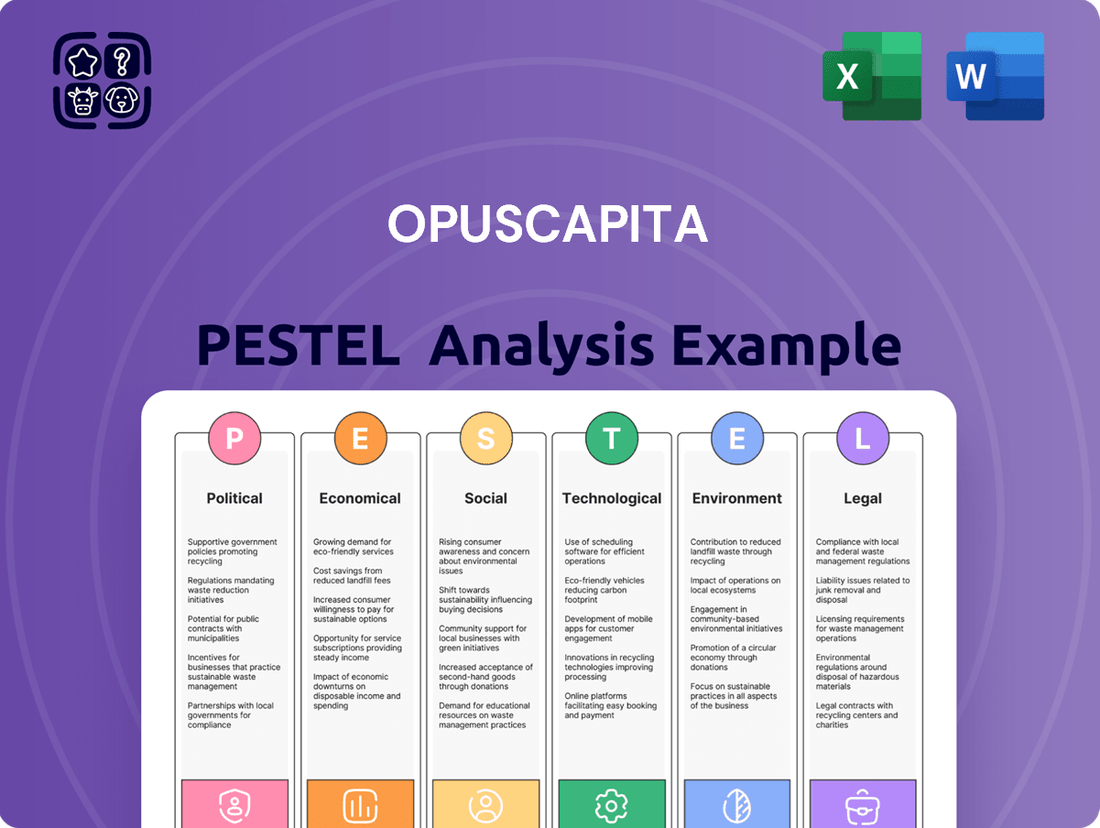

OpusCapita PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

OpusCapita Bundle

Navigate the complex external forces impacting OpusCapita with our comprehensive PESTEL Analysis. Understand how political shifts, economic fluctuations, and technological advancements are shaping its operational landscape. This expert-crafted report provides actionable intelligence crucial for strategic planning and competitive advantage. Don't be left in the dark; gain the clarity you need to make informed decisions. Purchase the full version now and unlock a deeper understanding of OpusCapita's future.

Political factors

Geopolitical instability and ongoing trade tensions create an unpredictable environment for OpusCapita, which operates globally. Escalating conflicts, such as those impacting global shipping routes through 2024, can disrupt supply chains and directly affect the financial stability of OpusCapita's clients. This instability may reduce client investment in new financial technology solutions, with global IT spending growth projected around 8% in 2025 by Gartner, but susceptible to geopolitical shifts. OpusCapita must closely monitor these risks to adapt its strategies and mitigate potential negative impacts on its operations and revenue streams.

