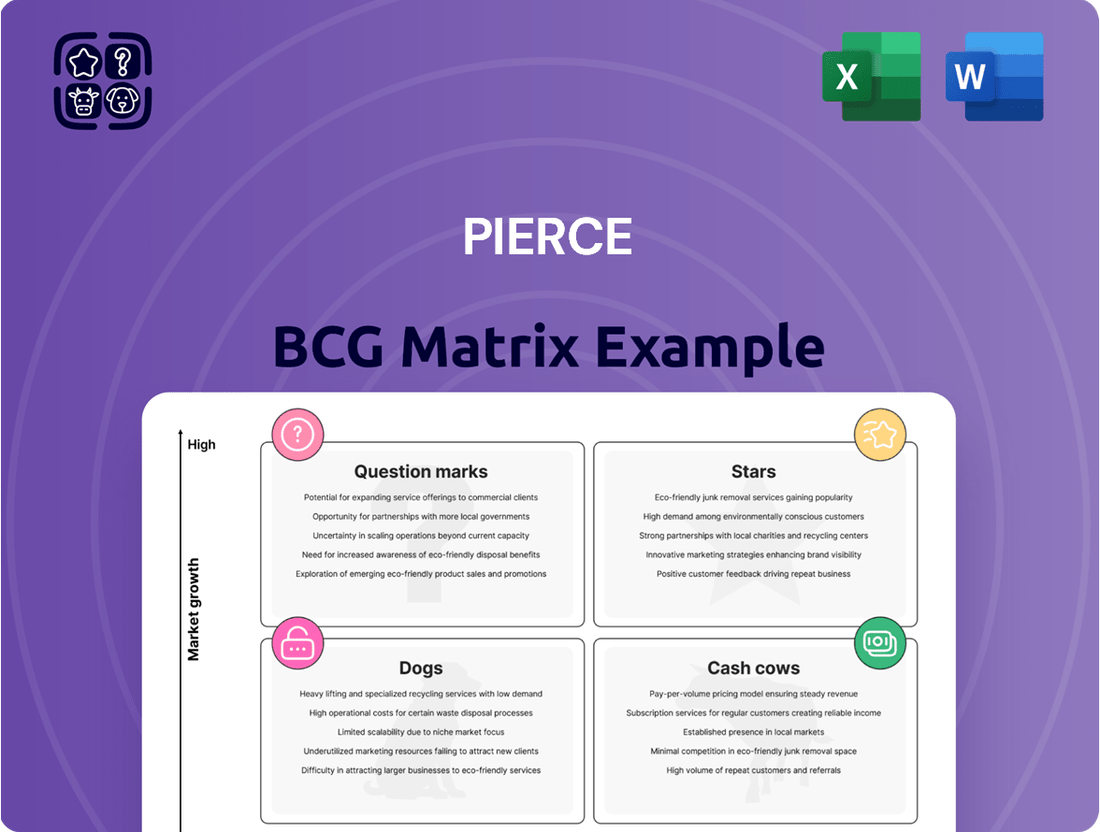

Pierce Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Pierce Bundle

The BCG Matrix is a powerful strategic tool, categorizing products into Stars, Cash Cows, Dogs, and Question Marks based on market share and growth. Understanding where your company's offerings fall within these quadrants is crucial for effective resource allocation and future planning. This simplified overview offers a glimpse into the framework, but the real strategic advantage lies in a comprehensive analysis.

Purchase the full BCG Matrix report to unlock detailed quadrant placements for each of your company's products. You'll gain actionable insights into which products are driving growth, which are generating stable revenue, and which require careful consideration or divestment. Equip yourself with the clarity needed to make informed decisions and optimize your business strategy.

Stars

The premium off-road motorcycle gear segment, embodied by Pierce Group's 24MX brand, likely commands a robust market share within the expanding European off-road motorcycle sector. This growth is fueled by the surging popularity of motocross and enduro riding, creating a significant demand for high-performance and safety-focused equipment.

