Okta Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Okta Bundle

Okta operates in a dynamic cybersecurity landscape shaped by intense competition and evolving threats. Understanding the forces that influence its market position is crucial for any stakeholder. Our analysis delves into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the identity and access management sector.

The complete report reveals the real forces shaping Okta’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Okta's deep reliance on major cloud infrastructure providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform presents a key factor in its supplier bargaining power. These providers offer the foundational computing, storage, and networking services essential for Okta's cloud-based identity and access management solutions.

The critical nature of these services, coupled with the substantial costs and technical complexities involved in migrating its entire operational infrastructure, could empower these suppliers. However, the increasing commoditization of basic cloud services and Okta's significant scale as a customer may serve to temper this supplier leverage. For instance, as of late 2024, the public cloud market, dominated by these three players, continues to see competitive pricing pressures, which could benefit large consumers like Okta.

The bargaining power of suppliers in the cybersecurity sector, particularly for specialized talent, is significant. The demand for skilled identity and access management (IAM) engineers and security professionals far outstrips the available supply. This scarcity directly translates into higher labor costs for companies like Okta. For instance, in 2024, the average salary for a cybersecurity engineer in the US was reported to be around $120,000, with senior roles commanding considerably more, reflecting the intense competition for these critical skills.

This intense competition for niche talent means that skilled cybersecurity professionals hold considerable sway. They can command premium salaries and benefits, and companies must invest heavily in recruitment and retention strategies. Okta's success hinges on its ability to attract and keep these highly sought-after individuals, as their expertise is fundamental to developing and maintaining cutting-edge security solutions.

Okta's reliance on third-party software components, libraries, and APIs is a significant factor in understanding supplier bargaining power. By integrating these external elements, Okta enhances its platform's capabilities. However, if these critical components are proprietary or come from a small pool of suppliers, those vendors gain leverage. This leverage can manifest in their ability to dictate licensing terms, adjust pricing, or influence the future development roadmap of the integrated software.

Suppliers can wield power by controlling the availability and evolution of essential software. For instance, if a key API that Okta depends on undergoes a significant change or becomes more expensive, it directly impacts Okta's operational costs and product strategy. This dependency necessitates a constant evaluation of these relationships to mitigate potential disruptions and ensure competitive pricing for Okta's services.

Okta actively manages these dependencies by exploring various strategies. This includes developing in-house alternatives for critical functions, thereby reducing reliance on external providers. Additionally, the company may seek out and integrate open-source solutions, which can offer greater flexibility and potentially lower costs, thereby diminishing the bargaining power of proprietary software suppliers.

Hardware and Network Equipment Providers

While Okta is a software-focused company, it still relies on hardware and network equipment for its core operations and data centers. The market for general IT hardware is highly competitive and largely commoditized, which typically limits the bargaining power of suppliers in this segment.

However, specialized networking equipment or components designed for high-security data environments could offer certain suppliers more leverage. This is because the availability of niche, high-performance components may be less widespread. For instance, in 2023, the global network infrastructure market was valued at approximately $37.5 billion, with a significant portion dedicated to enterprise-grade solutions that demand specialized components.

The overall bargaining power of hardware and network equipment providers for a company like Okta is generally considered moderate. This is due to the availability of multiple vendors for most standard equipment and the presence of strong competition within the broader technology supply chain.

- Supplier Concentration: Moderate, as many hardware components are sourced from multiple, competitive manufacturers.

- Switching Costs: Can be high for specialized network infrastructure, but generally manageable for standard hardware.

- Supplier Differentiation: Low for commoditized hardware, but can be high for proprietary or high-security components.

- Importance of Input: Critical for operational uptime, but multiple sourcing options mitigate supplier power.

Specialized Security Tool Vendors

Okta relies on specialized security tool vendors to bolster its internal defenses and platform security. Vendors providing highly specialized cybersecurity solutions, especially those with advanced threat intelligence or unique protective features, can wield some bargaining power. This is due to the essential nature of their products and the challenge in sourcing equally effective alternatives.

For instance, the cybersecurity market is dynamic, with many niche providers focusing on specific vulnerabilities. The difficulty in switching to a different vendor for a critical security function, especially if it involves complex integration, can give these specialized vendors leverage. Okta's strategy, including acquisitions like Spera Security in late 2023, directly addresses this by building internal capabilities and lessening dependency on external specialized providers for certain security needs.

