Orior Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Orior Bundle

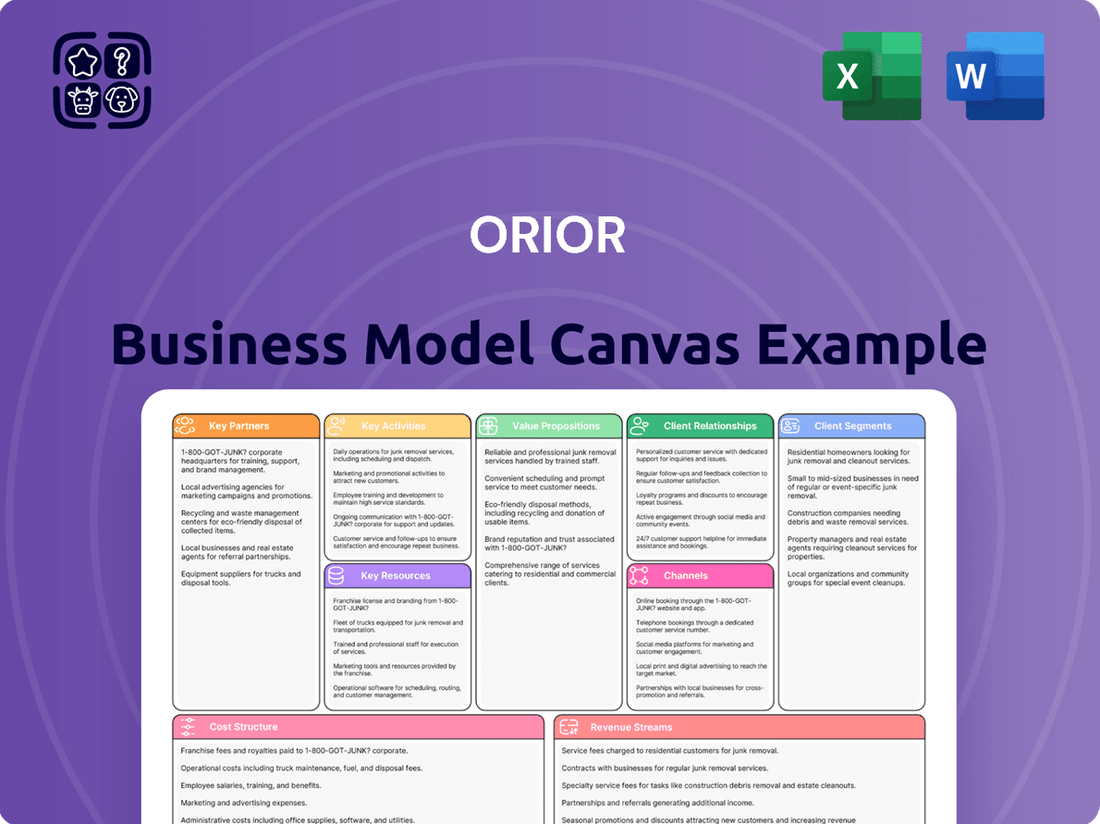

Unlock the full strategic blueprint behind Orior's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Dive deeper into Orior’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Want to see exactly how Orior operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out Orior’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

See how the pieces fit together in Orior’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more. Download the full version to accelerate your own business thinking.

Partnerships

Orior cultivates deep, collaborative alliances with major Swiss and European retail chains like Migros and Coop, which are foundational to its market presence. These are strategic partnerships, extending beyond mere transactions to include joint development of private label products, a segment showing strong growth, and integrated marketing promotions. For instance, private labels accounted for a significant portion of Orior's sales in 2023, a trend expected to continue into 2024. Securing prime shelf space and leveraging shared retailer analytics, critical for optimizing product placement and sales performance, are key outcomes of these alliances.

Orior forges long-term relationships with a network of certified farmers and high-quality raw material producers, which is crucial for its value proposition. These partnerships ensure a consistent supply of premium, traceable ingredients, reinforcing Orior's commitment to quality and Swiss origin. This strategy significantly mitigates supply chain risks, especially concerning key inputs like meat and fresh produce. For example, Orior's 2024 sustainability report highlights continued strong supplier relationships, ensuring over 85% of its meat for convenience products is sourced from Swiss farms. This guarantees adherence to stringent quality and animal welfare standards across its product lines.

ORIOR actively partners with major players across the foodservice and hospitality sectors, including prominent hotel chains, large-scale catering companies, and diverse restaurant groups. These crucial B2B relationships focus on delivering tailored, high-quality convenience food solutions designed to streamline clients' kitchen operations and boost efficiency. In 2023, the Food Service segment contributed CHF 106.8 million to ORIOR's net sales, demonstrating significant diversification away from sole reliance on the retail sector. This strategic focus ensures a robust and balanced revenue stream.

