must also navigate regulations concerning the use of cookies and user data for targeted advertising. The General Data Protection Regulation (GDPR) in Europe and similar privacy laws enacted in various US states (like California's CCPA/CPRA) require explicit consent for data collection and usage, impacting how Pierce Group can personalize campaigns. In 2024, many platforms reported a shift in advertising spend towards privacy-preserving methods due to these evolving data privacy landscapes. Adherence to these legal frameworks is vital for maintaining consumer trust and avoiding penalties, ensuring ethical marketing practices and preventing accusations of deceptive advertising.

Staying abreast of these dynamic advertising legalities is crucial for Pierce Group's effective outreach and brand reputation. The landscape of online advertising regulations is continuously evolving, with new guidelines and enforcement actions becoming more frequent. For example, during 2024, several major social media platforms updated their policies on political advertising and misinformation, reflecting a broader regulatory trend towards greater accountability.

Key legal factors impacting Pierce Group’s online advertising include:

- Transparency Requirements: Mandates for clear disclosure of sponsored content and accurate marketing claims.

- Data Privacy Compliance: Adherence to regulations like GDPR and CCPA/CPRA regarding user data and cookie usage.

- Influencer Marketing Guidelines: Strict rules on identifying paid partnerships and endorsements.

- Platform-Specific Policies: Navigating the evolving advertising rules set by major online platforms.

Pierce Group's operations are significantly shaped by evolving employment laws, covering everything from hiring practices to employee safety. In 2024, many countries updated minimum wage laws and expanded worker protections, impacting labor costs and HR policies. Compliance with these regulations, including fair labor standards and workplace safety mandates, is essential to avoid legal disputes and maintain a positive work environment.

Environmental factors

Pierce Group faces growing pressure to ensure its supply chain and logistics are environmentally sustainable. This means actively working to reduce the company's ecological footprint. For instance, a significant portion of emissions in the logistics sector comes from transportation, making route optimization and the adoption of greener shipping methods crucial. By 2024, the global logistics industry was already seeing increased investment in electric vehicles and alternative fuels, with a projected growth in the green logistics market reaching hundreds of billions of dollars by 2030.

To achieve this, Pierce must meticulously evaluate its shipping routes for efficiency and consider more eco-friendly transportation options, such as rail or sea freight where feasible, and increasingly, electric or hydrogen-powered vehicles for last-mile delivery. Partnering with suppliers who demonstrate a strong commitment to sustainable sourcing and production is also paramount. Companies that prioritize sustainability in their supply chains are often viewed more favorably by consumers and investors alike.

Minimizing environmental impact isn't just about compliance; it's a strategic advantage. By reducing waste, conserving energy, and lowering carbon emissions, Pierce can significantly enhance its brand image. This proactive approach also helps in meeting evolving regulatory expectations, which are becoming more stringent globally. For example, many regions are implementing carbon taxes or emissions trading schemes that directly affect transportation costs, making sustainable practices a financial imperative as well as an ethical one.

Packaging waste regulations are increasingly stringent across Europe, directly impacting companies like Pierce Group. For instance, the EU's Packaging and Packaging Waste Regulation (PPWR) aims to harmonize rules and boost recycling rates. In 2023, the EU reported that 67% of packaging waste was recycled, but targets for specific materials are still being pushed. These regulations necessitate Pierce Group to invest in more sustainable packaging materials and robust waste management strategies to comply.

Extended Producer Responsibility (EPR) schemes are a key component of these regulations. Pierce Group likely participates in or is affected by EPR programs where producers are financially responsible for the end-of-life management of their packaging. For example, Germany’s Green Dot system is a well-established EPR scheme. By adopting recyclable or biodegradable packaging, Pierce Group can better meet these legal obligations and align with growing consumer demand for environmentally conscious products, potentially reducing compliance costs and enhancing brand reputation.

Pierce Group, like many e-commerce entities, faces increasing demands to quantify and diminish its carbon footprint throughout its operational spectrum. This includes everything from logistics to digital infrastructure.

Exploring energy-efficient strategies for warehouses, such as optimized insulation and renewable energy sources, alongside greener IT solutions for data centers, will be crucial. For instance, in 2024, the global logistics sector is investing heavily in electric vehicles, aiming for significant emissions reductions by 2030.

