Orior Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Orior Bundle

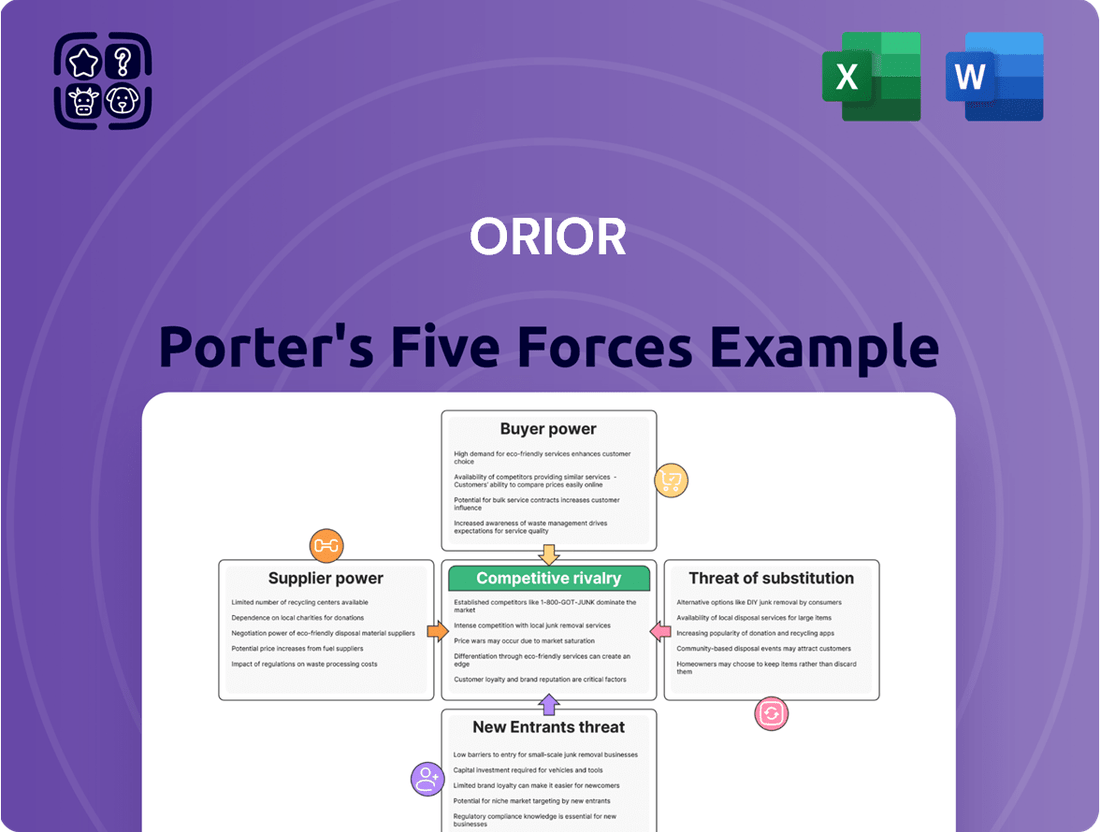

Porter's Five Forces Analysis provides a powerful lens to understand the competitive landscape Orior operates within. By examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry, we can uncover the key forces shaping Orior's market position.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Orior’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

ORIOR's culinary product quality often relies on specific, high-quality raw materials, creating significant supplier leverage. Suppliers of unique ingredients, such as specialty meats for traditional Bündnerfleisch, hold substantial bargaining power due to their exclusivity. This dependence can lead to heightened price sensitivity for ORIOR, especially given ongoing inflationary pressures in raw material markets observed in early 2024. The limited availability of alternative suppliers further exacerbates supply chain vulnerability, impacting production costs and schedules.

In the Swiss market, Orior faces significant supplier concentration for key agricultural inputs, particularly within specialized segments like organic produce or specific meat cuts.

This concentrated supplier base grants these entities substantial leverage in dictating price negotiations and contract terms, directly impacting Orior's cost of goods sold in 2024.

A notable example of this dynamic is the complaint filed in early 2025 by Swiss fruit and vegetable producers against supermarket chain Coop, alleging market power abuse in procurement.

This highlights the ongoing tensions and power imbalances within the Swiss food supply chain, where suppliers can exert considerable influence due to limited alternatives.

