Okta Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Okta Bundle

Curious about Okta's strategic positioning in the competitive identity and access management landscape? This preview offers a glimpse into how Okta's offerings might be categorized within the BCG Matrix. Discover if their products are Stars, Cash Cows, Dogs, or Question Marks, and begin to understand their market share and growth potential.

To truly unlock actionable insights and guide your investment decisions, dive deeper into the full Okta BCG Matrix. Gain a comprehensive understanding of each product's quadrant placement and the strategic implications for Okta's future growth and profitability. Purchase the complete report for a clear roadmap to smart allocation.

This essential report provides a detailed, quadrant-by-quadrant breakdown of Okta's product portfolio, offering data-backed recommendations to navigate the dynamic cybersecurity market. Equip yourself with the strategic clarity needed to make informed decisions and capitalize on opportunities.

Don't miss out on the complete strategic picture. Get instant access to the full Okta BCG Matrix and identify which of their solutions are market leaders, which might be resource drains, and where future capital should be directed. Purchase now for a ready-to-use strategic tool.

Invest in a complete understanding of Okta's product strategy. Our full BCG Matrix report goes beyond theory, delivering tailored strategic moves based on Okta's actual market position, helping you plan smarter and more effectively.

Stars

Okta's Workforce Identity Cloud, specifically its Single Sign-On (SSO) and Multi-Factor Authentication (MFA) capabilities, represents a cornerstone of its business. These offerings are central to enterprise identity and access management, a market experiencing robust growth.

As of early 2024, Okta continues to hold a leading position in the Identity and Access Management (IAM) market, with its SSO and MFA solutions being key drivers of this dominance. The demand for enhanced digital security and streamlined user access fuels the expansion of this segment.

These foundational security products are critical for businesses seeking to protect their digital assets and manage user access efficiently. Okta's consistent innovation in this area ensures it remains at the forefront, fostering strong customer retention and attracting new enterprise clients.

Okta's market leadership in SSO and MFA is well-established, with analysts frequently citing its comprehensive feature set and scalability. This segment is expected to see continued expansion as cybersecurity threats evolve, making these services indispensable for organizations worldwide.

Okta's Customer Identity Cloud, bolstered by its 2021 acquisition of Auth0, is a dominant force in the burgeoning Customer Identity and Access Management (CIAM) market. This segment is vital for companies aiming to create secure and user-friendly customer interactions, with Okta's platform particularly lauded for its developer-centric approach and comprehensive capabilities. The CIAM market itself is experiencing substantial growth, with projections indicating continued expansion, positioning Okta's Customer Identity Cloud as a prime 'Star' performer within its portfolio.

Okta Identity Governance (OIG) is a rising star in the identity and access management space. Its growth is fueled by a market demanding stricter compliance and precise control over who can access what. This product is well-positioned to capitalize on these trends.

The Identity Governance and Administration (IGA) market itself is experiencing robust expansion. Projections show it growing at a compound annual growth rate of 16.47% through 2030. This impressive trajectory underscores the significant future potential for OIG as it captures market share.

Okta's strategy of integrating identity governance with its broader identity solutions creates a powerful offering. This comprehensive approach helps organizations manage user access more effectively, a critical need in today's complex digital environments. As businesses increasingly prioritize security and streamlined operations, OIG's integrated nature becomes a key differentiator.

Privileged Access Management (PAM)

Okta's expansion into Privileged Access Management (PAM) through its Secure SaaS Service Accounts feature represents a strategic move into a high-growth segment of the Identity and Access Management (IAM) market. PAM is essential for modern cybersecurity, focusing on reducing persistent access rights and safeguarding critical accounts. This initiative is poised to significantly bolster Okta's revenue streams, with projections suggesting substantial contributions by 2026-2027 as organizations increasingly prioritize robust security for their privileged identities. The global PAM market was valued at approximately $3.7 billion in 2023 and is expected to grow at a CAGR of over 20% in the coming years.