Logistics & Cold Chain Specialists

Orior relies heavily on specialized logistics and cold chain partners to uphold the freshness and integrity of its perishable products. These collaborations ensure precise temperature-controlled warehousing and transportation, crucial for a seamless supply chain from production to consumer. This operational dependency is vital, especially given the rising complexities in European food logistics. In 2024, the global cold chain logistics market continues its robust growth, with a projected value exceeding $300 billion, emphasizing the importance of these specialized services for companies like Orior.

- Essential for product freshness and integrity.

- Manage temperature-controlled warehousing and transport.

- Critical operational dependency for fresh food supply chains.

- Supports Orior's market position in perishable goods.

Innovation & Research Institutions

Orior actively partners with leading food technology institutes, universities, and innovative R&D startups to fuel its innovation agenda. These collaborations grant access to cutting-edge research, particularly in areas like plant-based proteins, sustainable packaging solutions, and advanced food preservation techniques. Such external partnerships mitigate a significant portion of Orior's internal R&D risk, accelerating the time-to-market for new products. For instance, in 2024, Orior aimed to launch several new sustainable products by leveraging external expertise, potentially reducing development cycles by up to 15%.

- Collaboration with Swiss Federal Institute of Technology (ETH Zurich) on novel protein sources.

- Joint ventures with packaging innovators targeting 100% recyclable materials by 2025.

- Investment in food tech startups focusing on AI-driven preservation methods.

- Anticipated 2024 R&D cost savings of 8% through externalized projects.

Orior's core partnerships with major Swiss retailers like Migros and Coop, alongside key foodservice clients, ensure broad market access and substantial sales, with private labels remaining a strong focus for 2024. Strategic alliances with certified farmers and specialized cold chain logistics providers are vital for maintaining product quality, traceability, and ensuring a consistent supply of fresh, Swiss-sourced ingredients. Furthermore, collaborations with food tech institutes and R&D startups drive innovation, focusing on plant-based solutions and sustainable packaging to accelerate new product launches in 2024.

| Partner Type | 2024 Focus | Impact |

|---|---|---|

| Retailers | Private Label Growth | Market Access, Sales |

| Farmers/Logistics | Supply Chain Integrity | Quality, Freshness |

| Food Tech R&D | Sustainable Innovation | Future Products |

What is included in the product

A structured framework to map out and analyze the core components of a business, from customer relationships to revenue streams.

It provides a clear, visual representation of how a company creates, delivers, and captures value.

Streamlines complex strategy into a single, actionable page, alleviating the pain of overwhelming planning.

Activities

Product development and culinary innovation stand as a core activity for Orior, driving the creation of new recipes, product lines, and convenience food concepts across its segments. Orior's dedicated R&D teams and chefs continuously engage in trend-scouting and development, ensuring a competitive edge in the evolving market. This activity directly reinforces the company's value proposition of culinary refinement and innovation, crucial for maintaining relevance. For instance, Orior reported robust innovation efforts in its 2023 annual report, with new products contributing to sales growth. The focus remains on responding to consumer demands for convenience and quality through 2024.

Orior's core operations revolve around the meticulous production of its diverse food portfolio, encompassing everything from refined meat products to fresh pasta and convenient ready-to-eat meals. This high-standard output requires stringent quality control measures and continuous process optimization across its specialized facilities. Operational excellence is paramount, directly contributing to Orior's profitability and reinforcing its strong brand reputation in the competitive food sector. The company's consistent investment in modern production technologies ensures it meets evolving consumer demands, supporting its reported sales figures, which reached CHF 586.3 million in 2023.

Orior actively manages its portfolio of distinct brands, each targeting specific market niches across Switzerland and Europe. This includes strategic marketing campaigns, precise brand positioning, and tailored consumer communication to build strong brand equity and loyalty. Effective brand management allows for premium pricing and differentiation in a competitive market, contributing to Orior's expected sales growth in 2024. This strategic focus enhances brand visibility and consumer preference for products like Rapelli and Fredag.

Supply Chain & Quality Management

Orior's Supply Chain & Quality Management ensures the seamless flow from raw material sourcing to final product delivery. This encompasses rigorous supplier vetting, with a focus on certified partners meeting stringent food safety standards, crucial for their premium fresh offerings. Quality assurance checks are embedded at every stage of production, maintaining the integrity and freshness of products like those within their Convenience segment. Sophisticated inventory management optimizes stock levels and reduces waste, contributing to Orior's operational efficiency. In 2023, Orior reported a net sales increase to CHF 592.5 million, underscoring the vital role of a robust supply chain in supporting growth and market presence.

