Paragon Care PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Paragon Care Bundle

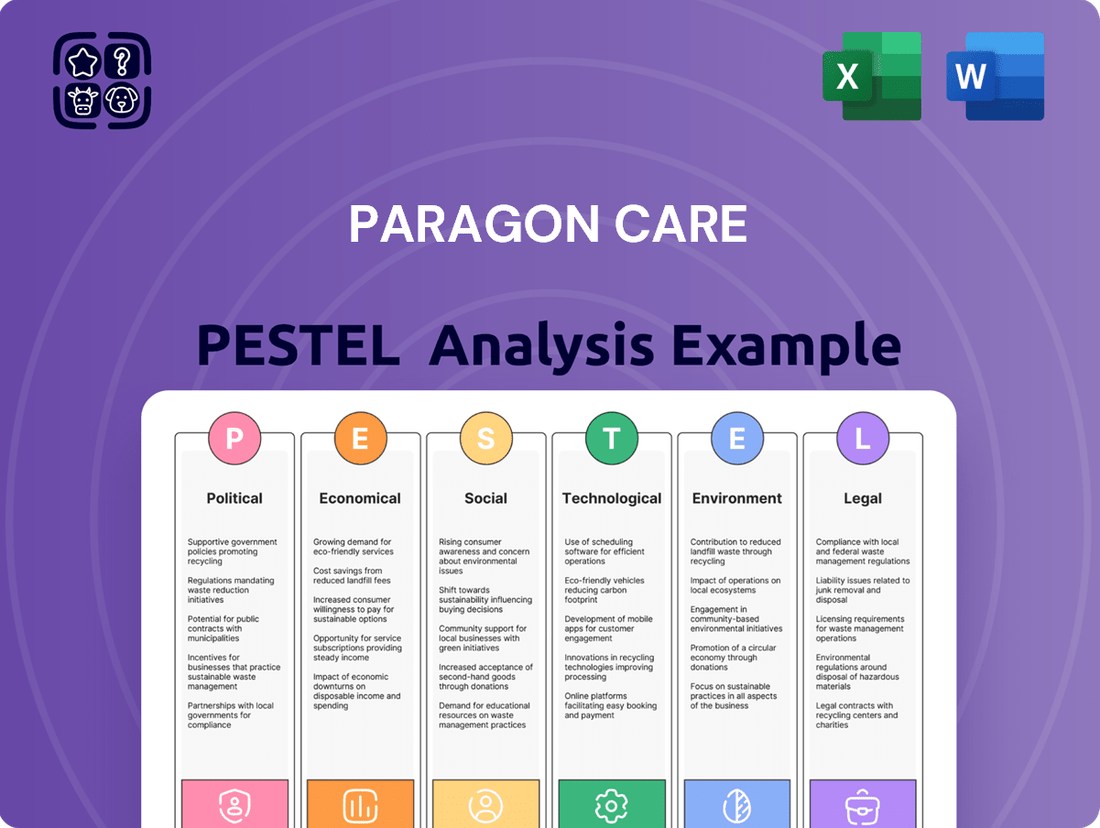

Gain a competitive advantage with our comprehensive PESTLE Analysis of Paragon Care. Understand the intricate interplay of political, economic, social, technological, legal, and environmental factors that are shaping the company's trajectory. This expert-crafted report is your key to unlocking strategic opportunities and mitigating potential risks. Download the full version now for actionable intelligence that will empower your decision-making and propel your business forward.

Political factors

Government healthcare spending and policy shifts in Australia and New Zealand are critical drivers for Paragon Care. Recent Australian Federal Budgets, including the 2024-25 and projected 2025-26, highlight substantial allocations towards Medicare, public hospitals, and aged care. For instance, an $8.5 billion investment in Medicare aims to strengthen the universal healthcare system, enhancing accessibility and affordability.

This increased government funding creates direct opportunities for Paragon Care by potentially boosting demand for its healthcare equipment and services from public health facilities. Such budgetary commitments signal a supportive environment for healthcare providers and suppliers, translating into increased procurement and service utilization.

Australia's Therapeutic Goods Administration (TGA) and New Zealand's Medsafe are continuously updating their medical device regulations. These changes are designed to bolster the regulatory framework, increase openness, and elevate patient safety. For instance, the TGA's reforms, coming into effect in July 2024 and March 2025, introduce novel requirements for custom-made medical devices and the reporting of adverse events.

Paragon Care must diligently ensure all its offerings align with these dynamic standards. While adherence might incur additional compliance expenses, successfully navigating these regulatory shifts is crucial for maintaining and building market confidence and trust among consumers and healthcare providers.