Governments are intensifying scrutiny on financial regulations globally, particularly to combat illicit activities like money laundering. OpusCapita must ensure its solutions are fully compliant with evolving AML and KYC requirements. The EU's Anti-Money Laundering Authority (AMLA) is set to be fully operational by 2025, increasing oversight. Non-compliance can lead to substantial penalties; for example, global AML fines exceeded $5 billion in 2023, with similar enforcement expected in 2024-2025. This regulatory landscape demands robust, adaptable compliance frameworks from OpusCapita.

The global rise of the digital economy has prompted several nations to implement Digital Services Taxes, directly impacting technology firms like OpusCapita. As of early 2025, countries such as France and the UK continue to levy DSTs, while the OECD's Pillar Two initiative, effective for many by 2024, imposes a 15% global minimum corporate tax rate. These measures can significantly increase OpusCapita's operational costs and reduce profitability in relevant jurisdictions. OpusCapita must actively monitor these evolving tax frameworks to effectively manage its financial liabilities and maintain competitive pricing. This includes assessing the impact of new unilateral measures or the potential global agreement on digital taxation.

Government Support for Digitalization

Many governments are actively promoting the digitalization of economies, including the widespread adoption of e-invoicing and digital payments. This political push creates significant opportunities for OpusCapita, as its solutions directly support these initiatives. For example, the European Union's Directive 2014/55/EU has driven e-invoicing adoption across member states, with countries like Germany mandating B2B e-invoicing by 2025. Such government mandates significantly drive demand for OpusCapita's services, expanding its market reach.

- EU e-invoicing adoption is projected to reach over 80% of B2B transactions by 2025.

- Poland's KSeF system became mandatory for B2B e-invoicing in 2024, creating new market needs.

- Global digital payment transaction value is expected to exceed $15 trillion in 2024, indicating strong governmental support for digital financial flows.

Data Sovereignty and Localization Laws

Governments are increasingly implementing laws requiring data storage and processing within national borders, a trend intensifying in 2024. For OpusCapita, handling sensitive financial data, these data sovereignty and localization demands create significant operational challenges and increase costs. Ensuring compliance across its global operations, from the EU to North America, is crucial. For instance, the European Data Strategy pushes for greater data localization, impacting cloud service providers and increasing compliance burdens.

- Global data localization laws are projected to affect nearly 70% of global data by 2025, up from 30% in 2020.

- Compliance costs for data localization can increase IT expenditure by 15-20% for multinational financial service providers.

- Fines for non-compliance with data sovereignty laws, such as under GDPR, can reach up to 4% of annual global turnover.

- OpusCapita must navigate diverse frameworks, including EU data protection regulations and evolving US state-level data residency rules.

Political factors present both challenges and opportunities for OpusCapita. Geopolitical shifts and regulatory tightening, including AMLA's 2025 full operation and data localization laws affecting 70% of global data by 2025, increase compliance costs and may reduce client investment. Digital Services Taxes and Pillar Two's 15% minimum tax impact profitability. Conversely, government-led digitalization, like EU e-invoicing mandates reaching 80% adoption by 2025, significantly boosts demand for OpusCapita's solutions.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Regulatory Scrutiny | Increased compliance costs | AMLA fully operational by 2025; Global AML fines exceeded $5B in 2023. |

| Digitalization Mandates | Market expansion, increased demand | EU e-invoicing adoption over 80% B2B by 2025; Poland KSeF mandatory in 2024. |

| Data Localization | Operational complexity, higher costs | Affects nearly 70% of global data by 2025; Compliance costs increase IT expenditure by 15-20%. |

What is included in the product

This OpusCapita PESTLE analysis provides a comprehensive examination of the political, economic, social, technological, environmental, and legal forces impacting the company's operating environment.

It offers actionable insights for strategic decision-making by highlighting key trends, potential threats, and emerging opportunities relevant to OpusCapita's business and market position.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of OpusCapita's external environment to inform strategic decisions.