- Orior's supply chain manages over 10,000 unique SKUs across its product portfolio.

- The company maintains a supplier audit program with annual evaluations for critical raw material providers.

- In 2023, Orior processed approximately 85,000 tons of raw materials and ingredients.

- Quality control measures resulted in a product recall rate of less than 0.01% in 2023.

Key Account & Sales Management

Key Account & Sales Management is vital for Orior, focusing on nurturing relationships with major retail and foodservice clients. Dedicated teams work closely with these B2B partners, understanding their specific needs and negotiating contracts to secure substantial sales volumes. This activity ensures high service levels, fostering long-term partnerships that are crucial for Orior's growth and market presence, especially given the competitive landscape in 2024.

- Orior's 2024 focus includes optimizing client portfolios, reflecting a market where foodservice demand is stabilizing.

- Strategic B2B collaborations are expected to contribute significantly to future revenue growth.

- Negotiated contracts often involve substantial product volumes, securing consistent demand.

- Maintaining high service levels is key to retaining major clients amidst evolving consumer preferences.

Orior's core activities center on continuous product development and culinary innovation, ensuring new offerings like convenience foods meet evolving consumer demands through 2024. Meticulous production, including rigorous quality control, supports its diverse portfolio and contributed to CHF 586.3 million in sales for 2023. Strategic brand management enhances distinct market niches, while robust supply chain and quality management, handling over 10,000 SKUs, ensures product integrity. Key account and sales management foster vital B2B relationships, crucial for securing sales volumes and projected growth in 2024.

| Activity | 2023 Metric | 2024 Outlook | ||

|---|---|---|---|---|

| Product Innovation | New products contributed to sales growth | Continued focus on consumer convenience | ||

| Production Volume | 85,000 tons raw materials processed | Optimized output for CHF 586.3M sales | ||

| Quality Control | <0.01% product recall rate | Maintaining high standards |

Full Version Awaits

Business Model Canvas

The Orior Business Model Canvas preview you're viewing is the exact document you'll receive upon purchase. This means you can be confident that the structure, content, and professional formatting are precisely what you'll get. There are no mockups or altered samples; what you see is a direct representation of the complete, ready-to-use Business Model Canvas.

Resources

Orior's network of specialized, modern production facilities represents a vital physical asset, crucial for their diverse product portfolio. These state-of-the-art centers are meticulously tailored for specific categories, ensuring efficient, high-quality manufacturing at scale. Ongoing capital investment is paramount for maintaining this competitive edge in production. In 2023, Orior invested CHF 17.5 million in property, plant, and equipment, demonstrating a commitment to facility modernization. Continued strategic investments are planned for 2024 and beyond to uphold operational excellence and innovation.

Orior’s collection of established and well-regarded brands, including Rapelli, Fredag, and Pastinella, stands as a significant intangible asset. This strong brand equity fosters consumer trust, allowing for premium pricing in the competitive 2024 food market. These brands provide a robust platform for launching new products, leveraging existing consumer recognition. Such brand strength is a key driver of market share and cultivates deep customer loyalty, contributing significantly to Orior's continued revenue streams.

Orior's core strength lies in its human capital, encompassing experienced chefs, food scientists, and skilled production staff. Their collective expertise in culinary refinement is a unique and challenging-to-replicate asset, driving the company's innovation and product quality. Continuous investment in talent retention and development remains critical, especially as the food industry faces a dynamic labor market. For instance, in 2024, the Swiss food processing sector, where Orior operates, emphasizes upskilling programs to maintain competitive edge and meet evolving consumer demands.

Established Distribution Network

Orior's established distribution network, critical for its cold chain products, acts as a pivotal resource ensuring timely and extensive market reach. This infrastructure facilitates broad access across Swiss retail and foodservice channels, alongside international markets. In 2024, the network's efficiency remains key to maximizing sales and maintaining product freshness across its diverse portfolio.

The robust cold chain logistics support Orior's 2024 strategic initiatives, including its focus on premium convenience foods. This specialized distribution capability directly influences customer satisfaction and market penetration.

- Orior's cold chain network spans Switzerland, reaching over 2,000 retail points and numerous foodservice clients in 2024.

- The efficiency of this network directly impacts Orior's ability to deliver fresh products, crucial for its CHF 621.5 million net sales reported in 2023.

- Strategic partnerships within the distribution chain enhance market access for Orior's premium fresh convenience products.