Both Australian and New Zealand governments are actively reforming their aged care sectors, spurred by demographic shifts and recent Royal Commission findings. Australia's new Aged Care Act 2024, effective November 2025, emphasizes enhanced quality and safety, alongside a new Support at Home program. Concurrently, New Zealand is re-evaluating its aged care funding mechanisms.

These policy shifts create significant avenues for Paragon Care to broaden its service portfolio. The focus on quality, safety, and home-based care aligns directly with government priorities, presenting opportunities for expansion in both aged care facilities and in-home support services.

Healthcare Workforce and Capacity Initiatives

Government efforts to bolster the healthcare workforce directly impact companies like Paragon Care. For instance, the Australian government's commitment to increasing the number of training places for doctors and nurses, alongside funding for new Medicare Urgent Care Clinics, signals a push towards greater healthcare capacity. This expansion in services and personnel naturally translates to a higher demand for the medical equipment and consumables that Paragon Care supplies.

The expansion of healthcare services, driven by government initiatives, creates a direct correlation with the demand for medical supplies. As more healthcare professionals are trained and facilities are established or expanded to meet patient needs, the pipeline for equipment and consumables strengthens. This trend is particularly relevant in the 2024-2025 period, as the healthcare sector continues to adapt to post-pandemic demands and government investment in primary care access.

Key government initiatives influencing the healthcare sector include:

- Increased funding for Medicare Urgent Care Clinics: Aiming to ease pressure on emergency departments and improve access to primary care.

- Expansion of training programs for healthcare professionals: Addressing critical shortages in doctors and nurses across Australia.

- Focus on rural and regional healthcare: Initiatives to improve service delivery in underserved areas, potentially increasing demand for a broader range of equipment.

Trade Policies and International Relations

Trade policies significantly influence Paragon Care's operations by affecting the import of medical devices and raw materials. For instance, Australia's trade agreements with countries like the United States and those in the European Union, key suppliers of advanced medical technology, directly impact the cost and availability of essential products. Fluctuations in these agreements or the imposition of new tariffs can alter the company's cost structure and supply chain reliability.

The stability of international relations is paramount for Paragon Care's ability to maintain consistent product sourcing and manage operational expenses. Disruptions in global supply chains, often stemming from geopolitical tensions or trade disputes, can lead to delays and increased costs for medical equipment and consumables. As of early 2024, ongoing global economic uncertainties and shifts in manufacturing hubs continue to present challenges that require careful navigation by companies like Paragon Care.

Paragon Care's reliance on imported goods means that Australian trade policies, such as those related to free trade agreements or import duties, directly influence its competitive pricing and product accessibility. For example, the Australia-United Kingdom Free Trade Agreement, which came into effect in mid-2023, aims to reduce barriers, potentially benefiting companies importing from the UK. However, the overall global trade environment remains complex, with varying regulations and potential for unexpected policy changes.

- Trade Agreements: Australia's participation in agreements like CPTPP and its bilateral deals directly impact import costs for medical devices.

- Supply Chain Stability: Geopolitical events and trade tensions in 2024 continue to pose risks to the consistent flow of medical supplies.

- Regulatory Alignment: Differences in product standards and regulatory requirements between Australia and its trading partners necessitate careful compliance management.

- Cost Management: Tariffs and import duties are critical factors influencing Paragon Care's overall cost of goods sold and pricing strategies.

Government policy in Australia and New Zealand significantly impacts Paragon Care's market. Increased healthcare spending, as seen in the 2024-25 Australian Federal Budget with an $8.5 billion Medicare investment, directly boosts demand for Paragon Care's products and services. Regulatory reforms by bodies like the TGA, with changes affecting medical devices from July 2024 and March 2025, necessitate strict adherence for market access and trust.

What is included in the product

The Paragon Care PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company, providing a comprehensive understanding of its external operating landscape.

Provides a clear, actionable framework for identifying and mitigating external threats and opportunities, thereby reducing uncertainty and improving strategic decision-making for Paragon Care.

Economic factors

Healthcare spending in Australia and New Zealand is a critical driver for Paragon Care's revenue. In 2022-23, Australia's total health expenditure reached $252.5 billion, indicating a return to robust spending levels post-pandemic. This significant investment, largely fueled by government funding, directly influences the demand for Paragon Care's offerings.

The sustained commitment to healthcare infrastructure, especially within hospitals and primary care settings, is paramount for ensuring consistent demand for Paragon Care's products and services. Fluctuations in government health budgets or changes in healthcare policy can introduce variability, but the overall upward trend in expenditure provides a positive outlook.

Inflationary pressures directly impact Paragon Care's operational expenses, notably affecting the cost of imported medical supplies, international freight charges, and essential labor. These rising costs necessitate careful management to maintain profitability in the healthcare sector.