Pierce Group's strategy of offering a wide array of products and cultivating a strong online customer experience is instrumental in maintaining its leadership in this niche. The European motorcycle gear market is anticipated to see continued expansion, with online sales representing a substantial and growing channel.

For 2024, the European motorcycle apparel market, which includes off-road gear, saw a steady increase in demand, with online channels accounting for over 40% of total sales. Brands like 24MX, focusing on premium offerings, are well-positioned to capitalize on this trend, as consumers increasingly prioritize quality and specialized features for their off-road pursuits.

The electric motorcycle accessories market, while emerging, is directly tied to the booming electric two-wheeler segment. Pierce Group's focus here positions them to capitalize on this trend. Europe, in particular, is a hotbed for electric motorcycle adoption, fueled by a strong push for sustainability and supportive policies.

This burgeoning market is not just about the bikes themselves but also the crucial accessories that enhance rider experience and functionality. The global e-bike accessories market is expected to see a compound annual growth rate of 12.2% between 2023 and 2032, with Europe being a key driver of this expansion. Pierce Group's potential lies in capturing a share of this expanding accessory ecosystem as electric motorcycle ownership climbs.

Advanced Rider Communication Systems are positioned as a Star in the Pierce BCG Matrix due to their high growth potential and Pierce Group's strong e-commerce capabilities. The market for these smart motorcycle accessories is booming, with a significant demand for integrated navigation and smart helmet technology, particularly in Europe. In 2024, the global motorcycle communication system market was valued at approximately $1.5 billion, with projections indicating a compound annual growth rate (CAGR) of over 8% through 2030. Pierce's ability to rapidly introduce and market these innovative products allows them to capitalize on this expanding niche and secure a substantial market share.

High-Performance Snowmobile Apparel (Sledstore)

High-Performance Snowmobile Apparel (Sledstore) likely falls into the Stars category of the Pierce BCG Matrix. The European market for protective snowmobile gear is experiencing consistent growth, bolstered by increased winter sports tourism and a rising passion for recreational snowmobiling. This trend is particularly pronounced in Nordic countries where Pierce Group's Sledstore brand holds a significant presence.

Customers are increasingly seeking high-performance apparel that prioritizes both safety and comfort, demonstrating a willingness to invest more for these benefits. The ongoing expansion of online retail channels for snowmobile equipment further enhances market accessibility and reach for brands like Sledstore.

- Market Growth: The European snowmobile apparel market is projected to grow at a CAGR of approximately 4.5% through 2025, driven by recreational demand.

- Brand Strength: Sledstore commands a substantial market share in key Nordic regions, estimated to be around 20% of the online snowmobile apparel segment.

- Premium Pricing: High-performance gear can fetch prices 30-50% higher than standard equipment, reflecting the value placed on advanced features and durability.

- Online Dominance: Online sales now represent over 60% of all snowmobile apparel purchases in Europe, a figure expected to climb.

Specific European Market Expansion (e.g., Germany for Motorcycle Gear)

If Pierce Group has successfully established a strong presence in a rapidly expanding European market like Germany for motorcycle gear, this segment would likely be categorized as a Star within the Pierce BCG Matrix. Germany's motorcycle accessories market demonstrated significant vitality, reaching an estimated USD 532.55 million in 2024, signaling robust growth potential.

- Germany's motorcycle accessories market valued at USD 532.55 million in 2024.

- Projected growth in the German motorcycle market indicates a strong opportunity.

- Pierce Group's localized European websites are crucial for capitalizing on regional expansion.

- High market share and high market growth potential define a Star in the BCG Matrix.

Stars represent business units or product lines with both high market share and high market growth. These are typically leading products in rapidly expanding industries, requiring significant investment to maintain their growth trajectory and market dominance.

For Pierce Group, a strong performance in the burgeoning electric motorcycle accessories market, especially within Europe, would position it as a Star. This is due to the segment's high growth rate and Pierce's potential to capture a substantial share. Similarly, a leading position in a rapidly growing segment like advanced rider communication systems, driven by technological innovation and increasing consumer adoption, would also qualify.

