OpusCapita Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

OpusCapita Bundle

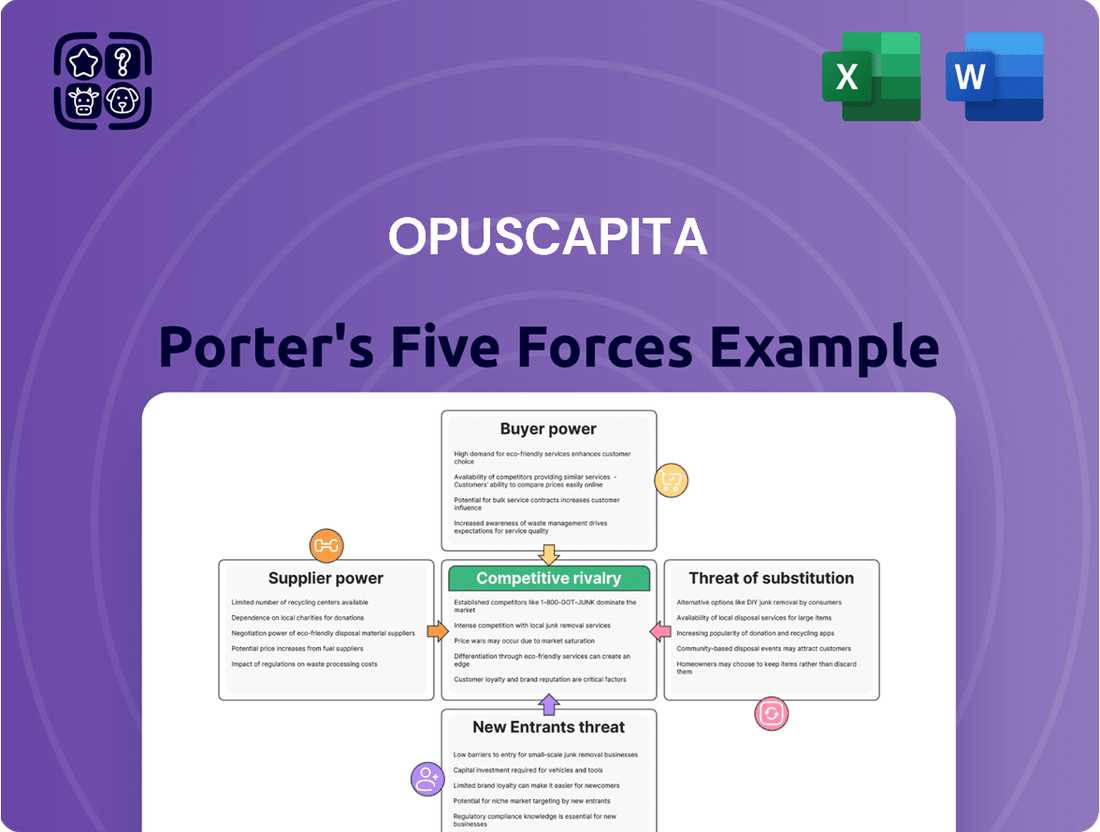

OpusCapita operates in a dynamic market shaped by several key competitive forces, including the bargaining power of buyers and suppliers, the threat of new entrants, and the intensity of rivalry among existing players.

Understanding these forces is crucial for any business aiming to succeed in this sector.

The threat of substitute products also plays a significant role in defining OpusCapita's strategic landscape.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore OpusCapita’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The market for specialized financial software and cloud infrastructure remains highly concentrated, giving dominant vendors significant leverage. OpusCapita's operational stability relies heavily on these key technology providers, notably major cloud service companies like Amazon Web Services and Microsoft Azure. Their significant market share, exceeding 60% combined in early 2024 for cloud infrastructure, empowers them to dictate terms. Any adjustments in their pricing structures or service agreements can directly impact OpusCapita's operational costs and profit margins. This deep dependency is a critical factor, as OpusCapita's core SaaS platform is built upon these foundational technological ecosystems.

Suppliers providing advanced AI, machine learning, and robotic process automation (RPA) technologies exert significant power. As OpusCapita targets up to 95% automation in areas like accounts payable, these specialized suppliers become critical for innovation. The reliance on their unique expertise, especially as AI adoption surged in 2024, often leads to higher costs. This dependency can result in less favorable contract terms for OpusCapita, impacting its operational efficiency and overall profitability.

OpusCapita’s business model fundamentally relies on strategic partnerships with interoperability providers and financial institutions to expand its network reach. These partners, whose technology and extensive networks are crucial for seamless transaction processing, hold significant bargaining power. For instance, in 2024, the continued reliance on robust partner ecosystems for global payment and e-invoicing flows underscores their integral role. The quality and breadth of these partner networks directly enhance OpusCapita’s value proposition to its diverse client base.