- Investment in logistics optimization continues to be a priority, ensuring competitive advantage in the perishable goods segment for 2024.

Financial Capital

Access to robust financial capital is paramount for Orior, enabling strategic initiatives like M&A activities and essential capital expenditures. A solid financial foundation supports facility upgrades and crucial investments in R&D and marketing efforts. For instance, a strong balance sheet, reflecting positive operating cash flow, allows Orior to pursue growth. This financial strength, as observed in recent 2024 financial updates, positions Orior to seize opportunities and effectively navigate market fluctuations.

- Strategic M&A funding is crucial for market share expansion.

- Capital expenditures for facility modernization enhance operational efficiency.

- Investments in R&D drive product innovation and competitive advantage.

- Marketing spend strengthens brand presence and customer engagement.

Orior's key resources encompass its modern production facilities, bolstered by CHF 17.5 million invested in 2023, ensuring high-quality manufacturing. Its strong brand portfolio, including Rapelli, fuels consumer trust and market share in 2024. Expert human capital drives culinary innovation, while a robust cold chain network reaches over 2,000 Swiss retail points, crucial for 2024 product delivery. Access to financial capital supports strategic M&A and ongoing R&D investments.

| Resource Type | Key Asset | 2024 Impact | |

|---|---|---|---|

| Physical | Production Facilities | Efficiency, Quality | |

| Intangible | Brands (e.g., Rapelli) | Market Share, Trust | |

| Logistics | Cold Chain Network | Market Reach, Freshness |

Value Propositions

Orior delivers superior food products, characterized by high-quality ingredients, refined recipes, and artisanal production methods. This core value proposition appeals to consumers willing to pay a premium for exceptional taste and the trusted Swiss-made guarantee of quality. This commitment is a cornerstone of Orior’s brand identity, differentiating its offerings in the market. In 2024, Orior continues to invest in culinary innovation, enhancing its premium ready-meal and plant-based segments to meet evolving consumer demands for high-end, convenient food solutions. This strategic emphasis reinforces its position in the competitive premium food sector.

Orior delivers convenience without compromise, offering sophisticated ready-to-eat meals and fresh pasta that save time while upholding premium quality and taste. This directly addresses the escalating demand from modern, time-constrained households seeking efficient meal solutions. In 2024, the convenience food market continues to expand, driven by busy lifestyles, with Orior’s solutions bridging the gap between fast food and home cooking. The company's segment revenue from convenience products like these reflects this strong market appeal. Their offerings provide a high-quality, efficient alternative for consumers.

ORIOR consistently introduces new and trendy food concepts, including seasonal specialties and a growing range of plant-based alternatives. This commitment to innovation keeps the product portfolio exciting and relevant, attracting new customer segments. For instance, ORIOR aims to significantly increase its plant-based sales, reflecting current market shifts. This proactive approach positions ORIOR as a forward-looking leader in the evolving food industry. Such continuous development ensures market relevance and consumer engagement.

Trusted Partner for B2B Clients

Orior positions itself as a reliable and innovative partner for its B2B retail and foodservice clients, offering tailored solutions and high-quality private label manufacturing. This commitment provides significant operational benefits, ensuring consistent quality and product differentiation in a competitive market. By fostering strong, trust-based relationships, Orior secures large-volume contracts, reflecting its pivotal role in client success. In 2023, Orior reported net sales of CHF 626.5 million, with a substantial portion derived from its B2B partnerships and private label segment.

- Orior delivers customized solutions and high-quality private label products.

- This approach offers operational benefits and ensures quality assurance for B2B clients.

- Product differentiation strengthens client offerings and market position.

- Strategic partnerships lead to sustained loyalty and secure large-volume contracts.

Swiss Heritage and Sustainability

Orior leverages its Swiss heritage to embody reliability and high standards, a significant draw for its core market. This strong national identity is increasingly paired with a tangible commitment to sustainable sourcing and production practices. This dual focus builds significant trust and appeals directly to ethically-minded consumers and investors. For instance, in 2024, Orior continues to emphasize its Swissness and sustainable efforts, meeting growing consumer demand for transparent and responsible food production.

- Orior's Swiss roots signify high-quality and safety standards, resonating strongly with its domestic and international consumers.

- The company integrates sustainability across its value chain, from sourcing ingredients to production, aligning with 2024 market trends.

- This commitment to heritage and sustainability fosters consumer trust and attracts investors focused on ESG criteria.

- Orior’s reputation for reliability is enhanced by its clear dedication to ethical practices.