- Criticality of Offerings: Specialized security tools are vital for Okta's robust platform, making it harder to switch.

- Limited Substitutes: The unique nature of advanced threat intelligence or defensive capabilities means few direct, equally effective replacements exist.

- Vendor Leverage: This reliance can give specialized vendors some negotiating power over pricing and terms.

- Okta's Mitigation: Strategic acquisitions, such as Spera Security in late 2023, are used to internalize critical security functions and reduce external vendor dependence.

Okta's bargaining power with suppliers is influenced by several factors, including its reliance on cloud infrastructure, specialized talent, and third-party software. The company navigates these relationships by diversifying its supplier base, investing in in-house capabilities, and leveraging its scale to negotiate favorable terms. For example, the competitive landscape of cloud services, with major providers like AWS, Azure, and Google Cloud continually adjusting pricing, offers Okta some leverage as a significant customer. In 2024, the global public cloud market continued to show robust growth, underpinning the availability of these essential services.

The demand for skilled cybersecurity professionals significantly empowers suppliers of talent. In 2024, the average salary for a cybersecurity engineer in the US hovered around $120,000, highlighting the premium placed on these specialized skills. Okta's ability to attract and retain this talent is paramount, as these professionals are crucial for developing and maintaining its advanced identity and access management solutions. This scarcity of expertise gives skilled individuals considerable negotiating power.

Okta also depends on third-party software and APIs to enhance its platform. When these components are proprietary or from a limited set of vendors, those suppliers gain leverage through pricing and feature roadmaps. Okta counters this by exploring open-source alternatives and developing in-house solutions, thereby reducing its dependence on external proprietary software providers and mitigating supplier power.

| Factor | Okta's Position | Impact on Supplier Bargaining Power |

| Cloud Infrastructure Providers (AWS, Azure, GCP) | High reliance, significant customer scale | Moderate; competitive pricing in the cloud market tempers supplier leverage. |

| Specialized Cybersecurity Talent | High demand, critical for product development | High; scarcity of skilled professionals gives them significant negotiating power. |

| Third-Party Software & APIs | Integration for enhanced capabilities | Moderate to High; dependent on the uniqueness and availability of proprietary components. |

| Hardware & Network Equipment | Reliance for data centers | Low to Moderate; largely commoditized market with multiple vendors. |

| Specialized Security Tool Vendors | Essential for platform security | Moderate; criticality and limited substitutes give some vendors leverage. |