The PAM offering addresses a crucial gap in securing elevated privileges, which are often exploited in sophisticated cyberattacks. Okta's solution aims to provide granular control and continuous monitoring, thereby minimizing the attack surface associated with service accounts and administrative credentials. This strategic pivot aligns with the growing demand for comprehensive security solutions that manage the entire lifecycle of digital identities, including those with elevated access.

- High Growth Potential: PAM is a rapidly expanding sector within IAM, driven by increasing cyber threats targeting privileged accounts.

- Market Need: Securely managing service accounts and eliminating standing privileges is a critical requirement for enterprise security.

- Future Revenue Driver: Okta's PAM solution is anticipated to become a significant contributor to the company's overall growth by 2026-2027.

- Competitive Landscape: The PAM market, while competitive, offers substantial opportunity for innovative solutions like Okta's.

Okta AI Capabilities

Okta AI capabilities, integrated into both Workforce Identity Cloud and Customer Identity Cloud, are a significant growth driver in the identity and access management (IAM) sector. These AI-powered features focus on crucial areas like threat detection and streamlining identity workflows, directly addressing key cybersecurity trends.

Okta's strategic investment in AI positions it to capitalize on the increasing demand for intelligent security solutions. By empowering organizations with AI, Okta aims to enhance both security postures and user experiences, a critical differentiator in the competitive IAM market.

- AI-Driven Threat Detection: Okta's AI analyzes user behavior and system logs to identify and flag suspicious activities in real-time, significantly reducing the risk of breaches.

- Enhanced Identity Workflows: AI automates and optimizes tasks such as user provisioning, deprovisioning, and access reviews, leading to greater efficiency and reduced administrative overhead.

- Improved User Experience: Features like adaptive multi-factor authentication (MFA) use AI to assess risk and apply appropriate authentication challenges, balancing security with seamless access.

- Market Position: Okta's commitment to AI innovation solidifies its standing in the IAM market, particularly as organizations increasingly rely on AI for advanced security and operational improvements.

Okta's core offerings, including Single Sign-On (SSO) and Multi-Factor Authentication (MFA), are firmly established as market leaders, fitting the 'Star' category due to their high market share and continued growth. The demand for robust identity and access management solutions remains strong, positioning these products for sustained success. Okta's Customer Identity Cloud, enhanced by the Auth0 acquisition, also shines as a Star, dominating the growing CIAM market with its developer-friendly platform.

Okta Identity Governance (OIG) is another strong contender for the Star quadrant, benefiting from the rapidly expanding Identity Governance and Administration (IGA) market, which is projected to grow significantly. The company's strategic push into Privileged Access Management (PAM) with its Secure SaaS Service Accounts feature is also a key growth area, poised to become a substantial revenue driver. Finally, Okta's AI capabilities, integrated across its product suite, are fueling innovation and enhancing security, further solidifying its Star status in the evolving IAM landscape.

| Product Area | Market Share | Growth Rate | Okta's Position | Category |

|---|---|---|---|---|

| Workforce Identity (SSO/MFA) | Leading | High | Dominant | Star |

| Customer Identity (CIAM) | Leading (with Auth0) | Very High | Dominant | Star |

| Identity Governance (IGA) | Growing rapidly | High (16.47% CAGR through 2030) | Strong | Star |

| Privileged Access Management (PAM) | Emerging | Very High (>20% CAGR) | Growing | Potential Star |

| AI Capabilities | Integrated across products | High | Innovator | Enhancer (Star) |