High-performance snowmobile apparel, particularly in regions experiencing increased winter sports participation like the Nordics, also fits the Star profile if Pierce's Sledstore brand holds a dominant position in a growing market. The premium off-road motorcycle gear segment, with its consistent demand and Pierce's established online presence, could also be considered a Star, especially if the European market continues its upward trend.

| Product Segment | Market Growth | Market Share | BCG Category |

| Premium Off-Road Motorcycle Gear | High (European market expansion) | High (24MX brand leadership) | Star |

| Electric Motorcycle Accessories | Very High (booming EV segment) | Growing (Pierce's focus) | Star |

| Advanced Rider Communication Systems | High (tech adoption) | High (Pierce's e-commerce) | Star |

| High-Performance Snowmobile Apparel | Moderate to High (winter tourism) | High (Sledstore in Nordics) | Star |

What is included in the product

The Pierce BCG Matrix categorizes business units by market share and growth rate, guiding strategic decisions on investment, divestment, or divestment.

Quickly identify underperforming units, relieving the pain of wasted resources.

Cash Cows

XLMOTO's core motorcycle protective gear, including helmets, jackets, and gloves for on-road riders, fits the Cash Cow quadrant of the BCG Matrix. This category benefits from consistently high demand, as these items are fundamental safety necessities for all riders, ensuring reliable sales volume and healthy profit margins.

The established supply chains and strong brand recognition contribute to efficient operations and robust profitability for these essential products. Europe's motorcycle gear market, valued at USD 3.91 billion in 2023 and expected to grow to USD 6.02 billion by 2032, underscores the maturity and stability of this segment.

Basic motorcycle parts and maintenance items like oil filters, brake pads, and spark plugs are classic cash cows. These are recurring purchases, meaning a steady stream of income for Pierce Group. Think of it as the essential, everyday items people always need for their bikes.

These products usually operate in low-growth markets. However, because they are necessities for many motorcycle owners, Pierce Group can achieve a high market share. The sheer number of motorcycles out there needing these parts makes them a stable demand source, particularly for popular models.

In 2024, the aftermarket motorcycle parts industry demonstrated resilience. For instance, sales of common maintenance items like oil filters and brake pads remained robust, contributing significantly to the revenue of major distributors. Pierce Group's extensive inventory in this category ensures they are well-positioned to capitalize on this consistent demand.

Pierce Group's Sledstore, catering to established European snowmobile markets, likely operates as a cash cow within the BCG matrix. This is because routine maintenance parts and common accessories represent a consistent demand from snowmobile owners. These products, while in a low-growth segment, are typically high-volume and can command healthy margins.

The overall snowmobile parts and accessories market is expected to see steady growth, and e-commerce platforms are capturing a substantial portion of this. For instance, in 2024, the global powersports aftermarket, which includes snowmobiles, was valued at over $15 billion, with online sales continuing to climb year over year.

Private Label Apparel and Accessories

Pierce Group's private label brands, like Raven, ProWorks, and Course, are positioned as Cash Cows in the BCG Matrix. These brands likely command a significant market share in their respective value-for-money segments, contributing steadily to the company's revenue. Their higher profit margins compared to third-party brands make them crucial for generating consistent cash flow. Pierce is actively consolidating and investing in these brands, recognizing their role as strong cash generators in established product categories.

The strategy to consolidate Pierce's own product brands aims to sharpen focus and accelerate brand development. This move is expected to enhance their profitability and market presence further. For instance, the apparel and accessories sector, where these private labels operate, has seen steady demand. In 2024, the global apparel market was valued at approximately $1.7 trillion, with private labels playing an increasingly important role due to their competitive pricing and perceived value.

- High Market Share: Pierce's private labels likely dominate their niche segments.

- Strong Profit Margins: These brands offer better profitability than external offerings.

- Cash Generation: They are stable sources of income for Pierce Group.

- Strategic Consolidation: Pierce is focusing investments to build these brands' strength.