While specific data for Paragon Care is unavailable, broader economic trends highlight potential headwinds. A May 2025 CommBank report indicated that younger demographics, specifically Gen Z Australians, are reducing healthcare expenditures due to escalating cost of living. This suggests a wider consumer sentiment of economic caution that could translate into decreased demand for private healthcare services.

Consequently, Paragon Care must strategically navigate these economic challenges by optimizing supply chain costs and implementing agile pricing strategies. Balancing the need to absorb increased expenses with maintaining competitive service pricing is critical for sustained financial health in the current economic climate.

Changes in interest rates directly affect Paragon Care's cost of borrowing for crucial operations like expanding facilities or managing day-to-day working capital. Simultaneously, fluctuating rates impact the financial capacity of their healthcare clients, such as hospitals and aged care providers, to invest in new technologies or infrastructure.

For instance, if the Reserve Bank of Australia (RBA) maintains or increases its cash rate, it's likely to translate to higher borrowing costs for Paragon Care and its clients. This can make significant capital expenditures, like purchasing advanced medical equipment or renovating aged care homes, less attractive for these institutions, potentially dampening demand for Paragon Care's higher-ticket items.

In early 2024, Australia's official cash rate remained at 4.35%, a level that has put pressure on many businesses and consumers. This sustained higher rate environment necessitates careful financial planning for Paragon Care, influencing decisions around investment in new product lines or strategic acquisitions, as the cost of capital becomes a more significant consideration.

Economic Growth and Consumer Confidence

Australia's GDP growth was projected to moderate in 2024, following robust post-pandemic recovery. For instance, the Reserve Bank of Australia (RBA) anticipated GDP growth around 2% for the fiscal year ending June 2025. This general economic expansion directly influences disposable income, potentially boosting private healthcare expenditure.

Consumer confidence in Australia, as measured by the Westpac-Melbourne Institute Consumer Sentiment Index, showed fluctuations throughout 2024. A sustained period of higher confidence typically correlates with increased spending on non-essential services, including elective medical procedures, which would benefit companies like Paragon Care.

New Zealand's economic outlook for 2024 and 2025 also presented a mixed picture, with inflation concerns impacting consumer spending power. However, a stable or recovering economy in New Zealand would similarly encourage greater private healthcare investment and a higher uptake of private health insurance.

- Australian GDP Growth (FY25 projection): Approximately 2% (RBA).

- Consumer Confidence Indicator: Westpac-Melbourne Institute Consumer Sentiment Index (monitoring fluctuations for insights into spending).

- Impact on Healthcare: Stronger economies generally lead to increased private healthcare spending and elective procedure uptake.

- Benefit to Providers: Higher consumer confidence can translate to greater willingness to invest in private health insurance and medical services.

Exchange Rate Volatility

Exchange rate volatility poses a significant challenge for Paragon Care, particularly given its reliance on imported medical equipment. Fluctuations between the Australian dollar (AUD) and currencies like the US dollar (USD) directly influence the cost of goods sold. For instance, if the AUD weakens, the cost of imported medical devices increases, potentially squeezing profit margins.

In 2024, the AUD has experienced periods of weakness against the USD. For example, the AUD/USD exchange rate hovered around 0.66 in early 2024, down from averages closer to 0.68 in late 2023. This trend suggests that Paragon Care likely faced higher import costs for its specialized equipment during this period.

- Impact on Cost of Goods Sold: A depreciating AUD directly increases the AUD-denominated cost of procuring medical equipment and devices from overseas suppliers.

- Profit Margin Pressure: If Paragon Care cannot fully pass on these increased import costs to its customers due to competitive pressures or contractual agreements, its profit margins will be negatively impacted.

- Currency Hedging Strategies: The company may employ currency hedging strategies to mitigate some of this risk, but these can also incur costs and are not always perfectly effective.

- NZD Considerations: Similar dynamics apply to the New Zealand dollar (NZD) if Paragon Care sources equipment through New Zealand or if the NZD's performance impacts its overall financial health. The NZD/USD rate has also seen volatility, trading in a range that can affect import costs for the company.

Economic growth directly influences healthcare spending, with Australia's GDP projected to grow around 2% in FY25. This expansion supports increased private healthcare expenditure and elective procedure uptake. Consumer confidence also plays a role; a strong sentiment typically correlates with higher spending on private medical services.

Inflationary pressures, however, increase operational costs for Paragon Care, particularly for imported medical supplies and freight. Rising interest rates, like the RBA's 4.35% cash rate in early 2024, impact borrowing costs for both Paragon Care and its clients, potentially slowing investment in new equipment.