What is included in the product

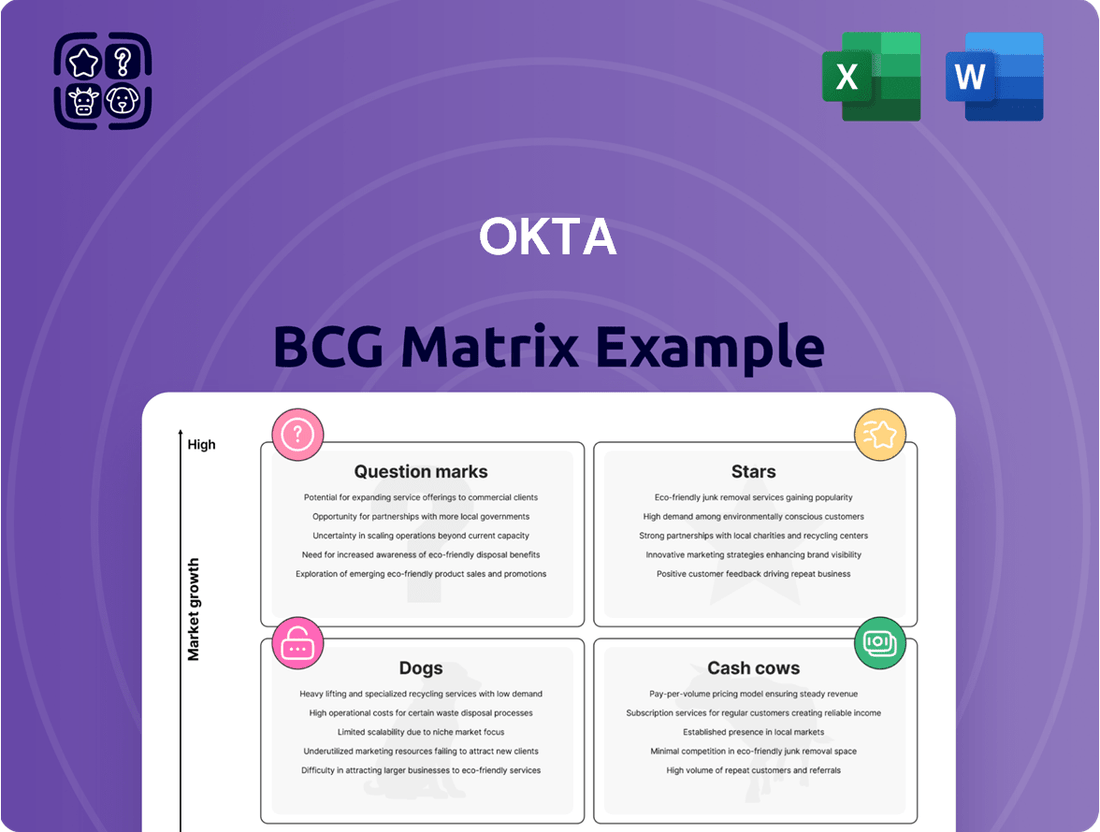

The Okta BCG Matrix analyzes Okta's product portfolio by market share and growth, guiding strategic decisions for Stars, Cash Cows, Question Marks, and Dogs.

Okta's BCG Matrix analysis simplifies complex product portfolios, relieving the pain of resource allocation by clearly identifying Stars, Cash Cows, Question Marks, and Dogs.

Cash Cows

Okta's subscription revenue model is a clear cash cow, representing a dominant 98% of its total revenue in fiscal year 2025. This strong reliance on subscriptions highlights the predictability and stability of Okta's income. The company experienced a robust 15.3% growth in this segment during FY2025, underscoring its continued market strength and customer adoption.

The Software as a Service (SaaS) nature of Okta's business inherently supports a low-cost, high-margin revenue stream from its existing customer base. This recurring revenue, bolstered by consistent growth, provides the financial flexibility needed to invest in other areas of the business. The predictable cash flow generated by these subscriptions is a key strength for Okta.

Okta's established Workforce Single Sign-On (SSO) and Multi-Factor Authentication (MFA) customer base is a prime example of a Cash Cow in the BCG Matrix. This segment boasts a significant market share among enterprise clients, translating into robust and dependable cash flow. These loyal customers, often bound by long-term agreements, require minimal additional investment in sales and marketing, ensuring sustained profitability for Okta. The inherent stickiness of these fundamental identity services solidifies their position as a consistent revenue generator.