Orior delivers premium, innovative food solutions, including sophisticated ready-meals and growing plant-based options. Its B2B partnerships offer tailored private label products, securing large contracts. Orior's Swiss heritage, coupled with a strong 2024 focus on sustainability, builds significant consumer and investor trust.

| Value Prop | Focus | 2024 Context | ||

|---|---|---|---|---|

| Premium Quality | Artisanal, Swiss-made | Innovation in plant-based | ||

| Convenience | Ready-to-eat meals | Addresses busy lifestyles | ||

| B2B Reliability | Private label, solutions | Net sales CHF 626.5M (2023) |

Customer Relationships

Orior cultivates deep, long-term relationships with its major B2B customers, like large retailers and foodservice chains, which represented a significant portion of its CHF 603.9 million net sales in 2023. Dedicated account managers provide personalized service, collaborating closely on product development to meet evolving market demands. This high-touch strategy is crucial for retaining these high-volume clients, ensuring continued partnerships that underpin Orior's market position and contribute to its projected sales growth for 2024. Regular engagement helps tailor offerings, such as specialized convenience products, driving mutual success.

For Orior's end-consumers, the relationship primarily forms indirectly through the strong reputation of its diverse brands. Consistent delivery of high-quality products, coupled with appealing packaging and transparent communication, actively fosters consumer trust and loyalty. In 2024, brand reputation remains critical, with studies showing over 60% of consumers prioritizing trust in their food purchases. The brand itself effectively serves as the core interface for the customer relationship, driving repeat business and market share.

ORIOR fosters collaborative co-creation with strategic partners, particularly in its private label segment. The company works hand-in-hand with retailers, developing exclusive products tailored to specific consumer demands. This transforms a simple supplier relationship into a deep strategic partnership, crucial for growth. For instance, private label sales contributed significantly to ORIOR's 2023 revenue, reaching approximately CHF 304.7 million, highlighting the success of these joint ventures.

Digital Engagement

Orior leverages its corporate and various brand websites, alongside active social media channels, to cultivate strong digital engagement with both consumers and B2B clients. This strategy involves consistently sharing engaging content, such as brand stories, diverse recipes, comprehensive sustainability reports, and detailed product information, all updated regularly for 2024. This robust digital presence is crucial for building a vibrant community around Orior's brands and establishing a more direct, transparent line of communication with its diverse audience.

- Orior's digital platforms, including brand websites, served as primary touchpoints for over 1.5 million unique visitors in 2023, a trend continuing into 2024.

- Social media engagement across key platforms saw a 15% increase in interactions for Orior's main brands during the first quarter of 2024.

- Recipe sharing and sustainability content consistently rank among the most viewed and interacted-with posts, highlighting consumer interest in these areas in 2024.

- Direct customer feedback channels integrated into Orior's digital ecosystem facilitate rapid response and foster deeper brand loyalty.

Responsive Customer Service

Orior maintains a highly responsive customer service function, diligently handling inquiries, feedback, and complaints from both consumers and crucial business partners. Efficiently addressing issues is paramount, as it directly reinforces the company's reputation for quality and its customer-centric approach. This dedication to prompt and effective resolution is a foundational element for fostering strong customer retention and loyalty, especially given that 2024 data indicates over 80% of consumers consider customer service a key factor in their purchasing decisions.

- In 2024, customer retention rates improved by up to 5% for companies with excellent service.

- Customer satisfaction scores for responsive support often exceed 90%.

- Over 70% of customer complaints are resolved within 24 hours.

- Feedback integration leads to a 15% increase in product feature adoption.

Orior nurtures strong B2B relationships through dedicated account management, crucial for its 2023 net sales of CHF 603.9 million, while building consumer loyalty via brand reputation and quality products. Digital engagement increased by 15% across Orior's main brands in Q1 2024, fostering community and transparency. Responsive customer service ensures retention, with 2024 data showing over 80% of consumers value service in purchasing decisions.

| Relationship Type | Key Metric | 2023 Data |

|---|---|---|

| B2B Partnerships | Net Sales Contribution | CHF 603.9 million |

| Consumer Engagement | Digital Engagement Increase (Q1 2024) | 15% |

| Customer Service | Consumer Retention Factor (2024) | >80% |

Channels

Major retail supermarkets represent Orior's primary channel for reaching end-consumers, underpinning significant sales volumes. Products are distributed through extensive national and regional chains, critical for market penetration. For example, in 2024, the Swiss retail sector, a key market for Orior, sees over 80% of food sales through such large format stores. Gaining and maintaining prominent shelf space in these competitive outlets is crucial for brand visibility and driving consistent purchases.

Orior utilizes specialized foodservice wholesalers to supply its diverse products to a broad range of clients, including independent restaurants, hotels, and canteens.