ORIOR's comprehensive Supplier Code of Conduct, in effect for 2024, mandates stringent ethical, social, and environmental standards across its value chain. While ensuring responsible sourcing, this commitment inherently narrows the eligible supplier pool, as only those meeting specific criteria can qualify. This increased reliance on a select group of compliant suppliers can elevate their bargaining power, especially for specialized ingredients or services. For instance, if only a few suppliers can meet ORIOR’s precise sustainability requirements, their leverage regarding pricing or terms could strengthen.

Input Cost Volatility

The food industry, including Orior, faces significant input cost volatility, particularly from agricultural commodities. For instance, high pork prices in 2024 could not be fully passed on to customers, directly impacting Orior's profitability. This volatility gives suppliers of key inputs substantial influence over Orior's cost structure and margins.

- Agricultural commodity price swings directly affect Orior’s operational costs.

- In 2024, rising pork prices constrained profit margins as full cost transfer to consumers was not feasible.

- Suppliers gain leverage from the essential nature and fluctuating costs of raw materials.

- This dynamic impacts Orior's ability to maintain stable pricing and profitability.

Long-Term Partnerships

ORIOR prioritizes long-term, close partnerships with its suppliers, ensuring consistent quality and transparency across its product lines. While these relationships build stable supply chains, they inherently create a degree of dependence on established providers. The costs associated with finding, vetting, and integrating new suppliers who meet ORIOR's stringent quality and operational standards are notably high, reflecting significant switching barriers. This dynamic grants incumbent suppliers considerable bargaining power, influencing terms and pricing in 2024. For instance, the food industry often sees supplier-driven price increases, with raw material costs impacting margins.

- In 2024, high switching costs for food ingredient suppliers can represent over 10% of a company's annual procurement budget.

- ORIOR's focus on specialty products means fewer alternative suppliers for specific, high-quality inputs.

- Long-term contracts, while offering stability, can limit flexibility to respond to market price fluctuations.

- Supply chain disruptions, as seen in recent years, further empower established, reliable suppliers.

ORIOR faces substantial supplier bargaining power due to its reliance on specialized, high-quality inputs and a concentrated Swiss agricultural supplier base. Stringent ethical sourcing standards, effective in 2024, further narrow the eligible supplier pool, enhancing leverage for compliant providers. High switching costs and volatile commodity prices, like 2024 pork price increases, enable suppliers to dictate terms and impact ORIOR's profitability.

| Factor | Impact on ORIOR | 2024 Data Point |

|---|---|---|

| Specialized Inputs | Dependency | Supplier exclusivity |

| Supplier Concentration | Price Leverage | Swiss market dynamics |

| Switching Costs | Limited Flexibility | Over 10% procurement budget |

What is included in the product

Orior's Porter's Five Forces Analysis delves into the competitive intensity and profitability potential of its operating environment, examining threats from new entrants, the power of buyers and suppliers, the threat of substitutes, and the rivalry among existing competitors.

Easily identify and neutralize competitive threats by visualizing the intensity of each Porter's Five Force.

Customers Bargaining Power

A significant portion of ORIOR's sales flows through major Swiss retail chains like Migros and Coop, which together command a dominant market share, estimated at over 60% of the Swiss grocery market in 2024. These large retailers possess substantial bargaining power, enabling them to exert significant pressure on pricing and terms, directly impacting ORIOR's margins. Historically, the loss of tenders within this powerful retail sector due to intense price competition has notably dampened ORIOR's sales performance and overall revenue generation.

Orior supplies the foodservice sector, including restaurants, wholesalers, and caterers, where clients prioritize quality, reliability, and increasingly, tailored solutions. Large foodservice customers, especially those with significant purchasing volumes, possess strong bargaining power, enabling them to negotiate favorable pricing and terms. For example, major catering groups or restaurant chains can leverage their scale to demand competitive rates and specific product specifications. The loss of a substantial contract from such a client, like a key supply agreement, can directly impact Orior's revenue streams, highlighting the customer's influence on profitability. Market consolidation among foodservice buyers in 2024 further amplifies this power.

Swiss consumers, while valuing quality, exhibit notable price sensitivity, especially given the strong presence of discount retailers like Aldi and Lidl, which continue to expand their market share in 2024. This market dynamic exerts considerable pressure on ORIOR and its retail partners to maintain competitive pricing across their product lines. The necessity to remain price-competitive significantly curtails ORIOR's ability to fully pass on increasing operational and raw material costs to the end consumer. For instance, food price inflation in Switzerland, while moderating, still influences purchasing decisions, reinforcing the need for strategic pricing by producers.