Okta's Lifecycle Management solution, a cornerstone of its identity and access management offerings, represents a classic Cash Cow within the BCG Matrix framework. This product automates the complex processes of user provisioning and de-provisioning, a critical function for organizations seeking to streamline operations and bolster security. Its mature market presence and established demand ensure a consistent and predictable revenue stream for Okta.

The steady demand for Lifecycle Management stems from its ability to significantly enhance security and compliance for customers. By automating user access management, it reduces the risk of unauthorized access and helps businesses meet regulatory requirements efficiently. This operational efficiency translates into high profit margins for Okta, as the product is well-established and requires less investment in innovation compared to newer offerings.

In 2024, the market for identity and access management (IAM) solutions, where Lifecycle Management plays a crucial role, continued its robust growth, with analysts projecting the global IAM market to reach over $100 billion by the end of the year. Okta's Lifecycle Management, as a leading solution, captures a significant portion of this market, benefiting from the ongoing digital transformation trends that necessitate strong identity controls.

Universal Directory

Okta's Universal Directory serves as a cornerstone for its customer base, acting as a central hub for managing user, application, and device information within a cloud environment. This established product, while not experiencing rapid expansion itself, generates a steady and reliable revenue stream due to its deep integration and broad adoption across Okta's services.

Positioned as a Cash Cow within the Boston Consulting Group (BCG) matrix, the Universal Directory embodies the characteristics of high market share in a low-growth sector. Its foundational nature means it underpins many of Okta's other, potentially higher-growth offerings, ensuring its continued relevance and profitability.

- Revenue Stability: The Universal Directory contributes a predictable and consistent revenue stream for Okta, reflecting its mature market position.

- Customer Lock-in: Its integral role in managing core identity data creates significant stickiness for existing customers, making it difficult to replace.

- Foundational Service: It acts as a critical enabler for other Okta products, driving adoption and revenue for the broader Okta ecosystem.

- Mature Market: While the identity and access management market continues to evolve, the core directory services component is considered a more mature segment.

Professional Services

Okta's Professional Services, encompassing consulting, implementation, and training, represent a mature segment within its business model. While these services have seen a slight revenue dip from 2023 to an estimated 2025, they remain a vital contributor to Okta's overall cash flow. These services are crucial for ensuring large enterprises effectively adopt and optimize Okta's identity and access management solutions.

Despite not being the primary engine for rapid growth, Professional Services offer a stable, supplementary revenue stream. Their established processes and deep product knowledge enable them to support customer success, which in turn reinforces the value proposition of Okta's core offerings. This segment's consistent performance, even with minor revenue fluctuations, solidifies its role as a cash cow.

- Mature Revenue Stream: Professional Services contribute steady cash flow, albeit with a projected slight revenue decline from 2023-2025.

- Customer Adoption Support: These services are key to facilitating the successful implementation and ongoing optimization of Okta's products for enterprise clients.

- Supplementary Income: While not a high-growth area, they provide valuable additional revenue and support the broader ecosystem.

- Established Processes: The mature nature of these services means efficient operations and predictable cash generation.

Okta's core subscription revenue, particularly from its established Workforce Single Sign-On (SSO) and Multi-Factor Authentication (MFA) solutions, firmly places them as Cash Cows in the BCG Matrix. These offerings boast a dominant market share among enterprise clients, generating a predictable and substantial cash flow. The inherent stickiness of these fundamental identity services, often secured by long-term contracts, requires minimal incremental investment, ensuring sustained profitability.

The Universal Directory, while in a mature market segment, also functions as a Cash Cow. It serves as a foundational element for Okta's broader product suite, driving deep integration and customer lock-in. This stability contributes significantly to Okta's overall financial health, providing reliable revenue streams that can support investments in more dynamic areas of the business.