High Switching Costs for Integrated Solutions

The deep integration of supplier technologies into OpusCapita's platform, particularly for core functionalities like AI-driven data capture and cloud hosting, creates substantial switching costs. Shifting to a new provider for these embedded solutions would necessitate significant investment in development, extensive testing, and complex data migration efforts. Such operational disruption and financial outlay empower existing suppliers in negotiations, as OpusCapita's dependence on their established infrastructure is high. For example, enterprise software migrations can cost millions, with data from 2024 indicating that over 60% of companies find data migration a major challenge.

- Significant investment in re-platforming and data migration.

- Operational disruption and retraining expenses for staff.

- High risk of data loss or system downtime during transition.

- Lengthy implementation cycles, potentially taking over 12-18 months.

Acquisition by GEP

Following its acquisition by GEP in July 2024, OpusCapita's supplier relationships will likely undergo re-evaluation and consolidation with GEP's extensive network. This strategic integration could either increase or decrease the power of individual suppliers, depending on their strategic importance to the newly combined entity. The merger provides a significant opportunity to renegotiate terms from a position of greater scale and optimized supply chain management.

- GEP's global reach potentially diversifies OpusCapita's supplier base.

- Consolidation may lead to fewer but more strategically important suppliers.

- Negotiating leverage is enhanced by the combined entity's purchasing volume.

- Supplier power dynamic shifts based on GEP's existing procurement infrastructure.

Suppliers hold substantial power, primarily driven by the concentrated market for cloud infrastructure, where major vendors like AWS and Azure commanded over 60% market share in 2024. High switching costs, due to deep integration of AI and core technologies, further empower these specialized providers. The July 2024 GEP acquisition may shift this dynamic, potentially enhancing OpusCapita's negotiation leverage.

| Supplier Type | Market Share (2024) | Impact on OpusCapita |

|---|---|---|

| Cloud Infrastructure | >60% (AWS, Azure) | High operational dependency |

| AI/RPA Solutions | Specialized Vendors | Critical for 95% automation goal |

| Switching Costs | Millions (software migration) | Significant financial outlay |

What is included in the product

This analysis meticulously breaks down the competitive forces impacting OpusCapita, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the potential of substitutes.

Instantly visualize competitive intensity across all five forces, providing a clear, actionable overview for strategic planning.

Customers Bargaining Power

For large enterprises, OpusCapita's solutions often become deeply embedded within their ERP and financial workflows, creating substantial switching costs. This deep integration means that migrating to a competitor involves significant business disruption, complex data migration challenges, and extensive retraining for personnel. Such an undertaking can be immensely costly, with major enterprise software migrations often extending over a year and incurring millions in expenses in 2024. Consequently, customers are less likely to switch providers over minor price changes, thereby diminishing their bargaining power against OpusCapita.

The procure-to-pay P2P and financial automation market, valued at USD 9.77 billion in 2024, is highly competitive with numerous vendors. This gives customers, especially those not deeply integrated, significant bargaining power. They can easily compare features, pricing, and service levels from a wide array of providers. Key competitors include SAP Ariba, which reported strong cloud revenue growth in 2023, and Coupa, acquired by Thoma Bravo in 2023, along with Basware.

Customers increasingly demand integrated, end-to-end solutions covering the entire financial process chain, from procurement to payment. This empowers them to negotiate better terms for comprehensive service suites. For instance, the global spend management software market, valued at approximately $8.5 billion in 2024, highlights this demand for unified platforms. OpusCapita's acquisition by GEP in 2023 directly addresses this shift, aiming to offer a broader product portfolio and mitigate customer bargaining power by meeting their need for complete, seamless financial solutions.

Price Sensitivity in a Competitive Market

In a market with numerous alternatives, customers exhibit significant price sensitivity. They can easily solicit competing quotes from multiple vendors, compelling providers like OpusCapita to price their solutions competitively to secure and retain business. This dynamic is particularly evident for more standardized services such as e-invoicing, where the perceived value differentiation among providers can be minimal. For instance, the global e-invoicing market was projected to reach approximately $15.5 billion in 2024, indicating a vast and competitive landscape.

- Customers readily compare prices across a fragmented vendor landscape.

- The ease of switching providers increases customer leverage.

- OpusCapita must offer competitive pricing, especially for commoditized services.

- The global e-invoicing market's 2024 valuation underscores intense competition.