Exchange rate volatility, such as the AUD/USD hovering around 0.66 in early 2024, directly affects the cost of imported medical devices. Weakening of the Australian dollar increases these costs, putting pressure on profit margins if not passed on to customers.

| Economic Factor | 2024/2025 Data Point | Impact on Paragon Care |

| GDP Growth (Australia, FY25 Projection) | ~2% (RBA) | Supports increased private healthcare spending. |

| Official Cash Rate (Australia, Early 2024) | 4.35% | Increases borrowing costs for company and clients. |

| AUD/USD Exchange Rate (Early 2024) | ~0.66 | Increases cost of imported medical equipment. |

| Consumer Confidence | Fluctuating (Westpac-Melbourne Institute Index) | Higher confidence may boost elective procedure demand. |

Preview the Actual Deliverable

Paragon Care PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Paragon Care. Understand the critical external influences shaping their strategic landscape and future growth opportunities.

Sociological factors

Both Australia and New Zealand are experiencing a significant aging of their populations, a trend that directly fuels demand for healthcare. This demographic shift means a greater need for services catering to chronic conditions and specialized aged care. For instance, New Zealand is expected to see its over-65 population reach 20% by 2028, a clear indicator of this trend.

This aging demographic is a substantial growth opportunity for companies like Paragon Care. As individuals age, their requirements for medical supplies, equipment, and devices naturally increase. The continued expansion of the over-65 demographic in Australia further solidifies this as a fundamental market driver.

The increasing number of people living with chronic diseases like diabetes and heart conditions is a significant driver for healthcare providers and suppliers. These ongoing conditions require regular medical attention and monitoring equipment, creating a steady demand for the products and services Paragon Care offers. This trend is not slowing down; for instance, in Australia, the prevalence of chronic diseases accounts for a substantial portion of the healthcare burden, impacting patient needs and market dynamics.

Growing public awareness regarding health and wellness is significantly reshaping healthcare demands. This heightened consciousness means people are more proactive about their well-being and expect higher standards from healthcare providers and the technologies they use. For instance, the global digital health market was valued at approximately USD 200 billion in 2023 and is projected to experience robust growth, indicating a clear trend towards embracing advanced solutions.

Consumers are now seeking not just treatment, but also preventative care and personalized medical interventions. This shift in expectations directly fuels the demand for innovative medical equipment and services that offer better outcomes and improved patient experiences. Paragon Care, by offering modern medical technologies, aligns with this trend, catering to a clientele that prioritizes quality, efficacy, and cutting-edge advancements in their healthcare journey.

Lifestyle Changes and Health Trends

Societal lifestyle shifts, such as increased sedentary habits and evolving dietary patterns, are directly contributing to a rise in chronic diseases. This growing prevalence of lifestyle-related illnesses, like type 2 diabetes and cardiovascular conditions, is a significant driver of healthcare demand, impacting sectors like aged care. For instance, the World Health Organization reported in 2024 that non-communicable diseases, largely lifestyle-driven, account for approximately 74% of all deaths globally, underscoring the scale of this public health challenge.

Conversely, a powerful counter-trend is the escalating public interest in preventative health and wellness. This shift fosters opportunities for companies offering solutions that support proactive health management, from fitness programs to nutritional supplements and early diagnostic tools. Paragon Care, for example, can leverage this trend by expanding its offerings in preventative screenings and wellness-focused services. In 2025, the global wellness market is projected to reach $7.0 trillion, demonstrating substantial consumer willingness to invest in their health.

- Increased chronic disease burden: Lifestyle factors are escalating the need for ongoing healthcare services.

- Growth in preventative health market: Consumers are actively seeking ways to manage and improve their well-being proactively.

- Opportunity for wellness solutions: Companies can capitalize on the demand for products and services that support healthy living.

- Impact on aged care demand: The long-term health consequences of lifestyle choices directly influence the need for aged care facilities and services.

Regional Disparities in Healthcare Access

Significant disparities in healthcare access persist between urban centers and remote regions across Australia and New Zealand. For example, in 2023, the Australian Institute of Health and Welfare reported that people in regional and remote areas were more likely to experience poorer health outcomes and have less access to specialist services compared to their metropolitan counterparts. This creates a clear demand for innovative healthcare delivery models.

Telehealth and mobile healthcare services are increasingly vital solutions to address these geographical barriers. During the 2023-2024 financial year, the Australian government continued to invest in telehealth initiatives, with Medicare benefits covering over 100 million telehealth services, demonstrating their widespread adoption and necessity. These services allow patients in underserved areas to connect with healthcare professionals remotely, improving convenience and reducing travel burdens.