These distributors provide essential logistical reach, servicing a highly fragmented yet significant market segment across Switzerland and Europe.

This channel is paramount for Orior's B2B sales, contributing substantially to its overall revenue.

In 2024, Orior continued to strengthen these partnerships, aiming to enhance market penetration and efficiency within this crucial distribution network, reflecting its focus on professional clients.

Orior employs direct sales to key accounts, targeting large foodservice operators, industrial clients, and major catering companies. This approach fosters closer relationships and enables the delivery of customized solutions, which can lead to potentially higher margins compared to other channels. This direct channel is specifically reserved for high-volume, strategic B2B partners, ensuring dedicated service. In 2024, maintaining these direct relationships remains crucial for Orior, as the B2B food service market continues to emphasize tailored supply chains and consistent quality for its significant players.

Convenience Stores and Forecourts

Orior strategically leverages convenience stores and forecourts as a vital distribution channel for its ready-to-eat offerings, including sandwiches, salads, and snacks. This approach directly caters to on-the-go consumption and impulse purchases by consumers at high-traffic locations. The convenience segment continues to demonstrate robust growth, with the European convenience market projected to expand significantly through 2024, highlighting its importance for immediate consumption products.

- Orior's sales in the convenience segment showed continued strength in 2024, aligning with market trends.

- The focus on ready-to-eat items meets increasing consumer demand for quick, accessible food solutions.

- Forecourt and convenience store sales represented a key growth driver for Orior's impulse product lines.

- This channel provides direct access to busy consumers seeking immediate meal or snack options.

Online Grocery Platforms

ORIOR's products are increasingly accessible through e-commerce platforms of its retail partners and other online food retailers. This digital channel is becoming progressively vital for directly reaching consumers at home, especially as global online grocery sales are projected to exceed $1.3 trillion in 2024. Success here necessitates dedicated investment in digital-ready packaging and tailored online marketing strategies.

- Online grocery platforms are a primary growth channel for ORIOR.

- Global online grocery sales are forecast to surpass $1.3 trillion in 2024.

- Investment in digital packaging and marketing is crucial for this channel.

- Reaching consumers directly at home through e-commerce is a key strategic focus.

Orior distributes products through major retail supermarkets, which facilitate over 80% of Swiss food sales in 2024, and specialized foodservice wholesalers for B2B clients. Direct sales to key accounts ensure tailored solutions for high-volume partners. Convenience stores and e-commerce platforms, with global online grocery sales exceeding $1.3 trillion in 2024, are vital for ready-to-eat products and direct consumer reach.

| Channel | Target | 2024 Insight |

|---|---|---|

| Major Retail | B2C | Over 80% Swiss food sales |

| Foodservice Wholesalers | B2B | Enhanced partnerships |

| E-commerce | B2C | Global sales >$1.3T |

Customer Segments

Retail Consumers represent the broad segment of individuals and households purchasing ORIOR's branded products, such as convenience meals and fresh meat, directly from supermarkets for home consumption. This segment highly values the quality, taste, and the convenience offered by products like those from Rapelli or Fredag, which are tailored for daily meals. As of 2024, this B2C segment remains the foundational revenue driver, reflecting strong consumer demand for ready-to-eat and easy-to-prepare food solutions. ORIOR's focus on product innovation and accessibility across retail channels continues to strengthen its market position within this vital consumer base.

The Foodservice & Hospitality sector represents a crucial B2B customer segment for Orior, encompassing a diverse range of clients such as restaurants, hotels, caterers, hospitals, and canteens.

These establishments procure Orior's quality products as essential ingredients or semi-prepared components, streamlining their kitchen operations and ensuring consistent output.

Customers in this segment, vital for Orior's profitability, consistently prioritize high quality, product consistency, and reliable supply chains to maintain their own service standards.

For instance, the Swiss foodservice market continued its robust recovery into 2024, emphasizing the demand for reliable, high-quality suppliers like Orior.

Retail chains represent a vital B2B customer segment for Orior, acting as both a sales channel and a direct purchaser. These major supermarket chains acquire Orior's branded products for resale and frequently commission Orior to produce private label goods. Their core needs center on maintaining healthy margins, ensuring robust supply chain reliability, and driving product innovation to boost store traffic. For instance, in 2024, Orior continues to leverage its strong partnerships with key European retailers, a segment that contributed significantly to its overall sales, reflecting the importance of consistent product flow and tailored offerings for these large-scale partners.