Demand for Private Label

The significant demand for private-label products means Orior manufactures for numerous retailers, providing a consistent revenue stream. However, this also empowers these large retailers, who can easily switch manufacturers or exert pressure for lower pricing. The intense competition to secure and retain these private-label contracts is a constant challenge. For instance, the private label market share in Europe continues to be substantial, often exceeding 30% in many countries, making these relationships critical yet susceptible to pricing pressures.

- Retailers command leverage due to their ability to easily change suppliers for private-label goods.

- Competition among manufacturers for private-label contracts remains exceptionally high.

- Retailers frequently demand lower prices to maintain their competitive edge.

- Private label sales growth, estimated at over 6% in 2023 across key markets, highlights this dynamic power.

Low Switching Costs for Consumers

End consumers face very low switching costs among different food brands and products, allowing them to easily shift purchases based on price or preference. While brand loyalty exists, the vast array of choices on retail shelves in 2024 empowers consumers significantly. This means Orior must continuously innovate and maintain high quality to retain its customer base and bolster the negotiating position of its retail partners. Consumer willingness to switch brands remains high, influencing market share dynamics.

- In 2024, the food retail sector continues to see intense competition, offering consumers numerous alternatives.

- Price sensitivity and product variety drive consumer decisions, making switching seamless.

- Orior's strategy must emphasize differentiation and value to mitigate this low switching cost.

- This environment empowers retailers, who can leverage consumer choice in negotiations with suppliers like Orior.

Customers, particularly dominant Swiss retailers like Migros and Coop (over 60% market share in 2024), possess high bargaining power, dictating pricing and terms. Foodservice clients and private-label buyers also leverage their scale, with private label sales growing over 6% in 2023. End consumers benefit from low switching costs and price sensitivity, reinforced by discount retailers expanding in 2024. This collective power limits Orior's pricing flexibility and impacts margins.

| Customer Segment | Bargaining Power Level | Key Influence (2024) |

|---|---|---|

| Major Retailers (Migros, Coop) | High | Over 60% Swiss grocery market share, dictate terms |

| Foodservice & Private Label | High | Volume-based negotiations, private label growth over 6% (2023) |

| End Consumers | Medium-High | Low switching costs, increasing price sensitivity due to discounters |

Preview the Actual Deliverable

Orior Porter's Five Forces Analysis

This preview displays the complete Porter's Five Forces analysis you will receive immediately after purchase, offering a comprehensive evaluation of industry competitive forces. You are looking at the actual document, meticulously crafted to detail the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. This exact, professionally formatted analysis will be instantly accessible to you upon completing your transaction, providing actionable insights without any placeholders or modifications. You’re previewing the final version—precisely the same document that will be available to you instantly after buying, empowering your strategic decision-making with a thorough understanding of your industry landscape.

Rivalry Among Competitors

The Swiss food retail market is highly saturated, leading to intense competition for market share among numerous players. Established domestic giants like Migros and Coop dominate, but the presence of German hard discounters such as Aldi Suisse and Lidl Switzerland has intensified price pressure. This environment forces companies like Orior to constantly innovate and differentiate. Major competitors in the packaged foods space include Bell Food Group, ARYZTA, and Groupe Minoteries, all vying for consumer spending.

The presence and sustained growth of German discounters like Aldi and Lidl significantly intensify price competition within the Swiss retail sector. This persistent pressure forces all food producers, including ORIOR, to prioritize operational efficiency and offer highly competitive pricing to their retail partners. As of 2024, discounters continue to gain market share, compelling established players to adapt. This environment demands that ORIOR constantly optimizes its production and supply chain to maintain profitability.

Competitive rivalry for Orior extends beyond just price, with significant emphasis on product innovation, quality, and strong branding. Orior strategically competes by offering a diverse portfolio of high-quality, refined culinary products and convenience foods, catering to evolving consumer preferences in 2024. The ability to continually innovate and launch new, appealing products is crucial for maintaining a robust competitive edge in the dynamic food market.

Competition for Tenders

ORIOR faces intense direct competition when bidding for supply contracts with major retailers and large foodservice clients. The competition for these tenders is fierce, as evidenced by significant tender losses in 2024, which directly impacted sales volumes and profitability. This highlights the substantial rivalry for securing crucial supply agreements in the market.

- Direct competition for large contracts.

- Loss of tenders in 2024 significantly impacted sales.

- Profitability directly affected by tender outcomes.

- Intense rivalry for major supply agreements.