Paragon Care is well-positioned to capitalize on this trend by providing a broad spectrum of medical products and solutions. Their offerings can directly support the infrastructure and technology required for expanding telehealth capabilities and equipping mobile healthcare units. This strategic alignment allows Paragon Care to contribute to equitable healthcare distribution.

- Rural Healthcare Challenges: Residents in rural Australia and New Zealand often face longer wait times for medical appointments and limited availability of specialist care.

- Telehealth Growth: The uptake of telehealth services has surged, with projections indicating continued expansion driven by technological advancements and patient preference for convenience. In 2024, telehealth consultations in Australia were estimated to account for a substantial portion of primary care interactions.

- Mobile Health Solutions: Mobile clinics and portable diagnostic equipment are critical for reaching isolated communities, offering essential screenings and treatments closer to home.

- Paragon Care's Role: The company's diverse product portfolio, including diagnostic equipment and patient monitoring systems, can facilitate the deployment and effectiveness of these remote healthcare solutions.

Societal shifts in health awareness and lifestyle choices are significantly impacting healthcare needs. The growing prevalence of chronic diseases, often linked to sedentary habits and dietary patterns, directly increases demand for ongoing medical services and aged care solutions. For instance, in 2024, the World Health Organization noted that non-communicable diseases accounted for about 74% of global deaths, highlighting the scale of this issue.

Technological factors

Rapid advancements in medical technology are constantly reshaping the healthcare sector. New diagnostic tools, sophisticated surgical equipment, and innovative treatment devices are emerging at an accelerated pace. For Paragon Care, successfully integrating and distributing these cutting-edge products is paramount to maintaining its competitive advantage and addressing the evolving needs of clinicians.

The surge in digital health and telehealth, significantly boosted by global events, is reshaping healthcare delivery. In Australia, telehealth accessibility has improved with enhanced Medicare funding, effectively bridging geographical divides. This trend presents a clear avenue for Paragon Care to provide essential equipment that supports digital platforms and remote patient monitoring solutions.

Artificial intelligence is rapidly transforming Australian healthcare, with applications ranging from advanced diagnostics and patient triage to predictive analytics for disease outbreaks and operational efficiency. For instance, AI is being used to analyze medical images with remarkable accuracy, potentially speeding up diagnoses and reducing errors. This technological wave presents significant opportunities for companies like Paragon Care.

Paragon Care can strategically integrate AI into its business model. This could involve offering AI-powered diagnostic tools or patient management software, thereby enhancing its product portfolio. Internally, AI can optimize operations, such as predictive maintenance for critical medical equipment, minimizing downtime and associated costs, or streamlining complex supply chain logistics to ensure timely delivery of essential medical supplies.

Data Analytics and Interoperability

The healthcare sector's increasing reliance on data analytics is a significant technological driver. For Paragon Care, this means that products facilitating improved patient outcomes, streamlining operations, and enabling personalized medicine will be in high demand. For instance, the global healthcare analytics market was valued at approximately USD 22.1 billion in 2023 and is projected to grow significantly, indicating a strong market appetite for data-driven solutions.

Interoperability, the ability of different systems to exchange and use data, is crucial for unlocking the full potential of data analytics in healthcare. Paragon Care's success will likely hinge on its capacity to develop and offer products that integrate smoothly with existing hospital information systems, such as Electronic Health Records (EHRs). This seamless integration allows for the aggregation of diverse data points, which is essential for generating actionable, data-driven insights that can inform clinical and operational decisions.

- Growing Demand for Data-Driven Healthcare: The global healthcare analytics market is expanding rapidly, with projections indicating continued robust growth through 2030.

- Interoperability as a Key Enabler: Seamless data exchange between healthcare systems is paramount for effective data analytics and personalized patient care.

- Paragon Care's Strategic Imperative: The company's ability to offer products that integrate with existing hospital IT infrastructure is critical for its future market position.

- Impact on Operational Efficiency: Enhanced data analytics can lead to significant improvements in hospital workflow and resource management, a key benefit for providers.

3D Printing and Custom Medical Devices

The growing adoption of 3D printing is revolutionizing the medical device sector, enabling the creation of highly customized, patient-specific implants and equipment. This technological advancement allows for unparalleled precision in manufacturing, catering directly to individual patient anatomy and needs. For instance, custom orthopedic implants, such as hip or knee replacements, can be designed and printed based on a patient's unique scan data, leading to better fit and potentially improved outcomes.

Regulatory bodies are adapting to these innovations. In Australia, the Therapeutic Goods Administration (TGA) has updated its regulations concerning personalized medical devices. A significant aspect of this is the transition period allowing these devices to be included in the Australian Register of Therapeutic Goods (ARTG) until July 2029. This provides a clear pathway for manufacturers and innovators in the personalized medical device space.