Professional Services, despite a projected slight revenue dip between 2023 and 2025, remain a vital Cash Cow. These services ensure effective customer adoption and optimization of Okta's identity solutions, generating supplementary but consistent revenue. Their established processes and deep product knowledge contribute to predictable cash generation, reinforcing customer loyalty.

| Product/Service | BCG Category | Market Share | Market Growth | Cash Flow Generation |

|---|---|---|---|---|

| Workforce SSO/MFA | Cash Cow | High | Low | High |

| Universal Directory | Cash Cow | High | Low | High |

| Professional Services | Cash Cow | Moderate | Low | Moderate |

Delivered as Shown

Okta BCG Matrix

The Okta BCG Matrix preview you are currently viewing is the identical, fully polished document you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no altered content – just the complete, professionally formatted strategic analysis ready for your immediate business planning needs.

Dogs

Legacy on-premises integrations within Okta's portfolio, while not the core focus, could be categorized as Cash Cows or potentially Question Marks depending on their specific market position and resource allocation. These integrations often cater to a shrinking segment of the market still reliant on older infrastructure, demanding continued support and maintenance. For instance, if an on-premises connector for a legacy ERP system requires substantial engineering effort but serves a limited, declining customer base, it might represent a resource drain without significant future growth potential.

Certain highly specialized or niche integrations within Okta's portfolio might fall into the 'Dogs' category of the BCG Matrix. These are typically integrations that serve a very small, perhaps even declining, market segment. Their usage is low, and they offer minimal contribution to Okta's overall growth or profitability, requiring significant maintenance for little return.

For example, consider an integration tailored for a legacy enterprise resource planning (ERP) system used by only a handful of Okta's largest clients. While critical for those specific customers, the broader market demand for such a niche integration is negligible. In 2024, Okta's focus remains on expanding its core identity and access management solutions, making these specialized offerings less of a strategic priority for new development.

Okta's legacy customer identity products, now largely superseded by Auth0, represent its Discontinued or Deprecated Products/Features in the BCG Matrix context. These offerings face declining market share as customers transition to more advanced platforms.

Okta's strategic shift towards Auth0 signifies a deliberate phasing out of older identity solutions. This move reflects a clear understanding that these legacy products have reached their maturity and are no longer drivers of significant growth.

The company's focus is on minimizing further investment in these deprecated areas. Instead, resources are being strategically reallocated to support and enhance newer, more competitive identity management solutions.

By acknowledging and managing these legacy products, Okta can concentrate its efforts on innovation and market leadership in the rapidly evolving identity and access management space.

Underutilized Free Tier Offerings (if not leading to paid conversion)

While Okta's Auth0 Free Plan aims to draw developers, a substantial segment of these users not upgrading to paid subscriptions, while still consuming platform resources, can be categorized as a 'Dog' within the BCG matrix. This occurs when the free offering, despite its initial appeal, fails to translate into a meaningful revenue stream or strategic advantage. In 2023, Okta reported that while its customer base grew, the conversion rate from free to paid tiers for some of its developer-focused products remained a key area for optimization.

This 'Dog' quadrant signifies a low market share of paying customers within a specific segment, where the free tier isn't effectively fueling growth or revenue. For instance, if a significant percentage of developers utilize Auth0 for personal projects or early-stage prototypes without ever needing advanced features or scaling that necessitate a paid plan, these users represent a cost without a direct return. Okta's focus in 2024 is to better identify and nurture these users, potentially through enhanced onboarding and feature previews that highlight the value of paid tiers.

- Low Conversion Rates: A scenario where a high volume of developers use the free tier but a disproportionately small number convert to paid plans.

- Resource Consumption: Free users still require infrastructure and support, creating operational costs for Okta.

- Missed Growth Opportunities: The free tier, in this context, isn't effectively acting as a lead generator for higher-value customer segments.

- Strategic Re-evaluation: Okta may need to refine its free tier strategy or paid tier value proposition to improve conversion metrics.