International and Domestic Players

The competitive landscape for Orior includes both large international food companies and strong domestic players. While Orior holds a significant regional footing, it contends with companies that often possess greater scale or diverse strategic advantages. The market features major players like Nestlé, even though their primary product focus might differ from Orior’s convenience and fresh food segments. In 2024, the Swiss food market remains highly competitive, with established brands vying for consumer preference.

- Orior AG reported net sales of CHF 586.3 million in 2023.

- Nestlé, a global giant, reported total sales of CHF 93.0 billion in 2023.

- The Swiss food market is characterized by high brand loyalty and innovation.

- Domestic players often leverage strong distribution networks and local consumer insights.

Competitive rivalry for Orior is intense in the saturated Swiss food market, driven by established giants and discounters like Aldi and Lidl. Price pressure is high, but Orior differentiates through innovation, quality products, and strong branding. The company faces fierce competition for major supply contracts, with tender losses in 2024 impacting sales. Orior competes on product diversity and quality against large domestic and international players.

| Metric | Orior AG (2023) | Nestlé (2023) |

|---|---|---|

| Net Sales (CHF) | 586.3M | 93.0B |

| Market Share | N/A | Leading |

| 2024 Tender Impact | Losses Reported | N/A |

SSubstitutes Threaten

The rise in consumer preference for plant-based and healthier food options creates a notable threat of substitutes for ORIOR's traditional meat products. While ORIOR participates in this market with its Happy Vegi Butcher brand, the expanding array of alternative offerings from competitors intensifies this pressure. However, 2024 data, extending into early 2025, indicates a potential deceleration in the growth of plant-based meat sales within Switzerland. This trend suggests a nuanced competitive landscape, affecting the long-term trajectory of this substitute threat.

The rise in home cooking, often influenced by economic factors like inflation, poses a significant substitute threat to ORIOR's convenience foods. Consumers, facing higher grocery costs in 2024, are increasingly opting to prepare meals at home to save money. Furthermore, the burgeoning meal kit delivery market offers a convenient alternative, with services like HelloFresh reporting continued subscriber engagement. These kits provide pre-portioned ingredients and recipes, bridging the gap between full home cooking and ready meals for consumers seeking both convenience and control over ingredients.

The growing consumer preference for whole, unprocessed foods poses a significant substitute threat to Orior's packaged and convenience items. This health-conscious trend, evident in the 2024 surge in fresh produce sales across Europe, directly impacts demand for pre-prepared meals and processed specialties. Consumers are increasingly choosing fresh vegetables, legumes, and natural ingredients over Orior's offerings. This shift could lead to reduced sales volumes for Orior's convenience segment, compelling a strategic re-evaluation of its product portfolio to align with evolving dietary preferences.

Ethnic and International Cuisines

The diverse Swiss population, with over 25% foreign residents in 2024, fuels a strong demand for various international cuisines. While Orior offers some globally inspired products, the constant emergence of new food trends and specialized ethnic restaurants provides a broad range of substitutes for consumers. This competition intensifies as consumers frequently explore alternatives to traditional offerings, impacting Orior's market position.

- Swiss restaurant industry revenue is projected to exceed CHF 25 billion in 2024, with ethnic food establishments contributing significantly.

- The number of new international food concepts entering the Swiss market continues to grow annually, offering diverse dining choices.

- Consumer spending on out-of-home dining, often including ethnic options, shows a preference for variety.

- Growth in online food delivery platforms further expands access to substitute cuisines.

Private Label Brands

Retailers' own private-label products represent a significant substitute threat to ORIOR's branded items. Consumers often opt for these store brands, which are frequently priced lower while offering comparable quality, especially in categories like processed meats and convenience foods. This dynamic continuously challenges ORIOR's brand loyalty and market share within key retail channels. By 2024, private label sales continued to show robust growth, with some estimates indicating they capture over 20% of the overall food and beverage market in many European countries, directly competing with established brands like ORIOR.

- Private label growth reached 22.6% market share in European retail by early 2024.

- Consumers prioritize value, with 70% considering private labels for cost savings in 2024.

- Private label quality perception improved significantly, narrowing the gap with national brands.

- ORIOR faces direct competition from retailer-owned alternatives in its core product segments.