This technological shift presents a significant opportunity for companies like Paragon Care. By leveraging 3D printing, Paragon Care could significantly expand its offerings to include highly customized medical solutions. This could range from patient-matched prosthetics and surgical guides to specialized equipment tailored for specific clinical applications. Such an expansion has the potential to broaden Paragon Care's market reach and solidify its position in niche, high-value segments of the healthcare market.

The economic impact is substantial. The global 3D printing medical devices market was valued at approximately USD 2.6 billion in 2023 and is projected to reach USD 7.4 billion by 2030, growing at a compound annual growth rate (CAGR) of around 16.2% during this period. This growth underscores the increasing demand for personalized healthcare solutions driven by technological advancements.

- Personalized Implants: 3D printing enables the creation of patient-matched implants, such as cranial plates or joint replacements, improving surgical fit and recovery.

- Custom Surgical Guides: These guides, printed based on patient scans, assist surgeons in precise bone cutting and implant placement during complex procedures.

- Regulatory Adaptation: The TGA's extended deadline of July 2029 for personalized medical devices in the ARTG provides a crucial window for market entry and compliance.

- Market Expansion: Paragon Care can tap into the rapidly growing personalized medical device market, estimated to reach USD 7.4 billion by 2030, by integrating 3D printing capabilities.

Technological advancements are fundamentally reshaping healthcare delivery, with AI, telehealth, and data analytics driving efficiency and personalized care. Paragon Care must strategically integrate these innovations to remain competitive and meet evolving clinical demands. The company's ability to offer interoperable solutions that leverage data analytics is crucial for unlocking new market opportunities and enhancing operational performance.

Legal factors

Paragon Care navigates the stringent Therapeutic Goods Administration (TGA) regulations in Australia, which dictate the import, manufacture, and distribution of medical devices. These rules are crucial for ensuring product safety and efficacy in the healthcare market.

Recent TGA reforms, implemented from July 2024, introduce new compliance burdens, particularly for software-based medical devices. There are also updated classification rules for devices incorporating specific substances, requiring careful attention to detail.

Adherence to these detailed and continuously evolving TGA requirements is non-negotiable for Paragon Care. Failure to comply can result in significant penalties and the potential loss of market access for its product portfolio.

In New Zealand, Medsafe oversees the regulation of medical devices, necessitating their listing within the Web Assisted Notification of Devices (WAND) database. This regulatory framework ensures product safety and efficacy for the New Zealand market.

A significant upcoming change is the proposed Medical Products Bill, slated to replace the existing Medicines Act 1981 by 2026. This legislation aims to modernize and implement risk-proportionate regulatory approaches for medical products.

Paragon Care must effectively manage compliance across both Australian and New Zealand regulatory environments, which, while distinct, often exhibit harmonization in their requirements, impacting market access and product lifecycle management.

Paragon Care must navigate Australia's rigorous product liability laws and evolving safety standards for medical equipment. The Therapeutic Goods Administration's (TGA) Medical Device Reforms, particularly those coming into effect from March 2025, mandate adverse event reporting for healthcare facilities, alongside existing and updated conditions for manufacturers and sponsors.

Failure to comply with these regulations can lead to significant legal repercussions, including fines and product recalls. For instance, a recall of faulty medical devices can incur substantial costs and reputational damage, impacting future sales and partnerships. Ensuring the highest product quality, implementing thorough post-market surveillance, and providing exceptionally clear instructions for use are paramount to minimizing these legal exposures and maintaining trust.

Privacy and Data Security Laws (e.g., APP, NZ Privacy Act)

Paragon Care operates within a landscape where patient data privacy and cybersecurity are paramount, especially with the growing digitalization of healthcare services. Laws like Australia's Australian Privacy Principles (APP) and New Zealand's Privacy Act 2020 directly impact how the company handles sensitive patient information. Failure to comply can lead to significant legal penalties and reputational damage.

Given the increasing reliance on digital health solutions and medical equipment that process patient data, Paragon Care must maintain robust data security measures. For instance, the Australian Notifiable Data Breaches (NDB) scheme, part of the Privacy Act, mandates reporting of eligible data breaches, underscoring the seriousness of data protection. In 2023, there was a notable increase in cyberattacks targeting healthcare organizations globally, highlighting the critical need for proactive compliance.

- APP Compliance: Paragon Care must adhere to the Australian Privacy Principles concerning the collection, use, disclosure, and security of personal information.

- NZ Privacy Act 2020: This legislation imposes obligations on how organizations collect, store, use, and disclose personal information, including breach notification requirements.