Increasing Importance of E-invoicing Mandates

Government mandates for e-invoicing, particularly across Europe, significantly reshape customer bargaining power. In the short term, these mandates, such as France's e-invoicing rollout by 2026, compel businesses to adopt compliant solutions, temporarily reducing their leverage as they must procure a service. However, this regulatory push also attracts numerous new providers to the market, fostering increased competition and ultimately enhancing customer choice in the long run. The global e-invoicing market is projected to reach $20 billion by 2027, driven by 2024 compliance needs.

- EU VAT in the Digital Age (ViDA) initiative accelerates mandatory e-invoicing, impacting all EU member states.

- Italy's SDI system has been mandatory since 2019, showcasing early adoption and market maturity.

- Poland introduced its mandatory KSeF system in 2024, requiring businesses to use a central platform.

- Latin America, with countries like Mexico and Brazil, has also widely adopted e-invoicing mandates for years.

Customers' bargaining power against OpusCapita is mixed; deeply integrated enterprise clients face high switching costs. However, the highly competitive procure-to-pay and e-invoicing markets, valued at $9.77 billion and $15.5 billion respectively in 2024, empower customers to demand competitive pricing and comprehensive solutions. This dynamic, intensified by regulatory mandates like Poland's KSeF system in 2024, compels OpusCapita to continuously innovate and offer value.

| Market Segment | 2024 Valuation (Approx.) | Key Customer Impact |

|---|---|---|

| Procure-to-Pay (P2P) | $9.77 Billion | High competition, increased customer choice. |

| Global E-invoicing | $15.5 Billion | Price sensitivity, demand for compliance. |

| Spend Management Software | $8.5 Billion | Demand for integrated, end-to-end solutions. |

Preview the Actual Deliverable

OpusCapita Porter's Five Forces Analysis

This preview showcases the complete OpusCapita Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape. You are viewing the exact document you will receive immediately after purchase, ensuring no surprises or missing information. This analysis delves into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. The detailed insights provided are ready for your immediate use, offering a comprehensive understanding of OpusCapita's strategic positioning.

Rivalry Among Competitors

The financial software market is intensely competitive, featuring a wide array of players. Established enterprise giants like SAP and Oracle, alongside specialized providers such as Coupa, Basware, and Tradeshift, create a highly rivalrous environment. Companies compete fiercely on features, price, and innovation, driven by a growing demand for digital finance solutions. This fragmented landscape includes both global leaders and strong regional competitors, all vying for market share in 2024 as the sector continues to expand.

The industry is seeing significant consolidation, exemplified by GEP's acquisition of OpusCapita in July 2024. This strategic move combines GEP's global procurement platform with OpusCapita's e-invoicing and AP automation strength. This integration intensifies competitive rivalry, as other market players now face a more formidable, integrated competitor. Such mergers and acquisitions are a crucial dynamic shaping the competitive landscape in 2024, directly impacting market shares.

The competitive rivalry for OpusCapita is intensely shaped by the rapid pace of technological innovation, particularly in areas like AI, machine learning, and automation. Companies are in a constant race to develop and deploy more intelligent and efficient solutions for processes such as invoice automation and cash management. For instance, the global AI in financial services market is projected to reach over 40 billion USD in 2024, highlighting significant investment. Firms that fail to keep up with these advancements risk quickly becoming obsolete in a market where efficiency and cutting-edge features are paramount.

Focus on Integration and Platform Strategy

Competitive rivalry increasingly centers on unified platform offerings rather than individual products. Major competitors like Coupa, acquired by Vista Equity Partners in 2023 for $8 billion, and SAP Ariba, which reported strong cloud growth in 2024, market comprehensive source-to-pay suites. OpusCapita's strategic integration with GEP directly addresses this trend, enhancing its holistic solution set to improve competitive standing.

- Coupa's 2024 revenue projections indicate continued growth in the integrated business spend management market.

- SAP Ariba's cloud revenue growth for 2024 reinforces the demand for end-to-end solutions.

- The global procurement software market is projected to reach $10.5 billion by 2024, driven by platform adoption.

- OpusCapita's GEP integration aims to capture a larger share of the unified procure-to-pay market.

Global vs. Local Expertise

The competitive landscape for OpusCapita includes both global e-invoicing giants and specialized local providers. Local experts often possess superior knowledge of regional regulations, such as varying e-invoicing mandates across European Union member states in 2024. OpusCapita has historically leveraged its strong local expertise, especially within the Nordics and DACH regions, providing tailored compliance solutions. This rivalry plays out on a global scale for large multinational clients seeking unified platforms and on a local level for regional businesses with specific regulatory needs, impacting market share.