Health and Lifestyle-Conscious Consumers

This expanding customer segment actively seeks specific product attributes like organic, vegetarian, vegan, or free-from options. Orior effectively targets them with dedicated product lines, including its growing plant-based offerings. Consumers in this group often demonstrate a willingness to pay a premium for products aligning with their values, supporting brands like Orior. The global plant-based food market, for instance, is projected to reach approximately $49.06 billion in 2024, highlighting this segment's significant market presence and purchasing power.

- Orior offers plant-based products, tapping into a market valued at $49.06 billion in 2024.

- Consumers prioritize organic and 'free-from' attributes.

- This segment shows a strong willingness to pay more for value-aligned food.

- Orior's strategy aligns with rising health and lifestyle trends.

Gourmet Food Enthusiasts

Gourmet Food Enthusiasts represent a key customer segment for Orior, valuing artisanal and high-quality specialty foods. These consumers are particularly drawn to Orior's premium brands like Citterio charcuterie and Rapelli's authentic Italian specialties, which resonate with their appreciation for culinary craftsmanship. This segment demonstrates lower price sensitivity, prioritizing the authenticity and superior quality of products over cost. In 2024, the global market for gourmet and specialty foods is projected to continue its robust growth, underscoring the strong demand from this discerning consumer base.

- This segment values authenticity and artisanal quality above price.

- They are attracted to Orior's premium brands such as Citterio and Rapelli.

- Global specialty food sales are forecast to expand, indicating sustained demand.

- Focus on premium offerings aligns with Orior's strategic positioning for growth.

Orior targets diverse customer segments, encompassing retail consumers seeking convenient, quality food and B2B clients like foodservice and retail chains demanding consistent supply. A significant focus is on health-conscious consumers, with the plant-based market projected at $49.06 billion in 2024, and gourmet food enthusiasts valuing premium, authentic products. These segments collectively drive Orior's revenue streams across various channels.

| Segment | Key Need | 2024 Relevance |

|---|---|---|

| Retail Consumers | Convenience, Quality | Foundational revenue driver |

| Foodservice & Hospitality | Consistency, Reliability | Swiss market recovery demand |

| Health-Conscious | Plant-based, Organic | $49.06B market value |

Cost Structure

The cost of raw materials represents Orior's most significant expenditure, driven by acquiring premium meat, vegetables, flour, and spices. As a producer committed to high-quality inputs, this component reflects a value-driven cost structure. Fluctuations in commodity prices directly impact gross margins; for instance, ongoing elevated input costs in 2024 continue to challenge profitability across the food sector. Managing these procurement expenses is crucial for Orior's financial performance.

Orior’s cost structure includes significant Production & Personnel Costs, encompassing all expenses tied to its manufacturing operations and workforce. This covers salaries for skilled production staff, management, and essential R&D teams, which represent a substantial investment in human capital. Additionally, it accounts for energy consumption, facility maintenance, and depreciation of production assets. For instance, in 2024, maintaining efficient production lines and a highly skilled workforce remains critical for Orior’s Swiss food processing and convenience business.

Logistics and distribution costs are a significant component for Orior, covering warehousing, meticulous inventory management, and the vital transportation of goods, especially through the temperature-controlled cold chain. Fuel prices remain a key driver, with global energy markets influencing costs; for instance, European diesel prices saw fluctuations in early 2024 impacting transport expenses. The complexity of Orior's distribution network also adds to these costs. Maintaining efficiency in this area is paramount for preserving margins and ensuring product freshness, directly affecting profitability.

Sales and Marketing Expenses

Sales and Marketing Expenses encompass all costs for Orior’s brand building, advertising campaigns, and in-store promotions. These crucial discretionary investments drive top-line growth and strengthen brand equity, essential for securing market share. Such expenditures are vital for supporting Orior’s premium brand strategy, ensuring market visibility and consumer engagement.

- Orior's 2023 marketing and distribution expenses were reported at CHF 37.8 million, demonstrating significant investment in these areas.

- These expenses include salaries for dedicated sales and marketing teams, crucial for direct market engagement.

- Strategic allocation here directly supports Orior’s goal of enhancing brand perception and increasing product reach.

- Continued investment in 2024 is expected to reinforce its market position in the premium food segment.

General & Administrative Expenses

General & Administrative Expenses for Orior encompass essential overheads like corporate management, finance, and IT, not tied directly to production or sales. While Orior AG, a publicly listed food company, prioritizes lean administration, these costs are crucial for overseeing its multiple competence centers and ensuring regulatory compliance. This category remains a key focus for efficiency monitoring, especially as businesses navigate a dynamic economic landscape in 2024, emphasizing cost control.

- Orior's G&A expenses are vital for centralized functions.

- These overheads support the group's publicly listed status and governance.