- Digital Health Risks: The company's involvement in digital health solutions increases its exposure to data security risks, necessitating stringent cybersecurity protocols.

- Regulatory Scrutiny: Healthcare data is highly regulated, and non-compliance can result in substantial fines, with penalties under Australia's Privacy Act potentially reaching millions of dollars.

Competition Law and Anti-Trust Regulations

Paragon Care must navigate competition laws and anti-trust regulations to maintain fair market practices, especially following its merger with CH2 Holdings in June 2024. This ensures compliance in both Australia and New Zealand, preventing any abuse of market power within the healthcare supply chain.

Adherence to these regulations is crucial for Paragon Care to avoid penalties and maintain its reputation as a responsible market participant. For instance, the Australian Competition and Consumer Commission (ACCC) actively monitors mergers and acquisitions to safeguard consumer interests and promote a competitive landscape. In 2023, the ACCC reviewed numerous significant transactions, highlighting the rigorous scrutiny applied to market consolidation.

- Merger Scrutiny: Paragon Care's merger with CH2 Holdings in June 2024 necessitates thorough review by competition authorities in Australia and New Zealand to ensure no undue market concentration.

- Anti-trust Compliance: Continuous monitoring of business practices is vital to prevent any actions that could be construed as anti-competitive, such as price-fixing or exclusionary conduct.

- Market Fair Play: Operating within the healthcare supply sector, Paragon Care's commitment to fair competition benefits not only consumers but also smaller suppliers and potential new entrants.

- Regulatory Oversight: Authorities like the ACCC in Australia play a key role in upholding competition law, investigating breaches and imposing sanctions when necessary to preserve market integrity.

Paragon Care faces stringent legal frameworks in both Australia and New Zealand, impacting its operations and product lifecycle. The Therapeutic Goods Administration (TGA) in Australia imposes strict rules on medical devices, with recent reforms from July 2024 affecting software-based devices and updated classification for devices with specific substances.

New Zealand's regulatory landscape, overseen by Medsafe, is also evolving with a proposed Medical Products Bill by 2026 to modernize medical product regulations. Paragon Care's compliance efforts must account for these distinct yet often harmonized requirements to ensure market access.

The company's commitment to product liability laws and safety standards is critical, especially with TGA's Medical Device Reforms from March 2025 mandating adverse event reporting for healthcare facilities. Non-compliance risks substantial fines and recalls, underscoring the need for robust quality control and post-market surveillance.

Data privacy and cybersecurity are also significant legal considerations, governed by Australia's Privacy Act and New Zealand's Privacy Act 2020. The Australian Notifiable Data Breaches scheme highlights the imperative for strong data security measures, particularly for digital health solutions, with a reported global increase in cyberattacks on healthcare organizations in 2023.

Environmental factors

Australian companies, including those in the healthcare sector like Paragon Care, are now subject to mandatory sustainability reporting requirements, with the initial phase kicking off in January 2025 for larger organizations. This means Paragon Care will need to be ready to disclose its environmental performance.

These initial reports will concentrate on crucial areas such as climate-related risks and greenhouse gas emissions. For instance, companies will be expected to detail their Scope 1, 2, and potentially Scope 3 emissions, providing a clearer picture of their carbon footprint.

To meet these new obligations, Paragon Care will have to implement strong reporting frameworks. This will involve collecting and verifying environmental data, ensuring accuracy and reliability in their disclosures to meet regulatory standards and stakeholder expectations.

By establishing these robust systems, Paragon Care can enhance transparency regarding its environmental impact. This proactive approach not only ensures compliance but also builds trust with investors, customers, and the wider community who increasingly value sustainable business practices.

Paragon Care operates within an industry that inherently produces substantial waste, ranging from medical device packaging to decommissioned equipment. For instance, in 2023, the Australian healthcare sector's waste management was a significant focus, with hospitals alone generating an estimated 80,000 tonnes of waste annually, a portion of which is directly attributable to the consumables and devices used.

Effective waste management is therefore crucial for Paragon Care. This involves implementing sustainable practices not only for the disposal of consumables but also for the end-of-life management of the medical equipment they supply.

Considering the environmental impact across the entire product lifecycle, from manufacturing to final disposal, is paramount. Paragon Care could explore circular economy principles to minimize waste, potentially through refurbishment or recycling programs for certain types of equipment.

The company's commitment to responsible disposal of both single-use consumables and durable equipment will be increasingly scrutinized by regulators and environmentally conscious stakeholders, impacting brand reputation and operational costs.