- The global e-invoicing market is projected to reach $20.5 billion by 2024.

- Local compliance regulations, like Italy's FatturaPA or France's upcoming e-invoicing mandate in 2024, create barriers to entry for non-specialized providers.

- OpusCapita's strong presence in the Nordics, a region with high e-invoicing adoption rates, gives it a competitive edge against broader global players.

- Customer retention in the e-invoicing sector heavily relies on a provider's ability to adapt to evolving local tax and compliance rules.

Competitive rivalry for OpusCapita is intense, fueled by the rapid pace of technological innovation in AI and the demand for unified platform solutions. The July 2024 acquisition by GEP significantly reshapes this landscape, creating a more formidable integrated competitor. Firms fiercely compete on features, price, and the ability to adapt to evolving local compliance needs and global market trends in 2024.

| Metric | 2024 Projection | Context |

|---|---|---|

| AI in Financial Services Market | $40+ Billion USD | Driving innovation in automation |

| Global E-invoicing Market | $20.5 Billion USD | Market size for core services |

| Global Procurement Software Market | $10.5 Billion USD | Demand for unified platforms |

SSubstitutes Threaten

For smaller businesses or those with lower transaction volumes, a significant substitute to OpusCapita's offerings remains the continued reliance on in-house manual or semi-automated processes, often utilizing standard office software like spreadsheets. While inherently inefficient, the perceived high upfront cost of implementing a dedicated procure-to-pay or cash management solution can make this a viable short-term alternative, especially for companies with less than 50 employees. OpusCapita's primary challenge is to clearly demonstrate a compelling return on investment, showcasing how automated solutions can reduce processing costs, which for manual invoice processing can exceed $10-15 per invoice in 2024, far outweighing initial software outlays.

Many large Enterprise Resource Planning (ERP) systems from vendors like SAP and Oracle pose a significant substitute threat, offering integrated modules for procurement and accounts payable. Businesses often opt for these built-in functionalities to avoid the complexity and cost of adding another vendor, even if less specialized than OpusCapita. This preference for integrated suites, with SAP and Oracle holding substantial market shares in 2024, consolidates purchasing decisions within existing enterprise software ecosystems.

The threat of outsourcing finance and accounting operations to Business Process Outsourcing (BPO) providers is significant for OpusCapita. These BPO firms, like Genpact or Accenture, utilize their proprietary platforms and staff to manage extensive processes such as accounts payable and receivable for clients. This comprehensive service acts as a direct substitute for businesses licensing a SaaS solution directly from OpusCapita, offering an alternative that doesn't require in-house software integration or management. In 2024, the global BPO market size continued its robust growth, with finance and accounting outsourcing remaining a major segment, driven by companies seeking cost efficiencies and specialized expertise.

Fintech Startups Offering Point Solutions

The fintech landscape presents a significant threat from startups offering specialized, point solutions. Instead of adopting an integrated platform, businesses increasingly opt to combine various best-of-breed applications for tasks like expense management or e-invoicing. This modular approach, driven by agile innovators, undermines the appeal of comprehensive systems. The global fintech market is projected to reach over $300 billion in 2024, highlighting the scale of this competitive pressure.

- Market fragmentation by niche providers.

- Shift towards best-of-breed application stitching.

- Increased competition from innovative startups.

- Fintech market size exceeding $300 billion in 2024.

Blockchain and Decentralized Finance (DeFi)

Emerging technologies like blockchain and decentralized finance (DeFi) platforms present a long-term, disruptive threat of substitution for financial intermediaries. These innovations could eventually enable direct, peer-to-peer B2B transactions and smart contracts, potentially bypassing the need for platforms like OpusCapita. For instance, the global blockchain market size is projected to reach approximately $15.9 billion in 2024, indicating significant ongoing investment and adoption. While not an immediate threat, this is a critical trend to monitor for future strategic planning.

- The global enterprise blockchain market is growing, with a projected compound annual growth rate (CAGR) of over 48% from 2024 to 2030.

- DeFi total value locked (TVL) fluctuates but demonstrates an increasing interest in decentralized financial services, nearing $100 billion in early 2024.

- Pilot programs for tokenized assets and cross-border payments leveraging blockchain are expanding, showcasing future direct transaction capabilities.

- Regulatory frameworks are evolving, which could accelerate or decelerate the mainstream adoption of these substitute technologies in B2B.