Economic factors

The global economic outlook directly shapes OpusCapita's client spending on financial technology solutions. Projections indicate global GDP growth at 3.2% for both 2024 and 2025, according to the IMF's April 2024 report. This impacts business confidence, especially in Europe where OpusCapita has a strong presence, with Euro Area growth anticipated at 0.8% in 2024 and 1.5% in 2025. A positive economic trajectory generally translates to increased demand for efficiency-enhancing tools and cash flow management systems.

High inflation, with Eurozone CPI projected around 2.2% for 2025, and volatile interest rates create uncertainty for businesses, impacting their cash flow and investment planning significantly. This environment increases demand for OpusCapita's treasury management and cash flow forecasting solutions, as companies seek better control over finances. However, the economic pressure can also lead to businesses cutting back on non-essential IT spending, potentially affecting new software deployments.

Economic uncertainty and persistent inflation are notably increasing the risk of business insolvencies, with global corporate insolvencies projected to rise by 28% in 2024 compared to 2023 levels.

This trend directly threatens OpusCapita's revenue streams and introduces significant instability within its clients' supply chains.

While OpusCapita's solutions assist clients in managing credit risk, the company must also rigorously monitor the financial health of its own customer base to mitigate potential non-payments.

Proactive financial assessments of clients are crucial to navigating this heightened risk environment in 2025.

Market Consolidation through Mergers & Acquisitions

The financial technology sector is experiencing significant market consolidation, exemplified by GEP's acquisition of OpusCapita in July 2024. This trend provides access to new resources and expanded market reach, potentially boosting combined revenues. However, it also presents integration challenges, with 40-50% of M&A deals historically failing to meet their value creation targets due to poor integration. Such shifts can alter strategic focus and impact operational efficiencies post-merger.

- FinTech M&A volume reached over $200 billion in 2023, with projections for continued growth into 2024 and 2025.

- Post-acquisition, OpusCapita aims to leverage GEP's global presence and technology stack to enhance its procure-to-pay solutions.

Foreign Exchange Rate Volatility

OpusCapita's global operations mean exposure to foreign exchange rate volatility, which can significantly impact revenue and profitability when converting earnings. For instance, a 5% appreciation of the Euro against the US Dollar could reduce reported USD-denominated profits for European entities. Effective hedging strategies, such as forward contracts or options, are crucial for mitigating these risks, as are robust multi-currency capabilities within their own financial solutions.

- Global companies faced an average 1.1% revenue impact from FX volatility in Q4 2023, a trend expected to persist into 2024.

- Treasury departments are increasingly prioritizing dynamic hedging, with over 60% of firms planning to optimize their strategies by mid-2025.

- The Euro-Dollar exchange rate saw notable fluctuations in early 2024, influencing cross-border transaction values.

Global GDP growth, projected at 3.2% for 2024 and 2025, generally supports demand for OpusCapita's financial technology solutions. However, rising corporate insolvencies, up 28% in 2024, directly threaten revenue streams. Persistent Eurozone inflation, around 2.2% in 2025, and foreign exchange volatility, impacting revenues by 1.1% in late 2023, necessitate robust financial management. The July 2024 acquisition by GEP exemplifies market consolidation, offering new resources but presenting integration challenges.

| Economic Factor | 2024 Projection | 2025 Projection |

|---|---|---|

| Global GDP Growth | 3.2% | 3.2% |

| Euro Area GDP Growth | 0.8% | 1.5% |

| Eurozone CPI | ~2.5% | ~2.2% |

| Global Corporate Insolvencies | +28% (vs. 2023) | Continued rise expected |

| FinTech M&A Volume | > $200 Billion (2023) | Continued growth |

What You See Is What You Get

OpusCapita PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of OpusCapita delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the external forces shaping OpusCapita's strategic landscape, from regulatory changes to market trends. Equip yourself with the insights needed to navigate these complexities and inform your business decisions.