Paragon Care's supply chain environmental footprint, particularly concerning transportation emissions and supplier sustainability, is under increasing scrutiny. The push for greener procurement and reduced carbon emissions throughout the value chain is a significant trend. In 2024, for example, the global logistics sector accounted for approximately 10% of total greenhouse gas emissions, highlighting the scale of this challenge.

By actively engaging with and selecting environmentally responsible suppliers, Paragon Care can effectively mitigate operational risks and bolster its corporate reputation. For instance, companies that prioritize sustainable sourcing often see improved operational efficiency and reduced waste, which can translate into cost savings. This focus on sustainability aligns with growing investor expectations, with ESG (Environmental, Social, and Governance) factors increasingly influencing investment decisions.

Climate Change Impact on Health Infrastructure

Climate change poses an indirect but significant threat to healthcare infrastructure. Extreme weather events, such as floods and heatwaves, can damage facilities and disrupt essential services. For instance, in 2023, Australia experienced numerous severe weather events, leading to localized disruptions in healthcare delivery. This can directly impact demand for specific medical supplies and create vulnerabilities in supply chains, a critical consideration for companies like Paragon Care.

Paragon Care must assess and bolster the resilience of its operational framework and supply chain against climate-related disruptions. The increasing frequency and intensity of extreme weather events globally, including those in Australia, necessitate proactive strategies to mitigate potential impacts on service continuity and resource availability. This includes diversifying supply sources and investing in robust infrastructure.

- Increased demand for climate-related health services: Heatstroke, respiratory illnesses exacerbated by air pollution, and vector-borne diseases can surge during extreme weather, straining healthcare capacity.

- Supply chain disruptions: Flooding or severe storms can impede the transport of medical equipment and pharmaceuticals, impacting inventory levels and patient care.

- Infrastructure damage: Hospitals and clinics, particularly those in coastal or flood-prone areas, face risks of physical damage from extreme weather, requiring costly repairs or relocation.

- Operational continuity: Ensuring uninterrupted power, water, and communication services during climate-related emergencies is paramount for healthcare providers.

Green Procurement and ESG Considerations

The healthcare sector, including providers Paragon Care serves, faces mounting pressure to adopt green procurement practices. This means suppliers are increasingly assessed not just on cost and quality, but also on their Environmental, Social, and Governance (ESG) credentials. For instance, by 2025, many Australian government tenders in healthcare will likely incorporate stricter ESG scoring, impacting procurement decisions.

Paragon Care can leverage its commitment to sustainability to gain a competitive edge. By actively demonstrating strong ESG performance, the company can align with the evolving expectations of its clients and the wider industry. This strategic alignment is crucial as ESG investing continues its upward trajectory, with global sustainable investments projected to exceed $50 trillion by 2025, influencing supply chain choices.

- Growing Demand for Sustainable Healthcare: Healthcare organizations are prioritizing suppliers with robust ESG frameworks, leading to increased scrutiny of environmental impact and ethical sourcing.

- ESG as a Competitive Differentiator: Paragon Care's proactive embrace of ESG principles can enhance its reputation and attract business from environmentally and socially conscious healthcare providers.

- Regulatory and Policy Tailwinds: Government initiatives and evolving healthcare policies are increasingly embedding ESG requirements into procurement processes, making it a non-negotiable aspect for suppliers.

- Alignment with Global Trends: Demonstrating strong ESG performance positions Paragon Care favorably within a global market that is rapidly integrating sustainability into all facets of business operations.

Paragon Care is navigating a landscape where environmental reporting is becoming mandatory, with initial requirements focusing on climate risks and emissions starting January 2025 for larger entities. This necessitates robust data collection and verification processes to ensure accurate and reliable disclosures, building trust with stakeholders who increasingly value sustainability.

Waste management is a critical environmental consideration, given the healthcare sector's significant waste generation, estimated at 80,000 tonnes annually from hospitals alone in Australia as of 2023. Paragon Care must implement sustainable practices for consumables and equipment, potentially embracing circular economy principles to minimize its environmental footprint across the product lifecycle.

The company's supply chain emissions, particularly from transportation, are under scrutiny, with the global logistics sector contributing around 10% of greenhouse gas emissions in 2024. Prioritizing environmentally responsible suppliers can mitigate risks, improve efficiency, and align with growing investor demands for strong ESG performance.

Climate change presents risks of infrastructure damage and supply chain disruptions from extreme weather events, as seen with numerous severe events in Australia during 2023. Paragon Care must enhance the resilience of its operations and supply chain against these growing climate-related threats to ensure service continuity.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Paragon Care is constructed using a robust blend of public government data, reputable healthcare industry reports, and established economic and demographic databases. This ensures our insights into political, economic, social, technological, legal, and environmental factors are grounded in current, verifiable information.