OpusCapita faces diverse substitution threats, from continued reliance on inefficient manual processes (costing over $10-15 per invoice in 2024) to integrated ERP systems like SAP and Oracle. The rise of BPO providers and specialized fintech solutions (a market over $300 billion in 2024) also challenges their offerings. Long-term, emerging blockchain and DeFi technologies (global blockchain market $15.9 billion in 2024) pose a disruptive risk by enabling direct transactions.

| Substitute Category | 2024 Impact | OpusCapita Challenge | ||

|---|---|---|---|---|

| Manual Processes | Invoice cost $10-15+ | Demonstrate ROI | ||

| ERP Systems (SAP/Oracle) | High market share | Integration preference | ||

| BPO Providers | Robust market growth | Outsourcing appeal | ||

| Fintech Point Solutions | $300B+ market | Best-of-breed trend | ||

| Blockchain/DeFi | $15.9B market | Long-term disruption |

Entrants Threaten

Entering the financial process automation market, like OpusCapita's domain, demands substantial capital investment in technology, infrastructure, and robust security measures. Building a compliant platform also requires deep expertise in complex finance, procurement, and international e-invoicing regulations. For instance, global investment in FinTech infrastructure in 2024 continues to be in the billions, reflecting these high costs. This significant upfront expenditure and specialized knowledge requirement effectively deter many potential new entrants from competing. These barriers ensure a formidable challenge for any aspiring market participant.

New entrants face a significant hurdle in establishing the extensive, trusted networks of buyers and suppliers vital for e-invoicing and supply chain finance solutions. OpusCapita and leading competitors possess vast networks, collectively serving millions of organizations globally in 2024. Building this scale and deep integration is time-consuming and capital-intensive for newcomers. Trust and a proven track record are paramount in handling sensitive financial transactions, which established players have cultivated over years, making market entry challenging.

Established players like OpusCapita, now integrated into GEP, benefit from substantial economies of scale across their development, marketing, and operational processes. They can efficiently process millions of transactions at a very low marginal cost, a critical advantage in the digital finance and procurement sector. This allows for highly competitive pricing strategies, which new entrants would find exceedingly difficult to match given the initial investment required. This inherent cost efficiency acts as a formidable barrier, making it challenging for smaller, newer companies to compete effectively on price and volume in 2024. This scale ensures market dominance and operational efficiency.

Low-Code and AI Platforms as Enablers

The proliferation of low-code development platforms and accessible AI technologies is lowering the barrier to entry for many niche financial software applications. New startups can now rapidly develop and deploy innovative point solutions, often with significantly less initial investment than traditionally required. This agility enables the emergence of new, specialized competitors focusing on underserved segments of the market, potentially impacting OpusCapita's competitive landscape. The global low-code development platform market is projected to reach approximately $30 billion in 2024. These platforms democratize software creation, fostering a more dynamic competitive environment.

- Low-code platforms enable rapid application development, reducing time-to-market for new entrants.

- Accessible AI tools allow startups to embed advanced functionalities without extensive R&D.

- Reduced initial investment costs lower the financial hurdle for new competitors.

- The low-code market is expected to grow, indicating continued ease of entry.

Competition from Adjacent Markets

Companies from adjacent markets, such as logistics, supply chain management, or broader enterprise software, pose a notable threat by potentially entering the financial automation space. These firms often possess an established customer base and brand recognition, which they can leverage to offer new financial services. The acquisition of OpusCapita by GEP, a leading supply chain software and consulting firm, perfectly illustrates this market entry strategy. This dynamic means traditional financial automation providers face increased competition from well-resourced players expanding their service portfolios in 2024.

- Adjacent market players leveraging existing customer trust to cross-sell financial automation.

- Supply chain and enterprise software firms expanding their offerings into financial services.

- The GEP acquisition of OpusCapita demonstrates a direct entry from an adjacent market.

The threat of new entrants in financial process automation is complex, balancing high traditional barriers with emerging facilitators. While substantial capital investment in FinTech infrastructure, reaching billions in 2024, and extensive network building deter many, low-code platforms and accessible AI are lowering entry costs. The global low-code market is projected to hit approximately $30 billion in 2024, enabling agile startups. Additionally, established players from adjacent markets, like GEP acquiring OpusCapita, pose a significant entry threat by leveraging existing customer bases.

| Barrier/Facilitator | Impact on New Entrants | 2024 Data/Context |

|---|---|---|

| High Capital/Expertise | Deters most entrants | FinTech infrastructure investment in billions |

| Network Effects/Trust | Difficult to replicate established scale | Millions of organizations served by incumbents |

| Low-Code/AI Enablement | Lowers entry cost for niche solutions | Global low-code market ~$30 billion |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a comprehensive review of publicly available financial reports, industry-specific market research, and reputable business news outlets. This ensures a robust understanding of competitive dynamics and strategic positioning within the relevant sectors.