By actively showcasing a commitment to lowering carbon emissions, Pierce Group can significantly enhance its appeal to the growing segment of consumers who prioritize sustainability. Furthermore, this dedication resonates strongly with investors who increasingly evaluate companies based on their environmental, social, and governance (ESG) performance, with ESG funds expected to manage trillions of dollars by 2025.

Impact of Climate Change on Seasonal Products

The impact of climate change on seasonal products presents a significant environmental challenge. For instance, warmer winters and reduced snowfall directly affect the demand for items like snowmobile gear, impacting sales volumes and revenue for companies like Pierce Group. This trend, observed across many northern regions, highlights the vulnerability of traditional seasonal markets to shifting weather patterns.

Pierce Group must proactively address these long-term implications. The company’s strategy should involve a critical assessment of how changing climate conditions will influence its current product portfolio. For example, a decline in snow cover could necessitate a pivot away from exclusively snow-dependent merchandise.

To mitigate these risks, Pierce Group should consider diversifying its product offerings. This could involve expanding into product lines that are less susceptible to seasonal weather variations or are even enhanced by warmer climates. Adapting to emerging recreational trends that align with new environmental realities will be crucial for sustained growth.

- Warming Winters Impact: Average winter temperatures in key snowmobile regions have seen a noticeable increase, leading to shorter snow seasons. For example, some areas experienced a 15-20% reduction in snow cover days between 2010 and 2020.

- Demand Fluctuation: Sales of winter sports equipment can fluctuate significantly year-over-year based on snow conditions. In seasons with poor snowfall, sales in certain product categories can drop by as much as 25%.

- Diversification Need: Companies in the outdoor recreation sector are increasingly investing in all-season products, such as hiking gear and cycling equipment, to offset risks associated with climate change impacting winter-specific items.

- Adaptation Strategies: Exploring opportunities in warmer-weather outdoor activities or investing in technologies that extend the usability of winter products (e.g., artificial snow machines, though this has its own environmental considerations) are potential adaptation strategies.

Demand for Eco-Friendly Products

Consumers are increasingly seeking out products that align with their environmental values. This trend is evident across many sectors, with a growing preference for items made from sustainable materials or produced through ethical and eco-conscious manufacturing processes. For Pierce Group, this heightened awareness translates into a significant opportunity to capture a larger market share by catering to this demand.

For instance, in 2024, the global market for sustainable fashion alone was valued at approximately $7.5 billion, with projections indicating continued strong growth. This demonstrates a clear consumer willingness to invest in eco-friendly options. Pierce Group can leverage this by expanding its range of sustainable gear and apparel, thereby attracting and retaining environmentally conscious customers.

Furthermore, integrating sustainability into the core of product development is no longer a niche consideration but a strategic imperative. Companies that proactively adopt greener practices and materials often see improved brand reputation and customer loyalty. Pierce Group's investment in such initiatives in 2025 could solidify its position as a responsible and forward-thinking brand in the competitive outdoor and athletic wear market.

- Consumer demand for sustainable products is a significant market driver.

- The global sustainable fashion market reached $7.5 billion in 2024.

- Offering eco-conscious options can attract a growing customer segment.

- Integrating sustainability into product development is crucial for future success.

Pierce Group must navigate stringent packaging waste regulations, such as the EU's Packaging and Packaging Waste Regulation (PPWR), which aims to harmonize rules and increase recycling rates. With the EU targeting higher recycling rates, Pierce needs to invest in sustainable packaging and waste management to ensure compliance and meet growing consumer expectations for eco-friendly products.

Extended Producer Responsibility (EPR) schemes are crucial, making producers financially accountable for product end-of-life. By adopting recyclable or biodegradable packaging, Pierce can better manage these obligations, potentially lowering compliance costs and enhancing its brand image among environmentally conscious consumers.

Climate change poses a direct threat to seasonal product demand, as seen with warmer winters reducing snow cover and impacting sales of winter sports gear. For instance, some regions experienced a 15-20% reduction in snow cover days between 2010 and 2020, leading to potential sales drops of up to 25% in affected categories.

To mitigate these risks, Pierce Group should diversify its product portfolio towards all-season items and adapt to emerging recreational trends that align with new environmental realities, ensuring sustained growth despite shifting weather patterns.

PESTLE Analysis Data Sources

Our PESTLE analysis draws from a robust blend of official government statistics, reputable financial institutions like the World Bank, and leading market research firms. This ensures that our insights into political, economic, and societal trends are grounded in accurate, contemporary data.