Certain Regional Market Efforts with Low Penetration

Certain regional market efforts with low penetration, particularly in emerging international markets or niche domestic segments, can be viewed as Okta's potential 'Dogs' in a BCG matrix analysis. These are areas where Okta might have invested in sales, marketing, and product localization but has struggled to gain significant traction. For instance, while Okta's overall global revenue grew, specific initiatives in regions with less developed digital identity infrastructure might show minimal market share gains. In 2023, Okta reported a 19% year-over-year revenue increase, reaching $2.2 billion, yet the pace of adoption in certain less mature markets may not have kept pace with these broader gains.

These segments often represent a drain on resources without a clear path to substantial market share growth or profitability. The challenge lies in identifying which of these efforts are merely in an early growth phase versus those that are unlikely to ever achieve significant market penetration.

- Low Market Share: Okta's penetration in some emerging markets might still be in the single digits, indicating a struggle against entrenched local players or a lack of established demand.

- Stagnant Growth: Despite targeted campaigns, revenue growth from these specific regions may have shown flat or declining trends in recent reporting periods.

- Resource Consumption: Continued investment in sales teams, partnerships, and marketing for these low-penetration areas detracts from resources that could be allocated to high-growth opportunities.

- Strategic Re-evaluation Needed: Okta may need to consider divesting from or significantly altering its strategy in these 'Dog' markets to improve overall portfolio efficiency.

Okta's specialized, niche integrations, such as those for very old ERP systems, represent 'Dogs' in the BCG matrix. These cater to a tiny market, show minimal growth, and require upkeep without substantial returns. In 2024, Okta continues to prioritize core identity solutions, making these legacy connectors less of a strategic focus for expansion.

The Auth0 free tier, when failing to convert users to paid plans, can also be a 'Dog'. This occurs when a large user base consumes resources without generating revenue. Okta is working to improve conversion rates by highlighting the value of paid features.

Certain underdeveloped international markets or specific domestic segments where Okta has low penetration and stagnant growth can be classified as 'Dogs'. These areas consume resources without significant market share gains, necessitating a strategic review of continued investment.

| BCG Category | Okta Example | Market Share | Market Growth | Strategic Implication |

|---|---|---|---|---|

| Dogs | Niche legacy integrations | Very Low | Declining | Divest or minimize investment |

| Dogs | Auth0 Free Tier (Low Conversion) | Low (Paying Users) | Low | Refine value proposition or strategy |

| Dogs | Emerging markets with low penetration | Low | Stagnant/Low | Re-evaluate market approach or exit |

Question Marks

Okta is strategically expanding into non-human identity management, a rapidly growing sector that includes machine identities, devices, and AI agents. This focus is crucial as the number of these entities requiring secure access escalates. For instance, the global IoT device market is projected to reach over 30 billion connections by 2025, highlighting the immense scale of this challenge.

While this represents a high-growth opportunity, Okta's market share in this specific segment is still in its nascent stages. The company is actively developing its capabilities to capture this emerging demand.

To address this evolving landscape, Okta is investing in solutions such as Okta Privileged Access and Identity Security Posture Management. These offerings aim to provide robust security for the increasing number of non-human entities accessing critical systems and data.

Okta's newer Identity Threat Protection and Response (ITDR) solutions represent a significant move into a high-growth market segment. These offerings, which include integrations with platforms like Rubrik to gather user access risk signals, are addressing a critical need in today's cybersecurity landscape.

The rise of identity-based attacks has made ITDR an essential component of the modern identity security stack. As attackers increasingly target credentials and access privileges, solutions that can detect and respond to these threats are becoming paramount for organizations. The market for ITDR is expected to grow substantially in the coming years.

Okta is actively investing in developing and expanding its ITDR capabilities. While the company has a strong foundation in identity management, its market share within this specific, rapidly evolving ITDR sub-segment is still being established. This presents both an opportunity for growth and a challenge to capture market leadership.