What is included in the product

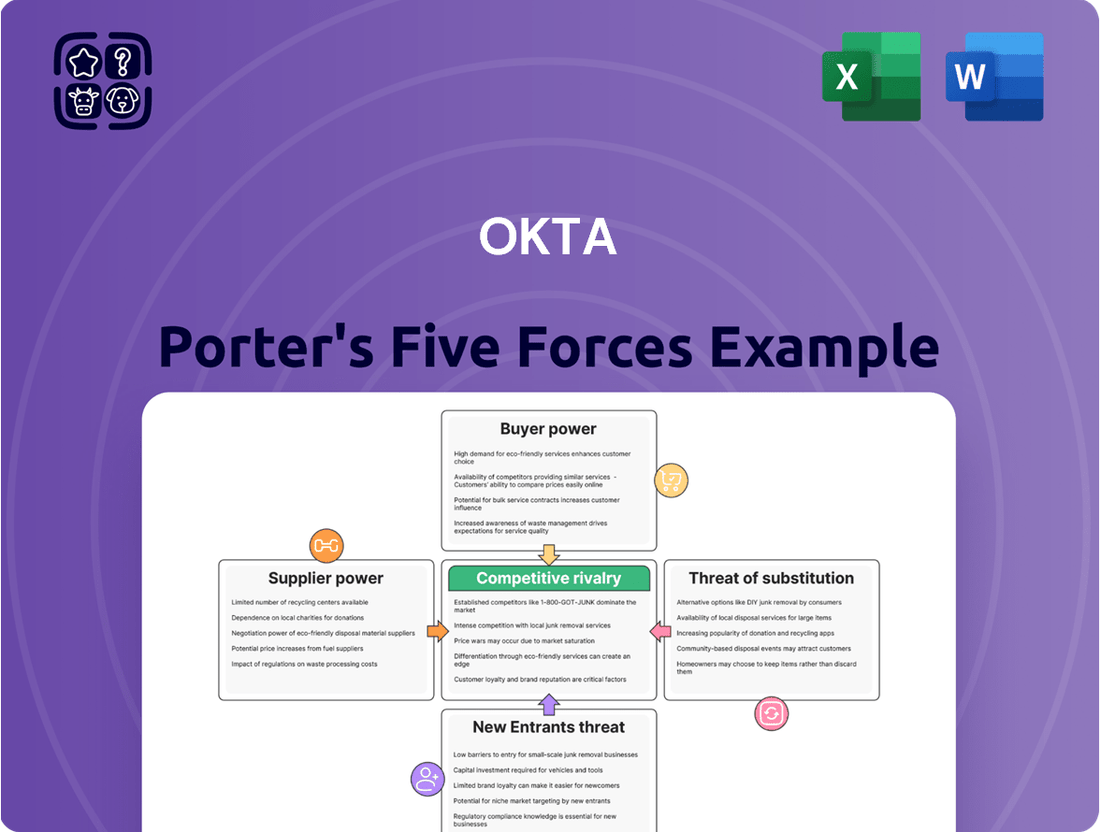

This analysis dissects Okta's competitive environment by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the identity and access management market.

Quickly identify and mitigate threats by visualizing the competitive landscape and understanding the intensity of each Porter's Five Forces on Okta.

Customers Bargaining Power

For large enterprise clients, moving away from an established Identity and Access Management (IAM) provider like Okta presents substantial hurdles. These include the complex processes of data migration, re-integrating with a multitude of existing applications, extensive employee retraining, and the very real risk of operational disruptions during the transition. These significant costs and complexities inherently limit their immediate ability to switch, thereby reducing their bargaining power.

Okta’s historical net dollar retention rates, while subject to market dynamics, have generally shown customers increasing their spending over time. This trend suggests that the high switching costs associated with their comprehensive IAM solutions contribute to customer stickiness and a reduced propensity to change providers, reinforcing Okta's position against customer power.

The Identity and Access Management (IAM) market is quite competitive, offering customers a good range of choices. Companies like Microsoft Entra ID, Ping Identity, SailPoint, OneLogin, and JumpCloud are all significant players, providing robust alternatives to Okta.

This availability of strong competitors directly empowers customers. When multiple vendors offer comparable or even specialized solutions, clients gain leverage, particularly when signing new agreements or renegotiating existing ones. They can easily compare features and pricing, knowing they have other viable paths.

Customers can use this competitive landscape to their advantage. For instance, a business looking for IAM solutions might receive quotes from several providers. This allows them to negotiate for more favorable pricing, better service level agreements, or specific feature enhancements, knowing that if Okta doesn't meet their demands, another vendor likely will.

Okta's pricing, primarily based on per-user monthly fees and feature-based tiers, can make customers sensitive to price, particularly for smaller businesses or as their user base expands. This sensitivity means customers can exert pressure by seeking out more cost-effective solutions. For instance, if Okta's pricing for a specific feature set significantly exceeds a competitor's, a customer might be inclined to switch, especially if the perceived value difference is minimal.

Customer Sophistication and Customization Needs

Okta serves a broad spectrum of customers, from small businesses to major corporations, each with distinct IT maturity and identity management needs. This diversity means some clients, particularly larger enterprises, possess considerable bargaining power due to their demand for tailored solutions and complex integrations.

These sophisticated clients often require advanced features and specific compliance capabilities, making them valuable but also influential in shaping product roadmaps and pricing. For instance, in 2024, large enterprise deals often involve extensive negotiation periods, reflecting the customer's ability to influence terms based on their significant revenue contribution and specialized requirements.

- Diverse Customer Needs: Okta's client base spans SMBs to Fortune 500 companies, with varying technical expertise.

- Enterprise Influence: Larger, more sophisticated customers often negotiate for customized features and integrations.

- Revenue Impact: Significant revenue from large clients can increase their leverage in demanding specific functionalities or pricing adjustments.

- Customization Demands: Advanced requirements for identity and access management solutions empower these customers.

Impact of Macroeconomic Conditions

Macroeconomic headwinds significantly impact enterprise IT spending, directly influencing customer bargaining power. When the economy faces challenges, businesses tend to tighten their belts, leading to reduced IT budgets and a tendency to postpone purchasing decisions for new software solutions. This environment empowers customers to negotiate harder for better pricing or more favorable terms as they prioritize cost optimization.