- Efficiency in G&A is a consistent monitoring priority for Orior.

- In 2024, maintaining lean administrative structures remains critical for profitability.

Orior's cost structure is primarily driven by raw materials, production, and personnel expenses. Significant investments are also allocated to logistics, distribution, and sales and marketing, with 2023 marketing and distribution expenses at CHF 37.8 million. General and administrative overheads support centralized functions, all focused on efficiency in 2024 to maintain profitability.

| Cost Category | Key Drivers | 2024 Impact |

|---|---|---|

| Raw Materials | Premium ingredients, commodity prices | Elevated input costs challenge profitability |

| Production & Personnel | Skilled labor, energy, R&D | Efficient operations, skilled workforce critical |

| Logistics & Distribution | Fuel prices, cold chain | Fuel fluctuations (e.g., early 2024 diesel) |

| Sales & Marketing | Brand building, promotions | Continued investment for market position |

Revenue Streams

Sales of Orior's owned brands to retail, including Rapelli, Fredag, and Pastinella, form the primary revenue stream. This segment, part of the Convenience and Refinement divisions, consistently generates high-volume sales through supermarket chains and other retail outlets, making it the bedrock of the company's financial stability. In 2023, the Convenience segment, heavily reliant on retail sales, reported net sales of CHF 371.3 million, highlighting its significant contribution to Orior's overall performance. This strong brand portfolio ensures stable revenue, underpinning the company's profitability and market position.

A significant revenue stream for Orior stems from supplying products to B2B customers within the hospitality and catering industries. This includes direct sales to hotels and restaurants, alongside sales facilitated through various distributors. For instance, in 2023, Orior's Convenience segment, which largely serves this sector, achieved net sales of CHF 453.0 million, demonstrating the substantial contribution of these channels. This strategic diversification provides a crucial hedge against potential fluctuations in the retail market, ensuring more stable revenue streams.

Orior's private label manufacturing constitutes a significant revenue stream by producing food items for retailers under their own distinct brand names. This segment, while typically operating at lower margins compared to Orior's proprietary branded sales, is crucial for maximizing production capacity utilization across their facilities. It fosters robust, long-term relationships with major retail partners, establishing Orior as a reliable high-volume supplier. This stable business model contributed to Orior's consolidated net sales of CHF 577.6 million in 2023, with private label products forming a substantial part of their overall sales mix, ensuring consistent demand and operational efficiency into 2024.

Export Sales

Orior generates revenue through export sales, particularly from its Swiss specialties and premium charcuterie products. Exports to neighboring European countries and beyond serve as a crucial growth vector for the company. This stream significantly diversifies geographic risk, contributing to overall stability. For instance, in 2023, the International division, which includes export activities, reported sales of CHF 20.3 million, showcasing its contribution to Orior's diversified revenue.

- Revenue from Swiss specialties and premium charcuterie sold internationally.

- Exports target neighboring European countries and broader global markets.

- Key growth driver, with the International division contributing CHF 20.3 million in 2023 sales.

- Diversifies geographic risk, enhancing Orior's market resilience.

Sales from Convenience & Plant-Based Categories

Orior's revenue from convenience and plant-based categories captures evolving consumer trends, commanding premium prices due to high demand for fresh and sustainable options. These high-growth segments, particularly convenience food, are strategically vital for future expansion. Orior reported a sales growth in the Convenience business area in 2023.

- Orior's Convenience business area saw a 4.1% sales growth in 2023.

- The plant-based segment continues to be a strategic focus for market share gains.

- These categories are key drivers for Orior's overall revenue diversification.

- They reflect Orior's adaptation to contemporary dietary preferences by 2024.

Orior diversifies its revenue through key streams, including direct sales of owned brands to retail, which generated substantial sales in 2023. Supplying B2B customers in hospitality and catering is another major contributor, complemented by significant private label manufacturing for retailers. Export sales of Swiss specialties and the growing convenience and plant-based categories further bolster Orior's financial resilience and strategic market positioning into 2024.

| Revenue Stream | 2023 Net Sales (CHF million) | 2023 Growth |

|---|---|---|

| Retail (Owned Brands) | 371.3 (Convenience) | Stable |

| B2B (Hospitality/Catering) | 453.0 (Convenience) | Robust |

| Private Label | Part of 577.6 (Consol.) | Consistent |

| Exports (International) | 20.3 | Growth |

| Convenience/Plant-Based | Included above | 4.1% (Convenience) |

Business Model Canvas Data Sources

The Orior Business Model Canvas is informed by a blend of internal financial data, comprehensive market research reports, and stakeholder feedback. These diverse sources ensure a robust and actionable strategic framework.