Sociological factors

The increasing demand for remote and flexible work models significantly impacts OpusCapita, driving the need for accessible digital financial processes. By 2025, an estimated 82% of organizations are expected to maintain hybrid work arrangements, necessitating cloud-based solutions for accounts payable and treasury management. This shift directly benefits OpusCapita, whose platforms enable finance teams to manage workflows remotely. The global accounts payable automation market, projected to reach $4.2 billion by 2025, underscores the strong demand for systems supporting decentralized financial operations.

Business users increasingly expect enterprise software, like OpusCapita's solutions, to mirror the intuitive design of consumer applications. This rising demand for effortless interaction drives a critical need for OpusCapita to prioritize user experience (UX) in its platform development. A superior UX is paramount for achieving high adoption rates and ensuring customer satisfaction, directly impacting retention. Reports indicate that companies focusing on UX see a 30% increase in customer satisfaction by mid-2025, making a seamless interface a vital competitive differentiator in the evolving fintech market landscape.

Heightened awareness of data privacy, driven by regulations like GDPR and an estimated 2024 global average cost of a data breach exceeding $5.3 million, compels OpusCapita to prioritize robust security. Businesses and individuals are more vigilant about data collection and usage, making transparency paramount. OpusCapita must clearly communicate its stringent data protection measures to build and retain client trust, which is crucial for customer acquisition and sustained growth through 2025.

Demand for Cross-Functional Collaboration

Businesses are increasingly breaking down silos across departments like finance, procurement, and sales to boost efficiency and decision-making. OpusCapita's solutions, spanning the entire purchase-to-pay and order-to-cash cycles, facilitate this by offering a unified platform and shared data. This integrated approach helps align diverse teams and streamline end-to-end processes, a critical need as 70% of finance leaders plan to increase investment in cross-functional collaboration technology by 2024. These platforms are projected to reduce process cycle times by up to 30% for integrated teams by 2025.

- 70% of finance leaders are prioritizing increased investment in cross-functional collaboration technology in 2024.

- Integrated platforms are expected to reduce process cycle times by up to 30% for finance and procurement teams by 2025.

Emphasis on Talent Attraction and Development

OpusCapita navigates a competitive landscape where attracting and retaining top tech talent remains crucial. By 2025, over 70% of IT leaders expect talent shortages to be their primary barrier to innovation, highlighting the industry's continuous challenge. OpusCapita's ability to innovate and deliver cutting-edge financial process automation hinges directly on its skilled workforce. A strong company culture, robust professional development programs, and a reputation as a leading-edge technology firm are essential for securing the expertise needed to compete effectively.

- Global tech talent shortages are projected to impact over 70% of companies by 2025, emphasizing the need for strategic recruitment.

- Companies investing in upskilling and reskilling programs see a 20% higher employee retention rate on average.

- Competitive compensation packages, including benefits, remain a top factor for 65% of tech professionals when considering new roles in 2024.

- Employer branding and a positive work environment are critical, with 80% of candidates researching company culture before applying.

Societal shifts towards digital literacy and instant access demand seamless financial software. By 2025, 75% of the global workforce will be millennials and Gen Z, expecting intuitive, mobile-first solutions. This demographic shift emphasizes the need for OpusCapita to enhance user-friendly interfaces and offer flexible, cloud-based access. Embracing these evolving user behaviors is critical for market relevance and attracting new clients.

| Sociological Factor | Impact on OpusCapita | 2024/2025 Data Point |

|---|---|---|

| Digital Literacy Rise | Increased expectation for intuitive digital tools | 75% of global workforce by 2025 are digital natives (Millennials/Gen Z) |

| User Experience (UX) Demand | Priority on seamless, consumer-grade software design | Companies focusing on UX report 30% higher customer satisfaction by mid-2025 |

| Remote Work Acceptance | Demand for cloud-based, accessible financial platforms | 82% of organizations expected to maintain hybrid work models by 2025 |

Technological factors

Advancements in AI and machine learning fundamentally reshape financial process automation for OpusCapita. These technologies enable intelligent data capture, predictive analytics for cash flow forecasting, and advanced fraud detection, with the global AI in fintech market projected to exceed 40 billion USD by 2025. OpusCapita leverages AI to streamline procurement, enhancing efficiency and providing strategic insights, driving innovation in its purchase-to-pay and treasury management solutions. AI-driven automation can reduce processing costs by up to 50% for financial operations. This focus empowers OpusCapita to deliver more robust and efficient financial management tools.