Okta's performance has reflected these broader economic pressures. For instance, Okta's net retention rate, a key indicator of customer loyalty and expansion, has experienced some softening, directly attributable to these macro-related factors. This suggests that customers are more cautious with their spending and are actively seeking ways to manage their IT expenditures more efficiently, thereby amplifying their leverage in negotiations.

- Reduced IT Budgets: Economic downturns often lead to cuts in enterprise IT spending.

- Delayed Purchasing Decisions: Customers may postpone investments in new technology solutions.

- Cost Optimization Focus: Companies prioritize cost savings, increasing pressure on vendors.

- Impact on Net Retention: Macroeconomic factors have contributed to pressure on Okta's net retention rate.

The bargaining power of customers for Okta is influenced by the availability of competitive IAM solutions and the high costs associated with switching, creating a dynamic where large enterprises, due to their scale and specific needs, can exert significant leverage in negotiations, especially during challenging economic periods in 2024.

Customers can leverage the competitive landscape to negotiate favorable terms. For example, in 2024, businesses actively compared pricing and feature sets from Okta and its rivals like Microsoft Entra ID and Ping Identity, using these comparisons to secure better deals.

Okta's pricing model, often based on per-user fees, makes price-sensitive customers more inclined to seek out alternative, potentially more cost-effective solutions, especially when the perceived value difference is minimal.

Macroeconomic conditions in 2024, such as reduced IT budgets, have amplified customer bargaining power as companies prioritize cost optimization, impacting vendor relationships and deal terms.

| Factor | Impact on Customer Bargaining Power | Example/Data Point (2024) |

|---|---|---|

| Competitive Landscape | Increases bargaining power | Presence of strong competitors like Microsoft Entra ID, Ping Identity |

| Switching Costs | Decreases bargaining power | High costs of data migration, retraining, and integration |

| Customer Size/Influence | Increases bargaining power for large enterprises | Negotiations for tailored solutions and pricing by Fortune 500 clients |

| Economic Conditions | Increases bargaining power | Reduced IT budgets leading to harder price negotiations |

What You See Is What You Get

Okta Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. This comprehensive Okta Porter's Five Forces Analysis delves into the competitive landscape, detailing the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry among existing competitors, and the threat of substitute products or services. Understanding these forces is crucial for Okta's strategic positioning and long-term success in the identity and access management market.

Rivalry Among Competitors

Okta faces intense competition from both broad-spectrum tech giants and niche IAM specialists. Major players like Microsoft, with its Entra ID (formerly Azure AD), leverage their extensive cloud ecosystems to offer integrated IAM solutions, creating a formidable challenge, especially for businesses already committed to Microsoft's platform. In 2024, Microsoft's continued expansion of Entra ID's capabilities and market penetration highlights this pressure.

Beyond Microsoft, established IAM vendors such as IBM, Ping Identity, SailPoint, OneLogin, and CyberArk also compete vigorously. These specialized firms often offer deep expertise and tailored solutions for complex enterprise needs, presenting a direct threat to Okta's market share. The cybersecurity landscape's evolving demands mean these competitors are constantly innovating their product suites to address emerging threats and compliance requirements.

Feature parity is high in the Identity and Access Management (IAM) market, with many competitors offering core functionalities such as Single Sign-On (SSO), Multi-Factor Authentication (MFA), and user lifecycle management. This means customers can often find similar baseline capabilities across various providers.

Okta distinguishes itself by providing a comprehensive platform catering to both workforce and customer identity needs, boasting a vast ecosystem of integrations and a strong cloud-first orientation. This broad approach aims to simplify identity management across an organization's entire digital footprint.

Rivals like Ping Identity, however, focus on differentiating through specialized strengths, such as advanced authentication methods, robust identity governance capabilities, and flexible hybrid deployment options. This creates a competitive landscape where specific feature sets and deployment adaptability become key battlegrounds.

The intense competition forces players like Okta to continuously innovate and refine their offerings to stand out. For instance, Okta’s strong market position in cloud IAM, as evidenced by its significant revenue growth, highlights the importance of its cloud-native strategy in a market where many enterprises are migrating their operations.

Competitive rivalry in the identity and access management (IAM) space, particularly concerning pricing, is intense. For instance, OneLogin has positioned itself as a more budget-conscious alternative, making it an attractive option for small to medium-sized businesses looking to control costs.