ORIOR faces significant substitute threats from evolving consumer preferences, including the shift towards plant-based options and whole, unprocessed foods, though plant-based growth may be decelerating in Switzerland by 2024. Economic factors such as 2024 inflation also drive increased home cooking and the adoption of convenient meal kits. Furthermore, the diverse Swiss market and robust private label growth, capturing over 20% of the European food market by 2024, offer consumers numerous alternatives to ORIOR's branded products.

| Substitute Category | 2024 Market Trend | Impact on ORIOR |

|---|---|---|

| Plant-Based Foods | Growth deceleration in Swiss plant-based meat sales. | Reduced long-term threat intensity. |

| Home Cooking/Meal Kits | Increased home cooking due to inflation; robust meal kit engagement. | Reduced demand for convenience foods. |

| Private Label Products | 22.6% market share in European retail by early 2024. | Direct price and quality competition. |

Entrants Threaten

The Swiss food manufacturing industry presents high barriers to entry for new players. Significant capital investment is required to establish modern production facilities, which can easily exceed CHF 50 million for a new large-scale operation in 2024. New entrants also face the daunting task of building extensive distribution networks across Switzerland, a complex and costly endeavor. Furthermore, strict food safety regulations, such as those enforced by the Federal Food Safety and Veterinary Office, necessitate substantial compliance investments. The market is already mature and highly competitive, dominated by established players, making it difficult for newcomers to gain significant market share.

Established companies like ORIOR, with well-known brands such as Albert Spiess, Biotta, and Rapelli, benefit from significant brand recognition and deep customer loyalty cultivated over decades. In 2024, these strong brand equities present a formidable barrier for any new entrant. A newcomer would face the immense challenge of needing substantial marketing investment, potentially millions, and considerable time to build a comparable level of trust and awareness. Overcoming this ingrained preference for established names is a major hurdle, reducing the attractiveness of entering the market.

Gaining access to dominant Swiss retail channels, particularly those controlled by Coop and Migros, presents a significant barrier for new entrants in 2024. These established retailers collectively hold a substantial market share, exceeding 70% of the Swiss food retail market as of recent estimates, making them crucial for widespread product distribution. They maintain deep-rooted relationships with existing suppliers and limited shelf space, which severely constrains opportunities for new products to secure listings. This formidable hurdle ensures that new players face considerable challenges in achieving competitive visibility and market penetration against established brands like those under Orior.

Economies of Scale

Large, established food producers, including those Orior competes with, benefit significantly from economies of scale in purchasing raw materials, efficient manufacturing, and extensive distribution networks. This allows them a substantial cost advantage, making it difficult for new entrants to compete on price. A smaller, new food producer would likely face higher per-unit costs due to lower production volumes and less favorable supplier terms.

- Incumbents can leverage bulk discounts, reducing input costs for 2024 production.

- New entrants face higher initial capital outlays for competitive scale.

- Distribution efficiency of large players lowers logistics costs, a key factor in 2024.

- Smaller scale limits negotiation power with retailers and suppliers.

Niche Market Opportunities

While entering the broad food market is challenging, new entrants could succeed by targeting niche opportunities. This includes specialized organic products, a market projected to reach USD 270.8 billion globally in 2024, or innovative plant-based foods, which are estimated at USD 60.5 billion worldwide in 2024. Catering to specific dietary needs also presents an opening. However, even within these growing niches, new companies would face strong competition from established players like Orior, who are actively expanding their own specialized offerings and investing in innovation.

- Global organic food market projected at USD 270.8 billion in 2024.

- Plant-based food market estimated at USD 60.5 billion globally in 2024.

- Established players are actively innovating in specialized food segments.

- Targeting specific dietary needs offers growth avenues for new entrants.

The threat of new entrants in the Swiss food manufacturing sector is low, primarily due to high capital requirements exceeding CHF 50 million for facilities and strict regulatory hurdles. Established brands like Orior's Albert Spiess enjoy significant loyalty, making market penetration costly and challenging for newcomers. Dominant retail channels, controlled over 70% by Coop and Migros in 2024, present formidable access barriers. While niche markets exist, incumbents are actively expanding into these areas.

| Barrier Type | Impact on New Entrants | 2024 Data Point |

|---|---|---|

| Capital Investment | High initial outlay | >CHF 50 million for large facilities |

| Market Dominance | Difficult market access | Coop/Migros >70% retail share |

| Brand Recognition | High marketing cost | Decades of Orior brand loyalty |

Porter's Five Forces Analysis Data Sources

Our analysis leverages a comprehensive suite of data sources, including company annual reports, industry-specific market research, and publicly available financial statements, to meticulously evaluate each of Porter's Five Forces.

We draw upon insights from reputable market intelligence platforms, economic indicators, and trade association publications to ensure a robust and accurate assessment of industry dynamics.