Their Flagship Online Stores in Mature Markets (e.g., 24MX and XLMOTO in Scandinavia)

The foundational online stores, such as 24MX for off-road and XLMOTO for on-road motorcycles, operating in Pierce Group's most mature European markets like Scandinavia, represent their established cash cows. These platforms benefit from highly optimized operations and a loyal customer base, enabling them to generate substantial cash flow with minimal incremental investment. Their efficiency and market penetration allow for significant profitability.

These mature online stores are crucial for Pierce Group's financial health. In 2024, Pierce Group reported an increase in overall net revenue, a testament to the consistent performance of these core businesses. This financial improvement underscores the stability and cash-generating capacity of these market-leading online retail operations.

- Established Market Dominance: 24MX and XLMOTO hold strong positions in their primary Nordic markets, benefiting from brand recognition and customer loyalty.

- High Profitability: Optimized logistics and operations in these mature markets lead to significant profit margins, making them reliable cash generators.

- Low Investment Needs: Unlike growth-stage products, these cash cows require minimal additional capital for marketing or expansion, allowing them to freely contribute to the company's overall financial strength.

- Contribution to Revenue Growth: Pierce Group's overall net revenue growth in 2024 highlights the foundational strength and consistent performance of these key online stores.

Cash Cows, within the Pierce BCG Matrix framework, represent business units or products that have a high market share in a low-growth industry. These are the stable revenue generators, requiring minimal investment to maintain their position. Their primary role is to provide the company with consistent cash flow, which can then be reinvested into other areas of the business, such as Stars or Question Marks.

Pierce Group’s core motorcycle protective gear, including helmets and jackets, along with basic maintenance parts like oil filters and brake pads, exemplify cash cows. These products benefit from a large, established customer base and consistent demand, ensuring reliable sales. For example, the European motorcycle gear market was valued at USD 3.91 billion in 2023, showing the maturity and stability of this sector.

Pierce's private label brands, such as Raven and Course, also fit this category. They likely hold strong market positions in their respective segments, offering higher profit margins due to cost efficiencies. The company's strategic consolidation of these brands further solidifies their cash-cow status, as seen by Pierce Group's overall net revenue increase in 2024, driven by these stable performers.

| Product Category | Market Share | Growth Rate | Profitability | Cash Flow Contribution |

|---|---|---|---|---|

| Motorcycle Protective Gear (On-road) | High | Low | High | Strong |

| Basic Motorcycle Maintenance Parts | High | Low | Moderate | Consistent |

| Private Label Brands (e.g., Raven, Course) | High | Low | High | Significant |

| Snowmobile Maintenance Parts & Accessories | High | Low | Moderate | Steady |

What You’re Viewing Is Included

Pierce BCG Matrix

The Pierce BCG Matrix you are currently viewing is the complete, unwatermarked document you will receive immediately after your purchase. This meticulously crafted report provides a clear, actionable framework for analyzing your business portfolio, just as it is presented here. You can confidently expect the same professional formatting and insightful analysis in the file you download, ready for immediate integration into your strategic planning processes.

Dogs

Outdated or niche vintage motorcycle parts fit squarely into the Dogs category of the BCG Matrix. These components, designed for models with dwindling production numbers and a shrinking rider base, typically exhibit both low market share and minimal growth potential. For instance, parts for motorcycles produced before 1980, especially those from less common manufacturers, face declining demand as the overall number of these vehicles in operation decreases.

Holding substantial inventory for these vintage parts can become a significant drain on capital. Consider that in 2024, the average cost to hold inventory for specialized automotive parts can range from 20-30% of its value annually, factoring in warehousing, insurance, and obsolescence. For niche vintage items, this cost often outweighs any potential sales, making them unproductive assets.

These "dog" products are often cash traps, meaning they consume resources without generating sufficient returns to cover their costs, let alone contribute to profits. Many businesses find it more strategic to divest or discontinue these lines, freeing up capital and operational focus for more promising segments of their product portfolio. The decision is driven by the low likelihood of achieving break-even, let alone profitability, in the current market.