Okta's advanced AI-driven governance features, like the Governance Analyzer powered by Okta AI, are positioned to address a critical market need for automated identity risk assessment. These capabilities, recently launched or in early access, leverage artificial intelligence to provide users with actionable risk scores and tailored recommendations for identity and access management.

While these innovative features are new to the market, their potential for disruption is significant. Their current market share is naturally low due to their recent introduction, but their ability to streamline complex governance processes positions them for rapid adoption.

The integration of AI in identity governance signifies a shift towards proactive risk mitigation. By analyzing user behavior and access patterns, Okta's AI aims to identify potential security threats before they escalate, a crucial capability in today's evolving threat landscape.

If these AI-driven governance tools gain widespread acceptance and demonstrate tangible improvements in security posture and operational efficiency, they are highly likely to move into the Star quadrant of the BCG matrix, indicating high market growth and a strong competitive position for Okta.

On-Premise Connector for Identity Governance (e.g., SAP)

Okta's new On-Premise Connector for Identity Governance, initially focusing on SAP, is designed to bridge the gap between modern cloud-based identity management and critical legacy on-premises applications. This strategic move allows Okta to cater to organizations that maintain hybrid IT infrastructures, a significant portion of the enterprise market. The company is entering a niche with substantial growth potential as businesses increasingly seek to unify governance across both cloud and on-premise environments.

This offering positions Okta to capture market share from companies that are unlikely to fully migrate away from core on-premises systems like SAP in the near future. Gartner forecasts that by 2025, over 70% of organizations will be operating in a hybrid or multi-cloud environment, underscoring the demand for such solutions.

- Market Entry: Okta's On-Prem Connector for Identity Governance (starting with SAP) represents a new product line targeting hybrid environments.

- Target Audience: Enterprises with significant investments in on-premises applications that require modern identity governance capabilities.

- Market Potential: Addresses a growing need as companies adopt cloud governance strategies while retaining essential legacy systems.

- Competitive Landscape: Aims to secure a foothold in a segment where integrated governance solutions are increasingly sought after.

Okta's Developer Portal for AI-Ready APIs

Okta's upcoming Developer Portal, designed to make APIs 'AI-ready' and ensure secure developer access, positions the company in the rapidly expanding field of AI application security. This emerging market, while currently small for Okta, presents substantial growth prospects as AI adoption accelerates and the security of AI agents becomes increasingly critical.

The portal aims to simplify the integration of Okta's identity and access management solutions into AI-powered applications, a key differentiator in a market where security is often an afterthought in early AI development. By focusing on this niche, Okta is building a foundation for future market leadership.

- Market Focus: Targeting the nascent but high-potential AI application security market.

- Strategic Positioning: Investing in an emerging offering with significant future growth driven by AI adoption.

- Competitive Landscape: Currently low market share due to the offering's newness, but poised for expansion.

- Growth Potential: Expected to capitalize on the increasing need for secure access for AI agents and applications.

Okta's AI-driven governance tools, like the Governance Analyzer, address a critical need for automated identity risk assessment. These nascent features, while currently holding a low market share due to their recent introduction, are positioned for rapid adoption given their potential to streamline complex governance processes. Their success in demonstrating tangible security and efficiency improvements could propel them into the Star quadrant.

Okta's new On-Premise Connector for Identity Governance, starting with SAP, targets hybrid IT environments, a sector with substantial growth potential. This offering addresses the demand for unified governance across cloud and on-premise systems, a critical need for enterprises with significant investments in legacy applications. Gartner's 2025 forecast of over 70% of organizations operating in hybrid or multi-cloud environments underscores this market's importance.

The upcoming Developer Portal, focused on making APIs AI-ready and securing developer access, places Okta in the expanding AI application security market. Although Okta's current market share in this emerging area is low, the rapid acceleration of AI adoption signals significant future growth prospects. This focus builds a foundation for future market leadership in securing AI agents and applications.

BCG Matrix Data Sources

Our BCG Matrix leverages extensive public financial data, including revenue and profitability from company filings, alongside proprietary market research and industry growth forecasts.