Okta's pricing structure can become a point of contention as user counts increase or when organizations require more sophisticated features, leading to a perception of complexity or higher overall expenditure. This competitive pressure necessitates Okta’s ongoing efforts to demonstrate its superior value through advanced capabilities, scalability, and robust security measures.

To counter this, Okta employs strategies such as offering tiered pricing based on feature sets and user volume, alongside volume discounts specifically designed for large enterprise clients. For example, in early 2024, Okta’s pricing models typically ranged from around $5 to $15 per user per month, depending on the chosen product suite and commitment level, with enterprise agreements often negotiated for significant discounts.

Innovation and R&D Investment

The Identity and Access Management (IAM) market thrives on constant innovation, driven by fast-paced technological shifts and an ever-changing landscape of cyber threats. This necessitates substantial research and development (R&D) investment from key players like Okta. Okta's commitment to R&D is evident in its focus on expanding its product suite, particularly in crucial areas such as privileged access management and AI-powered threat detection, along with developing new functionalities for generative AI.

Competitors are equally aggressive in their R&D spending, fostering an intense competition for developing cutting-edge features, bolstering security measures, and refining user experiences.

- Okta's R&D Focus Areas: Privileged Access Management, AI-driven threat detection, Generative AI features.

- Market Driver: Rapid technological changes and evolving cyber threats demand continuous innovation.

- Competitive Landscape: Competitors also invest heavily in R&D, leading to a feature and security arms race.

- Impact: This rivalry pushes the entire market towards more advanced and secure IAM solutions.

Customer Retention and Market Share Dynamics

Competitive rivalry within the Identity and Access Management (IAM) sector is intense, directly impacting customer retention and market share dynamics for companies like Okta. Okta maintained a strong leadership position in the IAM submarket, securing an 11.2% market share in 2024. However, this landscape is characterized by significant competitive pressure, notably from Microsoft, which has been actively expanding its market presence. This competition underscores the challenges Okta faces in both attracting new customers and, crucially, retaining its existing client base.

Okta's strategic focus on acquiring larger, high-value enterprise customers is a direct response to this competitive environment. Success in retaining these significant accounts is paramount for sustained growth and market share. The company's net dollar retention rate serves as a key metric, illustrating its effectiveness in not only keeping existing customers but also expanding revenue from them through upsells and cross-sells. This ability to deepen relationships and increase wallet share is vital for fending off rivals and solidifying Okta's position.

- Okta's 2024 IAM market share: 11.2%

- Key Competitor: Microsoft, with increasing market share.

- Okta's strategy: Focus on high-value customer acquisition.

- Key Retention Metric: Net dollar retention rate.

Competitive rivalry in the IAM market is fierce, with Okta facing strong challenges from tech giants like Microsoft and specialized IAM providers. In 2024, Okta held an 11.2% market share, but Microsoft's expanding presence, particularly with Entra ID, puts significant pressure on Okta's customer base. This intense competition necessitates continuous innovation and a focus on customer retention through strategies like maintaining a healthy net dollar retention rate.

| Key Competitor | 2024 Market Share (IAM) | Key Differentiator/Strategy |

| Microsoft (Entra ID) | Significant and growing | Integrated cloud ecosystem, broad adoption |

| Ping Identity | Niche player | Advanced authentication, hybrid deployment |

| OneLogin | Niche player | Cost-conscious alternative, SMB focus |

| Okta | 11.2% | Comprehensive platform, cloud-first, strong integrations |

SSubstitutes Threaten

Large enterprises with substantial IT budgets and specialized requirements might opt to build their own identity and access management (IAM) systems. This bypasses the need for external providers like Okta, offering ultimate control and tailored functionalities. For instance, a major financial institution with unique security protocols might find internal development more aligned with its needs, even with the significant investment required.

Many organizations continue to rely on established on-premise Identity and Access Management (IAM) systems, like traditional Active Directory. These older systems can function as substitutes for modern cloud-based solutions such as Okta. Despite potentially lacking the cutting-edge features and flexibility of cloud platforms, the significant investment in existing infrastructure and the sheer effort involved in migration create a strong inertia that discourages switching. Okta's strategy often involves integrating with and helping to modernize these existing environments, rather than forcing a complete rip-and-replace.

For smaller businesses or those with less complex identity management needs, manual processes or simpler, less integrated tools can act as substitutes for sophisticated Identity and Access Management (IAM) solutions like Okta. These can include basic password managers or even shared spreadsheets, though they are significantly less secure and efficient. These low-cost alternatives appeal to organizations that either cannot afford or do not perceive the need for advanced IAM platforms.