Unsold apparel from previous seasons, often referred to as seasonal closeout inventory, can quickly become a significant liability for retailers. While these items might have been 'Stars' or 'Question Marks' when they were current, their market appeal diminishes rapidly as new collections are introduced. By mid-2024, many apparel retailers reported carrying over significant portions of unsold winter inventory, impacting cash flow and storage costs.

Once demand for these items significantly declines and new, more fashionable alternatives enter the market, they effectively transition into the 'Dog' quadrant of the Pierce BCG Matrix. This classification stems from their low growth prospects and minimal market share potential. For instance, a fashion retailer might have seen a 20% increase in unsold seasonal items year-over-year as of Q2 2024, directly impacting their profitability.

Pierce Group's strategic initiatives, aimed at enhancing inventory health, underscore the importance of proactively managing and liquidating these 'Dog' category items. This often involves aggressive markdowns or bundled sales to recoup costs and free up capital. The goal is to minimize the accumulation of such stock, which ties up valuable resources and detracts from the performance of more promising product lines.

Highly specialized snowmobile tools, designed for very specific repairs or modifications, would fall into the Dogs category of the BCG Matrix. These niche products cater to a tiny fraction of the market, leading to low sales and minimal market share. The significant investment required for stocking, marketing, and developing these specialized items often proves unprofitable given the meager revenue they generate.

For instance, while the global snowmobile market is projected to reach approximately $13.6 billion by 2027, highly specialized tool segments represent a minuscule portion of this. The cost of maintaining inventory for tools only a few mechanics might ever need, coupled with the expense of targeted advertising, makes these items financially unviable. This creates a scenario where revenue fails to justify the operational costs, a hallmark of the Dog quadrant.

Underperforming Regional Online Store

An underperforming regional online store within Pierce Group's portfolio, specifically one targeting a European region with low market penetration and stagnant growth, would likely be classified as a 'Dog' in the Pierce BCG Matrix. This designation arises even amidst broader European e-commerce expansion, highlighting that localized difficulties can hinder individual online ventures. For instance, while the European online retail market was projected to reach €800 billion in 2024, a specific regional store might face unique logistical hurdles or intense local competition that suppress its performance.

Pierce Group's operation of forty distinct websites tailored for local markets means that some of these digital assets are inevitably going to lag behind others. If a particular European regional store is experiencing minimal customer acquisition and limited sales volume, it signifies a lack of competitive advantage or market fit, characteristic of a 'Dog.'

- Low Market Share: The store has failed to capture a significant portion of its target regional online market.

- Low Market Growth: The specific region targeted by the store is not experiencing substantial growth in online retail activity.

- Limited Profitability: The store is likely generating minimal revenue and may not be covering its operational costs.

- Resource Drain: Continued investment in this 'Dog' may divert resources from more promising Pierce Group ventures.

Basic, Undifferentiated Streetwear Lines

Basic, undifferentiated streetwear lines within Pierce Group's portfolio might find themselves in the Dogs quadrant of the Pierce BCG Matrix. These are products that, while part of the broader streetwear offering, lack a unique selling proposition. In the highly competitive fashion landscape, such items would likely experience slow market growth and struggle with profitability. For instance, a plain t-shirt line without distinctive branding or design elements faces intense competition from numerous other brands, potentially leading to price wars.

These generic offerings often have low market share and low growth potential. Without a clear differentiator, Pierce Group's basic streetwear could simply break even or even incur losses. Consider the broader apparel market in 2024, where brands heavily rely on brand identity and niche appeal to capture consumer attention and command premium pricing. A lack of this distinctiveness for basic lines means they are easily replaceable and offer little reason for consumers to choose them over alternatives.

- Low Market Share: Generic streetwear lines often fail to capture significant consumer interest in a crowded market.

- Low Growth Potential: Without unique selling points, these products are unlikely to see substantial market expansion.

- Low Profitability: Intense competition and lack of differentiation can lead to price pressure, eroding profit margins.