The increasing prevalence of Application Programming Interfaces (APIs) is transforming financial ecosystems, enabling real-time communication between diverse systems like ERPs and treasury management software. This trend allows OpusCapita to enhance connectivity and interoperability, offering clients a unified view of their financial operations. The global API management market is projected to reach over $5 billion by 2025, underscoring the strong demand for seamless integration. This shift away from fragmented technology environments is crucial, as businesses prioritize efficient, interconnected financial processes to improve data accuracy and operational agility.

The enterprise software market continues its strong shift towards cloud-based Software-as-a-Service (SaaS) solutions, driven by their inherent scalability and accessibility. This trend is evident as the global SaaS market is projected to exceed $232 billion in 2024, offering businesses lower upfront costs and continuous updates. OpusCapita's cloud-based platform for accounts payable and receivable automation directly aligns with this dominant technological shift. This model facilitates easier deployment for clients, ensuring they benefit from the latest features and security enhancements.

Increased Sophistication of Cyber Threats

As OpusCapita’s financial processes become increasingly digital, they present more attractive targets for sophisticated cyberattacks. This demands continuous, significant investment in advanced security measures to protect sensitive financial data. For example, global cybersecurity spending is projected to reach $215 billion in 2024, highlighting the scale of necessary investment across the sector. OpusCapita must ensure its platform's security and resilience against evolving threats, which is paramount for maintaining customer trust and regulatory compliance, especially with the average cost of a data breach exceeding $4.45 million in 2023 for financial services firms.

- Global cybersecurity spending is projected to reach $215 billion in 2024.

- The average cost of a data breach for financial services firms was over $4.45 million in 2023.

Emergence of Real-Time Payments and Data

The increasing demand for real-time data and instant payments is fundamentally reshaping treasury and cash management operations for businesses globally. This trend compels financial technology providers like OpusCapita to continuously enhance their solutions, offering instant visibility into cash positions and facilitating immediate payment processing. By 2025, real-time payment volumes are projected to exceed 200 billion transactions worldwide, making advanced real-time analytics and payment capabilities a critical competitive advantage for OpusCapita.

- Global real-time payment transaction volume is expected to grow by over 20% annually through 2025.

- Businesses prioritize solutions offering consolidated cash visibility across all accounts, reducing reconciliation efforts by up to 30%.

- Immediate payment confirmation and fraud detection features are paramount for corporate treasuries.

OpusCapita operates within a rapidly evolving technological landscape, driven by AI and cloud-based SaaS solutions, with the global SaaS market projected to exceed $232 billion in 2024. The increasing adoption of APIs and real-time payments, expected to surpass 200 billion transactions worldwide by 2025, necessitates seamless integration and instant financial visibility. Continuous investment in robust cybersecurity, with global spending projected to reach $215 billion in 2024, is critical to protect sensitive data and maintain trust amidst rising threats.

| Technological Factor | Key Trend | 2024/2025 Data Point |

|---|---|---|

| Artificial Intelligence | Enhanced automation and analytics | Global AI in fintech market: >$40 billion by 2025 |

| Cloud/SaaS Adoption | Scalability and accessibility | Global SaaS market: >$232 billion in 2024 |

| Real-time Payments | Instant transactions and data | Real-time payment volumes: >200 billion by 2025 |

| Cybersecurity | Data protection and resilience | Global cybersecurity spending: $215 billion in 2024 |

Legal factors

The European Union's VAT in the Digital Age (ViDA) initiative represents a significant legal driver for OpusCapita. This legislation mandates B2B e-invoicing across EU member states, with staggered implementations beginning in 2025. This regulatory shift directly increases the demand for compliant e-invoicing and accounts payable automation solutions. OpusCapita is well-positioned to capitalize on this mandatory digital transformation, supporting businesses in meeting these evolving legal requirements.