General-Purpose Cloud Provider Identity Services

Major cloud providers like Amazon Web Services (AWS IAM) and Google (Google Identity Platform) are increasingly offering robust identity management services. These services are tightly integrated into their respective cloud infrastructures, making them a compelling option for businesses heavily invested in a single cloud ecosystem.

For organizations that primarily operate within AWS or Google Cloud, these native identity solutions can indeed act as substitutes for third-party identity providers like Okta. This is particularly true for core identity and access management functions within those specific cloud environments.

- AWS IAM Identity Center managed 70% of AWS customer identities as of late 2023.

- Google Cloud's Identity Platform reported over 300 million active monthly users in early 2024.

- The global cloud identity and access management market was valued at approximately $25 billion in 2023, with significant growth driven by cloud adoption.

- For organizations with multi-cloud or hybrid cloud strategies, these native services are less of a direct substitute for Okta's broader integration capabilities.

Alternative Security Frameworks and Decentralized Identity

The cybersecurity landscape is constantly shifting, and this evolution could bring forth alternative security frameworks or decentralized identity solutions that diminish the need for centralized Identity and Access Management (IAM) providers like Okta.

While still in their early stages, technologies such as blockchain-based identity and self-sovereign identity have the potential to become significant substitutes in the long run. These innovations could fundamentally alter identity management and authentication processes, potentially sidestepping traditional IAM platforms altogether.

Ping Identity, a competitor, is actively investing in and exploring decentralized identity solutions, indicating a broader industry trend towards these alternative approaches. This exploration suggests a future where users have more control over their digital identities, potentially reducing reliance on single-vendor solutions.

- Emerging Technologies: Blockchain and self-sovereign identity offer new paradigms for digital identity management.

- Reduced Reliance: These alternatives could decrease customer dependence on centralized IAM providers.

- Industry Exploration: Competitors like Ping Identity are actively developing decentralized identity capabilities.

- Potential Disruption: A widespread adoption of these substitutes could significantly impact Okta's market position.

The threat of substitutes for Okta's Identity and Access Management (IAM) solutions is multifaceted, encompassing everything from in-house built systems to emerging decentralized identity technologies. Major cloud providers like AWS and Google offer integrated IAM services, which can be compelling substitutes for organizations deeply embedded within their ecosystems. For instance, AWS IAM Identity Center managed 70% of AWS customer identities in late 2023, highlighting the significant adoption of native cloud IAM. Similarly, Google Cloud's Identity Platform served over 300 million active monthly users in early 2024.

Established on-premise systems, like Active Directory, also persist as substitutes due to substantial existing investments and migration inertia. Even simpler manual processes or basic password managers serve as alternatives for organizations with less complex needs, albeit with considerable security trade-offs. The global cloud IAM market, valued around $25 billion in 2023, indicates a substantial opportunity but also a competitive landscape where substitutes play a role.

| Substitute Category | Examples | Key Considerations | Market Impact (as of 2023/2024) |

|---|---|---|---|

| In-House Development | Custom-built IAM systems | High control, tailored functionality, significant investment | Viable for large enterprises with unique security needs |

| Cloud-Native IAM | AWS IAM Identity Center, Google Identity Platform | Seamless integration within cloud ecosystems | AWS IAM Identity Center: 70% of AWS customer identities (late 2023) Google Identity Platform: 300M+ monthly users (early 2024) |

| Legacy On-Premise Systems | Active Directory | Existing infrastructure, migration inertia | Still prevalent, though being modernized |

| Simpler/Manual Solutions | Password managers, spreadsheets | Low cost, basic functionality, lower security | Used by smaller organizations with less complex needs |

| Emerging Technologies | Blockchain, Self-Sovereign Identity | Potential for user control, future disruption | Early stages, but companies like Ping Identity are exploring |

Entrants Threaten

Entering the Identity and Access Management (IAM) market, particularly for enterprise-grade solutions, demands significant financial backing. New players need to allocate substantial capital towards building robust infrastructure, developing cutting-edge technology, and recruiting specialized talent. This isn't a market where you can start small and grow; the upfront investment is considerable.

Furthermore, the imperative for continuous innovation means new entrants must commit heavily to research and development. To even stand a chance against established leaders, they need to create scalable, secure, and feature-rich platforms. Okta's own commitment to R&D, exceeding $600 million annually in recent years, underscores the depth of investment required to remain competitive and develop advanced IAM capabilities.