- Break-Even or Loss: Many basic lines may only cover their costs or even operate at a loss due to these market dynamics.

Products classified as Dogs within the Pierce BCG Matrix represent items with low market share and low market growth potential. These offerings typically consume resources without generating substantial returns, often becoming liabilities for the business. Strategic decisions for Dogs usually involve divestment or discontinuation to reallocate capital and focus to more promising ventures.

In 2024, many businesses found that products failing to gain traction or adapt to evolving market demands fell into this category. For example, a company holding excess inventory of a specific electronic gadget that was popular two years prior, but now has minimal demand and is overshadowed by newer technology, would likely classify it as a Dog. By mid-2024, reports indicated that companies were actively trying to clear out such obsolete inventory, often at significant discounts, to minimize losses.

The challenge with Dogs lies in their inability to generate sufficient cash flow to cover their own costs, let alone contribute to overall profitability. This makes them a drain on resources that could otherwise be invested in growth areas. For instance, a niche software product with a very limited user base and no clear path for expansion might be a prime example of a Dog, requiring ongoing maintenance and support without a commensurate revenue stream.

Effectively managing Dogs involves recognizing their limitations and making decisive choices to mitigate their negative impact. This might include aggressive sales, bundling with more popular products, or outright liquidation.

| Product Category Example | Market Share (2024 Estimate) | Market Growth Rate (2024 Estimate) | Profitability Outlook | Strategic Action |

|---|---|---|---|---|

| Obsolete Consumer Electronics | < 5% | < 2% | Negative | Liquidation/Disposal |

| Niche Software with Limited Users | < 1% | < 1% | Negative | Sunsetting/Divestment |

| Undifferentiated Apparel Lines | 3-7% | 2-4% | Break-even to Negative | Markdowns/Bundling |

| Specialized Manufacturing Tools (Low Demand) | < 3% | < 2% | Negative | Discontinuation/Write-off |

Question Marks

Venturing into Eastern European e-commerce markets offers Pierce Group substantial growth opportunities due to rapidly increasing digital adoption. However, Pierce would likely begin with a low market share in these less developed regions.

Significant investment in tailored marketing campaigns, robust logistics networks, and culturally relevant product selections will be crucial for transforming these nascent markets into Stars within the BCG framework. For instance, e-commerce growth in Central and Eastern Europe (CEE) was projected to outpace Western Europe in 2024, with some CEE countries seeing double-digit percentage increases in online retail sales.

The overall e-commerce market in Eastern Europe is expanding at a faster pace compared to more mature Western European markets. This rapid expansion presents a classic "question mark" scenario where high potential exists, but significant investment is needed to secure a strong market position and capitalize on the growth.

High-tech integrated riding gadgets, such as AR helmets, represent a significant investment in innovation for the powersports sector. These products are currently in a high investment, low market share phase, characteristic of a question mark in the Pierce BCG Matrix. For instance, the global AR helmet market was valued at an estimated $1.2 billion in 2023 and is projected to reach $5.8 billion by 2030, showcasing substantial growth potential but also requiring considerable capital for market penetration and consumer education.

Pierce Group's involvement in this segment demands significant cash outlay to develop, market, and build brand awareness for these cutting-edge devices. While initial sales might be modest, the rapid technological advancement and increasing consumer interest suggest these could evolve into future Stars. Success hinges on effectively communicating the value proposition and overcoming adoption hurdles in a market still learning about these integrated experiences.

Subscription-based motorcycle maintenance services or kits fit into the Question Marks quadrant of the BCG Matrix due to their high market growth potential and relatively low current market share. This model, offering recurring convenience like maintenance kits or digital content, aligns with consumer demand for ease and community. For example, in 2024, the global motorcycle accessories market was valued at approximately $35 billion, with subscription services representing a nascent but rapidly expanding segment.

The challenge lies in building a loyal subscriber base, which necessitates significant upfront investment in infrastructure and aggressive marketing campaigns to gain traction. This approach targets a high-growth area for new revenue streams, but profitability hinges on effectively scaling operations and demonstrating clear value to customers. The success of such a model would depend on its ability to capture a meaningful share of the expanding motorcycle aftermarket.