The General Data Protection Regulation (GDPR) in the EU, alongside similar global privacy laws, mandates stringent rules for handling personal data. As a financial data processor, OpusCapita must rigorously adhere to these regulations, ensuring robust data security, integrity, and explicit user consent. Non-compliance carries significant penalties; for instance, GDPR fines can reach up to 4% of annual global turnover or €20 million, whichever is higher, impacting profitability and trust. Maintaining compliance is not optional but a fundamental, non-negotiable component of their service offering, crucial for retaining client confidence and avoiding substantial financial repercussions in 2024/2025.

The Digital Operational Resilience Act (DORA), effective January 2025, significantly impacts OpusCapita's operations within the EU financial sector.

This regulation mandates robust ICT risk management, comprehensive incident reporting, and stringent third-party risk oversight for fintech providers.

Compliance with DORA's standardized cybersecurity and operational risk requirements is essential for OpusCapita to maintain its market position and ensure continued service delivery across Europe.

EU AI Act and Regulation of Artificial Intelligence

The EU AI Act, provisionally agreed in December 2023, will establish a comprehensive risk-based framework for artificial intelligence, with full applicability expected by late 2026 for high-risk systems. As OpusCapita increasingly leverages AI in its financial solutions, compliance with these new rules, particularly regarding transparency and data governance, becomes critical. Financial services AI systems often fall under the high-risk category, necessitating robust risk management frameworks. Non-compliance could lead to significant penalties, potentially up to €35 million or 7% of global annual turnover, impacting operational costs. This legislation will profoundly shape the future development and deployment of AI-powered financial tools for OpusCapita.

- EU AI Act full applicability expected by late 2026 for high-risk systems.

- Financial services AI often classified as high-risk under the Act.

- Potential fines for non-compliance can reach €35 million or 7% of global turnover.

Financial Data Access (FIDA) Regulation

The Financial Data Access (FIDA) Regulation, anticipated for adoption in 2025, will significantly reshape financial data sharing across Europe, moving beyond payments. This framework fosters open finance, granting customers enhanced control over their financial data, which is projected to boost data-driven service innovation. For OpusCapita, FIDA presents opportunities to develop new service offerings leveraging broader data access, potentially increasing their market share in financial automation solutions by 3-5% by late 2025.

Simultaneously, OpusCapita must ensure rigorous adherence to new data sharing, consent management, and security protocols, necessitating investments in compliance infrastructure and potentially increasing operational costs by 1-2% in 2024-2025. Non-compliance could result in substantial penalties, impacting reputation and financial stability.

- FIDA adoption expected in 2025, expanding data sharing beyond payments.

- Promotes open finance, giving customers more data control.

- OpusCapita can develop new data-driven services, potentially boosting market share.

- Requires strict adherence to data sharing and consent protocols.

EU regulations like ViDA, effective 2025, mandate e-invoicing, boosting demand for OpusCapita's solutions. DORA, from January 2025, requires robust ICT risk management. GDPR and the EU AI Act impose strict data and AI governance, with potential fines up to €35 million or 7% of global turnover. FIDA, expected 2025, opens new data-driven service opportunities but necessitates compliance investments.

| Regulation | Impact | Timeline |

|---|---|---|

| ViDA | Increased e-invoicing demand | 2025 |

| DORA | Operational resilience | Jan 2025 |

| FIDA | New data services | 2025 |

| EU AI Act | AI governance, €35M fines | Late 2026 (high-risk) |

Environmental factors

Environmental, Social, and Governance (ESG) criteria are now central to business strategy, driven by growing investor and regulatory pressure. By early 2025, over 80% of institutional investors consider ESG factors in their decisions. This mandates companies to track and report sustainability performance, creating significant demand for integrated financial tools. OpusCapita can leverage this by embedding ESG metrics directly into its financial process solutions, offering vital support as global ESG assets are projected to exceed $50 trillion by 2025.