A significant barrier to entry for new Identity and Access Management (IAM) platforms is the sheer necessity for extensive integrations. A robust IAM solution must connect with a vast array of applications, directories, and existing IT infrastructure to be truly effective.

Okta, for instance, has cultivated an impressive ecosystem with over 7,000 pre-built integrations. Replicating this level of connectivity is a monumental task for any newcomer, demanding substantial investment in development, ongoing maintenance, and strategic alliances to build out a comparable network.

In cybersecurity, brand reputation and trust are incredibly important, acting as a significant barrier for new entrants. Established companies like Okta have spent years cultivating strong brand recognition, making customers feel secure entrusting them with highly sensitive identity information. For instance, Okta's customer base includes a vast number of enterprise clients who rely on their consistent performance and security protocols.

Newcomers struggle to replicate this deep-seated trust, especially when the consequences of identity data breaches are so severe. Building a reputation for unwavering reliability takes time and a flawless track record, something nascent companies simply haven't had the chance to prove.

Even leading companies face scrutiny; a significant cybersecurity incident can quickly erode years of trust. This highlights how crucial a solid reputation is, and how difficult it is for new players to break into a market where confidence is king.

Regulatory Compliance and Security Certifications

The Identity and Access Management (IAM) sector is heavily regulated, with stringent compliance demands from frameworks like GDPR, HIPAA, and Sarbanes-Oxley. New entrants face a significant barrier in understanding and adhering to these complex rules. Obtaining critical security certifications, such as ISO 27001 or SOC 2, is also a lengthy and expensive undertaking, often requiring substantial upfront investment.

Navigating this intricate regulatory environment and securing the necessary certifications is a major deterrent for potential new competitors. For instance, a data breach in 2023 impacting millions of users led to significant fines and reputational damage for a prominent IAM provider, highlighting the severe consequences of non-compliance. The cost and time associated with achieving and maintaining these standards can easily run into millions of dollars.

- Regulatory Hurdles: Compliance with GDPR, HIPAA, and SOX demands significant legal and operational resources for new IAM entrants.

- Certification Costs: Achieving certifications like ISO 27001 or SOC 2 can cost hundreds of thousands of dollars and take over a year to complete.

- Reputational Risk: Non-compliance or security failures can lead to substantial fines, estimated to be up to 4% of global annual revenue for GDPR violations, and severe damage to customer trust.

- Time to Market: The extensive compliance and certification processes delay market entry, giving established players a competitive advantage.

Network Effects and Customer Lock-in

Existing identity and access management (IAM) providers, like Okta, benefit significantly from network effects. The more users and integrated applications a platform has, the more valuable it becomes for everyone on it. This creates a powerful flywheel effect; as more organizations adopt Okta, its ability to connect users to a vast array of services grows, further solidifying its position.

Customer lock-in is a substantial barrier for new entrants. Migrating from an established IAM solution involves considerable effort and cost. This includes reconfiguring user directories, updating security policies, and retraining staff, all of which can be disruptive and expensive. For instance, in 2023, Okta reported a substantial portion of its revenue came from existing customers, highlighting the strength of this retention.

These combined factors, network effects and customer lock-in, make it exceptionally challenging for newcomers to gain traction. A new entrant would need to offer a vastly superior or significantly cheaper solution to overcome the inertia and embedded value of incumbent platforms. The sheer scale of integrations and user data already present on established systems represents a formidable hurdle.

- Network Effects: The value of Okta’s platform increases with each new user and integrated application.

- Customer Lock-in: High switching costs make it difficult and expensive for organizations to move to a new IAM provider.

- Barriers to Entry: New entrants face significant challenges in replicating the integrated ecosystem and user base of established players.

- Data and Integrations: Okta’s extensive library of pre-built integrations and accumulated user data further strengthens its competitive moat.

The threat of new entrants in the Identity and Access Management (IAM) market, particularly for enterprise solutions, is generally low due to substantial barriers. High capital requirements for technology development and infrastructure, coupled with the need for extensive integrations, demand significant upfront investment. Furthermore, established players like Okta have cultivated strong brand recognition and trust, essential in a sector dealing with sensitive data.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Okta leverages data from industry analyst reports, financial statements of key competitors, and market research databases to understand the competitive landscape.