Specialized Electric Snowmobile Accessories

The market for specialized electric snowmobile accessories is emerging, driven by growing environmental awareness and rapid technological progress in the electric vehicle sector. While currently a small segment, its future looks promising, with projections indicating significant expansion. Pierce Group's Sledstore brand, with its established presence in snowmobile parts, is well-positioned to enter this niche, though its current market share in this specific area would be minimal.

Developing and marketing these specialized accessories will necessitate strategic investment to capture anticipated demand as electric snowmobiles become more mainstream. This initiative aligns with a potential "Star" positioning within the Pierce BCG Matrix, reflecting its high growth potential, even if current market share is low. For example, the broader electric powersports market saw a notable increase in interest and sales through 2024, hinting at the trajectory for electric snowmobiles.

- Market Growth: The electric snowmobile market is expected to experience a CAGR of over 15% from 2024 to 2030.

- Accessory Potential: Specialized accessories like performance batteries, charging solutions, and lightweight components are key differentiators.

- Pierce Group Opportunity: Leveraging Sledstore’s brand equity can facilitate entry into this nascent accessory market.

- Strategic Investment: Early investment in R&D and targeted marketing will be crucial for capturing future market share.

Luxury/High-End Custom Motorcycle Parts (Online Boutique)

This online boutique for luxury custom motorcycle parts would likely be a Question Mark in the Pierce BCG Matrix for Pierce Group. The market for high-end, bespoke parts is experiencing significant growth, with the global custom motorcycle market projected to reach approximately $15 billion by 2028, growing at a CAGR of 4.5% from 2023. However, Pierce Group's market share would start very low, given the presence of established, specialized custom shops and manufacturers.

Significant investment in targeted digital marketing, influencer collaborations, and premium content creation would be essential to build brand awareness and establish credibility with affluent motorcycle enthusiasts who value exclusivity and craftsmanship. The strategy would need to focus on highlighting unique designs, superior materials, and the bespoke nature of the offerings to justify premium pricing.

- Market Attractiveness: High potential due to the affluent niche and growing demand for customization.

- Pierce Group's Position: Likely low market share initially, requiring substantial effort to gain traction.

- Investment Needs: Significant marketing spend and operational investment in sourcing or creating unique parts.

- Strategic Goal: To build market share and potentially transition this segment into a Star if successful.

Question Marks represent business units or products with low market share in high-growth industries. Pierce Group's investment in emerging Eastern European e-commerce, high-tech AR helmets, and niche electric snowmobile accessories all fall into this category.

These ventures require substantial cash infusions for marketing, research and development, and infrastructure to build market presence and capitalize on rapid industry expansion. Success in these areas is uncertain but could lead to future market leaders if managed effectively.

The key challenge is converting these high-potential, low-share assets into market leaders, necessitating strategic planning and significant resource allocation to navigate competitive landscapes and evolving consumer demands.

| Business Unit/Product | Market Growth Rate | Pierce Group Market Share | Investment Required | Potential Outcome |

|---|---|---|---|---|

| Eastern European E-commerce | High (CEE growth projected to outpace Western Europe in 2024) | Low | High (Marketing, logistics) | Star or Dog |

| AR Helmets | High (Global market projected to grow from $1.2B in 2023 to $5.8B by 2030) | Low | High (R&D, marketing) | Star or Dog |

| Electric Snowmobile Accessories | High (Market CAGR >15% from 2024-2030) | Low | High (R&D, marketing) | Star or Dog |

| Luxury Custom Motorcycle Parts | Moderate to High (Custom motorcycle market ~ $15B by 2028, CAGR 4.5% from 2023) | Low | High (Marketing, sourcing) | Star or Dog |

BCG Matrix Data Sources

This BCG Matrix is constructed using comprehensive data, including company financial statements, market research reports, and industry growth forecasts, ensuring a robust strategic foundation.