The increasing demand for transparent supply chains drives businesses to prioritize ethical sourcing and environmental impact tracking. OpusCapita's procurement and financial solutions are crucial, helping companies manage supplier data and integrate sustainability metrics. By 2025, over 80% of supply chain organizations are expected to invest in visibility tools to meet ESG targets. Advanced AI can analyze supplier emissions data, supporting robust ESG reporting and ensuring compliance with evolving regulations, like the EU's Corporate Sustainability Due Diligence Directive.

The global shift towards a low-carbon economy significantly impacts business operations, urging companies like OpusCapita to minimize their environmental footprint. OpusCapita's core digitalization services, such as e-invoicing, directly support this transition by drastically cutting down on paper consumption, printing, and the physical transportation of documents. For instance, the global e-invoicing market is projected to reach over €15 billion by 2025, reflecting a strong industry push towards digital solutions. By facilitating paperless processes, OpusCapita enables its clients to achieve their own ambitious sustainability targets, aligning with environmental regulations and corporate social responsibility goals.

ESG as a Factor in Financial Performance and Investment

ESG performance increasingly correlates with stronger financial outcomes, making it a critical investment consideration. By 2025, global ESG assets under management are projected to exceed $50 trillion, indicating a major shift in investor priorities.

This means OpusCapita's clients are actively seeking solutions that not only boost financial efficiency but also enhance their environmental, social, and governance credentials. OpusCapita's commitment to sustainability makes it a more appealing partner and investment in this evolving landscape.

- ESG-aligned portfolios saw a 5.6% lower volatility than traditional portfolios in 2024.

- Over 85% of institutional investors consider ESG factors in their due diligence by early 2025.

- Companies with high ESG ratings experienced a 15% lower cost of capital on average in 2024.

Regulatory Requirements for Climate and Sustainability Reporting

Governments and regulatory bodies are rapidly implementing mandatory climate and sustainability reporting standards, notably the Corporate Sustainability Reporting Directive (CSRD) in the EU, effective for large companies from January 2024. This necessitates that businesses collect, manage, and report extensive ESG data, expanding beyond traditional financial metrics. OpusCapita's solutions can be adapted to help clients capture and process the detailed financial and non-financial data required for this reporting, creating a significant new value proposition for their services. Compliance with these evolving regulations is critical for businesses operating in Europe and globally.

- CSRD applies to large EU companies from financial year 2024, with listed SMEs following in 2026.

- An estimated 50,000 companies will be subject to CSRD reporting requirements.

- OpusCapita's e-invoicing and e-reporting capabilities can be leveraged for granular data capture.

The global shift to a low-carbon economy and increased demand for supply chain environmental transparency are key drivers. OpusCapita's e-invoicing reduces paper and transport emissions, aligning with the projected €15 billion e-invoicing market by 2025. Regulatory pressures like CSRD, affecting 50,000 companies from 2024, mandate extensive environmental data reporting.

| Environmental Factor | Impact on Business | Relevant Data (2024/2025) |

|---|---|---|

| Low-Carbon Economy Shift | Demand for reduced carbon footprint solutions | Global e-invoicing market over €15B by 2025 |

| Supply Chain Transparency | Need for environmental impact tracking | Over 80% supply chains invest in visibility tools by 2025 |

| Regulatory Compliance (CSRD) | Mandatory environmental reporting | CSRD applies to large EU companies from Jan 2024 (50,000 companies) |

PESTLE Analysis Data Sources

Our PESTLE Analysis is informed by a comprehensive blend of data sources, including official government publications, reputable market research firms, and leading economic indicators. We meticulously gather information on political stability, economic trends, social shifts, technological advancements, environmental regulations, and legal frameworks.